The EU Sustainable Finance Disclosure Regulation implemented in March 2021 defines to what extent funds can describe themselves as green.

In 2022 a new taxonomy will state which business activities are green – although even here, EU states pushing to include gas and nuclear power as environmentally friendly has sparked controversy.

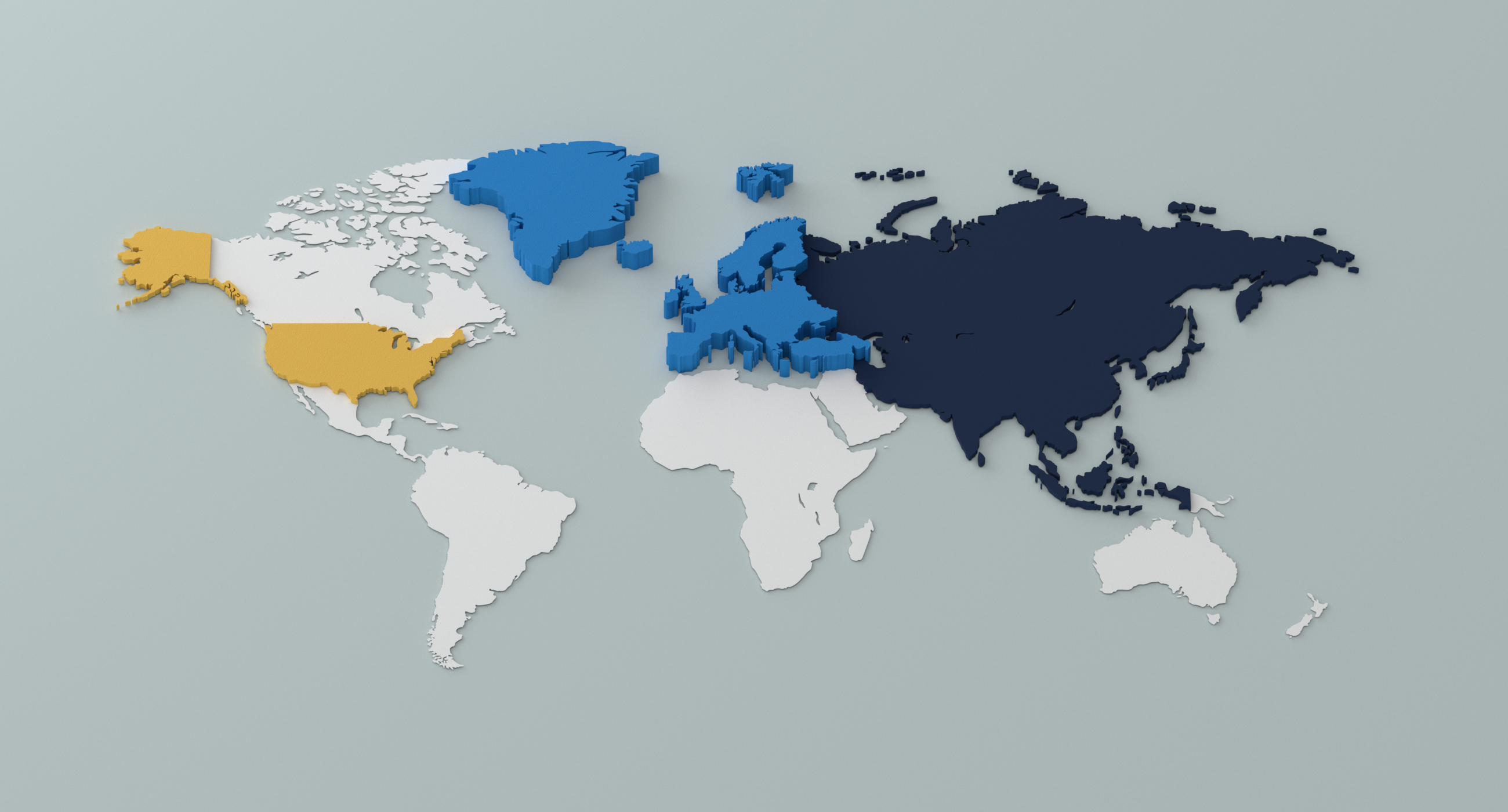

Europe

5

Regulation and standards

Regulations and standards are setting out to eliminate greenwashing, yet they can unintentionally become primarily product labelling schemes that are useful for marketing. On 10 March 2021, the European Union’s Sustainable Finance Disclosure Regulation came into effect.

Aiming to discourage greenwashing and encourage responsible and sustainable investment, it was heralded as leading the way globally. The regulation required asset managers to classify their funds into three categories, depending on their investment objectives. Article 6 covered all managed funds, Article 8 funds promote environmental or social characteristics, and Article 9 funds have a sustainable investment objective.

As new regulations and standards emerge, a lack of clarity has led to greenwashing concerns. However, progress toward a global baseline of sustainability disclosures is now underway and in time, definitions should become clearer as mandatory standards become effective.

Inflows rise in Article 8 and Article 9 funds, falling in Article 6

Q2

Q3

Q4

0

20

40

60

80

100

120

140

EUR billion

160

180

200

Article 6

Article 8

Article 9

Source: Morningstar Direct. Data as of 31 Dec 2021

An unexpectedly high number and broad range of funds were labelled as Article 8 (light green) and Article 9 (dark green). In fact, 6,862 funds were classified as Article 8 by the end of the first quarter of 2022 and 898 as Article 9, according to Morningstar. As money flooded in, by March 2022, assets in the two categories of funds reached EUR 4.2 trillion, representing nearly half of all funds sold in the EU.

Despite the introduction of a regulatory framework, uncertainty around greenwashing lingers. In a report published in September, the Netherlands Authority for the Financial Markets (AFM) said there were “still uncertainties with regard to the correct interpretation of some requirements,” noting that some of the funds it reviewed lacked detailed descriptions of their sustainability objectives. Regulators have some work to do before labels for ESG funds become reliable.

The New Greenwashing Regulations and Standards World

Notably, the International Sustainability Standards Board is introducing new ground rules for companies reporting on sustainability, which should further improve disclosures on environmental and other sustainability issues.

(Please Roll Over the Regions to Reveal)

The Pursuit of Outperformance

Learn More

Conclusion

There is no doubt that climate change is now having profound implications on how long-term investors build their portfolios. Yet ESG investing is rightly under intense scrutiny as commercial pressure and ambiguous definitions risk leading to greenwashing.

The debate about what it means to be green is deeply complex – but that’s ok. As Kermit the Frog from The Muppets said, it’s not easy being green. However, it is important for asset managers to act with integrity by promoting transparency, building expertise, and establishing trust.

For asset owners, it can be difficult to decipher fact from fiction. There are many different definitions of sustainable investing, but above all asset owners must be clear what their sustainable investing objectives are. Then they can scrutinize their asset managers, who need to be honest about their constraints and limitations as much as their ambitions.

They need to act with integrity and engage with a “show us” approach to allow asset owners to select suitable investment products, ensuring that marketing pledges are consistent with how portfolios are invested. When both asset managers and owners have clear goals in mind, clients can look beyond disagreements over what it means to be “green” and choose investments based on their own priorities across the environmental, social, and governance categories.

Globally, though, standards are steadily being introduced that will help to narrow the scope for greenwashing.

Eugenia Jackson

Global Head of ESG, PGIM

Clients will have many different approaches to ESG. Some may pursue ESG strategies to enhance long-term returns, others - a public pension fund perhaps - may forgo a small amount of financial return in exchange for reduced carbon emissions on the understanding that its beneficiaries want to have a sustainable world to retire into as well as a pension pot. People may disagree with or learn from each other’s approaches to ESG - but the most important element to ESG is that asset managers understand their client’s expectations and objectives and are clear about trade-offs and, vitally, that they do what they say they will do.”

Turning to Asia, new climate disclosure rules are being introduced in China and Singapore, which will also aid investment decisions and narrow the scope for corporate greenwashing.

Asia

In the US, the Securities and Exchange Commission in May 2022 proposed two new rules for ESG funds and advisers, potentially creating new disclosure requirements for these funds and expanding on SEC rules around fund names.

USA

Source: Morningstar Direct. Data as of 31 Dec 2021,

EUR billion

Q2

Q3

Q4

0

20

40

60

80

100

120

140

160

180

200

Article 8

Article 9

Article 6

Explore

Explore

Explore

Explore

Explore

Explore

Explore

Now Reading

Now Reading

Now Reading

Now Reading

Now Reading

Now Reading

Now Reading

Select a Chapter to Continue:

Chapters Menu

Explore

Explore

Explore

Explore

Explore

Explore

Explore

Now Reading

Now Reading

Now Reading

Now Reading

Now Reading

Now Reading

Now Reading

Select a Chapter to Continue:

CLOSE

Explore

Explore

Explore

Explore

Explore

Explore

Explore

Now Reading

Now Reading

Now Reading

Now Reading

Now Reading

Now Reading

Now Reading