View in Spanish

Areas of Expertise

Our Latin American Global Services team at Prager Metis has wide-ranging expertise in inbound and outbound regulations concerning both Latin American and U.S. tax systems. We routinely leverage our vast knowledge to overcome cultural barriers between Latin America and the United States, ensuring a seamless transition for your business operations.

Our deep understanding of the nuances and intricacies that exist within these two distinct regulatory frameworks allows us to provide comprehensive solutions tailored to your specific needs.

Customized solutions meticulously crafted to align with your unique organizational goals and challenges

Elite cadre of cross-functional specialists spanning multiple disciplines

Agile and adaptable approach, ensuring seamless integration with your existing systems and processes

Cutting-edge methodologies and best practices honed through years of experience

OUR SERVICES

Bookkeeping

Our LATAM Desk provides comprehensive bookkeeping, budgeting, and forecasting services tailored for businesses operating in Latin America. We ensure accurate financial records, insightful budgets, and reliable forecasts to support informed decision-making.

Financial Statements

We handle the preparation of financial statements, corporate income tax returns, and individual income tax returns for clients with operations or investments in Latin America ensuring full compliance with local regulations.

Audit and Review

Our Latin American Desk offers audit, review, and compilation services adhering to Latin American and international accounting standards. We provide independent assurance and accurate financial reporting for businesses operating in LATAM.

Bookkeeping

How it helps your business: Accurate financial records and forecasts are crucial for making informed business decisions. Our services help you understand your financial position, plan for the future, and identify areas for growth or cost savings, giving you a competitive edge in the LATAM market.

Financial Statements

How it helps your business: Navigating Latin America's complex tax landscape can be challenging. Our expert preparation of financial statements and tax returns ensures compliance, minimizes tax liabilities, and helps you avoid costly penalties, allowing you to focus on growing your business with peace of mind.

Audit and Review

How it helps your business: Reliable financial reporting builds trust with stakeholders, investors, and lenders. Our audit and review services enhance your credibility, improve internal controls, and provide valuable insights into your financial health, supporting your business's growth and sustainability in Latin America.

Tax Planning

Our LATAM Desk offers multi-jurisdictional tax consulting, planning, and compliance services, including pre-immigration planning, expatriate consulting, and structuring for special purposes, ensuring tax efficiency for cross-border operations.

Tax Planning

How it helps your business: Effective international tax planning is essential for businesses operating across borders. Our services help you optimize your global tax position, ensure compliance with LATAM and international regulations, and maximize after-tax returns on your cross-border investments and operations.

For acquisitions or investments in LATAM, our team conducts thorough financial and tax due diligence, identifying potential risks and opportunities to support informed decision-making.

Due Diligence

How it helps your business: Thorough due diligence is critical for successful investments in LATAM. Our services help you uncover hidden liabilities, verify financial information, and identify tax risks. This deep understanding allows you to make confident decisions and negotiate better terms in your business ventures.

Due Diligence

Our team provides comprehensive support throughout the M&A lifecycle for transactions involving LATAM entities. We offer strategic advisory, due diligence, valuation, structuring, and post-merger integration services.

M&A

M&A

How it helps your business: M&A can be a powerful growth strategy. Our expertise helps you identify suitable targets, negotiate favorable terms, and seamlessly integrate operations. We guide you through the complexities of an M&A, maximizing value and minimizing risks in these transformative transactions.

Bienvenido

INDUSTRY INSIGHTS AND NEWS

To support your international tax planning and compliance needs, we provide access to a comprehensive suite of valuable resources. Our extensive library includes whitepapers and articles on international tax topics, ensuring you stay informed about the latest developments and trends. Additionally, we offer tax calendars and deadlines, keeping you ahead of critical filing dates and obligations.

