Introduction

About Luminate

About the Author

After years of upheaval, 2025 was supposed to be a return to normalcy for Los Angeles’�beleaguered entertainment industry, hence the “Survive ’til ’25” catchphrase heard throughout 2024. January’s tragic wildfires upended that expectation almost immediately, while fresh data showed film and TV production in the city was hitting new lows even before the fires. Now, with 2025 halfway over, tongue-wagging about L.A. becoming the next Detroit is seemingly at an all-time high.��It’s not easy to dissect how the industry got here, but suffice it to say a closer look at the trends underlying L.A.’s production downturn quickly reveals much more at work than the aftereffects of Hollywood’s dual strikes. If our analysis paints a bleak picture — for the City of Angels in particular and the U.S. generally — it’s partly because there are few, if any, concrete proposals on the table that would realistically address the hurdles facing the industry. Bringing runaway production back home to Hollywood demands a nuanced, multipronged approach. Here’s hoping this report contributes something constructive to that conversation.

Luminate is the entertainment industry’s most trusted data partner, unleashing access to the most essential, objective and trustworthy information across music, film and television, with data compiled from hundreds of verified sources. Today, the company maintains its more than 30-year legacy of accurate storytelling by powering the iconic Billboard music charts, while also acting as the premiere database for the television and film industries, which includes fueling Variety’s Streaming Originals Charts. Working closely with record labels, artists, studios, production companies, networks, tech companies, and more, Luminate offers the most valued source of comprehensive, independent, and foundational entertainment data that drives industry forward. Luminate is an independently operated company and a subsidiary of PME TopCo., a joint venture between Penske Media Corporation and Eldridge.

Luminate is the entertainment industry’s most trusted data partner, unleashing access to the most essential, objective, and trustworthy information across music, film and television, with data compiled from hundreds of verified sources. Today, the company maintains its more than 30-year legacy of accurate storytelling by powering the iconic Billboard music charts, while also acting as the premiere database for the television and film industries, which includes fueling Variety’s Streaming Originals Charts. Working closely with record labels, artists, studios, production companies, networks, tech companies, and more, Luminate offers the most valued source of comprehensive, independent, and foundational entertainment data that drives industry forward. Luminate is an independently operated company and a subsidiary of PME TopCo., a joint venture between Penske Media Corporation and Eldridge.

Tyler Aquilina is a Luminate media analyst, covering the streaming and content landscapes and their effects on the media/tech business. He was previously at Entertainment Weekly, where he wrote on, among many topics, the film industry, streaming and worker issues in Hollywood.

IN THIS

REPORT

Los Angeles’ Decline

Post-Peak TV Output

2025 Production

Unscripted Production�

U.S. Financial Incentives

Global Financial Incentives

U.S. vs. Other Countries

International Series

Key Production Locations

Film Budgets�

Los Angeles’ Decline

01

02

03

04

05

06

07

08

09

10

01

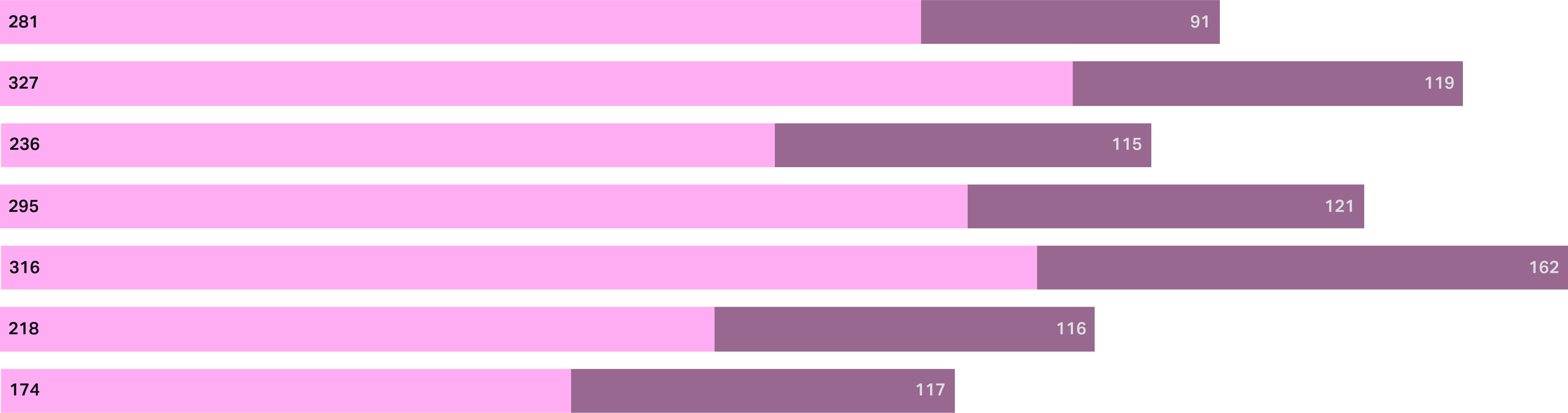

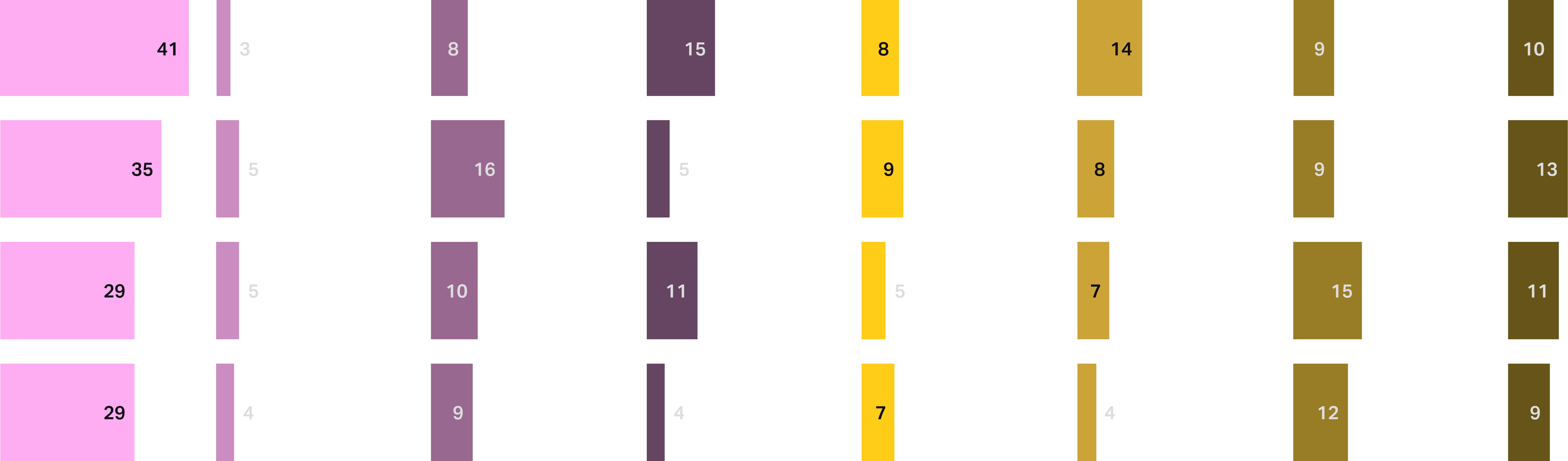

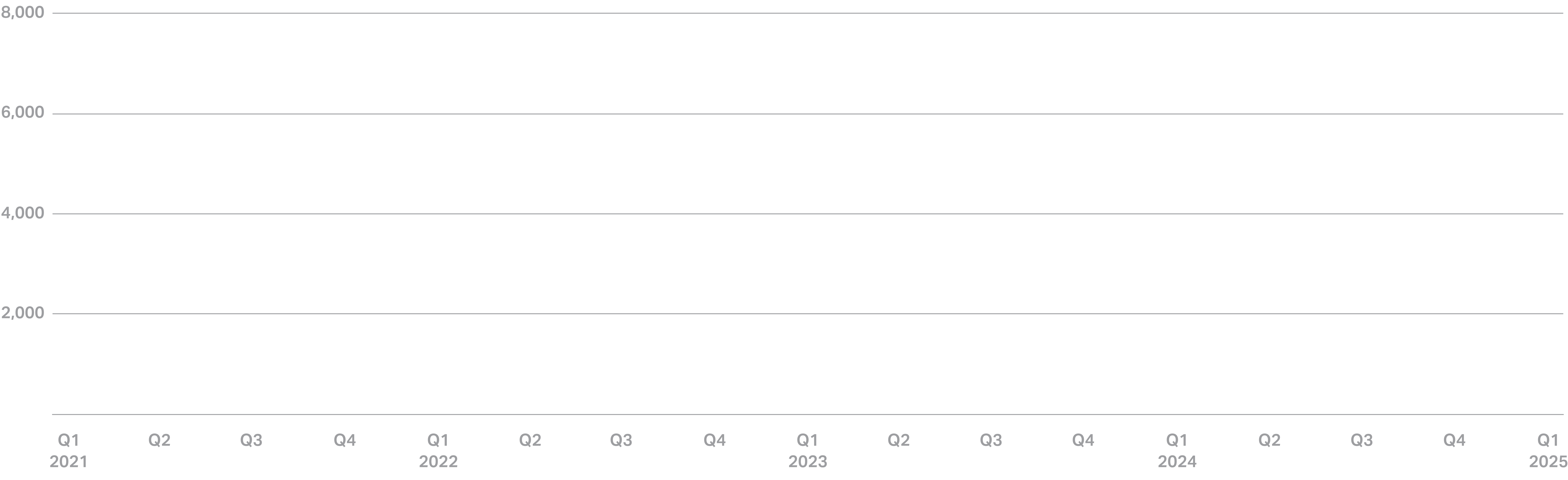

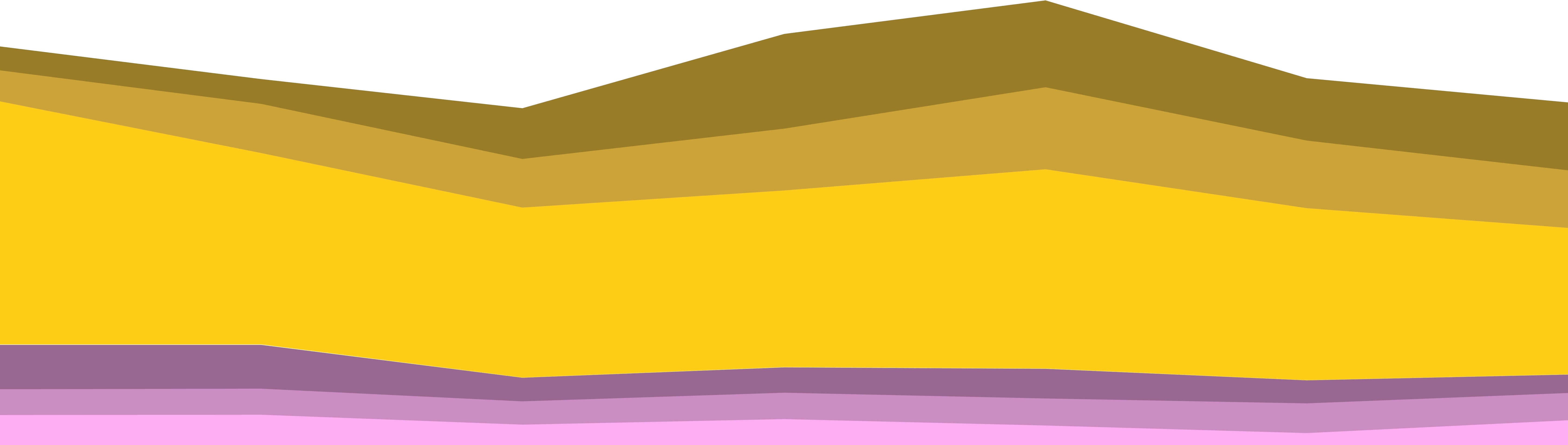

Though its underlying causes have been at work for decades, Los Angeles’ ebb as a production center reached a tipping point with the end of peak TV and the 2023 industry strikes. FilmLA reported 2024 saw the second-lowest annual level of L.A. production (ahead of only 2020), and 2025 has so far dropped even further.

Source: FilmLA Note: Includes commercial shoot days; figures based on days of permitted production within jurisdictions served by FilmLA; “shoot day” (or “SD”) is defined as crew’s permission to film at one or more defined locations in any 24-hour period

Aggregate Los Angeles Film & TV Shoot Days

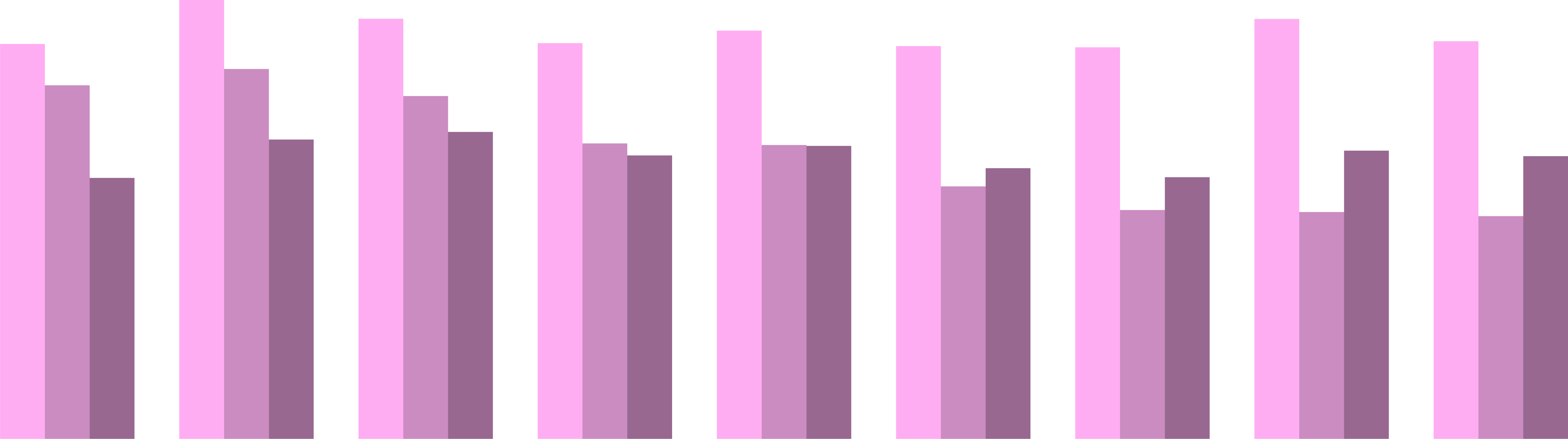

With this decline has come a bloodletting for the region’s film and TV workers, who have seen thousands of jobs disappear with little hope of returning in the near future, if at all. California averaged 92,000 production jobs in Q1, down 35% year over year from 2022 and nearly 20% versus a decade ago.

Greater Los Angeles Film & TV Production Jobs, 2022-24

Source :U.S. Bureau of Labor Statistics

L.A.’s downturn cannot be easily or swiftly reversed, despite the policy proposals now on the table. For one thing, rising costs for labor and materials, likely to be exacerbated by the Trump tariffs, will only push more projects elsewhere.

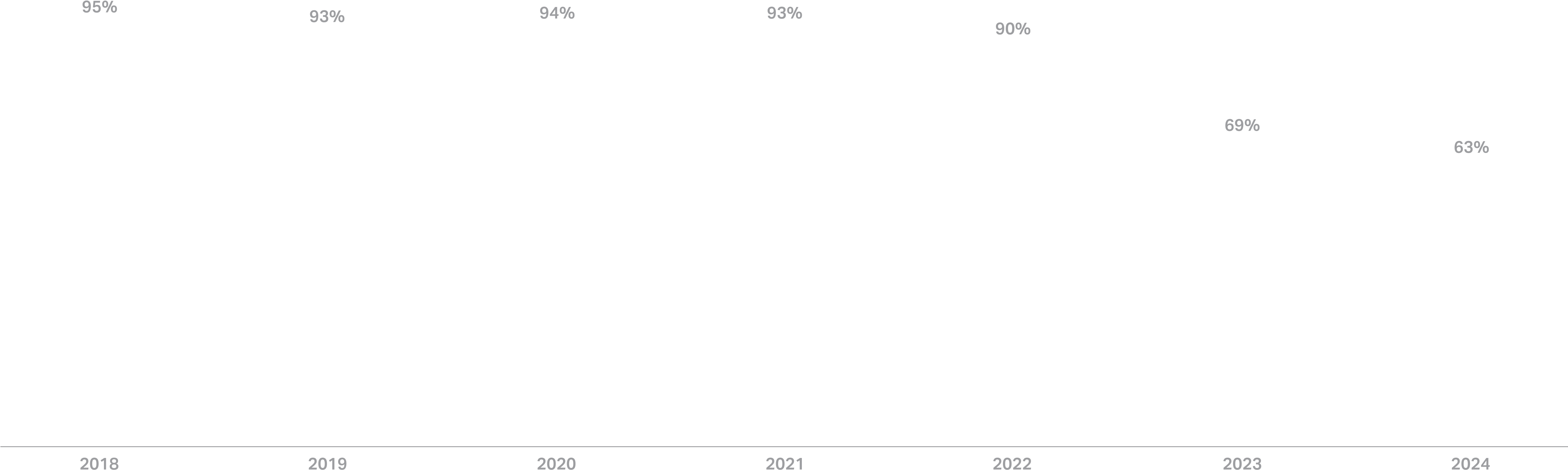

Los Angeles Soundstage Average Annual Occupancy

Source: FilmLA; Note: Based on aggregated data sourced from�17 participating studios in greater Los Angeles that combined own�and/or operate approximately 82% of L.A.’s certified stage market

Post-Peak TV Output

02

L.A.’s downturn cannot be easily or swiftly reversed, despite the policy proposals now on the table. For one thing, rising costs for labor and materials, likely to be exacerbated by the Trump tariffs, will only push more projects elsewhere.

