Explore the timeline

Discover how PGIM was established to become one of the world's leading money managers.

1800s

1900s

From 1923 to 1999 the firm went through the industrial revolution and expanded

its offerings on a global scale.

2000s

Learn more about our brand evolution and what inspired the name change to PGIM.

1875

1878

John Fairfield Dryden establishes the Prudential Friendly Society in Newark, NJ. “Friendly Society” is dropped from the name in 1877.

Prudential Financial, Inc. (PFI) becomes one of the first companies to issue residential and commercial property loans.

i

Our first group pension contract is issued to the Cleveland Public Library, still a client to this day.

Our fixed income investment business begins managing fixed income accounts for institutional clients.

During the Great Depression, we avoid foreclosing on farmers, increasing the number of farm mortgages and loans we issue.

We set up a new commercial and industrial loan department to provide capital to small and mid-size companies.

PFI is among the first life insurance companies to create separate accounts to manage third-party investments outside our general account.

We launch the first open-end commingled real estate fund for U.S. investors.

Our quantitative management investment business begins to manage U.S. equity accounts for institutional clients.

The firm acquires Jennison Associates, expanding our capabilities as an asset manager for other institutions.

Our mutual fund management business is established, now called PGIM Investments, to administer our growing family of mutual funds.

1923

1928

1929

1956

1962

1970

1975

1985

1987

2000

PGIM acquires asset management company in Taiwan,

now called PGIM SITE,

2008

2013

When the world stops lending capital to mid-size businesses during the Financial Crisis, PGIM continues to provide funding, by issuing $15 billion in loans.

PGIM Investments launches UCITS fund platform to provide global clients access to PGIM’s investment strategies

2014

2015

2016

Creation of the PGIM Institutional Advisory & Solutions group. Advising institutional clients on a variety of asset allocation and portfolio construction topics, and delivering bespoke research based on an institution’s specific objectives.

Prudential Tower opens in Newark, NJ as headquarters of our global investment management business.

Our investment management business is rebranded as PGIM, a name for the next 140 years.

