Robin Stern

Executive Assistant and Program Manager

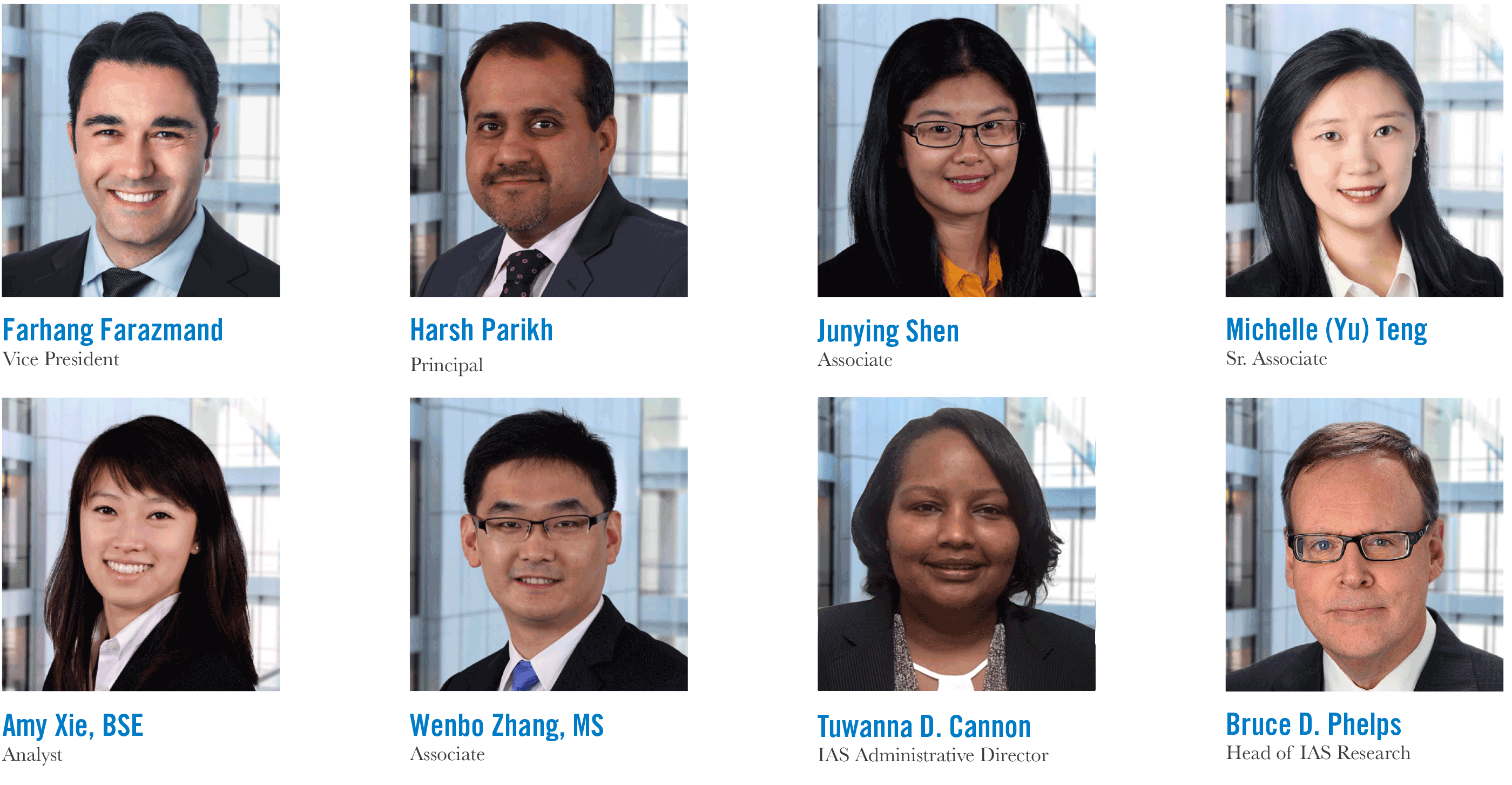

Harsh Parikh, PhD

Junying Shen, MS

Michelle (Yu) Teng, PhD, CFA

Noah Weisberger, PhD

Wenbo Zhang, MS

Bruce D. Phelps, CFA

Vice President

Principal

Senior Associate

Vice President

Senior Associate

Executive Assistant and Program Manager

Head of IAS

Noah Weisberger,

Managing Director

Noah Weisberger is a Managing Director in PGIM’s Institutional Advisory & Solutions (IAS) group, joining after 17 years on the sell-side of the industry. Most recently, Noah was a Managing Director and Chief U.S. Portfolio Strategist at Sanford Bernstein, where he and his team were responsible for conducting tactical and strategic equity-market research, market forecasting, and the management of a model portfolio. Prior to joining Sanford Bernstein, Noah spent 14 years at Goldman Sachs Global Investment Research as a Managing Director and Senior Market Economist, focusing on the intersection of macroeconomics and markets, across geographies and asset classes. Noah began his career as a Staff Macroeconomist at the Council of Economic Advisers. He received a BA in Mathematics from Yeshiva University and a PhD in Economics from Harvard University.

