5G

Applications beyond mobile could be impacted by decoupling if fears about security implications override the desire for cooperation on innovative new ideas.

Initial investment in 5G

Pre-commercial 5G deployed

5G networks launched

Global 5G Deployment

$1.4 tn

China to invest in tech infrastructure to 2025.

costs for 5G will rise

As the U.S. leans on allies to cut out China from 5G infrastructure, and China de-Americanizes its own 5G ecosystem.

Both the U.S. and China are increasing investment in technology to mitigate the impact of decoupling. The trade war impedes the exchange of IP and expertise in technological research and development.

Estimated range of increased costs of restricting a key 5G infrastructure player in building networks in these countries over the next decade: Australia, Canada, France, Germany, Japan, India, United Kingdom, and the U.S.

+8-29%

Estimated cost of removing

Huawei 5G equipment in the U.K.

by 2027 in response to U.S. SANCTIONS.

$2.8 bn

5G will be transformative for our country, but only if we have confidence in the security and resilience of the infrastructure it is built upon.”

How the U.S. and China internally manage their respective spectrum policies, network deployment costs, and … 5G networks will ultimately determine who is better positioned for global leadership.”

Source: Oxford Economics

Source: Reuters

British Secretary of State for Digital, Oliver Dowden

“

“

5G has the potential to enable fundamentally new applications, industries and business models,…via unprecedented use cases… for mobile, eHealth, autonomous vehicles, smart cities, smart homes and IoT.”

Institute of Electrical and Electronics Engineers

Nicole Turner Lee, Brookings Institute

$250 BN

The U.S. Innovation and Competition Act (USICA) will invest heavily in domestic semiconductors, telecoms, lithium, rare earths and tech supply chains to counter China’s perceived threat.

+32%

Expected global 5G services compound annual growth rate 2020 to 2027.

“

“

5G is at the frontline of technological competition, and China appears to be the stronger competitor.

5G Generation Gap

Technology is a foremost issue in the U.S.-China relationship. China sees a critical need for technology-led productivity enhancements, while the U.S. is unwilling to relinquish its sizable technological edge to a strategic competitor.”

5G, who’s got the bandwidth?

Technology

Three Focal Points for the U.S.-China Relationship, PGIM Fixed Income, March 2021

Forecast 2026

2020

Sub-Saharan Africa

Middle East and North Africa

India, Nepal and Bhutan

Southeast Asia and Oceania

China

1250

1000

750

500

250

0

Northeast Asia, excl. China

Central and Eastern Europe

Western Europe

Latin America

North America

5G Subs

in Millions

Source: Ericsson

Source: GSA 5G Market Snapshot

Network slicing allows telcos to create multiple end-to-end networks on one infrastructure platform. Decoupling limits this potential because of national security concerns and the need for global standards and access.

Potential revenue per annum

of Network Slicing Market by 2025.

$300 bn

Source: Mordor Intelligence

Read More

of U.S. businesses in China want the U.S. government to refrain from aggressive rhetoric and actions.

of U.S. businesses in China say the Phase One trade deal mitigated the impact of bilateral trade frictions.

PRESSURE MAY MITIGATE ESCALATION OF TRADE TENSIONS. THE PHASE ONE TRADE DEAL HAS ALREADY MADE A POSITIVE IMPACT.

46%

53%

Source: AmCham China 2021 China Business Climate Survey

Potential losses to U.S. and Chinese economies by 2030 if all U.S.-China trade is subjected to a 25% tariff.

U.S. Chamber of Commerce, 2021

Trade decoupling means forgoing market access not only today, but ever more importantly, for years to come.”

“

China and the U.S. are at a pivotal moment in their trade relationship. Two polarized outcomes, and a spectrum between them are possible: a decoupled relationship with long-term tariffs and an adversarial attitude underpinned by protectionism and mistrust; or a thawing in the geopolitical environment, leading to open trade, reduced tariffs and newfound cooperation.

While decoupling represents a significant drag on many sectors, strategic coupling could increase overall trade to higher levels than before the trade war.

Even if the aggregate impact is one of lost growth, investment opportunities will appear along the way, not just in China and in the U.S. but from Europe to ASEAN to South Asia. Cutting-edge technologies are at the center of potential disruption by decoupling but they also present opportunities to be on the right side of a compelling investment theme. These sectors include 5G, semiconductors, solar, electric vehicles (EVs) and rare earth.

U.S. Chamber of Commerce, 2021

U.S. Chamber of Commerce, 2021

Institute of Electrical and Electronics Engineers

Trade decoupling means forgoing market access not only today, but ever more importantly, for years to come.”

How the U.S. and China internally manage their respective spectrum policies, network deployment costs, and expectations around the anticipated revenue models enabled over 5G networks will ultimately determine who is better positioned for global leadership.”

5G has the potential to enable fundamentally new applications, industries and business models, and dramatically improve quality of life around the world via unprecedented use cases… for mobile, eHealth, autonomous vehicles, smart cities, smart homes, and the IoT.”

“

“

“

Technology:

5G

Applications beyond mobile could be impacted by decoupling if fears about security implications override the desire for cooperation on innovative new ideas.

5G

5G Generation Gap

5G is at the frontline of technological competition, and China appears to be the stronger competitor.

Expected global 5G services compound annual growth rate 2020 to 2027.

+32%

Global 5G Deployment

5G networks launched

Pre-commercial 5G deployed

Source: GSA 5G Market Snapshot

Initial investment into 5G

Source: Ericsson

in Millions

5G Subs

North America

Latin America

Western Europe

Central and Eastern Europe

Northeast Asia exc. China

0

250

China

Southeast Asia and Oceania

India, Nepal and Bhutan

Middle East and North Africa

Sub-Saharan Africa

500

750

1000

1250

2020

Forecast 2026

Source: GSMA

US$300 bn

Potential revenue per annum of Network Slicing Market by 2025.

Network slicing allows telcos to create multiple end-to-end networks on one infrastructure platform. Decoupling limits this potential because of national security concerns and the need for global standards and access.

