INTRODUCTION

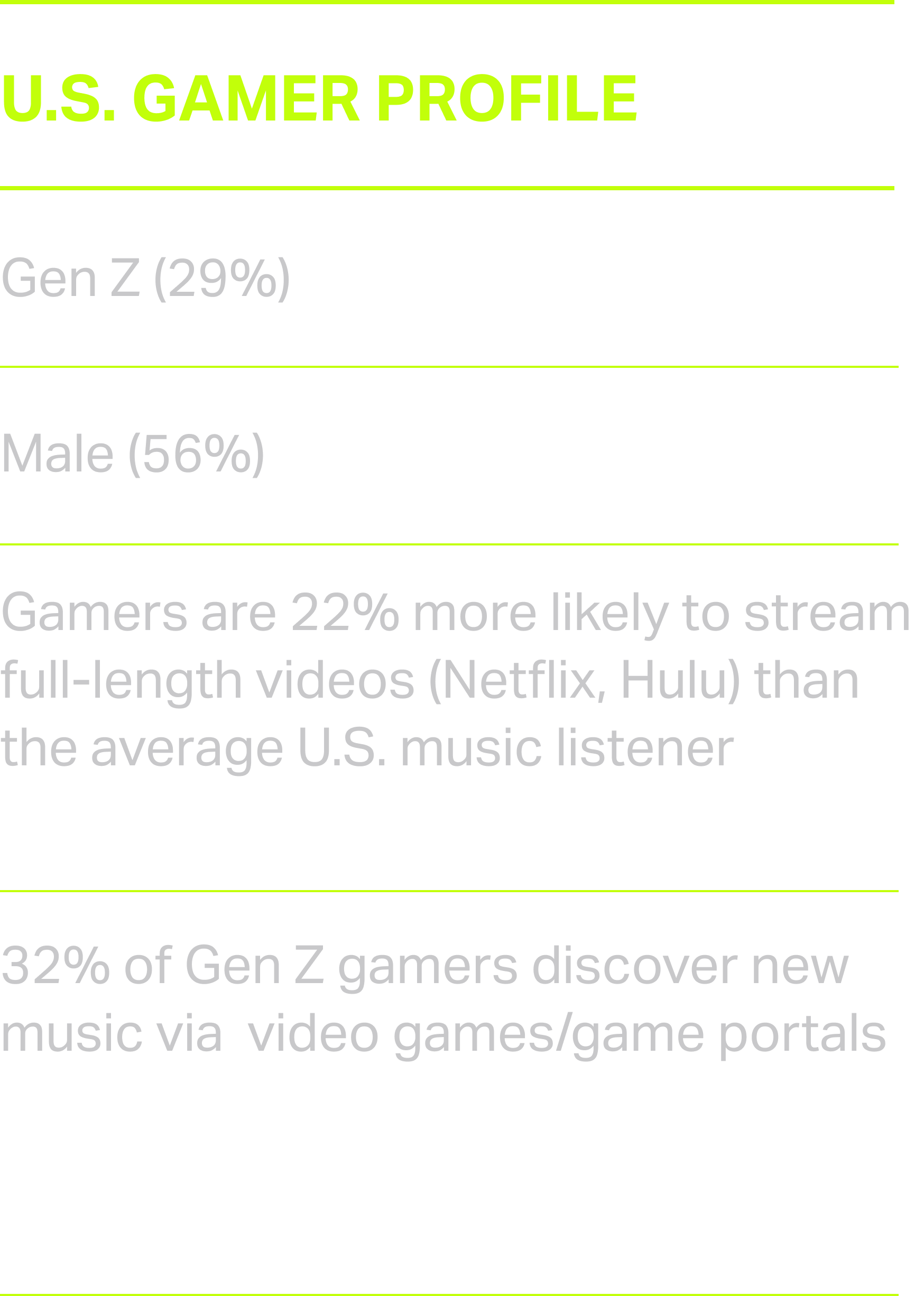

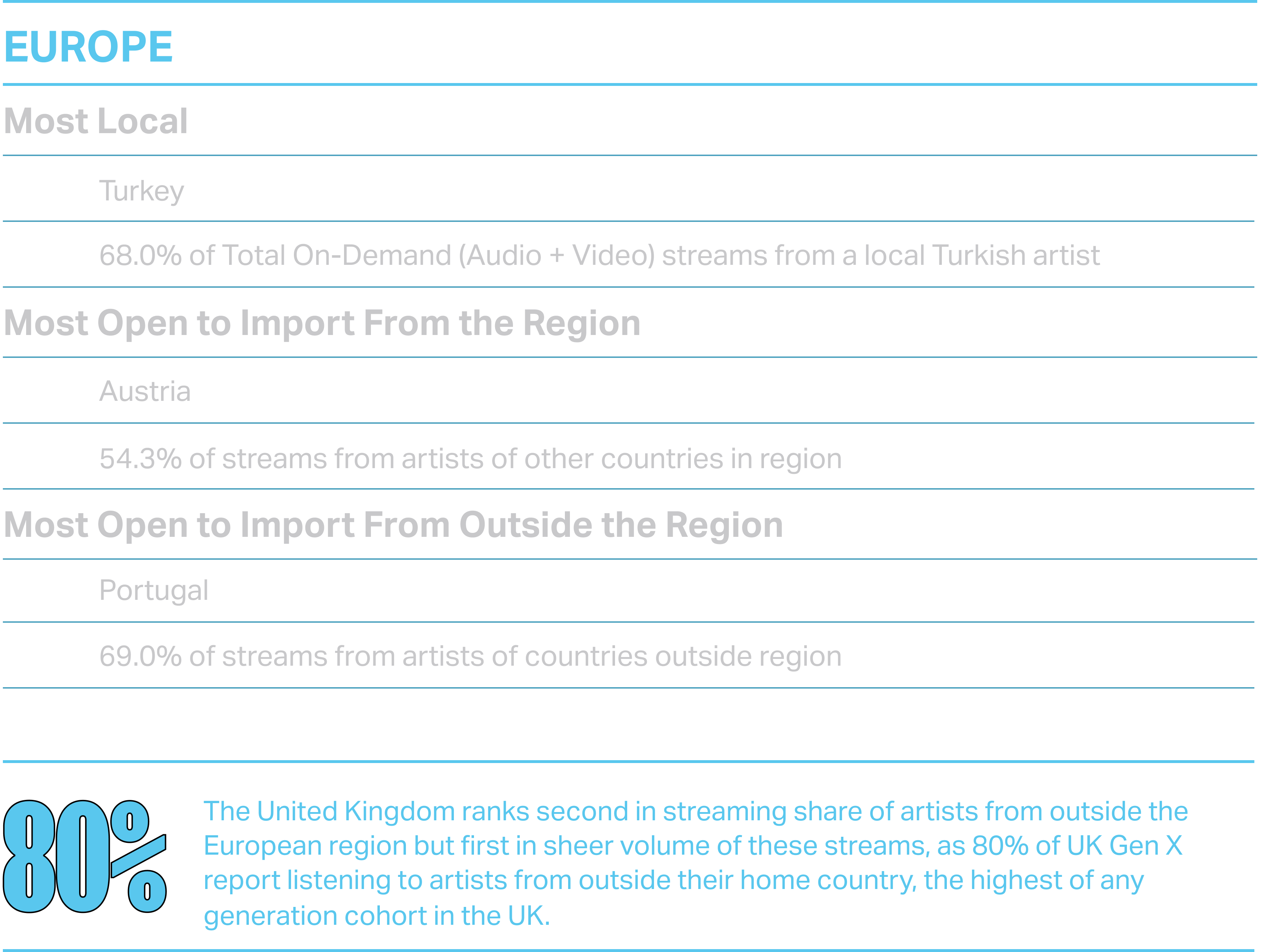

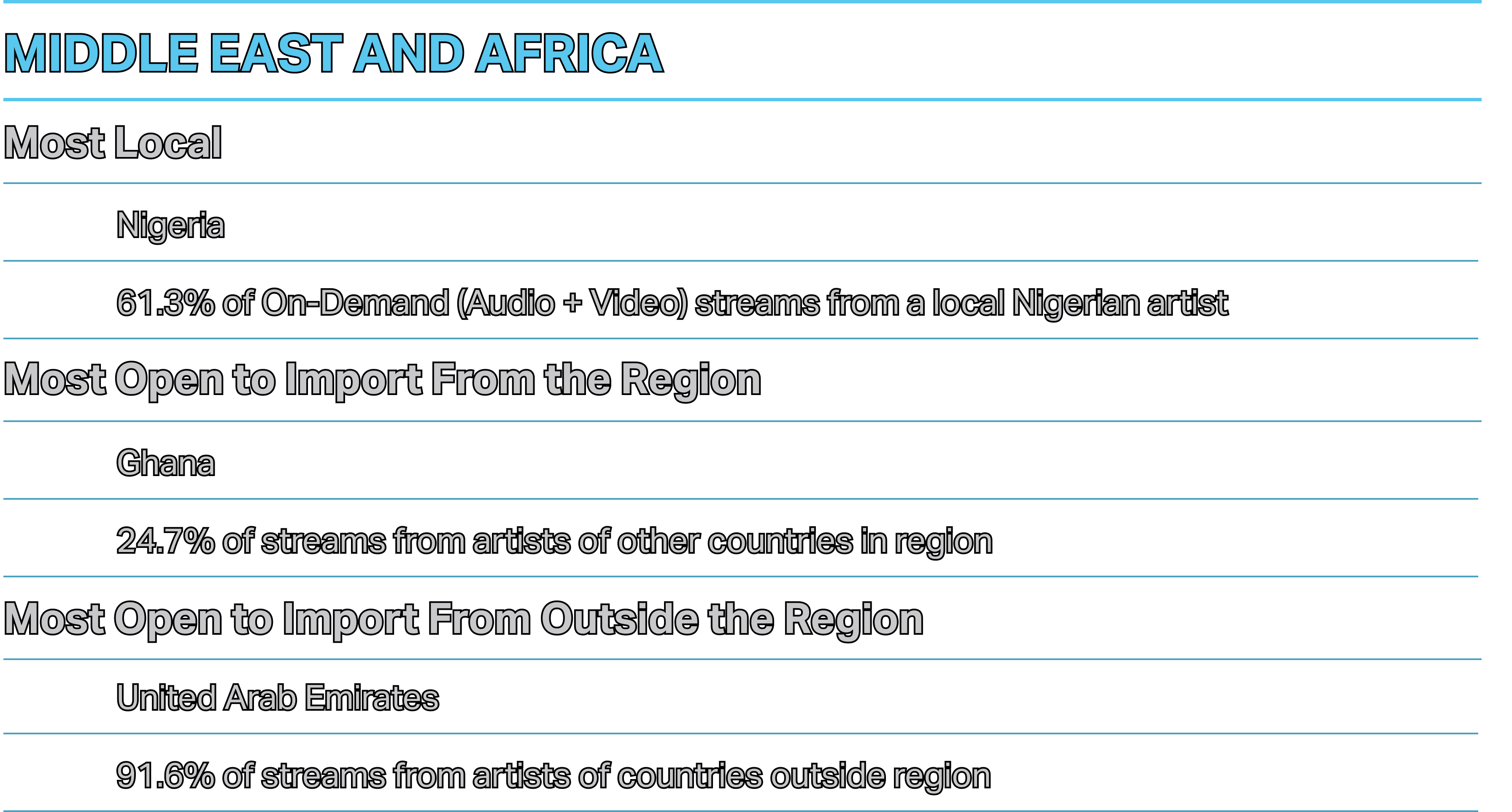

Midway through 2025, our focus at Luminate remains squarely on the intersection of growth and disruption within the music industry. Undoubtedly, the past six months have already delivered an abundance of both. From Los Angeles to Tokyo, New York to London and everywhere the music industry operates, two questions consistently emerge: Where is the next wave of growth coming from, and is AI an enabler or a disruptor in this evolving landscape? Our 2025 Midyear Music Report directly addresses the first question and sets the stage for a deeper exploration of the second.��Luminate’s operational scope has expanded dramatically in just four years. Following extensive investment, our technology now processes over 30 trillion data points across more than 200 million recordings, spanning more than 60 markets and, in some cases, analyzing data that extends back beyond three decades. In an industry increasingly driven by data and constantly seeking to understand future trends, Luminate provides an unparalleled solution for our global customers and partners. As AI technologies become more deeply integrated into every facet of our lives and businesses, accurate and actionable data stands as the crucial differentiator for any business aiming to navigate this complex future.��With an industry narrative of slowing growth in streaming, our data confirms a deceleration in growth for both U.S. and Global On-Demand Audio streaming. U.S. streaming grew by 5% and global streaming by 10%, compared to 8% and 15% respectively in 2024. However, our Midyear Music Report identifies numerous opportunities for continued diversification and growth across the industry. For example, the evolving interplay of generations, genres and growth is clearly demonstrated by the resurgence of the Christian/Gospel genre. This multifaceted trend is fueled by its artistic evolution, enhanced accessibility through digital platforms, influence of modern worship movements, rise of powerful subgenres such as Christian Hip-Hop and a growing consumer demand for authentic content.��In 2022, Luminate significantly expanded its global music coverage to 48 countries, a number that is now over 60 with the recent addition of key markets across the Middle East, North Africa and Sub-Saharan Africa. Our bet that music would become more global than ever in 2025 is validated through our Export Power Rankings. Comparing rapidly expanding markets such as the Middle East and Africa with Latin America, the data highlights distinct regional trends. Nigeria and Brazil show strong local consumption, with 61% and 75% of streams, respectively, originating from local artists. Conversely, Ghana and Bolivia are most receptive to regional imports in their area, at 25% and 65%, respectively, while markets including the UAE and Peru see a significant portion of their streams (92% and 36%) from artists outside their region.��In 2025, Luminate further extended its coverage to include musical activity within gaming environments, initially launching with Epic Games. The music industry has long identified gaming as a significant growth opportunity, and the sector is eager to highlight its importance to artists and labels. Luminate is uniquely positioned to narrate this trend, and we look forward to collaborating with more gaming partners in the coming quarters.

As the integration of Luminate’s data across music, film and television continues, we are uncovering more and more examples of transmedia impact. The transmedia opportunity represents the strategic advantage of telling a unified story, or brand building, across multiple distinct media platforms, with each uniquely contributing to the overall narrative experience. Among the many instances observed in 2025, Led Zeppelin and LISA stand out. The documentary Becoming Led Zeppelin, streaming on Netflix, emerged as the year’s top music documentary so far, driving a sustained 23% increase in the band’s streaming over four months. Similarly, Thai artist LISA recently starred as Mook in Season 3 of HBO’s The White Lotus. The show’s release coincided with LISA’s Alter Ego album launch, introducing her to new audiences as her TV role attracted fans to the series, particularly those interested in travel — a central theme of The White Lotus.��Finally, we turn to AI. Luminate data indicates that one in three U.S. music listeners express being “somewhat” or “very” comfortable with the use of generative AI to create song instrumentals, with younger audiences showing even higher comfort levels. While 44% report discomfort with generative AI creating new original songs performed by an AI voice, listeners of certain genres, such as EDM and K-pop, are notably more open to this practice. Currently, the emergence of artists including The Velvet Sundown and Aventhis marks a pivotal and inherently controversial moment in the long history of technology’s influence on music. Unlike previous technological advancements that primarily augmented human artistry or transformed distribution, these acts appear to be fundamentally AI generated, directly challenging the very definition of artistry itself. The historical trajectory of technology in music has predominantly been a narrative of amplification and accessibility, from recording devices preserving sound to digital audio workstations empowering creators and democratizing listening. ��However, the significant streaming activity of artists such as The Velvet Sundown and Aventhis signifies a new frontier where technology transcends its role as a mere tool to become a direct competitor. Their very presence challenges existing economic models, legal frameworks and the foundational definitions of artistry within the music industry. Their rise necessitates a critical examination of ownership, compensation, authenticity and the future of human creativity in an increasingly AI-driven world. And the ongoing debate surrounding them encompasses both the rapidly improving quality of their music and also the profound existential and economic questions they pose for human artists. Look to Luminate in the coming months to provide more clarity on the scale and impact of AI-generated music on the industry.��We often say that Luminate delivers facts, not opinions. While some of the observations in this report lean into analysis, we appreciate you taking the time to review these insights. We’re confident they’ll prove valuable as you navigate the data-driven music industry in the months ahead. ��Be sure to let us know.

Rob Jonas / CEO Luminate

Redefining Entertainment Intelligence.

Luminate continues to deliver powerful, actionable data and insights across music, film and television. In the first half of 2025, we expanded our customer and partner ecosystem, released groundbreaking features and expanded our global footprint. Here’s a snapshot of what we’ve done — and we can’t wait for the second half of the year!�������

ABOUT

LUMINATE

Luminate is the entertainment industry’s most trusted data partner, delivering the most essential, objective and trustworthy insights to drive businesses forward across music, film and television. Operating at the intersection of technology and creativity, Luminate manages 30 trillion data points from hundreds of verified sources and is globally recognized for its AI achievements. The company’s products and expert consultative services offer unparalleled cultural significance, consistently fueling Billboard’s authoritative music charts for over 30 years, driving Variety’s Streaming Originals charts and acting as an official data source for the Golden Globes. Luminate is an independently operated company, a subsidiary of PME TopCo., a joint venture between Penske Media Corporation and Eldridge.

IN THIS�. REPORT

Midyear Metrics

Streaming Atlas

Import / Export

Engagement Horizon

Artist Spectrum

Future in Focus

Midyear Charts

01

02

03

04

05

06

07

Midyear Metrics�

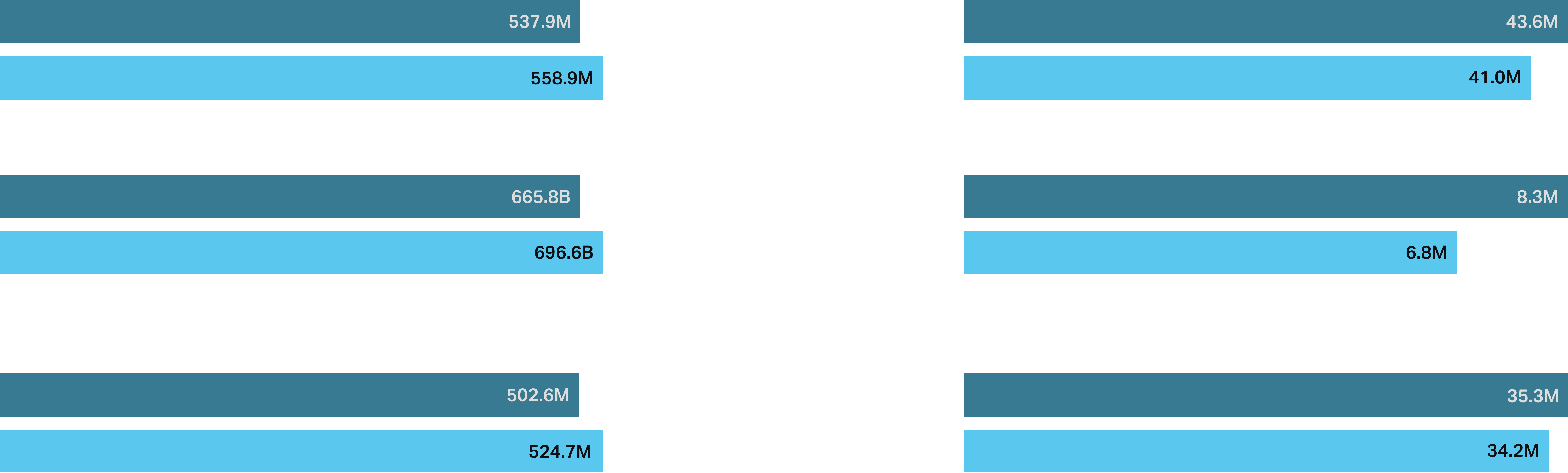

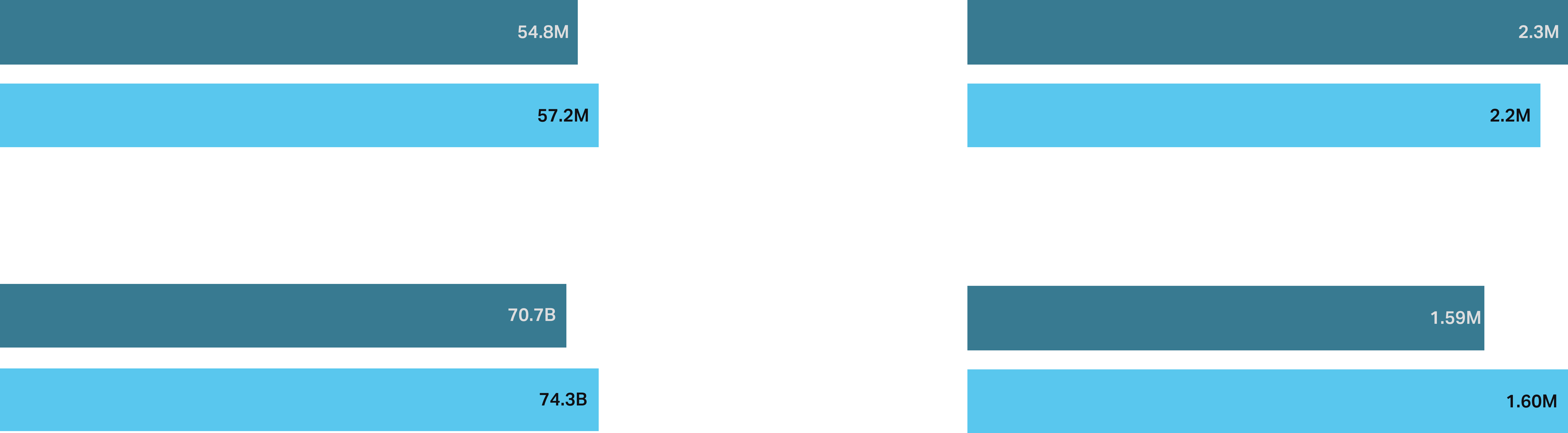

Consumption & Sales

�

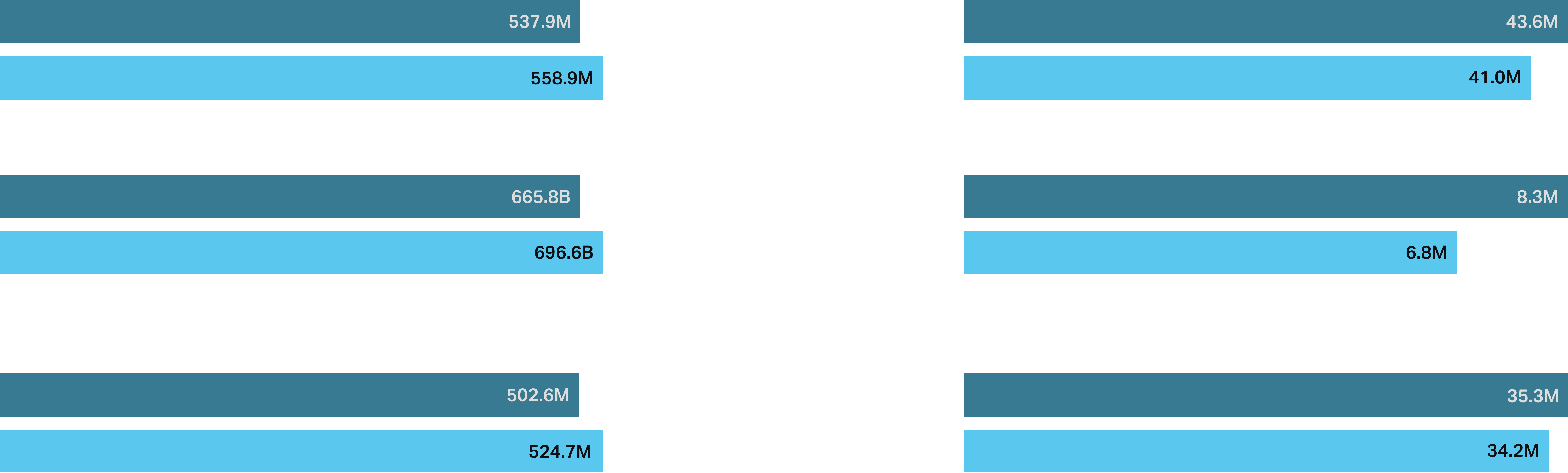

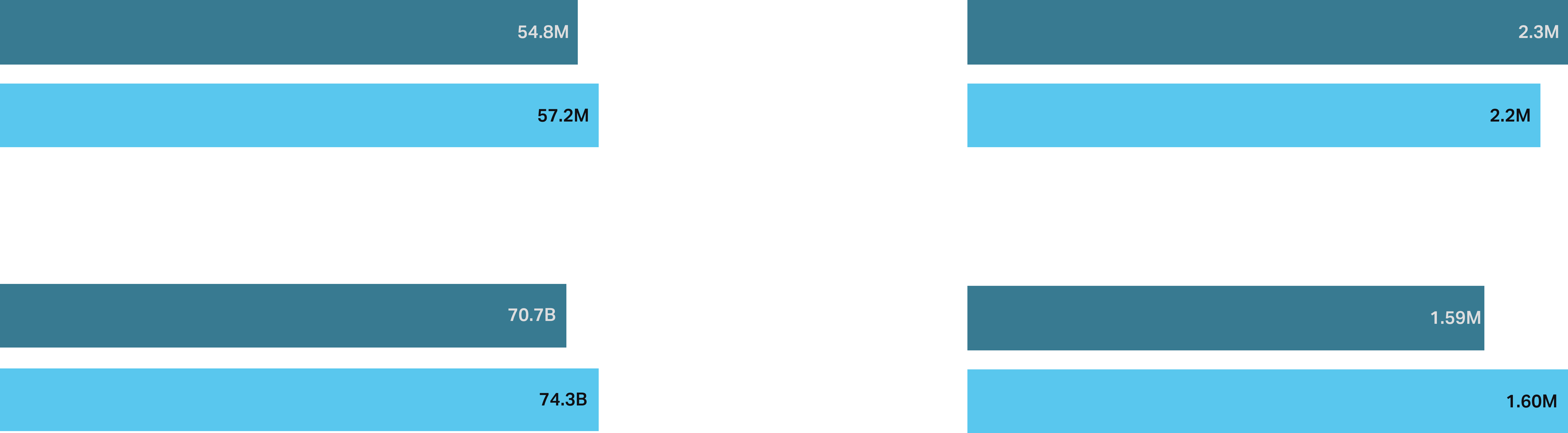

DATE RANGE FOR CONSUMPTION DATA:�WEEKS 1-26 2025 VS. WEEKS 1-26 2024 (1/3/25-7/3/25 vs. 12/29/23-6/27/24)

Harnessed our partnership with Snowflake to deliver data and insights faster��Launched in-game music consumption activity into our platform, unlocking a key music discovery channel for Gen Z and Gen Alpha��Revealed country-level music activity in 13 additional countries in the Middle East and Africa, bringing our total to 60 countries, as well as provided a full global view��Evolved the Luminate Index, measuring artists’ star power for brand integrations or partnerships��Expanded business in the Asia-Pacific region through market development partners KreatorsNetwork in South Korea and Billboard Japan��Expanded API access, upgrading Music and debuting Streaming Viewership (M), unlocking deeper data access and analysis��Introduced Audience Demographic Data in Streaming Viewership (M) to reveal age and gender breakdowns for top film and series titles on the major U.S. streaming platforms��Learn more about our data and solutions at luminatedata.com.

