Let's Talk About Life Insurance

Have you had a conversation with your family about life insurance?

It might not feel like the most natural discussion to have around your dinner table, yet it’s one of the most important. While the topic can feel a little heavy, it doesn’t have to be. Talking about life insurance and the steps you’re taking to protect your family can be reassuring and empowering to everyone in your family.

September is Life Insurance Awareness Month, an ideal time for families to start or continue conversations about money management, financial planning and life insurance. Some of the latest research helps us understand why it's critical to have these conversations in the first place.

In fact, in January 2024, 51% of consumers reported owning life insurance, which is down significantly from 63% in 2011, according to LIMRA’s annual Insurance Barometer Study. In addition, 22% of people who own life insurance say they do not have enough coverage.

Another study, commissioned by Prudential, showed that while people with higher household incomes are more likely to have life insurance than those with lower incomes, 15% of those with household incomes of $100,000 or more do not have any life insurance coverage.

The main reason to have life insurance is because you want your loved ones to receive money after you die to help them financially. But there are many other reasons, too. Let’s start by understanding the opportunities to include life insurance as part of your overall financial plans.

Getty Images

Here's why it's so important to have a family conversation about life insurance and financial planning. It may be easier than you think.

This Grocery Method Can Save You Time and Money

If you’re tired of spending a fortune every time you go to the grocery store, this viral budgeting method could help. The 6-to-1 grocery method, popularized on TikTok by Chef Will Coleman, can help make grocery shopping easier and put more money in your pocket.

Even though inflation is cooling, grocery prices remain elevated, putting a strain on many household’s budgets, and the last inflation report actually showed a jump in food prices. The food at home index rose 0.4% in September, with a 2.3% increase for all food items over the previous year. Meats, poultry, fish and eggs rose 3.9% over the previous year.

High prices have led many individuals to try alternative budgeting methods, like the 60/30/10 method, to more effectively manage their money. The 6-to-1 grocery method tackles one particular aspect of your spending — grocery shopping.

Learning Center Home

Getty Images

The 6-to-1 grocery method can help you save money, reduce waste, and eat healthier.

Your Kid Is a New Driver:

Will Your Car Insurance Take a Hit?

Learning Center Home

Preservation Retirement Services

The most exciting day of your life may in fact be when you first became a parent. Gone are the days when the father-to-be paces in the waiting room smoking a cigar while the mother-to-be promises bloody murder. Fast-forward 15 or so years into the future, when you took your little bundle of joy out for their first time to practice driving. Remember how great that felt, the wind in your hair, the freedom of having a personal chauffeur in your future, images of the second job as a taxi driver to your child slowly fading away?

No? You mean you were petrified, holding on to the inside of the car for dear life and questioning every choice you’ve made in your life? Yeah, join the club. Teaching your kid to drive is not for the faint of heart, and that includes your insurance company.

Most likely, but you can try to lessen the blow by asking about discounts and teaching your child as much as you can before they get their license.

How to Buy Homeowners Insurance

Learning Center Home

Getty Images

Are you buying a home? Congratulations. That's a huge milestone. With it comes the need to protect this new asset for the years ahead. How to protect it? You'll need homeowners insurance.

Unfortunately, home insurance rates are high. Rates have increased 11.5% since 2022 and now cost $2,728 per year, or $227 per month on average, according to MarketWatch. So you'll want to shop around to ensure you get the best price.

But before you can start comparing quotes, you’ll need to decide how much and what type of coverage to get. A home’s insurance value is based on the cost to rebuild the house, not the market value.

You can get an estimate of the home’s rebuilding cost at AccuCoverage.com, which asks many questions about the house's size, building materials and additional details. It then uses the same building-cost database that insurers use. Or you can work with an agent or the insurer to come up with an estimate.

Here's what you need to know about buying homeowners insurance.

Planning to buy homeowners insurance for the first time? Here's what you need to know and how to get started.

Learning Center Home

Getty Images

Quit putting it off, because it's vital for you and your heirs. From wills and trusts to executors and taxes, here are some essential points to keep in mind.

Learning Center Home

NYSUT NOTE: Life insurance is absolutely vital, from covering daily basics to taking outstanding debts off your family members' plates. Metropolitan Life Insurance Company's Term Life Insurance Plan, endorsed by the NYSUT Member Benefits Trust, offers term life insurance coverage for you or your spouse/certified domestic partner. At premiums negotiated especially for NYSUT members, qualified applicants can get coverage up to $1 million.

The 10 Cheapest Countries to Visit

Learning Center Home

Getty Images

If you're planning your next solo or family vacation and have to stick to a strict budget, no problem. We've found the cheapest countries to visit around the world. Despite the effects of inflation on everything from eggs to electric cars, there are many places where the dollar will work in your favor, getting you an exotic trip for less than you might expect.

Our ranking is based on the average estimated daily cost you'll pay once you reach your destination, considering daily prices for accommodation and food for one person. The missing element is the cost of airfare, but flight costs vary so much depending on the time of year you're traveling, and where you're flying from, and to, that it's not helpful to factor those into our selections. If you want to know how to find and save money on flights to Europe, we've got some strategies for doing just that.

To inspire your flight hunting, here are 10 of the cheapest countries to travel to in 2024.

Data sources include TheGlobalEconomy.com, Numbeo's cost of living database, and Budget Your Trip.

Despite inflation, there are still great places to visit in the world where you can have an amazing experience without breaking the bank.

529 Plans Hit a New Milestone: Why They're So Popular

Getty Images

More families have been taking advantage of 529 plans than ever, with the number of new accounts opened rising each year. And thanks to this surge in popularity, 529s have just hit a new milestone.

Savings in 529 plans across the country have surpassed half a trillion dollars for the first time, according to the College Savings Plans Network (CSPN), a network of the National Association of State Treasurers. Over $508 billion has been invested across 16.8 million open 529 accounts nationally, with the average size of each account increasing from $13,188 in 2009 to $30,295 in 2024.

529 plans are powerful tools that can help you tackle rising education costs. So if you’re looking to save for your child or grandchild’s future college expenses, opening a 529 plan could be the best way to do so, given the plan's favorable tax treatment and the rising cost of a college education.

Mary Morris, Chair of the College Savings Plans Network and CEO of Invest529 says she finds it “encouraging” to see families increasingly recognize “the importance of postsecondary education and that 529 plans exist to help them make that a reality.”

Here’s what you need to know about 529 savings plans and why they’re more popular now than ever.

Recently, 529 plans hit a new milestone with over half a trillion dollars being saved in plans across the country. Why are 529 plans so popular?

I'm a Financial Professional: It's Time to Stop Planning Your Retirement Like It's 1995

Learning Center Home

Getty Images

When you hear the word "retirement," what picture comes to mind? For many, it's still some version of the classic image: Clock out at 65, cash in your pension or Social Security and settle into 20 golden years of golf and grandkids.

That version may have worked in 1995. But today? It's as outdated as floppy disks.

In my work helping clients prepare for retirement, I see a very different picture emerging. One that's longer, more fluid and far more personal. If you're still planning your retirement based on old rules, it's likely time to rethink your strategy.

Today's retirement isn't the same as in your parents' day. You need to be prepared for a much longer time frame and make a plan with purpose in mind.

Can Both Spouses Collect Social Security Benefits? Quick Facts You Need

Learning Center Home

Getty Images

If you’re 62 years of age or older, Social Security can provide you with a source of income when you retire or when you can no longer work due to a disability. When it comes to benefits, both spouses can receive Social Security, which is based on their individual earnings records and at what age they claim benefits. In other words, one spousal payment does not offset or affect the others.

That aside, Social Security has a maximum family benefit, which is the maximum amount you can collect monthly based on your earnings record. Although there is a formula for determining a beneficiary's maximum benefit amount, right now, the maximum amount is between 150% to 180% of the primary beneficiary’s full retirement benefit, according to the SSA.

What Retirees Must Know About Telehealth

Learning Center Home

© 2020 The Kiplinger Washington Editors Inc.

Don't Make These Big Mistakes When Claiming Your Social Security Benefits

Getty Images

Although Social Security adds stability to many people's retirement plans, nearly half (49%) don’t know how to maximize their benefits, according to a recent survey by Nationwide Financial. Another 33% of adults said they don’t know at what age they are or were eligible for full retirement benefits.

It's not hard to understand why many Americans are unclear about how Social Security benefits work. The rules are extensive and can be confusing. According to the survey, many people aren’t sure what their full retirement age (FRA) is, at what age they are eligible for full benefits, and if they should take benefits early or delay benefits until later in life. With over 72 million Americans on track to collect benefits from Social Security this year, knowing when to retire and how to maximize benefits is crucial.

If you don’t know how Social Security works, when to claim your benefits or how to maximize your benefits, you could be missing out on reaching your retirement goals. Here's what you need to know.

New survey reveals that many people don't know their full retirement age, aren’t sure the age they are or were eligible for full retirement benefits or take benefits too early.

© 2020 The Kiplinger Washington Editors Inc.

Learning Center Home

Learning Center Home

Getty Images

There’s Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare—and much more.

Learning Center Home

Are Credit Cards an Alternative Source of Income?

Why would a bank take $15,000 out of a client’s account with no explanation or any chance for the client to stop the action?

That’s the question my friend asked herself after receiving a distressed call from her son, an accomplished entrepreneur. What happened next highlights the danger of relying too heavily on credit.

Getty Images

Thinking that having credit available means you have another source of income is misguided.

Learning Center Home

New Rules, New Opportunities for Student Loans: An Expert Guide to Preparing for What's Next

Getty Images

Financial Learning Center

Powered by Kiplinger

Thinking that having credit available means you have another source of income is misguided.

CREDIT

Are Credit Cards an Alternative Source of Income?

Finance Fundamentals

The 6-to-1 grocery method can help you save money, reduce waste, and eat healthier.

This Grocery Method Can Save You Time and Money

Most likely, but you can try to lessen the blow by asking about discounts and teaching your child as much as you can before they get their license.

Your Kid Is a New Driver: Will Your Car Insurance Take a Hit?

Quit putting it off, because it's vital for you and your heirs. From wills and trusts to executors and taxes, here are some essential points to keep in mind.

Are You an Estate Planning Procrastinator? Where to Start

SHOPPING

car insurance

retirement

COLLEGE SAVINGS

RETIREMENT

When you're married but only one spouse works, leaving retirement planning to the working partner puts financial security at risk. A joint effort is vital.

How to Plan for Retirement When Only One Spouse Works

Recently, 529 plans hit a new milestone with over half a trillion dollars being saved in plans across the country. Why are 529 plans so popular?

529 Plans Hit a New Milestone: Why They're So Popular

SAVINGS

Experts say the Federal Reserve will cut interest rates again at the next Fed meeting. Here's what that means for savings rates.

What a Fed Rate Cut Means for Savings

Here's why it's so important to have a family conversation about life insurance and financial planning. It may be easier than you think.

INSURANCE

Let's Talk About Life Insurance

TRAVEL

Despite inflation, there are still great places to visit in the world where you can have an amazing experience without breaking the bank.

The 10 Cheapest Countries to Visit

RETIREMENT

Many people don't know their full retirement age, aren’t sure the age they are or were eligible for full retirement benefits or take benefits too early.

Don't Make These Big Mistakes When Claiming Your Social Security Benefits

RETIREMENT PLANNING

The Great Wealth Transfer is well underway, yet too many families aren't ready. Here's how to bridge the generation gap that could threaten your legacy.

SOCIAL SECURITY

Both spouses can collect Social Security based on their individual earnings records and at what age they claim benefits

Can Both Spouses Collect Social Security Benefits? Quick Facts You Need

I'm a Financial Adviser: You've Built Your Wealth, Now Make Sure Your Family Keeps It

MODERN RETIREMENT

Today's retirement isn't the same as in your parents' day. You need to be prepared for a much longer time frame and make a plan with purpose in mind.

I'm a Financial Professional: It's Time to Stop Planning Your Retirement Like It's 1995

Retirement Living

Rates are high this year, but you can still score a low mortgage rate with these tips.

real estate

Five Ways to Shop for a Low Mortgage Rate

Read More

Read More

Planning to buy homeowners insurance for the first time? Here's what you need to know and how to get started.

INSURANCE

How to Buy Homeowners Insurance

Financial Learning Center Resources

Need a Financial Planner?

Both spouses can collect Social Security based on their individual earnings records and at what age they claim benefits

Financial Learning Center

Powered by Kiplinger

There’s Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare—and much more.

There’s no one-size-fits-all formula for how much you’ll need.

Emergency Funds: How to Get Started

You worked hard to build your retirement nest egg. But do you know how to minimize taxes on your savings?

RETIREMENT

10 Questions Retirees Often Get Wrong About Taxes in Retirement

It’s often smart to borrow to boost your income and your assets.

Good Debt, Bad Debt: Knowing the Difference

CREDIT & DEBT

MEDICARE

Medicare Basics: 11 Things You Need to Know

SOCIAL SECURITY

Why visit a government office to get your Social Security business done? You can do much of that online.

14 Social Security Tasks You Can Do Online

Finding the lowest rate to protect you and your vehicle can be a challenge.

Reshop Your Car Insurance

INSURANCE

Parents may now use money from their 529 college-savings plans to help their children pay off student loans.

A New Way to Pay College Loans

STUDENT LOANS

Kiplinger Today

People have lots of questions about the new $3,000 or $3,600 child tax credit and the advance payments that the IRS will send to most families in 2021. Here are answers to some of those questions.

CORONAVIRUS AND YOUR MONEY

MOBILE VERSION TO BE COMPLETED AFTER DESKTOP APPROVAL

There are limits on what debt collectors can do to recoup what you owe. If you have medical debts, you have even more rights.

ESTATE PLANNING

How to Keep Tabs on Your Credit Reports

Free weekly access is ending, but several services let you view your credit files more than once a year.

CORONAVIRUS AND YOUR MONEY

RETIREMENT

You might be surprised to see some of the things you'll find yourself spending less or more on in your golden years.

10 Things You'll Spend Less and More on in Retirement

Retirement Living

CORONAVIRUS AND YOUR MONEY

The pandemic has created significant challenges for all types of senior living communities.

A COVID Storm Hits Senior Living

TRAVEL

Retirees wanting to take a cruise should plan for additional safety measures, such as temperature checks and wearing a mask in public areas.

How Cruise Ships Are Setting Sail During COVID

Use our road map to find an advisor who will truly look out for your best interests.

Financial Planning

How to Find a Financial Planner You Trust

Financial Learning Center Resources

Need a Financial Planner?

Long-Term Care Insurance

Auto and Home Insurance

Mortgage Discount Program

Synchrony Bank

Savings Program

403(b) Field Guide

What Is the Magic Number to Retire Comfortably?

New Rules, New Opportunities for Student Loans: An Expert Guide to Preparing for What's Next

The dream of retiring comfortably has just become a bit less expensive for most Americans, a recent study shows. Do you have enough socked away?

Major changes are coming to federal student loan rules, so it's a good time for borrowers to understand how these shifts will impact their financial planning.

Read More

Finish the year strong with smart money moves that can boost savings, trim taxes and set you up for a better 2026.

COLLEGE

RETIREMENT

PERSONAL FINANCE

6 Quick Money Moves to Make Before the Year Ends

Kiplinger Today

I'm a Financial Adviser: You've Built Your Wealth, Now Make Sure Your Family Keeps It

Getty Images

The most significant wealth transfer in history, an estimated $84 trillion, is underway as Baby Boomers pass on their fortunes to their Gen X and Millennial heirs.

But most families aren't ready, and the cultural divide between generations may make it more complicated than ever to preserve that legacy.

Until recently, Baby Boomers enjoyed unprecedented generational dominance, not only as the wealthiest generation but also the largest generation by population.

While Millennials have since come to outnumber the Boomers, the postwar generation still represents the wealthiest generation in U.S. history, holding more than 50% of the nation's household wealth.

As Baby Boomers continue to exit the workforce, the wealth they've built — fueled by decades of substantial salaries and asset growth — is beginning to move to their children and grandchildren, with ripple effects across family dynamics, the economy and the wealth management industry.

The Great Wealth Transfer is well underway, yet too many families aren't ready. Here's how to bridge the generation gap that could threaten your legacy.

Learning Center Home

Learning Center Home

Learning Center Home

Learning Center Home

Getty Images

Inflation tops health care costs as the biggest concern, and many preretirees are boosting their saving rate.

Living a Life of Purpose after Retirement: 3 Action Steps to Take

Getty Images

When someone asks about what you do, the answer shouldn’t be, “I’m retired.” There is more to the second half of your life … a lot more.

Learning Center Home

3 Strategies to Avoid Running

Out of Money in Retirement

Getty Images

For a financially sustainable retirement that could last 30 years or more, here are three ways to help manage your risks and avoid financial roadblocks in your golden years.

The trend of increasing life expectancy means that Americans are much more likely to live 25, 30 or even 35 years in retirement. The benefits of this trend include spending more time with your family and a higher chance of meeting your great-grandchildren. The downsides include the increased potential for running out of money close to the end of this retirement.

Today’s retirees can expect to live 40% longer than those who retired 70 years ago. Recent research reveals that affluent Americans are likely to live longer. This means that if you’ve had consistent access to health care and high income, you are more likely to enjoy a longer lifespan. Men in the top quintile of income born in 1960 will live on average 12.7 years longer than men who are in the lowest quintile of income; for women the equivalent is 13.6 years.

These raw numbers can be headache-inducing. However, the implications are profound. What they mean basically is that those who have recently retired or who are getting ready to retire, one out of three women and one in five men can expect to live to 90 years or beyond.

As retirements lengthen, they require more financial resources to support not only day-to-day expenses, but also the increased health care expenses that can crop up due to aging. It’s no surprise then, that 60% of pre-retirees surveyed by Allianz fear running out of money in retirement.

Fortunately, holistic retirement planning built around three strategies — minimizing taxes, managing savings and reducing market downside risks — can mitigate the risk of running out of money in retirement.

My friend’s son has started several successful businesses and worked in various fields, but as an entrepreneur, his income can be cyclical, sporadic and, at times, volatile. He’d called in a rare panic, blurting out information he usually wouldn’t share so freely and confessing that $15,000 had been stolen from one of his accounts.

My friend is nothing else if not a very protective mother bear; she doesn’t necessarily become involved in her son’s escapades, but because he seldom shared this type of information with her, she became concerned. She wanted to know what was going on, and eventually, he shared the story in painstaking detail.

As it turned out, even though he had maxed out all his credit cards while in between business ventures, he’d put together a plan to go to Europe and said he kept an account with $15,000 that was now gone.

When my friend asked how this money had been stolen, he told her it had been taken directly from his account without any warning or explanation.

She asked if the bank was applying it to his credit card debt.

He said that wasn’t possible because the credit card debt had been through a different bank.

She wondered if there was a paper trail proving the bank took the money without his authorization. If so, he could request it be returned to his account.

She kept asking questions until he specified which account and bank the money had disappeared from. The answer took her by surprise because she didn’t even know he had accounts with that bank.

She dug deeper and soon discovered that no, in fact, he did not have a checking or savings account with that bank.

But he did have a credit card. And that card had $15,000 of available credit — the money he’d been “saving” for his trip.

What had happened was not that the bank had stolen his money. When all his other cards were maxed out, his credit score had gone down, so the bank lowered his credit limit. That wasn’t his money, and it hadn’t been stolen; it had never been his to begin with.

No, he insisted. That was his money. He was saving that credit as his only source of income.

But what is income?

A cautionary tale

Getty Images

You’ve scrimped and saved, but are you really ready to retire? Here are some helpful calculations that could help you decide whether you can actually take the plunge.

See if you can relate to this … You have contributed to a 401(k), 403(b) or other employer-sponsored account at work, maybe you’re paying extra on the mortgage or have already paid it off, you keep cash on hand for those unexpected expenses or upcoming big-ticket purchases and you often wish there was a way to pay less in taxes.

You have worked for 30 or 40 years and are at or approaching Social Security eligibility and are now looking at when to take Social Security to maximize your benefits.

Sound familiar? Now, here’s what often comes next … You look at the account statements and begin to wonder whether the investments you have are the right ones to own for where you are in life. You begin weighing your options for making withdrawals from your retirement accounts. You aren’t sure exactly how this is done, and you’re nervous about the risk of a stock market pullback and the possibility of running out of money. And then it happens, you begin searching the internet for answers. (That may even be how you ended up here!) After a lot of searching and reading you realize that there are just too many opinions to choose from, and you resort to simply eliminating options that you’re not as familiar with or have heard negative things about. Then you take what’s left and try to put together a coherent strategy while continuing a search to find information that supports what you have contrived.

This is an all-too-common situation. Maybe this is exactly where you are or perhaps it describes something similar, but either way, you wouldn’t be reading this far into the article without some truth to what I am describing.

Regardless of the details, what you do next is critical to your long-term success. The decisions you make will determine the trajectory of your financial future, and it’s imperative to have a good plan to follow.

How to Know When You Can Retire

Getty Images

You’ve scrimped and saved, but are you really ready to retire? Here are some helpful calculations that could help you decide whether you can actually take the plunge.

See if you can relate to this … You have contributed to a 401(k), 403(b) or other employer-sponsored account at work, maybe you’re paying extra on the mortgage or have already paid it off, you keep cash on hand for those unexpected expenses or upcoming big-ticket purchases and you often wish there was a way to pay less in taxes.

You have worked for 30 or 40 years and are at or approaching Social Security eligibility and are now looking at when to take Social Security to maximize your benefits.

Sound familiar? Now, here’s what often comes next … You look at the account statements and begin to wonder whether the investments you have are the right ones to own for where you are in life. You begin weighing your options for making withdrawals from your retirement accounts. You aren’t sure exactly how this is done, and you’re nervous about the risk of a stock market pullback and the possibility of running out of money. And then it happens, you begin searching the internet for answers. (That may even be how you ended up here!) After a lot of searching and reading you realize that there are just too many opinions to choose from, and you resort to simply eliminating options that you’re not as familiar with or have heard negative things about. Then you take what’s left and try to put together a coherent strategy while continuing a search to find information that supports what you have contrived.

This is an all-too-common situation. Maybe this is exactly where you are or perhaps it describes something similar, but either way, you wouldn’t be reading this far into the article without some truth to what I am describing.

Regardless of the details, what you do next is critical to your long-term success. The decisions you make will determine the trajectory of your financial future, and it’s imperative to have a good plan to follow.

Learning Center Home

How to Know When You Can Retire

Getty Images

You’ve scrimped and saved, but are you really ready to retire? Here are some helpful calculations that could help you decide whether you can actually take the plunge.

See if you can relate to this … You have contributed to a 401(k), 403(b) or other employer-sponsored account at work, maybe you’re paying extra on the mortgage or have already paid it off, you keep cash on hand for those unexpected expenses or upcoming big-ticket purchases and you often wish there was a way to pay less in taxes.

You have worked for 30 or 40 years and are at or approaching Social Security eligibility and are now looking at when to take Social Security to maximize your benefits.

Sound familiar? Now, here’s what often comes next … You look at the account statements and begin to wonder whether the investments you have are the right ones to own for where you are in life. You begin weighing your options for making withdrawals from your retirement accounts. You aren’t sure exactly how this is done, and you’re nervous about the risk of a stock market pullback and the possibility of running out of money. And then it happens, you begin searching the internet for answers. (That may even be how you ended up here!) After a lot of searching and reading you realize that there are just too many opinions to choose from, and you resort to simply eliminating options that you’re not as familiar with or have heard negative things about. Then you take what’s left and try to put together a coherent strategy while continuing a search to find information that supports what you have contrived.

This is an all-too-common situation. Maybe this is exactly where you are or perhaps it describes something similar, but either way, you wouldn’t be reading this far into the article without some truth to what I am describing.

Regardless of the details, what you do next is critical to your long-term success. The decisions you make will determine the trajectory of your financial future, and it’s imperative to have a good plan to follow.

Learning Center Home

How to Know When You Can Retire

Getty Images

You’ve scrimped and saved, but are you really ready to retire? Here are some helpful calculations that could help you decide whether you can actually take the plunge.

See if you can relate to this … You have contributed to a 401(k), 403(b) or other employer-sponsored account at work, maybe you’re paying extra on the mortgage or have already paid it off, you keep cash on hand for those unexpected expenses or upcoming big-ticket purchases and you often wish there was a way to pay less in taxes.

You have worked for 30 or 40 years and are at or approaching Social Security eligibility and are now looking at when to take Social Security to maximize your benefits.

