Tariffs and workforce adjustments

For some employers, reducing staffing hours or headcount may

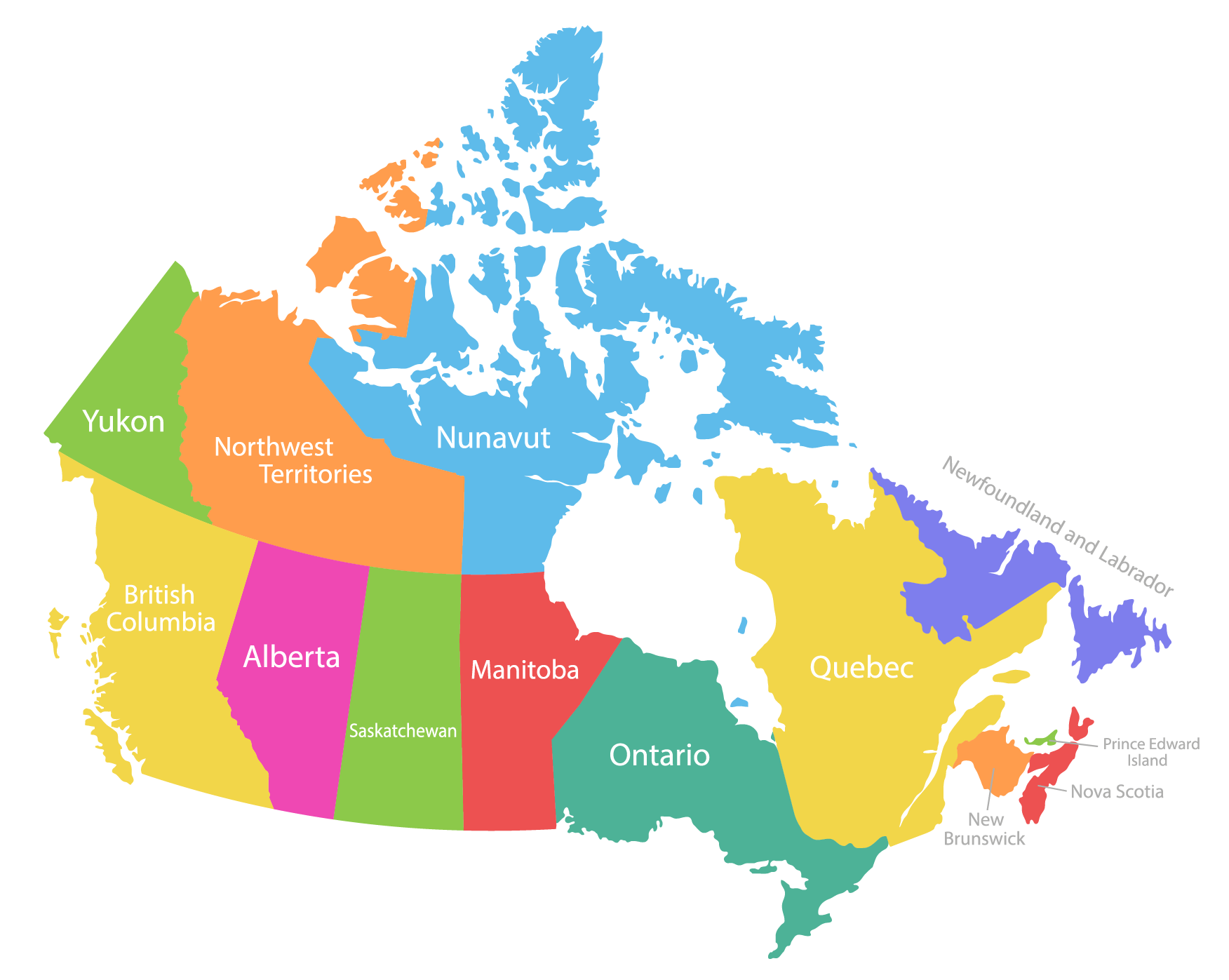

Click on a jurisdiction below for a selection of compliance deadlines and legislative initiatives

Court and tribunal decisions

Canadian employment law is largely driven by the court and tribunal

Canadian employment and labour quarterly

May 2025 | Issue 01

We are launching our new quarterly employment and labour newsletter at a historic time. Canada has elected a new federal government against the backdrop of an ever-evolving tariff dispute. Like our clients, we know that whatever changes these events bring, the work goes on. The Norton Rose Fulbright employment and labour team supports businesses in Canada and around the world in managing workforces in the face of change.