Mapping Music, Fans and Influences Worldwide

�

Streaming accounted for 92% of U.S. music consumption in early 2025, but a closer look reveals shifting genre dynamics and evolving audience behaviors. Luminate’s data highlights these trends, helping to understand emerging audience behaviors and offering insights into the future of music consumption.�

Streaming Atlas:

Global Metrics

U.S. Metrics

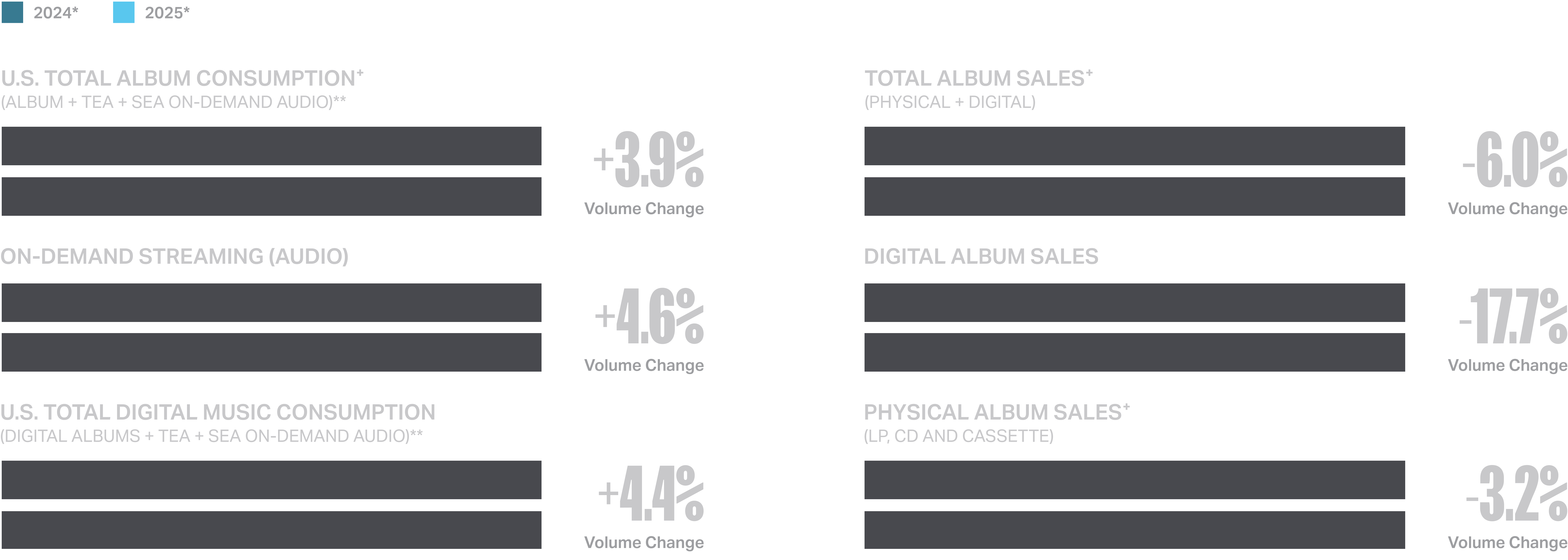

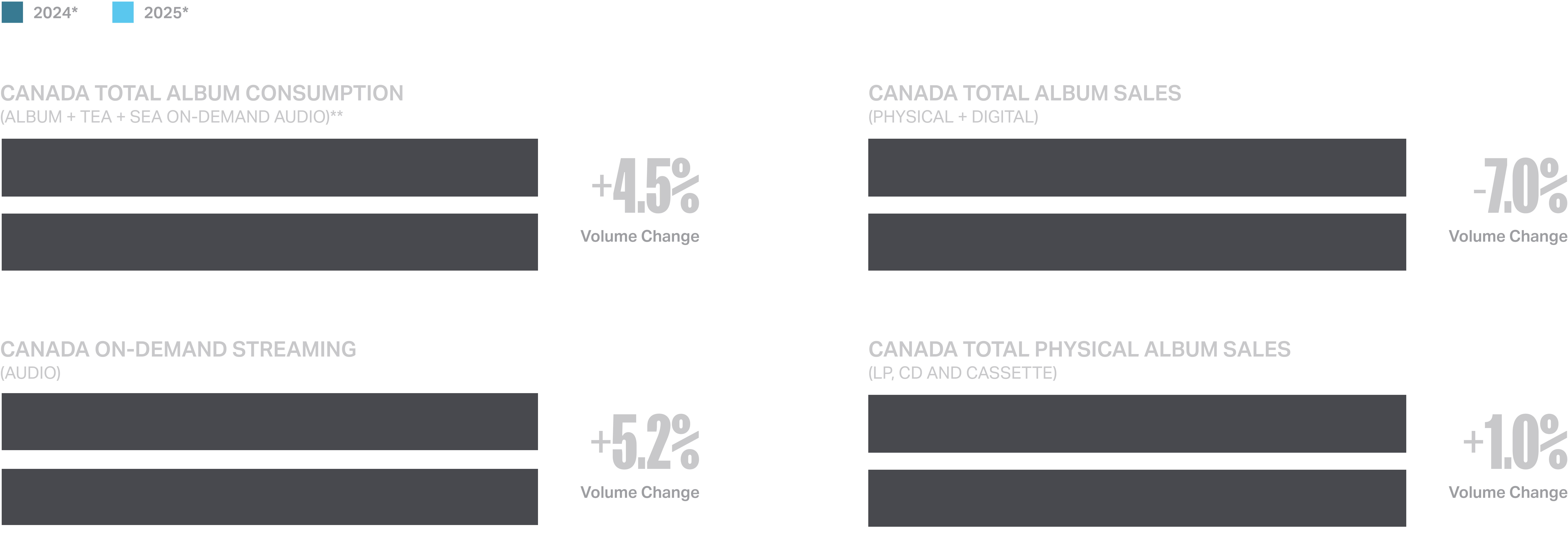

Canada Metrics

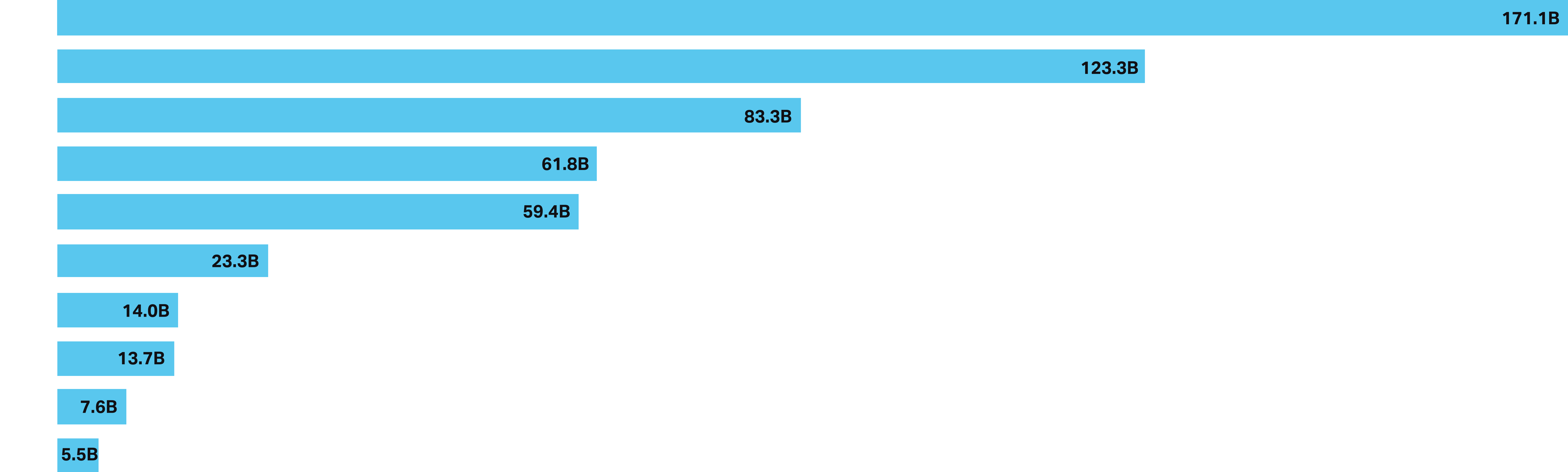

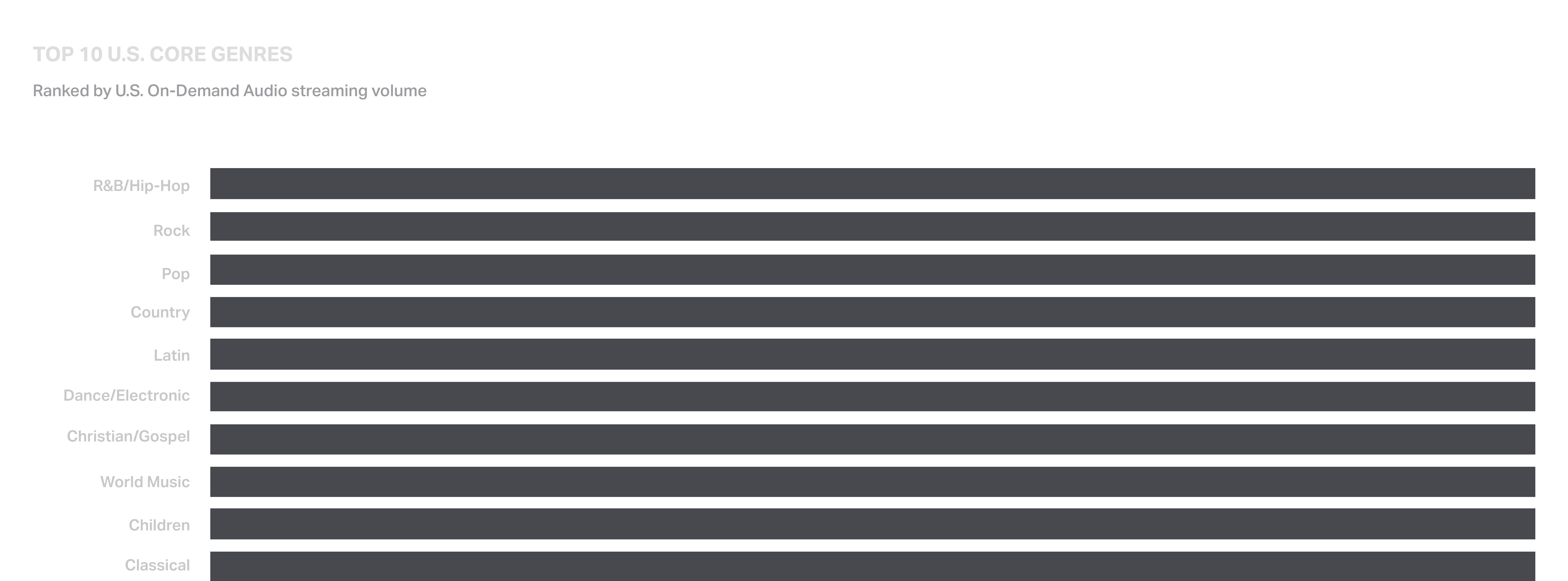

U.S. Core Genre Trends in 2025

While the top 10 U.S. core genres remain the same as in 2024, Christian/Gospel passes World Music to place 7th in On-Demand Audio (ODA) volume, while Rock leads in growth and the Sinners Original Motion Picture Soundtrack and the adjacent activity of featured artists helps drive Blues.

Highest-Growth Genres in U.S.

Ranked by On-Demand Audio sharepoint changes, H1 2025 vs. H1 2024

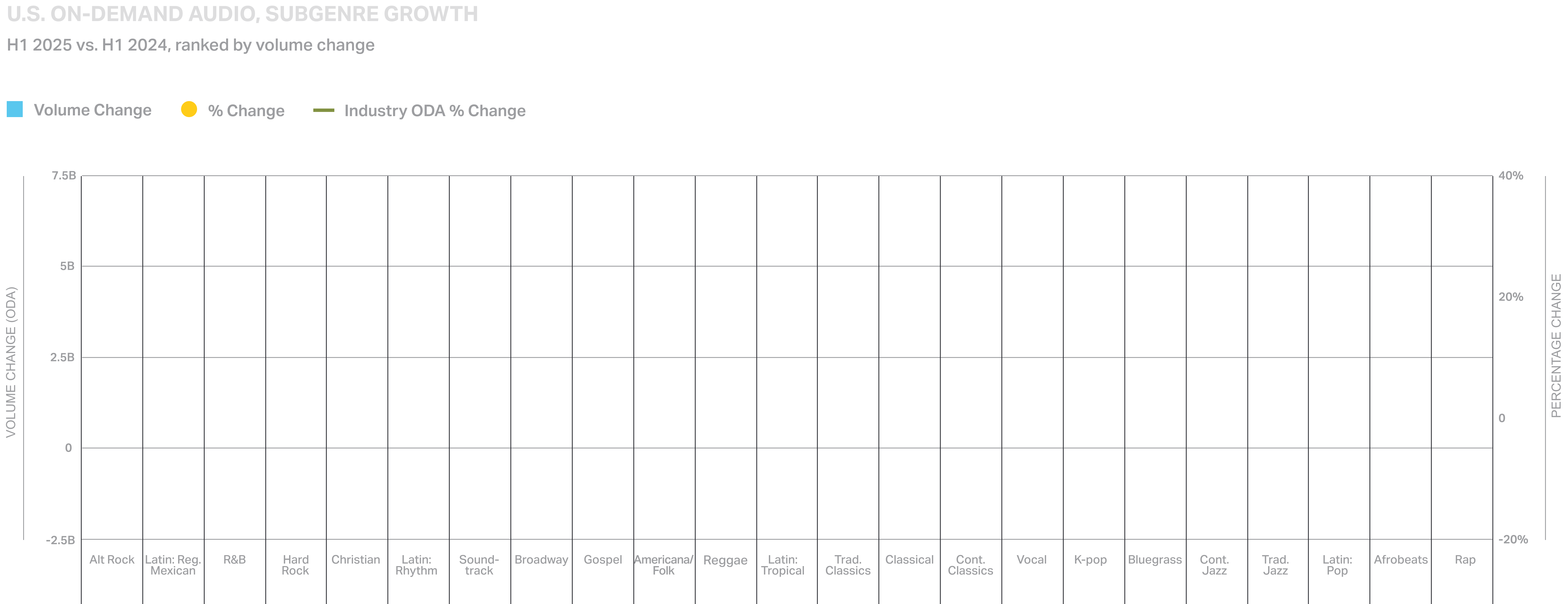

U.S. Subgenre Trends in 2025

Alt Rock leads all subgenres in volume change, while Regional Mexican, R&B, Hard Rock and Christian round out the top 5 in growth.

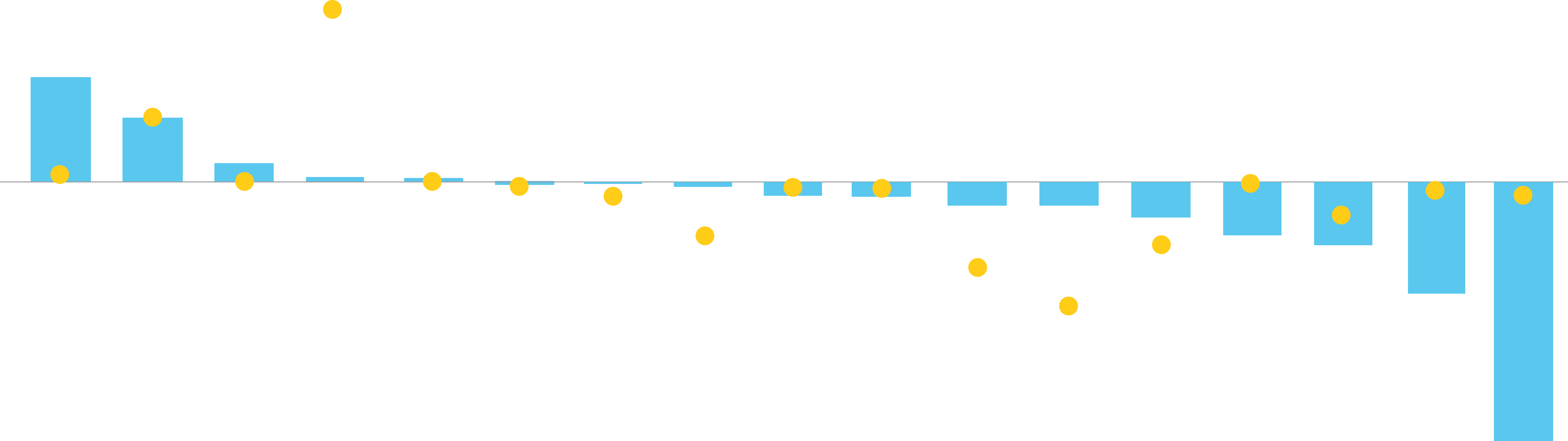

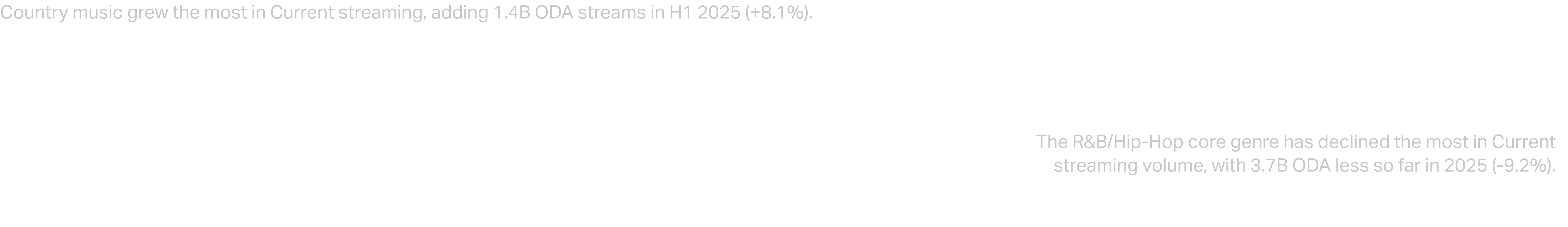

U.S. Current Music

When looking only at U.S. On-Demand Audio streaming of Current music (identified as tracks that are 18 months old or newer), this category declined 3.3% in volume compared with the

first half of 2024 (168.5B vs. 174.3B).

U.S. Current Music

However, this is not the first time a decline has been seen: As recently as 2022 and 2021, both first half-year totals posted less than the previous year. H1 2025 marks a two-year

growth percentage of 3.4% over H1 2023.

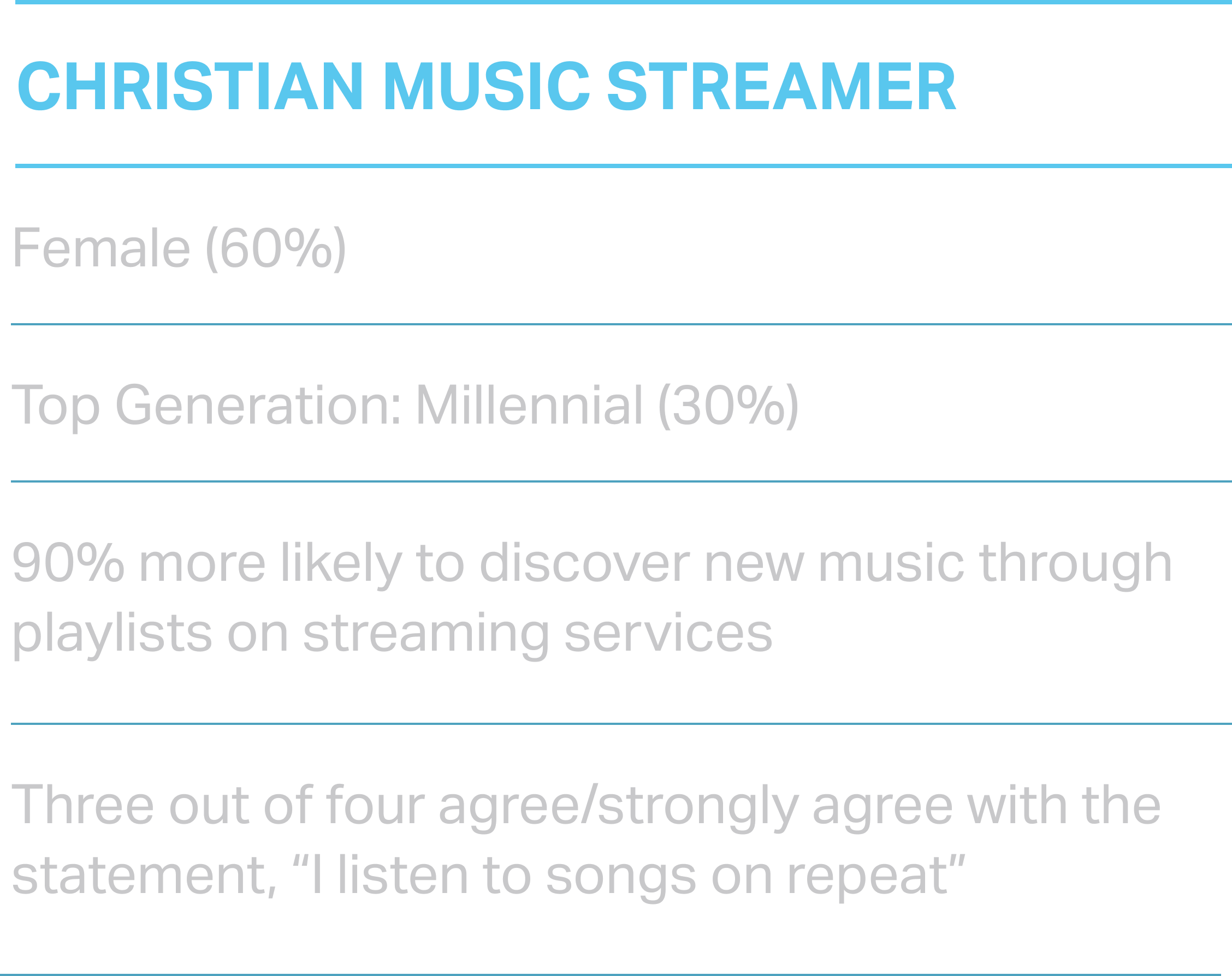

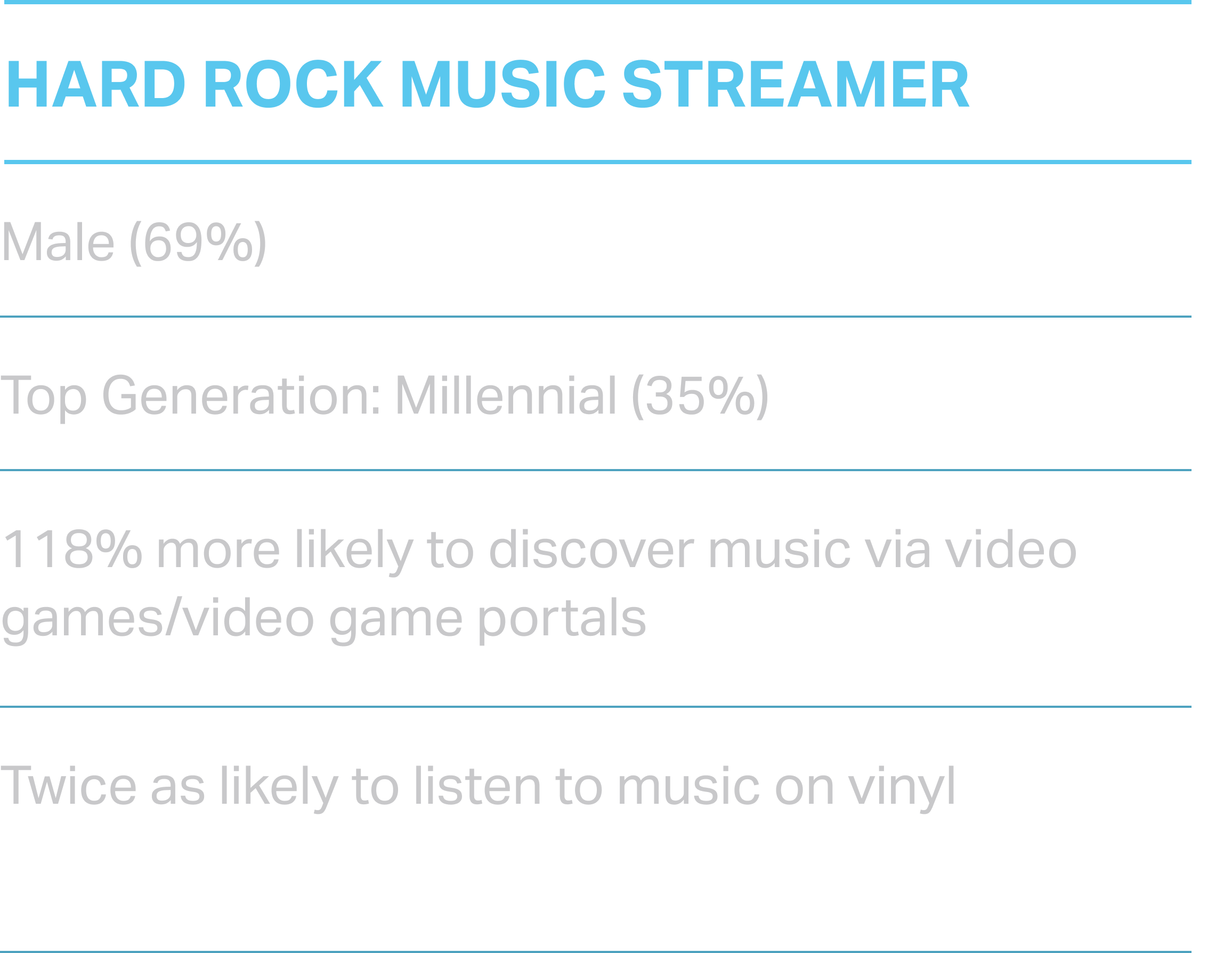

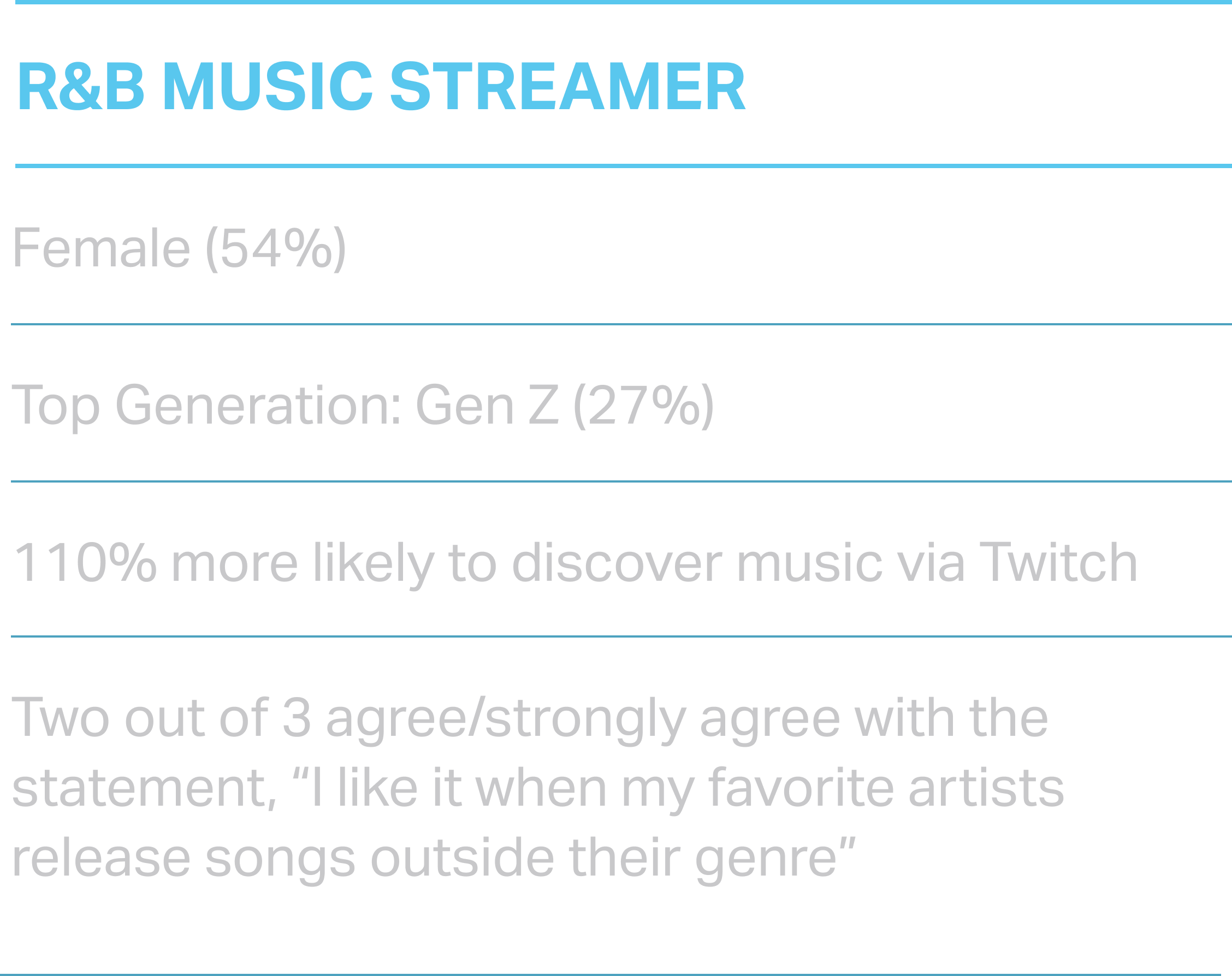

U.S. Listener Profiles: R&B, Hard Rock, Christian Music Streamers

Each of these subgenres has experienced growth in 2025. This is the first time in over three years that R&B has placed as a top 5 growth subgenre, while new album releases from

Sleep Token and Ghost debuted at No. 1 on the Billboard 200 to help drive Hard Rock. Christian music, meanwhile, is rising due to a younger, streaming-forward listener.

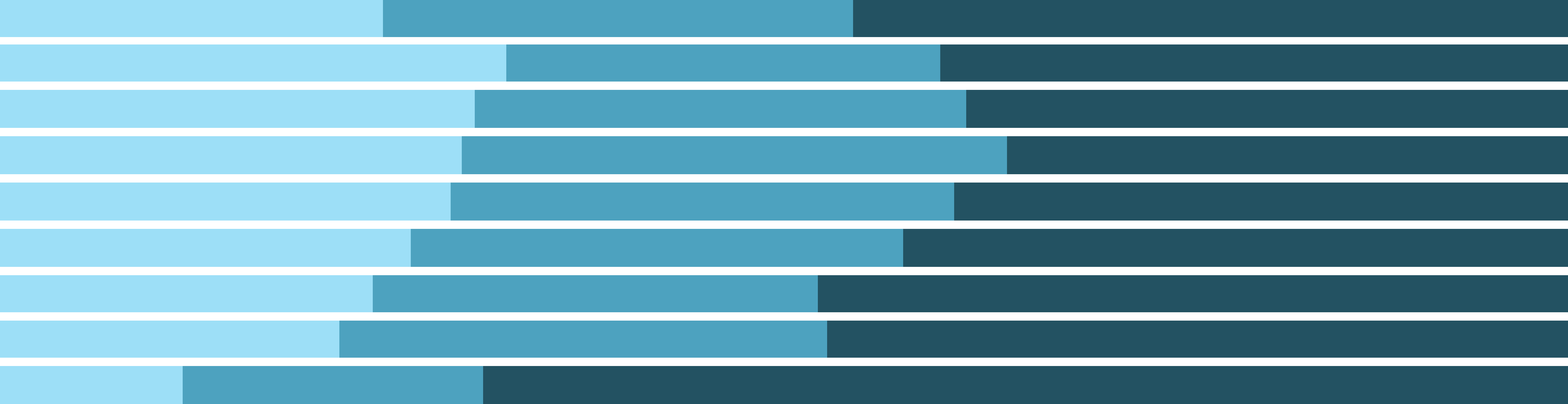

Release Age Listening

Christian/Gospel streaming leans the most Current, at 33%; 35% of World Music streaming is from tracks 18-60 months old, while 69% of Rock streaming is from music older than 60 months.

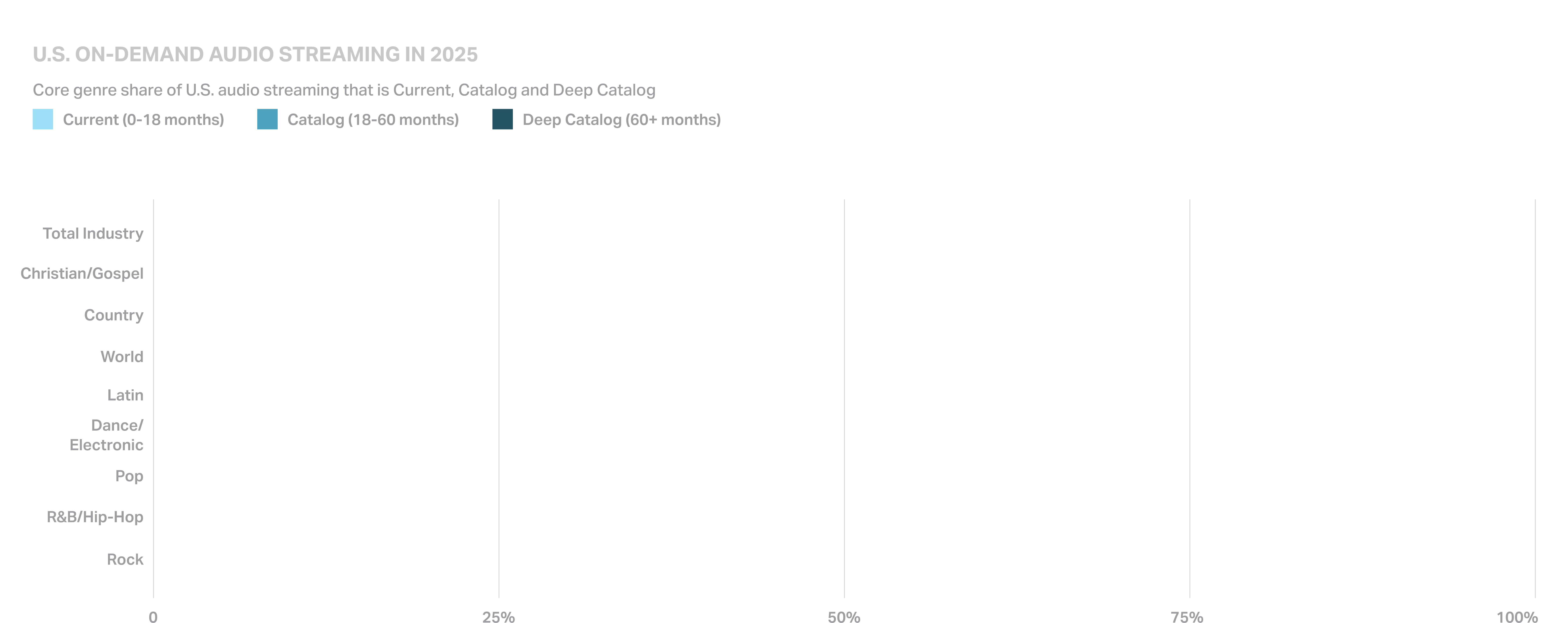

Recession Pop: It’s Not Just the Vibe That’s Back

New releases from artists such as Lady Gaga and Kesha fueled discussions of whether Recession Pop was back, but the data shows tracks released in the Great Recession era are also having a resurgence.

