Global Energy Perspective 2022

April 26, 2022 | Report

We’re in the midst of an energy transition that continues to evolve.

An economic rebound after the COVID-19 pandemic has triggered price spikes for multiple commodities. The conflict in Ukraine has led to even further increasing energy prices and security-of-supply concerns. However, the transition to a lower-carbon energy system continues and accelerates, and the coming decades will likely see a rapidly-changing energy landscape. Our Global Energy Perspective 2022 provides insights into the longer-term trends that will continue to be essential in shaping future energy systems.

Download the full executive summary

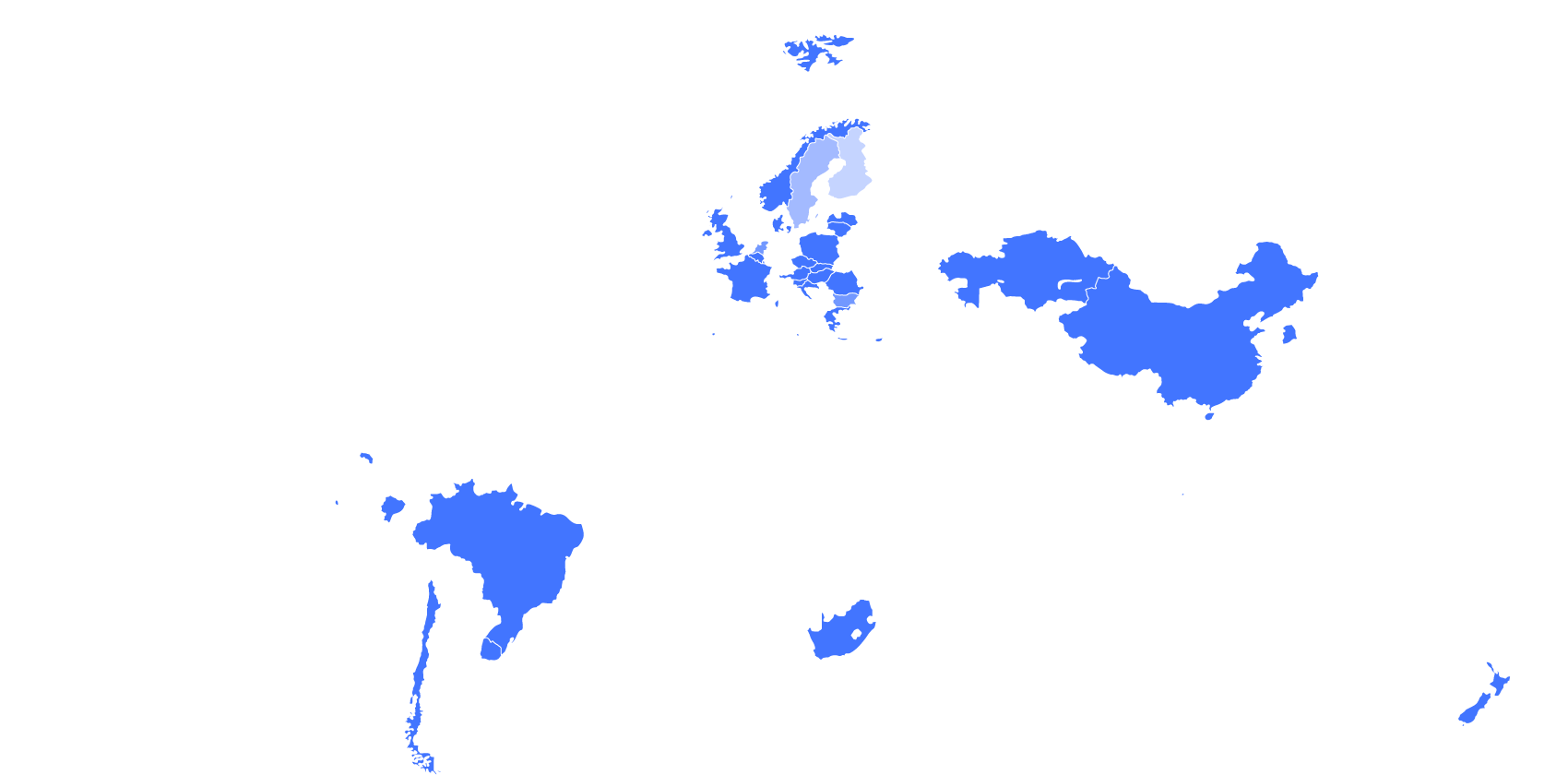

The commitment to reducing emissions has gained momentum

Leading up to COP26, a total of 64 countries have pledged or legislated achieving net zero in the coming decades.

89%

of global emissions

2019

2018

2020

41

Emissions-reducing commitments per country and year, %

Replay Animation

11

2021

47

Download the full executive summary

Electrification and renewables show accelerated growth

Going forward, the energy mix rapidly shifts towards power, synfuels, and hydrogen, representing 32% of the global energy mix by 2035 and 50% by 2050.

by 2050

50%

1990

2000

2010

2020

2030

2040

2050

50

100

150

200

250

300

350

400

450

500

Final energy consumption per fuel, million TJ

Electricity

60%

is the projected decline in coal demand by 2050, mainly driven by a regulatory and economic phase-out in the power and industry sectors.

10%

is the projected share of coal in global energy demand by 2050.

