Managing Director and Co-Chief Investment Officer of PGIM Fixed Income

Gregory Peters

Markets are in a much more fragile place, with terrible liquidity. The way I think about fragile market function is that the odds of a financial market accident are just higher."

Government bond markets are finding that liquidity increasingly tends to evaporate at moments of stress.

USD

1850

1900

1800

1750

1700

1650

1600

1550

Source: Refinitiv

Nov 30 2022

Jan 2 2020

1500

ICE BofA U.S. Treasury Index

One reason is that big banks no longer act as market makers, due to tighter regulatory controls. Apart from 2022’s gilts crisis, this illiquidity sparked a near-disaster in Treasuries in March 2020 and some observers fear that a so-called “volatility vortex” in U.S. markets could happen again. An index of market liquidity recently descended to the lows not seen since March 2020.

Government Bond Markets

Here are five areas where liquidity could suddenly disappear:

In 2000, non-banks held $51 trillion of financial assets, compared with banks’ $58 trillion, according to the Financial Stability Board. Its latest data shows that non-banks held $227 trillion in financial assets at the end of 2020 – far greater than banks at $180 trillion. That means no one knows exactly where leverage is and where financial risks might be lurking.

An unintended consequence of the regulation of banks that followed the GFC is that leverage has shifted to non-bank financial institutions that are harder to monitor.

Leveraged Finance

Source: European Central Bank: Banking Supervision

European Central Bank officials have reportedly been telling banks to cut down on extending debt to highly leveraged borrowers.

The ECB has warned of “significant deficiencies” in how banks evaluate and manage risks associated with this type of credit. Risks in leveraged lending have continued to increase, with global primary issuance reaching a new record of $4 trillion in 2021 while underwriting standards fell, according to the ECB.

Japan's Next Move

The possibility of a disorderly exit in Japan from its ultra-easy monetary policy is causing anxiety. Since 2016, Japan has capped its interest rates at close to zero by buying bonds in a policy called yield curve control.

With yields rising around the world, though, pressure is rising on the central bank to exit this policy early in 2023. Should it do so, there are fears that interest rates would swiftly move significantly higher, impacting investors in assets like Japanese government bonds who have taken comfort in the cap to leverage their holdings to increase returns. They could suffer large losses and margin calls, with reverberations throughout global markets.

Emerging Markets

Housing

Source: Refinitiv

The 10% Club – countries with yields exceeding or close to 10%

Once again, emerging markets are a source of worry as outflows from the countries’ stocks and bonds reach high levels.

Source: IMF

Many developing countries that are not commodities exporters and have dollar denominated debt, are suffering from depreciating currencies and rising borrowing costs, driven by the U.S. Fed’s rising rates, with the IMF recently estimating that 30% of emerging markets are at or near debt distress, with yields exceeding 10% (see 10% club chart).

Emerging market foreign currency bonds are now trading at high premiums to U.S. treasuries in signs of extreme stress. High reliance on short-term funding and foreign exchange borrowing leaves some emerging markets more exposed to changes in market sentiment and rising short-term dollar borrowing costs.

† The price to income ratio is the nominal house price index divided by the nominal disposable income per head and can be considered as a measure of affordability

Sources: Reuters Plus compiled statistics, Knight Frank Research Macrobond, OECD, Refinitiv, Hypostat