�When analyzing the growth of U.S. tracks released in the Great Recession of 2007-12, Pop songs from those years grew 6.4% in On-Demand Audio volume in 2025, outpacing the U.S. industry’s rate of 4.6%. The corresponding Pop share point increase of all tracks released 2007-12 is also more than 2x that of the next closest genre, showing 2025 audiences are gravitating to the Pop genre from this period.

New Lines of Trade

�

Luminate’s most recent Year-End Music Report introduced the Export Power Rankings to highlight evolving trade relationships in the global music ecosystem. In the first half of 2025, these rankings are paired with regional analysis, identifying countries that stream the most local, regional and ex-regional artists — and offering key insights for business entering new markets as well as

music audience signals on nativism.

Import/Export:

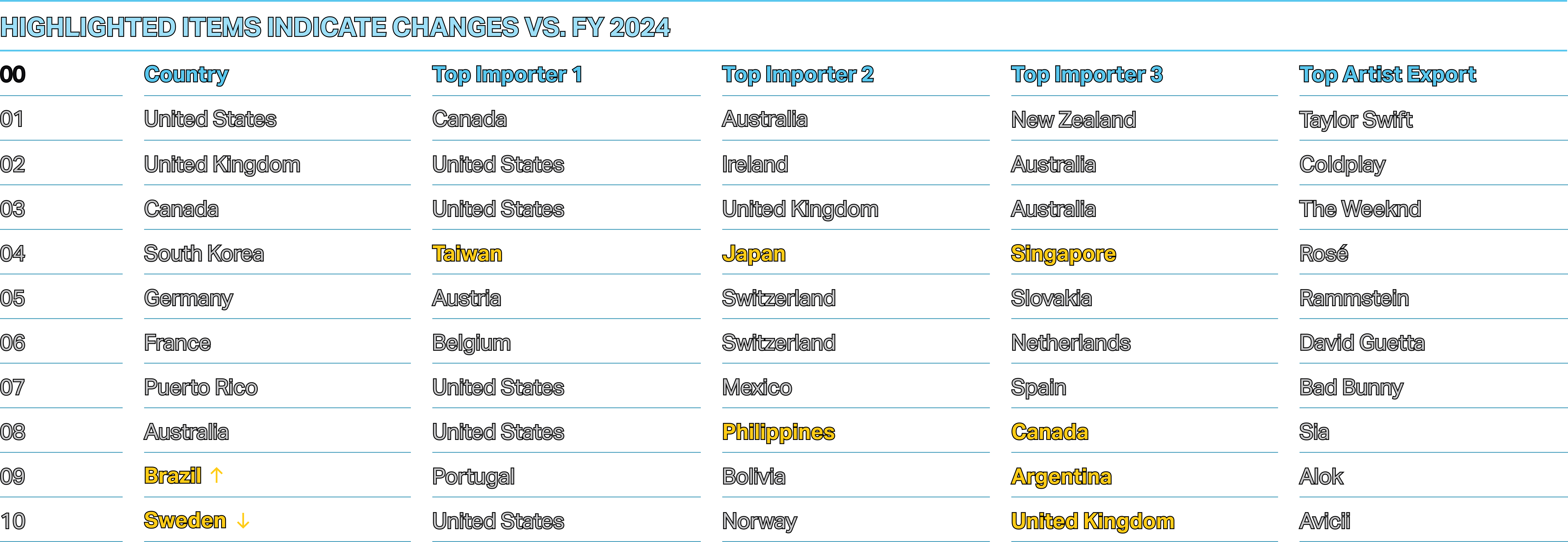

Top 10 Countries in Global Export Power

As global digital service providers (DSPs) facilitate the spread of music across borders, there’s an opportunity to increase a country’s cultural impact through music in foreign territories as well as identify clusters and analyze music trade relationships.

�Luminate Export Power Rankings evaluate a country’s ability to export recorded music globally. This score is a combination of four data points: the rank of artists in each country based on Total On-Demand Streaming and Country of Origin; the number of countries importing music from a given export country; the streaming size of importing countries; and the number of artists per export country reaching international audiences.

Import/Export: Country of Origin

An analysis of streaming share that is local, regional and ex-regional artists helps to identify countries that are importers and exporters throughout specific regions. This aids in understanding how music spreads globally, helps businesses identify relevant joint-venture relationships and answers such questions as which markets are the most insulated or native in their streaming behavior.

*1/3/25 - 7/3/25 (As compared to 12/29/23 - 6/27/24) / SOURCE: LUMINATE CONSUMPTION DATA

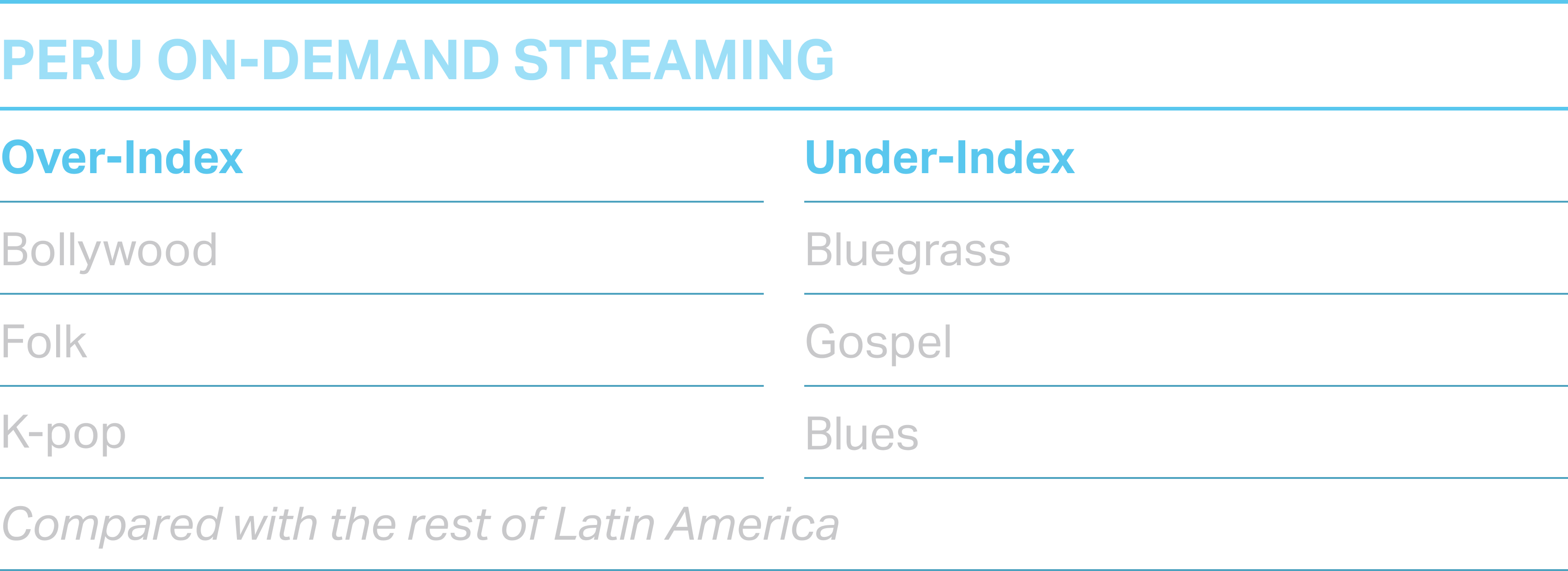

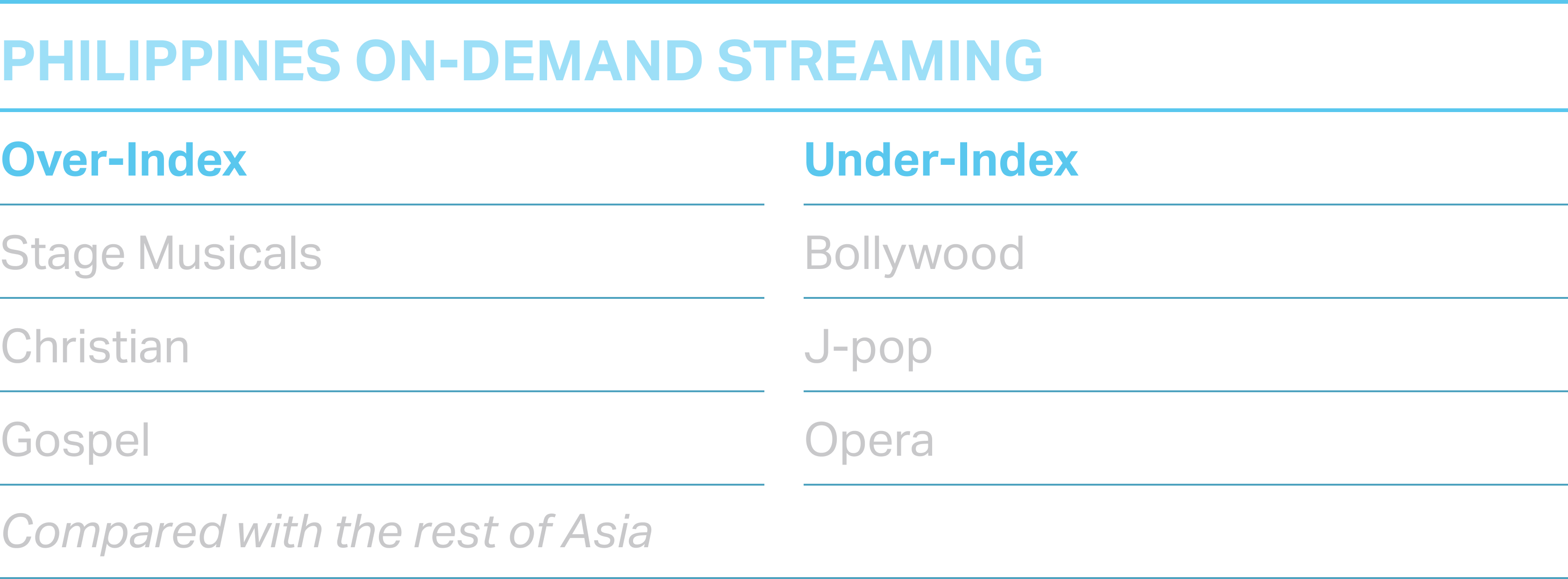

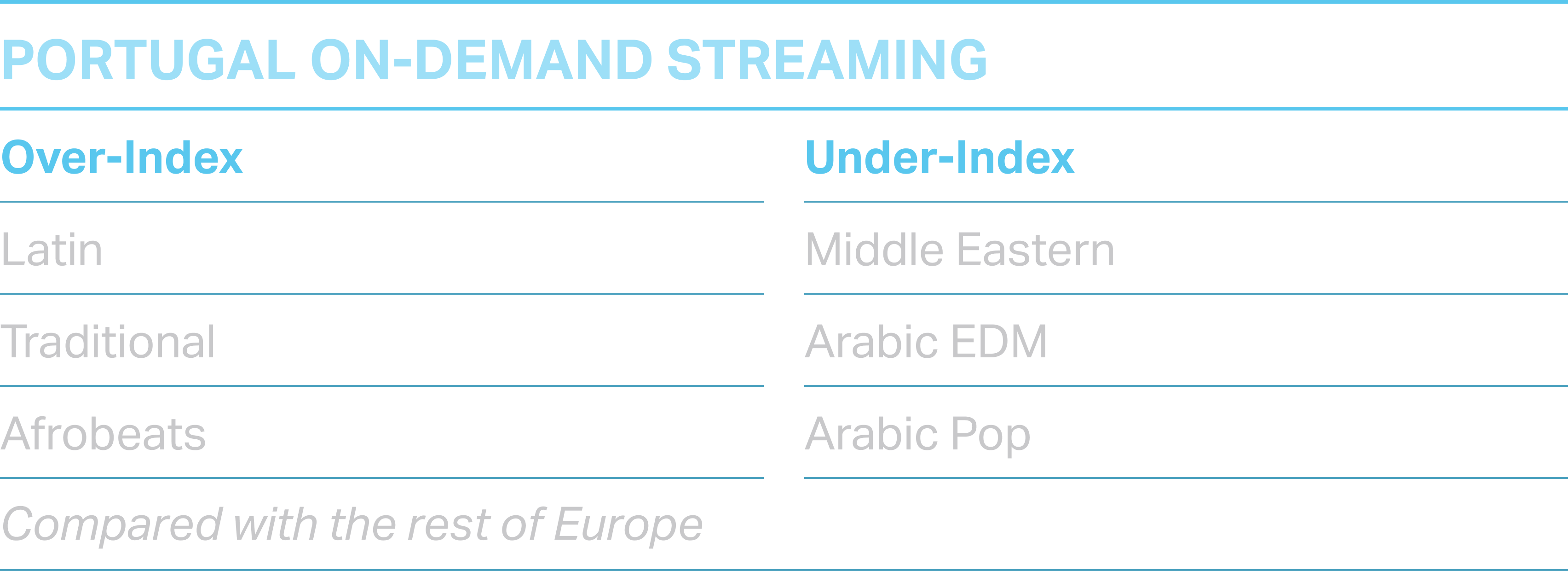

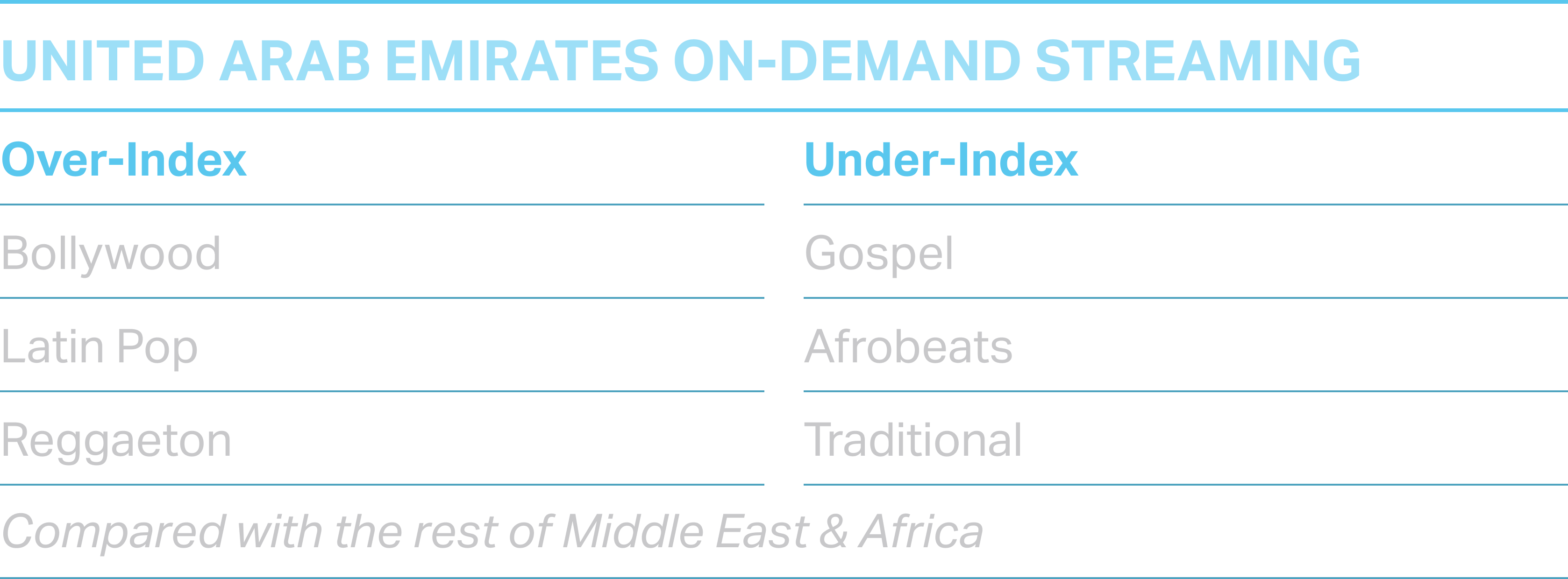

Import/Export: Genre Preference

In those countries that import the most music from outside their home region, these genres over- or under-index compared with their neighboring markets.

Understanding these genre preferences helps tailor marketing efforts to specific international territories.

Profiles of Tomorrow’s Super Fans

�

Streaming growth is slowing in mature Western markets, with U.S. On-Demand Audio growth declining from 6.4% in 2024 to 4.6% so far in 2025. Still, this creates an opportunity to deepen engagement and foster long-term loyalty with highly valuable consumers through innovation. This section showcases Luminate insights on fan engagement across community platforms, podcasts, video games and film & TV.�

Engagement Horizon:

*1/3/25 - 7/3/25 (As compared to 12/29/23 - 6/27/24)�** SEA (STREAM-EQUIVALENT ALBUMS): 1250 PREMIUM STREAMS = ONE ALBUM // 3750 AD-SUPPORTED STREAMS = ONE ALBUM; TEA (TRACK-EQUIVALENT ALBUMS): 10 DIGITAL TRACKS = ONE ALBUM�+U.S. physical sales metrics include modeled independent retail numbers. See Methodology and FAQ section at the back of this report for more�SOURCE: LUMINATE CONSUMPTION DATA

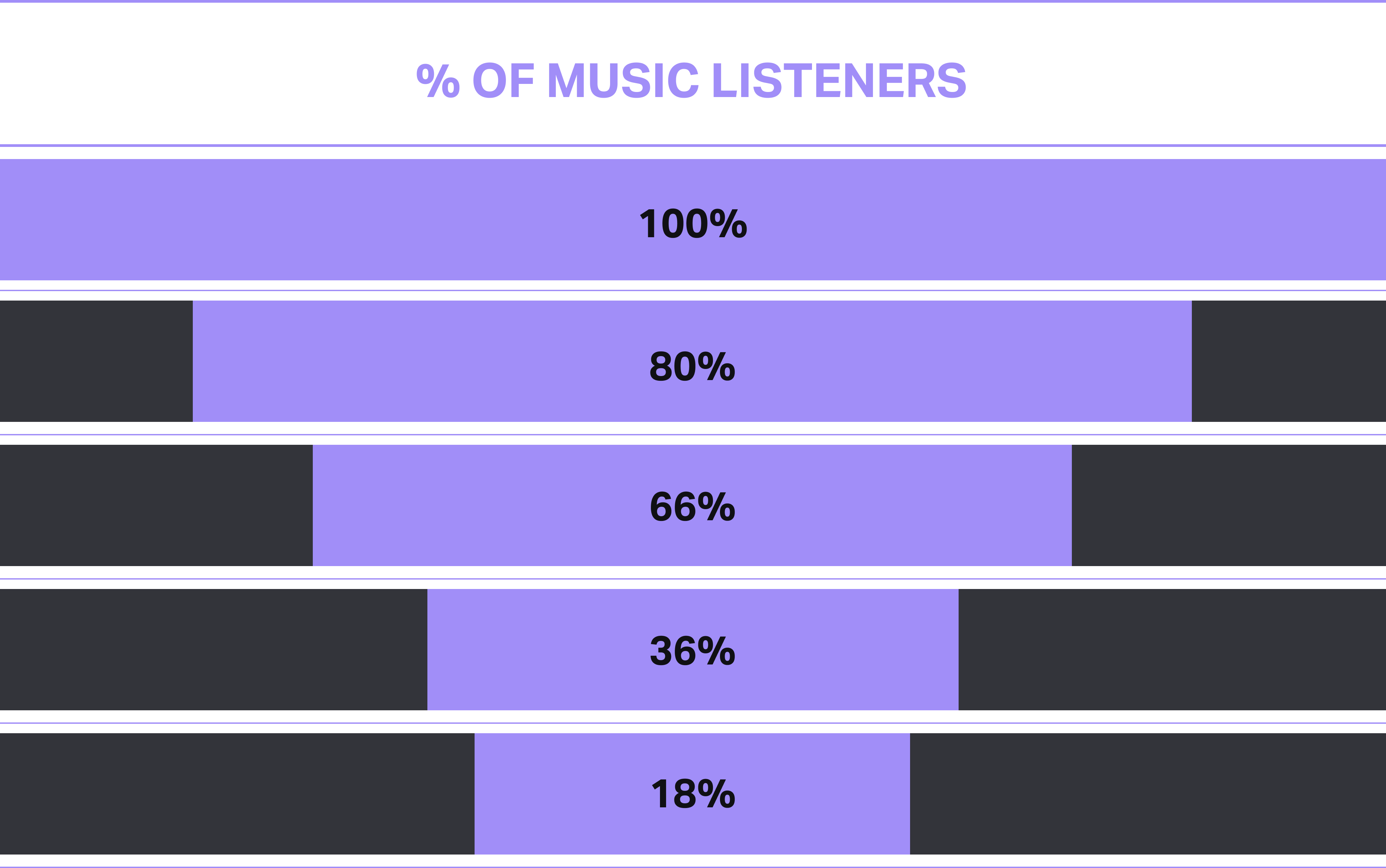

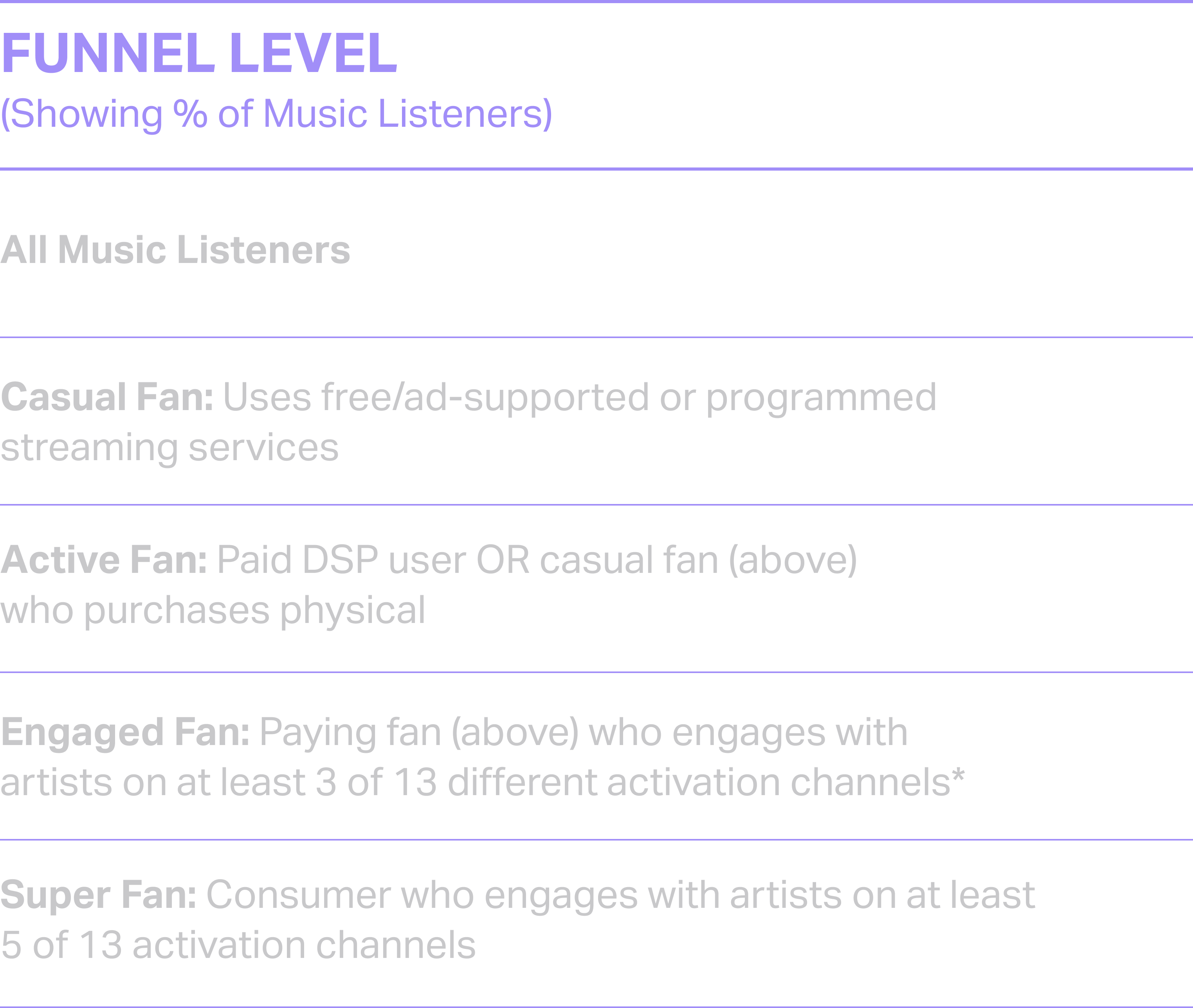

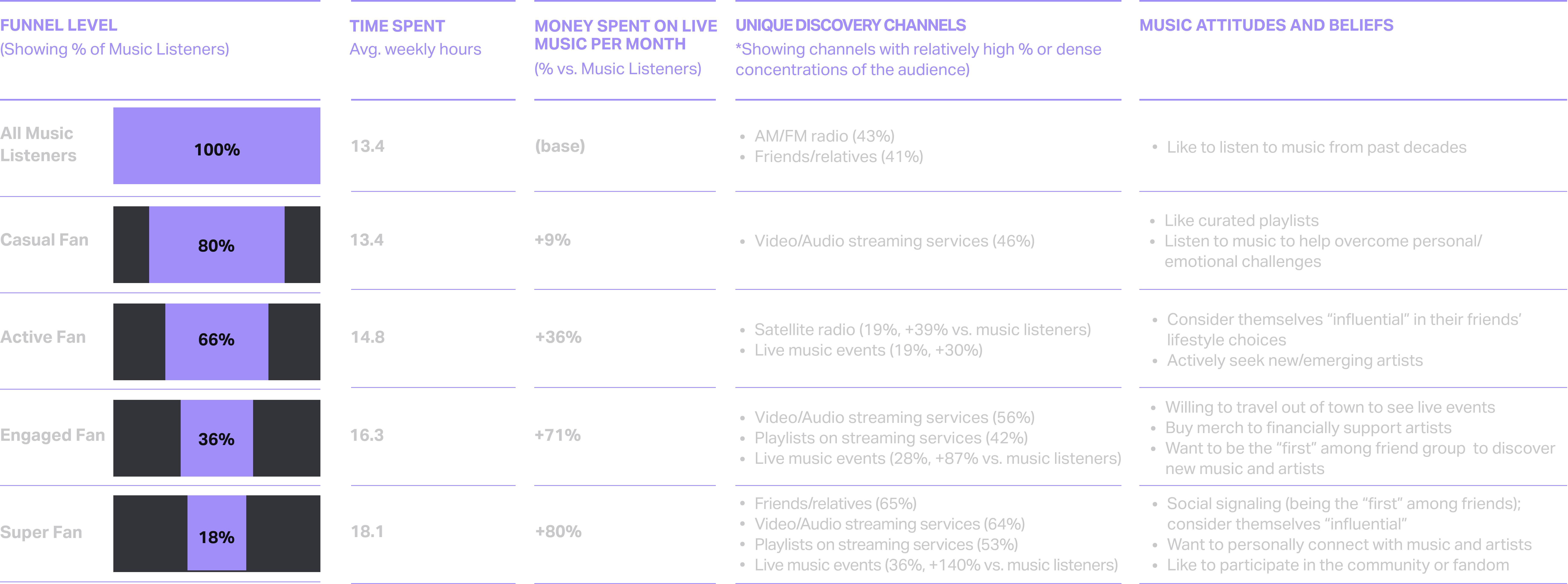

U.S. Fan Engagement Funnel

In Luminate’s most recent audience response data, 18% of U.S. music listeners are considered super fans, meaning they engage with artists and music in 5 or more ways. However, there are different levels of fandom, and understanding where specific fan groups fit into the Fan Engagement Funnel helps marketers tailor activations and devise strategies to move fans closer to super fan status.

U.S. Fan Levels: Attitudes, Behaviors and Beliefs

Different behaviors are evident at each level of fandom. For instance, Active Fans spend 14.8 hours with music weekly, but Engaged Fans spend not only more time with music but money

on music-related activities than the level above. The chart below highlights attitudes and behaviors that are first evident at any level. Here we isolate the point at which the behavior emerges

as a differentiator vs. the prior funnel level.