Sound familiar? Now, here’s what often comes next … You look at the account statements and begin to wonder whether the investments you have are the right ones to own for where you are in life. You begin weighing your options for making withdrawals from your retirement accounts. You aren’t sure exactly how this is done, and you’re nervous about the risk of a stock market pullback and the possibility of running out of money. And then it happens, you begin searching the internet for answers. (That may even be how you ended up here!) After a lot of searching and reading you realize that there are just too many opinions to choose from, and you resort to simply eliminating options that you’re not as familiar with or have heard negative things about. Then you take what’s left and try to put together a coherent strategy while continuing a search to find information that supports what you have contrived.

This is an all-too-common situation. Maybe this is exactly where you are or perhaps it describes something similar, but either way, you wouldn’t be reading this far into the article without some truth to what I am describing.

Regardless of the details, what you do next is critical to your long-term success. The decisions you make will determine the trajectory of your financial future, and it’s imperative to have a good plan to follow.

Learning Center Home

How to Know When You Can Retire

Getty Images

You’ve scrimped and saved, but are you really ready to retire? Here are some helpful calculations that could help you decide whether you can actually take the plunge.

See if you can relate to this … You have contributed to a 401(k), 403(b) or other employer-sponsored account at work, maybe you’re paying extra on the mortgage or have already paid it off, you keep cash on hand for those unexpected expenses or upcoming big-ticket purchases and you often wish there was a way to pay less in taxes.

You have worked for 30 or 40 years and are at or approaching Social Security eligibility and are now looking at when to take Social Security to maximize your benefits.

Sound familiar? Now, here’s what often comes next … You look at the account statements and begin to wonder whether the investments you have are the right ones to own for where you are in life. You begin weighing your options for making withdrawals from your retirement accounts. You aren’t sure exactly how this is done, and you’re nervous about the risk of a stock market pullback and the possibility of running out of money. And then it happens, you begin searching the internet for answers. (That may even be how you ended up here!) After a lot of searching and reading you realize that there are just too many opinions to choose from, and you resort to simply eliminating options that you’re not as familiar with or have heard negative things about. Then you take what’s left and try to put together a coherent strategy while continuing a search to find information that supports what you have contrived.

This is an all-too-common situation. Maybe this is exactly where you are or perhaps it describes something similar, but either way, you wouldn’t be reading this far into the article without some truth to what I am describing.

Regardless of the details, what you do next is critical to your long-term success. The decisions you make will determine the trajectory of your financial future, and it’s imperative to have a good plan to follow.

Learning Center Home

How to Know When You Can Retire

Getty Images

You’ve scrimped and saved, but are you really ready to retire? Here are some helpful calculations that could help you decide whether you can actually take the plunge.

See if you can relate to this … You have contributed to a 401(k), 403(b) or other employer-sponsored account at work, maybe you’re paying extra on the mortgage or have already paid it off, you keep cash on hand for those unexpected expenses or upcoming big-ticket purchases and you often wish there was a way to pay less in taxes.

You have worked for 30 or 40 years and are at or approaching Social Security eligibility and are now looking at when to take Social Security to maximize your benefits.

Sound familiar? Now, here’s what often comes next … You look at the account statements and begin to wonder whether the investments you have are the right ones to own for where you are in life. You begin weighing your options for making withdrawals from your retirement accounts. You aren’t sure exactly how this is done, and you’re nervous about the risk of a stock market pullback and the possibility of running out of money. And then it happens, you begin searching the internet for answers. (That may even be how you ended up here!) After a lot of searching and reading you realize that there are just too many opinions to choose from, and you resort to simply eliminating options that you’re not as familiar with or have heard negative things about. Then you take what’s left and try to put together a coherent strategy while continuing a search to find information that supports what you have contrived.

This is an all-too-common situation. Maybe this is exactly where you are or perhaps it describes something similar, but either way, you wouldn’t be reading this far into the article without some truth to what I am describing.

Regardless of the details, what you do next is critical to your long-term success. The decisions you make will determine the trajectory of your financial future, and it’s imperative to have a good plan to follow.