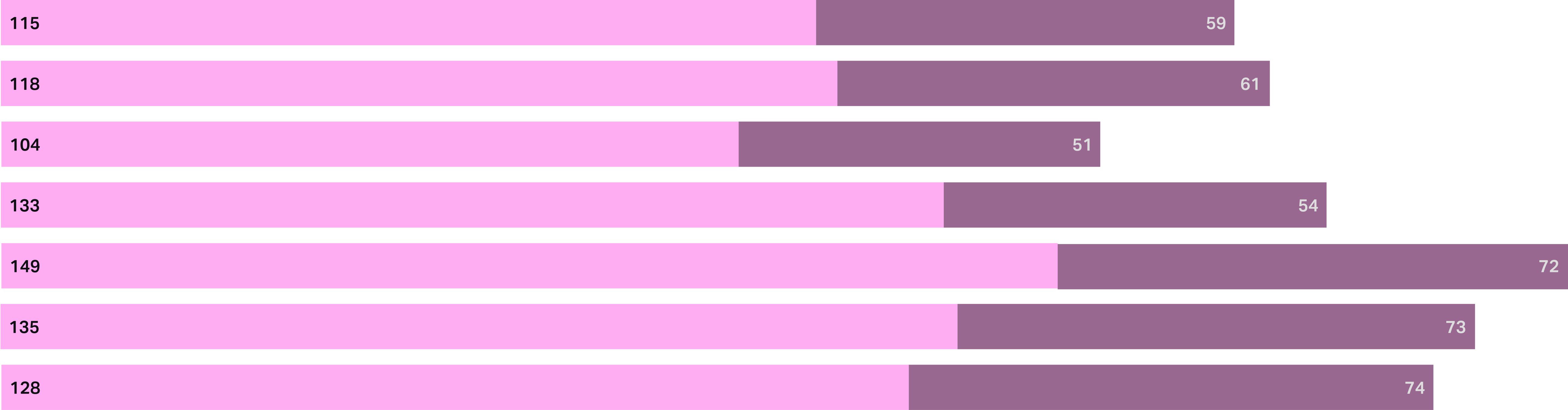

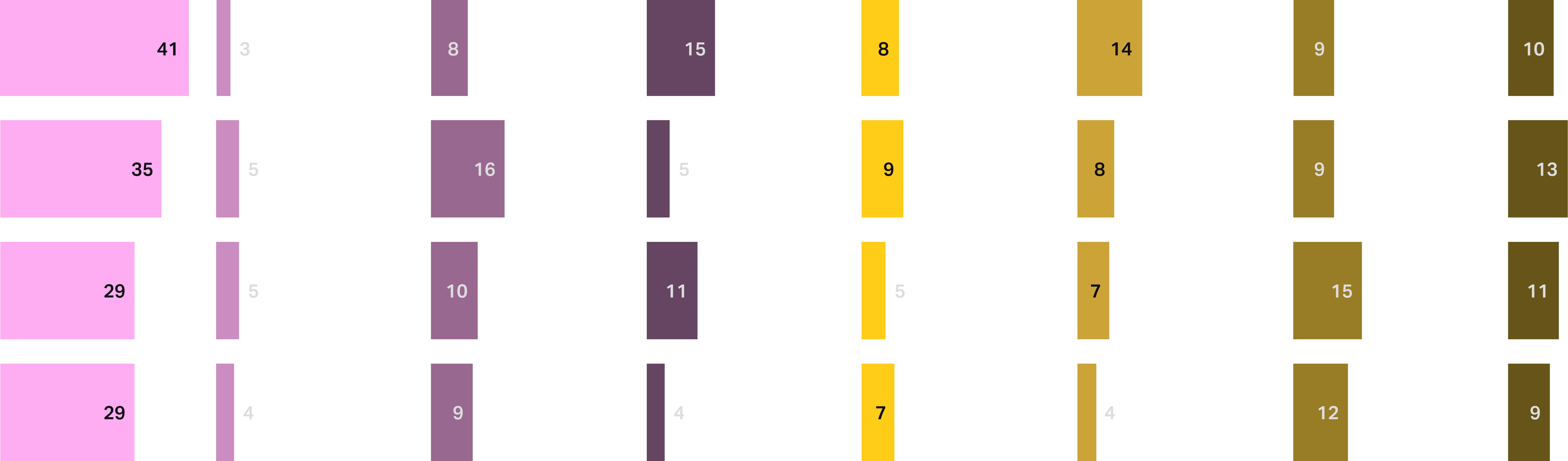

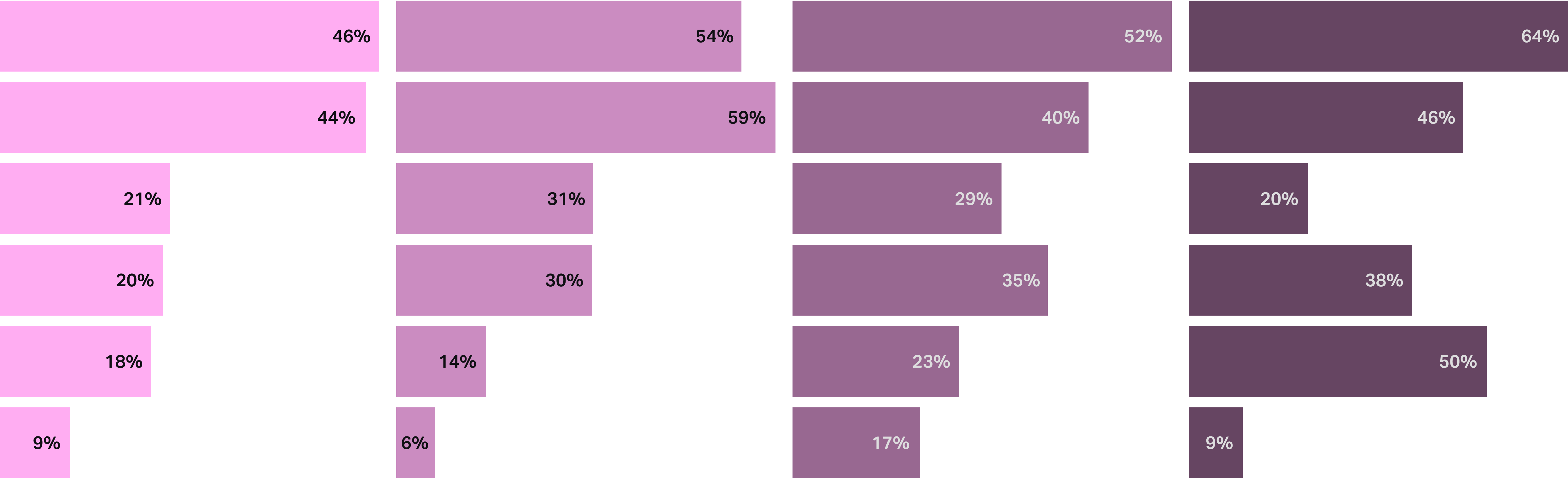

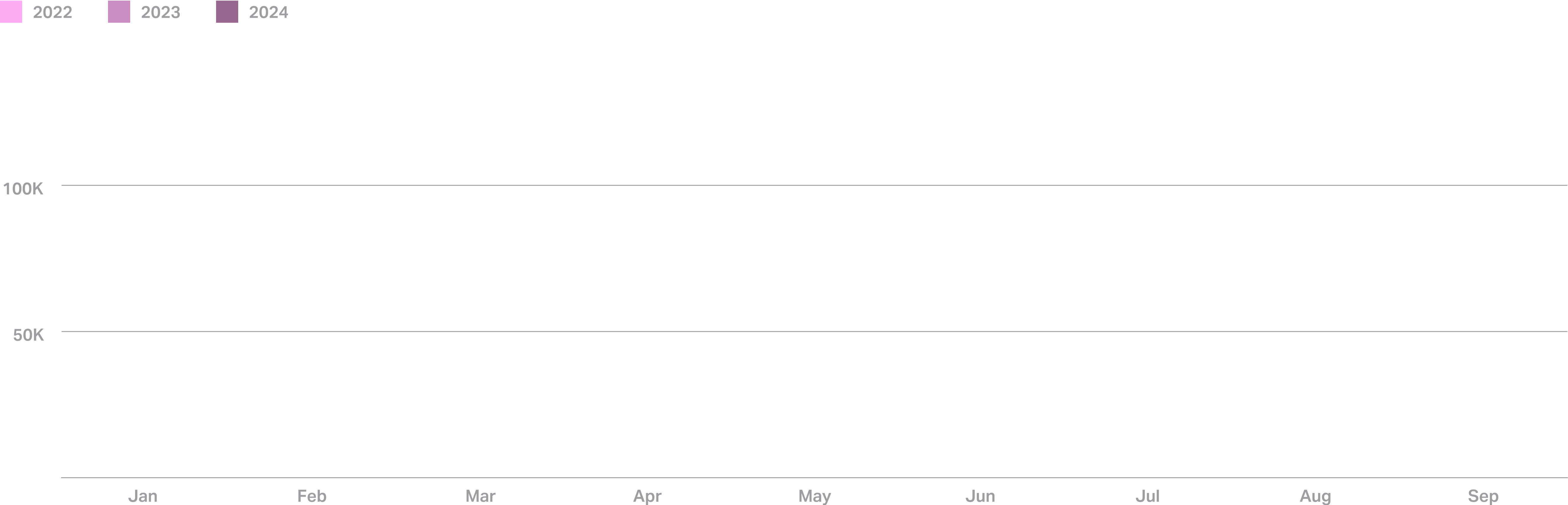

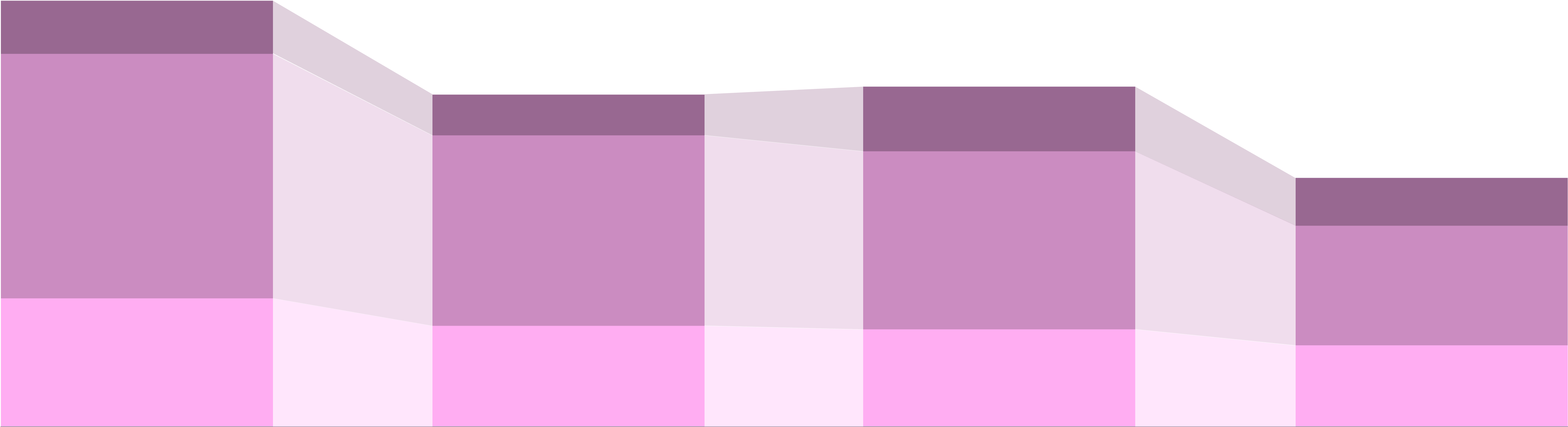

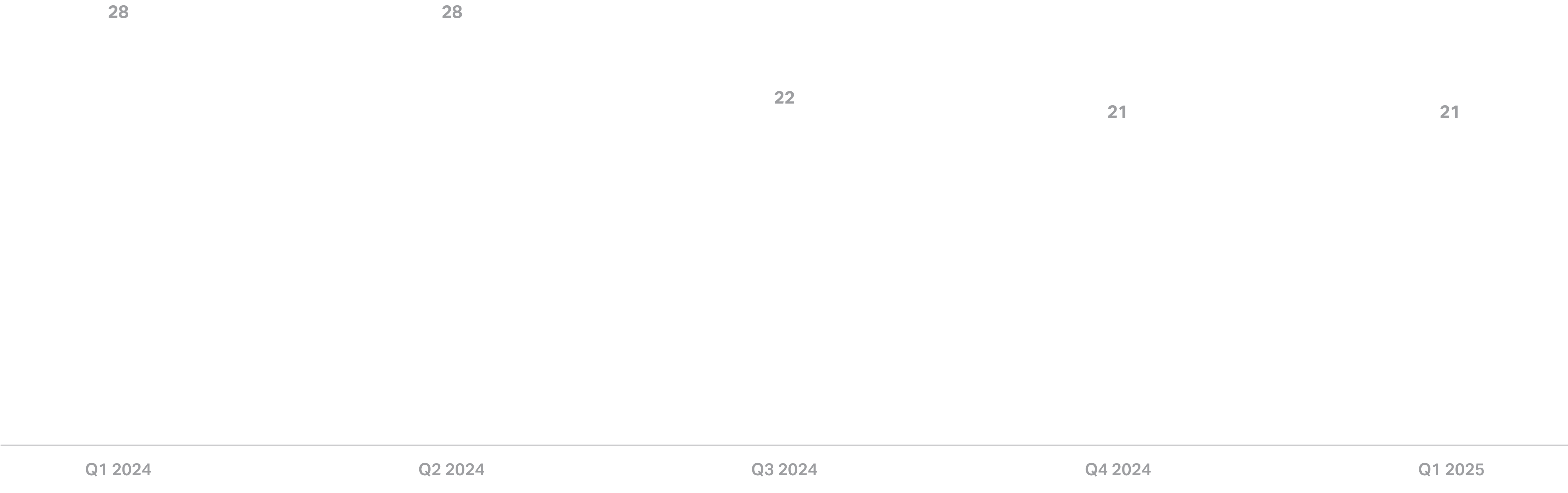

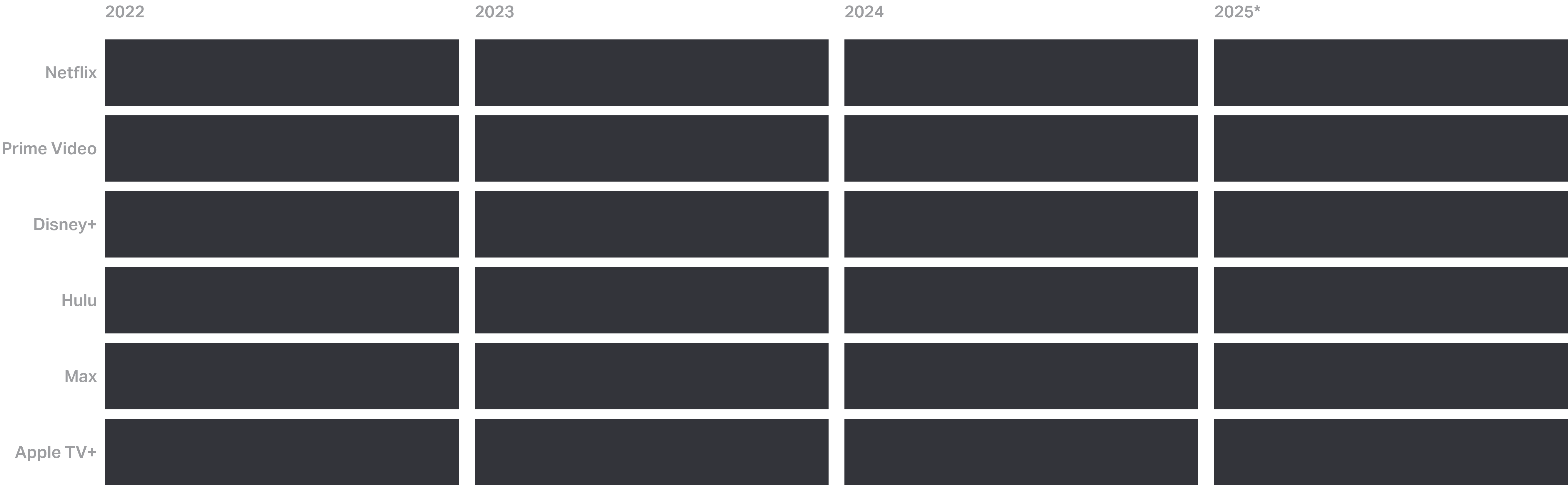

U.S.-Produced TV Premieres, Q1 2022-25

Source: Luminate Film & TV, Variety Intelligence Platform analysis Note: Excludes kids content

This was partly a correction from the strikes-related backlog of premieres in Q1 2024, but it’s also clear that cable networks have reached a point of no return, with original series premieres having shrunk more than 50% from 2022 levels. And that crumbling ecosystem underlies many of the industry’s current woes, with the production downturn no exception.