more info

more info

1800s

1900s

2000s

1800s

1900s

2000s

1800s

1900s

1800s

1900s

2000s

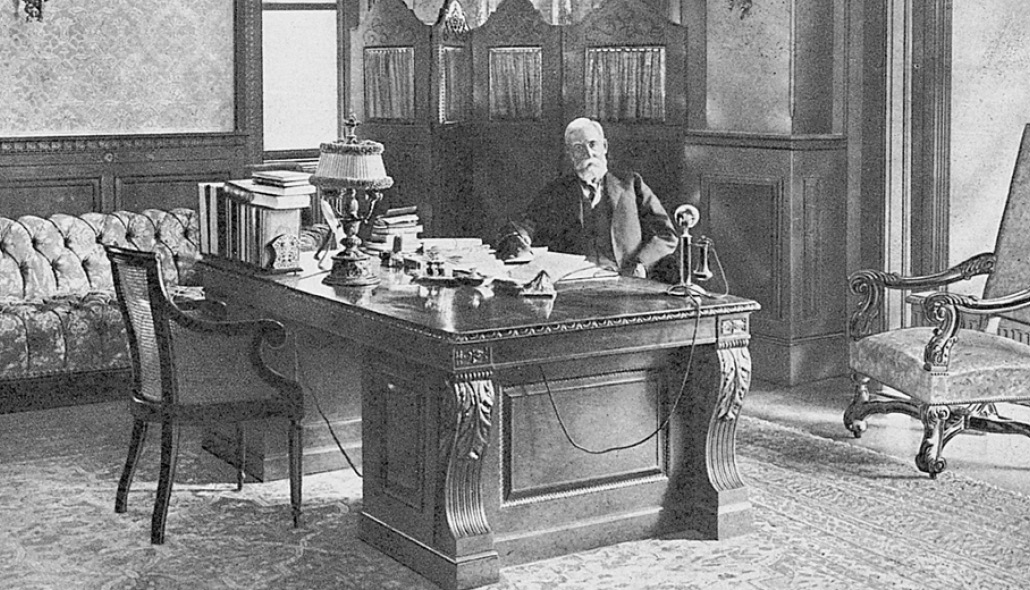

John F. Dryden founder of PFI

i

Jennison was founded in 1969

i

Shanghai Financial Center

i

General Motors HQ in Detroit

Tower Bridge In London

i

i

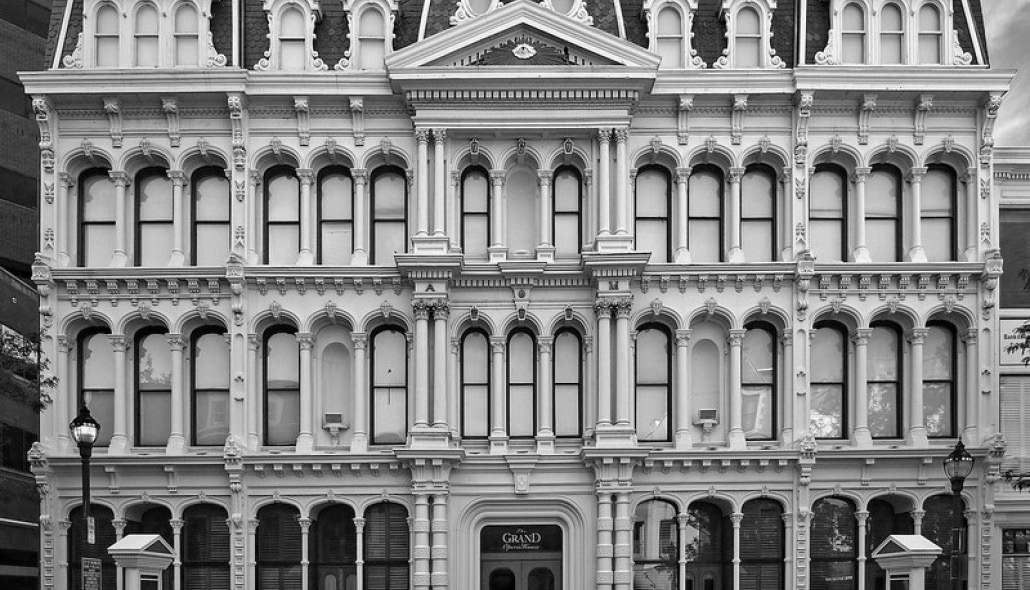

Prudential Tower: Located at 655 Broad Street, two blocks from the firm’s global corporate headquarters at 751 Broad Street and three blocks from its Washington Street building.

1875 John F. Dryden founded the Prudential Friendly Society (PFS) based upon the business premise that Insurance is not a product meant only for the rich. Raising the $30,000 in pledged capital which had been set as a goal. Although it had been decided the company could start doing business as soon as $6,000 had been subscribed, “it was like pulling eye teeth” to get the part of the initial funds, according to Dr. Ward.

Most of the investors were elected to the board of directors after the charter and the name of the Widows and Orphans Friendly Society were changed on February 18, 1875. A notice in the Newark Daily Advertiser of that date listed 24 persons, including Bassett and Dryden, as directors of the PFS.

1877: The name was officially changed to The Prudential Insurance Company of America (PICA). On March 15, 1877, the state legislature approved the change of the company’s name to PICA.

The new name represented hope rather than reality. The company was still, in essence, the Insurance Company of Newark, but it was ready to expand.

“Almost anyone, big businessman or little, can qualify for a Prudential Finanical, Inc. (PFI) load of mortgage. At the top of PFI’s list of borrowers is the who’s who of U.S. industry: International Business Machines [IBM], General Motors, Chrysler Corporation, Union Carbide and Carbon Corporation, International Harvester Goodyear Tire and Rubber.