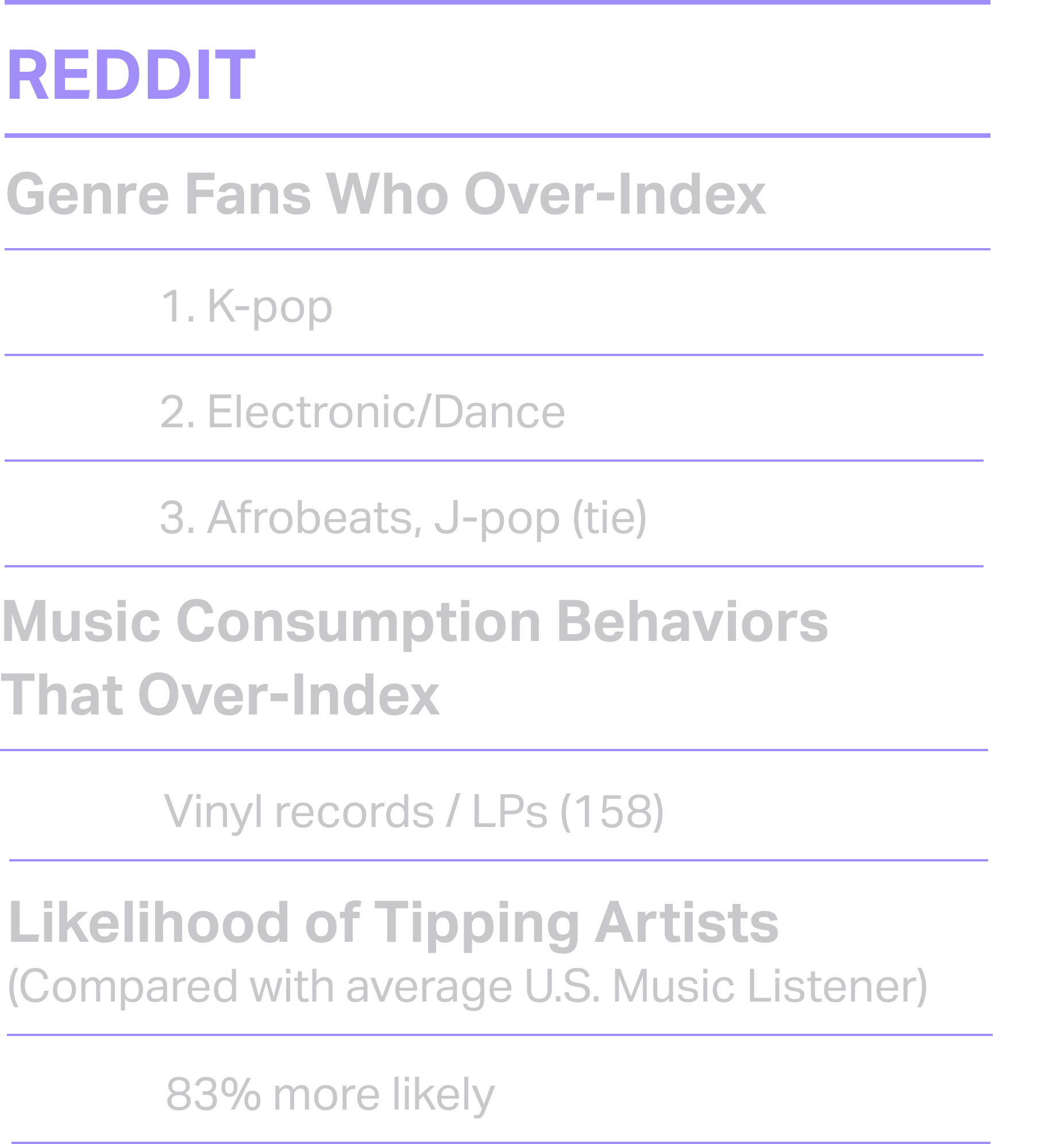

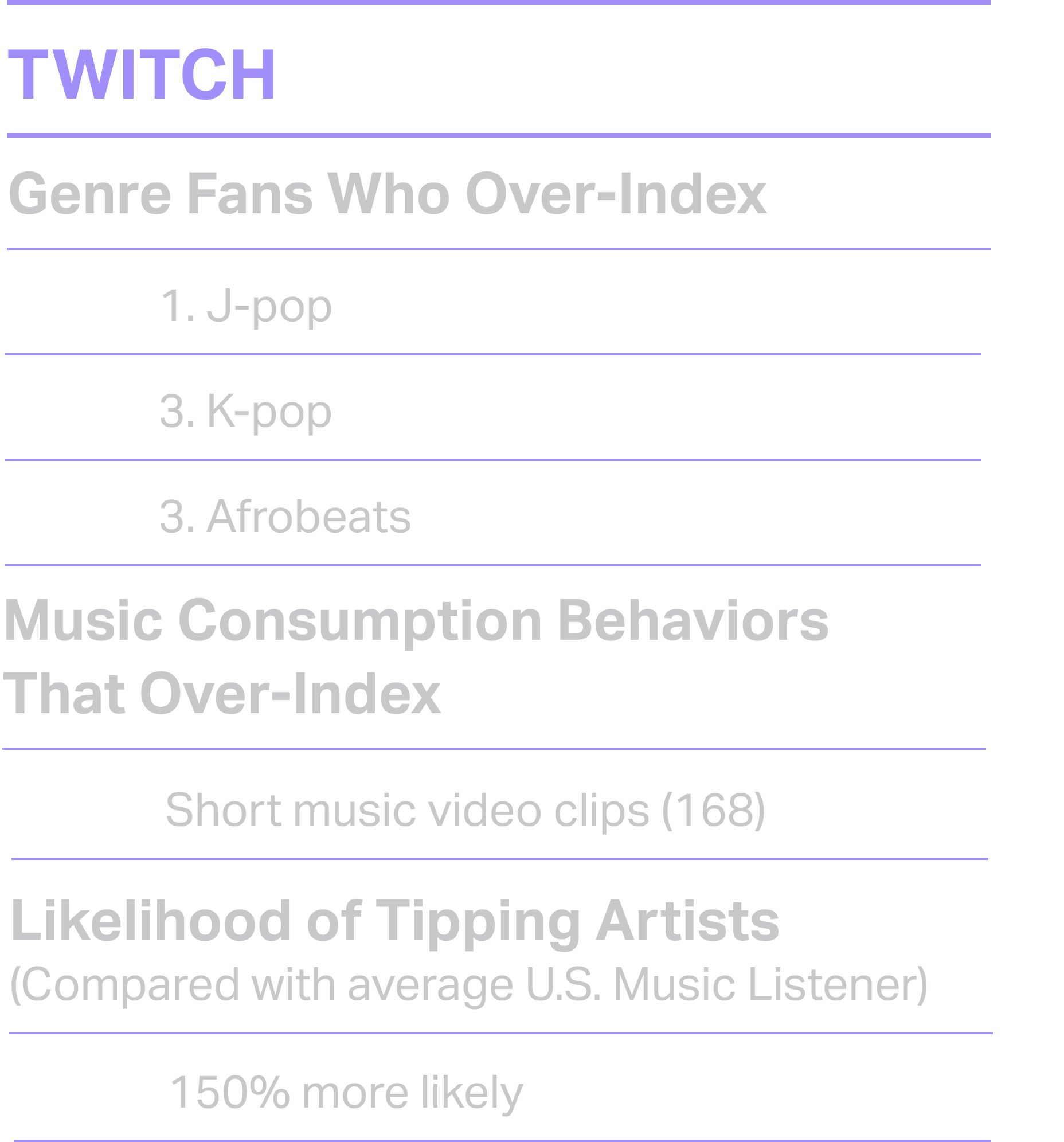

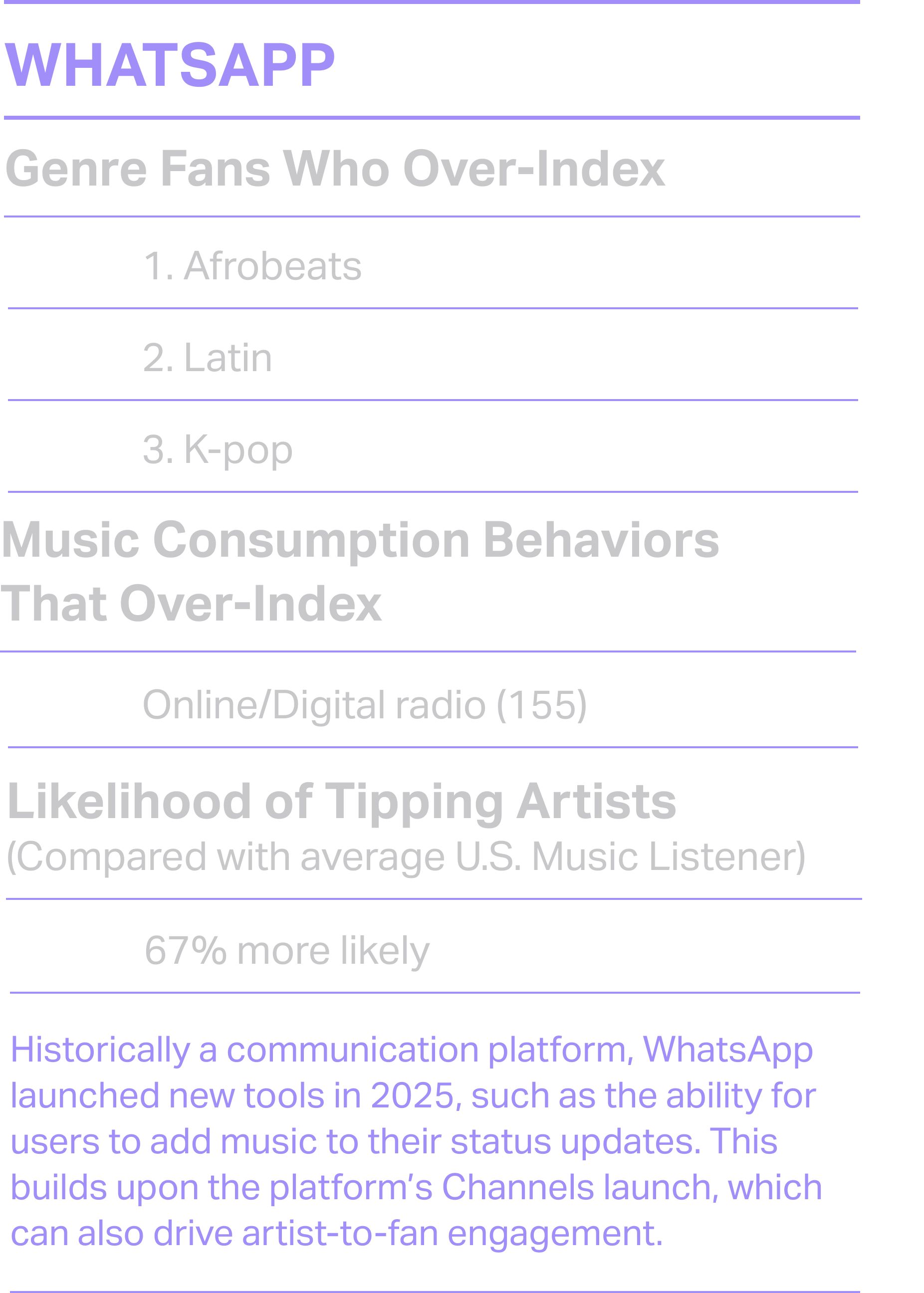

Community Engagement

Digital platforms enable deeper fan engagement and better targeting of niche communities. Genres with a high concentration of super fans perform exceptionally well on these platforms,

offering valuable insight into fan behaviors to drive even greater engagement and unlock new monetization opportunities.

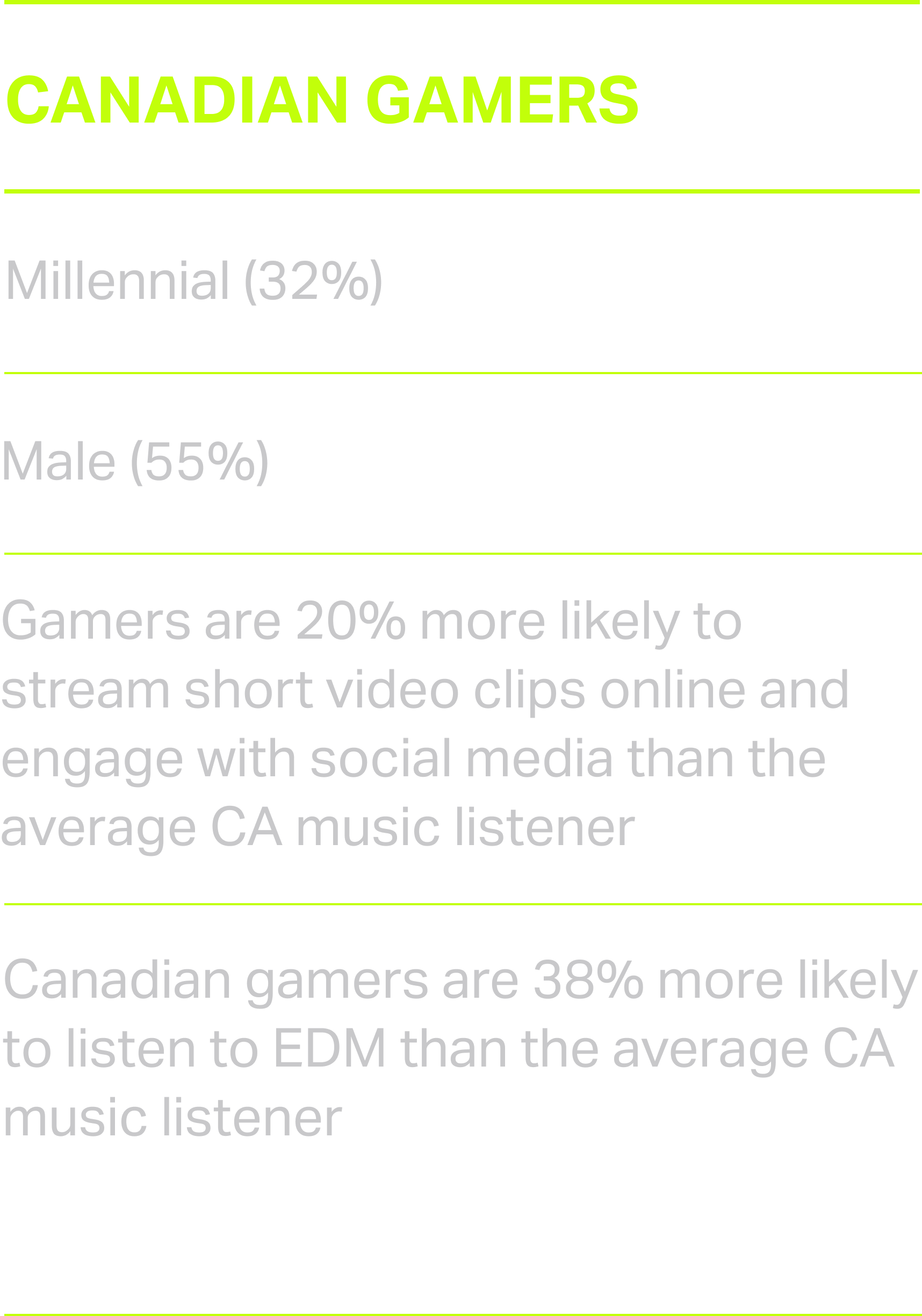

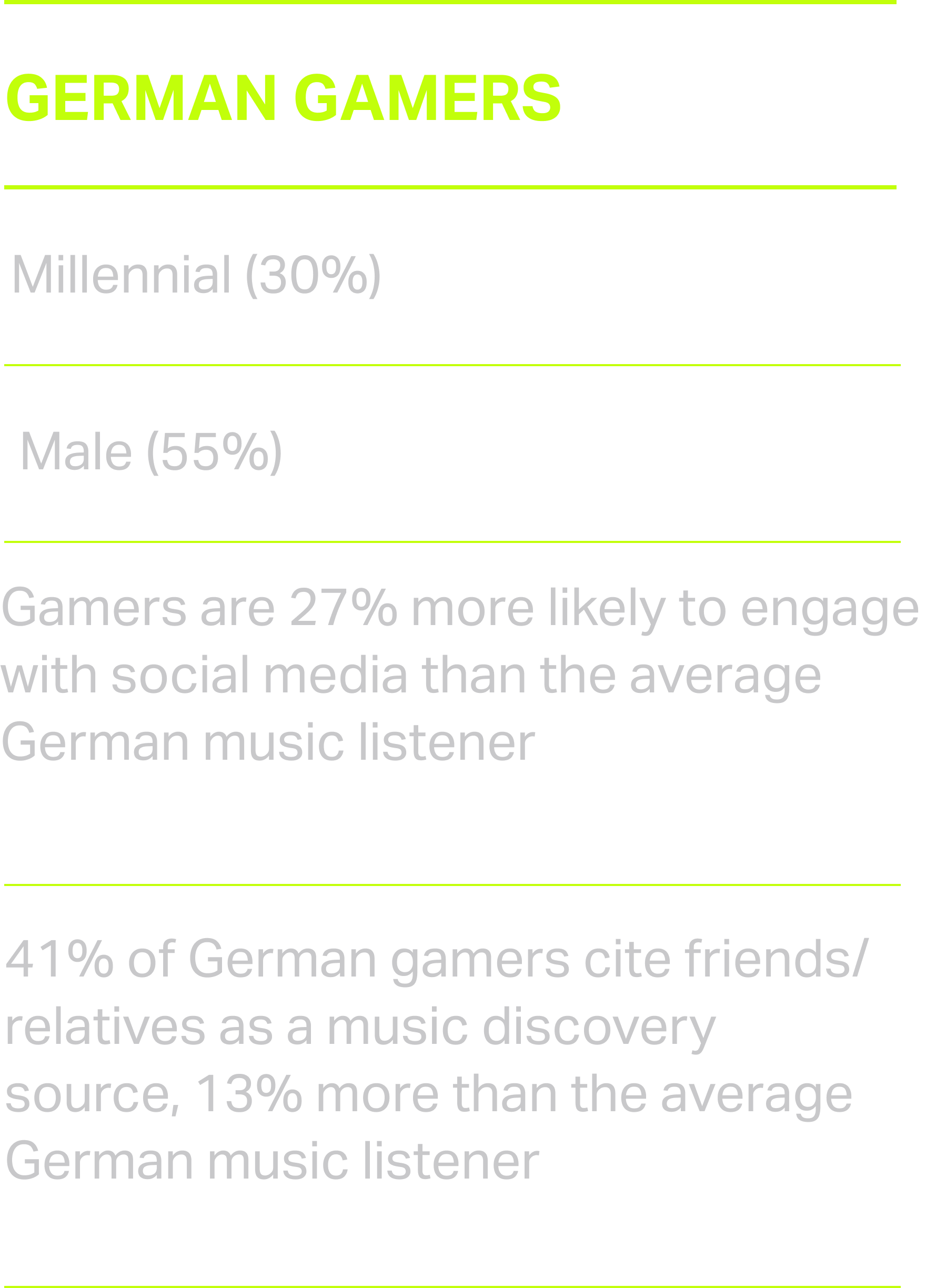

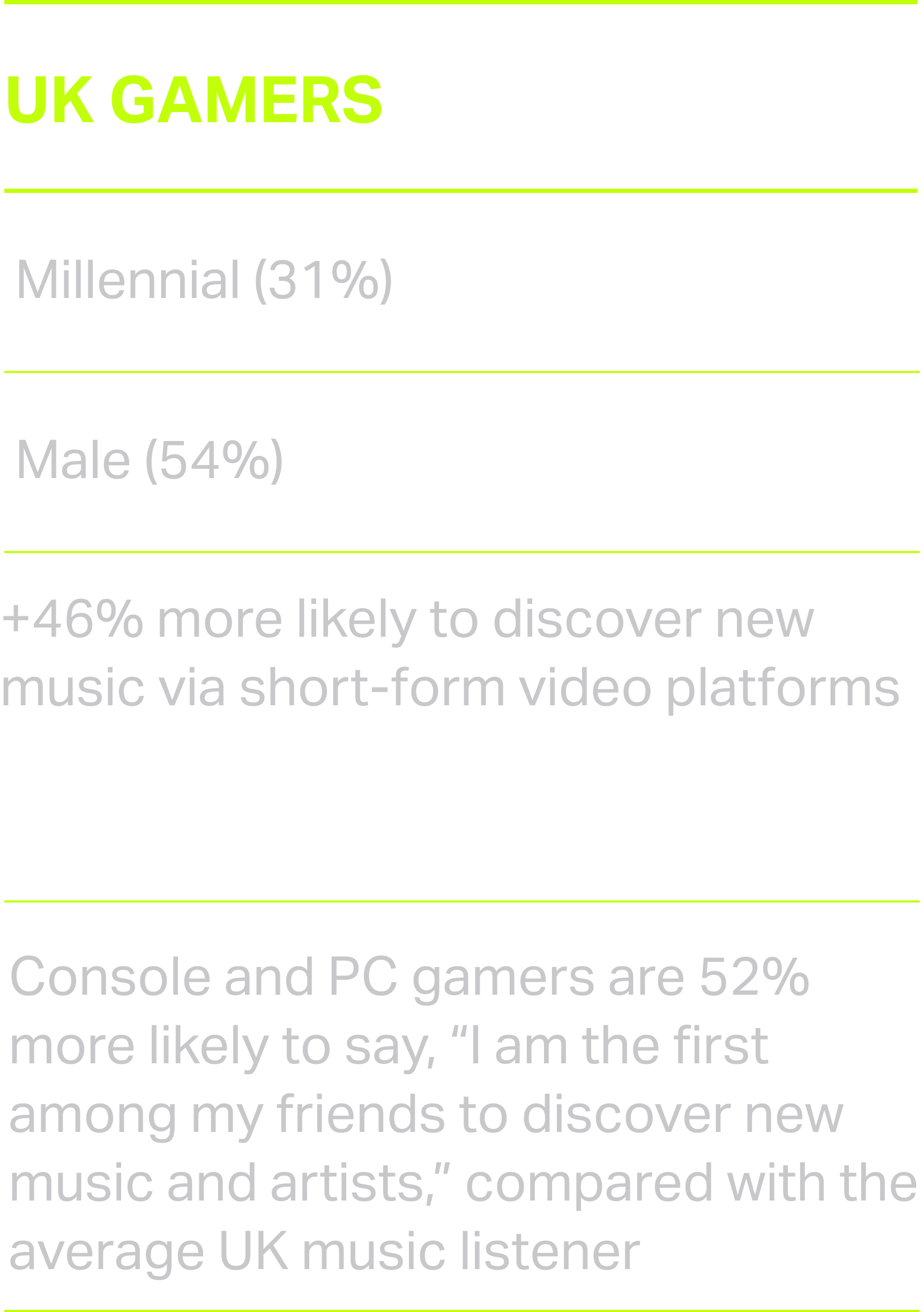

Gaming

�196.7M+ Global Interactive* On-Demand Streams 4/4-7/3/25

*New metric — Interactive On-Demand: Interactive On-Demand Audio streams are from gaming platforms that allow users to choose their own music and engage with songs as part of the experience. Interactive streams can be ad supported or premium and are presented in this report for the first time.

*1/3/25 - 7/3/25 (As compared to 12/29/23 - 6/27/24)�** SEA (STREAM-EQUIVALENT ALBUMS): 1250 PREMIUM STREAMS = ONE ALBUM // 3750 AD-SUPPORTED STREAMS = ONE ALBUM; TEA (TRACK-EQUIVALENT ALBUMS): 10 DIGITAL TRACKS = ONE ALBUM �SOURCE: LUMINATE CONSUMPTION DATA