As the U.S. leans on allies to cut out China from 5G infrastructure, and China de-Americanizes its own 5G ecosystem.

costs for 5G will rise

Source: Oxford Economics

+8-29%

Estimated range of increased costs of restricting a key 5G infrastructure player in building networks in these countries over the next decade: Australia, Canada, France, Germany, Japan, India, United Kingdom, and the U.S.

Source: Reuters

$2.8 bn

Estimated cost of removing Huawei 5G equipment in the U.K. by 2027 in response to U.S. SANCTIONS.

U.S. Chamber of Commerce, 2021

Read More

5G will be transformative for our country, but only if we have confidence in the security and resilience of the infrastructure it is built upon.”

“

Both the U.S. and China are increasing investment in technology to mitigate the impact of decoupling. The trade war impedes the exchange of IP and of expertise in technological research and development.

Biden's American Jobs Plan to invest in wide-ranging infrastructure including tech over 10 years.

$2 tn

PRESSURE MAY MITIGATE ESCALATION OF TRADE TENSIONS. THE PHASE ONE TRADE DEAL HAS ALREADY MADE A POSITIVE IMPACT

53%

46%

of U.S. businesses in China say Phase One trade deal mitigated the impact of bilateral trade frictions.

Source: AmCham China 2021 China Business Climate Survey

of U.S. businesses in China want the U.S. government to refrain from aggressive rhetoric and actions.

Source: Top 10 Semiconductor Vendors by Revenue, Worldwide, 2020 (Millions of U.S. Dollars) (January 2021), Gartner.

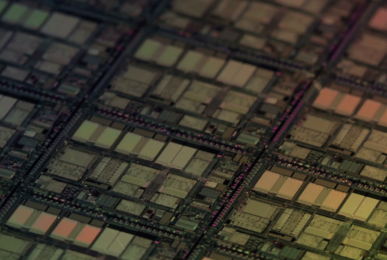

Semiconductors:

Who’s got the chips?

Semiconductors are central to consumer electronics. Today, China is the largest single country market for semiconductors, because it is a manufacturing and assembly hub for most of the world's smartphones and personal computers. But China doesn't have the semiconductor presence it wants. The leaders are Intel from the U.S. and Samsung Electronics from South Korea.

China semiconductor imports 2020

$350 bn

+14.6% over 2019

Top 10 Semiconductor Vendors by Revenue, Worldwide, 2020 ($US M)

Jordan Schneider

Senior Analyst, Rhodium

The most important change in respect to decoupling is getting China’s private sector on board with indigenization and making self-sufficient chips. The Huaweis and the Xiaomis are now very focused, in a way they were not five years ago, on helping to foster a domestic Chinese ecosystem.”

“

China’s IC Self-Sufficiency Goals from “Made in China 2025” Roadmap

China is ramping up self-sufficiency in semiconductors

Source: MIC 2025 Implementation Roadmap

Chinese chipmakers are boosting their R&D spending – but so are their more established rivals.

China still lags in chip innovation

R&D investment TSMC vs SMIC

For semiconductors, smaller is better. Taiwan Semiconductor Manufacturing Ltd's (TSMC) 2 nanometer chip is expected to hit the market in 2025. The smallest chip China's Semiconductor Manufacturing International Corporation (SMIC) can make is 14 nm and production is limited. The two firms’ R&D investments are also far apart.

Annual Standardized in $US M

If Full Decoupling Took Place and U.S. Semiconductor Sales to Chinese Customers Dropped to Zero:

TSMC

SMIC

Source: TSMC, SMIC company data

2019

2020

5,000.00

4,000.00

3,000.00

2,000.00

1,000.00

2016

2017

0.00

2018

-$12 BN R&D spending at U.S. semiconductor firms

0 bn

-25

-50

-75

-100

-US $83 BN annual sales revenue loss to U.S. makers

Source: BCG

-$13 BN capital spending

Manufacturer / Country

Intel

Samsung Electronics

70,244

56,197

3.7%

7.7%

15.6%

12.5%

2020 Revenue

2019-2020 Growth

2020

Market Share

SK hynix

Micron Technology

25,271

22,098

13.3%

9.1%

5.6%

4.9%

KIOXIA

Nvidia

10,208

10,095

30.4%

37.7%

2.3%

2.2%

Qualcomm

Broadcom

17,906

15,695

31.5%

2.4%

4.0%

3.5%

Texas Instruments

MediaTek

13,074

11,008

-2.2%

38.3%

2.9%

2.4%

Impact on U.S. GDP of Trade War De-escalation ($BN, 2020 Prices)

50

40

80

30

70

20

60

10

2022

2023

0

A de-escalation scenario is also possible

in which tariffs are gradually rolled back resulting in considerable impact on the U.S. economy.

2024

Source: Oxford Economics/Haver Analytics

2025

Yan Liang, Professor of Economics at Willamette University, Oregon.

The most practical approach to ‘being tough’ would be ‘competitive recoupling’, where the United States and China carefully manage their differences, coordinate and collaborate on areas of common interest, and compete on equal footing in areas such as technology and trade.”

“

China is vulnerable to disruption to supply of specialist goods that it cannot replicate – not just top-end chips for smartphones but exotic sensors and components, for which the U.S. is an important manufacturer.

Supply Chain

Truth and Hype about Rerouting

Semiconductors also illustrate a broader decoupling theme: the reorientation of supply chains throughout other parts of Asia that are not subject to tariffs or uncertainty, potentially mitigating the estimated $1 trillion or more losses to both sides.

Vietnam and South Asian countries like Bangladesh are frequently mentioned as nations that will benefit from this shift.

Shehriyar Antia, Head of Thematic Research at PGIM

Reshoring and reshaping supply chains does not mean abandoning China, but building more contingency.

Lessons learned from the pandemic had a profound impact on supply chain techniques, leading to a shift from a just-in-time approach to inventory to just-in-case, so as to mitigate uncertainties around supply.

The shifting of supply chains doesn’t happen instantly. Diversifying away from China was already underway in industries like auto components, tech and apparel.”

