Source: National Bureau of Economic Research, August 2023

1,568

Industrial policy interventions globally per year, up from just 34 in a little more than 10 years.

OUTFRONT SERIES

INDUSTRIAL POLICY’S IMPACT:

DEBT OR DIVIDEND?

Medical Devices

Numerical Control Tools and Robotics

Ocean Engineering Equipment and High-End Vessels

Energy Saving and

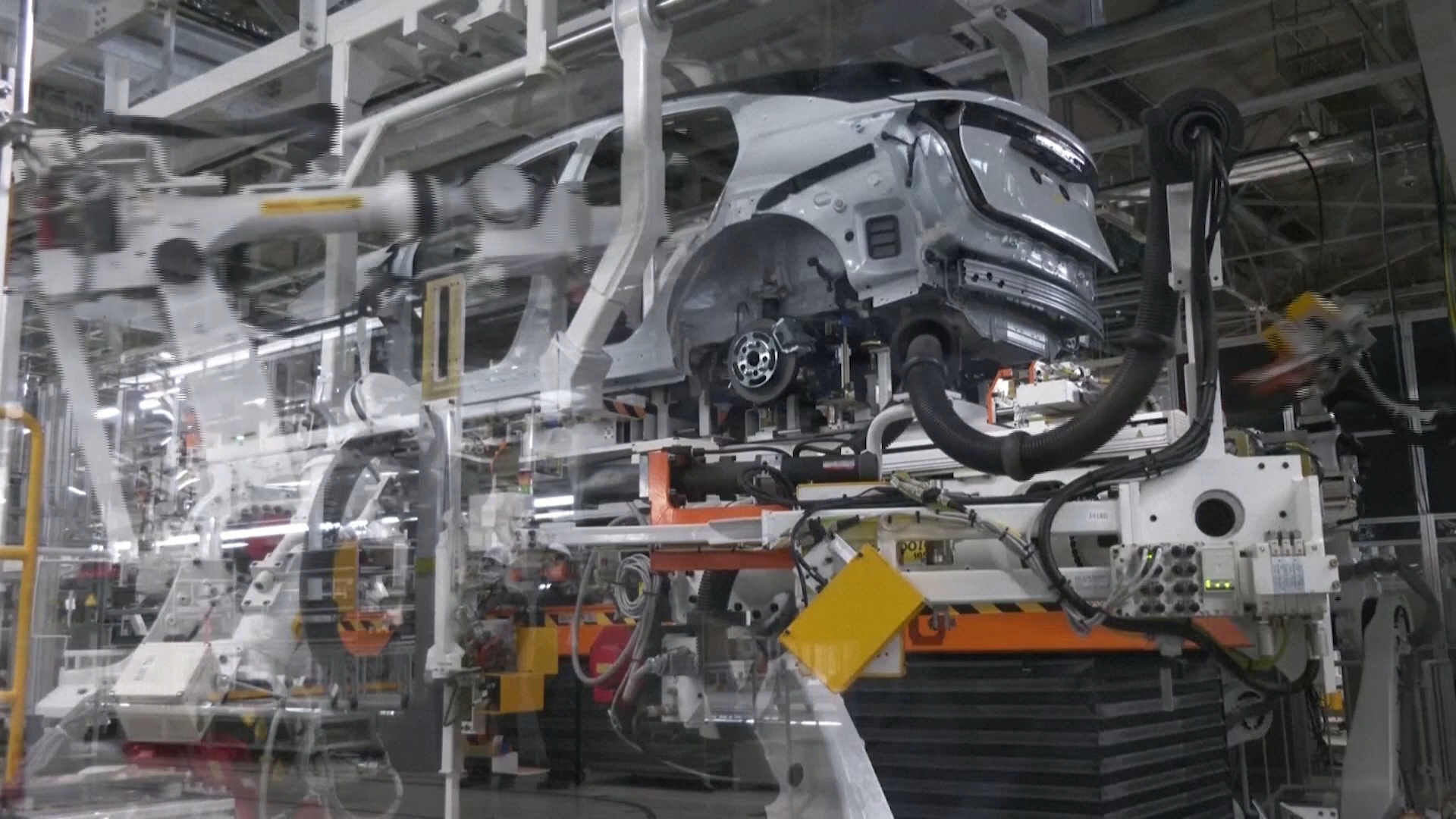

New Energy Vehicles

Railway Equipment

New Materials

Aerospace Equipment

Farming Machines

Information Technology

Electrical Equipment

Made in China 2025: Target sectors

The Rising Tide of Global Industrial Policy

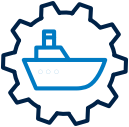

Together, the 2021 Infrastructure Investment and Jobs Act, the 2022 Inflation Reduction Act (IRA) and the 2022 CHIPS and Science Act amount to more than $2.4 trillion in funding over 10 years, although some estimates put the eventual costs much higher.

The U.S. joins the race

Signaling that national competition is replacing global cooperation, or globalization, the U.S. has made its largest commitment to industrial strategy since the Cold War.

Should that happen, it’s likely to help the public market equities of companies in the real economy most of all, including the types of industrial and infrastructure companies poised to gain from governments’ industrial strategies.

China's Total Debt to GDP Has Overtaken the U.S.

South Korea: Selected Economic Indicators, 1971-1986 in Percentage Change

It depended on government subsidies, commitments to absorb losses and financing for fixed development costs.

Source: EU Commission, December 2022

Source: EU Commission, September 2023

In reality, though, the bloc is struggling to counter the threat of U.S. subsidies which they fear could lead to an exodus of EU companies across the Atlantic if it cannot match the handouts on offer from Washington.

Flight paths: from Airbus to Comac

The EU and others struggle to compete

The creation of the Airbus consortium in the late 1960s is often hailed as a model of successful government intervention.