Learning Center Home

Find Income-Producing Assets

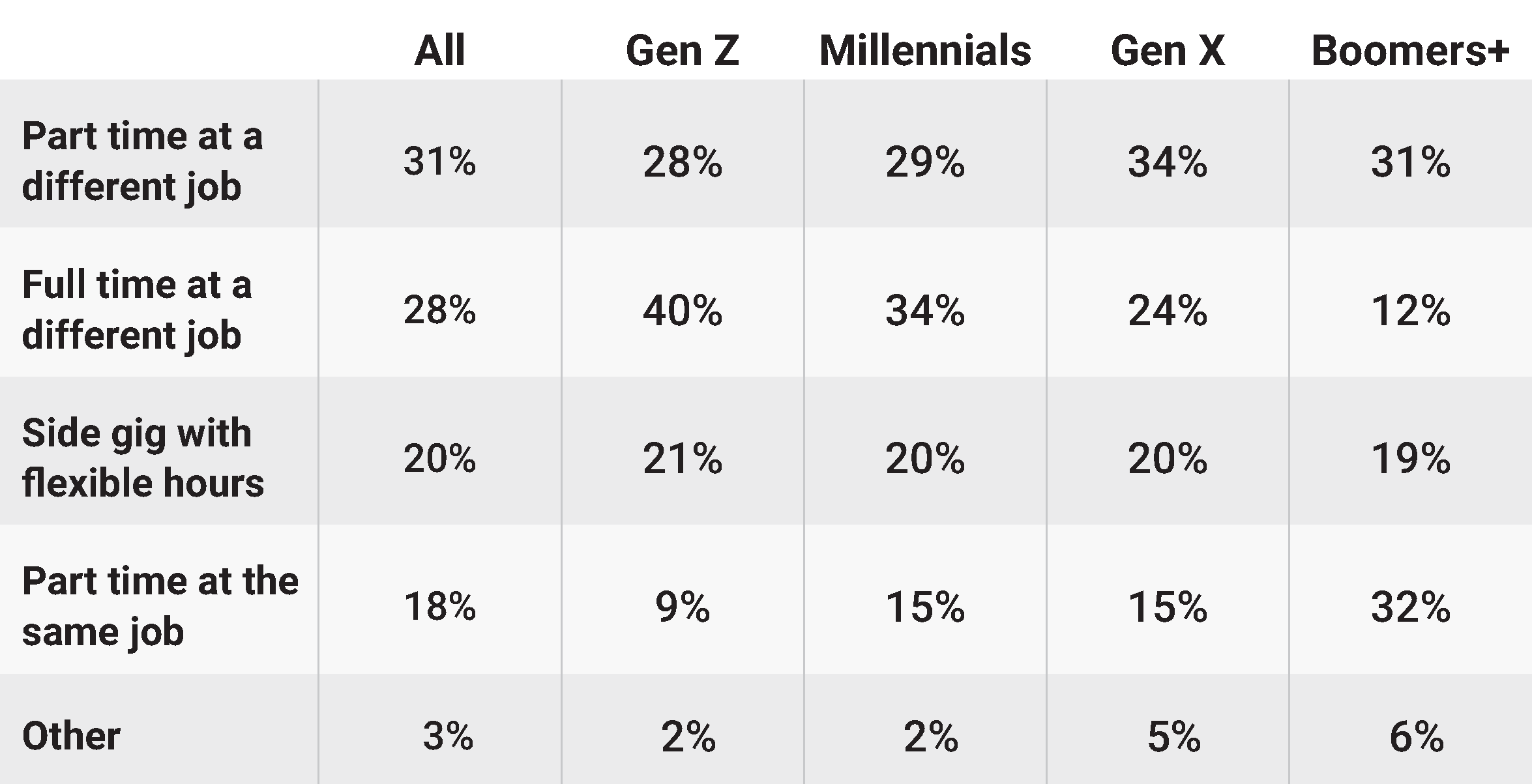

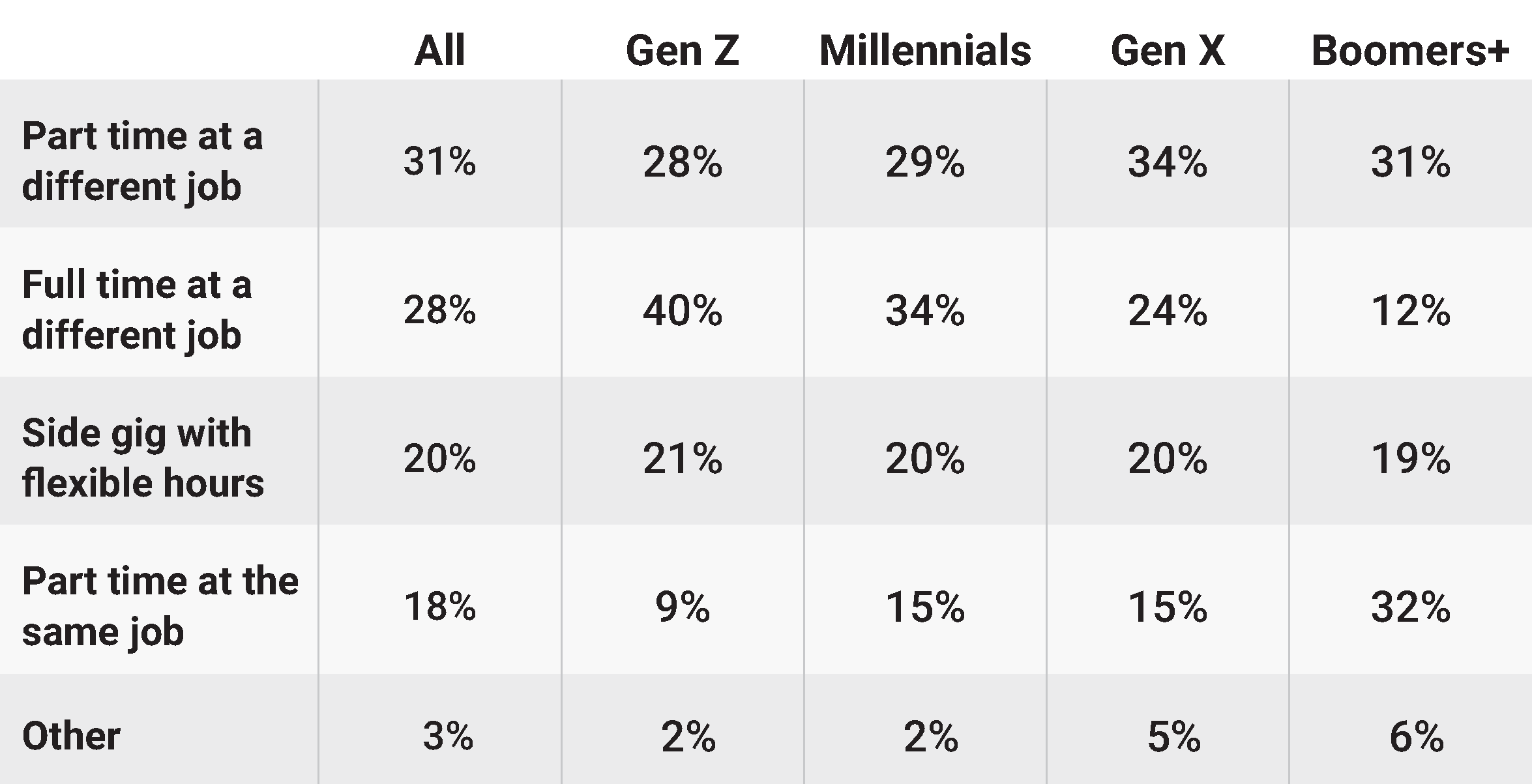

When you’re looking to fill your income gap, the obvious solution is to generate more income to fill it. How this is done can vary from person to person, but the primary outcome you’re looking for is income regardless of how you go about it.

If you’re wanting to remain active, you can consider taking on a part-time job, start or buy a business, acquire some rental properties or work another full-time job that you enjoy.

If you prefer not to work and want passive income, then you’re going to have to rely on income-oriented investments. This would be through specific types of income annuities or select alternative investments that are designed specifically for income.

When doing this, be sure you are working with a qualified professional who is properly licensed and who can education you on your options.

Get A Checklist

It is always a good idea to work off of a checklist, and regardless of where you are in this process, there are likely a few tweaks that can help increase your probability for a successful retirement. I encourage you to formulate a plan that articulates where you are, where you’re going and what needs to be done to start receiving the income you need.

You can download a retirement checklist for free and use it as a guide as you prepare for your retirement. In addition, taking a retirement readiness quiz can be a good idea, too. A quiz is a useful tool to measure your level of understanding about a topic or your readiness for progressing toward something.

This article was written by and presents the views of our contributing adviser(s), not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA.

About The Author

Brian Skrobonja, Investment Adviser Representative

Founder & President, Skrobonja Financial Group LLC

Brian Skrobonja is an author, blogger, podcaster and speaker. He is the founder of St. Louis Mo.-based wealth management firm Skrobonja Financial Group LLC. His goal is to help his audience discover the root of their beliefs about money and challenge them to think differently. Brian is the author of three books, and his Common Sense podcast was named one of the Top 10 by Forbes. In 2017, 2019 and 2020 Brian was awarded Best Wealth Manager and the Future 50 in 2018 from St. Louis Small Business.

1 2

Learning Center Home

1 2

NYSUT NOTE: Are you considering professional financial planning guidance? The NYSUT Member Benefits Corporation-endorsed Financial Counseling Program offers access to a team of Certified Financial Planners® and Registered Investment Advisors that provide members with fee-based financial counseling services. Get unbiased advice that is customized specifically for you and your financial situation. Visit the website for more information or to enroll.

© 2022 The Kiplinger Washington Editors Inc.

How to Know When You Can Retire

Getty Images

You’ve scrimped and saved, but are you really ready to retire? Here are some helpful calculations that could help you decide whether you can actually take the plunge.

See if you can relate to this … You have contributed to a 401(k), 403(b) or other employer-sponsored account at work, maybe you’re paying extra on the mortgage or have already paid it off, you keep cash on hand for those unexpected expenses or upcoming big-ticket purchases and you often wish there was a way to pay less in taxes.

You have worked for 30 or 40 years and are at or approaching Social Security eligibility and are now looking at when to take Social Security to maximize your benefits.

Sound familiar? Now, here’s what often comes next … You look at the account statements and begin to wonder whether the investments you have are the right ones to own for where you are in life. You begin weighing your options for making withdrawals from your retirement accounts. You aren’t sure exactly how this is done, and you’re nervous about the risk of a stock market pullback and the possibility of running out of money. And then it happens, you begin searching the internet for answers. (That may even be how you ended up here!) After a lot of searching and reading you realize that there are just too many opinions to choose from, and you resort to simply eliminating options that you’re not as familiar with or have heard negative things about. Then you take what’s left and try to put together a coherent strategy while continuing a search to find information that supports what you have contrived.

This is an all-too-common situation. Maybe this is exactly where you are or perhaps it describes something similar, but either way, you wouldn’t be reading this far into the article without some truth to what I am describing.

Regardless of the details, what you do next is critical to your long-term success. The decisions you make will determine the trajectory of your financial future, and it’s imperative to have a good plan to follow.

Learning Center Home

How to Know When You Can Retire

Getty Images

You’ve scrimped and saved, but are you really ready to retire? Here are some helpful calculations that could help you decide whether you can actually take the plunge.

Learning Center Home

How to Know When You Can Retire

Getty Images

You’ve scrimped and saved, but are you really ready to retire? Here are some helpful calculations that could help you decide whether you can actually take the plunge.

See if you can relate to this … You have contributed to a 401(k), 403(b) or other employer-sponsored account at work, maybe you’re paying extra on the mortgage or have already paid it off, you keep cash on hand for those unexpected expenses or upcoming big-ticket purchases and you often wish there was a way to pay less in taxes.

You have worked for 30 or 40 years and are at or approaching Social Security eligibility and are now looking at when to take Social Security to maximize your benefits.

Sound familiar? Now, here’s what often comes next … You look at the account statements and begin to wonder whether the investments you have are the right ones to own for where you are in life. You begin weighing your options for making withdrawals from your retirement accounts. You aren’t sure exactly how this is done, and you’re nervous about the risk of a stock market pullback and the possibility of running out of money. And then it happens, you begin searching the internet for answers. (That may even be how you ended up here!) After a lot of searching and reading you realize that there are just too many opinions to choose from, and you resort to simply eliminating options that you’re not as familiar with or have heard negative things about. Then you take what’s left and try to put together a coherent strategy while continuing a search to find information that supports what you have contrived.

This is an all-too-common situation. Maybe this is exactly where you are or perhaps it describes something similar, but either way, you wouldn’t be reading this far into the article without some truth to what I am describing.

Regardless of the details, what you do next is critical to your long-term success. The decisions you make will determine the trajectory of your financial future, and it’s imperative to have a good plan to follow.

