China is the main cog in the engine powering Australian trade. Therefore, if trade between the US and China is dissolved, investors fear Australia could get caught in the middle.

A trade ban between the world’s two largest economies also would threaten to weaken growth prospects and market sentiment across the globe, a potentially destructive force for a wide range of asset classes. This places a US-China ban on bilateral trade at the top of the risk-management list for Australia’s institutional investors.

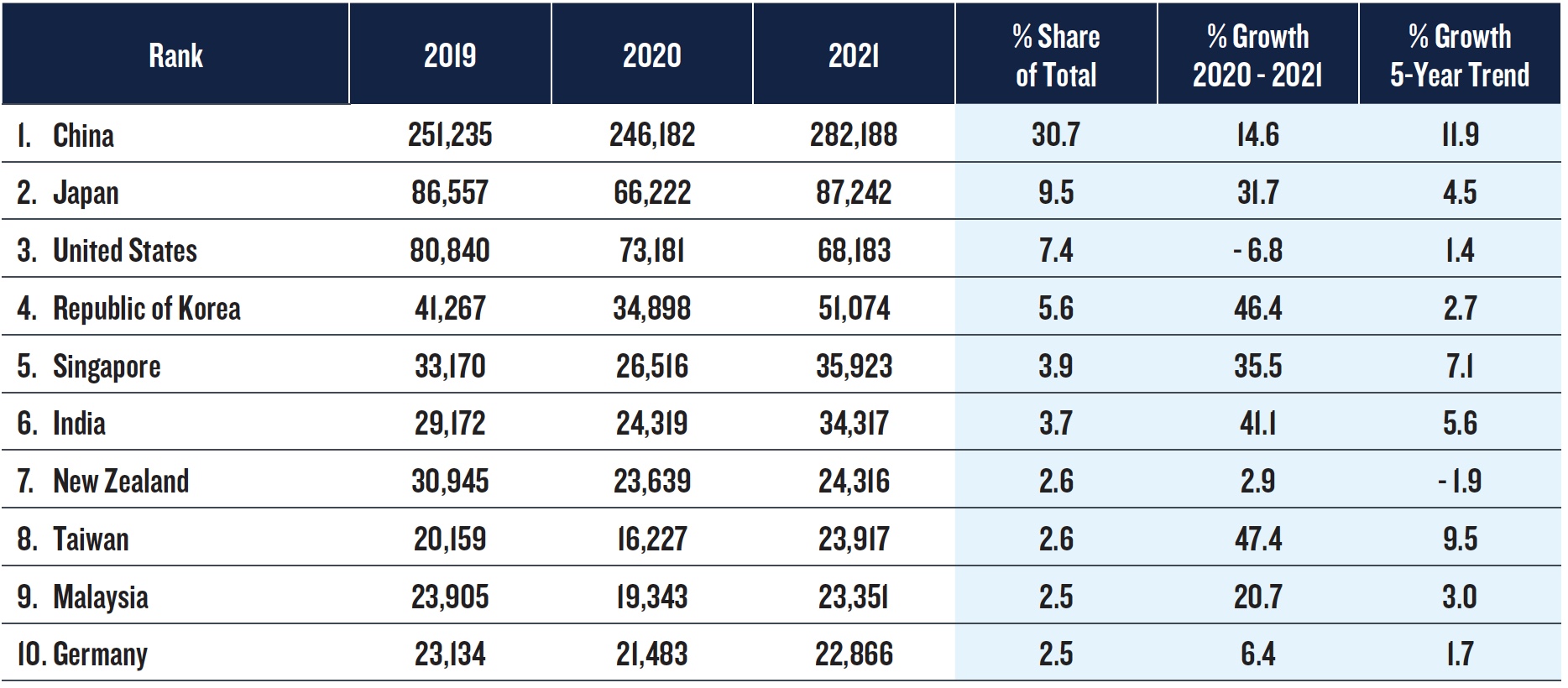

At over 30% of overall trade in 2021, China is by far Australia’s biggest trade partner – more than three times the size of its next largest partner, Japan. The trade relationship with China is fueled by exports, particularly commodities like iron ore and natural gas. Trade with China is also growing faster than Australia’s other trade relationships, expanding 11.9% over a five-year period ending in 2021.

As a result, investors in Australia are understandably sensitive to the tail risk that trade is banned between the US and China, considering the potential spillover effect for Australian markets and the economy.

Australia’s Top Two-Way Trading Partners (AUD in millions)

Source: Australian Government Department of Foreign Affairs and Trade

11.9%

GROWTH IN TRADE WITH CHINA OVER A FIVE-YEAR PERIOD

Download the report to read more >

Download the report to read more >