What’s the future of digital banking?

Consumers want more, but how can merchants and issuers get there?

How we bank and make payments has changed from using cash and reviewing paper statements to adopting mobile apps, digital wallets and biometrics for authentication. And while neobanks continue to challenge the status quo, innovations with digital banking have seemingly stagnated. With access at our fingertips to more financial tools than ever before, what’s next for digital banking?

Our research suggests we’re on the brink of major shifts in consumers’ attitudes, beliefs and habits, along with changing priorities for merchants and issuers. These changes will propel the upcoming wave of digital banking innovations that will address unmet needs.

"Doubtless, in the future we shall be able to sign our cheques by the rapid transmission of motion; we shall be able to trace criminals, send out their fingerprints, and carry on very many classes of business which, at present, require our bodily attention."

Over 100 years ago, forecasts were made about the year 2024. While some came true, such as Archibald M. Low’s foresight that people would be able to work from home, others remain futuristic dreams—like flying cars.

We have a fascination with predicting what the future holds

Archibald M. Low

“Wireless Possibilities,” 1924

RESEARCH REPORT

The next iteration of tools and solutions must offer a compelling next-gen experience if businesses want to win new customers. They should also offer merchants and issuers the opportunity to enhance their operations to help drive better financial performance.

Ushering in change requires players within the payments ecosystem to work together to create more unified, seamless experiences that connect merchants, consumers and issuers.

MARKET DYNAMICS

What’s propelling next-gen digital banking?

73% of consumers have given their email or phone number to a merchant to receive a digital receipt.1

%

00

75% of cardholders think �digital banking tools and features must be intuitive and easy to use, otherwise they won’t use them.2

%

00

Younger generations use their smartphone frequently to access financial information. About 60% of millennials log in to their accounts more than 5 times �per week.1

%

00

Consumers expect seamless digital experiences

THE BRINK OF TRANSFORMATION

Partners

Innovation

Opportunities

Preferences

Market

Transformation

92% of merchants are currently offering or planning to support digital receipts.3

%

00

Merchants see value in providing digital receipts in banking apps in order to enhance the customer experience, have a positive environmental impact and tap into powerful marketing opportunities.

Merchants are investing in digital

Globally, consumers’ preferences are shifting, yet research shows that across different regions there are many similarities. People increasingly desire a digital future with more connected and seamless experiences. These are blurring the lines between traditional merchant and issuer functions to create a next-gen experience.

We surveyed consumers around the world to understand their digital banking behavior and identify features they’d find useful in their banking app.1

Understanding digital banking behavior

CONSUMERS' PREFERENCES

Consumers who found �an unrecognized purchase �in their bank app

59%

U.S.

75%

U.K.

69%

BRAZIL

74%

AUSTRALIA

Consumers who reported �an unrecognized transaction �to their bank

85%

U.S.

69%

U.K.

90%

BRAZIL

75%

AUSTRALIA

Consumers who would find clearer merchant information

useful in their banking app

92%

U.S.

94%

U.K.

98%

BRAZIL

91%

AUSTRALIA

Consumers who would find subscription management tools useful in their banking app

54%

U.S.

62%

U.K.

59%

BRAZIL

52%

AUSTRALIA

Consumers who would find digital receipts useful in their banking app

94%

U.S.

86%

U.K.

96%

BRAZIL

93%

AUSTRALIA

Issuers can better meet consumers’ expectations by providing more details in banking apps1