“Europe will do whatever it takes to keep its competitive edge,” asserted Ursula von der Leyen, the commission president, in her annual 2023 State of the Union speech.

Over the 60 years since then, Airbus has grown to outsell Boeing. Airbus’s A320 family of passenger jets now has a market share of 59% in the key single-aisle market compared with Boeing’s 737 family, according to aviation consultancy Cirium.

The EU’s industrial policy focuses on what it calls its industrial ecosystems, across which it aims to foster twin green and digital transitions.

Source: Reuters, January 2020

Yet the Commercial Aircraft Corporation of China (COMAC) has failed to emulate Airbus’s success. Despite the state investing up to $70 billion, its C919 has yet to be certified by any major aviation authority outside China.

There are several parts to the European Union’s plan – including the Net-Zero Industry Act, the Critical Raw Materials Act and a reform of the electricity market’s design. Yet critics say that the EU goal to “speed up investment and financing for clean tech production in Europe” lacks funding. The proposed European sovereignty fund that was meant to pay for it has been shelved and critics say that any money promised is essentially reshuffling of existing commitments.

Taxpayer funds have been used to secure the future of a steel works and electric vehicle manufacturing, as well as to attract a battery factory. But the long-term strategy is unclear. Like other smaller economies that are constrained by the relatively small size of their public finances, it cannot match the spending power of the U.S. or China.

UK – the spending power gap?

Turning to the UK, the current government’s approach to industrial strategy appears reactive.

Airbus Overtakes Boeing in Delivery of Single-Aisle Passenger Jets

Already this can be seen in investments in U.S. semiconductors and clean-tech manufacturing, as well as Chinese EVs. The risk, though, is the effects of potentially higher interest rates for years to come.

CONCLUSION

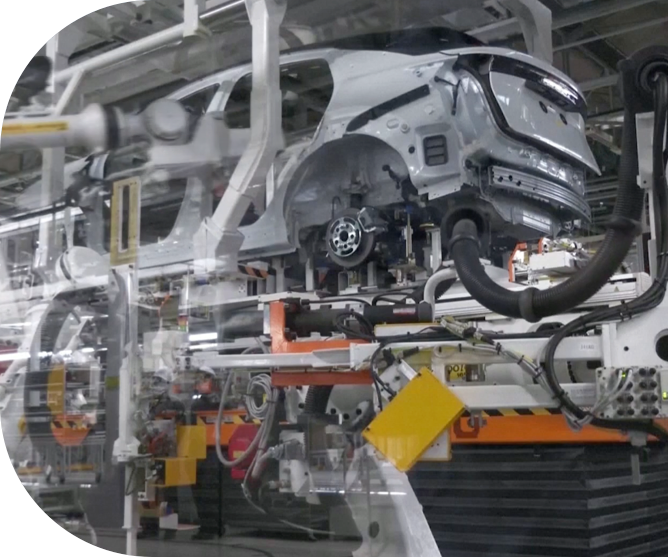

WILL HIGHER DEBT FOSTER HIGHER GROWTH?