The giants are only a fraction of PFI’s business. The company pours an even bigger chunk of its treasure into mortgages and loans to individuals and small businessmen… In every U.S. activity there is PFI money, from cattle and cotton to guided-missile factories, race tracks and country clubs.”

— Carr, William H.A., From Three Cents a Week… Englewood Cliffs: Prentice-Hall, 1975. Print.

“We are committed to delivering actively-managed investment strategies and solutions through a variety of investment vehicles to investors worldwide.”

Stuart Parker, president and CEO of PGIM Investments

1900s

2000s

1800s

2000s

1800s

1900s

2000s

1900s

2000s

While other large insurance companies are abandoning the agricultural market, PFI reports an increase in farm mortgages and loans from 1928 to 1929.

In January 1956, PFI issued an announcement that it was setting up a new Commercial and Industrial Loan Department to handle small and medium-sized loans.

In a statement announcing the creation of the new department, Carrol M. Shanks, the seventh company president (1946 – 1960), said, “We are confident that this new organization will facilitate the providing of capital needed for expansion in the field of moderate-sized loans.”

A commingled fund is a fund consisting of assets from several accounts that are blended together. Investors in commingled fund investments benefit from economies of scale, which allow for lower trading costs per dollar of investment, diversification and professional money management.

Prudential-Bache Securities (PBS) acquires Thomson McKinnon Securities, increasing their sales force by 30 percent making it the third-largest brokerage concern in the United States.

THE FUTURE

Today, our core values and focus on ethics are more important than ever. Clients need more than short-term success; they need a long-term partner.

As we look to the future, our continued commitment to investment performance, product innovation, and integrity will enable us to continue to deliver superior long-term results for our clients.

1875

1878

2013

1929

1956

1970

1987

read more

read more

read more

1800s

2018

read more

PGIM Investments launches active ETF (exchange-traded fund) platform

2018

2004

PGIM starts joint venture fund management company in China with Everbright Securities, today known as Everbright PGIM

2008

When the world stops lending capital to mid-size businesses during the Financial Crisis, PGIM continues to provide funding, by issuing $15 billion in loans.

2010

PGIM starts asset management business in Mumbai, India

2021

In August 2021, PGIM acquired montana capital partners, a Swiss-based secondary private equity manager to provide access to a fast-growing alternative investment opportunity.

more info

2004

PGIM starts joint venture fund management company in China with Everbright Securities, today known as Everbright PGIM

Learn more

2010

PGIM starts asset management business in Mumbai, India

Learn more

2021

In August 2021, PGIM acquired montana capital partners, a Swiss-based secondary private equity manager to provide access to a fast-growing alternative investment opportunity.

Learn more

read more

1875

1878

1923

1928

1929

1956

1962

1970

1975

1985

1987

2000

2004

2008

2010

2013

2014

2015

2016

2018

2021

PGIM launches PGIM Multi-Asset Solutions

PGIM Multi-Asset Solutions combines asset-liability management expertise with portfolio strategy and asset allocation to develop integrated solutions for institutional investors.

2022

2022

PGIM launches PGIM Private Alternatives

PGIM Private Alternatives is comprised of PGIM Private Capital, PGIM Real Estate and Montana Capital Partners, each specializing in distinct investment and financing solutions across private credit, real estate, agriculture, sustainable investing, infrastructure and private equity.

2023

2023

read more

read more

2022

PGIM launches PGIM Multi-Asset Solutions PGIM Multi-Asset Solutions combines asset-liability management expertise with portfolio strategy and asset allocation to develop integrated solutions for institutional investors.

2023

PGIM launches PGIM Private Alternative

PGIM Private Alternatives is comprised of PGIM Private Capital, PGIM Real Estate and Montana Capital Partners, each specializing in distinct investment and financing solutions across private credit, real estate, agriculture, sustainable investing, infrastructure and private equity.

read more

learn more

learn more

learn more

learn more

learn more

learn more

learn more

learn more

learn more

learn more