“

Tariffs encourage low-cost manufacturers to relocate from China to markets such as India, Indonesia, Bangladesh and Vietnam, improving the external balances of those economies.

While some supply chains reshore and reroute, U.S. companies remain committed to their foothold in China.

Strategic Coupling

of U.S. businesses are not considering relocating manufacturing outside China.

83%

Source: AmCham China 2021 China Business Climate Survey

Despite tariffs, bilateral U.S.–China trade is forecast to be strong following the Phase One agreement and if the pandemic abates.

Chinese Imports of Goods from the United States ($BN) in 2017-2019 and Estimated Under the China-U.S. Agreement in 2020-2021

Source: World Bank East Asia Pacific Economic Update April 2020

Agriculture

Textiles

Wearing

Apparel

Natural

Resources

Chemicals

Food

Metals

Transport

Equipment

Electronic

Equipment

Machinery

Other

Manufacturing

0

10

20

30

40

50

60

2017

2018

2019

2020

2021

No company represents the perils of geopolitical tensions more clearly than Huawei. The U.S. government's sanctions against the Chinese company have knock-on effects worldwide. For example, there is a lack of political clarity over whether European governments should accede to US demands to exclude equipment from Huawei.

“As with 4G, first-mover’s advantage is huge and countries rolling out 5G early will see most of the innovation,” an Ericsson spokeswoman said. So if European companies do observe US sanctions against China, they may be disadvantaged. Reuters’ analysis suggests 2021 could be a do-or-die year for Europe’s efforts to keep up in the race.

In addition, for 5G to reach its full potential beyond mobile applications, global standards and a degree of cross-border openness and trust are required.

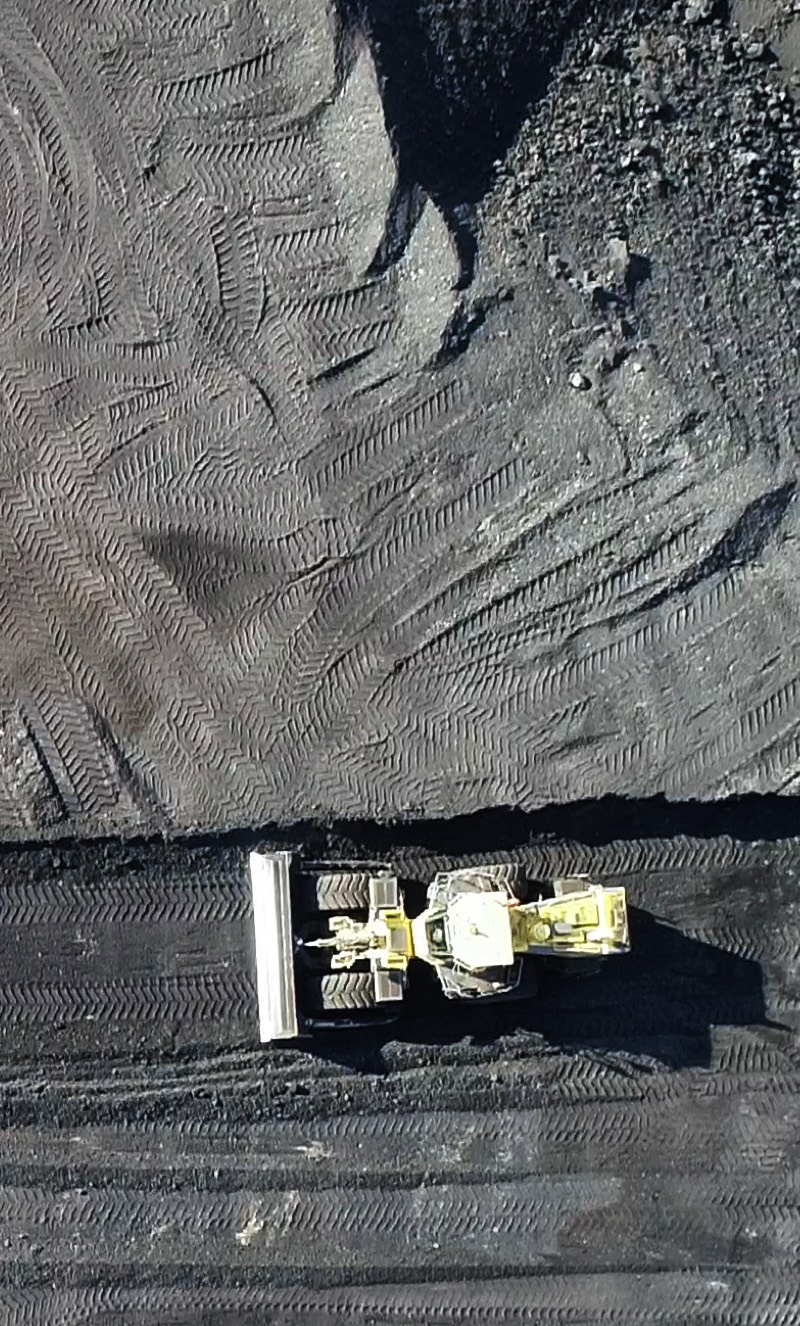

Commodities:

Raw and Rare

Supply chains for manufactured goods start with raw commodities. These too are disrupted by decoupling’s ramifications.

THE U.S. WILL FIND ITS

DEPENDENCY ON CHINESE RARE EARTHS HARD TO BREAK

AS THEY ARE ESSENTIAL

IN MANY HIGH-TECH

PRODUCTS.

Global Rare Earth Minerals Production 2019

AirPods and electric vehicles.

For the rest of the world, there is no avoiding the need for China in some supply chains: China dominates refinement of Neodymium, used in

of U.S. businesses are not considering relocating manufacturing outside China.

83%

Source: AmCham China 2021 China Business Climate Survey

There is a ripple effect beyond the U.S. and China.