Learning Center Home

How to Know When You Can Retire

Getty Images

You’ve scrimped and saved, but are you really ready to retire? Here are some helpful calculations that could help you decide whether you can actually take the plunge.

See if you can relate to this … You have contributed to a 401(k), 403(b) or other employer-sponsored account at work, maybe you’re paying extra on the mortgage or have already paid it off, you keep cash on hand for those unexpected expenses or upcoming big-ticket purchases and you often wish there was a way to pay less in taxes.

You have worked for 30 or 40 years and are at or approaching Social Security eligibility and are now looking at when to take Social Security to maximize your benefits.

Sound familiar? Now, here’s what often comes next … You look at the account statements and begin to wonder whether the investments you have are the right ones to own for where you are in life. You begin weighing your options for making withdrawals from your retirement accounts. You aren’t sure exactly how this is done, and you’re nervous about the risk of a stock market pullback and the possibility of running out of money. And then it happens, you begin searching the internet for answers. (That may even be how you ended up here!) After a lot of searching and reading you realize that there are just too many opinions to choose from, and you resort to simply eliminating options that you’re not as familiar with or have heard negative things about. Then you take what’s left and try to put together a coherent strategy while continuing a search to find information that supports what you have contrived.

This is an all-too-common situation. Maybe this is exactly where you are or perhaps it describes something similar, but either way, you wouldn’t be reading this far into the article without some truth to what I am describing.

Regardless of the details, what you do next is critical to your long-term success. The decisions you make will determine the trajectory of your financial future, and it’s imperative to have a good plan to follow.

Learning Center Home

How to Know When You Can Retire

Getty Images

You’ve scrimped and saved, but are you really ready to retire? Here are some helpful calculations that could help you decide whether you can actually take the plunge.

See if you can relate to this … You have contributed to a 401(k), 403(b) or other employer-sponsored account at work, maybe you’re paying extra on the mortgage or have already paid it off, you keep cash on hand for those unexpected expenses or upcoming big-ticket purchases and you often wish there was a way to pay less in taxes.

You have worked for 30 or 40 years and are at or approaching Social Security eligibility and are now looking at when to take Social Security to maximize your benefits.

Sound familiar? Now, here’s what often comes next … You look at the account statements and begin to wonder whether the investments you have are the right ones to own for where you are in life. You begin weighing your options for making withdrawals from your retirement accounts. You aren’t sure exactly how this is done, and you’re nervous about the risk of a stock market pullback and the possibility of running out of money. And then it happens, you begin searching the internet for answers. (That may even be how you ended up here!) After a lot of searching and reading you realize that there are just too many opinions to choose from, and you resort to simply eliminating options that you’re not as familiar with or have heard negative things about. Then you take what’s left and try to put together a coherent strategy while continuing a search to find information that supports what you have contrived.

This is an all-too-common situation. Maybe this is exactly where you are or perhaps it describes something similar, but either way, you wouldn’t be reading this far into the article without some truth to what I am describing.

Regardless of the details, what you do next is critical to your long-term success. The decisions you make will determine the trajectory of your financial future, and it’s imperative to have a good plan to follow.

Learning Center Home

Important Planning Considerations: Insurance & Long-Term Care

LONG TERM CARE INSURANCE

Your retirement plan isn’t complete until you’ve looked into getting the insurance you need, including a plan for long-term care.

LIFE INSURANCE

Millennials are feeling the need for life insurance due to COVID-19, and the way they’re shopping for it is different than in the past.

How Millennials Are Changing the Life Insurance Game

ESTATE PLANNING

The COVID-19 pandemic isn’t going away soon. This health crisis is dangerous for older Americans. Here is an overview of what you need to cover.

Saving for a rainy day can be a tall order, especially if you have recently experienced a financial setback. Taking even small steps can help you work toward the larger goal of building up your emergency savings.

SAVINGS

Rebuilding Emergency Savings: Take a Realistic Approach

HAPPY RETIREMENT

Finance Fundamentals

Conversation Starter 1: Money talks pay off

Fidelity Investment's 2021 Couples & Money Survey highlights that couples who make decisions about their finances together experience positive benefits. These are heartening statistics in contrast to the 2014 American Psychological Association's survey revealing that 31% of adults with partners cite money as a major source of conflict in a relationship.

In light of these findings, consider these talking points:

Heading into retirement brings a slew of new topics to grapple with, and one of the most maddening may be Medicare. Figuring out when to enroll in Medicare and which parts to enroll in can be daunting even for the savviest retirees. There's Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on.

And what is a doughnut hole, anyway? To help you wade into the waters of this complicated federal health insurance program for retirement-age Americans, here are 11 essential things you must know about Medicare.

Medicare Basics: 11 Things You Need to Know

Rebuilding Emergency Savings: Take a Realistic Approach

What if I need money fast but don’t have enough in my emergency fund?

If you find yourself in the midst of an emergency and haven’t built up sufficient savings, the guidance above may feel like too little, too late. Fortunately, there are short-term sources of funding and relief available, from temporary loan forbearance and debt relief, to lines of credit and new credit cards with zero-interest promotional periods, to employer assistance and unemployment.

Major changes are coming to federal student loan rules, so it's a good time for borrowers to understand how these shifts will impact their financial planning.

Student Loan Counseling

Credit/Debt Counseling

Need an Attorney?

Level Term Life Insurance

Term Life Insurance

Disability Insurance

Long-Term Care Insurance

Auto and Home Insurance

Mortgage Discount Program

Synchrony Bank Savings Program

Learning Center Archives

Student Loan Counseling

Credit/Debt Counseling

Need an Attorney?

Level Term Life Insurance

Term Life Insurance

Disability Insurance

Getting a bill for a medical procedure or an appointment you thought your insurance would cover can throw you for a loop. But if you think the bill was sent to you in error or you believe the amount listed is wrong, you can—and should—fight back. First, though, you need to know common mistakes to look for, as well as what your insurance plan does and does not cover.

Start by reviewing your insurer’s explanation of benefits. Was the service in network—that is, from providers that have typically agreed to reduced reimbursement from your insurance company? Next, call your insurer and ask the insurance representative to explain why the claim was denied (in part or in full), why certain services weren’t covered and what you need to do to fix it.

Denials of claims for in-network procedures are usually the easiest to resolve, says Katalin Goencz, a medical insurance and reimbursement specialist in Stamford, Conn. (Goencz also serves as the president of the nonprofit group Alliance of Claims Assistance Professionals.) If a provider sends incorrect information, it is required to resubmit corrected info directly to the insurance company once the provider has been alerted, she says. For example, an error in how a procedure was coded could lead to a denial, as could an outdated insurance card.

In some cases, you could simply be billed erroneously. For example, the Coronavirus Aid, Relief and Economic Security (CARES) Act mandated that providers offer COVID-19 vaccines and boosters at no charge. Providers are prohibited from charging co-payments or administrative fees. However, you could receive a bill for a COVID-19 vaccination if the provider bills you directly instead of your insurer or due to human error in medical billing systems. If you’re charged for a vaccine, call your provider and dispute the charges. Your insurer may also be willing to help you get the bill waived.

Likewise, the Affordable Care Act requires your insurance to cover all of the costs of annual physical exams and other preventive care. However, if your doctor decides to order extra tests, such as an electro-cardiogram to track heart issues, your insurance company may conclude that the service isn’t a necessary part of your physical exam and send you a bill.

How to Get Your Grown Children to Move Out

Wedding season is in full swing, and along with all the beauty and joy that it can bring, it’s also important to keep in mind that with marriage comes a fair amount of financial decisions and plans to be made. To be sure these are not always the first things we think about, but given my career in finance, I can’t help but bring them front and center.

Whether you are already part of a “we” or are forging a new connection, you’ll need a strong financial foundation for a meaningful and sustainable future. It may not sound romantic at first, but if you’re on the verge of moving your relationship forward in a big way, these three steps can help you deepen one of the most important bonds a couple can share: your finances.

Learning Center Home

Now Is the Time to Protect Your

Health Care Decision-Making Rights

How to Plan for Retirement When Only One Spouse Works

Getty Images

Learning Center Home

In a traditional pension plan, a worker is typically entitled to a normal benefit, payable for their lifetime and equal to a percentage of their final pay, assuming they meet certain work and retirement age requirements. For instance, a plan might stipulate that a participant will receive 50% of their final pay for life, provided they work for 30 years and retire at age 65.