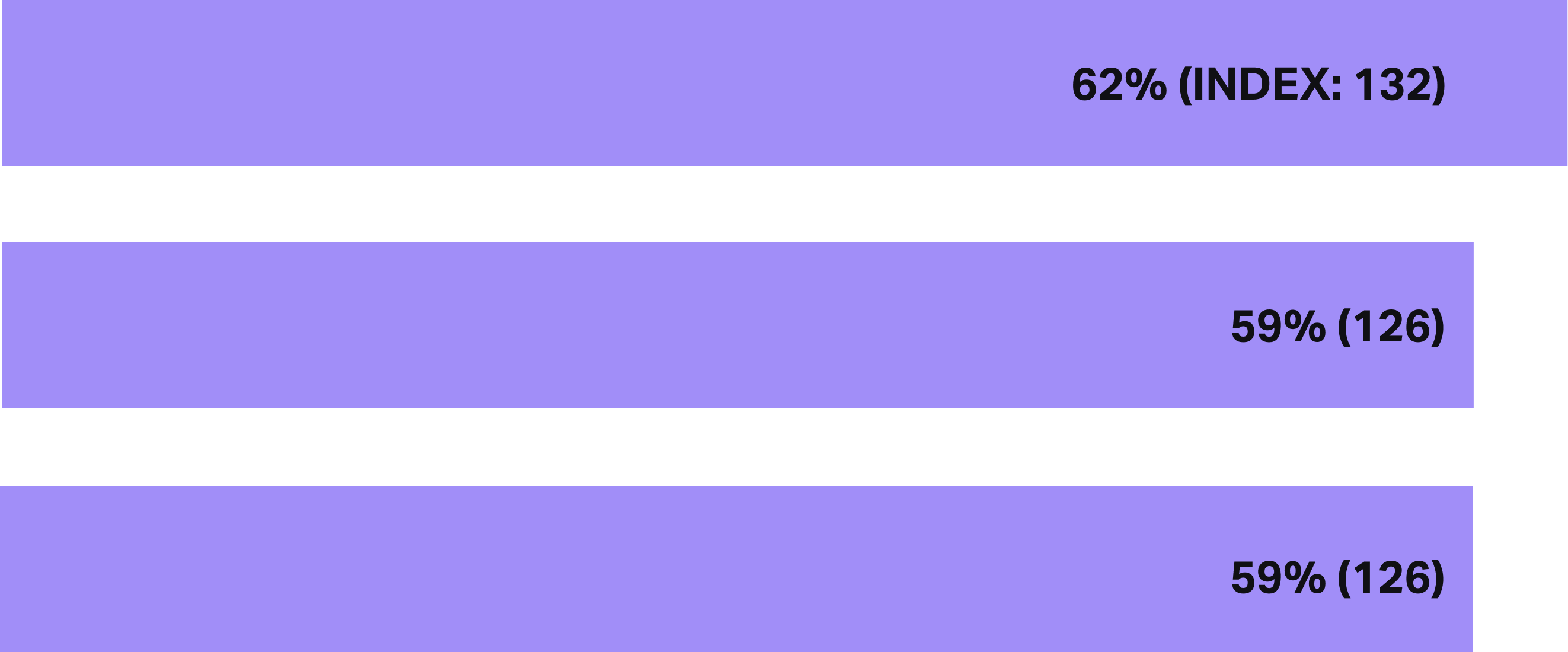

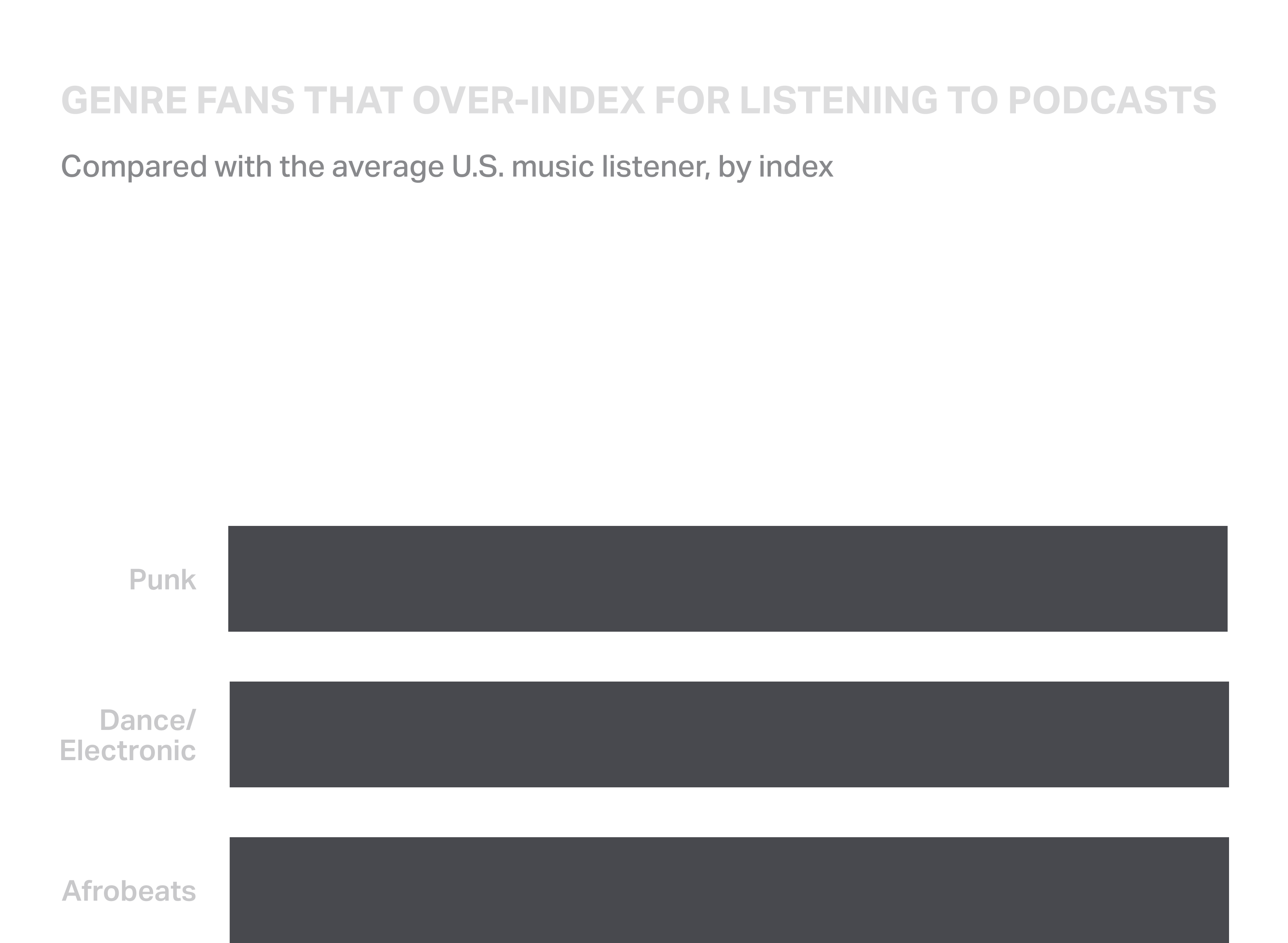

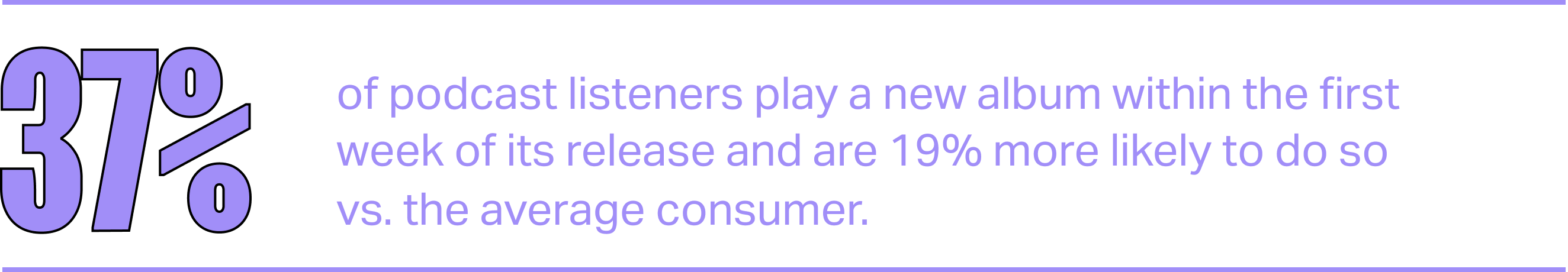

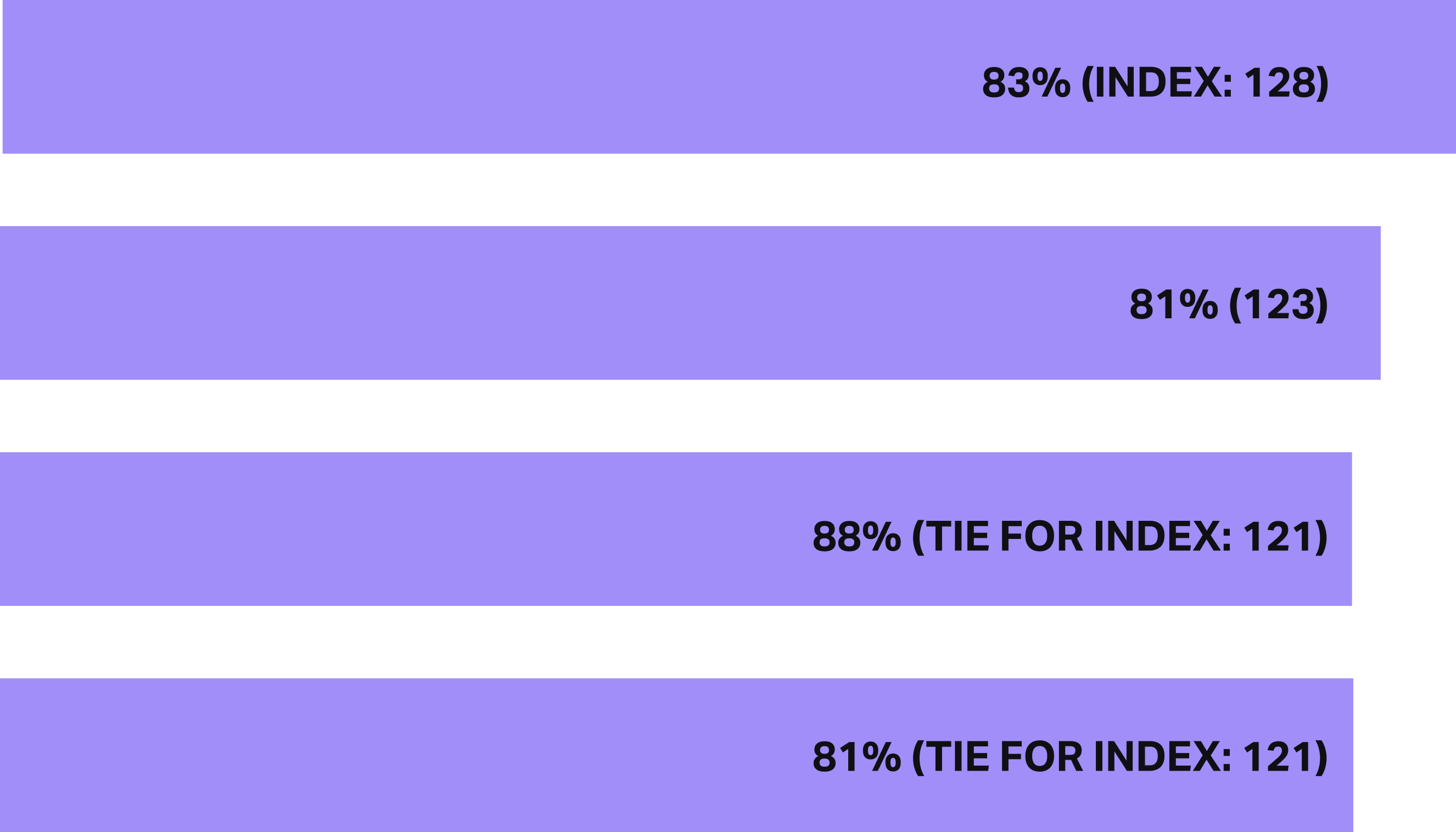

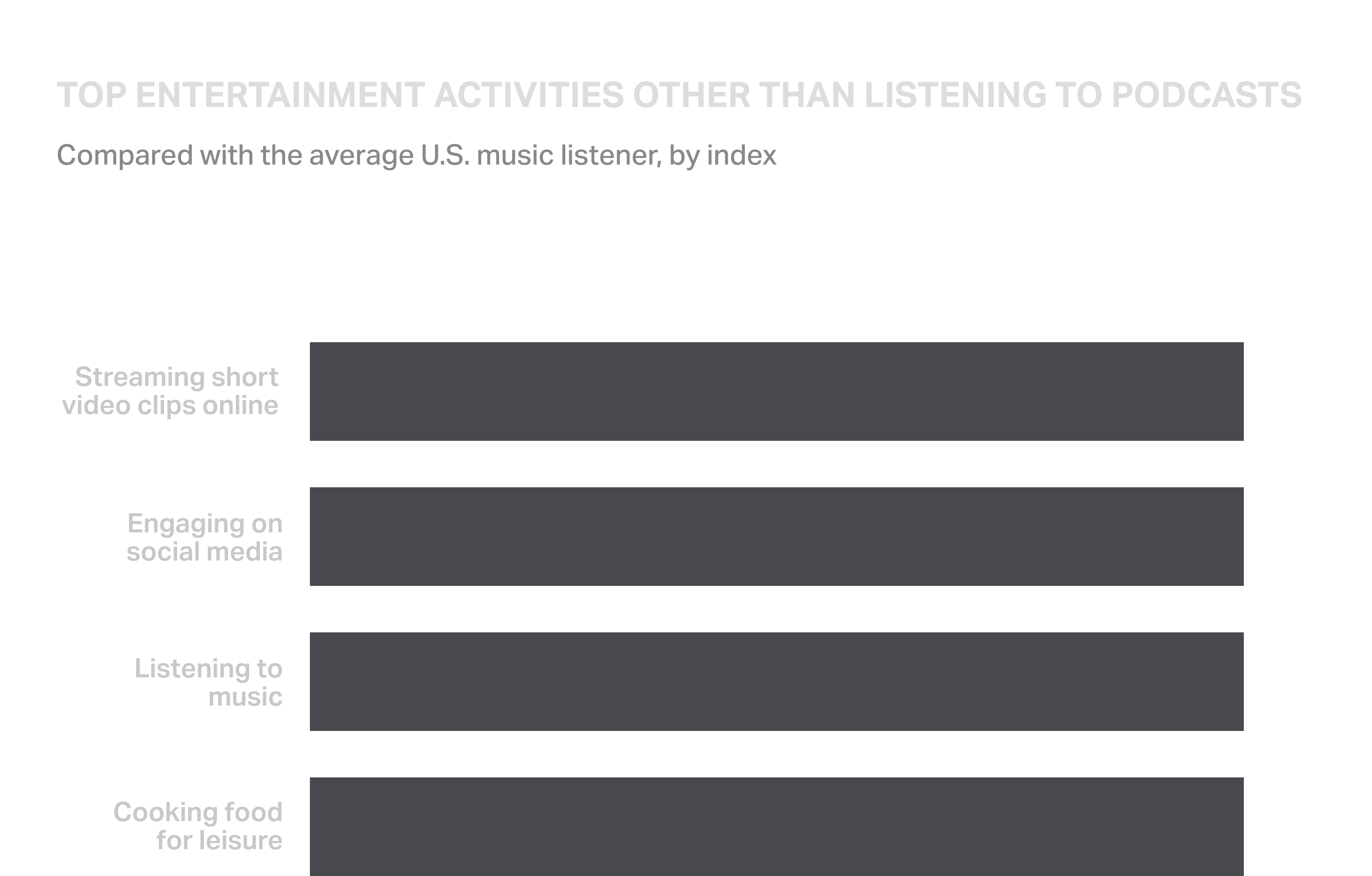

Podcasts

50% of U.S. podcast listeners are Gen Z or Millennial. While artists including Questlove and David Guetta host their own long-running podcasts, the format has become a key part of music marketing plans. But who are the listeners?

SOURCE: LUMINATE MUSIC CONSUMPTION DATA

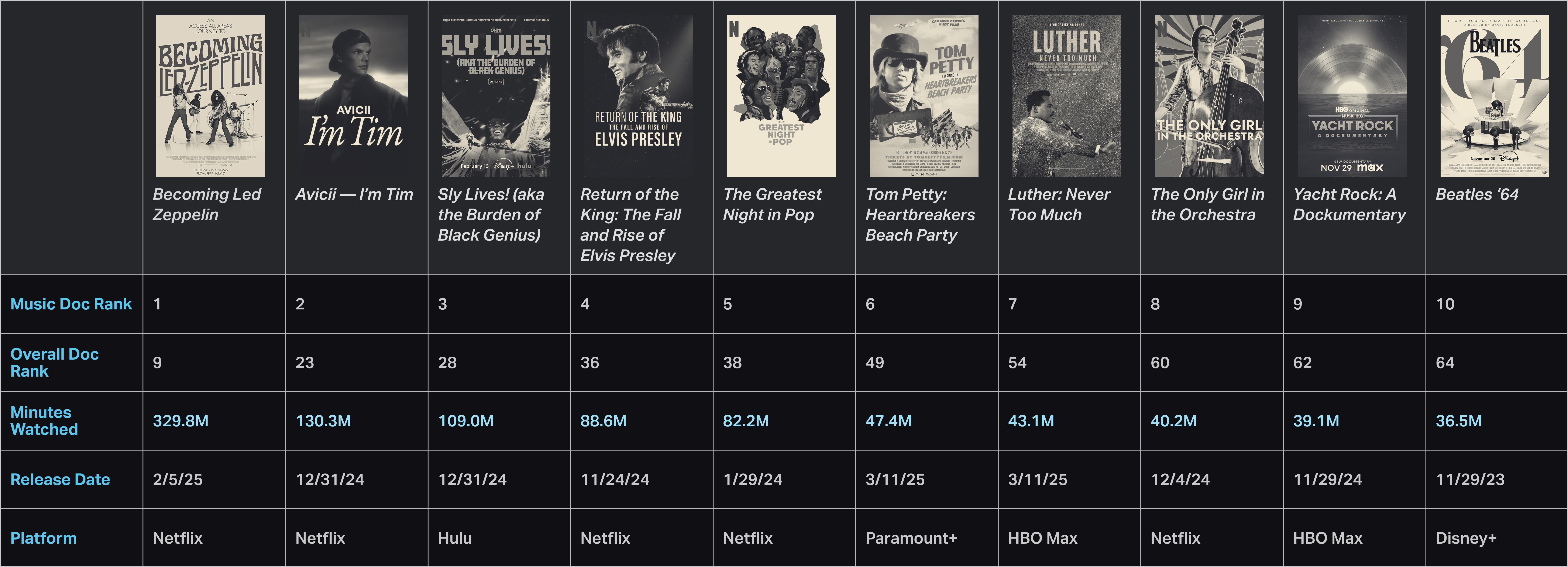

Top Music Documentaries So Far in 2025

Becoming Led Zeppelin ranks #1 in the U.S. as viewers gravitate to documentaries focusing on legacy artists.

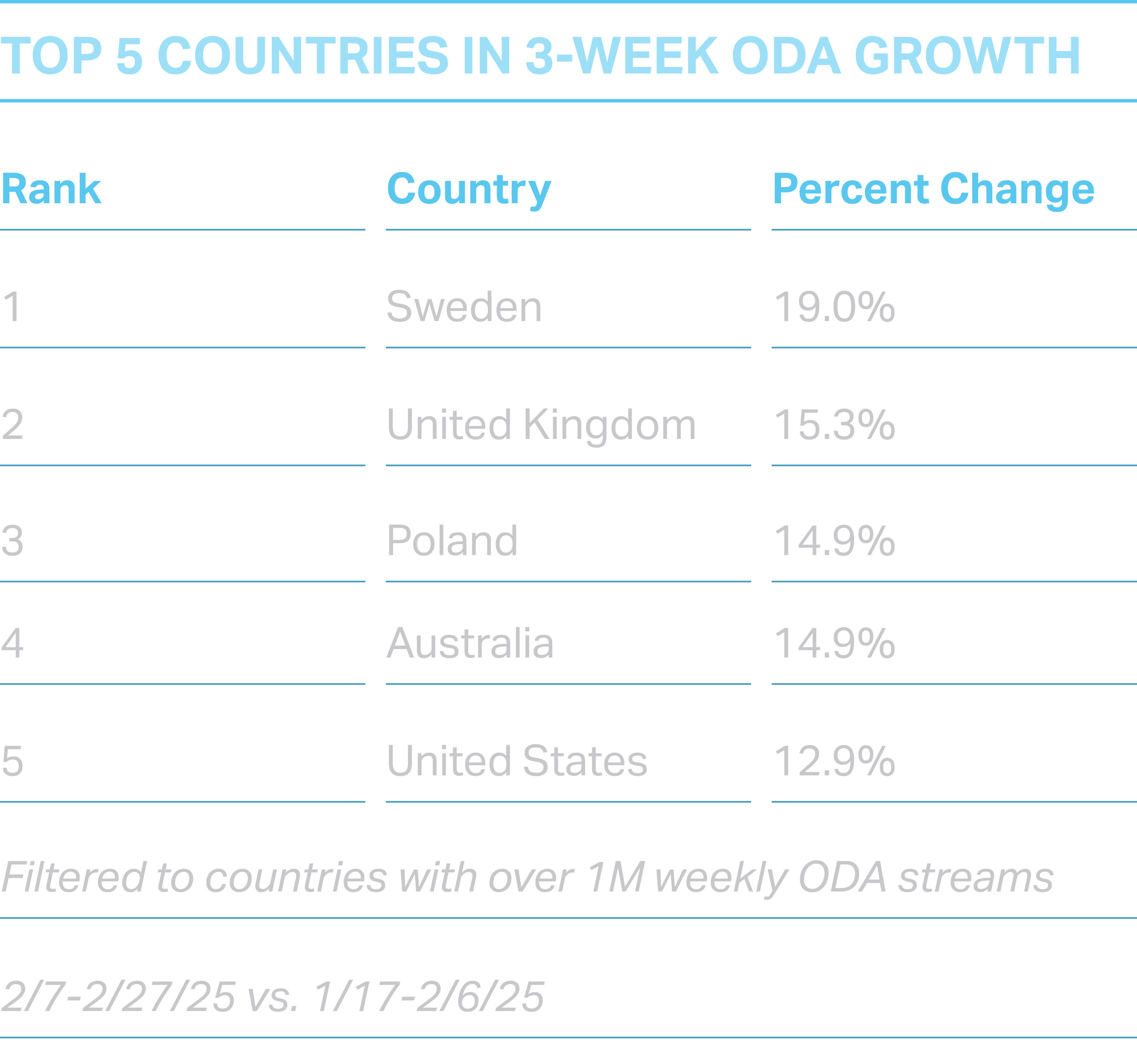

Top Music Documentaries So Far in 2025

Becoming Led Zeppelin ranks #1 in minutes watched, driving the iconic rock band’s Global On-Demand Audio streams to their highest-ever weekly peak: 40.4M for the week ending 2/27/25. Led Zeppelin’s streams have also sustained a new baseline average of 39M per week through 7/03/25, which is +23% over the previous period.