In Kirke v Spartan Controls Ltd, 2025 ABCA 40 the Alberta Court of Appeal held that a managerial employee was not entitled to wrongful dismissal damages for loss of a profit-sharing plan. While loss of compensation is normally measured across an employee’s “reasonable notice period”, the compensation in issue here

was related to the manager’s continued ownership of company shares under a Unanimous Shareholder Agreement. Prior to termination the employer exercised its right to buy back the manager’s shares, meaning the employee suffered no damages related to dismissal without notice. This sort of creative compensation structure can limit future termination liabilities for employers.

Alberta

British Columbia

Ontario

Canadian employment law is largely driven by the court and tribunal decisions. The Norton Rose Fulbright employment and labour team tracks such decisions, updating our clients when impactful decisions arise. These are a few recent decisions of interest for Canadian employers.

We’ll be back next quarter with a fresh update. Watch your inbox and share your ideas our way. If there’s a specific topic you’d like to see covered, we’d love to hear from you.

Andrew Schafer

Partner, Vancouver

Contact me

Read my bio

Cross-Canada update

Click on a jurisdiction below for a selection of compliance deadlines and legislative initiatives affecting employers operating in that jurisdiction. These lists are not exhaustive. Contact counsel for detailed compliance information for each jurisdiction.

Alberta

Compliance dates

March 31, 2025

Streamlined violence and harassment prevention requirements under health and safety legislation came into effect. Policy and procedure updates may be required.

March 31 – August 31, 2025

Expanded reservist leave available for Canadian Forces reservists participating in G7 Leaders summit taking place in Kananaskis June 15-17, 2025.

Alberta

British Columbia

Federal

Manitoba

New Brunswick

Newfoundland

and Labrador

Nova Scotia

Ontario

Prince Edward Island

Yukon

Yukon

British Columbia

Alberta

Ontario

New Brunswick

Nova Scotia

Newfoundland �and Labrador

Québec

Manitoba

British Columbia

Compliance dates

June 1, 2025

The general minimum wage will increase from $17.40/hour to $17.85/hour.

November 1, 2025

Employers with 300-999 employees must prepare and post their first pay transparency report. Employers with 1000+ employees were required to report in 2024.

Legislative Initiatives

Bill 11

This government bill was introduced for first reading on April 15, 2025. If adopted it will prohibit B.C. employers from requesting sick notes for short term health-related leaves under the B.C. Employment Standards Act.

Federal

Compliance dates

April 1, 2025

The federal minimum wage increased from $17.30/hour to $17.75/hour. The federal minimum wage applies unless a provincial minimum wage is higher in the place where the employee works, in which case that provincial minimum wage applies.

June 20, 2025

Federal replacement worker ban comes into effect. Replacement workers cannot be used during lawful strikes or lockouts (with narrow exceptions).

June 30, 2025

Filing deadline for the first annual report under the Pay Equity Act if employers posted their first pay equity plans in September 2024.

Manitoba

Compliance dates

May 1, 2025

Any organization with one or more employees in Manitoba will be subject to the information and communication standards under The Accessibility for Manitobans Act. Such organizations will be required to adopt policies, practices and training related to accessibility of public-facing information and communications.

October 1, 2025

The general minimum wage will increase from $15.80/hour to $16.00/hour.

Legislative Initiatives

Bill 29

Introduced for first reading on March 6, 2025. If adopted, Bill 29 will make several amendments to Manitoba’s Workplace Safety and Health Act, including an expansion of the purpose of the Act to include enabling workers to work in “psychologically safe workplaces”.

Bill 43

Introduced for first reading on March 18, 2025. If adopted, Bill 43 will amend the Human Rights Code to add “gender expression” as a prohibited ground of discrimination.

New Brunswick

Compliance dates

April 1, 2025

The general minimum wage increased from $15.30/hour

to $15.65/hour.

Legislative Initiatives

Bill 13

Introduced for first reading on March 25, 2025. If adopted, Bill 13 would make several changes to New Brunswick’s workers’ compensation statutes, including removal of exemptions for casual workers and outworkers.

Newfoundland and Labrador

Compliance dates

April 1, 2025

The general minimum wage increased from $15.60/hour to $16.00/hour.

Nova Scotia

Compliance dates

April 1, 2025

The general minimum wage increased from $15.20/hour to $15.70/hour.

April 1, 2025

Pursuant to Order in Council 2025-47, filed on February 18, 2025, the number of paid domestic violence leave days available under the Labour Standards Code increased from three days to five days.

October 1, 2025

The general minimum wage will increase from $15.70/hour to $16.50/hour.

Ontario

Compliance dates

July 1, 2025

Employers must provide new employees with information in writing about key employment details, including compensation, job duties, hours, location and more.

July 1, 2025

New minimum working standards for “digital platform workers” come into effect, affecting app-based ride-hailing and delivery drivers.

October 1, 2025

The general minimum wage will increase from $17.20/hour to $17.60/hour.

Quebec

Compliance dates

May 1, 2025

The general minimum wage will increase from $15.75/hour to $16.10/hour.

June 1, 2025

Employers with at least 25 employees in Quebec will be subject to francization requirements of the Charter of the French Language (the current threshold is 50 employees).

Legislative Initiatives

Bill 89 – Introduced for first reading on February 19, 2025. If adopted, Bill 89 would grant the government of Quebec new powers to prevent or end strikes or lock-outs in unionized, private sector workplaces.

Yukon

Compliance dates

April 1, 2025

The general minimum wage increased from $17.59/hour to $17.94/hour.

Cross-Canada update

Court and tribunal decisions

Québec

Creative compensation structure can limit termination liability

The Court of Appeal for British Columbia has confirmed that “common employer” liability requires more than mere administration of employment. The “common employer” doctrine is applied where related entities exert control over, and benefit from, an employment relationship. Both entities may be exposed to employment-related liabilities, even if only one of them is nominally the “employer” on paper.

In James McCallum & Associates Ltd. v. Courchene, 2025 BCCA 82 the Court of Appeal for British Columbia struck a wrongful dismissal claim against a payroll services provider on the basis that the claim did not plead sufficient facts to connect the provider to the employee. While the provider did administer the employee’s compensation, there was no other indication that it was a common enterprise with the nominal employer.

Providing payroll support does not trigger “common employer” liability

Diverging court decisions on the enforceability of employment contract termination clauses is causing confusion for all workplace parties as to what constitutes an enforceable termination clause in Ontario. Long overdue guidance on termination clauses may be coming soon. Is it permissible to reserve the right to terminate “for any reason” or “at any time?” Some judges have held yes, some no. Can a contract comply with the law simply by stating that the

employee will get everything they are entitled to “in the circumstances?” Again, some judges have held yes, �some no.

We are following closely two potential appeals on these questions, one to the Supreme Court of Canada and another to the Court of Appeal for Ontario, hoping appellate courts will provide guidance moving forward. We will provide updates when we have further information.

Long overdue guidance on termination clauses may be coming soon

A Quebec court held a CEO’s refusal to implement a restructuring plan was cause for termination. The CEO could not rely on his status as a director,

and his right to express dissent in that role, to reject the company’s strategic decisions.

See Fasano c. Servier Canada inc, 2024 QCCS 4366. An appeal has been filed in this case.

Executives must carry out company directives or risk termination

The federal Work-Sharing Program is designed to avoid layoffs in the face of temporary decreases in business activity. If program requirements are met, an employer, employees and Service Canada enter into a multi-party Work-Sharing agreement under which:

Available work is shared equally among employees.

Employment Insurance (EI) benefits are provided by the federal government as income support to employees who are working reduced hours, mitigating their income loss.

The Program keeps the workforce intact by supplementing employee wages even as work is temporarily reduced.

In response to tariff pressures, the Canadian government has expanded access to the Work-Sharing Program from March 7, 2025, to March 6, 2026.

See our update -

Federal support available to avoid tariff layoffs

Work-Sharing

Layoffs

Individual Termination

Group Termination

Overview: Tariffs and workforce adjustments

For some employers, reducing staffing hours or headcount may be a necessity in responding to the ongoing tariff dispute. There are many options for implementing such adjustments, each carrying unique procedural requirements and liabilities. This chart sets out four common workforce adjustment options. The team at Norton Rose Fulbright Canada can assist in reviewing these options and others.

A “layoff” is a temporary cessation of work where the employer expects to recall the employee at some point in the future. There are several legal considerations affecting layoffs.

At common law, a layoff for a non-unionized employee may be treated as a “constructive dismissal” (a termination of employment) unless it is authorized in the employment contract.

Employers should ensure they have the contractual right to lay off an employee before doing so.

Even where a layoff is authorized by contract, it must conform to minimum statutory standards dictating maximum length and minimum continued payments or benefits, or the layoff will be deemed a termination.��For unionized employees, collective agreements typically describe the layoff procedure an employer must follow.

Each Canadian jurisdiction has minimum statutory standards for notice of termination or pay in lieu, and, in some jurisdictions, severance pay and benefits continuation. These entitlements are mandatory. ��Additionally, Canadian common law (applicable in all jurisdictions except Quebec) requires employers provide employees with a lengthy period of “reasonable notice” of termination unless the employment contract provides otherwise.

Many employment contracts do not have enforceable provisions limiting an employee’s entitlement upon termination, meaning terminated employees are often entitled to lengthy reasonable notice periods or damages in lieu of such notice.

In Quebec, employers must provide notice or indemnity similar to common law reasonable notice, but this amount cannot be limited by contract.

Each Canadian jurisdiction has an additional set of statutory termination rules triggered when an employer terminates a threshold number of employees in a defined period of time. ��For example, if an Ontario employer terminates the employment of 50 or more employees in any four-week period, that employer owes enhanced notice

obligations to employees, unions (if any) and the government.

Before engaging in layoff or termination of multiple employees in a brief period, employers should review the applicable group termination provisions for their jurisdiction.

Partner, Calgary

Jeff Landmann

Contact me

Read my bio

Partner, Toronto

Jennifer Hodgins

Contact me

Read my bio

Partner, Ottawa

Heather Cameron

Contact me

Read my bio

Partner, Montréal

Éric Lallier

Contact me

Read my bio

Partner, Québec

Jean-Sébastien Cloutier

Contact me

Read my bio

Québec

Prince Edward Island

Prince Edward Island

Compliance dates

October 1, 2025

The general minimum wage will increase from $16.00/hour to $16.50/hour.

This newsletter will keep employers up to

date on Canadian employment and labour developments and best practices. If you have any questions, contact a member of our team."

Partner, Canadian National Chair, Employment and Labour

Herb Isherwood

Contact me

Read my bio

March 31, 2025

Streamlined violence and harassment prevention requirements under health and safety legislation came into effect. Policy and procedure updates may be required.

March 31 – August 31, 2025

Expanded reservist leave available for Canadian Forces reservists participating in G7 Leaders summit taking place in Kananaskis June 15-17, 2025.

June 1, 2025

The general minimum wage will increase from $17.40/hour to $17.85/hour.

November 1, 2025

Employers with 300-999 employees must prepare and post their first pay transparency report. Employers with 1000+ employees were required to report in 2024.

Legislative Initiatives

Bill 11

This government bill was introduced for first reading on April 15, 2025. If adopted it will prohibit B.C. employers from requesting sick notes for short term health-related leaves under the B.C. Employment Standards Act.

April 1, 2025

The federal minimum wage increased from $17.30/hour to $17.75/hour. The federal minimum wage applies unless a provincial minimum wage is higher in the place where the employee works, in which case that provincial minimum wage applies.

June 20, 2025

Federal replacement worker ban comes into effect. Replacement workers cannot be used during lawful strikes or lockouts (with narrow exceptions).

June 30, 2025

Filing deadline for the first annual report under the Pay Equity Act if employers posted their first pay equity plans in September 2024.

May 1, 2025

Any organization with one or more employees in Manitoba will be subject to the information and communication standards under The Accessibility for Manitobans Act. Such organizations will be required to adopt policies, practices and training related to accessibility of public-facing information and communications.

October 1, 2025

The general minimum wage will increase from $15.80/hour to $16.00/hour.

Legislative Initiatives

Bill 29

Introduced for first reading on March 6, 2025. If adopted, Bill 29 will make several amendments to Manitoba’s Workplace Safety and Health Act, including an expansion of the purpose of the Act to include enabling workers to work in “psychologically safe workplaces”.

Bill 43

Introduced for first reading on March 18, 2025. If adopted, Bill 43 will amend the Human Rights Code to add “gender expression” as a prohibited ground of discrimination.

April 1, 2025

The general minimum wage increased from $15.30/hour

to $15.65/hour.

Legislative Initiatives

Bill 13

Introduced for first reading on March 25, 2025. If adopted, Bill 13 would make several changes to New Brunswick’s workers’ compensation statutes, including removal of exemptions for casual workers and outworkers.

April 1, 2025

The general minimum wage increased from $15.20/hour to $15.70/hour.

April 1, 2025

Pursuant to Order in Council 2025-47, filed on February 18, 2025, the number or paid

July 1, 2025

Employers must provide new employees with information in writing about key employment details, including compensation, job duties, hours, location and more.

July 1, 2025

New minimum working standards for “digital platform workers” come

May 1, 2025

The general minimum wage will increase from $15.75/hour to $16.10/hour.

June 1, 2025

Employers with at least 25 employees in Quebec will be subject to francization requirements of the Charter of the French Language (the current

Work-Sharing

Work-Sharing

Layoffs