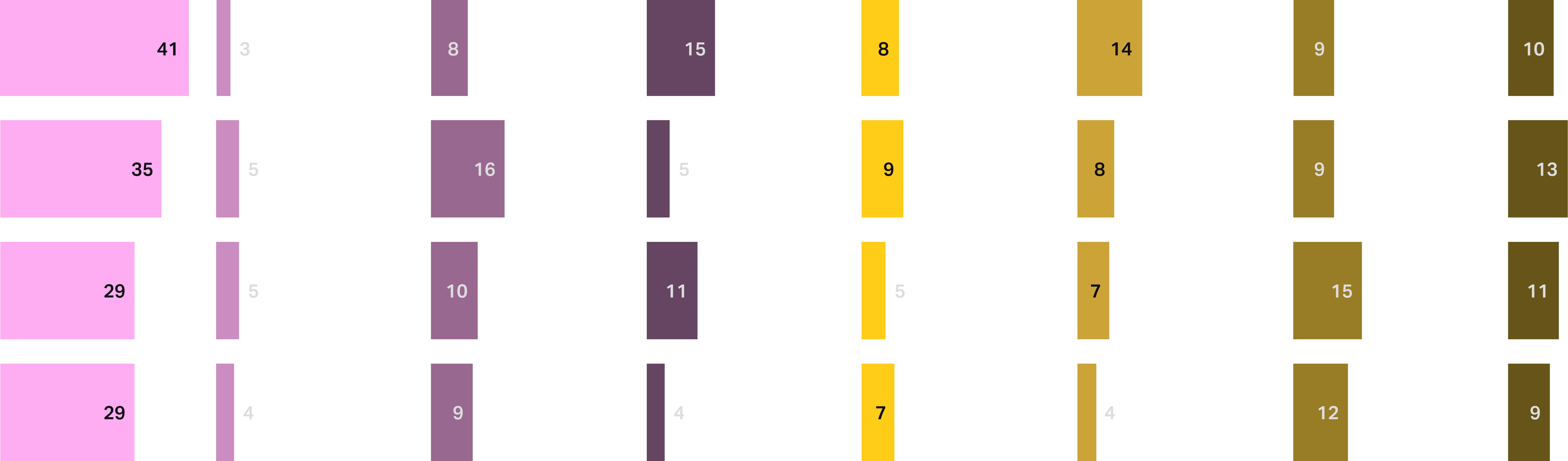

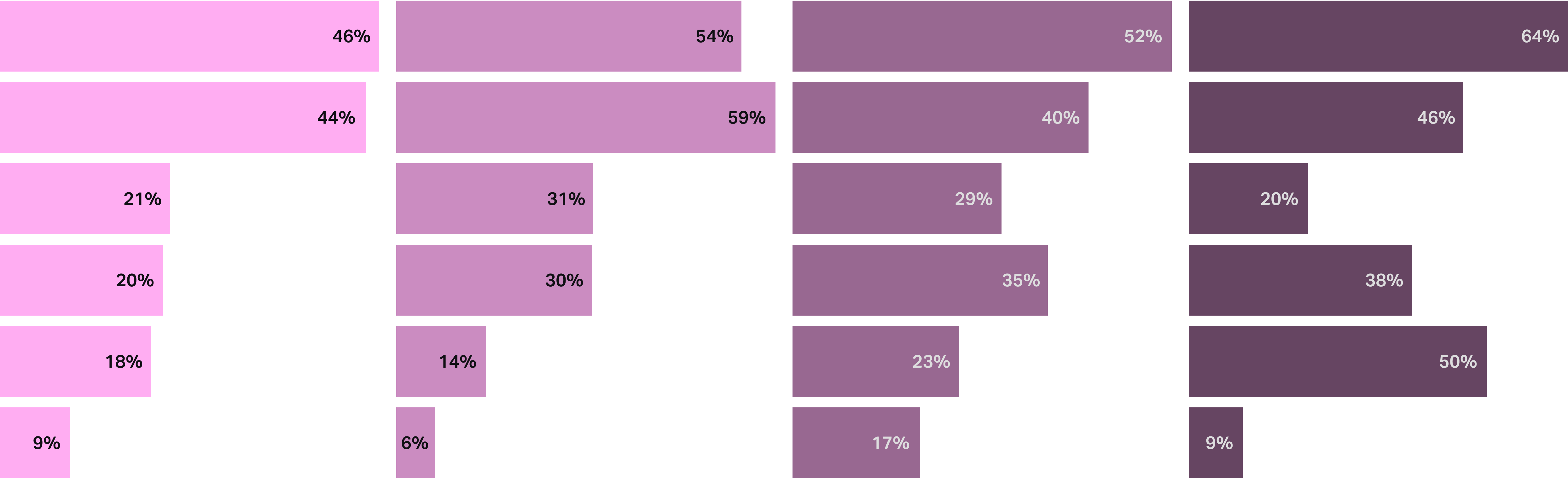

U.S.-Produced TV Premieres, by Platform & Format

Source: Luminate Film & TV

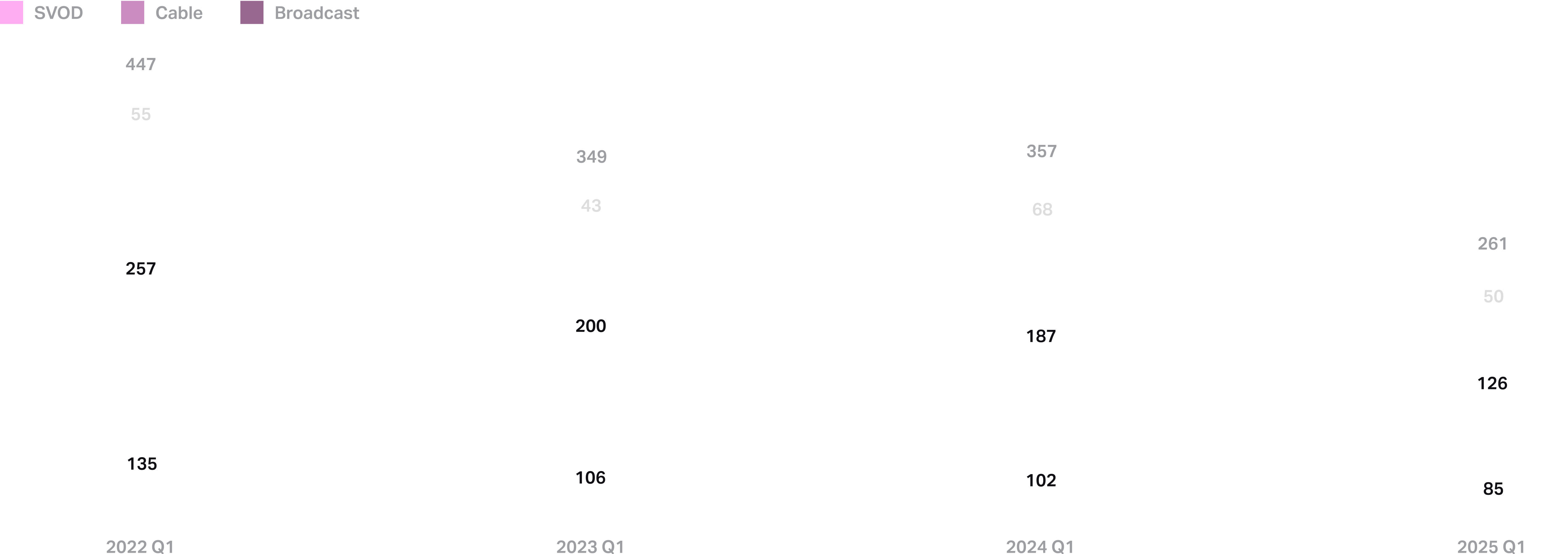

If anyone believed audience demand would push U.S. studios to reinvest in TV production for streaming, they must be disappointed. Live events and international series have helped to fill the void on SVOD, and it’s long since become apparent that the supply of peak TV has far outstripped demand.

U.S.-Produced TV Premieres on Major SVOD Platforms, Q1 2022-25

Source: Luminate Film & TV; note: Excludes kids content

2025 Production

03

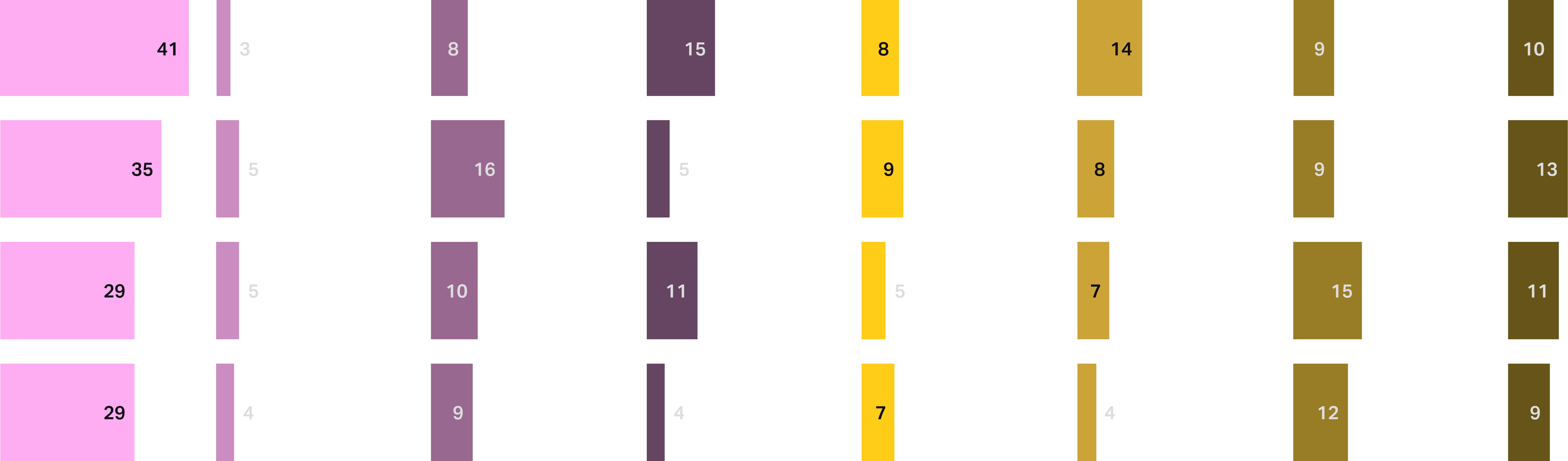

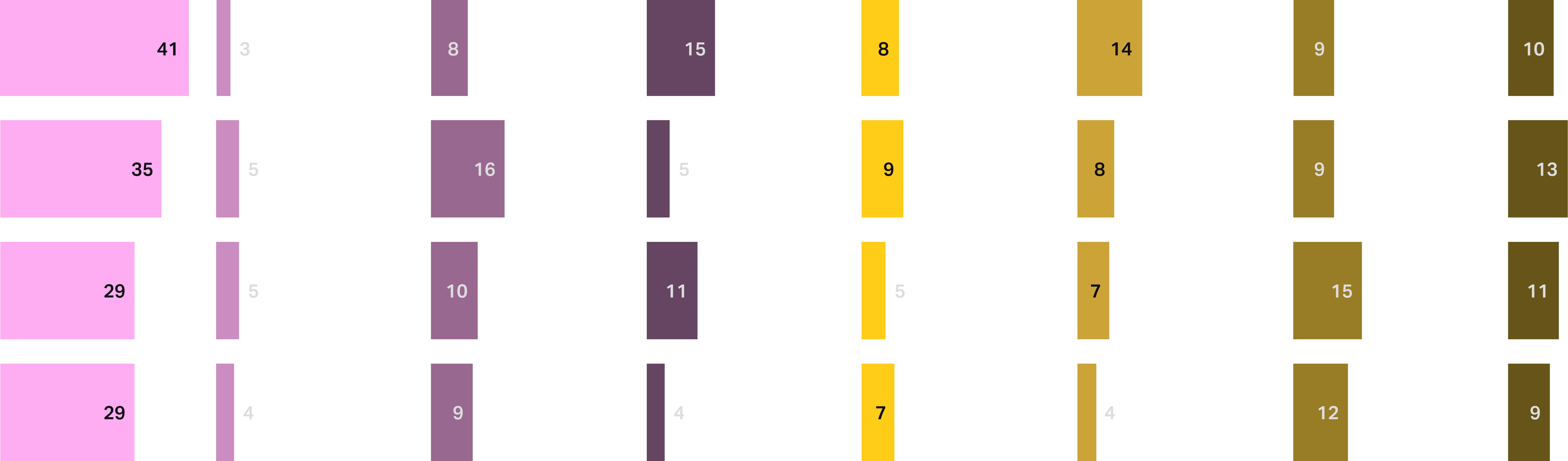

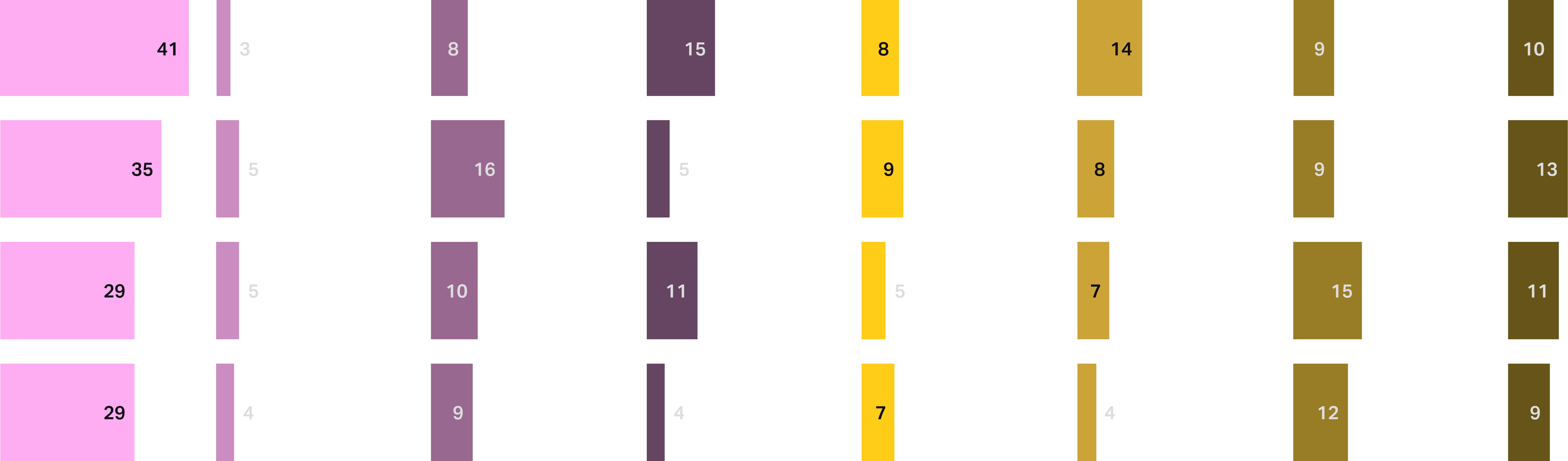

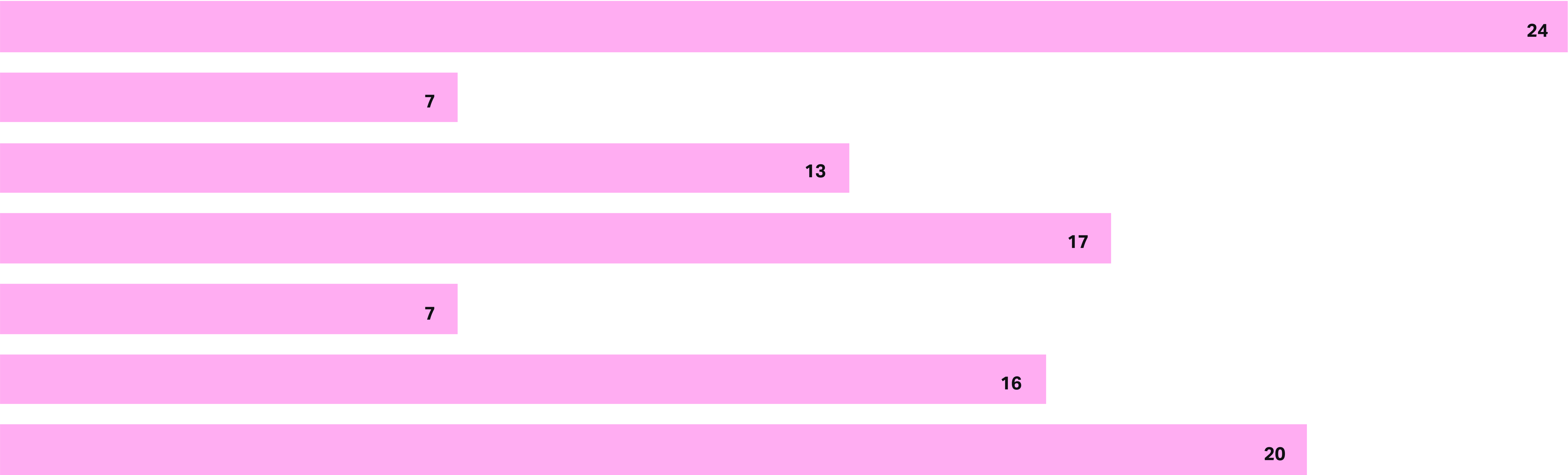

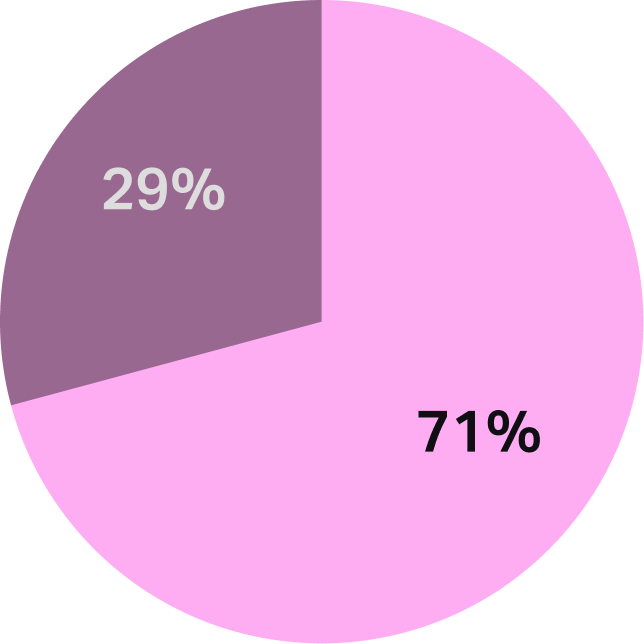

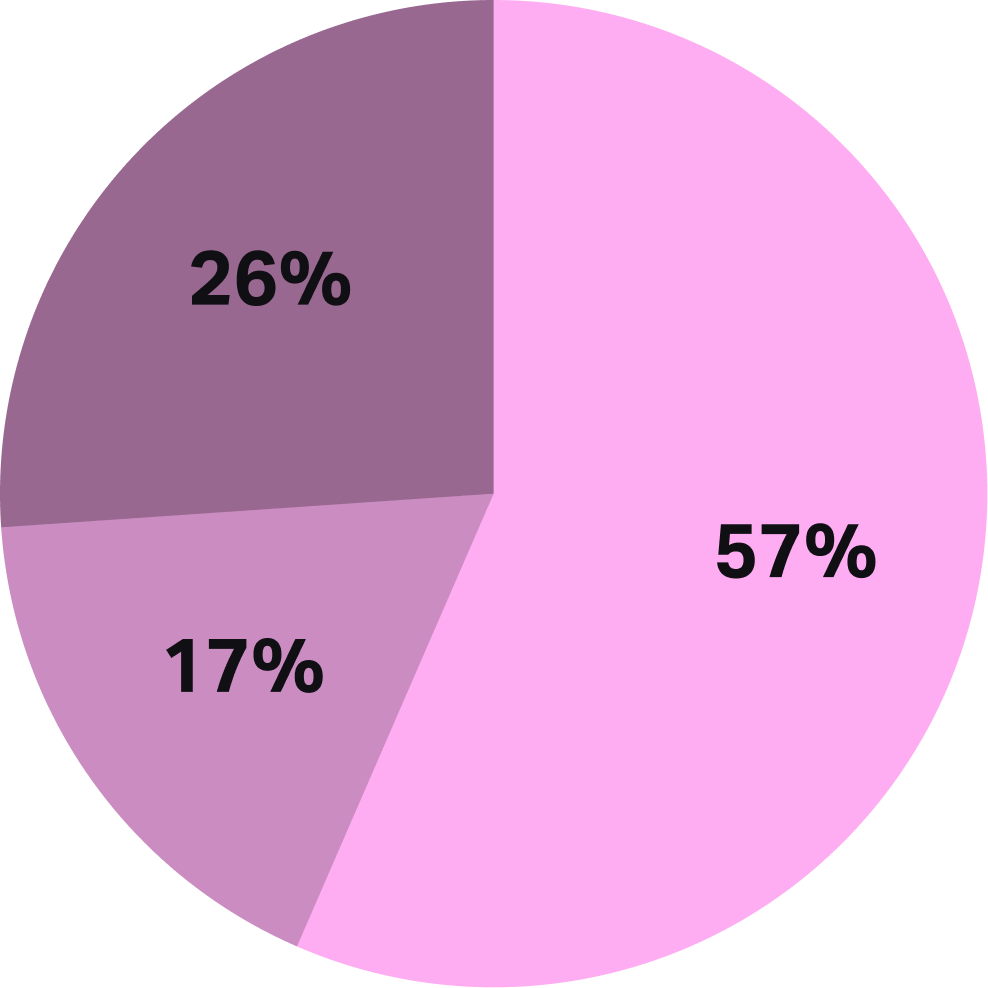

Thus far, 2025 has shown no signs of reversing the runaway production trend. Out of 87 scripted U.S. film and TV projects starting up in Q1, only 24 were slated to film even partially in L.A., with 40 titles (46% of the total) shooting entirely abroad.