SOURCE: LUMINATE MUSIC CONSUMPTION DATA

Tracking the Next Superstars, Rising Talents and More

�

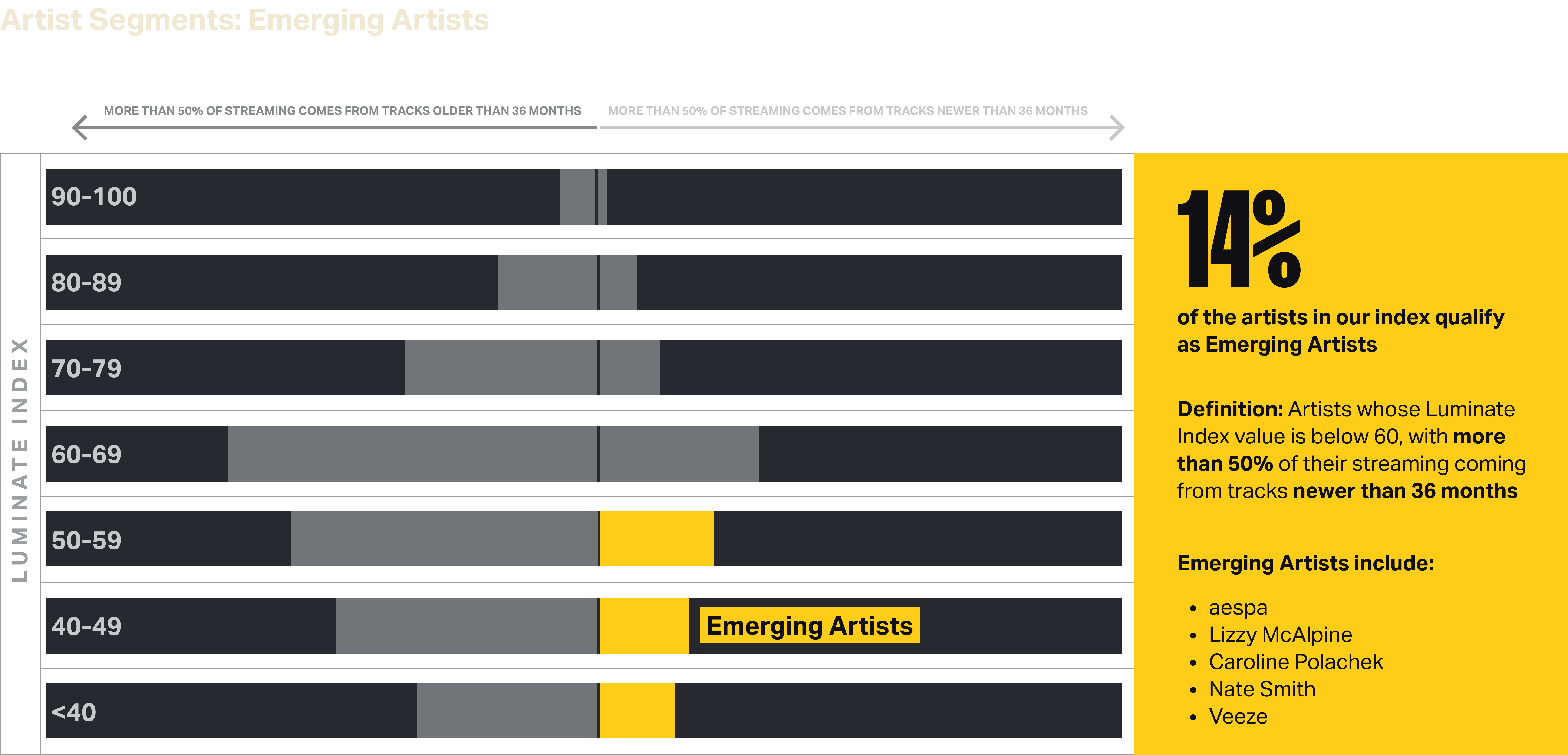

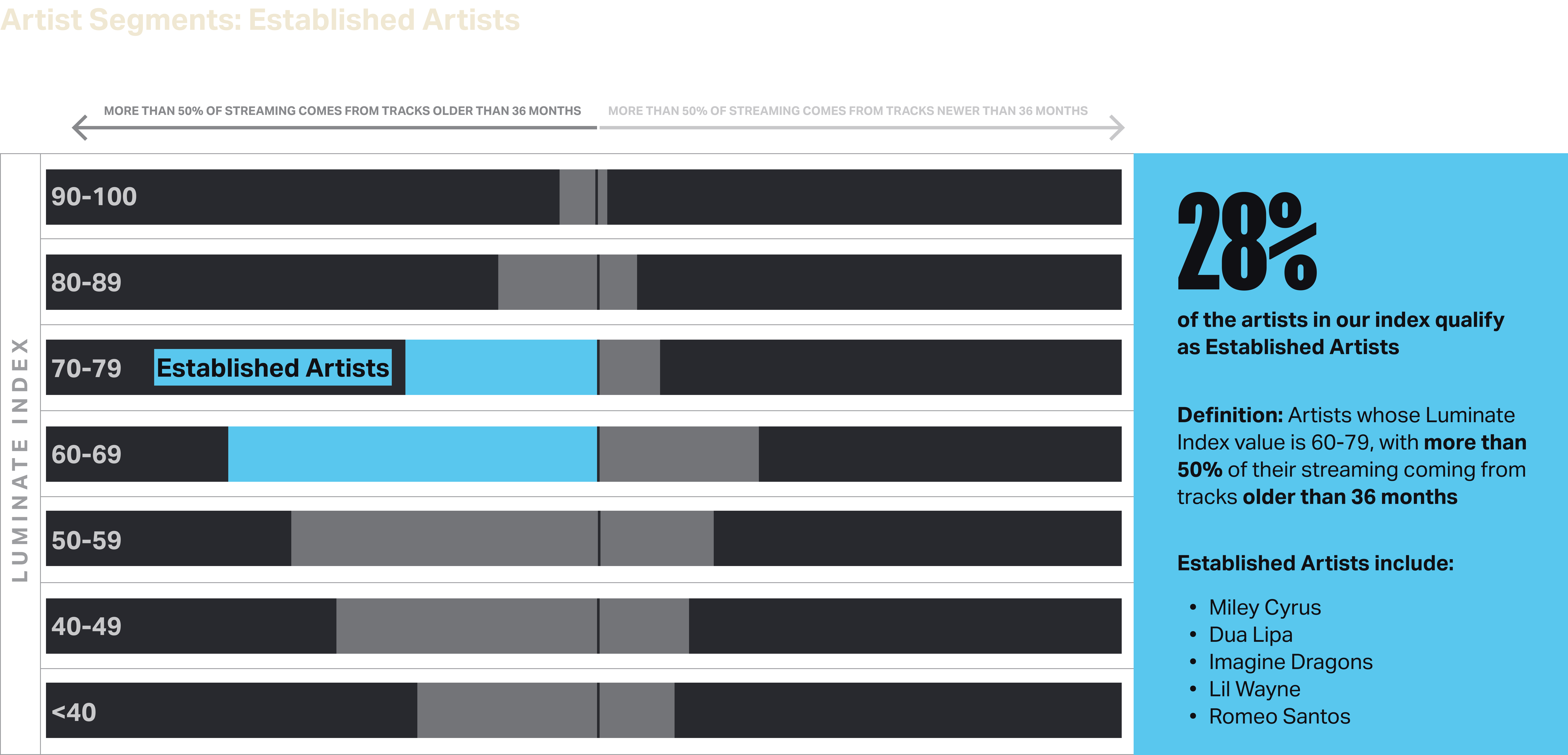

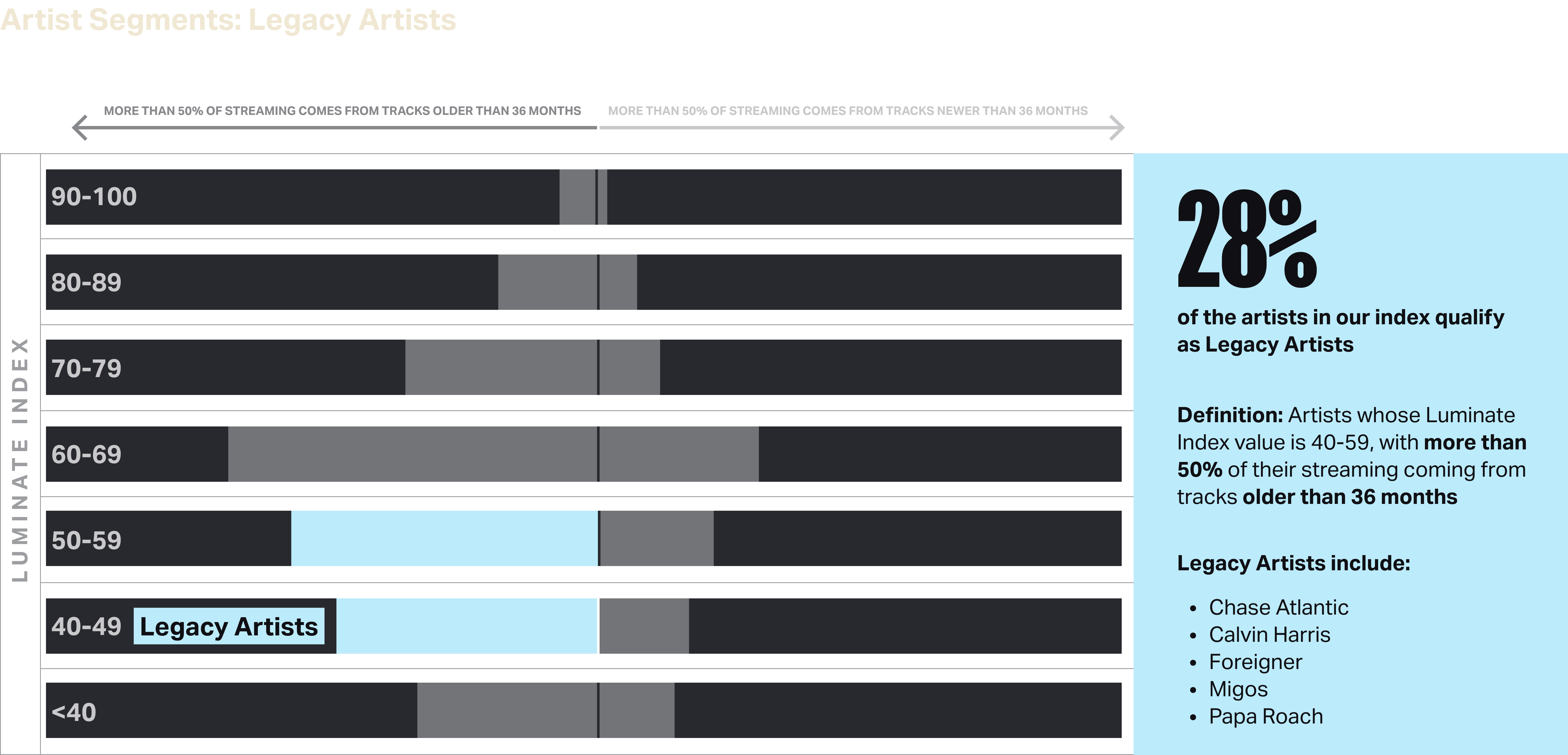

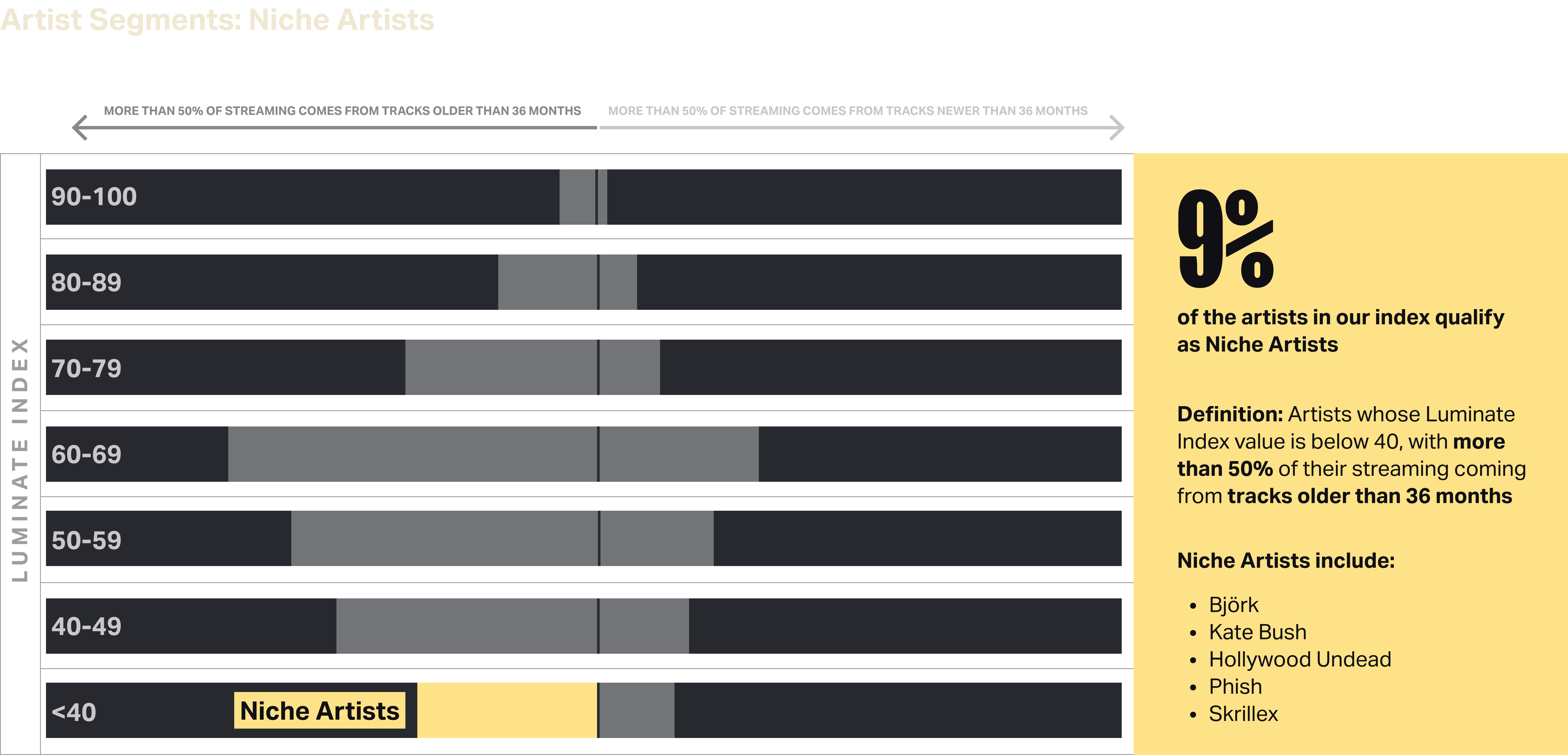

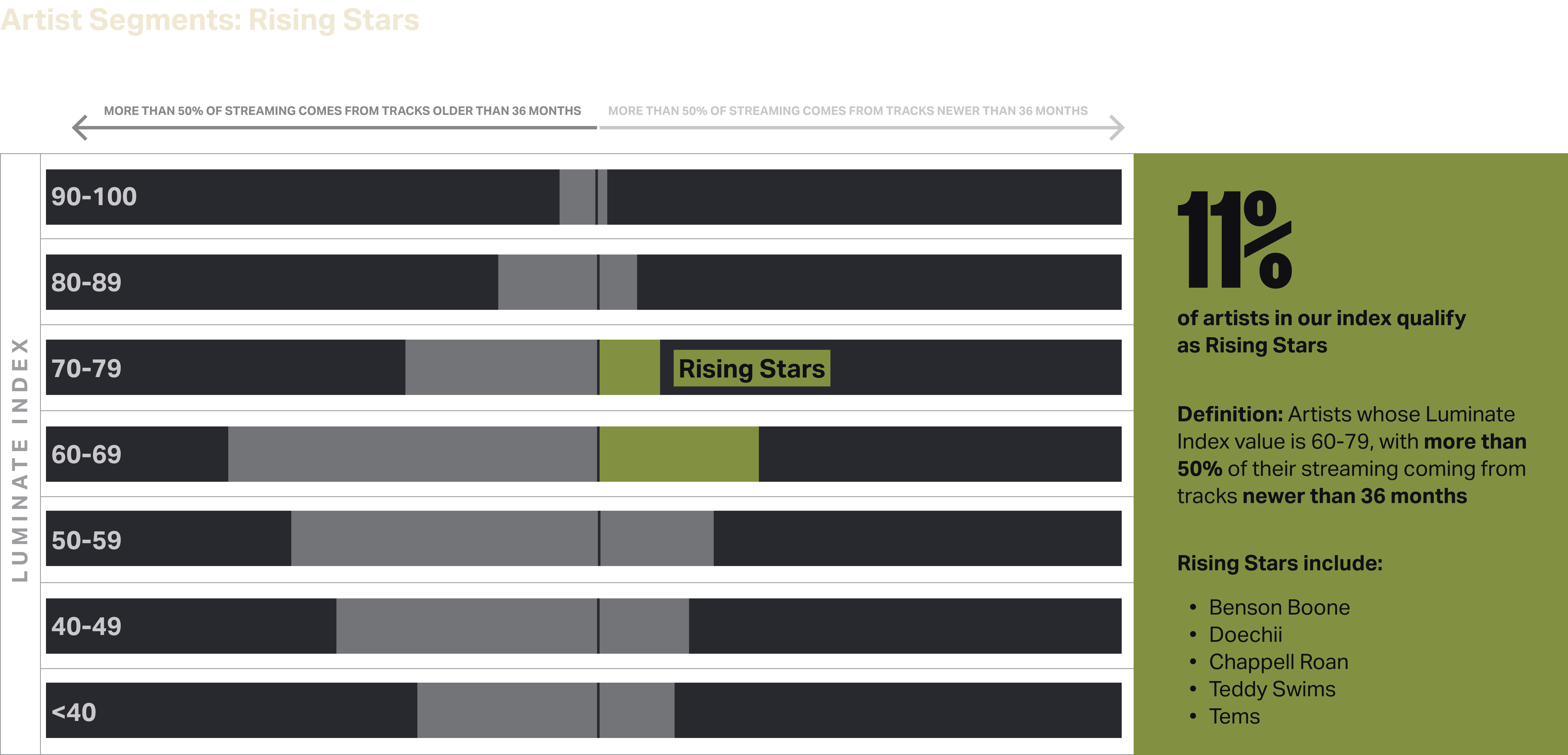

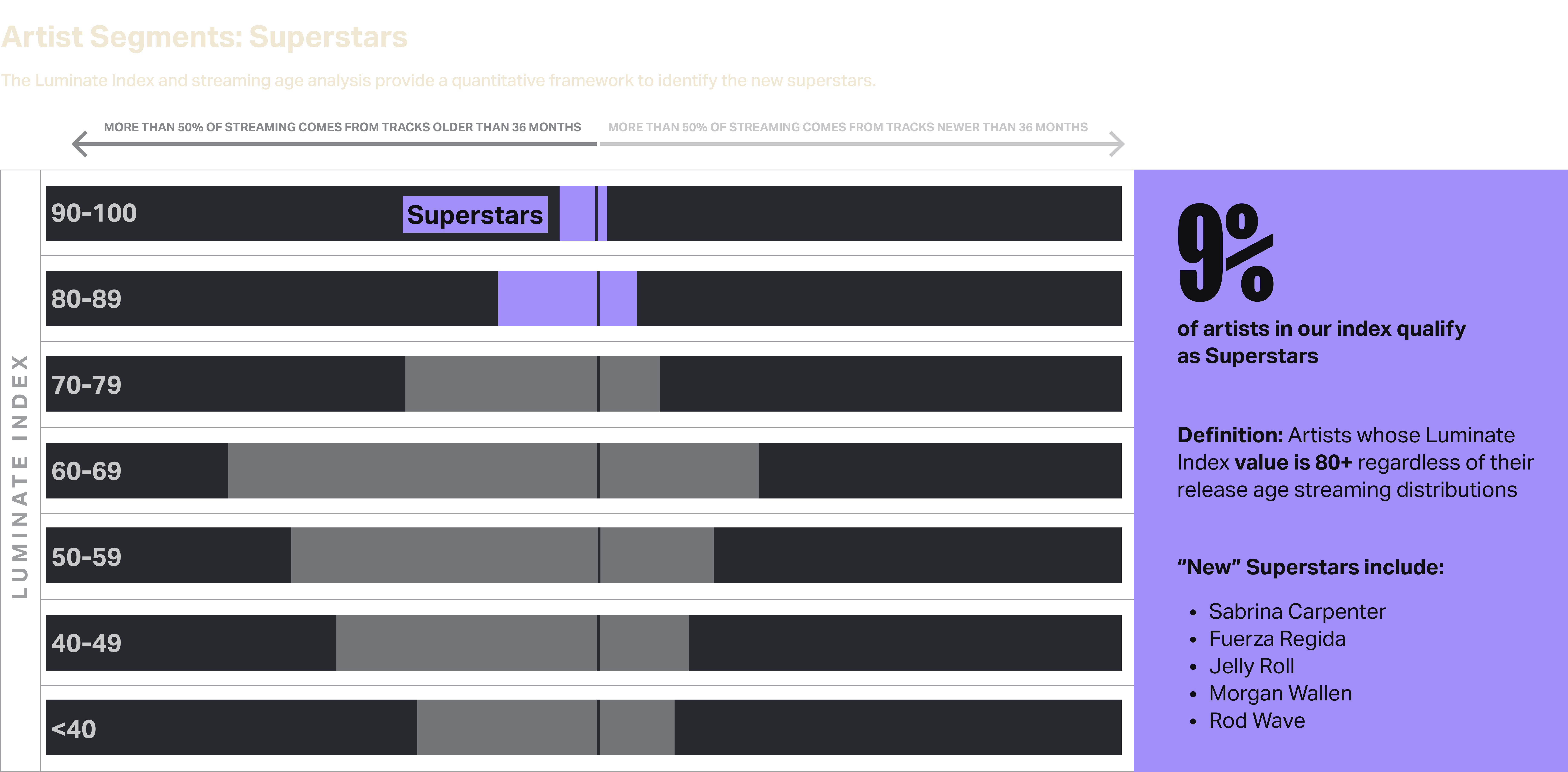

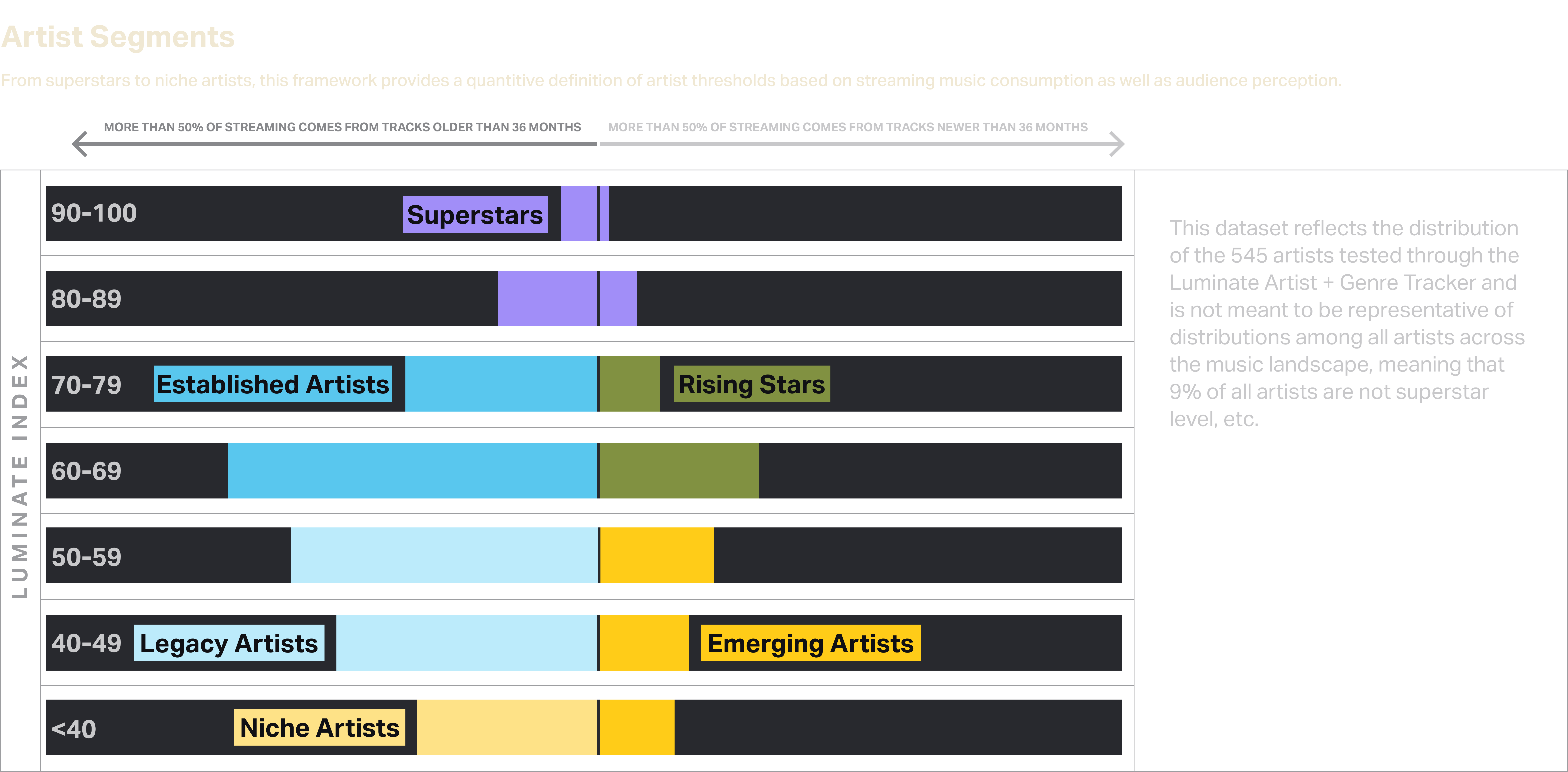

A key business focus is identifying the next generation of superstars who will energize the industry and captivate fans. This section leverages the Luminate Index for a quantitative analysis of emerging superstars, rising talents and tomorrow’s stars.�

Artist Spectrum:

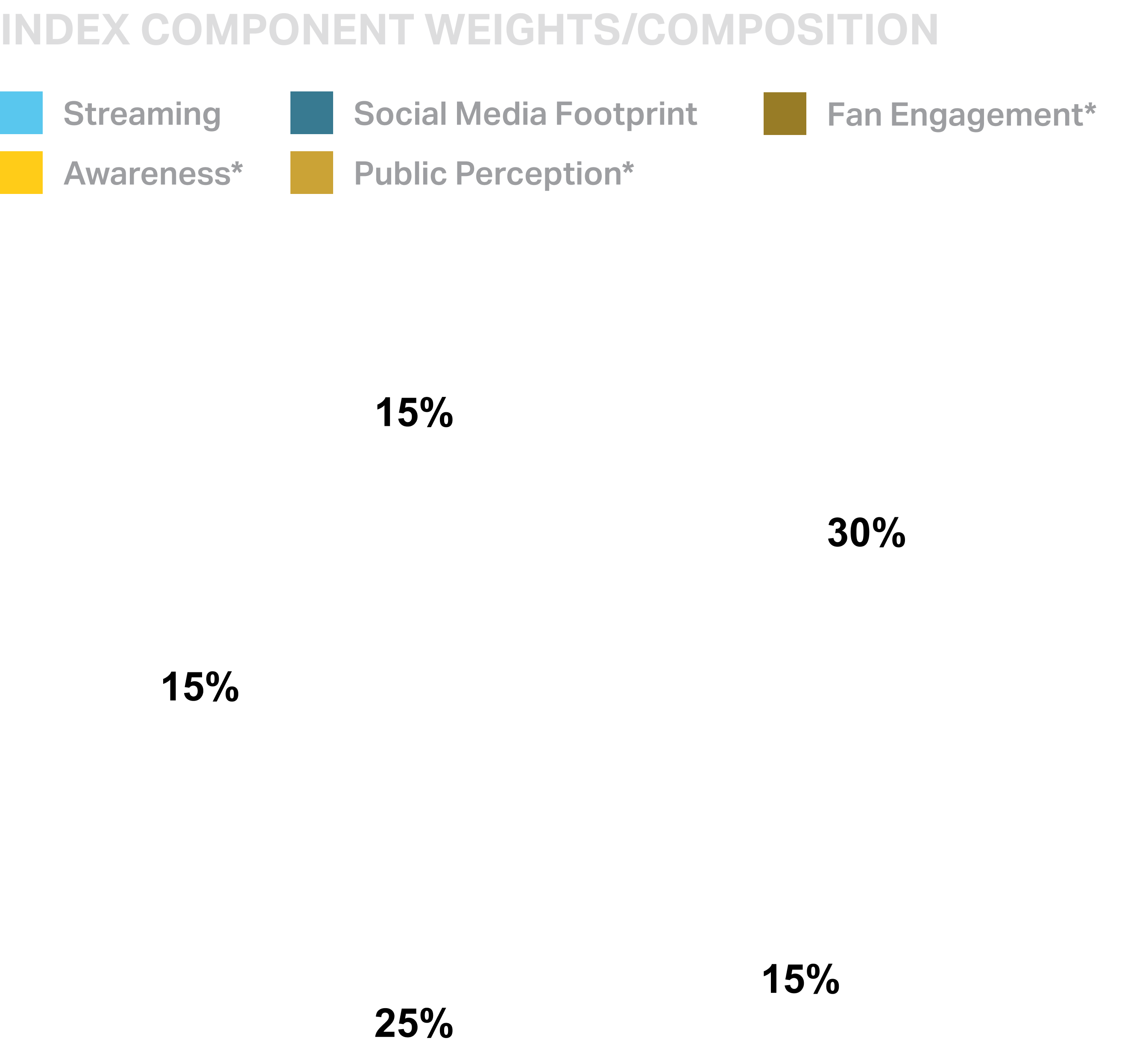

The Luminate Index

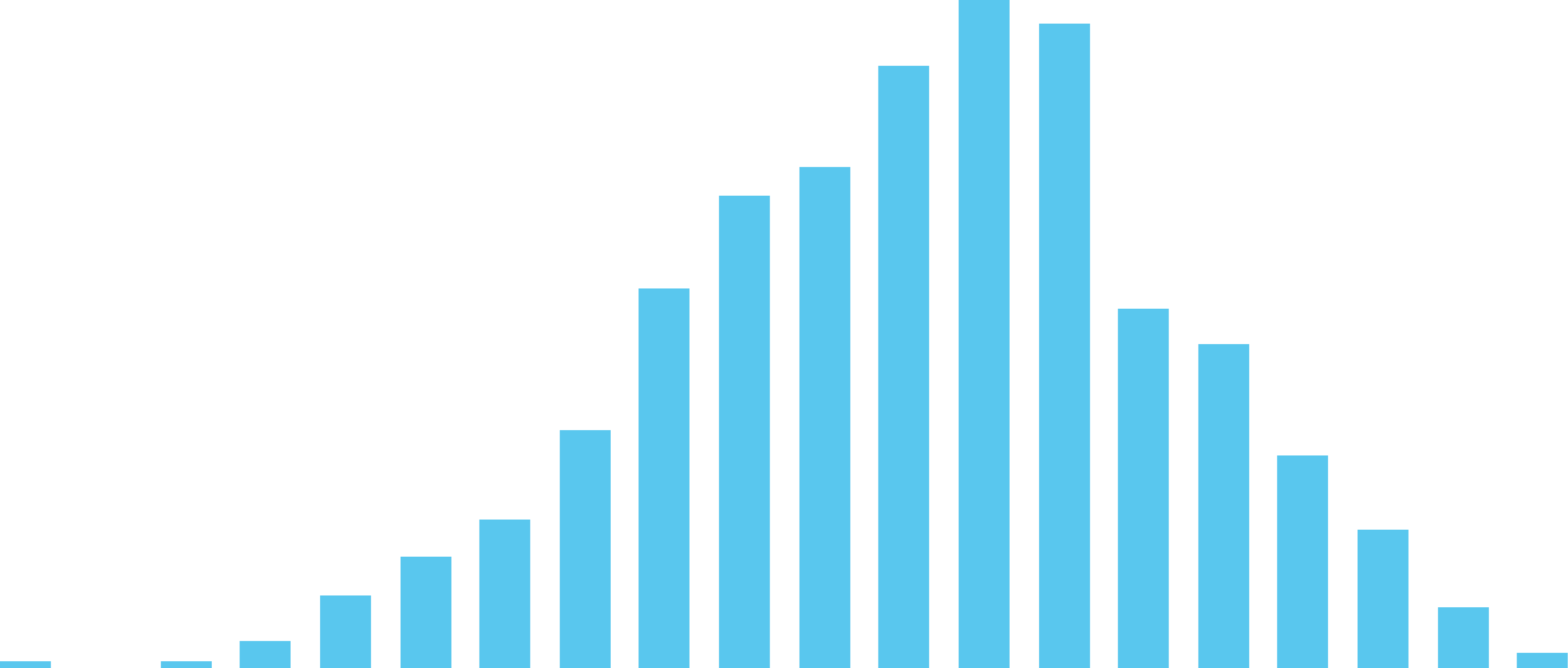

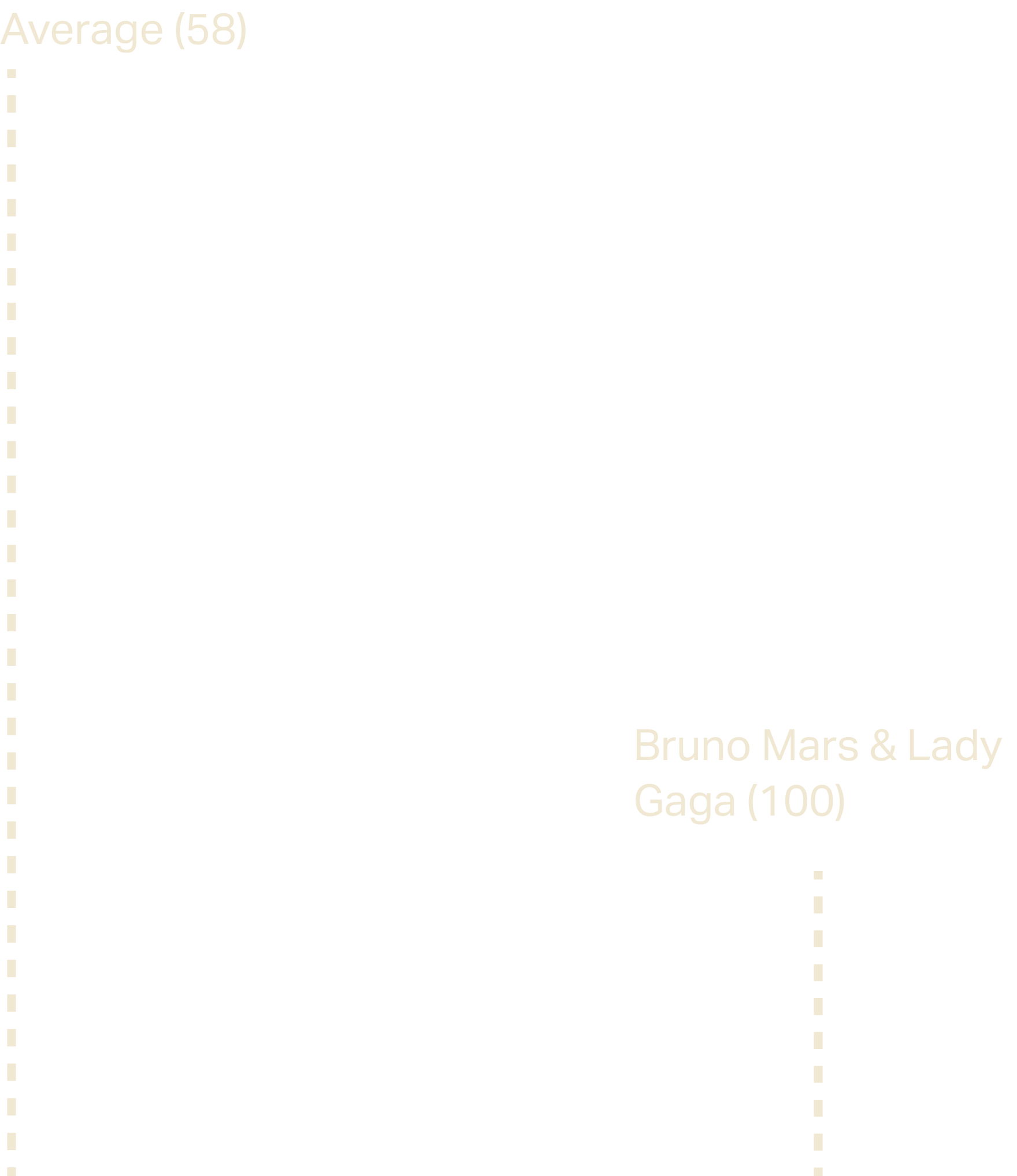

The Luminate Index provides an understanding of the depth, breadth and affinity of an artist’s fandom among consumers. It demonstrates a quantitative approach to defining the new class of superstars as well as other key artist segments.

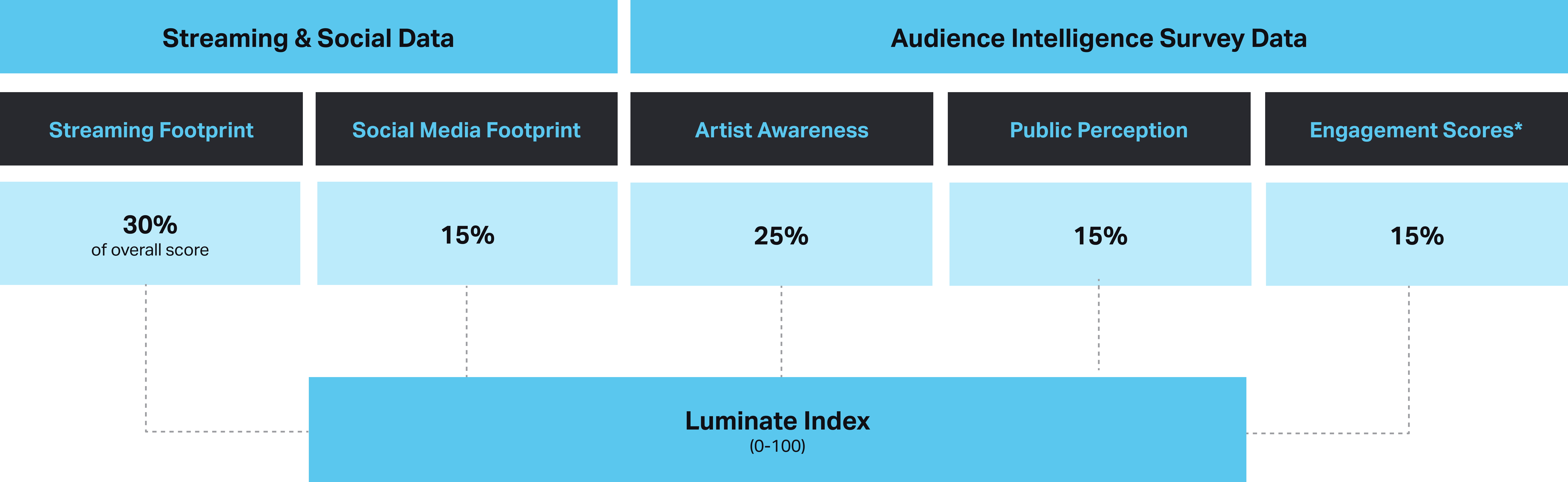

Luminate Index Methodology

The Luminate Index is a composite metric meant to provide labels, brands and agencies with an understanding of the depth, breadth and affinity of an artist’s fandom among U.S. consumers.

Each of the five unique components below contributes to that composite score, with some contributing more or less than others.

Spotlighting Top Music Trends to Watch

�

From cross-platform marketing to emerging audience perspectives on live music and AI, here are three brief looks at trends to keep an eye on over the rest of 2025.�

Future�in Focus:

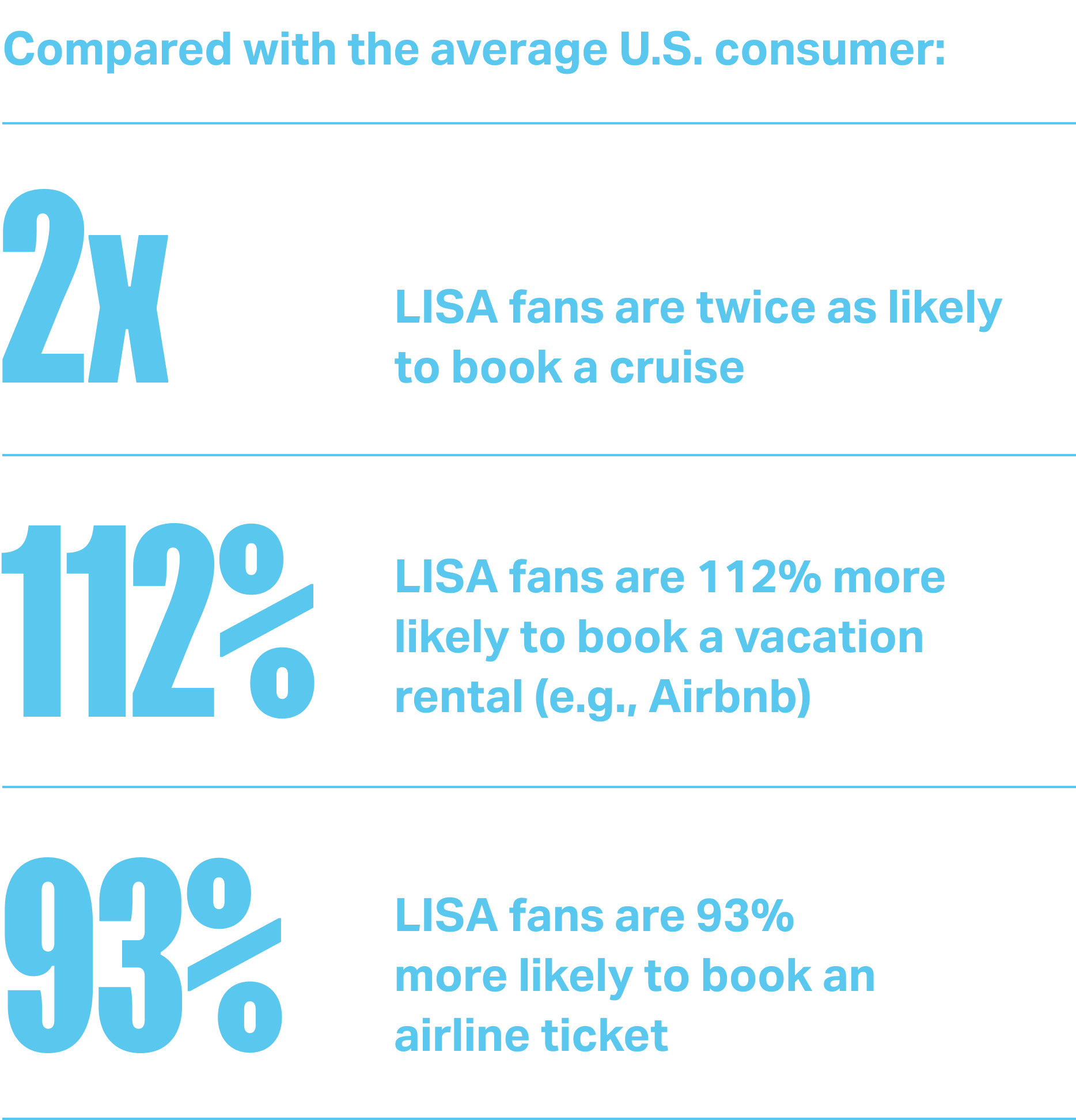

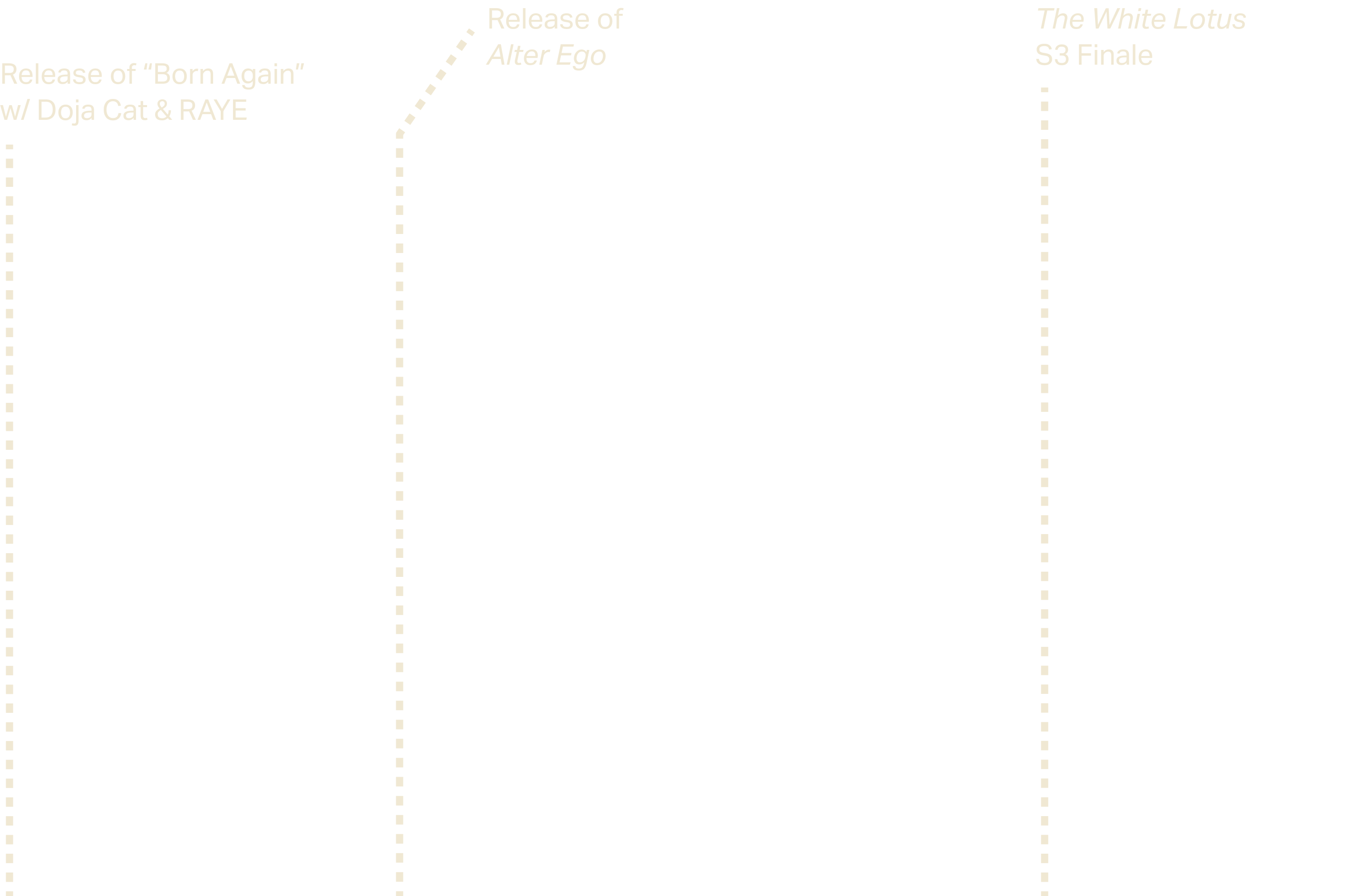

Cross-Platform Performance: Music, Film & TV and Lifestyle Converge in Today’s Entertainment