of consumers investigated �a purchase in the last 12 months

50%

investigated a transaction because they did not recognize it

24%

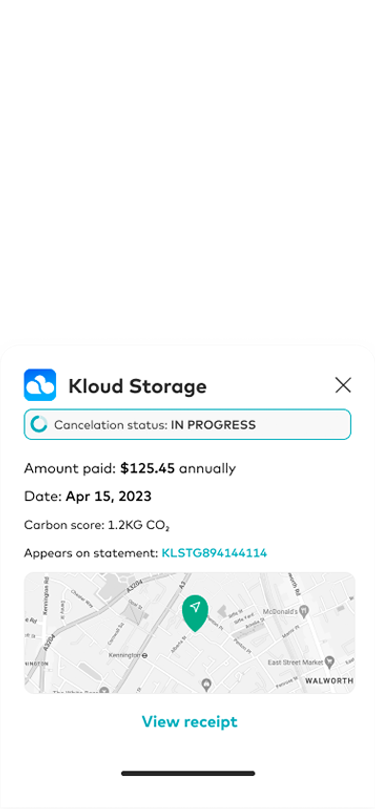

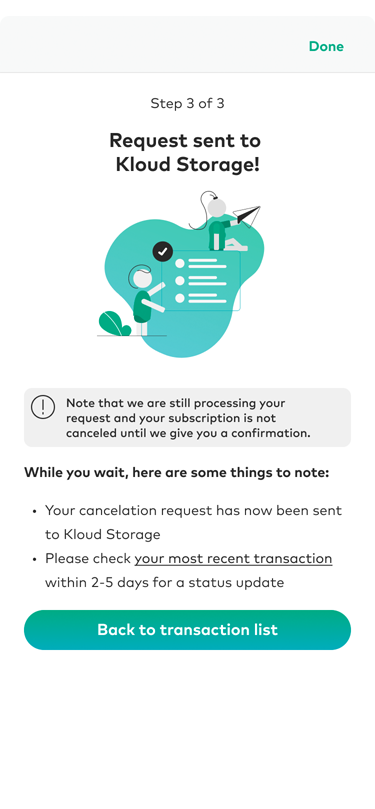

Our research found consumers want more information about their purchases, including the ability to better manage their subscriptions. These types of tools offer a better customer experience and lead to deeper loyalty. Merchants and issuers that provide more self-serve options can improve customer satisfaction scores, reduce chargebacks and decrease operational costs.

Reduce chargebacks with a next-gen digital experience

OPPORTUNITIES

Globally, 50% of consumers would consider switching banks to manage disputes through their online banking or mobile banking app.4