Read More

Source: WhiteHouse.gov

Source: DataCenter Knowledge

Source: GSA 5G Market Snapshot

Jordan Schneider

Senior Analyst, Rhodium

For semiconductors, smaller is better. Taiwan Semiconductor Manufacturing Limited’s (TSMC) 2 nanometer chip is expected to hit the market in 2025. The smallest chip China's Semiconductor Manufacturing International Corporation (SMIC) can make is 14nm and production is limited. The two firms’ R&D investments are also far apart.

Chinese chipmakers are boosting their R&D spending –

but so are their more established rivals.

China still lags in chip innovation

Read More

Top 10 Semiconductor Vendors by Revenue, Worldwide, 2020 ($M)

Intel

Samsung Electronics

SK hynix

Micron Technology

Qualcomm

Broadcom

Texas Instruments

MediaTek

KIOXIA

Nvidia

2020 Revenue

70,244

56,197

25,271

22,098

17,906

15,695

13,074

11,008

10,208

10,095

2020 Market Share

15.6 %

12.5 %

5.6 %

4.9 %

4.0 %

3.5 %

2.9 %

2.4 %

2.3 %

2.2 %

Country

Manufacturer

2019–2020 Growth

3.7 %

7.7 %

13.3 %

9.1 %

31.5 %

2.4 %

-2.2 %

38.3 %

30.4 %

37.7 %

USA

South Korea

South Korea

USA

USA

USA

USA

Taiwan

Japan

USA

The most important change in respect to decoupling is getting China’s private sector on board with indigenization and making self-sufficient chips. The Huaweis and the Xiaomis are now very focused…on helping to foster a domestic Chinese ecosystem.”

Semiconductors

2020

Size of China’s IC market reaches 60% of global market share

Size of China’s IC market reaches 70% of global market share

Domestic production reaches $140 BN (58% of domestic market demand)

Domestic production reaches $305.1 BN (80% of domestic market demand)

2030

R&D investment TSMC vs SMIC

Annual Standardized in $M

5,000

4,000

3,000

2,000

1,000

2016

2017

0

2018

2019

Source: TSMC, SMIC company data

2020

TSMC

SMIC

Who’s got the chips?

0

-25

-50

-75

-100

-U.S. $83 BN annual sales revenue loss to U.S. makers

-$12 BN R&D spending at U.S. semiconductor firms

-$13 BN capital spending

If Full Decoupling Took Place and U.S. Semiconductor Sales to Chinese Customers Dropped to Zero (in $BN):

Semiconductors are central to consumer electronics. Today; China is the largest single country market for semiconductors, because it is a manufacturing and assembly hub for most of the world's smartphones and personal computers. But China doesn't have the semiconductor presence it wants. The leaders are Intel from the U.S. and Samsung Electronics from South Korea.

China is ramping up self-sufficiency in semiconductors

China’s IC Self-Sufficiency Goals, from “Made in China 2025” Roadmap

“

China semiconductor imports 2020

$350 bn

+14.6% over 2019

China's semiconductor sector is growing at 16-20% p.a., according to the China Semiconductor Industry Association. A reliable Chinese semiconductor sector could extend to the creation of a new value chain not involving the U.S. The U.S. might then develop its own supply chain domestically, benefitting homegrown component makers there.

Decoupling could increase the likelihood of Chinese manufacturers trying to acquire technology and expertise.

This would be blocked if the U.S. CFIUS stopped Canyon Bridge Capital Partners from acquiring U.S. chipmaker Lattice Semiconductor Corporation in 2017 over concerns it was linked to the Chinese state, for example. So, chip specialists in other countries would become attractive.

But China is a long way behind at the very high end of chip technology. Without acquiring the capability, it will be playing catch-up at this elite level for a decade or more.

Eventually a bifurcated global semiconductor industry would develop.

China-Taiwan tensions are highly relevant to the semiconductor industry, as Taiwan creates 64% of all foundries, which supply chips to tech companies.

The Semiconductor Industry Association says that if Taiwan production was shut down for a year because of military or political circumstances, the cost to annual revenue for device makers worldwide would be $490 billion.

Source: South China Morning Post

Source: MIC 2025 Implementation Roadmap (from US Chamber of Commerce’s UNDERSTANDING DECOUPLING: Macro Trends and Industry Impacts)

Source: BCG

Source: Top 10 Semiconductor Vendors by Revenue, Worldwide, 2020 (January 2021), Gartner

Renewables

Going for green

Dr. Yew Wei Lit, Fellow in Social Sciences, Yale-NUS College

China-U.S. relations can... be a mix of bilateral climate cooperation and constructive competition… Who reaches net-zero emissions first and who becomes the largest renewable energy solution provider.”

SECTORS INCLUDING 5G, SEMICONDUCTORS AND RARE EARTHS WILL REMAIN TRADE BATTLEGROUNDS AND INVESTMENT THEMES WITH $1 TN TO $1.7 TN AT STAKE FOR THE ECONOMIES OF THE U.S. AND CHINA.

On the Horizon?

Three Focal Points for the U.S.-China Relationship,

PGIM Fixed Income,

March 2021

Three Focal Points for the U.S.-China Relationship,

PGIM Fixed Income,

March 2021

China’s threat to reunify with Taiwan is real and credible… the West’s largely rhetorical reaction to China’s accelerated integration of Hong Kong could embolden China to be more assertive towards Taiwan. It’s a risk the markets have essentially overlooked to this point.”

Beyond the fate of trade deal phases… We expect something of a technological arms race between the countries, likely resulting in competing platforms across a range of cutting-edge technologies.”

“

“

Sheena Chestnut Greitens, Associate Professor,

Lyndon B. Johnson School of Public Affairs at the University of Texas at Austin,

PGIM China Symposium February 2021

One potential area where I think there will be a push to get cooperation with both China and Europe is on climate.”

“

The Pursuit of Outperformance

0

175,018

62,200

55,500

45,930

26,869

20,120

13,108

11,300

9,483

7,862

50,000

100,000

150,000

200,000

Top 10 Solar Power Producers in 2019, in Megawatts

Megawatts Produced

China

U.S.

Japan

Germany

India

Italy

U.K.