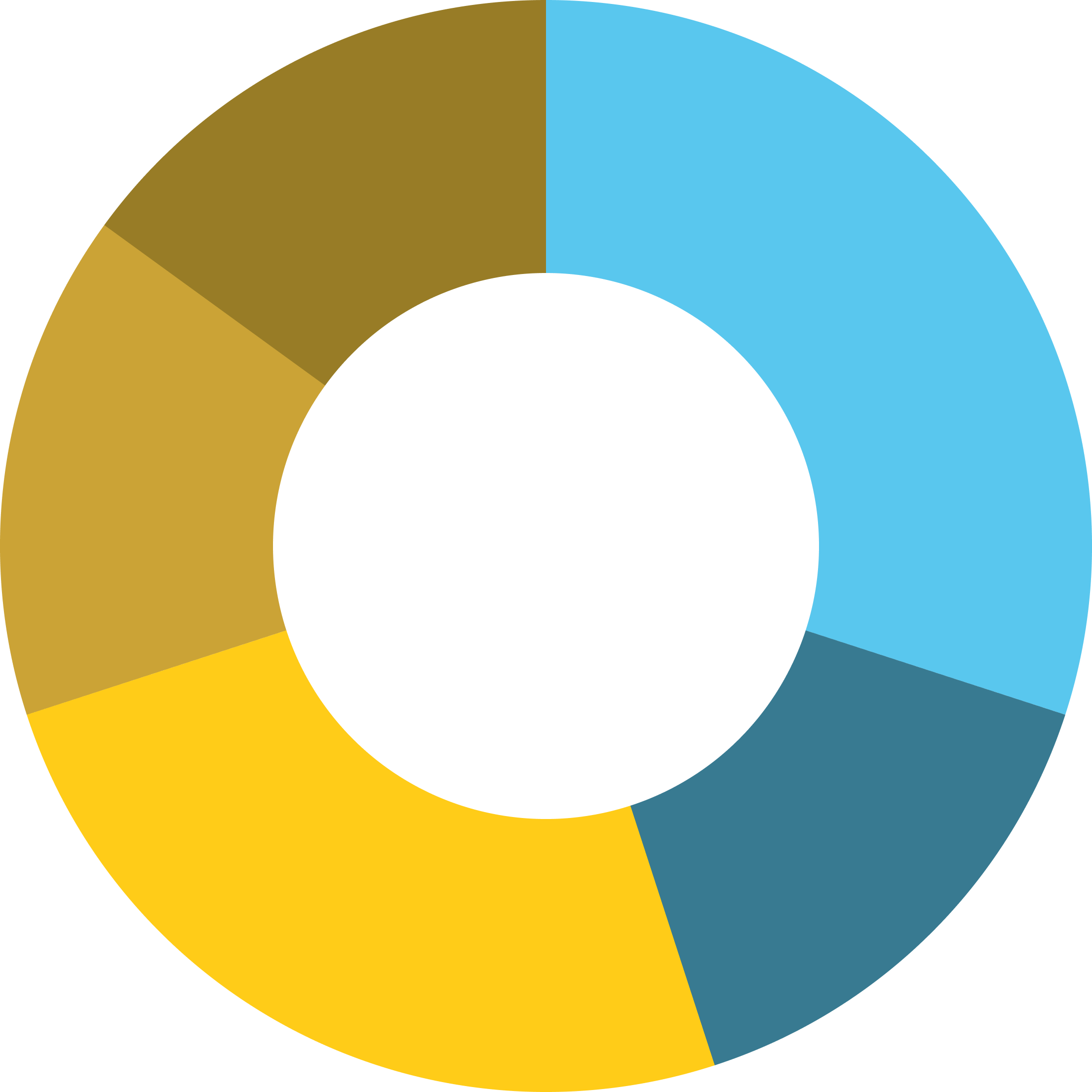

Thai artist LISA (also a member of K-pop group BLACKPINK) starred as Mook in season 3 of HBO’s The White Lotus. The season’s release window coincided with the release period for LISA’s album Alter Ego and helped introduce her to new audiences, while her presence in the show brought fans to the series who are particularly interested in travel — a key component of The White Lotus.

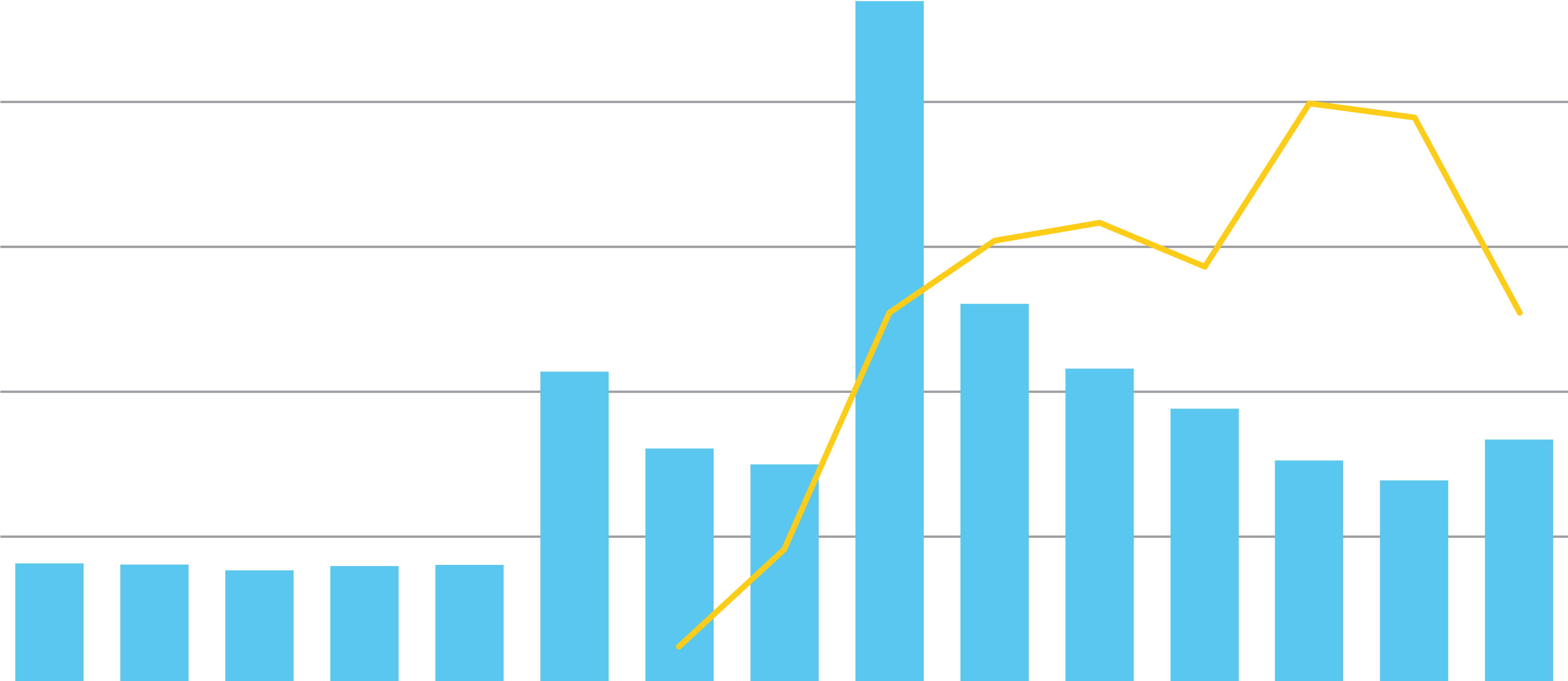

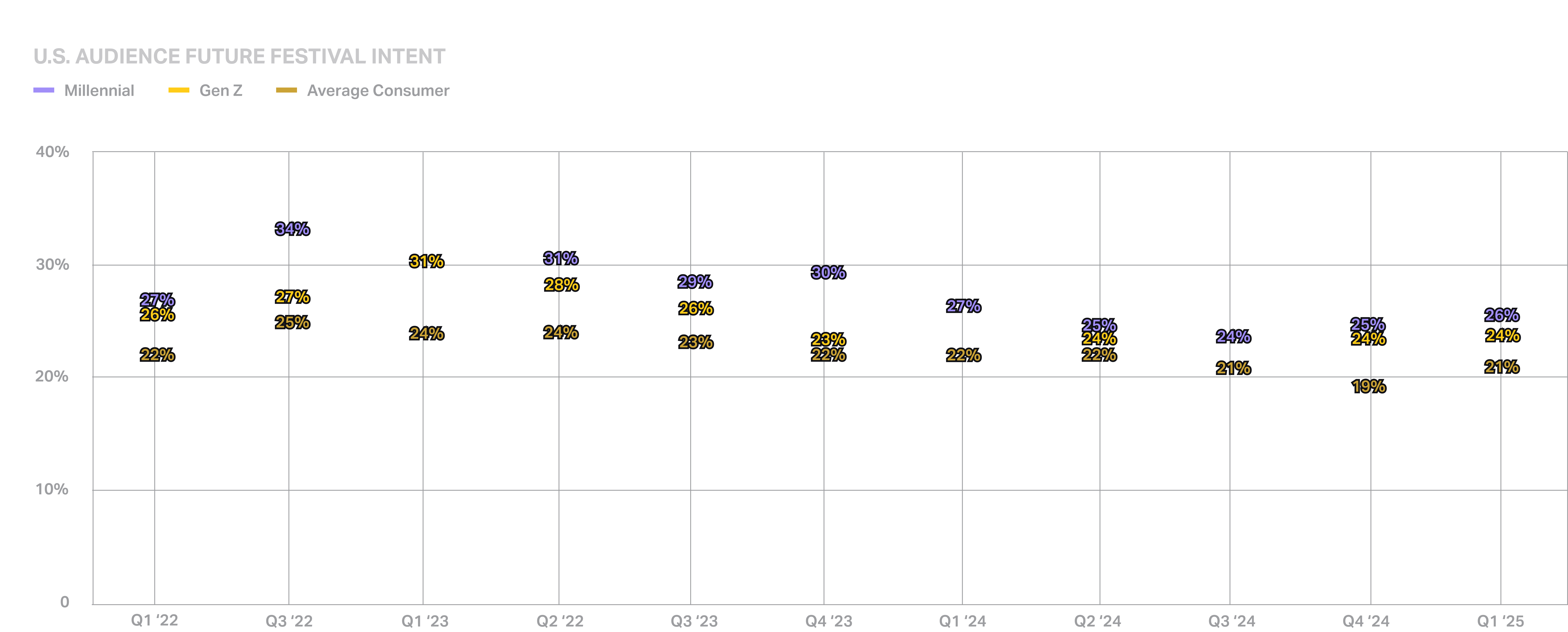

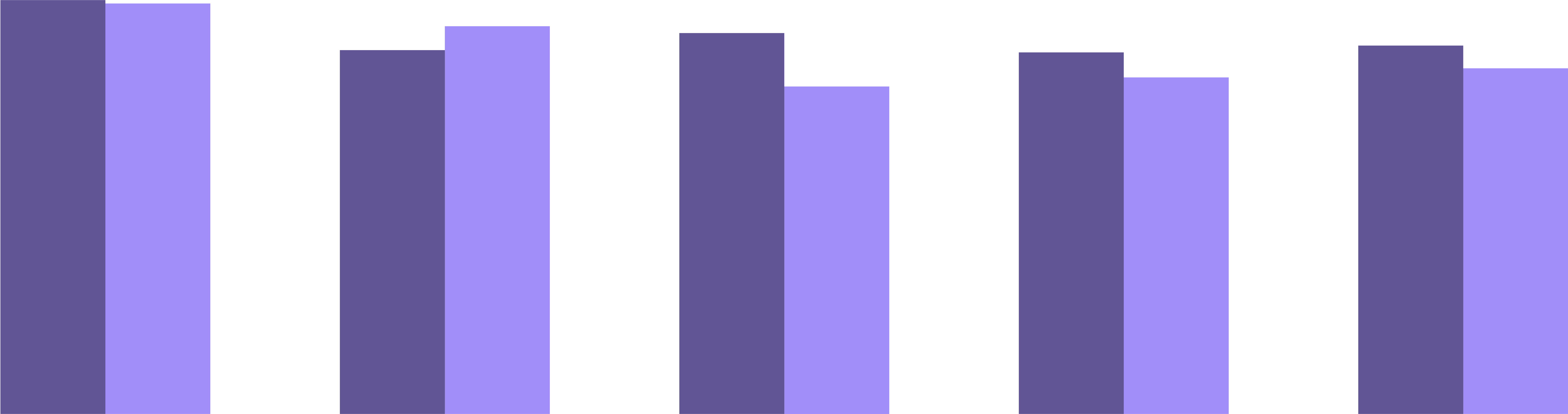

Future Festival Intent

In Q1 2025, intention to attend festivals was lower than it has been historically in the U.S., especially among Millennials. This aligns with industry news of challenges for U.S. festivals over the past 18 months. The upshot: Q1 2025 marks the first instance in several years where future festival intent actually improved vs. the previous quarter among the average consumer.

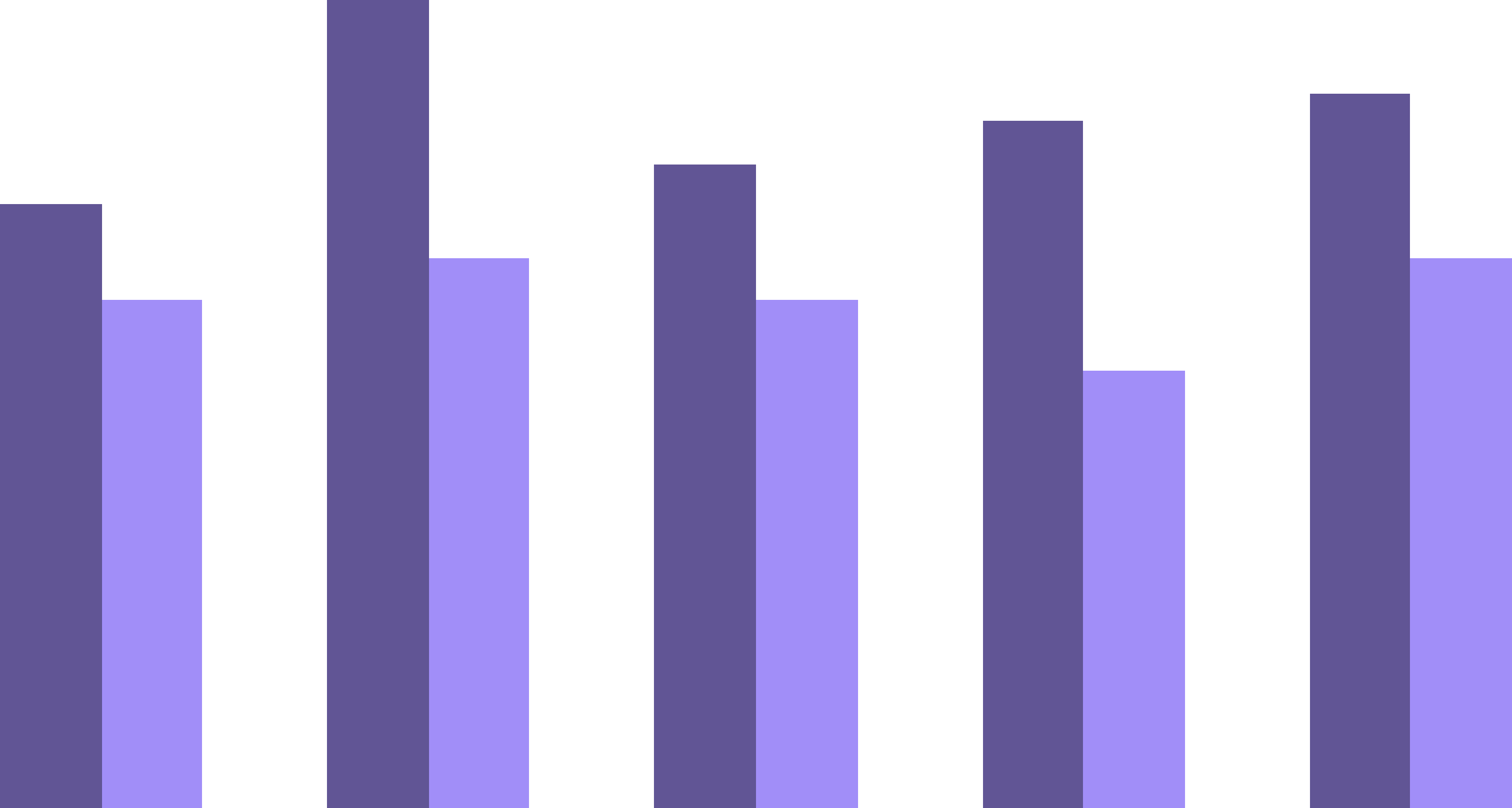

U.S. and Europe: Concerns Over Cost of Festival Tickets

Frustration over prices is the #1 barrier to buying festival tickets in each of these countries, however …

U.S. concern over ticket prices dipped slightly in Q1 2025 after a period of increase in recent quarters

Compared with festivalgoers in the U.S., concern over ticket prices is declining at a steeper rate in Italy, Germany and France

More festival attendees in the UK are citing the cost of a ticket as a concern compared with 2023

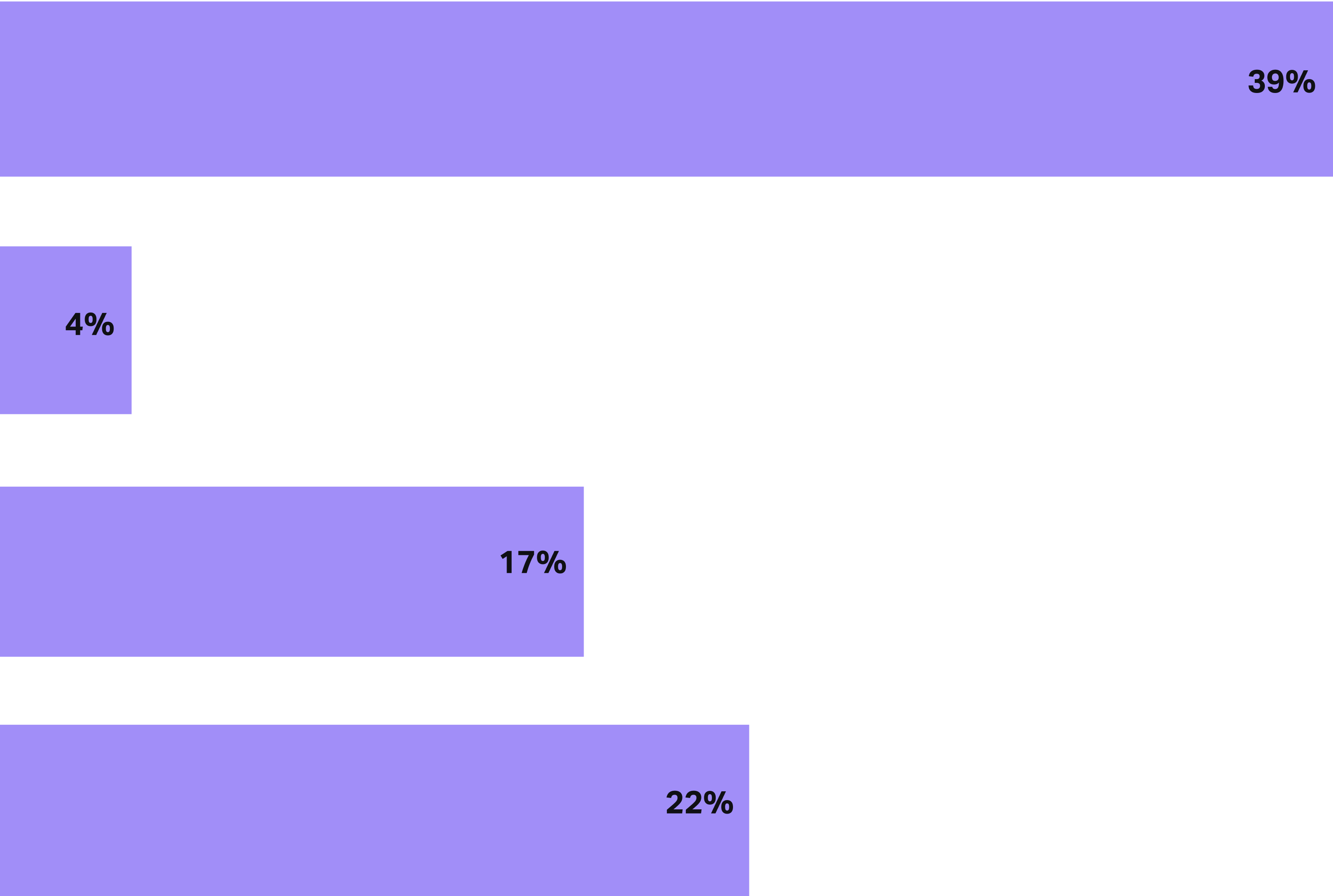

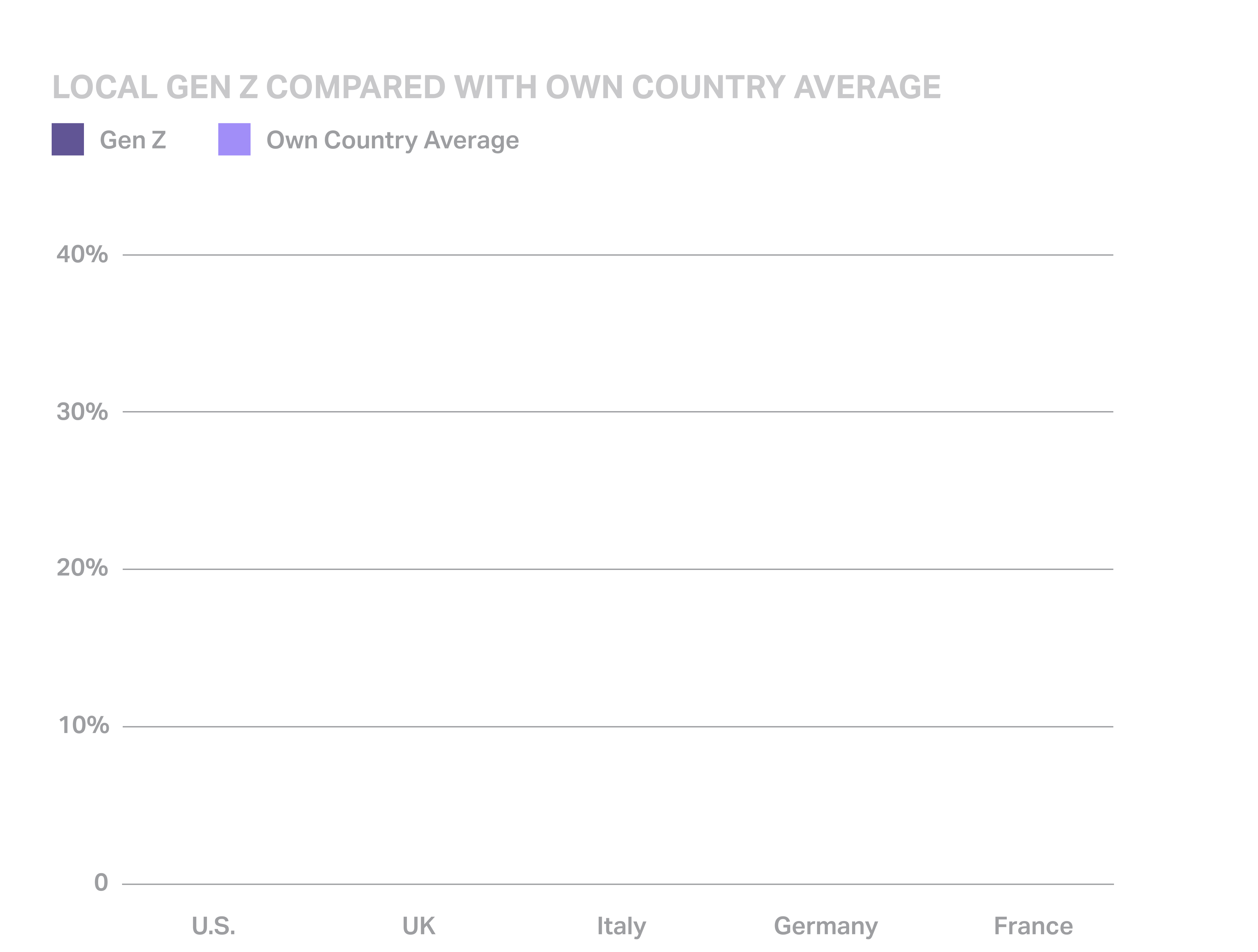

Gen Z in Europe: Future Festival Intent

Gen Z in the UK, Italy, Germany and France are more likely to attend festivals than the average consumer in their own country, with UK Gen Z in particular more interested than their fellow citizens. Additionally, compared with their U.S. counterparts, these fans are more likely to plan on attending a festival in the next 12 months, indicating the continued strength of the European festival market.

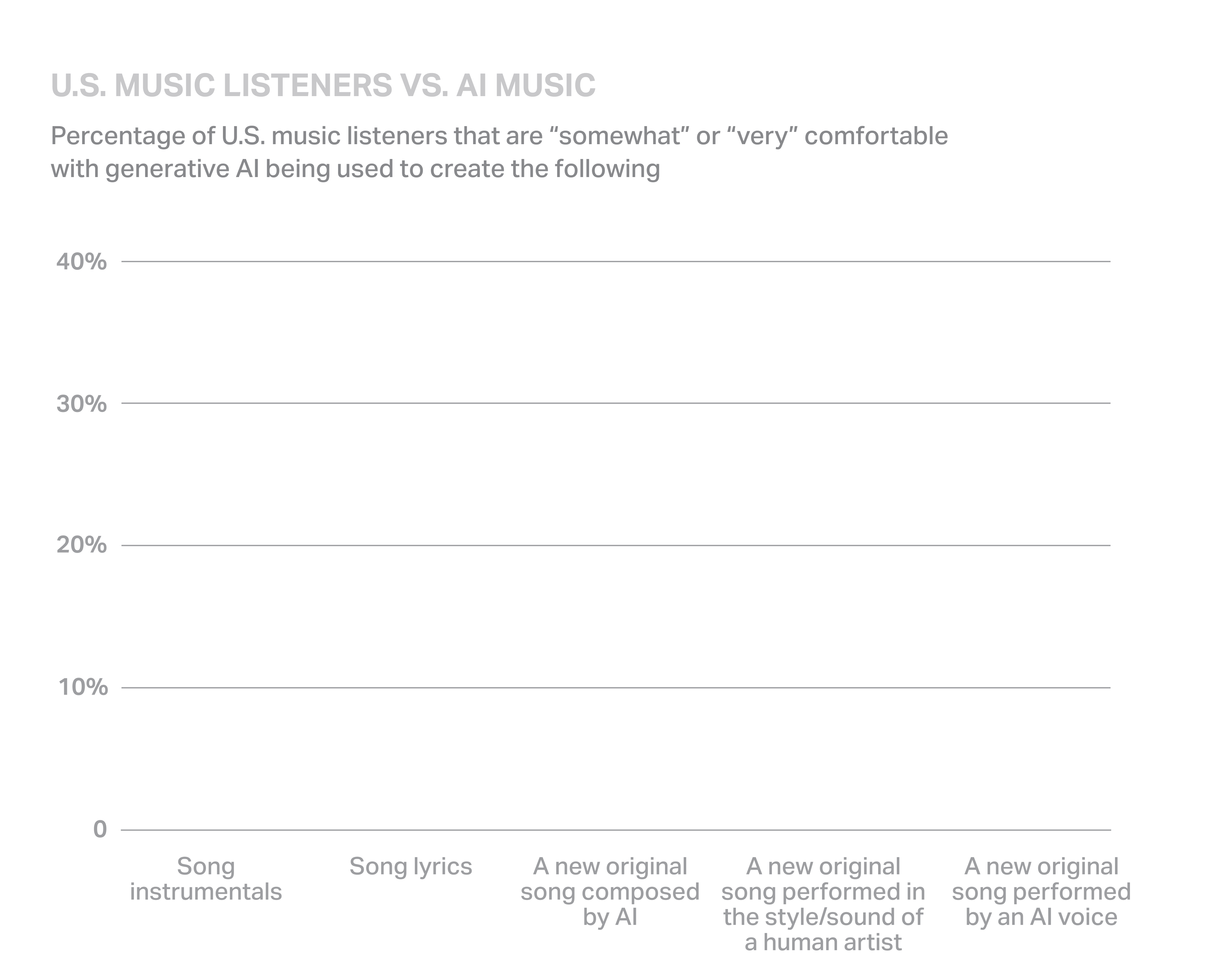

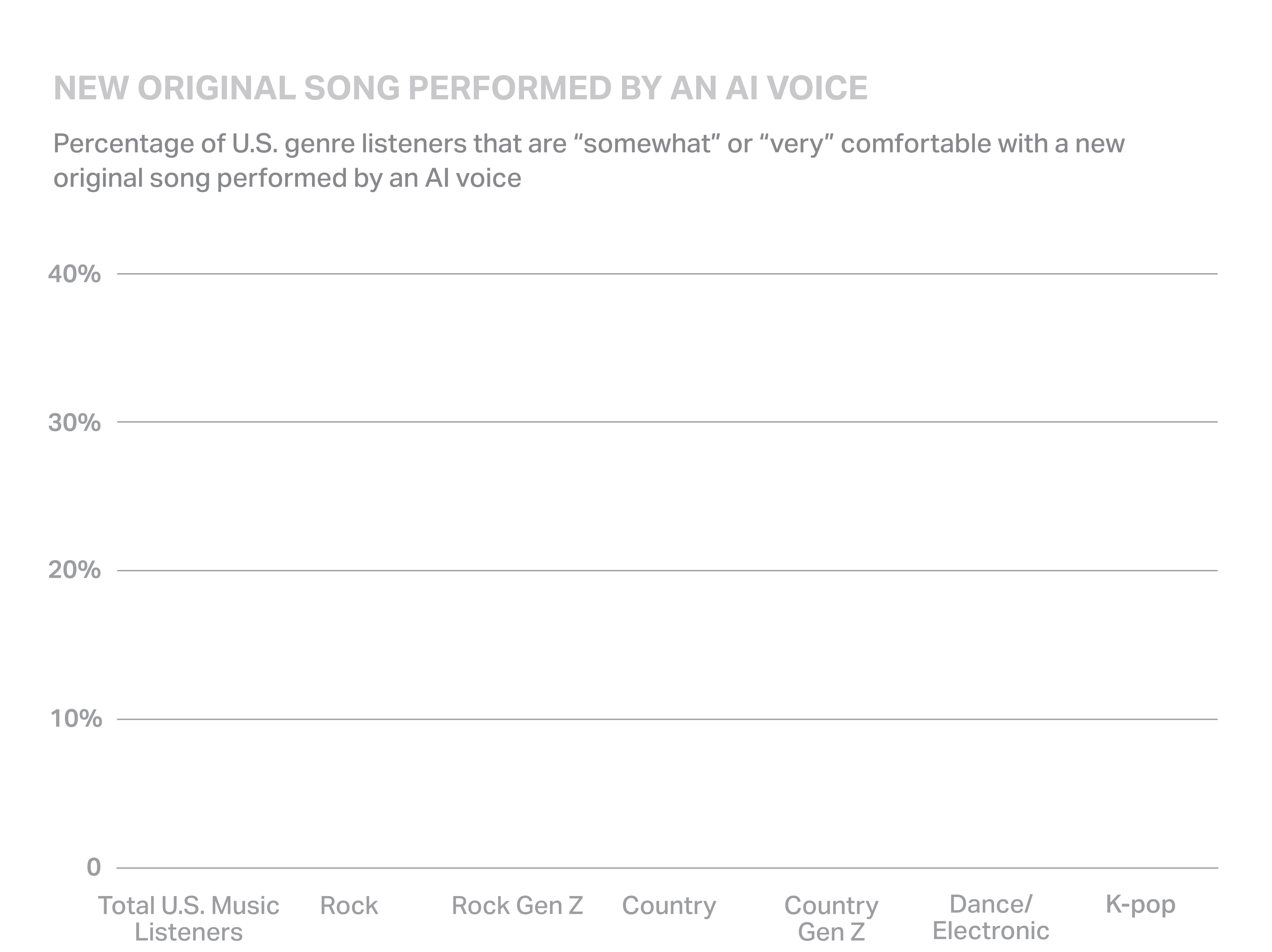

Generative AI for Music Creation

1 in 3 U.S. music listeners report being “somewhat” or “very” comfortable with the use of generative AI to create song instrumentals, with younger music listeners showing higher

levels of comfort. And while 44% report being “somewhat” or “very” uncomfortable with the use of gen AI for creation of a new original song performed by an AI voice, some genre listeners,

including EDM and K-pop, are more open to the practice.