At a pivotal time for national economies, it seems likely that today’s emerging industrial strategies will succeed in boosting key strategic sectors.

Source: DARPA, 2023

Governments in Britain, Germany and Japan have looked to build their own versions of DARPA, which eschews bureaucracy and big budgets – the U.S. president’s request to Congress for DARPA’s budget is $4.119 billion in 2023. That may well create still more foundational technologies for firms to build on.

There may also be long-term benefits for innovative young companies in private markets.

In particular, China and the United States have borrowings at, or close to, record levels. While this makes the U.S. vulnerable to further bond market jitters, in China it plays out through downward pressure on the yuan.

The race to harness industrial strategy to accelerate development of new technologies and the energy transition is happening at a time when the public finances are stretched.

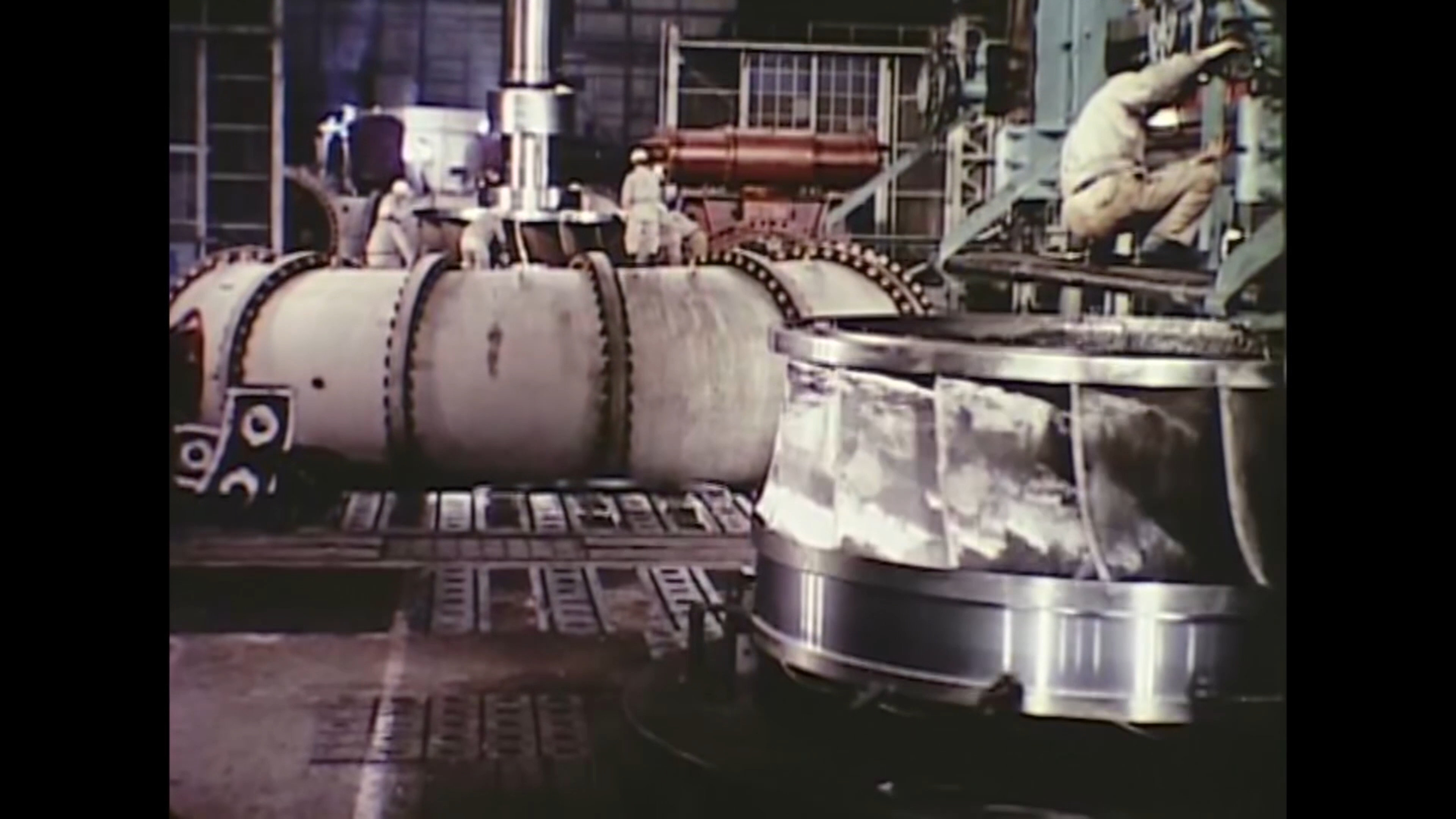

From the 1950s, the Ministry of International Trade and Industry (since renamed Ministry of Economy, Trade and Industry) promoted its favored sectors such as steel, shipbuilding, chemicals and machinery through a range of measures, including state loans and subsidies.

By the late 1960s, Japan had the second largest economy in the world. But growth stagnated in the 1990s, ending the country’s economic miracle.

Source: Economic Planning Board, Major Statistics of the Korean Economy 1987 (Seoul Economic Planning Board 1987)

Source: Ministry of Foreign Affairs of Japan

Source: "Industrialization and the State : The Korean Heavy and Chemical Industry Drive," Korean Development Institute, July 1995