Australia

France

South Korea

A battery shortage is on the horizon while innovation in the sector is gathering pace.

Demand

Supply

Balance

2019

2020

Shortage

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

Battery Supply Shortage Forecast to 2022

70%

8 of 14

SCARCE RAW MATERIALS ARE CENTRAL TO AN EMERGING ENERGY THEME: ELECTRIC VEHICLES (EVs).

China could use tactical decoupling to control supplies for batteries.

Growth of the EV sector is reliant upon the availability of cobalt and other components of batteries.

of the global supply of cobalt is from the Democratic Republic of Congo.

cobalt miners in DRC are Chinese-owned.

80%

of the world’s mined cobalt is refined by China.

THE COBALT CONUNDRUM

400

Estimated number of EV makers in China

2020

2025

2035

0%

20%

40%

60%

Growth for New Energy Vehicles in China

Seeking the next Tesla and Nio will be a preoccupation of investors.

Many decoupling themes impact lithium-ion batteries:

Resource scarcity, using soft power to gain supply, and potential gains for companies that maneuver around supply chain constraints.

The battle against climate change is an area where strategic recoupling is seen as a necessity.

China already makes more than

of the world’s solar cells.

70%

Supply chains and commodities also play into the global climate change challenge.

U.S. has set a target of net zero by 2050, while China has committed to carbon neutrality by 2060.

Source: World Population Review 2019

Source: OECD

Source: U.S. Geological Service

Source: OECD

Source: Center for Strategic and International Studies

Source: SNE Research

Read More

SO WHAT?

Investment themes -

The US Innovation and Competition Act (USICA)

Supply Chain

Truth and Hype about Rerouting

“

The most practical approach to ‘being tough’ would be ‘competitive recoupling’ where the U.S. and China carefully manage their differences, coordinate and collaborate on areas of common interest, and compete on equal footing in areas such as technology and trade.”

Yan Liang, Professor of Economics at Willamette University, Oregon

A de-escalation scenario

is also possible

in which tariffs are gradually rolled back, resulting in considerable impact on the U.S. economy.

Impact on U.S. GDP of Trade War De-escalation ($BN, 2020 Prices)

50

40

80

30

70

20

60

10

2022

2023

0

2024

2025

Chinese Imports of Goods from the United States ($BN) in 2017-2019 and Estimated Under the China-U.S. Agreement in 2020-2021.

Agriculture

Natural

Resources

Food

Textiles

Wearing

Apparel

Chemicals

Metals

Transport

Equipment

Electronic

Equipment

Machinery

Other

Manufacturing

2017

2018

2019

2020

2021

60

50

40

30

20

10

0

Despite tariffs, bilateral U.S.–China trade is forecast to be strong following the Phase One agreement and if the pandemic abates.

of U.S. businesses are not considering relocating manufacturing outside China.

83%

While some supply chains reshore and reroute, U.S. companies remain committed to their foothold in China.

Strategic Coupling

China is vulnerable to supply disruption of specialist goods that it cannot

replicate – not just top-end chips for smartphones but exotic sensors and components, for which the U.S. is an important manufacturer.

Reshoring and reshaping supply chains does not mean abandoning China but building more contingency.

Lessons learned from the pandemic have a profound impact on supply chain techniques, leading to a shift from a just-in-time approach to inventory to just-in-case, so as to mitigate uncertainties around supply.

Read More

TARIFFS ENCOURAGE LOW-COST MANUFACTURERS TO RELOCATE FROM CHINA TO MARKETS SUCH AS INDIA, INDONESIA, BANGLADESH AND VIETNAM.

Shehriyar Antia, Head of Thematic Research at PGIM

The shifting of supply chains doesn’t happen instantly. Diversifying away from China was already underway in industries like auto components, tech and apparel.”

“

Semiconductors also illustrate a broader decoupling theme: the reorientation of supply chains throughout other parts of Asia that are not subject to tariffs or uncertainty, potentially mitigating the estimated $1 trillion or more losses to both sides.

Vietnam and South Asian countries like Bangladesh are frequently mentioned as nations that will benefit from this shift.

When the COVID-19 pandemic broke out in early 2020, vulnerabilities around supplies of personal protective equipment (PPE) were thrown into stark relief as many countries had relied exclusively on China for items such as masks and ventilators.

Even if COVID-19 abates, countries want to make sure they have PPE available and possibly manufactured locally in case supply is disrupted. The UK, U.S., Canada and France are all examples of countries that brought PPE manufacturing onshore during COVID-19.

In the U.S., Ford and General Motors worked with medical device manufacturers to increase production of respirators, while in the UK, Airbus, Jaguar, Landrover and

Rolls-Royce were sent blueprints to manufacture ventilators.

This supports the reshoring theme, arguably making supply chains with China at the center less essential.

Source: AmCham China 2021 China Business Climate Survey

Source: World Bank East Asia Pacific Economic Update April 2020

Source: Oxford Economics/Haver Analytics

62,200

Top 10 Solar Power Producers in 2019, in Megawatts

0

55,500

45,930

26,869

20,120

13,108

11,300

9,483

7,862

50,000

100,000

Source: World Population Review 2019

China

U.S.

Japan

Germany

India

Italy

U.K.

Australia

France

South Korea

150,000

175,018

200,000

Megawatts Produced

Renewables:

Going for green

Supply chains and

commodities also play into

the global climate change challenge.

Both the U.S. and China have set ambitious decarbonization targets. The U.S. has set a target of net zero by 2050 while China has committed to carbon neutrality by 2060.

China already makes more than

of the world’s solar cells.

70%

Scarce Raw materials are central to an emerging energy theme: Electric Vehicles (EVs).

EVS are a priority for China.

Growth of the EV sector is reliant upon the availability of cobalt and other components of batteries.

THE COBALT CONUNDRUM

Source: OECD

80%

of the world’s mined cobalt is refined by China.

Source: U.S. Geological Service

70%

of the global supply of cobalt is from the Democratic Republic of Congo.

Source: OECD

8 of 14

cobalt miners in DRC are Chinese owned.

China could use tactical decoupling to control supplies for batteries.

Many decoupling themes impact lithium ion batteries.

Resource scarcity, using soft power to gain supply, a race for leadership in renewable technologies, and potential gains for companies that maneuver around supply chain constraints.

400

Estimated number of EV makers in China

Seeking the next Tesla and Nio will be a preoccupation of investors.

2020

Source: Center for Strategic and International Studies

2025

2035

0%

20%

40%

60%

Growth for New Energy Vehicles in China

The battle against climate change is an area where strategic recoupling is seen as a necessity.

Professor Sheena Chestnut Greitens, Associate Professor, Lyndon B. Johnson School of Public Affairs at the University of Texas at Austin

PGIM China Symposium February 2021

PGIM Perspectives,

Three Focal Points for the U.S.-China Relationship,

March 2021

PGIM Perspectives,

Three Focal Points for the U.S.-China Relationship,

March 2021

Dr. Yew Wei Lit, Fellow in Social Sciences, Yale-NUS College.

One potential area where I think there will be a push to get cooperation with both China and Europe is on climate.”

China’s threat to reunify with Taiwan is real and credible… In a scenario where the economic and military gap between the U.S. and China remains, the West’s largely rhetorical reaction to China’s accelerated integration of Hong Kong could embolden China to be more assertive towards Taiwan. It’s a risk the markets have essentially overlooked to this point.”

Beyond the fate of trade deal phases, China can exert significant economic leverage via the market access it provides to U.S. companies and affiliates. We expect something of a technological arms race between the countries, likely resulting in competing platforms across a range of cutting-edge technologies.”

China-U.S. relations can... be a mix of bilateral climate cooperation and constructive competition. The U.S. could challenge China to a showdown of climate supremacy: Who reaches net-zero emissions first and who becomes the largest renewable energy solution provider.”

“

“

“

“

Trade is the battleground upon which the decoupling war will take place with $1 TN to $1.7 TN at stake for either the U.S. or China.

On the Horizon?

The Pursuit of Outperformance

Source: SNE Research

Demand

Supply

Balance

Shortage

2019

2025

2030

A battery shortage is on the horizon while innovation in the sector is gathering pace.

Battery Supply Shortage Forecast to 2022

Total Production 213,000 tonnes, up from 190,000 tonnes in 2018.

China

62%

Australia

10%

U.S.

12%

Myanmar

10%

Russia

1%

India

1%

Madagascar

1%

Others

2%

China to invest in tech infrastructure to 2025

$1.4 tn

U.S. Chamber of Commerce, 2021

Trade decoupling means forgoing market access not only today, but ever more importantly, for years to come.”

“

Potential losses to U.S. and Chinese economies by 2030 if all U.S.-China trade is subjected to a 25% tariff.

China and the U.S. are at a pivotal moment in their trade relationship. Two polarized outcomes, and a spectrum between them, are possible: a decoupled relationship with long-term tariffs and an adversarial attitude underpinned by protectionism and mistrust; or a thawing in the geopolitical environment, leading to open trade, reduced tariffs and newfound cooperation.

While decoupling represents a significant drag on many sectors, strategic coupling could increase overall trade to higher levels than before the trade war. But recent legislation in the US, and rhetoric going in both directions, suggests suspicion and protectionism may be more powerful today than trade.

Even if the aggregate impact is one of lost growth, investment opportunities will appear along the way, not just in China and in the U.S. but from Europe to the ASEAN countries and South Asia. Cutting-edge technologies are at the center of potential disruption by decoupling but they also present opportunities to be on the right side of a compelling investment theme. These sectors include 5G, semiconductors, solar, electric vehicles (EVs) and rare earth.

STRATEGIC COUPLING, TACTICAL DECOUPLING

PRESENT

How to navigate the next decade of U.S.-China relations

+

Source: Oxford Economics/Haver Analytics

So What?

Investment Themes - 5G

So What?

Investment Themes -

The US INNOVATION AND COMPETITION ACT (USICA)

So What?

Investment Themes -

SEMICONDUCTORS

So What?

Investment Themes -

THE COVID EFFECT

2020

2030

Size of China’s IC market reaches 60% of global market share

Domestic production reaches $140 BN (58% of domestic market demand)

Size of China’s IC market reaches 70% of global market share

Domestic production reaches $305.1 BN (80% of domestic market demand)

SO WHAT?

INVESTMENT THEMES - COMMODITIES

KNOCK-ON EFFECT OF COMMODITY TENSIONS

The threat of a China ban on exports of rare earths to the US strengthens the valuation of anyone else who can supply these minerals. Several countries with alternative sources of rare earths, including Australia, Brazil and Canada may benefit. The 2020 pandemic aid and spending package also includes $800 mn to fund rare earth and strategic minerals research.

But new sources of rare earth won’t come cheap. The Perth US Asia Center estimates that rare earths not sourced from China will be 20-25% more expensive. The increased costs are due in part to stricter environmental standards that are not observed by Chinese producers. As an alternative, recycled materials are now in demand. Apple started using recycled rare earths in its iPhones to mitigate potential interruptions to the supply chain.

China’s dominance in the rare earth sector is entwined with its Belt and Road Initiative under which it has built in developing nations in exchange for security of commodities.

SO WHAT?

INVESTMENT THEMES -

THE COVID EFFECT

When the COVID-19 pandemic broke out in early 2020, vulnerabilities around supplies of personal protective equipment (PPE) were thrown into stark relief as many countries had relied exclusively on China for such items as masks and ventilators.

Even if COVID-19 abates, countries want to make sure they have PPE available and possibly manufactured locally in case supply is disrupted.The UK, US, Canada and France are all examples of countries that brought PPE manufacturing onshore during COVID-19.

In the US, Ford and General Motors worked with medical device manufacturers to increase production of respirators, while in the UK, Airbus, Jaguar, Landrover and Rolls Royce were sent blueprints to manufacture ventilators.

This supports the reshoring theme, arguably making supply chains with China at the center less essential.

SO WHAT?