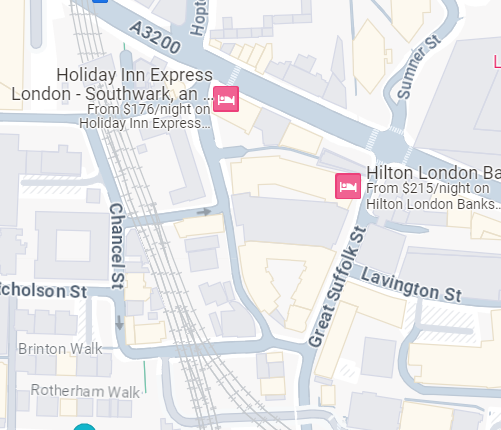

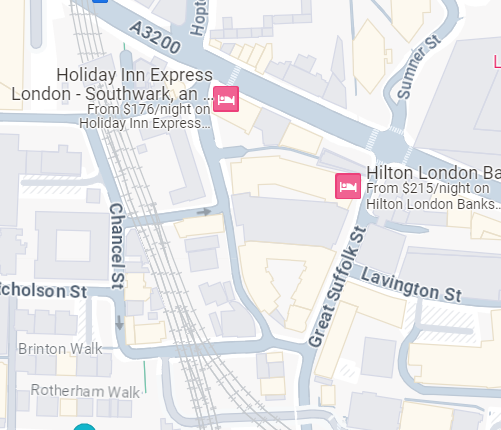

London office

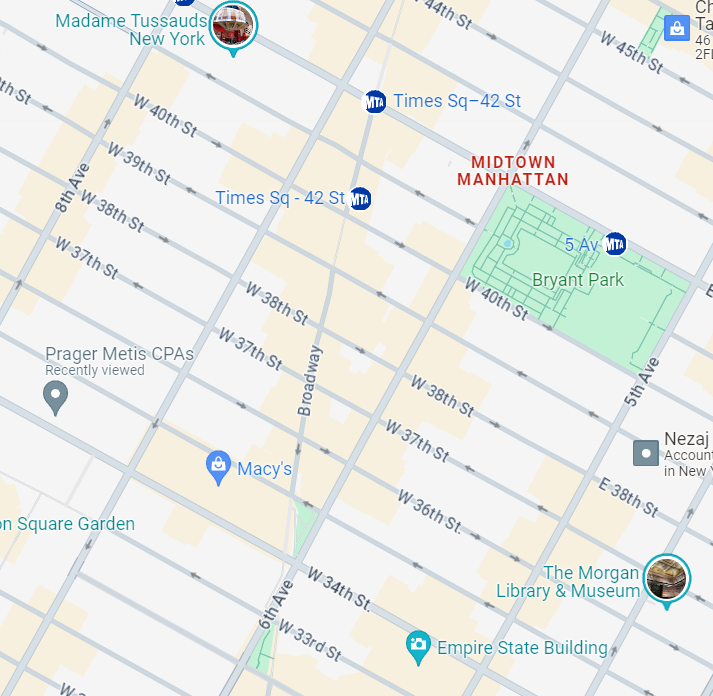

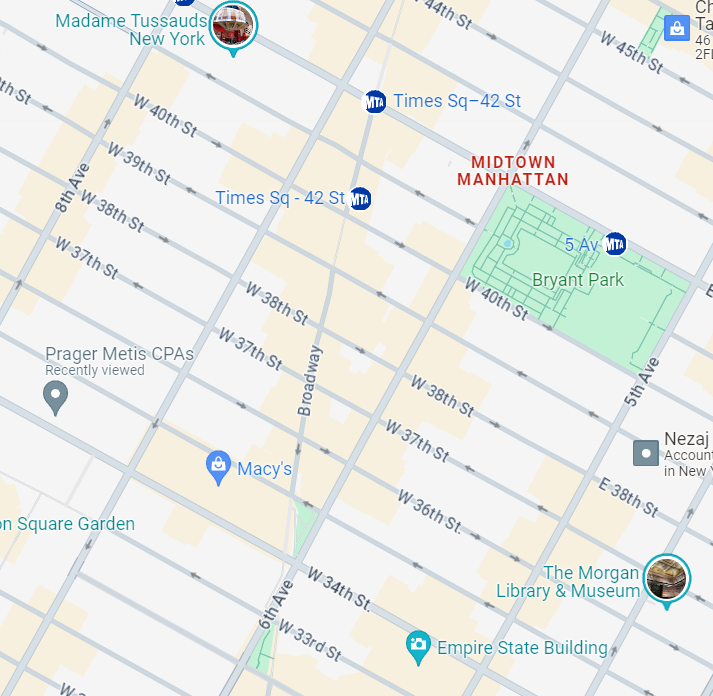

New York office

info@pragermetis.com

+1 212-643-0099

14 Penn Plaza, Suite 1800, New York, NY 10122

New York office

ukenquiries@pragermetis.com

+44 (0)20 7632 1400

5A Bear Lane, Southwark, London, SE1 0UH

London office

PRAGER METIS

OFFICE LOCATIONS

offices

learn more

GGI Global

The leading global alliance of independent professional services firms addressing their clients' local and cross-border needs.

learn more

Security standard that validates our Information Security Management System while protecting sensitive company and customer data.

ISO 27001

Prager Metis stays ahead of the curve by being a valuable member of organizations that bolster our reputation, network, and reach. Our active involvement in professional associations and industry groups allows us to collaborate with peers, share best practices, and contribute to the advancement of the accounting and tax profession.

ASSOCIATIONS AND CERTIFICATIONS

At Prager Metis, we have professionals with deep expertise in various industries. Our LATAM Team understands the unique challenges, regulations, and dynamics of your specific sector, whether manufacturing, technology, retail, or others. We provide tailored solutions catered to your organization's distinctive needs. With our industry-focused approach and comprehensive services, we help you navigate the complexities of your business environment and achieve your strategic goals.

INDUSTRY FOCUS

Through our active participation in prestigious organizations like the local Chamber of Commerce and GGI Global Alliance, the leading global alliance of independent professional services firms, we remain at the forefront of the latest developments and best practices in international tax and business matters. These affiliations enable us to cultivate strong relationships with industry leaders, facilitate the exchange of insights, and stay abreast of emerging trends, ultimately allowing us to enhance the quality of our services consistently.

professional network

