World Population Review

UK Office of National Statistics (October 2022)

Bank of International Settlements (Q2 2022)

Sources:

Today, a range of developed and developing countries have elevated debt levels. This may well indicate where some of the greater risks of financial crises lie.

Even now, pressures on debt are rising due to the expense of energy bills in Europe’s winter.

In Germany, the cost of the energy support package intended to protect residents from soaring gas and electricity prices has been reported at €200 billion, while the UK support package is expected to cost tens of billions of pounds.

Bull Markets Turn to Bear

Energy Costs Fuel Debt

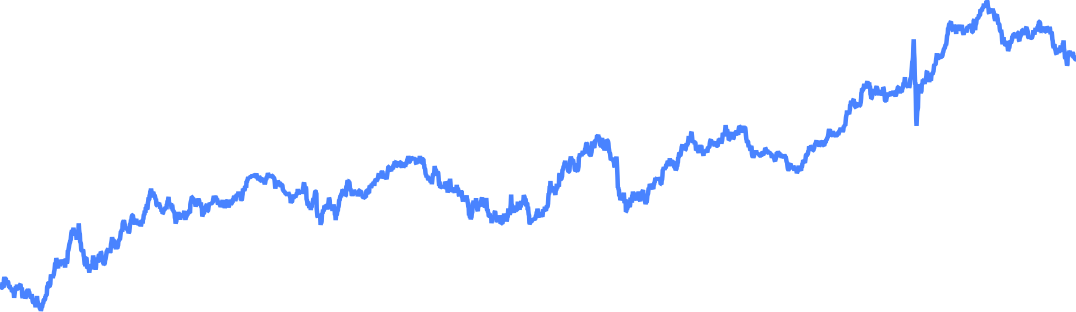

In the 2010-2020 decade of cheap money, most asset prices surged. There was a bull market in bonds, equities and real estate.

To escape depression, central banks introduced ultra-low and negative interest rate policies along with QE. The result: a world of debt-dependent growth.

Since the Federal Reserve made clear that it was determined to conquer inflation by raising rates at the end of 2021, though, the bull market has turned to bear. Unusually, virtually all asset prices are falling together.

The chart below shows how global debt spiked as a percentage of GDP in the pandemic.

Their rise accelerated afterwards, as both public and private sector debt rose during the “lower-for-longer” decade from 2010 to 2020, ahead of a final blowout during the pandemic.

2022’s record debt is a danger that was decades in the making. Debt levels started to rise before the GFC of 2007-2008, as new labor from developing economies such as China and eastern Europe suppressed inflation and interest rates.

Source: Refinitiv

Notable Indebted Countries, Debt-to-GDP ratios (%)

Total Global Debt Surpassed $300 Trillion in 2021

Source: Institute of International Finance + Reuters

% of GDP

Global debt (in USD)

% of GDP, weighted avg.

USD trillions

370

360

350

340

330

320

310

320

300

280

260

240

220

200

2022

2021

2020

2019

2018

2017

2016

2015

Bonds

Real estate

Equities

292%

China

206%

Greece

128%

Bahrain

266%

Japan

156%

Italy

134%

Portugal

350%

Venezuela

110%

United Kingdom

128%

United States

131%

Singapore

Chapters Menu

Explore

Explore

Explore

Explore

Explore

Select a Chapter to Continue:

CLOSE

Equities

Real estate

Bonds

Equities

Real estate

Bonds

150

Jan 2022

Nov 2022

200

250

300

150

2021

2020

2019

2018

2017

2016

2015

2014

2013

2011

2012

2010

200

250

300

USD

FTSE World Broad Investment-Grade Bond Index

Jan 1 2010 – Dec 31 2021

FTSE World Broad Investment-Grade Bond Index

2022 YTD

300

USD

FTSE Global All Cap Index rise

Jan 1 2010 – Dec 31 2021

FTSE Global All Cap Index

2022 YTD

300

Jan 2022

Nov 2022

700

800

900

400

500

600

700

800

900

400

500

600

2021

2020

2019

2018

2017

2016

2015

2014

2013

2011

2012

2010

50

100

150

300

250

200

100

150

300

250

200

MSCI World Real Estate

Jan 1 2010 – Dec 31 2021

MSCI World Real Estate

2022 YTD

50

USD

Jan 2022

Nov 2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2011

2012

2010

2022’s record debt is a danger that was decades in the making. Debt levels started to rise before the GFC of 2007-2008, as new labor from developing economies such as China and eastern Europe suppressed inflation and interest rates.

USD

2021

2020

2019

2018

2017

2016

2015

2014

2013

2011

2012

2010

USD

2021

2020

2019

2018

2017

2016

2015

2014

2013

2011

2012

2010

Jan 2022

Nov 2022

150

200

250

300

USD

Explore

Explore

Explore

Explore

Explore

Select a Chapter to Continue:

Explore

Explore

Explore

Explore

Explore

Select a Chapter to Continue:

Explore

Explore

Explore

Explore

Explore

Select a Chapter to Continue:

Explore

Explore

Explore

Explore

Explore

Select a Chapter to Continue: