FUND SOLUTIONS

EQUITY

QUANTITATIVE SOLUTIONS

Multi-Asset Solutions

Fixed Income

Alternatives

Our strategies

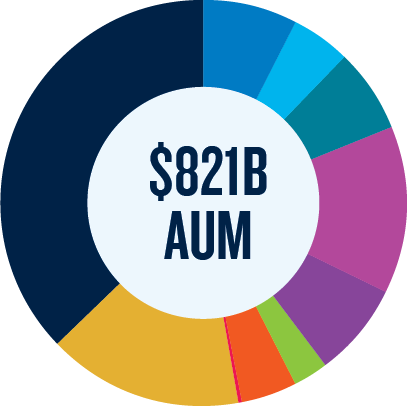

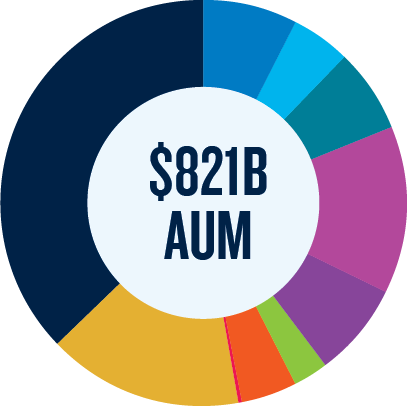

$1.33T AUM

$805B2

$210B3

$100B4

$10B

$319B7

$182B5

Stuart Parker

President

PGIM Investments

PGIM INVESTMENTS

Mutual Funds | ETFs | UCITS | SMAs | Direct Indexing | DC Solutions

USD $182B5

Fund manufacturer and distributor of PGIM's asset management capabilities offering active investment strategies across global markets.

Global Reach with Local Market Expertise

Industry Leading Growth

Investment Solutions Provider

Global scale with deep local market expertise dedicated to client services across the U.S., EMEA, APAC, and LATAM.

�Locally licensed asset managers in China, India, and Taiwan.

Global Reach with Local Market Expertise

Industry Leading Growth

Investment Solutions Provider

Global Reach with Local Market Expertise

Industry Leading Growth

Investment Solutions Provider

PGIM Investments is the 22nd-largest mutual fund family in the U.S.6

�13 out of 15 calendar years of positive net flows, resulting in the 7th-fastest organic mutual fund AUM growth since 20086.�

Global Reach with Local Market Expertise

Industry Leading Growth

Investment Solutions Provider

PGIM Investments delivers 100+ products globally spanning key asset classes.

VEHICLES

VEHICLES

Mutual funds

ETFs

Buffer ETFs

Strategist Models

Retail SMAs

Closed-end funds �(listed & unlisted)

UCITS funds

CITs

Experience & Stability

Rigorous Research

Collaborative Process

Asset Allocation

John Vibert

President & CEO

PGIM Fixed Income

PGIM FIXED INCOME

Public Fixed Income

Alternative strategies available

USD $805B2

An active global fixed income manager bringing scale, stability, and broad capabilities to the pursuit of consistently strong, risk-adjusted returns.

Risk Management Focused

Risk Management Focused

Experience & Stability

Rigorous Research

Collaborative Process

Risk Management Focused

Experience & Stability

Rigorous Research

Collaborative Process

Risk Management Focused

Experience & Stability

Rigorous Research

Collaborative Process

Risk Management Focused

Experience & Stability

Rigorous Research

Collaborative Process

Significant resources and infrastructure to specialise and add value. Focus on fundamental, bottom-up security selection through a relative value framework with ESG integration.

Experienced global research teams conduct in-depth fundamental, quantitative, and macroeconomic research and share research and insights with investment teams on local markets worldwide.

1,148 global employees with 355 investment professionals averaging 29 years investment experience and 23 years with the Firm2.

Emphasis on risk management, with comprehensive daily risk management, analysis, and reporting.

JENNISON ASSOCIATES

Public EQUITY | THEMATIC EQUITY | PUBLIC FIXED INCOME

Alternative strategies available

USD $210B3

One of the leading active equity managers in the U.S. with expertise in growth, value, blend, and specialty equity strategies serving institutional and private clients.

ACCOUNTABILITY

Long-Term Commitment

INVEST WITH CONVICTION

Entrepreneurial Culture

ACCOUNTABILITY

Long-Term Commitment

INVEST WITH CONVICTION

Entrepreneurial Culture

Jennison portfolios reflect the distinct insights and voices of all members on the team that, through a collaborative process, drive outcomes that are not dependent on any single individual.

ACCOUNTABILITY

Long-Term Commitment

INVEST WITH CONVICTION

Entrepreneurial Culture

Enduring client relationships built on client service, long-term outperformance objectives and seasoned investment teams.

ACCOUNTABILITY

Long-Term Commitment

INVEST WITH CONVICTION

Entrepreneurial Culture

Consistent skilled approach based on rigorous fundamental research and bottom-up security selection.

ACCOUNTABILITY

Long-Term Commitment

INVEST WITH CONVICTION

Entrepreneurial Culture

An enterprising investment culture focused on outperformance. Investment teams function as independent boutiques yet collaborate and share insights.

INVESTMENT CAPABILITIES

INVESTMENT CAPABILITIES

Linda Gibson

Chairman & CEO

PGIM Quantitative Solutions

PGIM QUANTITATIVE SOLUTIONS

Quantitative Equity | Systematic Macro | Global Multi-Asset Solutions

Alternative strategies available

USD $100B4

Equity and multi-asset investment solutions that navigate a broad range of investment environments. �Our data-driven approach employs sophisticated quant techniques to find solutions beyond alpha generation.