�Still, Los Angeles remains a key hub for TV, with 20 (out of 58) series observed commencing shooting there in the first quarter versus only four out of 29 films. This is partly due to smaller independent films going underreported prior to release, but it’s nonetheless evident that the studios have nearly abandoned L.A. for major film production.

U.S. Scripted Film & TV Production Locations, Q1 2025

Source: Luminate Film & TV�Note: Excludes animated projects; some titles may be counted more than

once due to filming at multiple locations

Disruption of filming by L.A.’s January wildfires was apparently minimal, despite the blazes’ disastrous impact on film and TV workers. These figures show the industry’s reduced volume and migratory projects are a “new normal,” not an aberration.

U.S. Legacy Studios’ Theatrical Films in Production

Source: Luminate Film & TV

Unscripted Production

04

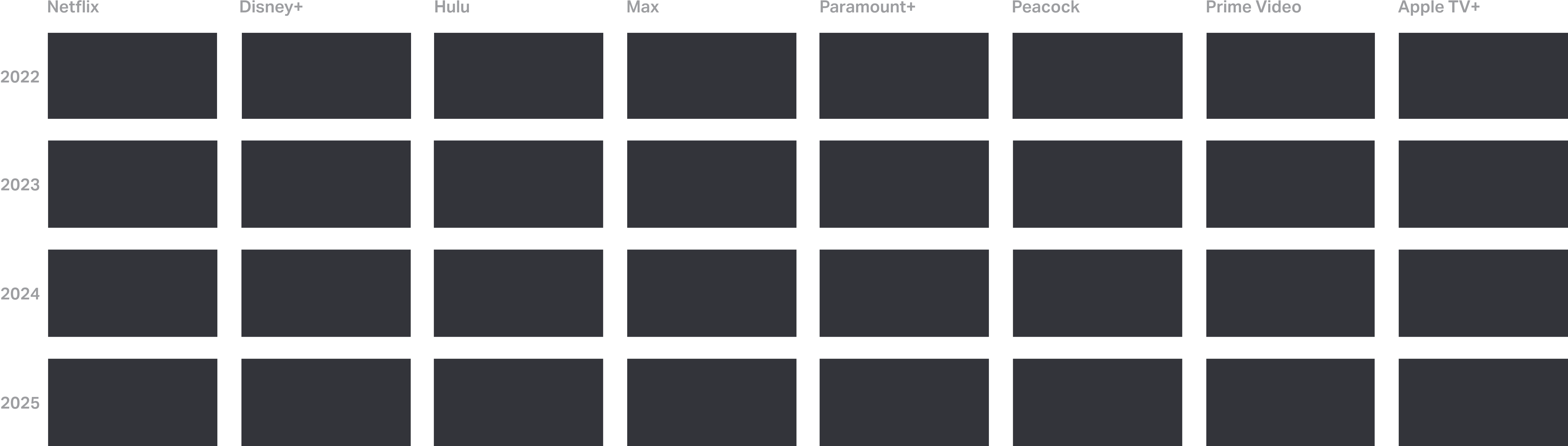

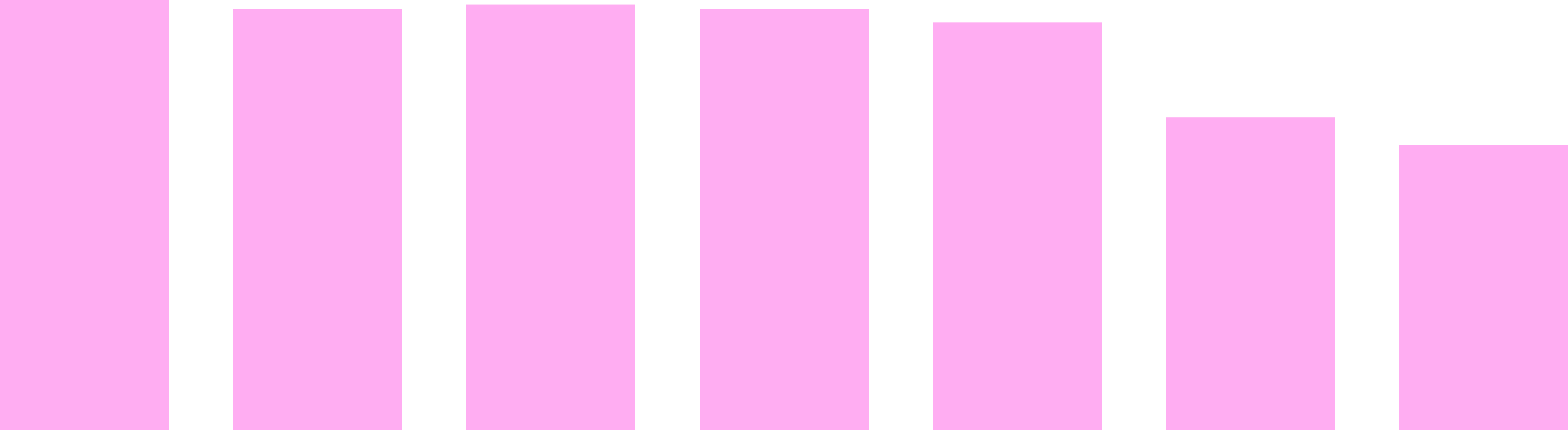

Unscripted TV hasn’t been immune to the trends affecting scripted projects. Corporate consolidation, the end of peak TV and spending cutbacks have all impacted reality series as well, and U.S. output plunged nearly 25% from 2022 to 2024, in line with the overall downturn in TV production.

U.S.-Produced TV Premieres on Broadcast, Cable & SVOD

Source: Luminate Film & TV, Variety Intelligence Platform analysis

Cable networks’ erosion is a major factor behind this plunge, but the unscripted space, similar to scripted, is seeing a push toward IP-driven, big-budget titles that crowd out other projects and often shoot internationally. See: Squid Game: The Challenge and Beast Games, largely filmed in the UK and Canada, respectively.

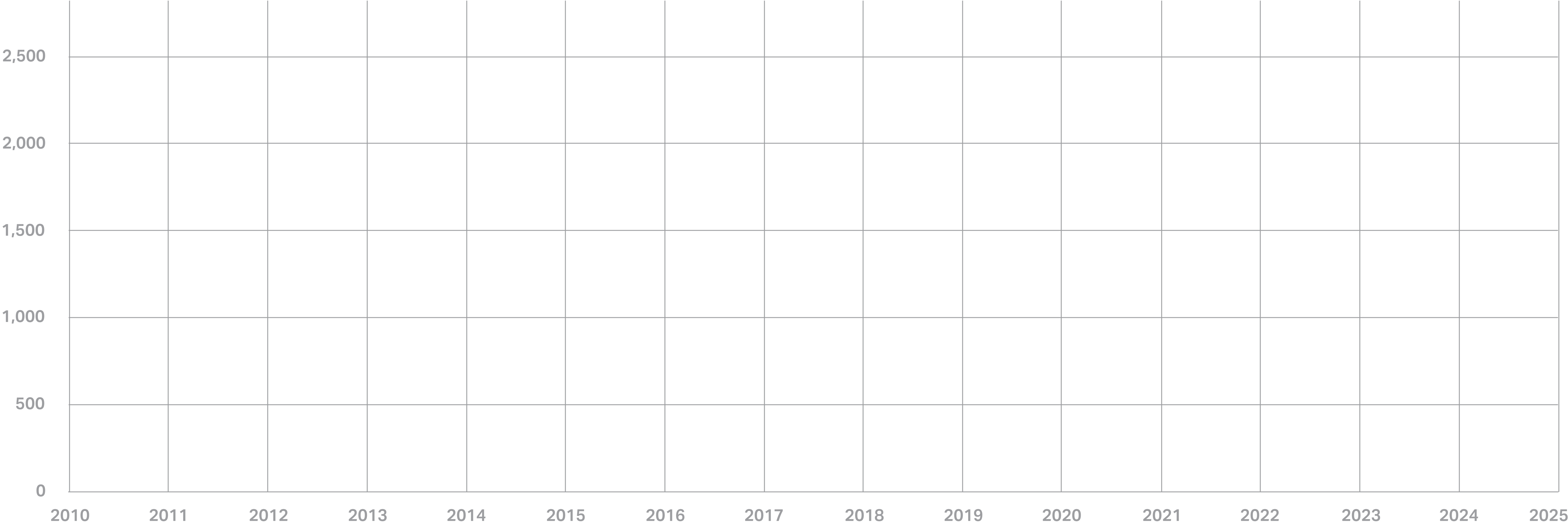

Los Angeles Reality TV Shoot Days, 2010-25

Source: FilmLA

At the same time, unscripted shows from other countries have surged on U.S. SVODs since 2020, while even some network game shows shifted production abroad to save money. It all contributed to a steep dropoff for reality TV shoots in L.A., rivaling anything in the scripted space.

International Unscripted TV Premieres on U.S. SVODs

Source: Luminate Film & TV, Variety Intelligence Platform analysis

U.S. Financial Incentives

05

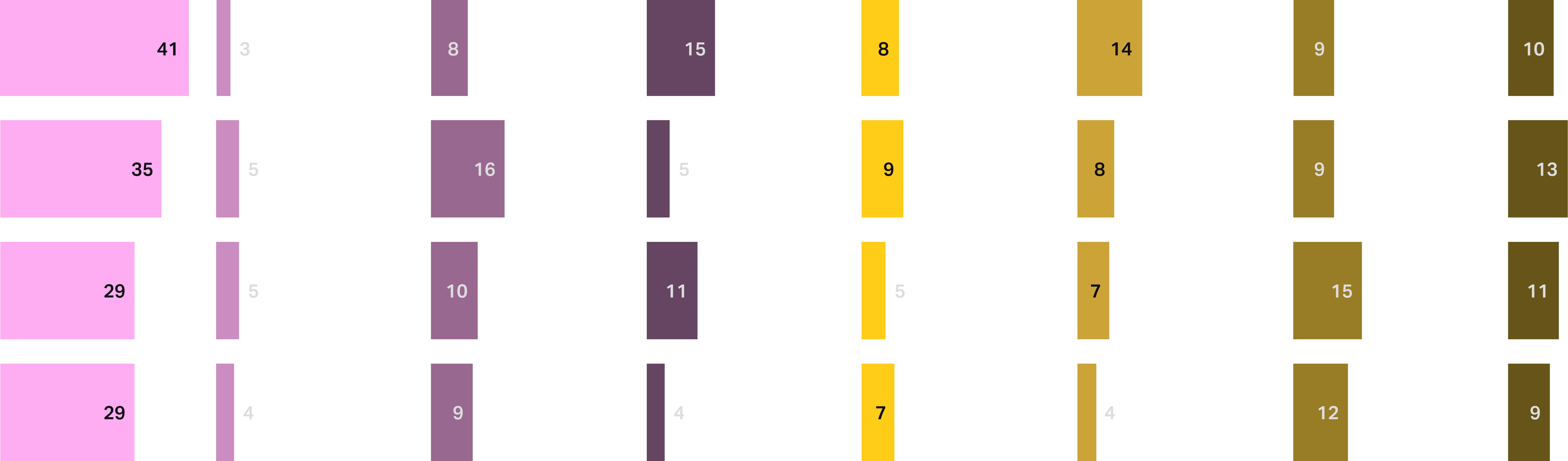

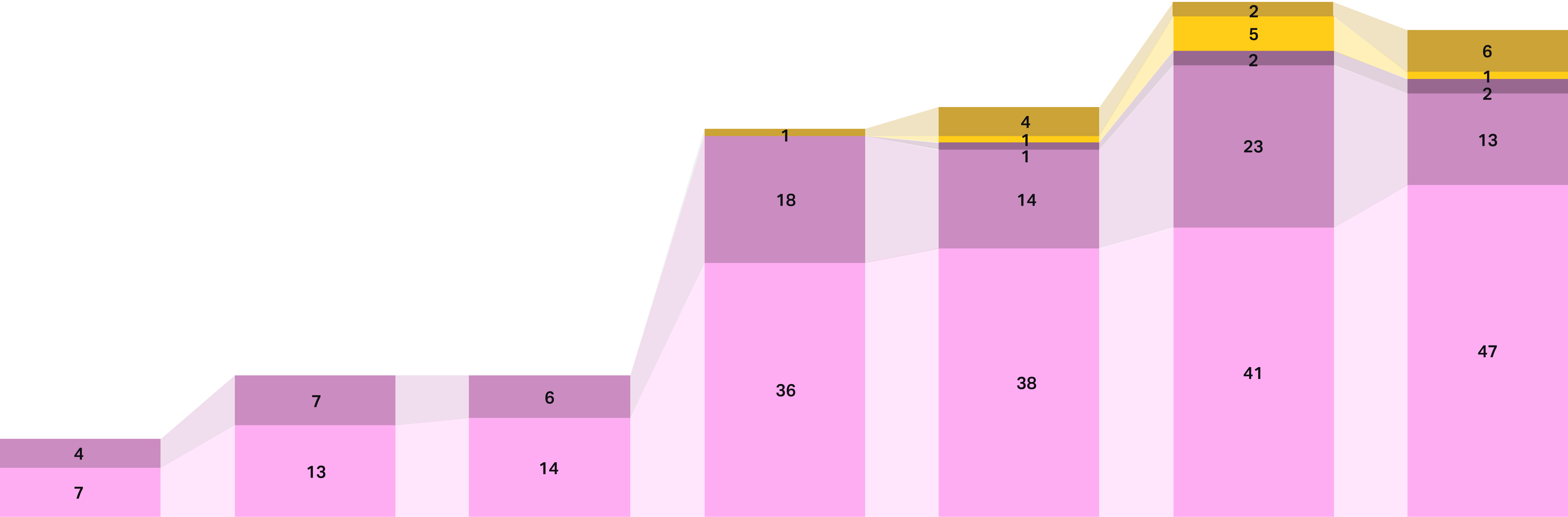

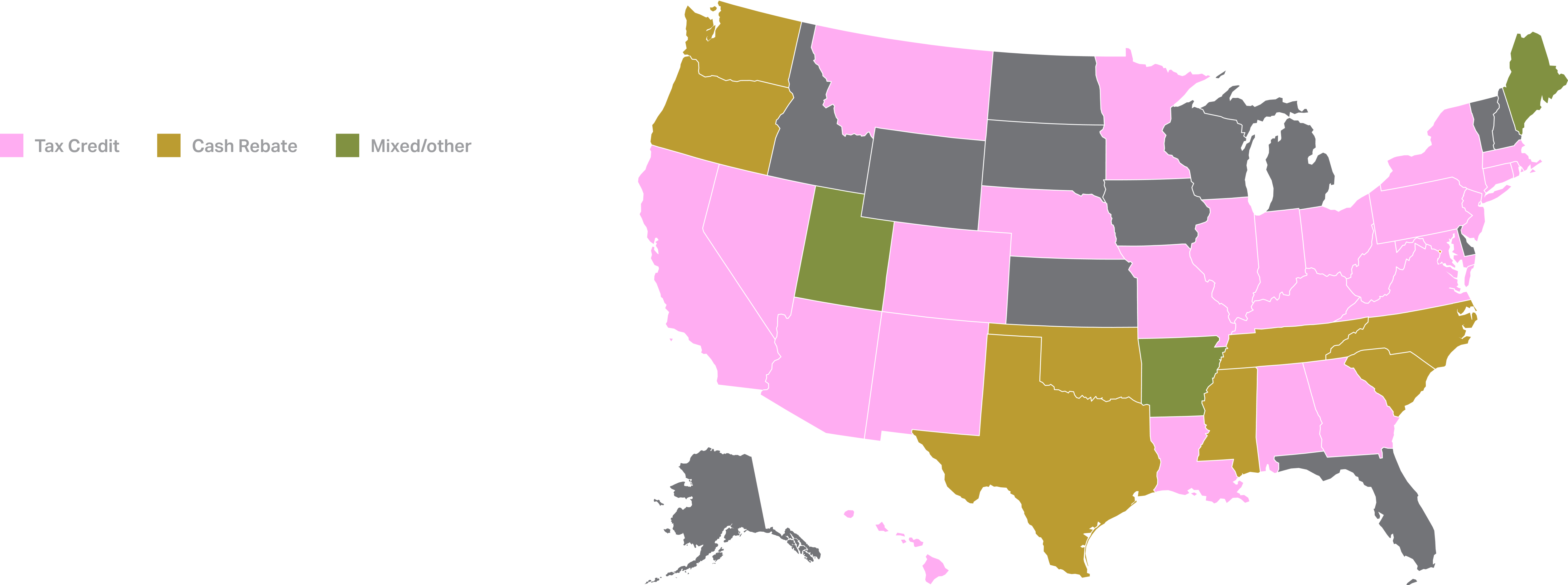

As California dawdled through the 2000s, other states dispensed billions in pursuit of Hollywood dollars to stimulate their economies. In 1992, Louisiana introduced the first U.S. film and TV tax incentive, and now 37 states (and D.C.) offer programs.

�Often, and accurately, described as an arms race, the competition among states to attract production has begun to bump up against fiscal realities. Incentives can undoubtedly lure spending to a state, but the long-term economic benefits are hotly debated. Louisiana even came close to axing its tax credit last year.