United Kingdom

United States

Sweden

Spain

Portugal

Norway

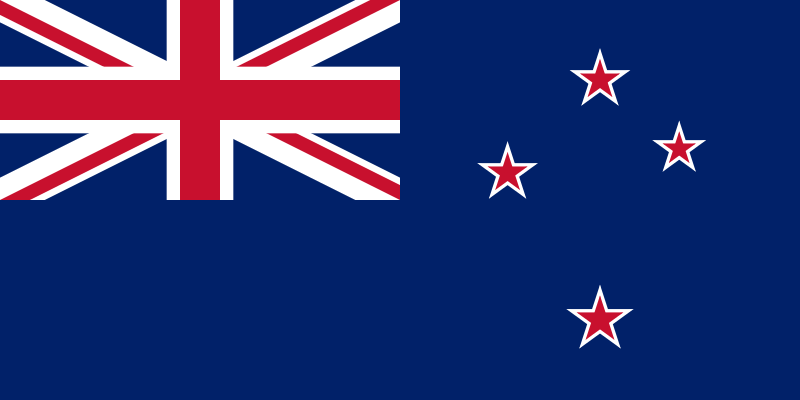

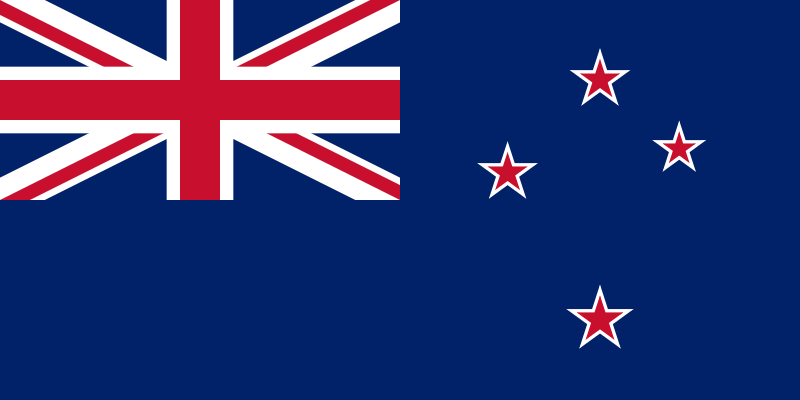

New Zealand

Netherlands

Luxembourg

Italy

Ireland

Germany

France

Finland

Denmark

Canada

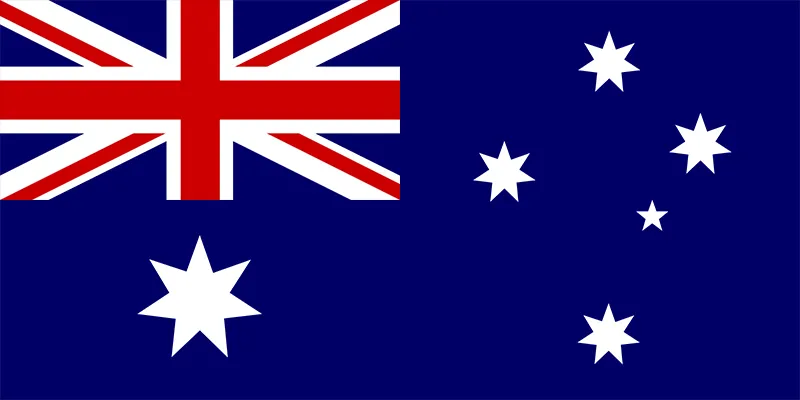

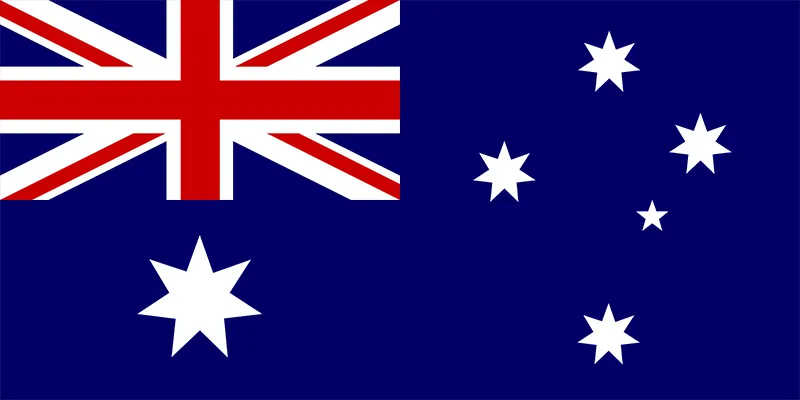

Australia

†

Housing Risk Indicators,

Selected Countries

Housing Risk Indicators

A surge in mortgage rates across much of the rich world will almost certainly cause house prices to fall.