INVESTMENT THEMES -

SEMICONDUCTORS

China's semiconductor sector is growing at 16-20% p.a. according to the China Semiconductor Industry Association. A reliable Chinese semiconductor sector could extend to the creation of a new value chain not involving the US. The US might then develop its own supply chain domestically, benefitting homegrown component makers there.

Decoupling could increase the likelihood of Chinese manufacturers trying to acquire technology and expertise.

This would be blocked in the US – CFIUS stopped Canyon Bridge Capital Partners from acquiring US chipmaker Lattice Semiconductor Corporation in 2017 over concerns it was linked to the Chinese state, for example. So chip specialists in other countries would become attractive.

But China is a long way behind at the very high end of chip technology. Without acquiring the capability, it will be playing catch-up at this elite level for a decade or more.

Eventually a bifurcated global semiconductor industry would develop.

China-Taiwan tensions are highly relevant to the semiconductor industry, as Taiwan creates 64% of all foundries, which supply chips to tech companies.

The Semiconductor Industry Association says that if Taiwan production was shut down for a year because of military or political circumstances, the cost to annual revenue for device makers world-wide would be US $490 BN.

SO WHAT?

INVESTMENT THEMES - THE US INNOVATION AND COMPETITION ACT (USICA)

The new act plans to commit $250 billion to bolster American technology and innovation, to counter China’s ambitions.

Read More

SO WHAT?

INVESTMENT THEMES - 5G

No company represents the perils of geopolitical tensions more clearly than Huawei. The US government's sanctions on the Chinese company have knock-on effects worldwide. For example, there is a lack of political clarity over whether European governments should accede to US demands to exclude equipment from Huawei.

“As with 4G, first-mover’s advantage is huge and countries rolling out 5G early will see most of the innovation,” an Ericsson spokeswoman said. So if European companies do observe US sanctions on China, they may be disadvantaged. Reuters’ analysis suggests 2021 could be a do-or-die year for Europe’s efforts to keep up in the race.

In addition, for 5G to reach its full potential beyond mobile applications, global standards and a degree of cross-border openness and trust are required.

Read More

Read More

Commodities

Supply Chain

Semiconductors

TECHNOLOGY

INTRO

Renewables

Renewables

Commodities

Supply Chain

Semiconductors

TECHNOLOGY

INTRO

Renewables

Commodities

Supply Chain

Semiconductors

TECHNOLOGY

INTRO

Renewables

Commodities

Supply Chain

Semiconductors

TECHNOLOGY

INTRO

Renewables

Commodities

Supply Chain

Semiconductors

TECHNOLOGY

INTRO

Renewables

Commodities

Supply Chain

Semiconductors

TECHNOLOGY

INTRO

Renewables

Commodities

Supply Chain

Semiconductors

TECHNOLOGY

INTRO

Renewables

Commodities

Supply Chain

Semiconductors

TECHNOLOGY

INTRO

Renewables

Commodities

Supply Chain

Semiconductors

TECHNOLOGY

INTRO

Geopolitical threats and rivalries may continue to impede a strengthening of trade ties.

On the Horizon?

“

SCARCE RAW MATERIALS ARE CENTRAL TO AN EMERGING ENERGY THEME: ELECTRIC VEHICLES (EVs).

EVS ARE A PRIORITY FOR CHINA.

Decoupling Advantage

U.S. (and European) 5G Suppliers

Decoupling Disadvantage

China – Loss of Business from U.S. and allies

Strategic Coupling

Decoupling Disadvantage: China

Decoupling Disadvantage: China

Decoupling Disadvantage: U.S. & China - Market Loss

Decoupling Disadvantage: China

Strategic Coupling

Decoupling Advantage: China

Decoupling Advantage: China

Strategic Coupling

Decoupling Disadvantage: China

Decoupling Disadvantage

U.S. & China – Market Loss

Decoupling Disadvantage: China

Decoupling Disadvantage: China

Decoupling Disadvantage: China

The new Act plans to commit $250 billion to bolster American technology and innovation, in order to counter China’s ambitions.

A total of $52 billion has been allocated to semiconductor research, design and manufacturing.

$49.5 billion for the “CHIPS for America Fund”, to encourage domestic chip production through incentives and R&D.

A total of $1.5 billion will go to developing open-architecture wireless technologies and ‘leap-ahead’ tech for U.S. mobile broadband.

The Act takes aim at Huawei, saying it “presents unacceptable

risks to our national security.”

The U.S. will also push for supply-chain transparency for semiconductors.

The Department of Energy will release a 10-year plan to develop a lithium battery supply chain, with EVs in mind.

The Department of Interior will lead a task force on rare earths, with the aim to produce, refine and recycle critical minerals in the US.

The Department of Commerce is considering an investigation into neodymium magnets under the related Trade Expansion Act.

Part of the Bill called Endless Frontier will overhaul the National Science Foundation and establish a Directorate for Technology and Innovation to address supply-chain resilience and technology innovation.

Generally, the Act is great news for any company able to assist the U.S. with these ambitions around domestic supply, security and self-sufficiency.

The Act will seek to advance an “Indo-Pacific strategy centered on strengthening U.S. alliances and partnerships,” in order to “confront China’s malign political influence and predatory economic practices.”

Some specific references to other countries within this strategy include Afghanistan and minerals, Pakistan and the Belt and Road Initiative, Indian economic and security challenges, and a broader mission to warn partners in the Middle East and North Africa about the risks of Chinese telecommunications infrastructure. This suggests the U.S. may step in as a source of funding, technology and infrastructure.

Overall, the Act’s tone is divisive and challenging, openly referring to China’s government as an “adversary.” It suggests more decoupling than recoupling.

China itself has reacted angrily to the Act and its wording. Foreign Ministry spokesman Wang Wenbin says the U.S. sees China as an “imaginary enemy” and that the legislation “distorts the facts.”

China itself has reacted angrily to the Act and its wording. Foreign Ministry spokesman Wang Wenbin says the U.S. sees China as an “imaginary enemy” and that the legislation “distorts the facts.”