South Korea, too, used industrial policy with initial success. In the early 1970s, the government initiated a strategy to develop its largely agrarian economy through the heavy and chemical industries.

The years that followed saw considerable success, but some studies have concluded the policy led to a waste of resources, increase in foreign debt and monopolies that ultimately laid the ground for labor conflicts.

It’s true that China’s industrial strategy is buying it dominance of some strategic sectors but it’s also creating massive over capacity.

Launched in 2015, the Made in China 2025 policy focused on leadership in strategic sectors such as robotics, information technology and clean energy.

Notably, China’s EV Gigafactory pipeline has swollen to an ambitious 4,200 GWh by 2030. This is twice what’s needed to convert the country’s entire vehicle fleet to battery electric vehicles, according to CRU, the business intelligence firm.

More recently, this has evolved into the “dual circulation” strategy – the notion of reducing dependence on foreign powers while strengthening domestic sourcing.

Source: China Briefing, December 2018

Source: Over capacity in China’s battery cell industry will lead to consolidation. CRU, 25 August 2023

*Source: Center for Strategic and International Studies May 2022

Source: Red Ink: Estimating Chinese Industrial Policy Spending in Comparative Perspective, May 2022

Even using conservative estimates, the country’s spending is enormous at $407 billion a year (at purchasing power parity exchange rates). This comes in many forms but chiefly subsidies and below-market credit to state-owned enterprises. That equates to at least 1.7%* of GDP. For comparison, the IRA that is the biggest part of Biden’s package never amounts to more than a fraction of 1%**, according to Moody’s Analytics.