U.S. States With Production Incentives

Source: Olsberg SPI, Variety Intelligence Platform research;�Note: Nebraska tax credit takes effect July 1, 2025

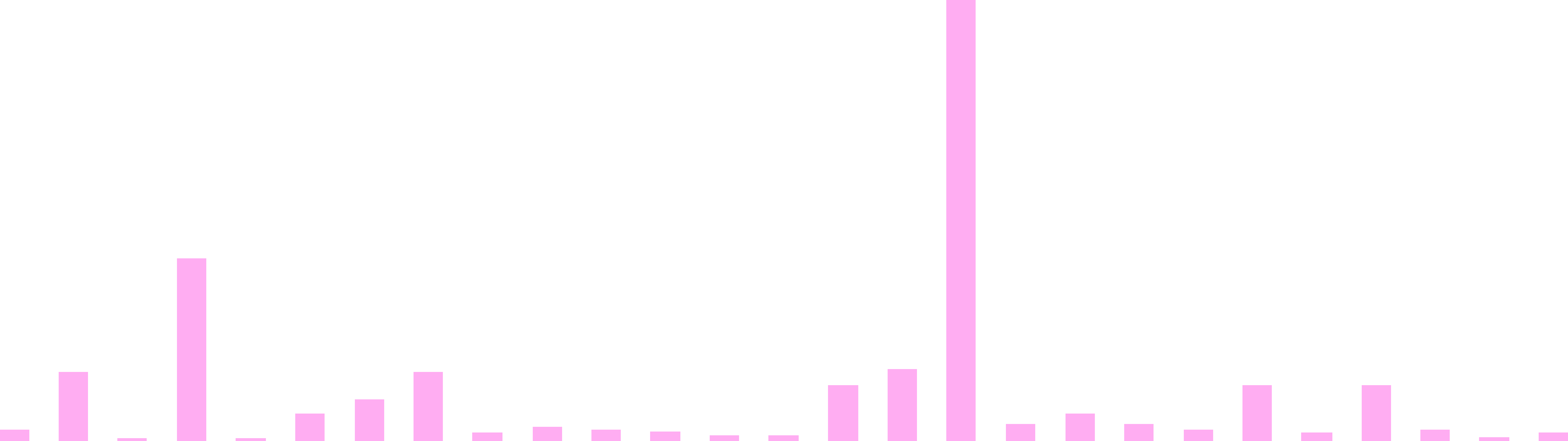

The rewards of financial incentives are more nuanced than the raw dollar figures suggest. Despite California now boasting one of the highest annual budget caps in the country, its tax credit is still far from the most advantageous. For instance, other states allow producers to sell unused credits, and many offer higher per-project credits than CA’s 20%.

Annual Film & TV Incentive Caps, by State

Source: Olsberg SPI “Global Production Incentives Index” Note: *MS Motion�Picture Incentive Program capped at $20M, MS Episodic Television Incentive Program at $10M; NC can award more than $31M per fiscal year if demand is present; TX can award $200M over 2024‐25 biennium

Global Financial Incentives�

06

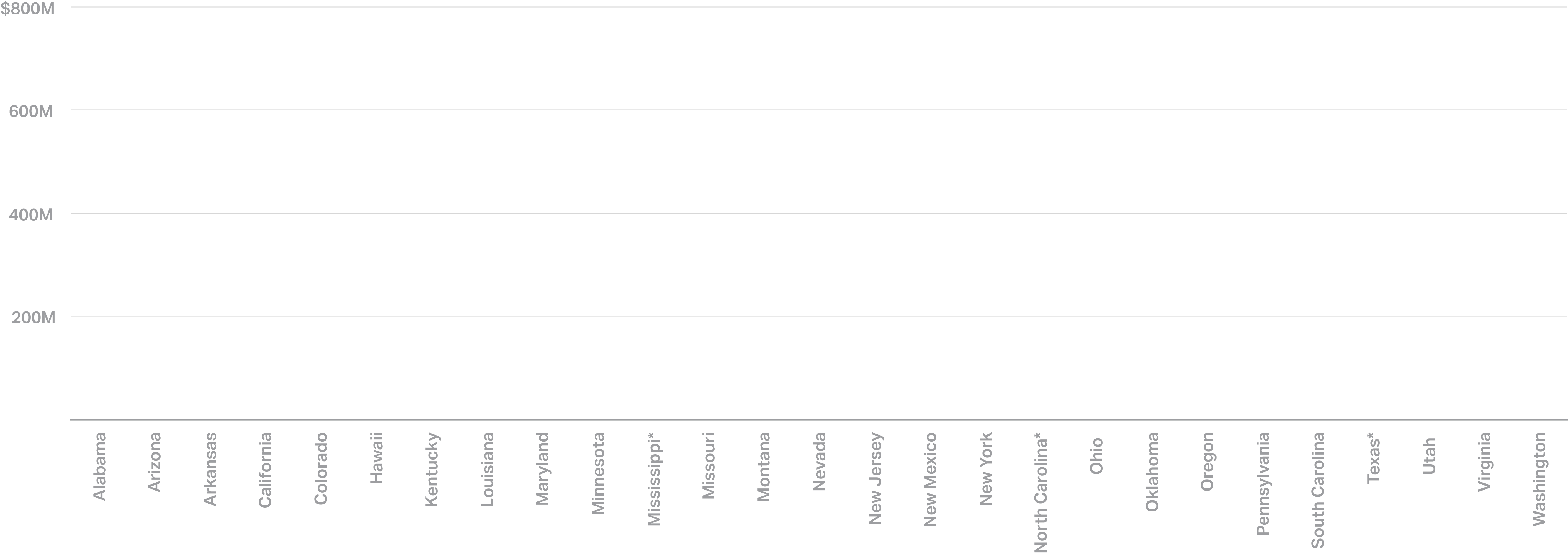

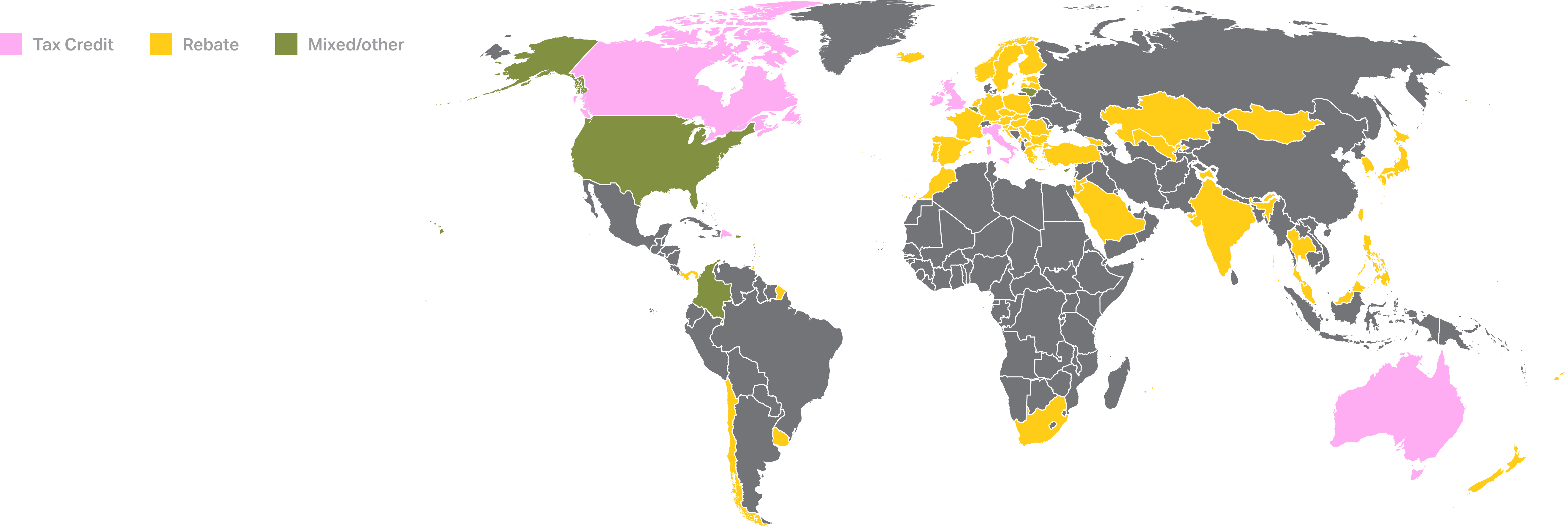

Financial incentives are not confined to the U.S., of course. One factor behind production’s increasing globalization has been the expansion of film and TV tax credits beyond the U.S., with Europe in particular vying for projects.

Global Production Incentive Types

Source: Olsberg SPI

Countries are often expanding or reconfiguring their incentives. In 2024 alone, the UK reworked its programs to provide more generous breaks, the Czech Republic boosted its credit from 20% to 25%, Thailand moved to raise its rebate to 30%, and Denmark approved a tax incentive to launch in 2026.�It should not be surprising that the most popular international locations for U.S.-based projects — the UK, Canada and Australia — offer some of the most generous incentives. None of these countries have per-project or annual caps on their tax credits, a particular benefit for big-budget productions that get larger savings from percentage-based credits.

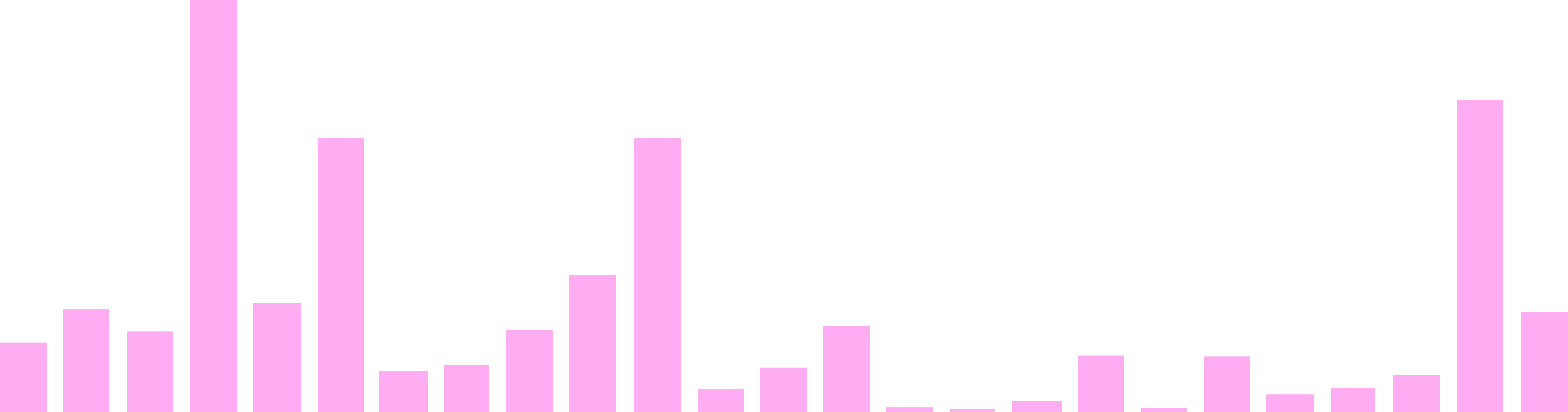

Per-Project Rebate Caps, by Country

Source: Olsberg SPI “Global Production Incentives Index” Note: *Portugal�refunds $6.6M for film, $3.3M per episode for series; **Spain refunds $22M per production, $11M per episode for series