NOTE: ONE TRACK CAN HAVE MULTIPLE SUBGENRES / SOURCE: LUMINATE MUSIC CONSUMPTION DATA

AI and Music Creation

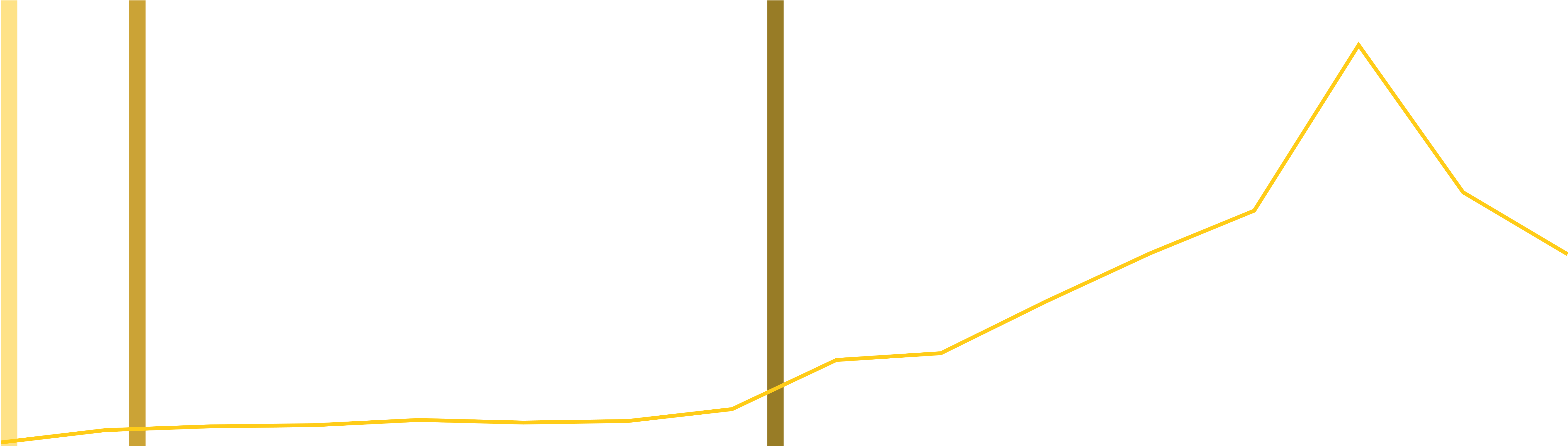

News headlines regarding the use of AI by some artists have circulated broadly in recent weeks. Aventhis has disclosed the use of AI in public creator descriptions while driving over 5M Global On-Demand Audio streams since April 18, 2025. As such, Aventhis’ YouTube channel describes his work as “a dark country project rising in the scene with gritty melodies, outlaw storytelling and a dark, cinematic tone ... Harnessing the creative power of AI as part of his artistic process, Aventhis brings a bold new edge to the genre ...” Learn more about the music industry's most important trends and current challenges in an upcoming Luminate special report; check out the back of this report for more details.

MIDYEAR CHARTS

SOURCE: LUMINATE MUSIC CONSUMPTION DATA

SOURCE: LUMINATE MUSIC CONSUMPTION DATA

NOTE: COMPARED WITH AVERAGE U.S. MUSIC LISTENER / SOURCE: LUMINATE INSIGHTS ARTIST + GENRE TRACKER (U.S.)

SOURCE: LUMINATE MUSIC CONSUMPTION DATA

SOURCE: LUMINATE MUSIC CONSUMPTION DATA

SOURCE: LUMINATE MUSIC CONSUMPTION DATA

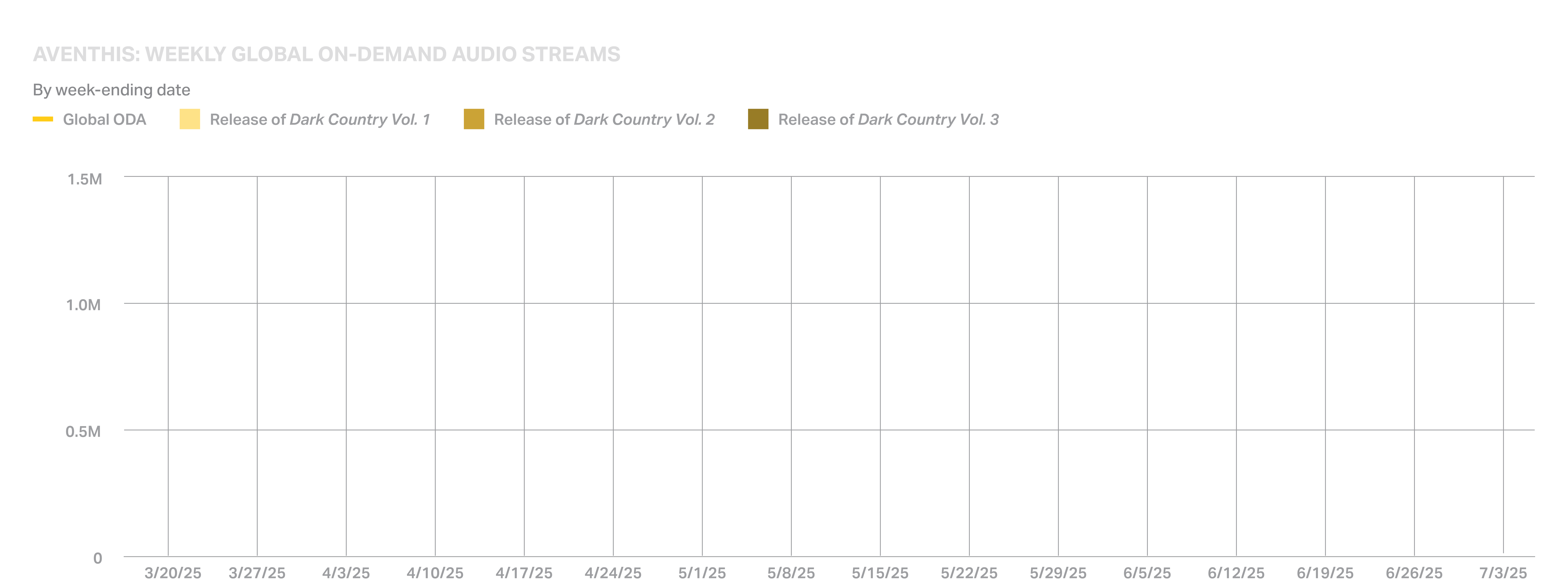

Global Top 10 Countries

Ranked by Overall Streaming Volume (Total On-Demand Audio + Video)

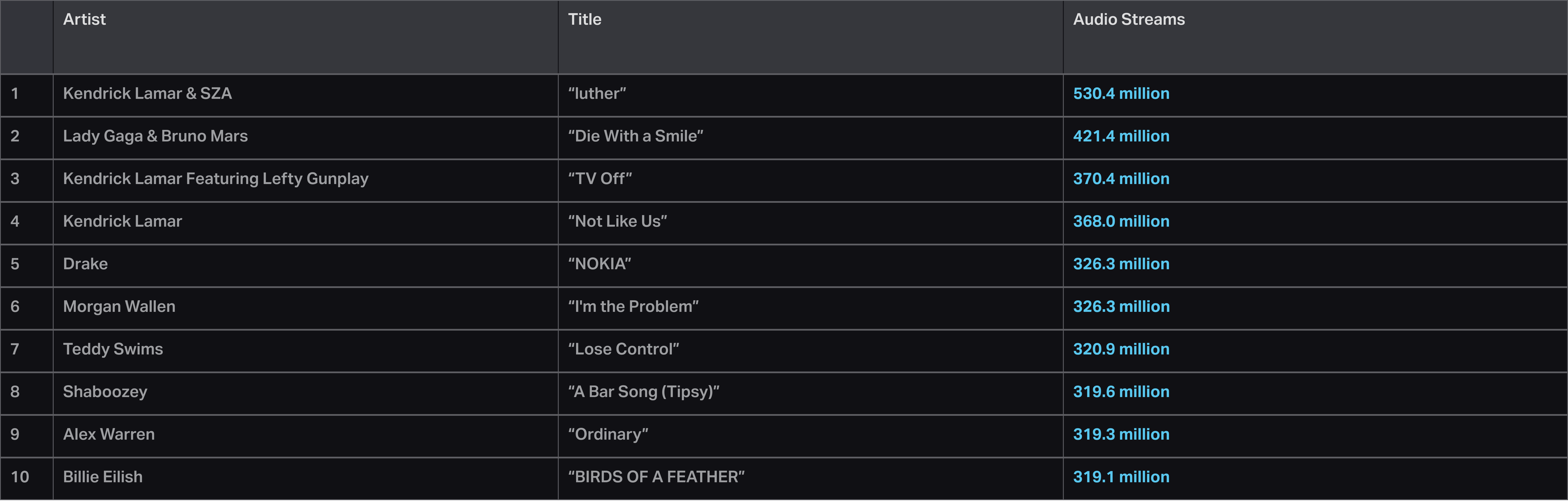

Global Top 10 Songs

On-Demand Audio Streams

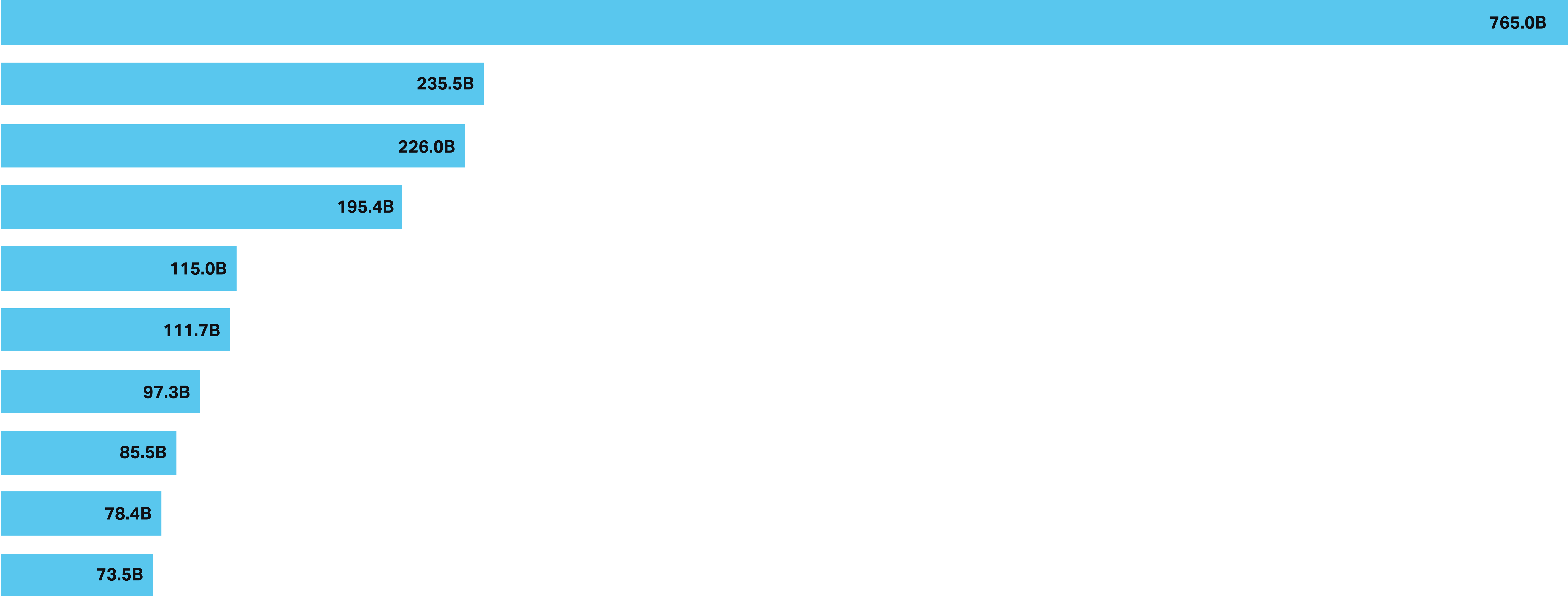

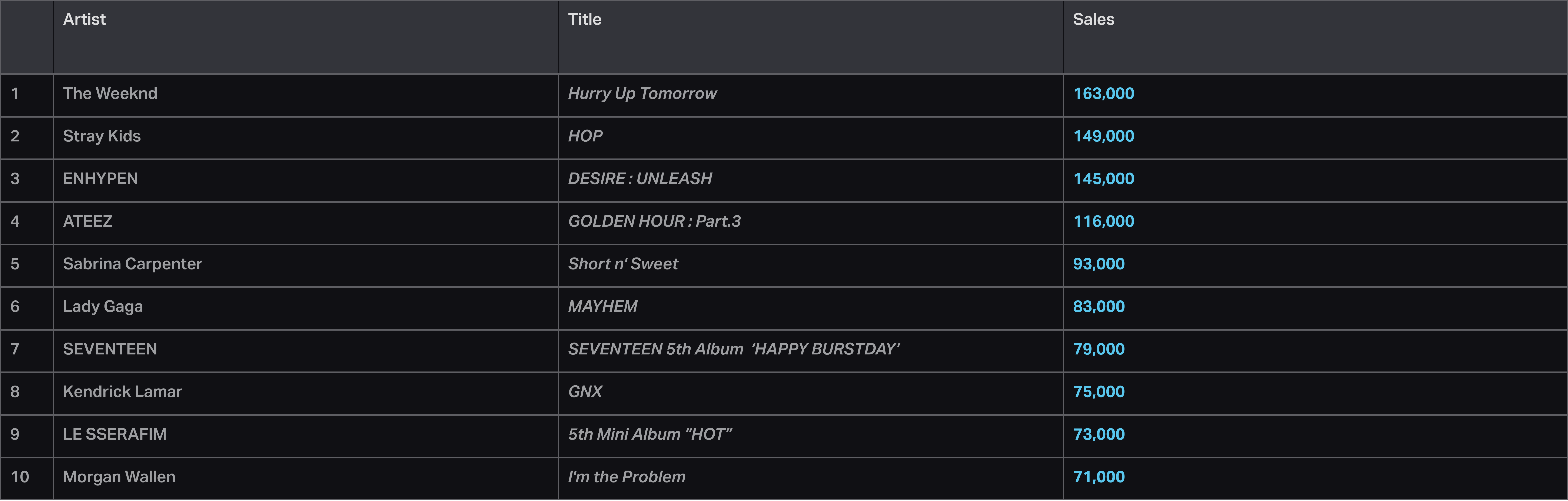

U.S. Top 10 Albums

Album Sales + TEA + SEA On-Demand (Audio + Video)

U.S. Top 10 Albums

Total Sales

SOURCE: LUMINATE MUSIC CONSUMPTION DATA

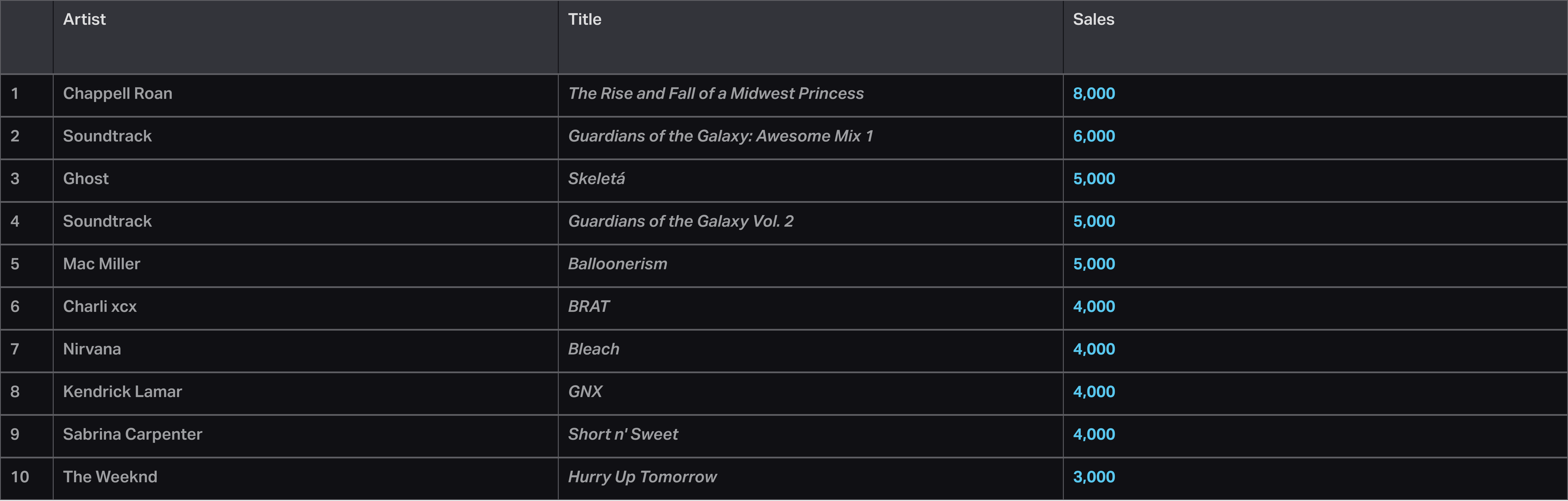

U.S. Top 10 CD Albums

Total Sales

*ACTIVATION CHANNELS LISTED IN METHODOLOGY & FAQ SECTION AT BACK OF REPORT/SOURCE: LUMINATE INSIGHTS MUSIC 360 (U.S.)

U.S. Top 10 Vinyl Albums

Total Sales

U.S. Top 10 Cassette Albums

Total Sales

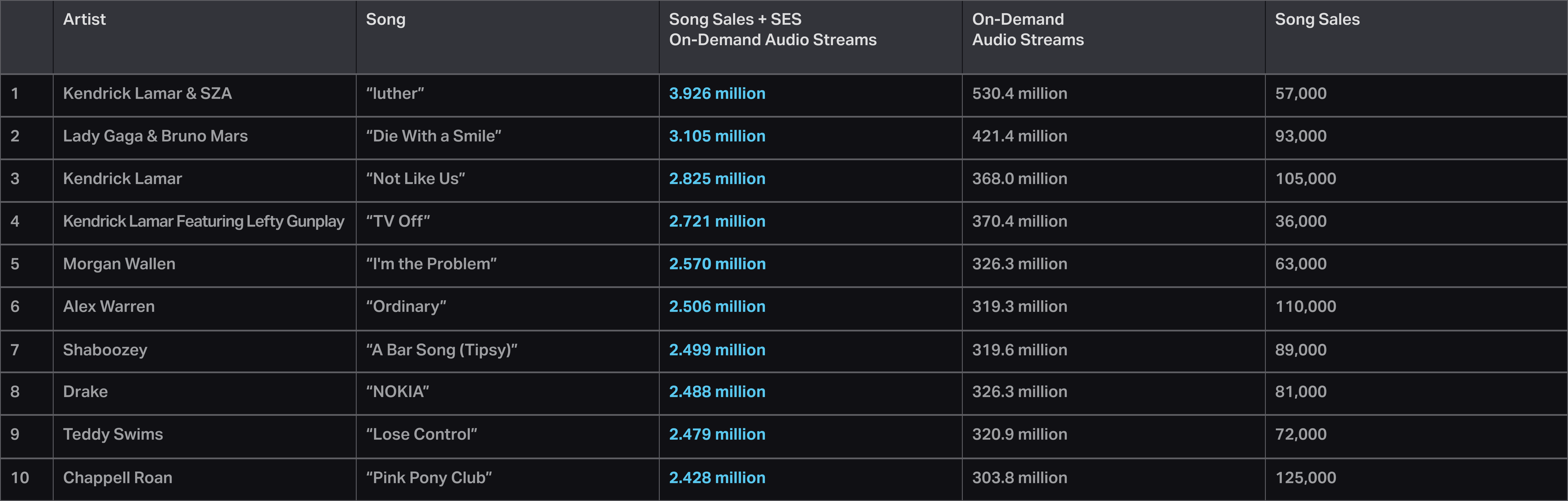

U.S. Top 10 Digital Song Consumption

Songs Sales + On-Demand Audio SES*

U.S. Top 10 Songs

On-Demand Audio Streams

SOURCE: LUMINATE INSIGHTS MUSIC 360 (U.S.)

U.S. Top 10 Songs

Programmed Audio Streams

U.S. Top 10 Radio Songs

Based on Audience

Canada Top 10 Albums

Album Sales + TEA + SEA On-Demand (Audio & Video)

Canada Top 10 Songs

On-Demand Audio Streams

SOURCE: LUMINATE INSIGHTS ARTIST + GENRE TRACKER (U.S.)

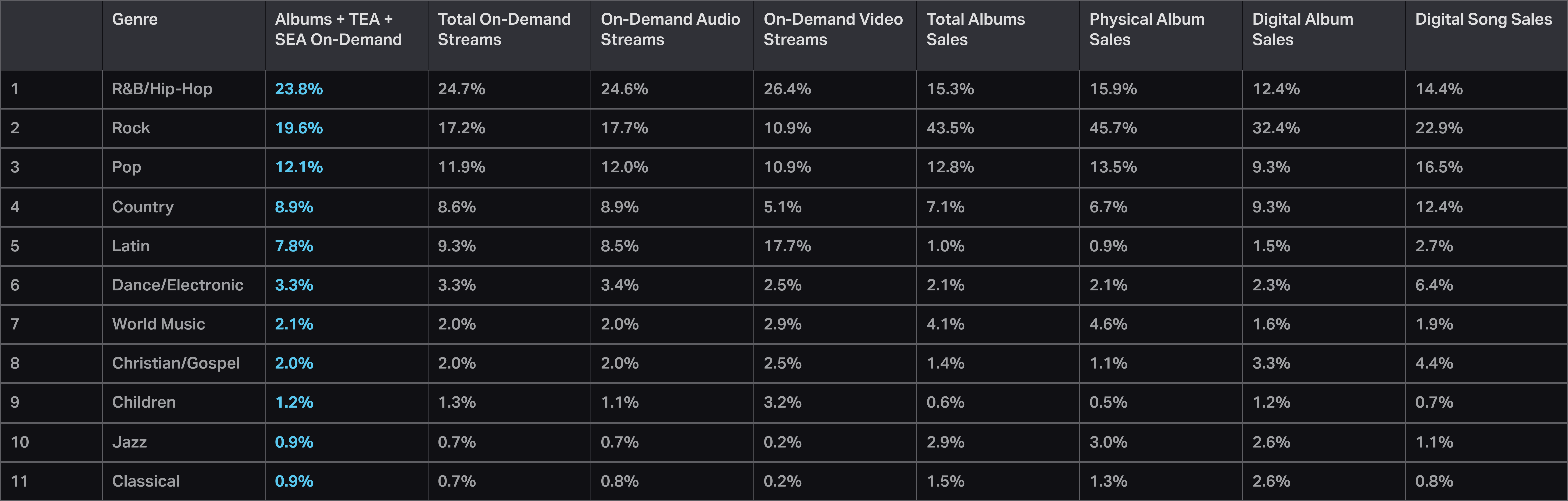

U.S. Share of Total Volume by Format and Genre

Selected Top Genres

SOURCE: LUMINATE INSIGHTS Music 360 (global)

U.S. Share of Total Album-Equivalent Consumption

By Format

Methodology & FAQ

Methodology & FAQ

SOURCE: LUMINATE INSIGHTS music 360 (U.S.)

Data Sources

This 2025 Midyear Music Report is powered by Luminate's industry-leading data used by entertainment executives, investors, brand leaders and technology visionaries. For more information or to inquire about accessing the data, please visit luminatedata.com.

Learn more about the music industry’s most important trends in a Luminate special report releasing Aug. 1 ��Available for purchase here for just $499

The major labels’ shift in focus from streaming user growth to “Super Fans”�How music publishing revenues surpassed the global film box office�Where live music stands amid record-high ticket prices and economic uncertainty

THE STATE OF THE MUSIC INDUSTRY 2025��Like other entertainment fields this year, the music industry finds itself in uncharted territory. ��Business is booming, but the days of riding post-pandemic demand to record revenues are ending. Streaming usership in major markets is approaching critical mass, prices for live music are exceeding audience budgets, music publishing’s revenue streams are endangered by the rise of AI, and musicians’ ability to live off of music is more tenuous than ever. The last time music’s leaders got too comfortable, the MP3 and Napster caught them off-guard, and the industry cratered. To this day, the value of music hasn’t recovered. ��This year presents an inflection point: To keep growing, the industry needs to regain the value music lost and protect itself from losing value further.��This Luminate special report, “Key Changes in the Music Industry,” lays out the solutions being implemented to keep the margins moving upward: more price tiers, more Super Fan experiences, more venues, more AI protections, more acquisitions and so on.�� These initiatives will mostly benefit the top-of-the-ladder companies implementing them. Others will have a profound impact — good and bad — on the smaller, independent corners of the industry. ��Either way, the music business is on the cusp of change. This report offers a comprehensive overview of where the industry stands — and hopefully informs those who will determine where it’s going.

SOURCE: LUMINATE STREAMING VIEWERSHIP (M)

SOURCE: LUMINATE MUSIC CONSUMPTION DATA

* Engagement metrics include: Tune-in/watch on TV, Live event ticketing, Livestream ticketing, Brand engagement �SOURCE: LUMINATE INSIGHTS; LUMINATE MUSIC CONSUMPTION DATA

*SURVEY-BASED COMPOnENTS�SOURCE: LUMINATE INSIGHTS; LUMINATE MUSIC CONSUMPTION DATA

SOURCE: LUMINATE INSIGHTS; LUMINATE MUSIC CONSUMPTION DATA�

SOURCE: LUMINATE MUSIC CONSUMPTION DATA; LUMINATE STREAMING VIEWERSHIP (M); LUMINATE INSIGHTS artist + genre tracker (u.s.) �

SOURCE: LUMINATE INSIGHTS Music 360 (u.s.) �

SOURCE: LUMINATE INSIGHTS music 360 (global) �

SOURCE: LUMINATE INSIGHTS music 360 (Global)�

SOURCE: LUMINATE INSIGHTS entertainment 365

SOURCE: LUMINATE MUSIC CONSUMPTION DATA; AVENTHIS OFFICIAL YOUTUBE CHANNEL DESCRIPTION (7/3/25)

Source: luminate music consumption data

Source: luminate music consumption data

Top 10 Albums (Album Sales + TEA + on-demand SEA): Ranked by equivalent album units comprising album sales, track equivalent albums (TEA) and streaming equivalent albums (SEA). Each unit = one album sale, or 10 tracks sold from an album, or 1,250 PREMIUM ON-DEMAND OFFICIAL STREAMS // 3,750 AD-SUPPORTED ON-DEMAND OFFICIAL STREAMS BY SONGS FROM AN ALBUM (UGC ON-DEMAND STREAMS NOT INCLUDED)

Source: luminate music consumption data

Source: luminate music consumption data

Source: luminate music consumption data

Source: luminate music consumption data

* Top 10 Digital Song Consumption: Ranked by traditional digital song sales + SES units, where 125 premium streams = one song // 375 ad-supported streams = one song;�ON-DEMAND VIDEO SONG STREAMING INCLUDES OFFICIAL, SONG UGC AND NON-SONG UGC

Source: luminate music consumption data

PROGRAMMED STREAMS ARE THOSE FROM DMCA-COMPLIANT SERVICES.

source: MEDIABASE; LUMINATE METRO RADIO STREAMING

Top 10 Albums (Album Sales + TEA + on-demand SEA): Ranked by equivalent album units, comprising album sales, track equivalent albums (TEA) and streaming equivalent albums (SEA). Each unit = one album sale, or 10 tracks sold from an album, or 1,250 PREMIUM ON-DEMAND OFFICIAL STREAMS // 3,750 AD-SUPPORTED ON-DEMAND OFFICIAL STREAMS BY SONGS FROM AN ALBUM (UGC ON-DEMAND STREAMS NOT INCLUDEd)

Source: luminate music consumption data

Source: luminate music consumption data

Source: luminate music consumption data

This dataset reflects the distribution of the 545 artists tested through the Luminate Artist + Genre Tracker and is not meant to be representative of distributions among all artists across the music landscape, meaning that 9% of all artists are not superstar level, etc.

click on each segment to learn more

click to

download a PDF

Click on region on map to view more info

ASIA

Middle East and Africa

Europe

Latin America