HARSH PARIKH,

Principal

Harsh Parikh is a Principal in the Institutional Advisory & Solutions group. Mr. Parikh is responsible for investment research and modeling. He joined Prudential Financial Inc. (PFI) in April 2015 from BNY Mellon’s Investment Strategy & Solutions Group, where he was most recently a Vice President, Portfolio Manager & Strategist. Besides advising institutional clients, Mr. Parikh was also co-portfolio manager for BNY Mellon Real Asset Strategy. Previously, he worked for GMAC Rescap and Countrywide Capital Markets. Mr. Parikh earned his B.E. degree from Gujarat University, his M.S. degree in Computer Science and M.S. degree in Mathematical Finance from the University of Southern California, and his Ph.D.degree in Finance from EDHEC Business School.

JUNYING SHEN, MS

Senior Associate

Junying Shen is a Senior Associate in the Institutional Advisory & Solutions (IAS) group, focusing on quantitative research related to traditional and alternative assets and the development of asset allocation model. Ms. Shen joined IAS in June 2017 from Market Risk Capital & Analysis team at Goldman Sachs & Co. as a senior analyst where she analyzed market risk factors for various product types including syndicated loans, public equity, private equity, and real estate assets. Ms. Shen earned her BS degrees in Finance and Mathematics from University of Illinois at Urbana-Champaign and an MS in Mathematics in Finance from New York University.

MICHELLE TENG,

Vice President

Michelle (Yu) Teng is a Vice President in PGIM’s Institutional Advisory & Solutions (IAS) group. She joined IAS from the Investment & Pension Solutions group in Prudential Retirement, where she focused on developing and delivering innovative solutions for the company’s institutional clients. Michelle was previously an Assistant Vice President at Bank of America Merrill Lynch, where she was responsible for building quantitative models in Global Markets. Ms. Teng received a Ph.D. in Electronic and Electrical Engineering from UCL (University College London) and an MBA from Tuck School of Business at Dartmouth. She holds the Chartered Financial Analyst® designation.

AMY XIE, bse

Analyst

Amy Xie is an Analyst in the Institutional Advisory & Solutions (IAS) group, focusing on client-driven research projects and infrastructure buildout. Ms. Xie joined IAS in July 2017 after graduating from Princeton University with a BSE degree in Chemical Engineering. She has experience in metabolic engineering and materials science research.

WENBO ZHANG, MS

Senior Associate

Wenbo Zhang is a Senior Associate in the Institutional Advisory & Solutions (IAS) group, focusing on quantitative investment research related to active management, strategic asset allocation and factor modelling research, and buildout of the group’s distributed data analysis and computation platform. Mr. Zhang joined PGIM IAS in August 2017 from Morgan Stanley FICC Macro group as an Associate, where he analyzed and managed the credit related exposure of the firm’s macro fixed income portfolio. Mr. Zhang achieved his B.S. degree in Mathematics and Economics from Wuhan University, M.S. in Statistics from University of North Carolina at Chapel Hill and M.S. in Financial Engineering from CUNY Baruch College.

BRUCE D. PHELPS, cfa

Managing Director, Head of IAS

Bruce Phelps is a Managing Director in PGIM’s Institutional Advisory & Solutions (IAS) group. He was previously Managing Director in the Quantitative Portfolio Strategy group at Barclays Capital/Lehman Brothers conducting client-based research on asset allocation, alternative benchmarks, risk modeling, liquidity measurement and evaluation of investment strategies. Prior to joining Lehman, Bruce was Managing Director and Portfolio Manager for Lehman Ark Asset Management where he was responsible for managing MBS and structured product portfolios and developing risk and performance attribution models. Previously, he was Senior Economist for the Chicago Board of Trade where he developed new futures and options contracts and the exchange’s electronic trading system. Bruce started his investment career as a credit analyst and foreign exchange trader for Wells Fargo Bank. Bruce received an AB degree (Economics) from Stanford University and a PhD (Economics) from Yale University. He is a CFA charterholder.

Robin Stern is the IAS Executive Assistant and Program Manager. Ms. Stern joined PGIM IAS in 2020 after over 19 years at AIG where she was a Executive assistant for senior level executives.

PhD

PhD

PhD, CFA

Vishv Jeet, PhD

Managing Director

Vishv Jeet,

Vice President

Vishv Jeet is a Vice President in PGIM’s Institutional Advisory & Solutions (IAS) group. He joined IAS from Burgiss, where he was an associate director of applied research focusing on the econometrics of private capital investments. In his role at Burgiss, Vishv developed models for private equity performance measurement, benchmarking, attribution, risk estimation, cash-flow forecasting, and commitment pacing. Prior to joining Burgiss, Vishv was a Sr. Researcher at Axioma Inc., where he contributed to equity-portfolio construction research including alpha and risk modeling, optimization, and performance attribution. Vishv started his career as an optimization expert for Gravitant Inc. (an IBM company). Vishv earned his B. Tech and M. Tech degrees in Mechanical Engineering from Indian Institute of Technology, Mumbai, India and his Ph.D. (Operations Research) from the University of Texas at Austin.

PhD

Robin Stern