INNOVATIVE

TRUSTED

NIMBLE

Innovative

Trusted

Nimble

For over 45 years, we have designed proprietary methods for our clients that provide interpretive flexibility and an inferential edge to solve beyond alpha.

Innovative

Trusted

Nimble

We seek to outperform client expectations in every way, with a high-touch approach at each stage of our partnership.

INNOVATIVE

Trusted

Nimble

We apply the latest technology and cutting-edge investment thinking in our pursuit of consistent, risk-adjusted, targeted returns and investment opportunities, customised for our clients.

Phil Waldeck

CEO

PGIM Portfolio Advisory

PGIM Multi-Asset Solutions

Insurance & Pension Solutions

USD $10B

The solutions specialist of PGIM, providing deep expertise and seamless, integrated solutions that seek to simplify institutional investors’ most complex challenges.

Deliver

Simplify

Solve

Solve

Deliver

Simplify

We partner closely with clients to provide insights into their most complex challenges, designing solutions ranging from:�

Outcome-oriented multi-asset solutions

Capital-efficient and risk-optimised yield solutions

Asset-liability modeling to support the design and implementation of strategic and tactical asset allocations

Solve

Simplify

Deliver

The depth and breadth of PGIM Multi-Asset Solutions’ expertise is focused on one thing – building tailor-made solutions to meet our clients' specific needs.

Solve

Simplify

Deliver

Our portfolio design and portfolio management experience leverages PGIM's broad and deep asset class capabilities across public and private markets.

explore our capabilites

Montana Capital Partners

PGIM Private Capital

PGIM Real Estate

PGIM Real Estate

Montana Capital Partners

PGIM Private Capital

PGIM Real Estate

PGIM Private Capital

Montana Capital Partners

PGIM Real Estate

PGIM Private Capital

Montana Capital Partners

Eric Adler

President & CEO

PGIM Investments

PGIM PRIVATE ALTERNATIVES

Mutual Funds | ETFs | UCITS | SMAs | Direct Indexing | DC Solutions

USD $319B7

Access a range of solutions across private credit, real estate, agriculture, sustainable investing, infrastructure and private equity.

Equity | Debt | Agriculture

USD $206B

#3 Real Estate Manager8

50+ year track record as a fiduciary to investors

Firmwide commitment to Net Zero by 20509 �and signatory of the UNPRI

Private Placements | Alternative Private Credit

$103B

#2 Privately Placed Debt Manager worldwide10

30+ year track record of investment expertise

Middle-market private credit capabilities in direct lending, mezzanine finance, energy and renewable power

Originated $16.1B of senior debt and junior capital to 241 middle-market companies and projects globally in 2022

PRIVATE EQUITY SECONDARIES

USD $3.7B11

100+ GP relationships

100+ transactions closed

Track record in managing and advising well-recognised institutions

Signatory of the UNPRI

Jeffrey Becker

Chairman & CEO

Jennison Associates

BROAD RANGE OF INVESTMENT CAPABILITIES

Alternatives

Public Equity

Public Fixed Income

U.S. Multi-Sector

Global Multi-Sector

Investment Grade Corporate

High Yield Bonds and Loans

Emerging Markets Debt

Municipal Bonds

Short,Intermediate, and Long Duration

Liability-Driven Investing

CLOs

Large Cap Growth Equity

Large Cap Value Equity

Large Cap Core Equity

Global, Developed & Emerging Markets

Small and Mid Cap Equity

Sector Strategies

Regional/Country Strategies

Equity Indexing

Fundamental and Quantitative

Strategic Alpha (ETFs)

Direct Indexing

Real Estate Equity and Debt

Multi-Sector Regional Strategies

Core, Core Plus, Value-Add

Investment-Grade to High-Yield Debt

Global Real Estate Securities

Asset Allocation

Asset Allocation

Asset Allocation

Find out more

Find out more

Find out more

Find out more

Find out more

Find out more

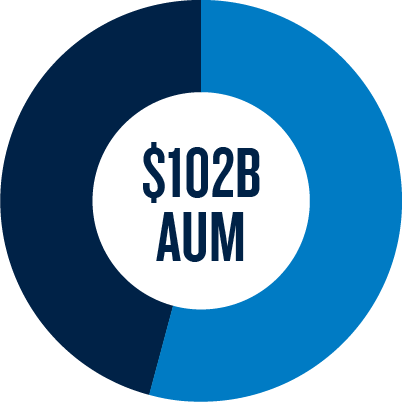

$805B

AUM

$210B

AUM

$102B

AUM/AUA

Learn More

Learn More

Learn More

*Note: AUM/AUA includes $6.6B from Deerpath Capital Management, L.P. (“Deerpath Capital”), a separate SEC registered investment adviser, in which PGIM acquired a majority stake in late 2023.

Real Estate

Infrastructure Debt

Direct Lending

Mezzanine (Corporate and Energy)

Investment Grade and Below �Investment Grade Private Placements

Private Credit

Securitized Products

Relative Value Fixed Income

Emerging Markets Long/Short

Unconstrained

Absolute Return

Healthcare Long/Short

Credit Opportunities

Private Equity Secondaries

Special Situations

Further Alternatives

Asset Allocation

Find out more

INVESTMENT CAPABILITIES

Find out more

Asset Allocation

$102B

AUM/AUA

Asset Allocation

Find out more

Find out more

VEHICLES

Find out more