U.S. vs. Other Countries�

07

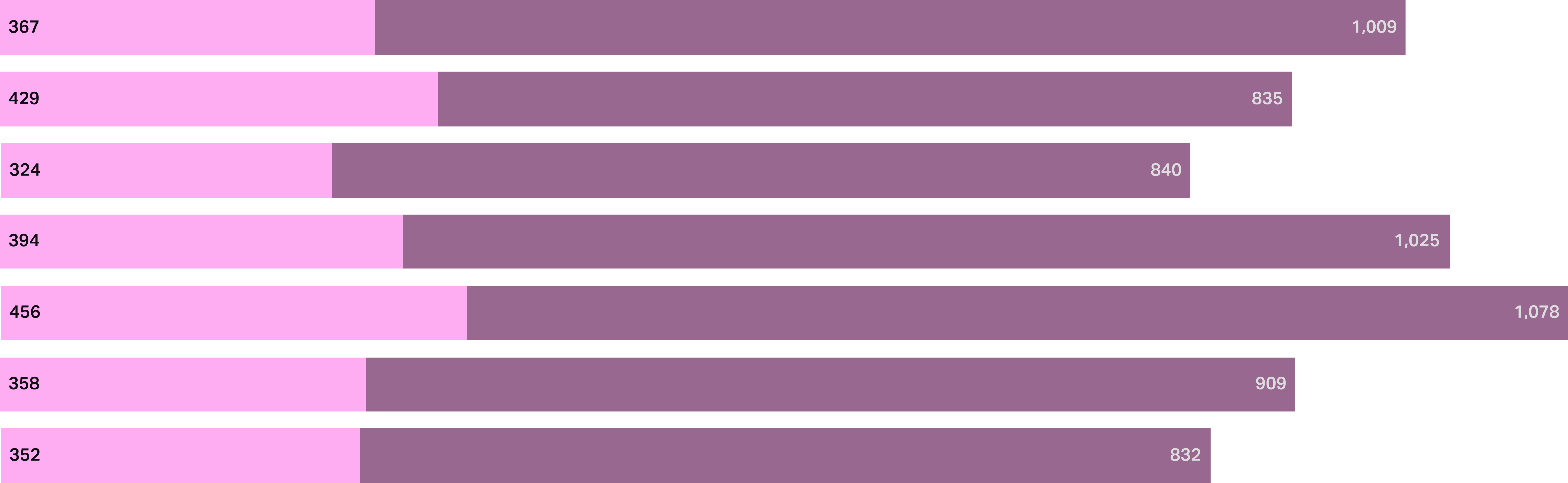

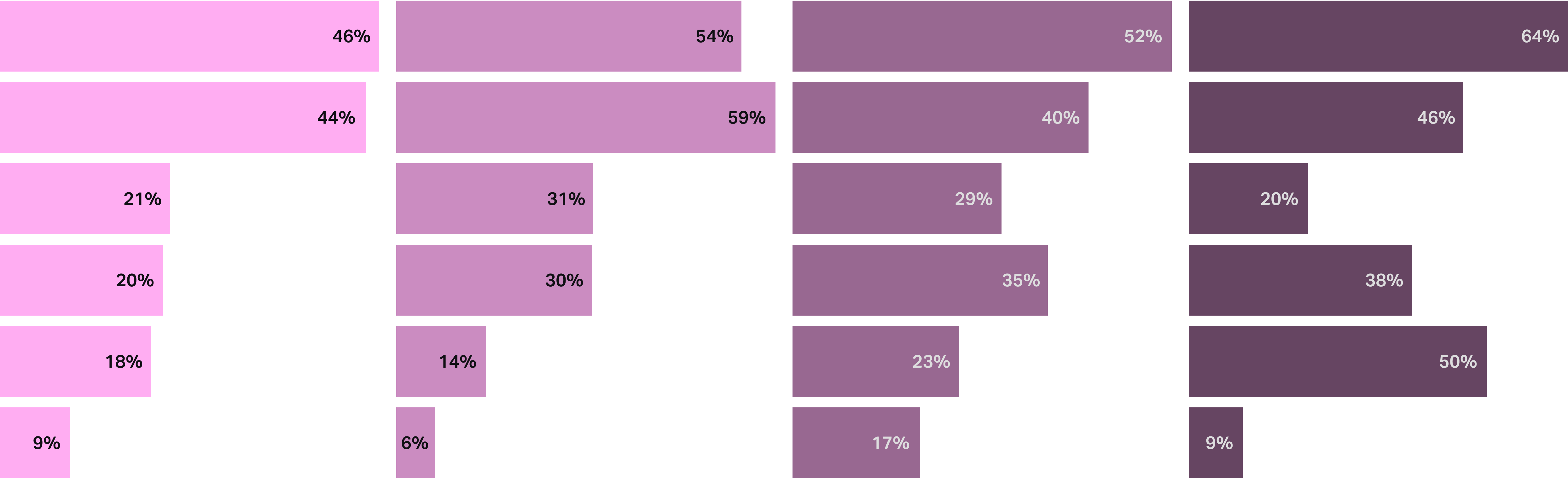

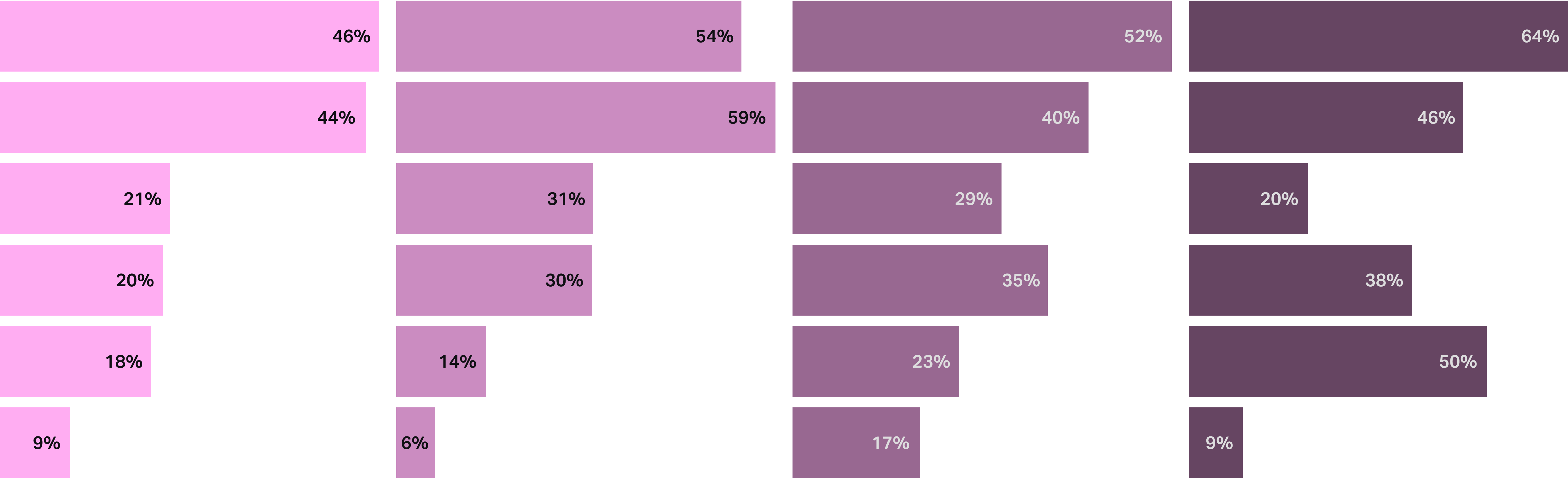

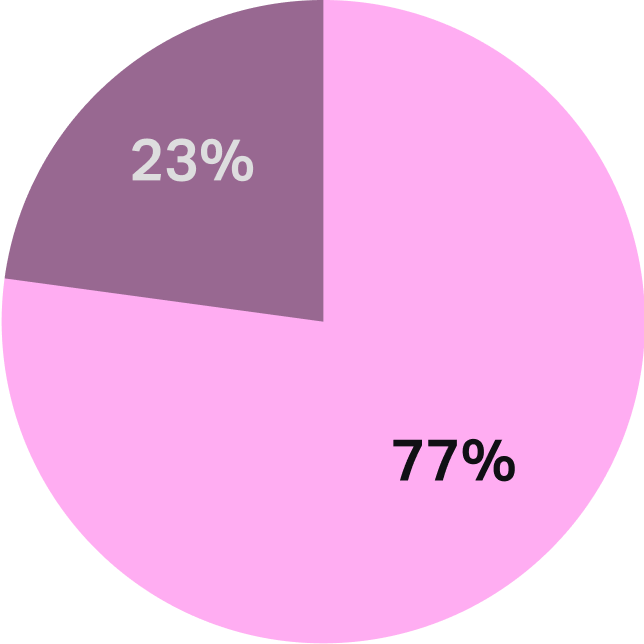

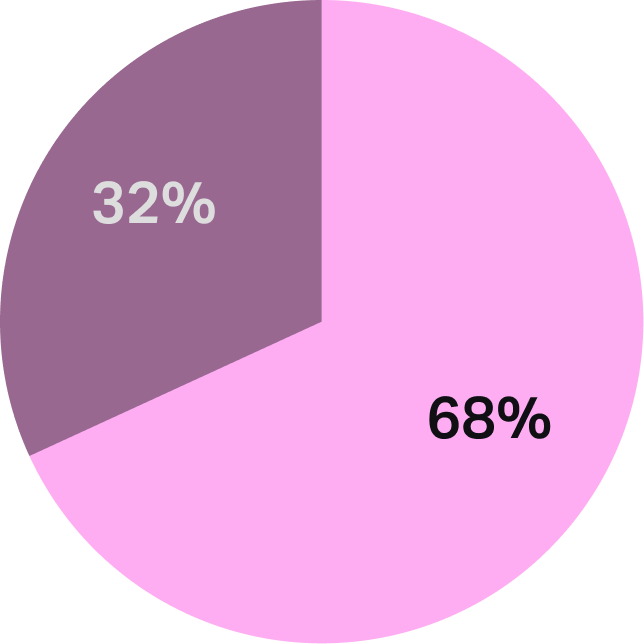

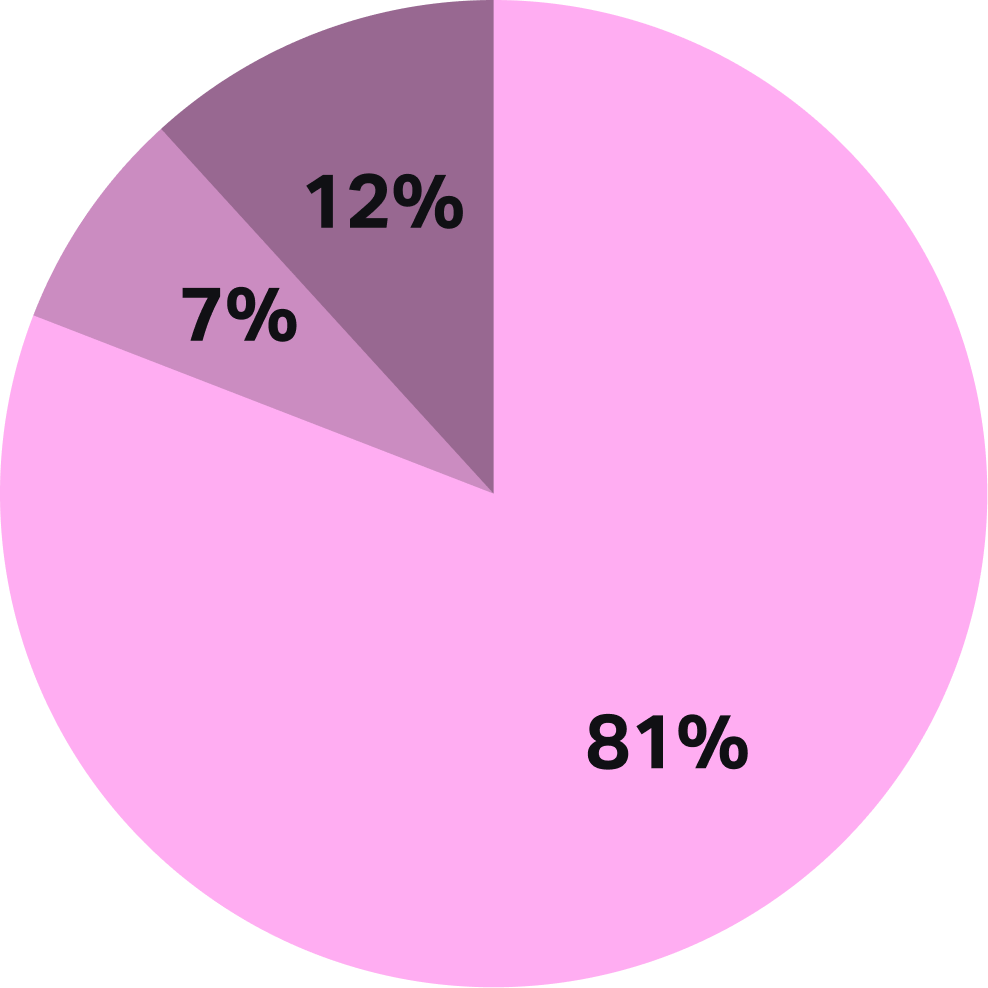

While U.S. studios still film most of their projects domestically, the annual proportion shot abroad has crept ever closer to 50%. With union labor rates rising and pressure to cut costs persisting, it may not be long before U.S. companies find it more advantageous to shift the bulk of production overseas.

U.S. Scripted Series Filming Locations

Source: Luminate Film & TV, Variety Intelligence Platform analysis; note: figures refer to titles released in given year(s)

However, the economic climate under the second Trump administration may yet upset this trend (even without a foreign-production tariff). Should the U.S. dollar weaken further, the financial benefits of shooting abroad will diminish, even as domestic inflation continues to increase the costs of production at home.

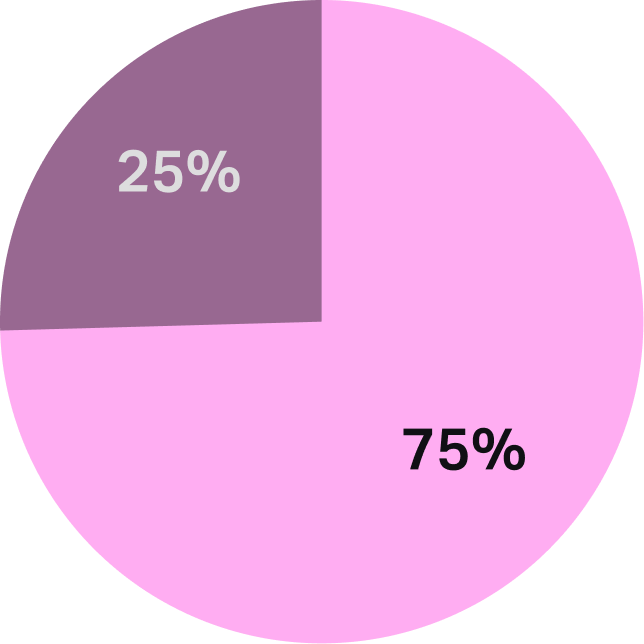

Major & Mini-Major U.S. Film Production Locations

Source: Luminate Film & TV, Variety Intelligence Platform analysis Note: Studios include the Big Five, A24, Amazon MGM, Annapurna, Apple, Lionsgate, Neon, Netflix, STXfilms, United Artists; figures refer to titles released in given year(s)

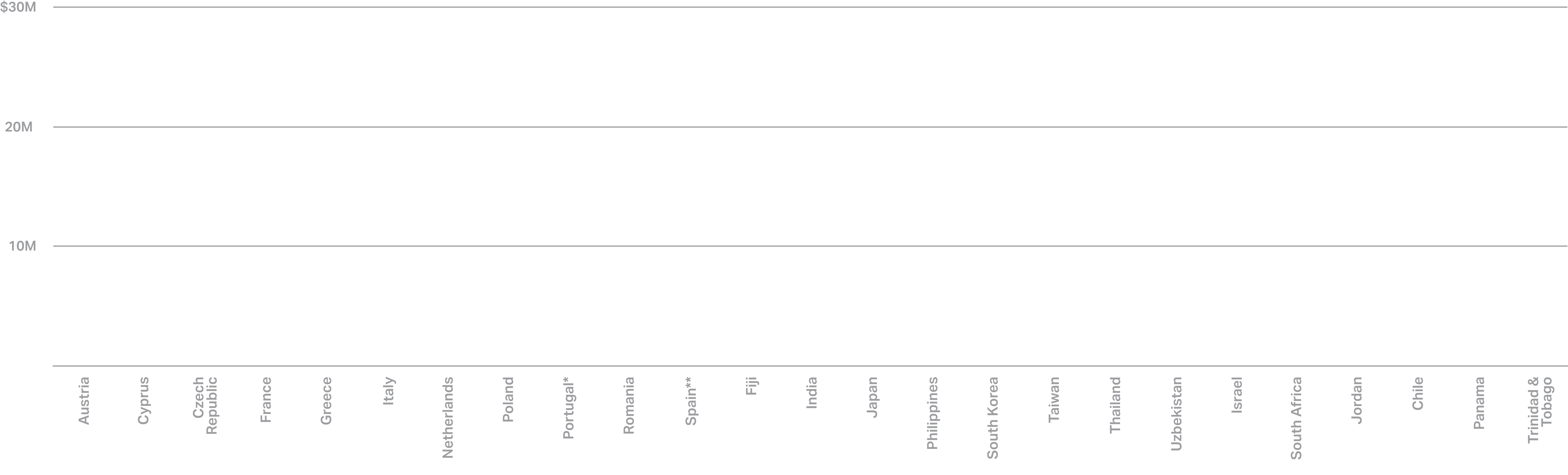

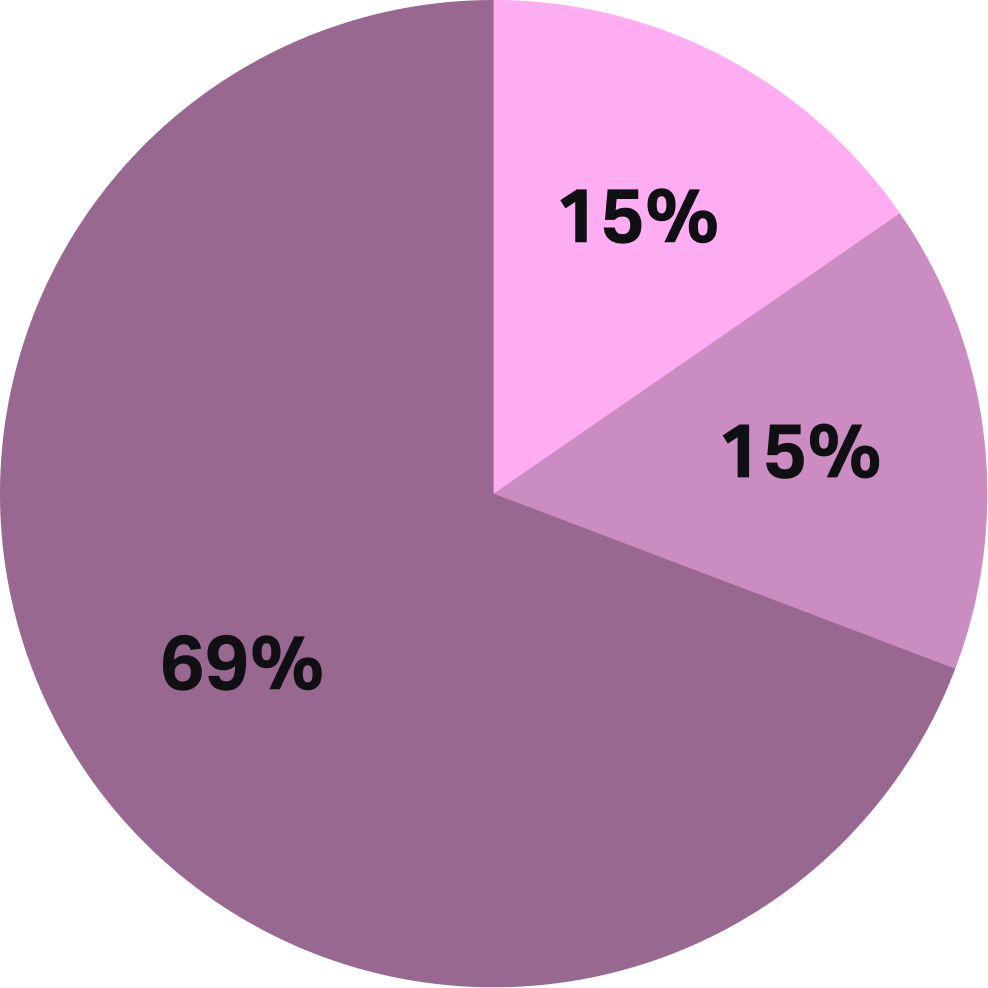

Though English-speaking countries have been the most popular, Eastern European nations, namely Hungary, are rising as production hubs thanks to their tax incentives, skilled (and often non-unionized) crews and favorable exchange rates. Watch this region closely in the years ahead.

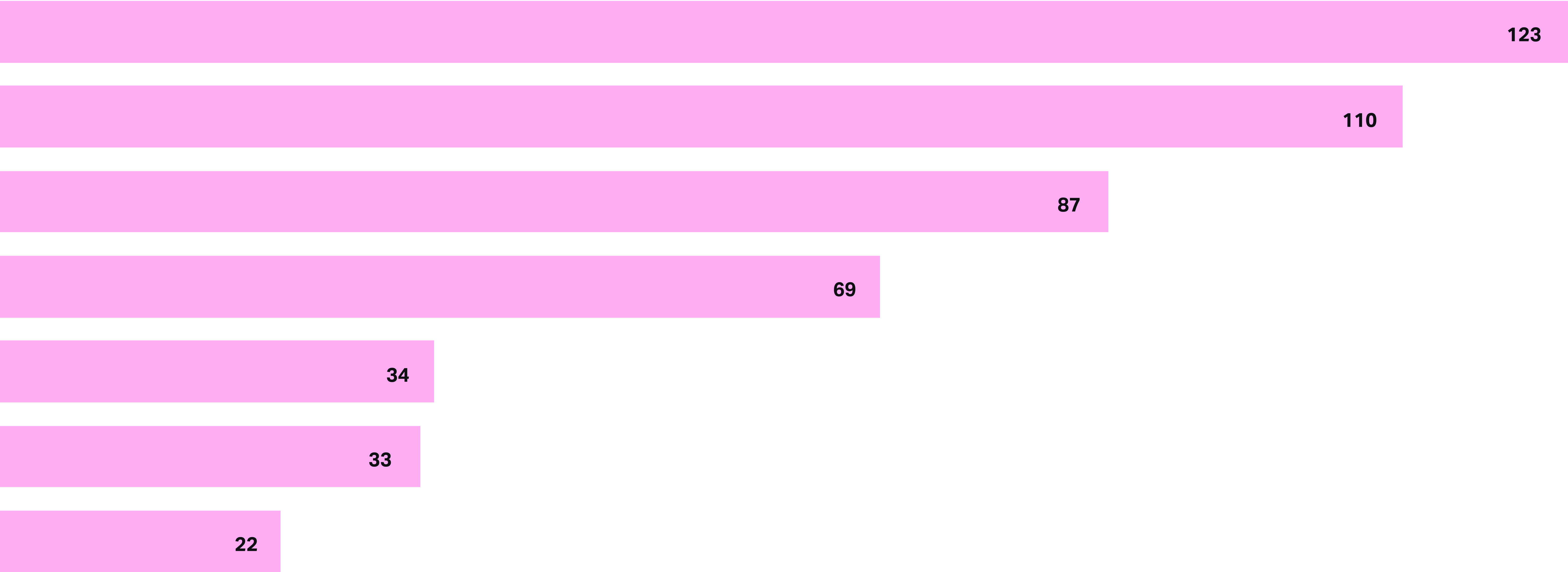

U.S. Major & Mini-Major Films Shot 2018-25, by Country

Source: Luminate Film & TV, Variety Intelligence Platform analysis Note: Studios include the Big Five, �A24, Amazon MGM, Annapurna, Apple, Lionsgate, Neon, Netflix, STXfilms, United Artists; some titles �may be counted more than once due to filming at multiple locations; figures refer to titles �released or scheduled for release in 2018-25

International Series��

08

There’s a key distinction between U.S.-produced shows shot abroad, non-English international titles and English-language imports from, say, the UK. All three categories are key to the increasingly globalized content market.

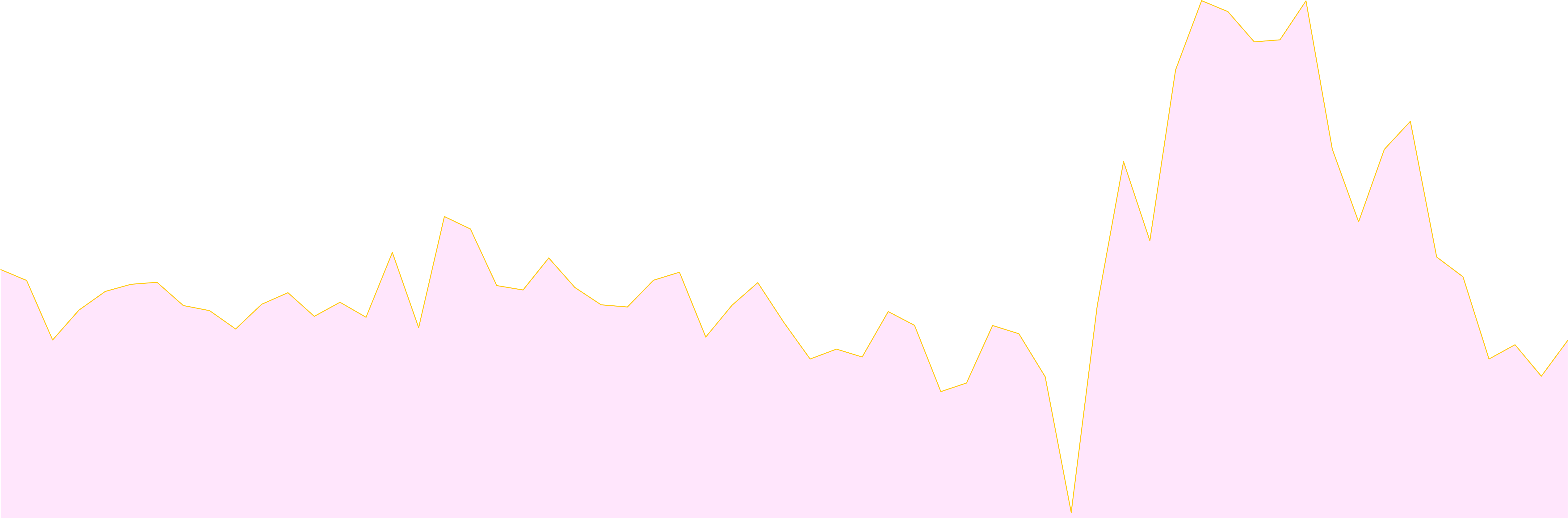

Non-English-Language Series Share of Total TV Output, by Service

Source: Luminate Film & TV, Variety Intelligence Platform analysis�Note: “Total output” includes all original TV season premieres in given year; *2025 data is Q1 only

Asian series dominate global content slates, owing largely to their international appeal. (Japanese content includes the popular anime format.) Some have surmised Trump-fueled enmity toward the U.S. could lead to higher local content requirements for global streamers, which would diversify output.

Local Originals From Major U.S.-Based SVODs, by Country

Source: Luminate Film & TV, Variety Intelligence Platform analysis

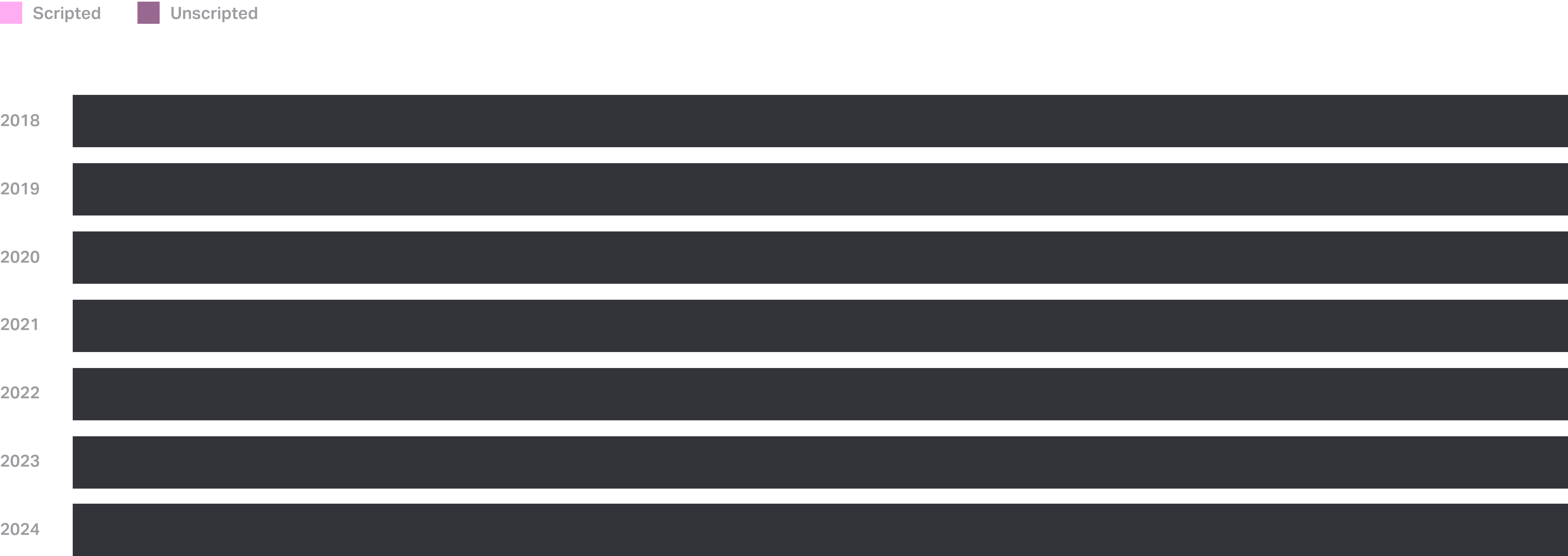

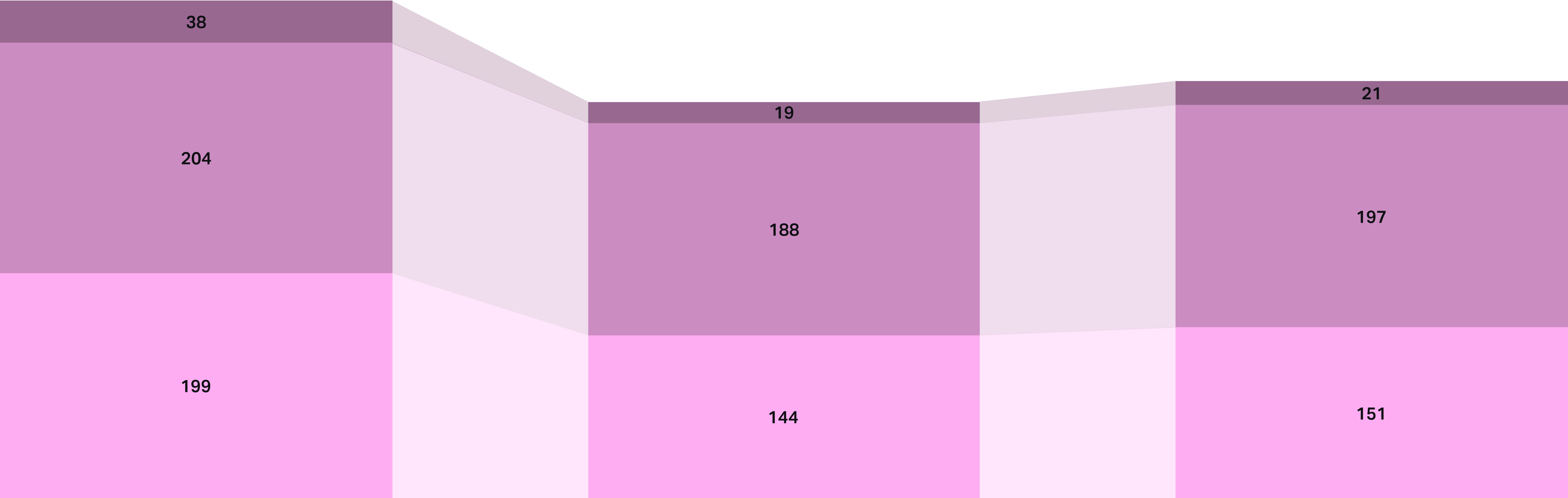

For Netflix, international series (including those in English) have accounted for more than half of its TV output since 2022. The decline in these series has been less steep than U.S.-produced titles (10% vs. 24% since 2022), due in part to Hollywood’s 2023 strikes but also to the streamer’s global ambitions, which require certain levels of homegrown international programming.

Netflix U.S. vs. Internationally Produced TV Premieres

Source: Luminate Film & TV, Variety Intelligence Platform analysis Note: Excludes kids content

Key Production Locations���

09

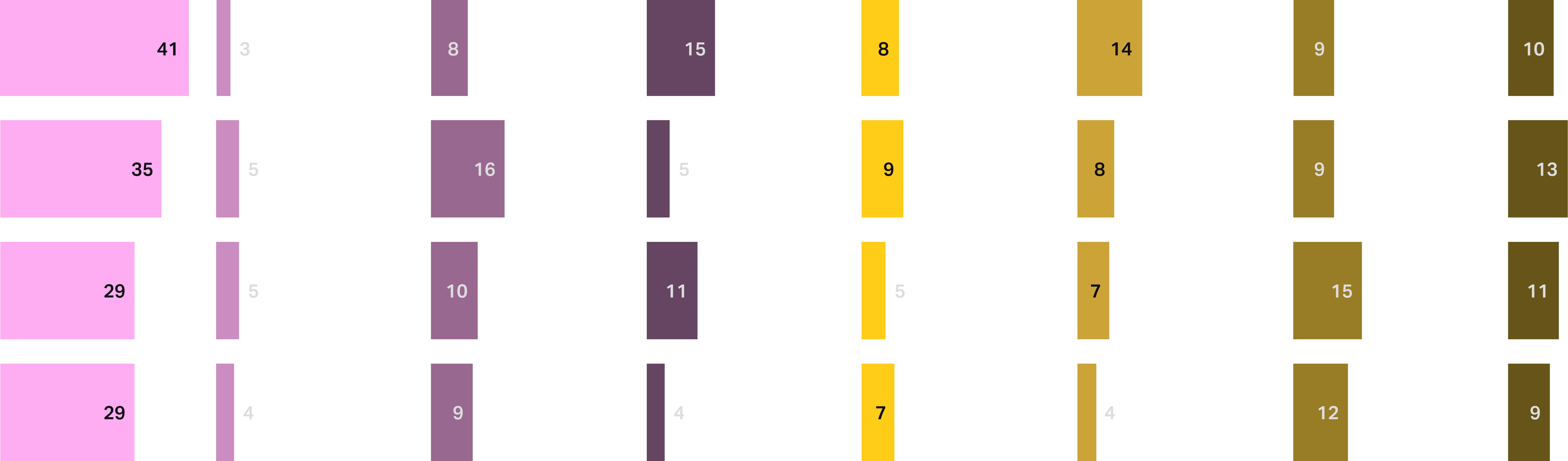

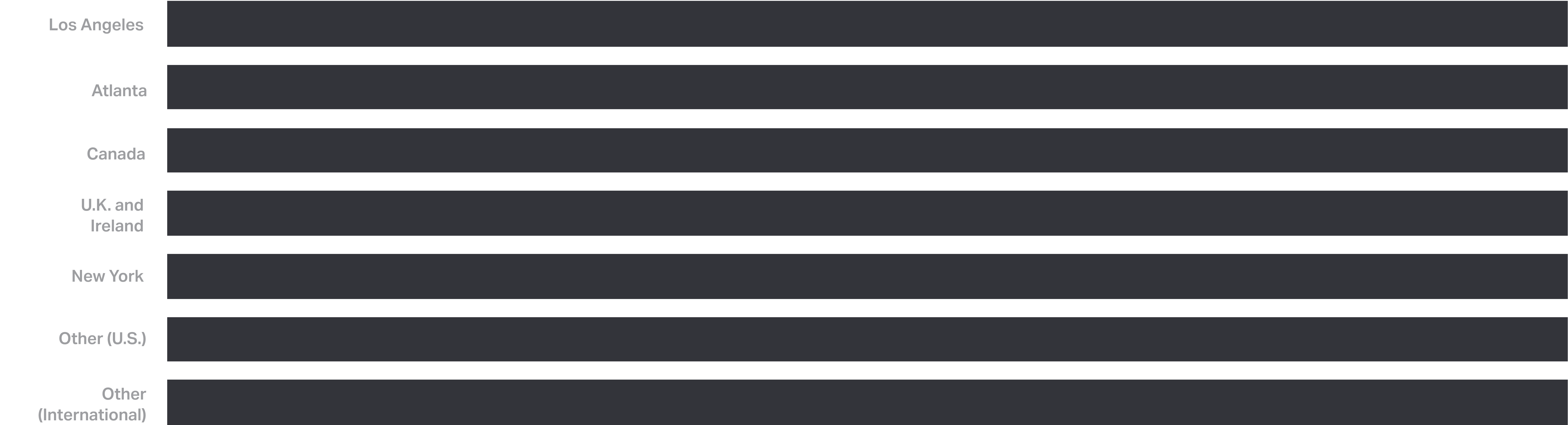

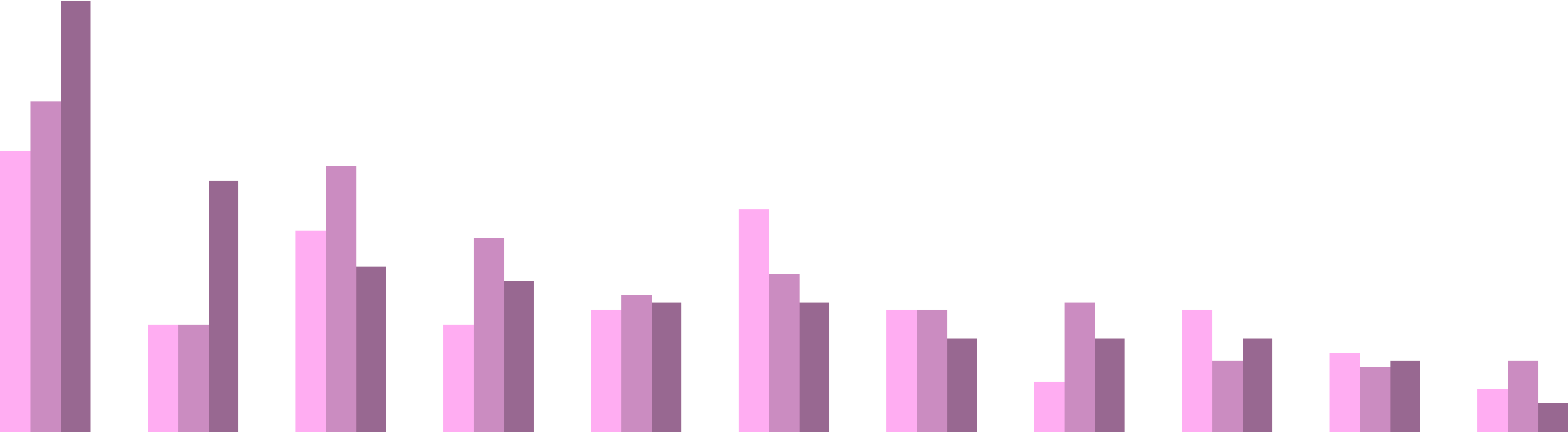

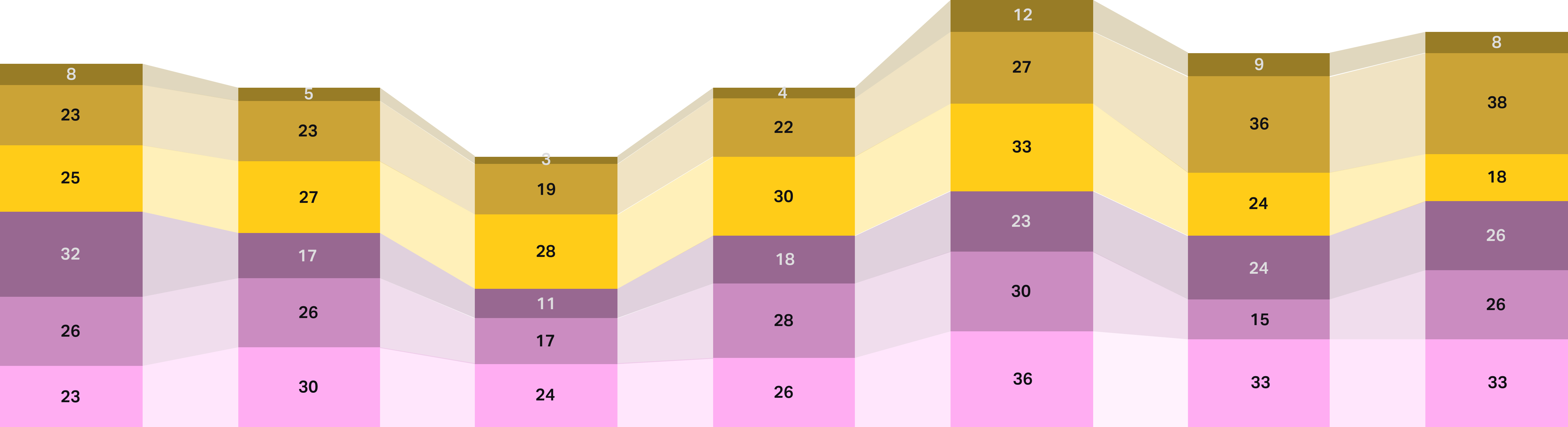

Numerous factors go into choosing shooting locales, including the availability and accessibility of equipment, facilities and crew; the cost of materials and labor; and financial incentives for the territory in question. L.A.’s advantage on the first count has been challenged as other hubs have emerged, giving its fiscal disadvantages more weight.