DARPA’s VC model

East Asia’s economic miracle

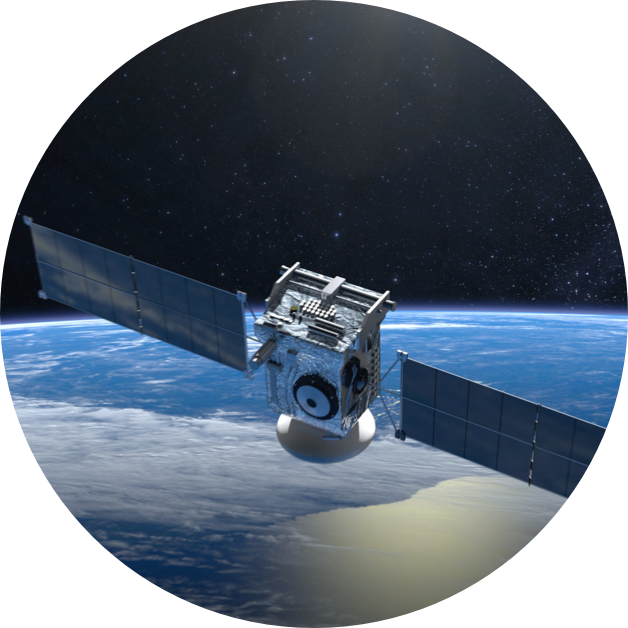

The Defense Advanced Research Projects Agency (DARPA) has since been at least partially credited with funding the foundational technologies behind critical innovations like weather satellites, GPS, drones, stealth technology, voice interfaces, the personal computer and the internet.

Source: UnHerd, June 2018

Most recently, it awarded a small firm called Moderna with $25m in 2013 to use messenger RNA to develop vaccines, preparing the way for its Covid-19 vaccine.

A different model was introduced in 1958 to make sure the U.S. would never again be surprised by developments in new technology after the Soviet Union launched the world’s first satellite, Sputnik.

The second half of the 20th Century was the heyday of industrial policy, with Japan the poster child.

China: the big spender

While industrial strategy fell out of fashion in many countries, it’s always been at the heart of China’s economic model.

1.5 million

Source: Labor Energy Partnership, August 2022

Estimated number of new jobs that could be created in U.S. semiconductor and clean tech production

+

1,568

1,594

852

632

705

228

260

242

136

144

56

20

34

Source: National Bureau of Economic Research, published August 2023 (data as of August 2022)

2022

1,200

400

1,600

800

0

1,800

1,000

200

1,400

600

Total number of industrial policy interventions

2012

2010

2018

2016

2014

There were 1,568 industrial policy interventions in the world in 2023 – up from just 34 in 2010, according to The New Economics of Industrial Policy, a paper from the National Bureau of Economic Research.

It’s a defining moment for economies. Nations are in a race to be at the forefront of both the coming technology revolution and the green energy transition. Nothing short of economic leadership – as well as growth, energy security and well-paid jobs – is at stake.

Yet coming at a time of high debts across many economies, the shift from free-market economics to industrial strategy brings risks. Will the huge costs of industrial strategy be rewarded in terms of higher GDP growth? Or will subsidies stifle competition and productivity while pushing up interest rates? There are implications for national finances and financial markets.

In a race to sharpen their competitive edge, nations are re-deploying industrial policy.

200%

300%

100%

350%

150%

250%

Source: Reuters, November 2023

United States

China

Source: Cirium fleets data, 2023

A320 family

737 family

2022

2023

2026

2024

2025

2027

2028

2029

2030

2031

2032

2033

2034

2035

There is this shift between the monetary and the fiscal authority, from what we've seen before to what we're seeing now, which is going to have big implications for interest rates. Now, the potential benefit of this new mix of fiscal and monetary is that it should drive higher investment and hopefully eventually higher potential growth so that GDP growth becomes more sustainable.”

Deputy Head of Global Economics at PGIM Fixed Income

Katharine Neiss

52

115

781

879

$550 billion

$167 billion

Inflation Reduction Act

$1,660 billion

CHIPS and Science Act of 2022

Bipartisan Infrastructure Bill

0

$2,000

$1,600

$1,200

$800

$400

Public Spending/Tax Incentives

Private Spending

Source: JP Morgan Private Bank, June 2023

Public and Private Spending (USD Billion) Over the Next 10 Years

Three recent U.S. policy bills include almost $2.4 trillion in funding.

A combination of tax credits, grants and loans may already be sparking a manufacturing boom. Companies have committed more than $200 billion in large-scale projects to boost US semiconductor and clean-tech production, that could create up to 1.5 million jobs.

Yet economists are divided on whether this will raise GDP growth over the next decade, meaning there will not necessarily be a pay back on the debt incurred.

The Biden administration is explicitly targeting technological leadership, security of supply chains, the energy transition and recapturing manufacturing jobs from abroad.

We're already seeing much higher debt levels, and that is pushing up on long-term interest rates. Now the downside to that is higher interest rates through higher public spending risks crowding out private investment. And if this increased public investment doesn't translate eventually into higher growth, that could lead to some very painful adjustments. But on the plus side, with governments clearly the direction of travel that they see through these industrial strategies, it does sort of give the private sector a north star of where we're going over the medium term that helps to coordinate in a way that can have positive spillovers.”

Deputy Head of Global Economics at PGIM Fixed Income

Katharine Neiss

America is adapting to intensified geopolitical competition for pre-eminence in the foundational technologies of our time.”

Chief Global Economist at PGIM Fixed Income and a former Deputy National Security Advisor for International Economics in the Biden administration

Daleep Singh

Number of orders

What is Industrial Policy?

4,208.9

1986

-19.4

1985

-1,035.9

1984

-1,763.5

1983

-2,594.4

1982

-3,628.3

1981

-4,384.10

1980

-4,384.10

1979

-1,780.8

1978

476.6

1977

-590.5

1976

-1,671.4

1975

-1,936.8

1974

-566

1973

-573.9

1972

$-1,045.9

1971

-10%

40%

50%

60%

30%

20%

10%

0

600

0

200

400

800

Trade Balance (USD Millions)

Real Exports

Wages

Consumer Price Index

Wholesale Price Index

Gross National Product

While industrial policy may well achieve its strategic economic goals, its dividends in terms of pure GDP growth are far harder to predict. If the past is a guide to the future, there could be costs in terms of higher debts, limited competition and suppressed productivity growth.

INTRO

growth

lessons

rates

conclusion

Download the PDF

Download the PDF

conclusion

rates

lessons

growth

INTRO

Download the PDF

conclusion

rates

lessons

growth

INTRO

Download the PDF

conclusion

rates

lessons

growth

INTRO

1

BORROWING TO FUEL GROWTH

2

LESSONS FROM THE 20TH CENTURY

3

Implications for interest rates and financial markets

**Source: Moody's August 2022

There are many definitions of industrial policy, often with subtle differences. However, the following OECD definition sums up what’s happening today:

“Industrial policy is any type of intervention or government policy that attempts to improve the business environment or to alter the structure of economic activity toward sectors, technologies or tasks that are expected to offer better prospects for economic growth or societal welfare than would occur in the absence of such intervention. ”

Source: OECD, Ken Warwick

INDUSTRIAL POLICY DEFINED

Download the PDF

Source: Cirium fleets data, 2023

2014

2016

2018

2010

2012

Total number of industrial policy interventions

600

1,400

200

1,000

1,800

0

800

1,600

400

1,200

2022

34

20

56

144

136

242

260

228

705

632

852

1,594

1,568

Private Spending

Public Spending/Tax Incentives

$400

$800

$1,200

$1,600

$2,000

0

Bipartisan Infrastructure Bill

CHIPS and Science

Act of 2022

$1,660 billion

Inflation Reduction Act

$167 billion

$550 billion

879

781

115

52

China

United States

250%

150%

350%

100%

300%

200%

800

400

200

0

600

2035

2034

2033

2032

2031

2030

2029

2028

2027

2025

2024

2026

2023

2022

737 family

A320 family

Number of orders

Gross National Product

Wholesale Price Index

Consumer Price Index

Wages

Real Exports

0

10%

20%

30%

60%

50%

40%

-10%

1972

Trade Balance (USD Millions)

The U.S. joins the race

There are many definitions of industrial policy, often with subtle differences. However, the following OECD definition sums up what’s happening today:

“Industrial policy is any type of intervention or government policy that attempts to improve the business environment or to alter the structure of economic activity toward sectors, technologies or tasks that are expected to offer better prospects for economic growth or societal welfare than would occur in the absence of such intervention. ”

Source: OECD, Ken Warwick

Download the PDF

conclusion

rates

lessons

growth

INTRO

2020

2012

2014

2016

2018

2008

2010

2022

Mar 2023

2020

2012

2014

2016

2018

2008

Mar

2023

2010

2022