%

00

%

00

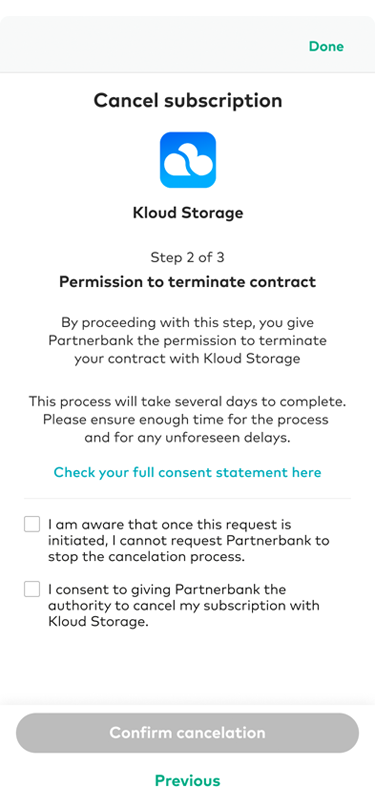

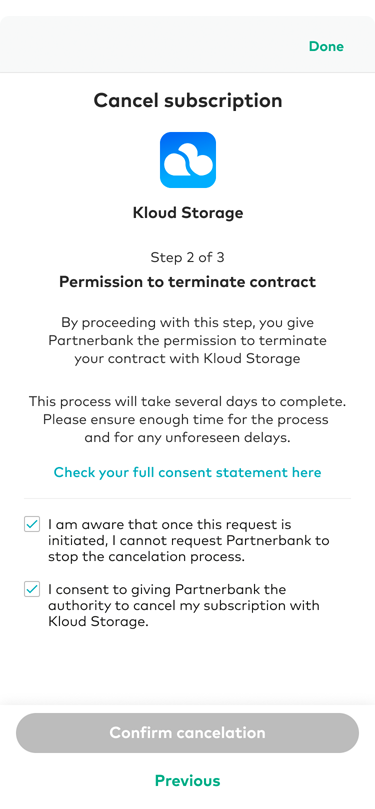

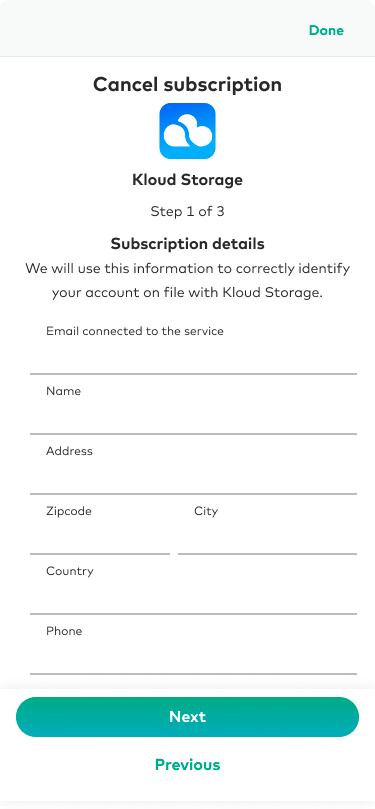

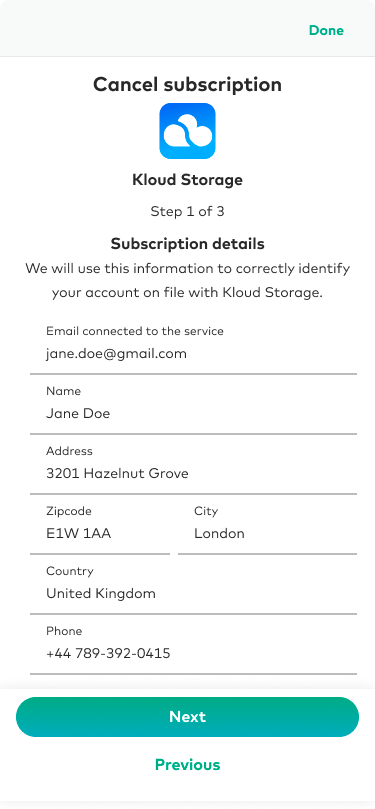

Percent of consumers who find it hard to figure out how to cancel or pause their subscriptions:1

50%

U.S.

46%

U.K.

33%

BRAZIL

35%

AUSTRALIA

Consumers surveyed who didn’t recognize a transaction contacted their bank. Over 80% believed that easier access to information about the merchant and their transaction would have improved the investigation.1

With access to the information and tools needed to solve many of their customers’ pain points, merchants play an important role in creating the future of digital banking. Many are investing in tools to help improve communication and data sharing between merchants, issuers and consumers.

Better digital tools enhance the customer experience and positively impact the bottom line; 80% of merchants surveyed agree that digital receipts help to lower dispute and chargeback rates.3

Merchants’ role �in advancing digital innovation

INNOVATION

65% offer chat feature on web

%

00

Merchants providing customer service with omnichannel tools

53% offer �email support

%

00

52% offer �phone support

%

00

20% offer text/SMS

%

00

33% of merchants offer a digital receipt through digital banking apps

%

00

Merchants providing digital receipts

Merchants offering subscription services

66% of merchants offer details beyond the purchase date and amount

%

00

56% of merchants offer a subscription service of some kind

%

00

44% of merchants plan to offer subscription services in the next 1–2 years

%

00

Subscription management solutions create a better experience for customers and help merchants reduce operational costs.

of merchants have a team of 30+ employees managing subscription related disputes.

About 30% or more of consumers changed their mind about canceling a subscription when offered a discount.5

Giving customers more control over their purchases in a digital banking app can provide a unique opportunity for merchants to retain customers.

25%

AUSTRALIA

42%

BRAZIL

29%

U.K.

28%

U.S.A.

In the future, digital banking will enable increased connection between consumers, merchants and issuers to more effectively share and manage finances — securely.

Making every aspect of the consumer experience seamless can present data challenges (e.g., the data must be modeled, matched, formatted and shared). However, it doesn’t have to be difficult. The right technology partners can support implementing the infrastructure and providing APIs and web-based portals. �

Reducing complexity and delivering innovation

PARTNErs

%

00

The majority of merchants that provide receipt data in a digital banking app prefer to leverage an industry partner like Mastercard due to the ease of implementation and ability to scale across financial institutions.3

The next generation digital banking wave is coming

Connect with an expert to prepare now.

Let’s connect

Sources: �1 Datos Insights. Digital Banking and Consumer Clarity: Q4 2023 Survey Findings.

2 Van Wexel, Ron. Will Banking Apps Be the New Super Apps? Aite-Novarica. March 2023.�3 Datos Insights. Merchant Perspectives on Digital Receipts and Digital Banking. �4 Will banking apps be the new super apps? Consumer attitudes toward new services in digital banking. Aite Novarica. March 2023.�5 Datos Insights. Survey of 2,568 consumers in the U.S., U.K., Australia and Brazil. Q4 2023.

Mastercard is a trademark of Mastercard International Incorporated. © 2024 Mastercard. All rights reserved.

00

%

00

%

1

3

1

2

1

3

1

1

1

4

Reduce operational costs

Retain more customers

5

3

We surveyed merchants to better understand �the tools they‘re currently providing consumers

Partners

Innovation

Opportunities

Consumers' preferences

Market dynamics

The brink of transformation

investigated a transaction because they did not recognize it

24%

of consumers investigated �a purchase in the last 12 months

50%

3