Much depends on how far house prices have risen or whether homeowners have borrowed with long-term fixed rate mortgages or floating rate mortgages that are highly sensitive to movements in interest rates. These could feed through into losses for non-bank financial institutions. Sweden and Norway are thought particularly vulnerable due to the high level of households with variable rate mortgages.

As central banks prioritize price stability over financial stability, the risks of a crack-up remain even though inflation appears to be easing from its highest levels. For now, it’s important to note that there’s no immediate indication that a major crisis will occur. But central banks have a delicate path to tread as they strive to quell inflation at a time of high debt and evident financial vulnerability.

Across financial markets, there are dangers of hidden risks accumulated in yesterday’s era of super-low interest rates.

These risks may lie in the public sector where governments have borrowed hugely through the pandemic and energy crisis.

Alternatively, they could be the result of investor leverage, as positions assumed to be low risk suddenly turn out to be far higher risk when interest rates rise. If sudden risks to financial stability crystallize, the Fed and other central banks might have to pause or even halt their monetary tightening.

Conclusion

1

3

4

5

14.6%

Nigeria

9.97%

Russia

11.3%

Turkey

12.9%

Pakistan

10.35%

South Africa

13.73%

Kenya

42.83%

Ghana

13.25%

Colombia

13.25%

Brazil

8.5%

Hungary

121.57

139.65

115.6

125.06

149.41

113.93

147.28

151.71

148.66

114.66

143.06

118.56

96.72

112.76

140.59

92.38

119.53

2015 = 0 - Q3 2022 or latest available

House Price to Income Ratio

3.5

4.5

1.75

2

2

4.25

2.5

2

2

2

4.25

1.25

2

2

2

2

3.1

Policy Rates

%-point increase

Jan 1 2021 - Dec 15 2022

23.6

45.3

32.2

5.3

29

26.4

38.1

39.7

34.7

21.8

41.7

18.8

14.1

17.2

28.1

9.7

26.7

% increase

2019-Q2 2022

House Prices

Chief Investment Officer, PGIM Wadhwani

Dr. Sushil Wadhwani

Macro conditions will be very difficult over the next two or three years. I strongly suspect that this is going to elicit significant political ructions and problems in the stability of our financial system. So, you're likely to see important unknown unknowns turn up. And our portfolios therefore have to be both defensive and diversified.”

The Pursuit of Outperformance

2

Chapters Menu

Explore

Explore

Explore

Explore

Explore

Select a Chapter to Continue:

CLOSE

Learn More

Australia

Canada

Denmark

Finland

France

Germany

Ireland

Italy

Luxembourg

Netherlands

New Zealand

Norway

Portugal

Spain

Sweden

United States

United Kingdom

2.85

2

2

2

2

1.25

3.75

2

2

2

2.5

3.5

2

2

1.75

3.75

2.15

119.53

92.38

140.59

112.76

96.72

118.56

143.06

114.66

148.66

151.71

147.28

113.93

149.41

125.06

115.6

139.65

121.57

26.7

9.7

28.1

17.2

14.1

18.8

41.7

21.8

34.7

39.7

38.1

26.4

29

5.3

32.2

45.3

23.6

%-point increase Jan 1st 2021 - Nov 8th 2022

%-point increase Jan 1st 2021 - Nov 8th 2022

%-point increase Jan 1st 2021 - Nov 8th 2022

Housing Risk Indicators

Brazil

13.25%

Policy Rates

House Price to Income Ratio

Policy Rates

House Price to Income Ratio

House Prices

Explore

Explore

Explore

Explore

Explore

Select a Chapter to Continue: