U.S.

China

Japan

Europe

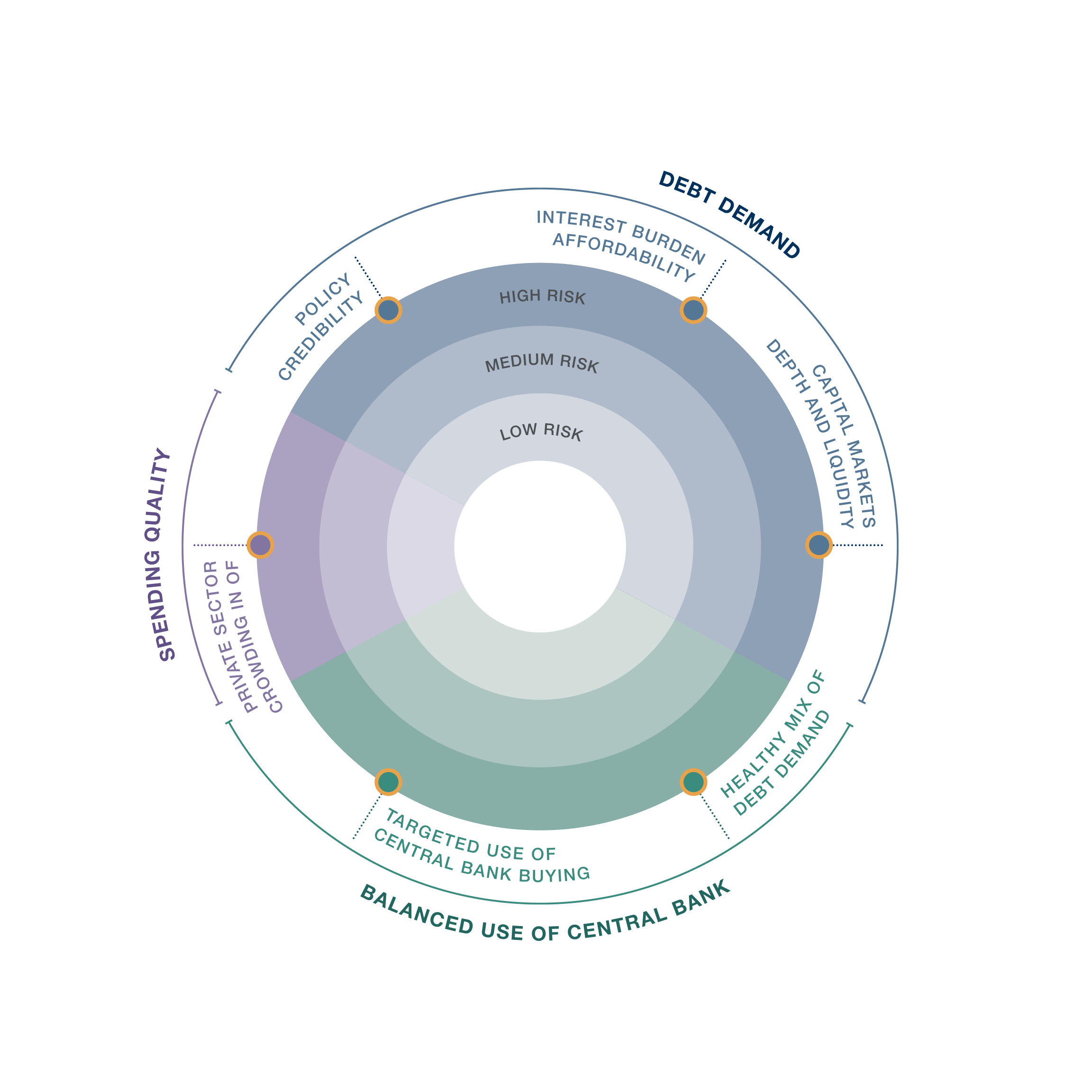

Crowding in of private sector

Government spending should boost, not block, private investment. Excessive borrowing risks crowding it out.

Policy credibility

Investors rely on trust in a country’s creditworthiness and clear, consistent debt policies.

Interest burden affordability

Debt and interest payments must stay within what the borrower can reasonably repay.

Healthy mix of debt demand

Debt sustainability improves when held broadly—domestically and by various diverse entities. Too little foreign interest may reflect weak confidence.

Targeted use of central bank buying

Outside crises, ongoing central bank purchases distort demand.

Capital markets depth and liquidity

Strong, liquid capital markets draw a broad range of investors.

Spending Quality

Is public money crowding in innovation, or stifling growth?

Are investors still buying—and at what cost?

Debt Demand

Are investors still buying—and at what cost?

Debt Demand

Are investors still buying—and at what cost?

Debt Demand

Is monetary policy a prudent backstop or a crutch?

Balanced use of central bank

Is monetary policy a prudent backstop or a crutch?

Balanced use of central bank

Crowding in of private sector

Government spending should boost, not block, private investment. Excessive borrowing risks crowding it out.

Crowding in of private sector

Government spending should boost, not block, private investment. Excessive borrowing risks crowding it out.

Is public money crowding in innovation, or stifling growth?

Spending Quality

Interest burden affordability

Debt and interest payments must stay within what the borrower can reasonably repay.

Are investors still buying—and at what cost?

Debt Demand

Policy credibility

Investors rely on trust in a country’s creditworthiness and clear, consistent debt policies.

Are investors still buying—and at what cost?

Debt Demand

Interest burden affordability

Debt and interest payments must stay within what the borrower can reasonably repay.

Are investors still buying—and at what cost?

Debt Demand

Is monetary policy a prudent backstop or a crutch?

Balanced use of central bank

Consider: quantitative easing and liquidity support should be used only during crisis and recovery periods; sustained central bank purchase programs suggest a structural lack of demand

Targeted use of central bank buying

Debt sustainability improves when held broadly—domestically and by various diverse entities. Too little foreign interest may reflect weak confidence.

Healthy mix of debt demand