Overall, the Act’s tone is divisive and challenging, openly referring to China’s government as an “adversary.” It suggests more decoupling than recoupling.

Overall, the Act’s tone is divisive and challenging, openly referring to China’s government as an “adversary.” It suggests more decoupling than recoupling.

The Act will seek to advance an “Indo-Pacific strategy centered on strengthening U.S. alliances and partnerships,” in order to “confront China’s malign political influence and predatory economic practices.”

Generally, the Act is great news for any company able to assist the U.S. with these ambitions around domestic supply, security and self-sufficiency.

Part of the Bill called Endless Frontier will overhaul the National Science Foundation and establish a Directorate for Technology and Innovation to address supply-chain resilience and technology innovation.

The Department of Commerce is considering an investigation into neodymium magnets under the related Trade Expansion Act.

The Department of Interior will lead a task force on rare earths, with the aim to produce, refine and recycle critical minerals in the US.

The Department of Energy will release a 10-year plan to develop a lithium battery supply chain, with EVs in mind.

The U.S. will also push for supply-chain transparency for semiconductors.

The Act takes aim at Huawei, saying it “presents unacceptable risks to our national security.”

A total of $1.5 billion will go to developing open-architecture wireless technologies and ‘leap-ahead’ tech for U.S. mobile broadband.

$49.5 billion for the “CHIPS for America Fund”, to encourage domestic chip production through incentives and R&D.

The new Act plans to commit $250 billion to bolster American technology and innovation, in order to counter China’s ambitions.

A total of $52 billion has been allocated to semiconductor research, design and manufacturing.

$49.5 billion for the “CHIPS for America Fund”, to encourage domestic chip production through incentives and R&D.

A total of $1.5 billion will go to developing open-architecture wireless technologies and ‘leap-ahead’ tech for U.S. mobile broadband.

The Act takes aim at Huawei, saying it “presents unacceptable

risks to our national security.”

The U.S. will also push for supply-chain transparency for semiconductors.

The Department of Energy will release a 10-year plan to develop a lithium battery supply chain, with EVs in mind.

The Department of Interior will lead a task force on rare earths, with the aim to produce, refine and recycle critical minerals in the US.

The Department of Commerce is considering an investigation into neodymium magnets under the related Trade Expansion Act.

Part of the Bill called Endless Frontier will overhaul the National Science Foundation and establish a Directorate for Technology and Innovation to address supply-chain resilience and technology innovation.

Generally, the Act is great news for any company able to assist the U.S. with these ambitions around domestic supply, security and self-sufficiency.

The Act will seek to advance an “Indo-Pacific strategy centered on strengthening U.S. alliances and partnerships,” in order to “confront China’s malign political influence and predatory economic practices.”

Some specific references to other countries within this strategy include Afghanistan and minerals, Pakistan and the Belt and Road Initiative, Indian economic and security challenges, and a broader mission to warn partners in the Middle East and North Africa about the risks of Chinese telecommunications infrastructure. This suggests the U.S. may step in as a source of funding, technology and infrastructure.

Overall, the Act’s tone is divisive and challenging, openly referring to China’s government as an “adversary.” It suggests more decoupling than recoupling.

China itself has reacted angrily to the Act and its wording. Foreign Ministry spokesman Wang Wenbin says the U.S. sees China as an “imaginary enemy” and that the legislation “distorts the facts.”

Figures and information provided are estimates subject to change.

Figures and information provided are estimates subject to change.

Figures and information provided are estimates subject to change.

Figures and information provided are estimates subject to change.

Figures and information provided are estimates subject to change.

Source: Ericsson

Figures and information provided are estimates subject to change.

Figures and information provided are estimates subject to change.

Source: Center for Strategic and International Studies

Figures and information provided are estimates subject to change.

Source: BCG

Figures and information provided are estimates subject to change.

Source: U.S. Chamber of Commerce, 2021

Data as of 05/30/2021 unless otherwise noted.

Explore more insights on China’s rising role in the world economy

OUTFRONT

Global Rare Earth Minerals Production 2019

Total Production 213,000 tonnes, up from 190,000 tonnes in 2018.

China

62%

Australia

10%

U.S.

12%

Myanmar

10%

Russia

1%

India

1%

Madagascar

1%

Others

2%

THE U.S. WILL FIND ITS

DEPENDENCY ON CHINESE RARE EARTHS HARD TO BREAK,

AS THEY ARE ESSENTIAL

IN MANY HIGH-TECH

PRODUCTS.

COMMODITIES

RAW AND RARE

There is a ripple effect beyond the U.S. and China.

of global neodymium is in China.

90%

AirPods and electric vehicles.

Read More

For the rest of the world, there is no avoiding the need for China in some supply chains: China dominates refinement of Neodymium, used in

Supply chains for manufactured goods start with raw commodities.

These too are disrupted by decoupling’s ramifications.

Decoupling Advantage: China

Source: Reuters/USGS

Source: Reuters

Renewables

Commodities

Supply Chain

Semiconductors

TECHNOLOGY

INTRO

Renewables

Commodities

Supply Chain

Semiconductors

TECHNOLOGY

INTRO

So What?

Investment Themes -

COMMODITIES

KNOCK-ON EFFECT OF COMMODITY TENSIONS

The threat of a China ban on exports of rare earths to the U.S. strengthens the valuation of anyone else who can supply these minerals – such as Lynas Rare Earths, an Australian company that received a $30 million investment from the U.S. Department of Defense in January 2021. The 2020 pandemic aid and spending package also includes $800 million to fund rare earth and strategic minerals research.

But new sources of rare earth won’t come cheap. The Perth USAsia Center estimates that rare earths not sourced from China will be 20-25% more expensive. The increased costs are due in part to stricter environmental standards that are not observed by Chinese producers. As an alternative, recycled materials are now in demand. Apple started using recycled rare earths in its iPhones to mitigate potential interruptions to the supply chain.

China’s dominance in the rare earth sector is entwined with its Belt and Road Initiative, under which it has built in developing nations in exchange for security of commodities.