However, when the participant is married, federal law generally requires that the pension be paid as a qualified joint and survivor annuity (QJSA), unless the non-working spouse agrees to a different arrangement. A QJSA ensures that the pension continues to be paid to the surviving spouse after the participant's death, typically at a reduced rate.

For example, Joe, who retires at age 65 with a final pay of $100,000, may be entitled to a $50,000 annual benefit for his lifetime. If he chooses a QJSA with a 50% survivor benefit, he might receive $45,000 annually during his lifetime, with $22,500 continuing to his spouse, Mary, if he predeceases her. The couple may also opt for a larger survivor benefit, though this will further reduce the initial pension amount.

It's essential for both spouses to understand the implications of these choices. Selecting a QJSA may mean receiving a lower benefit during their joint lives, but it may help provide financial protection for the surviving spouse.

Pension decisions for married couples

Spousal IRAs: An important tool for non-working spouses

These days, it’s not uncommon for the spouse with the highest income potential to provide for the family financially while the other spouse stays home to manage the household.

Although this arrangement can work well for child-rearing or eldercare responsibilities in the short term, it can present long-term retirement income planning risk for the non-working spouse. To mitigate this risk, it’s crucial for both spouses to be informed and actively involved in retirement planning decisions.

Understanding spousal rights related to retirement planning is a key step in ensuring financial security for the non-working spouse.

When you're married but only one spouse works, leaving retirement planning to the working partner puts financial security at risk. A joint effort is vital.

NYSUT NOTE: Keeping a close eye on your finances is even more important when only one spouse is in the workforce. The NYSUT Member Benefits Corporation–endorsed Financial Counseling Program can advise on a wide range of topics from estate planning to basic budgeting. It's only $260 annually for a full-service plan with unbiased, objective insight.

The 6-to-1 grocery method provides structure to your grocery list, making shopping easier and more cost-effective. Next time you go to the supermarket, you’ll buy six vegetables, five fruits, four proteins, three starches, two sauces/spreads and one "fun" item as a treat.

“This makes grocery shopping way easier, way cheaper and you get in and out, so you’re not there all day long,” Chef Coleman says in a TikTok explaining the method.

Before you go to the store, you may want to have an idea of some meal concepts you plan on cooking in order to narrow down your choices, but the method itself is meant to provide flexibility.

You might choose to buy what’s on sale (even if it’s not the vegetables or meat you initially planned on purchasing) to further increase your savings. Maybe you need to opt for frozen veggies instead of fresh ones. Or maybe you have a large family and need to increase the quantity of food you buy. Overall, the method is supposed to be adapted to your personal preferences and needs.

Tom Jauncey, CEO at Nautilus Marketing told Kiplinger he saves $50 a week by using this method and recommends it for individuals who want to streamline grocery shopping while saving money.

Health.com provides a great example of what a 6-to-1 grocery list looks like and what meals you can make with those ingredients.

The 6-to-1 grocery method

Before your lovely offspring first sits behind the wheel of a car, you need to be certain they are covered on your auto insurance policy. Check with your insurance agent or broker, and be sure that is done properly. Most of the time, there will not be an additional cost to add a person who has a learner’s permit to an auto insurance policy — but check to be sure. Do a good job as the driving coach, and you’ll be rewarded handsomely when it comes time for your dude or dudette to drive off on their own. Or will you?

When the day comes that your little (but getting bigger) one has a driver’s license, you must make that call to your insurance company to let them know that, as Rafiki says in The Lion King, “It is time.” The reaction from your insurance company will be not much different from the initial reaction you had when you first started teaching your child the rules of the road — sheer terror. Can you blame them?

Before you hit the road

Wills and trusts are legal instruments tailored to pass your assets to your heirs in the ways that you wish. A will takes effect after you die, whereas a trust, with someone designated to oversee it, can manage your assets while you’re still living.

A will is often used as a cost-effective option for those with smaller estates. A trust is often implemented when one has a large estate, wants more control over asset distribution and values privacy. Trusts help to bypass probate — the court-supervised process for distributing your property. Probate is a public process that is costly and time-intensive due to professional and administrative expenses. Depending on the type of assets or items that you own, the court requires professionals to assess an accurate value and ensure that they’re being distributed properly to the rightful heirs.

Often, people choose family members to administer the estate, but that can be challenging, especially if they don’t understand tax laws and have the expertise to manage certain types of complex assets, real estate and retirement accounts. In some cases, the process often becomes more expensive and time-intensive.

Then there are the family dynamics to consider when you choose an executor. If family members don’t get along or disagree on how the estate is being handled, that may also add more time and expense — in addition to mental anguish. If you do go the professional route to administer the estate, you want to balance the cost of paying an estate expert versus having a family member navigate the different pieces.

Selecting the right person to administer the estate

Are You an Estate Planning Procrastinator? Where to Start

Getty Images

Scoring a low mortgage rate is a top priority for many potential homebuyers, as owning a home has become increasingly more expensive over the last several years. Unfortunately, although mortgage rates fell significantly earlier this year — hitting their lowest level since February 2023 (6.09%) after the Fed's September rate cut — they've since crept back towards 7%. And according to Freddie Mac, they could still remain volatile following the Fed's anticipated rate cut this week.

High mortgage rates and home prices have long been pushing buyers out of the market and leading others to back out of deals. In June, as home prices hit an all-time high, 56,000 home purchases were canceled, equal to 15% of homes that went under contract, reports Redfin.

“I’m seeing some buyers pull out of the market because they can no longer afford a home loan,” Ralph DiBugnara, a senior vice president at Cardinal Financial, a national mortgage lender headquartered in Scottsdale, Ariz. said. “I’m also seeing a rise in the number of people who are getting cosigners, and I’m seeing a lot of buyers lowering their price range.”

According to Zillow, nearly one-quarter of listings (24.5%) received a price cut in June of this year as competition cooled and sellers looked to entice buyers. But a large swath of buyers are reassessing whether it's the right time for them to purchase a home. Many homebuyers are holding off on entering the market in case lower rates do materialise.

This makes sense because even a small change in mortgage rates can have a significant impact on how much homebuyers pay. To test that theory out, you can compare current mortgage rates with our tool, in partnership with Bankrate, below, or use our mortgage calculator to find your monthly payment.

Rates are high this year, but you can still score a low mortgage rate with these tips.

Five Ways to Shop for a Low Mortgage Rate

If you're looking to purchase a home in this market, taking these steps can help you score a low mortgage rate:

How to score a low mortgage rate

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA.

About the Author

Daniel Bortz

Contributing Writer, Kiplinger Personal Finance

Daniel Bortz is a freelance writer based in Arlington, Va. His work has been published by The New York Times, The Washington Post, Consumer Reports, Newsweek, and Money magazine, among others.

NYSUT NOTE: If you're trying to save even more money on your mortgage, the NYSUT Member Benefits Corporation-endorsed UnionDirect Mortgage Discount Program from Mid-Island Mortgage can save members up to $2,700. Whether you're looking for a new home or trying to lower your existing mortgage, this program may suit your needs.

Divorce is not easy, but you do not have to do it on your own. The divorce industry has stepped up to the plate with numerous legal, financial and emotional support structures to help empower those moving from coupledom to single life with the right legal advice and financial security.

Be sure to reach out to a divorce attorney who is highly recommended in your state as well as a Certified Divorce Financial Analyst™ to ensure that you understand all the legal and financial issues of your divorce.

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA.

Hands down, the 529 plan is a great way to save for college. The tax benefits are key. With a 529 plan, you pay no annual taxes on the investment gains inside the account, plus distributions for qualified expenses like tuition, certain fees and qualified room-and-board expenses are tax-free.

A relatively new provision allows account owners to withdraw $10,000 a year per student for private primary or secondary education.

Each state administers its own plan, and you are free to use any state’s plan. However, some states offer a state-tax deduction if you are a resident and use its in-state plan. That’s the basics, there is much more to know, but today I want to focus on five ways parents can maximize their 529 plan.

The Time Horizon Is Not Freshman Year

Parents of teenagers often ask me if they should open a 529. They wonder if it makes sense given how close the child may be to needing the money for college. While there are a variety of factors to consider, I remind parents the time horizon for needing the money for college is not freshman year, but by senior year. So, for instance, a parent with a 13-year-old may think they have only four years till they’ll need the 529 money, when in reality the time horizon could be eight years, since not all the money is withdrawn in the freshman year. If that is the case, then yes, eight years may still be enough time to invest in a 529. (There may be some financial aid considerations.)

Having said that, I probably wouldn’t invest all the 529 money in equity mutual funds, given the time horizon is only eight years — that is too risky. But perhaps the tuition payment earmarked for the eighth year, or senior year, could be invested in a dividend-paying mutual fund or a balanced mutual fund, since that has the longest time horizon. I suggest consulting with a qualified financial adviser who can help ensure your investment mix is aligned properly with your risk tolerance and time horizon.

Make a List

NYSUT NOTE: Divorce can be complicated, but when you have the right team in place it can help simplify the process. The NYSUT Member Benefits Trust-endorsed Legal Service Plan is available to help provide legal assistance for many of the issues that may be affected by divorce. Provided by the law firm of Feldman, Kramer & Monaco, P.C., NYSUT members can get unlimited access to toll-free legal advice from a national network of lawyers. For more information or to enroll, click here.

2. Gross up the monthly amount to account for taxes

It’s likely that the majority of your retirement savings will be taxed in some shape or form. Roth IRAs and municipal bonds are notable exceptions.

If your monthly expenses are $10,000 and your effective tax rate (how many cents you lose on the dollar to taxes) is 20%, divide $10,000/0.8, to arrive at $12,500 per month. That’s the gross amount you’ll need every month to end up with $10,000 in your bank account to cover your expenses.

NYSUT NOTE: Getting a plan in place to manage your debt isn’t always easy. But with the help of the NYSUT Member Benefits Corporation-endorsed Cambridge Credit Counseling program, NYSUT members have the opportunity to work with a certified counselor on possible debt elimination options. With over 20 years of experience assisting consumers with debt, Cambridge can work with you to determine the most appropriate course of action for your specific debt situation. Get a better understanding of debt consolidation, student loan repayment options and more by visiting the website today.

NYSUT NOTE: Divorce can be complicated, but when you have the right team in place it can help simplify the process. The NYSUT Member Benefits Trust-endorsed Legal Service Plan is available to help provide legal assistance for many of the issues that may be affected by divorce. Provided by the law firm of Feldman, Kramer & Monaco, P.C., NYSUT members can get unlimited access to toll-free legal advice from a national network of lawyers. For more information or to enroll, click here.

When the Fed raises interest rates, rates on savings accounts usually rise in tandem. For this reason, when the Fed started its rate-hiking campaign in March 2022 to reduce high inflation, savings rates rapidly rose. However, when the Fed cuts rates, which it's expected to do again this week, this means savings rates will also take a cut.

But don't expect your savings rate to drop off right away. As of right now, some of the top-earning high-yield savings accounts and CD accounts still offer rates of well over 4% and 5%, and after a rate cut, these accounts should still offer competitive rates — just not as good as they once were.

For example, at the start of September, a Marcus by Goldman Sachs savings account had an APY of 4.40%. After the September 18 Fed meeting, where they announced a 50 bps (0.50%) cut, Marcus dropped its savings rate to 4.25%, and in mid-October, it dropped to 4.10%, per a Kiplinger staffer with the account. So while the Fed cut 0.50%, Marcus over that month period cut 0.30%.

But the Fed isn't expected to stop after two rate cuts — and your savings rates will continue dropping throughout the next couple of years. Most central bankers expect one quarter-point cut to the federal funds rate this week, four more in 2025 and another four in 2026.

Still, if you don't already have one, it's worth opening a high-yield savings account despite the next Fed meeting, so you can take advantage of high rates before they significantly fall. Even though rates are lower, there are still higher returns for your cash in high-yield savings accounts than sitting in an average checking or savings account.

Another option, which can help you avoid falling rates completely, is to open a CD account. Since the APY on a CD account is fixed, if you lock up your cash in one now, you won't have to worry about your APY going down until the CD matures. Just make sure you're comfortable with not being able to access your cash until the account matures.

Getty Images

Experts say the Federal Reserve will cut interest rates again at the next Fed meeting. Here's what that means for savings rates.

Learning Center Home

What a Fed Rate Cut Means for Savings

NYSUT NOTE: No matter your age, you can get valuable financial advice from the NYSUT Member Benefits Corporation–endorsed Financial Counseling Program. All NYSUT members are eligible to enroll and, with a full-service plan costing only $260 annually, unbiased advice is only a phone call or virtual consultation away.

NYSUT NOTE: Whether you want to take our advice on one of these international trips or opt for a domestic vacation, the NYSUT Member Benefits Corporation–endorsed Grand Circle Travel & Overseas Adventure Travel program offers special pricing on group tours for American travelers over 50 years old. You can save $150 per person on published tours simply by being an NYSUT member!

Learning Center Home

1 2

How the Life Insurance Game Is Changing

Millennial consumers love customization. With so much information readily available, there is quite a bit you can do on your own if you choose to. And when you are ready and have questions or want a more guided experience, there is a financial professional who will be able to help. Whether by phone, by video, online or the good old-fashioned face-to-face meeting, a financial professional is always a great stop on this journey to be sure you have considered your needs and options. There are nuances to the features and benefits of life insurance, and an experienced professional can help you sort it all out. Among millennials who purchased life insurance in the pandemic, more than half used a live adviser, and 30% used both a live adviser and online elements in their purchase, according to Boston Consulting Group.

In addition to helping provide financial security for your loved ones in case you pass away, many life insurance policies now also offer optional riders (sometimes at additional cost) that can help address other concerns, like chronic illness or longevity risk.

Your move, millennials: Choose the method that works best for you. That may be an online-only purchase, using a live adviser, or some combination of the two. If you’re not sure where to turn for help, your employer may provide access to an adviser. It is also likely that friends or family members may have a referral for you. This is one of the most common ways advisers acquire new clients. Finally, many states have registration requirements and often have online directories of licensed financial professionals. Without a referral from someone you trust, it is a good rule of thumb to select two to three people to interview so that you can find the best person for you.

As millennials become more likely to purchase life insurance, insurers have evolved their offerings to create new products and innovations to meet their needs. That’s great news for first-time applicants who may find a much more painless process than expected.

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA.

About The Author

Salene Hitchcock-Gear, President of Prudential Individual Life Insurance

President of Prudential Individual Life Insurance, Prudential Financial

Salene Hitchcock-Gear represents Prudential as a director on the Women Presidents’ Organization Advisory Board and also serves on the board of trustees of the American College of Financial Services. In addition, Hitchcock-Gear has a bachelor’s degree from the University of Michigan, a Juris Doctor degree from New York University School of Law, as well as FINRA Series 7 and 24 securities licenses. She is a member of the New York State Bar Association.

Good news: You can have it your way!

NYSUT NOTE: The NYSUT Member Benefits Trust-endorsed WrapPlan® II Universal Life Insurance Plan underwritten by Transamerica Financial Life Insurance Company allows you to purchase life insurance coverage that increases as your term life coverage decreases or terminates. For more information on requirements and how it works, visit the NYSUT Member Benefits website today.

Kiplinger is part of Future plc, an international media group and leading digital publisher

© 2023 Future US LLC

Learning Center Home

1 2

Heading into retirement brings a slew of new topics to grapple with, and one of the most maddening may be Medicare. Figuring out when to enroll in Medicare and which parts to enroll in can be daunting even for the savviest retirees. There's Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on.

And what is a doughnut hole, anyway? To help you wade into the waters of this complicated federal health insurance program for retirement-age Americans, here are 11 essential things you must know about Medicare.

Getty Images

There’s Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare—and much more.

Learning Center Home

Medicare Basics: 11 Things You Need to Know

NYSUT NOTE: As interest rates continue to increase, there is no better time to address outstanding credit card debt. The NYSUT Member Benefits Corporation-endorsed Cam-bridge Credit Counseling program can help members get a better understanding of their debt consolidation and repayment options. NYSUT members are eligible for a free, no-obligation, debt and student loan consultation with one of Cambridge's certified counselors, who will help determine the most appropriate course of action for your spe-cific debt situation. To find out how to speak to a counselor, visit the website for more information.

NYSUT NOTE: As interest rates continue to increase, there is no better time to address outstanding credit card debt. The NYSUT Member Benefits Corporation-endorsed Cam-bridge Credit Counseling program can help members get a better understanding of their debt consolidation and repayment options. NYSUT members are eligible for a free, no-obligation, debt and student loan consultation with one of Cambridge's certified counselors, who will help determine the most appropriate course of action for your spe-cific debt situation. To find out how to speak to a counselor, visit the website for more information.