Major & Mini-Major U.S. Films Shot in Key Production Locations

Source: Luminate Film & TV, Variety Intelligence Platform analysis; note: Some titles may be counted more�than once due to filming at multiple major locations; studios include the Big Five, A24, Amazon MGM,�Annapurna, Apple, Lionsgate, Neon, Netflix, STXfilms, United Artists

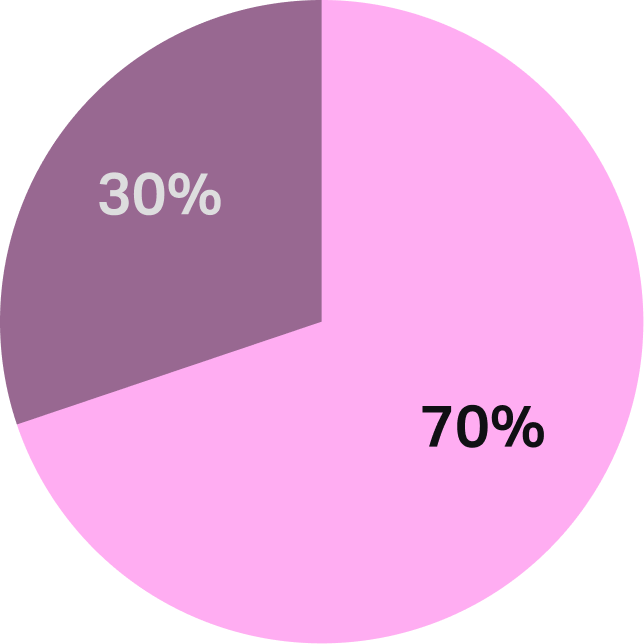

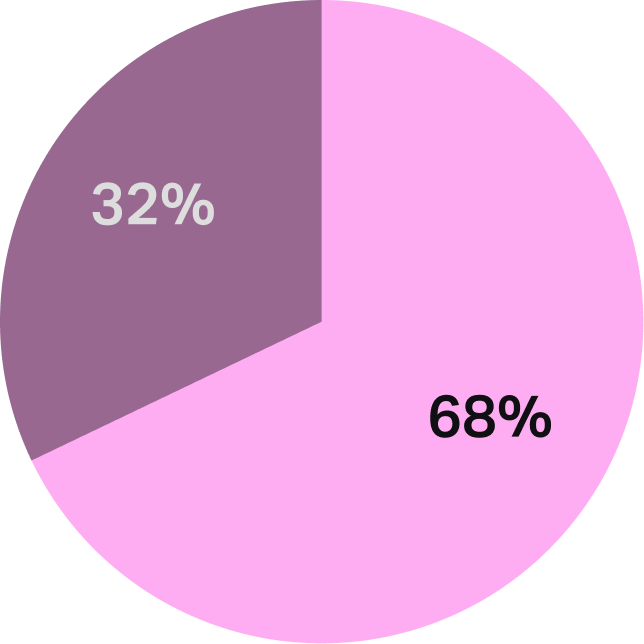

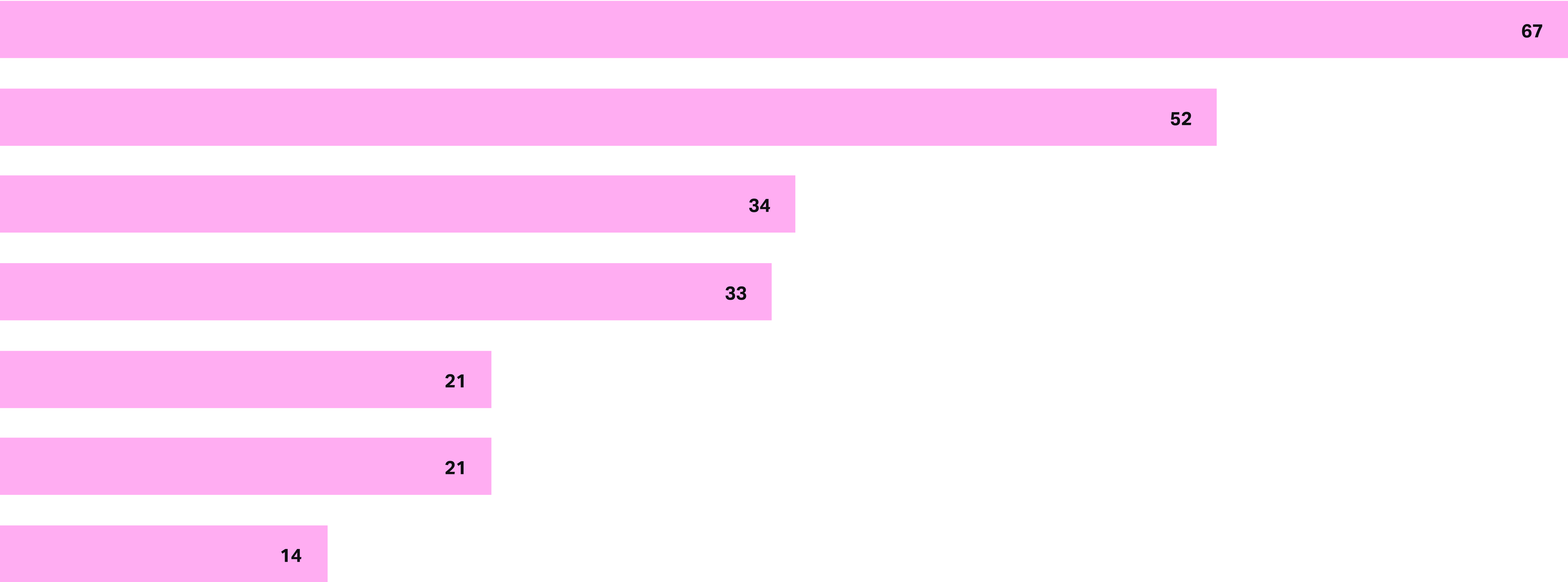

Luminate location data shows L.A. still outstrips other hubs in scripted U.S. TV production (while film has long been more diffuse). Combined, however, other areas have eaten away at the city’s share of series shot in major hubs, which shrank from 48% in 2018 to 33% in 2024.

U.S. Scripted Live-Action Series Filmed in Major Production Locations

Source: Luminate Film & TV, Variety Intelligence Platform analysis; note: Some titles may be counted more than once due to filming at multiple major locations

The dominant hubs continue to account for the majority of U.S.-made scripted film and TV production each year, even as their collective share has slipped. The competition for projects through infrastructure and incentives is likely to accelerate this trend.

U.S. Scripted Live-Action Film & TV Production Locations

Source: Luminate Film & TV, Variety Intelligence Platform analysis Note: Includes films released by U.S. major &�mini-major studios; “production hubs” includes Los Angeles, New York, Atlanta, Canada, U.K., Ireland, Australia and New Zealand

Film�Budgets����

10

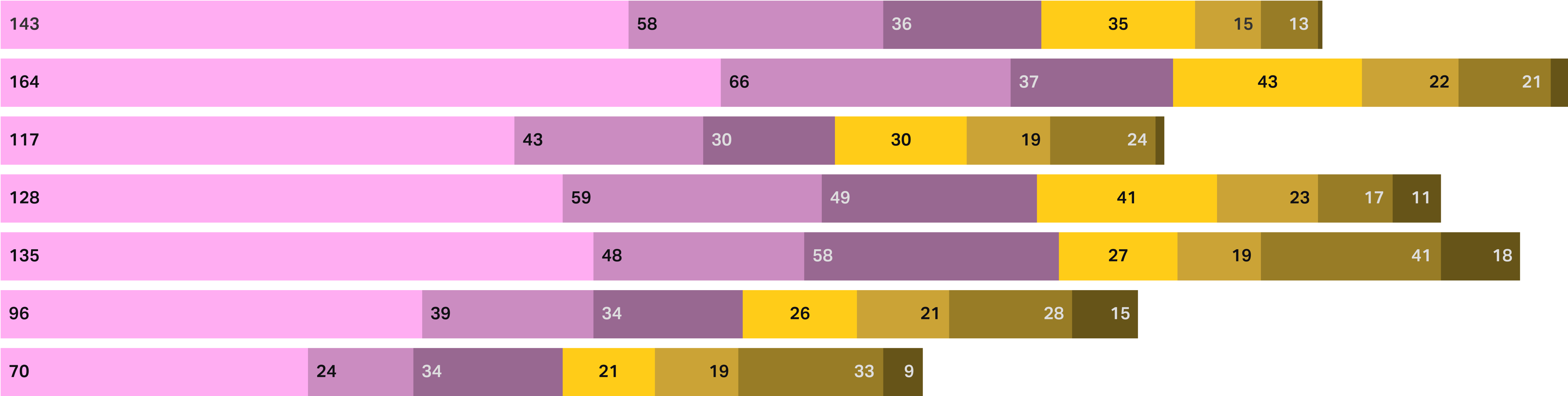

High- and low-budget film projects alike have leveraged the fiscal advantages of offshoring production in recent years. Sub-$10M indie The Brutalist and the nearly $200M Dune: Part Two are just two vastly disparate projects that both shot in Hungary, at least partially to keep costs down.

CA Film Tax Credit Recipient Budget Levels

Source: California Film Commission

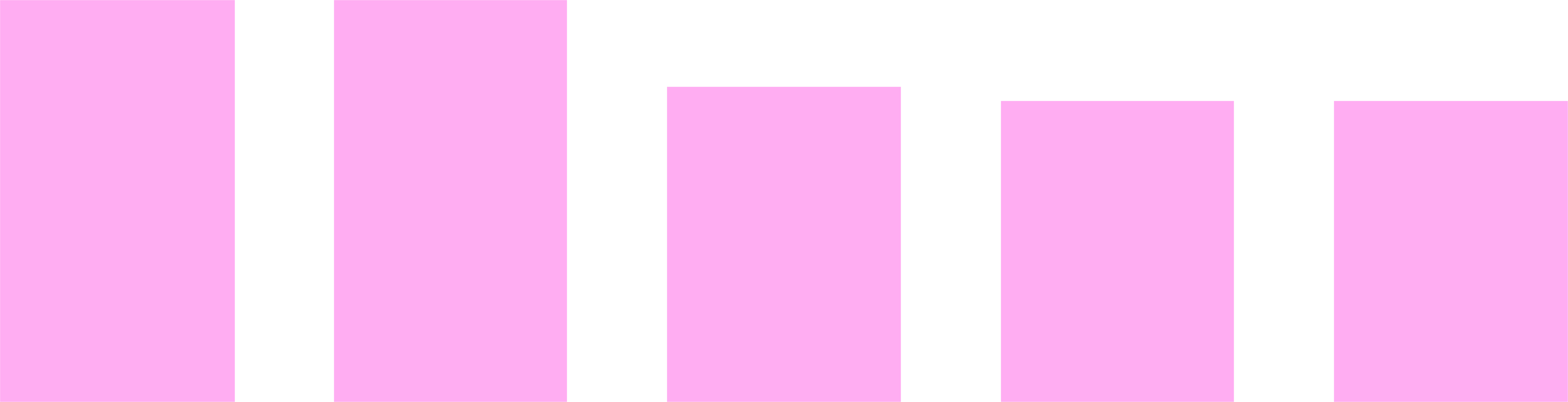

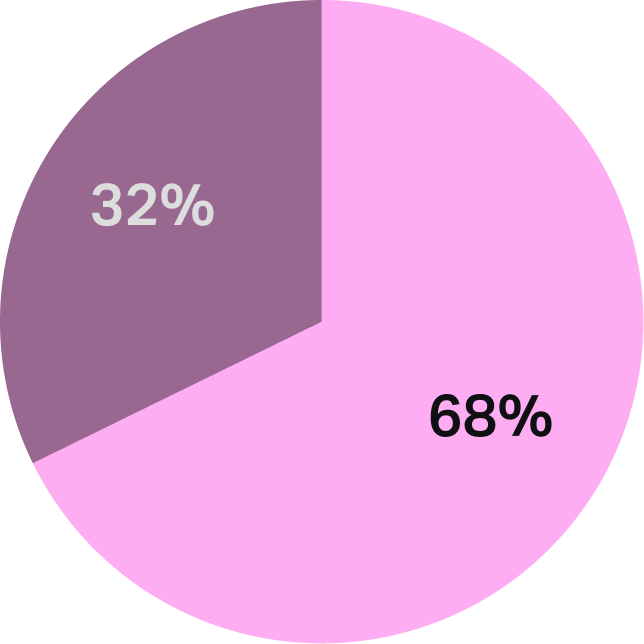

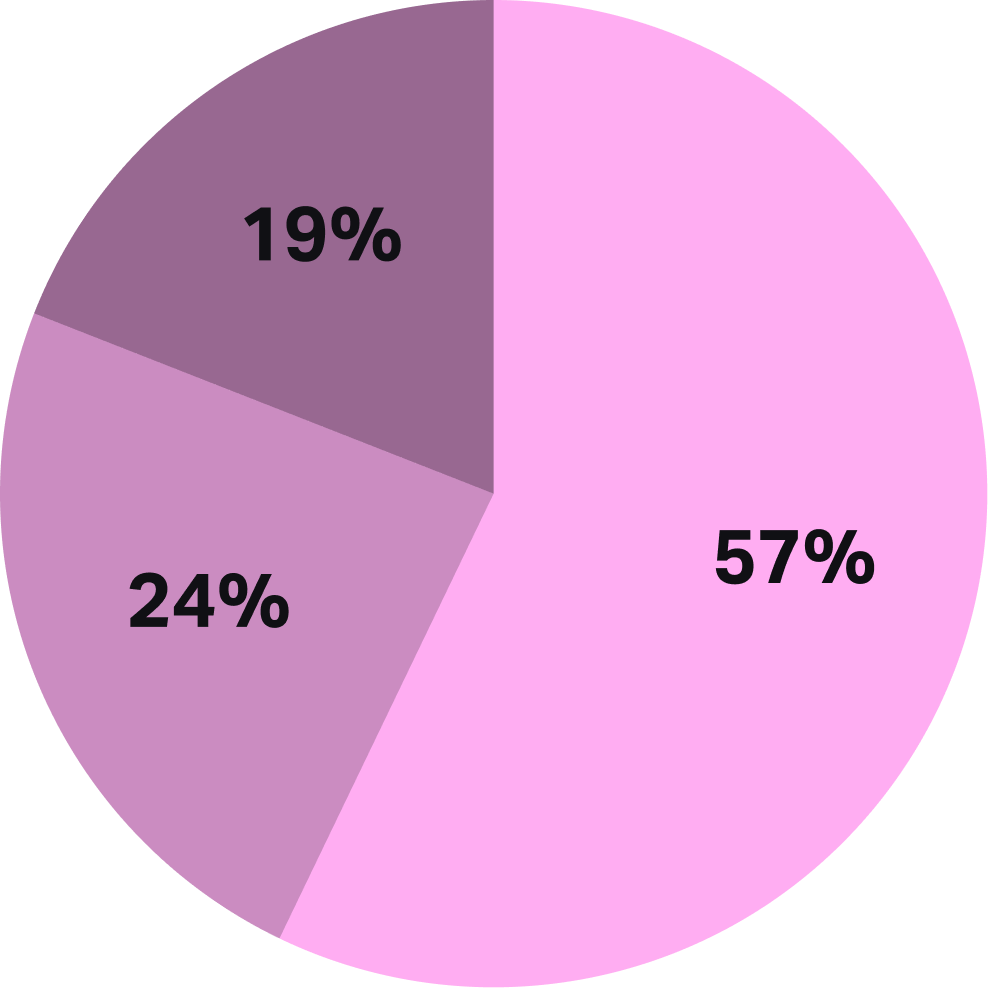

Out of 155 $100M-plus films released or slated for release from 2018 to 2025, just 34 filmed any portion in L.A. What’s more, exceedingly few were shot there entirely, with the city mostly supplementing production in other locations.

$100M+ Film Production Locations, 2018-25

Source: Luminate Film & TV, Variety Intelligence Platform analysis Note: Excludes animated films;�includes titles released or scheduled in this time frame; some may�be counted more than once due to multiple filming locations

The proportion of sub-$10M films shot in Los Angeles during that time is nearly equivalent (20% of 2018-25 releases vs. 22% for $100M+ films), but there is clearly still an appetite among indie filmmakers to shoot in the region. This could present an opportunity to boost filming activity if the city can ease the fiscal burden on producers.

Sub-$10M Budget Filming Locations, 2018-25

Source: Luminate Film & TV, Variety Intelligence Platform analysis�Note: Includes titles released or scheduled for release in this time frame; some may be�counted more than once due to multiple filming locations

click to download a PDF

For titles reported starting in Q1

Data as of May 2025

For those U.S. states with caps

Data as of November 2024

For countries with set limits

By release year

By release year

By release year

For releases by major and mini-major studios/streamers

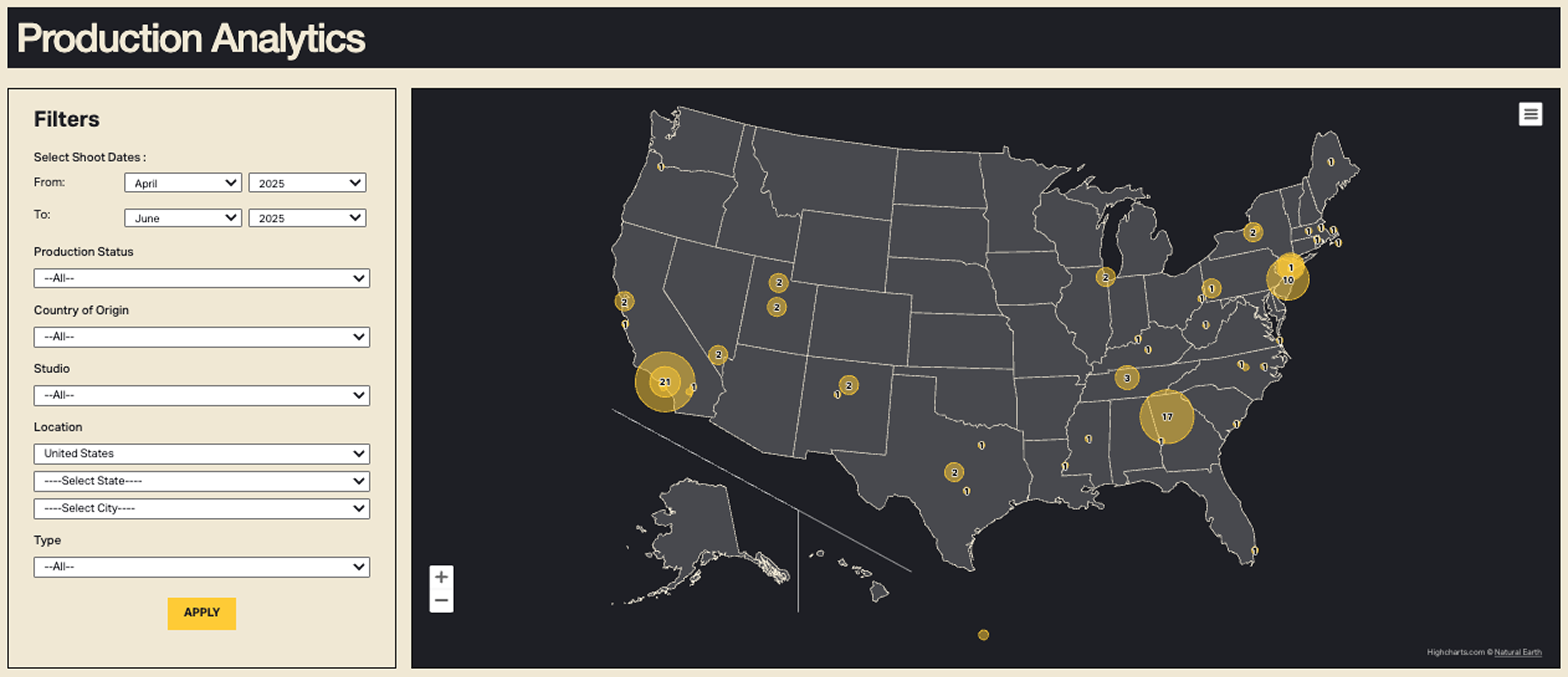

Looking to go deep on production analytics? Much of this report’s insights leveraged Luminate Film & TV’s comprehensive production-level data, and now we've launched a Production Analytics dashboard on Luminate Film & TV to answer even the most challenging content pipeline questions. Please visit filmandtv.luminatedata.com, and use the promo code PRODUCTION2025 for a free two-week trial.

Tyler Aquilina

Luminate media analyst

IN THIS

REPORT