Global coal demand has peaked in 2013. Despite a short-term revival following recovery from the impact of COVID-19, coal demand is projected to decline ~20% by the end of this decade. However, coal is projected to remain a significant part of the energy system to 2050 (depending on location and sector) which could pose a risk for future climate commitments.

Coal

Replay Animation

0

Coal

Oil

Natural gas

Bioenergy

Hydrogen

Electricity

Other

Hydrogen

Bioenergy

Natural gas

Oil

Coal

Coal

3–4%

p.a. is the projected growth rate in electricity demand from 2019 to 2050.

3×

is the projected electricity demand by 2050.

Power consumption is projected to triple by 2050 as electrification and living standards grow. Electrification is one of the first decarbonization levers, being the lowest-cost and easiest to implement in most sectors.

Electricity

Electricity

4–6×

is the projected hydrogen-demand growth by 2050.

50%

is the projected growth in hydrogen demand, mostly from road transport and new industrial uses.

Hydrogen demand is projected to grow fivefold by 2050, driven primarily by road transport, maritime, and aviation, while its supply is expected to shift from nearly 100% grey hydrogen to 95% clean production by 2050, as costs decline and policymakers support hydrogen technology adoption.

Hydrogen

Hydrogen

2-4×

is the projected increase in sustainable-fuels demand over the next 20 years.

$35B–$45B

is the projected investment in bioenergy by 2025.

Sustainable fuels can provide GHG emissions reductions comparable to electric vehicles, and could account for up to 37% of energy demand in transport by 2050. They are also applicable in multiple sectors and needed to meet decarbonization targets.

Bioenergy

Bioenergy

10%

is the projected growth of gas demand in the next decade.

15%

is the projected share of gas in primary energy demand by 2050.

Gas has gradually increased its share in the energy mix and is the most resilient among all fossil fuels given its lower carbon intensity. Gas is projected to play a pivotal role throughout the transition by its wide range of applications, and its demand is projected to peak by 2035.

Natural gas

Natural gas

75%

is the expected decline in liquids demand in road transport by 2050, after peaking in the early 2020s.

50%

is the projected share of crude oil used for combustion in 2050 liquids demand.

Global liquids demand is projected to peak around 104 MMb/d in the next two to five years, driven primarily by the uptake of electric vehicles. However, crude oil demand is projected to decline rapidly only beyond 2030, while most of remaining liquids demand growth will likely be seen in non-energy use of oil, and bio- and synfuels.

Oil

Oil

Global fossil-fuels demand is projected to peak between 2023–2025

The peak in fossil-fuels demand continues to move forward; oil is projected to peak in the next 5 years while gas remains the most resilient fossil fuel.

By 2050, fossil

fuels make up

of global energy demand

43%

1…

0

0

0

0

2…

0

0

0

0

2…

0

0

0

0

2…

0

0

0

0

2…

0

0

0

0

2…

0

0

0

0

1990

2000

2010

2020

2030

2040

2050

40

60

80

100

120

140

160

180

200

Natural gas

Oil

Coal

2035

2025

2013

Global fossil-fuel demand, million TJ

Replay Animation

Emissions peak before 2030 across all scenarios, but the decline is insufficient for a 1.5º pathway

Even if all countries deliver on their current net-zero commitments, global emissions remain far away from a 1.5ºC pathway.

Current Trajectory

2.4ºC

Current trajectory of renewables cost decline continues, however currently active policies remain insufficient to close gap to ambition

(1.9º–2.9º)

Further Acceleration

1.9ºC

Further acceleration of transition driven by technology and regulatory evolution, though financial and technical constraints remain

(1.6º–2.4º)

Achieved Commitments

1.7ºC

Net-zero commitments achieved by leading countries through purposeful policies; followers transition at slower pace

(1.4º–2.1º)

1.5ºC Pathway

<1.5ºC

Aggressive regulatory constraints on the carbon intensity of fuels result in the rapid adoption of decarbonization technologies across all sectors (eg, EVs, alternative fuels, hydrogen, etc.)

Future growth in energy investments could be driven almost entirely by renewables and decarbonization technologies

Substantial investments are required across sectors to accelerate the energy transition, and expected returns are highly scenario dependent, especially in the conventional energy segment.

Global investments in the energy sector, $ billion

2012

2015

2020

2025

2030

2035

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

250

0

500

750

1000

1250

1500

1750

2000

Power, conventional

Gas

Oil

Renewables

Decarbonization technologies are projected to make up more than a fourth of global investments in the energy sector in

all scenarios

Decarbonization

technologies

Investments in oil and gas are projected to stay stable in absolute values, however their share of the global energy investments mix is projected to decrease from 54% in 2021 to 36% in 2035

Power, conventional

Gas

Oil

Renewables

Power, conventional

Gas

Oil

Next

Prev

Investments in renewables are projected to grow by 4% per year until 2035, accounting for 37% of global energy investments in the next 15 years

Next

Prev

Next

Prev

Download the full executive summary

Download the full executive summary

How could the energy transition unfold?

The conflict in Ukraine

Share of 2019 emissions, %

Global net energy-related CO₂ emissions, GtCO₂ p.a.

Temperature rise

Pathway

Temperature rise

Pathway

Temperature rise

Pathway

Temperature rise

Pathway

Get in touch

Get in touch

The boundaries and names shown on this map do not imply official endorsement or acceptance by McKinsey & Company