Our team's extensive experience in navigating the complexities of cross-border transactions, coupled with our commitment to continuous learning and collaboration, empowers us to deliver innovative and effective solutions that transcend cultural and regulatory boundaries. Whether you require guidance on tax planning, compliance, or advisory services, our Latin America Global Services team is well-equipped to address your unique challenges and facilitate a seamless transition for your business operations between LATAM and the United States.

service suite

Our Latin America team's deep understanding of the nuances that exist between the LATAM and U.S. business environments allows us to provide seamless guidance and support to companies seeking to establish or grow their presence in the U.S. market.

We recognize that venturing into a new market can be a daunting endeavor, fraught with complexities that extend beyond mere financial considerations.

OUR ETHOS

Our team addresses the fashion industry's unique financial challenges, specializing in inventory management, royalty accounting, and brand valuation. We ensure compliance with regulations while optimizing performance across design, production, and retail.

Our team excels in financial management for manufacturing, providing guidance on cost accounting, supply chain finance, and cross-border operations. We ensure compliance with Latin American regulations while enhancing operational efficiency.

We offer comprehensive financial services for sports organizations and athletes, handling complex contracts, image rights management, and international tax planning. Our expertise ensures compliance with sports regulations and optimizes financial performance.

FASHION

MANUFACTURING

SPORTS

LUXURY RETAIL

Team Members

600+

Partners and Principals

100+

Offices Globally

24

Quick Facts

Our Latin America team's deep understanding of the nuances that exist between the LATAM and U.S. business environments allows us to provide seamless guidance and support to companies seeking to establish or grow their presence in the U.S. market. We recognize that venturing into a new market can be a daunting endeavor, fraught with complexities that extend beyond mere financial considerations.

Our Team

Our Company

Our History

Our Commitment

Our Proven Success

Our Team

Through our comprehensive suite of services, we empower Latin American businesses to overcome these hurdles and thrive in the dynamic U.S. market. Our team acts as a trusted partner, offering tailored solutions that address the unique needs of your organization, while ensuring compliance with relevant laws and regulations.

Our Proven Success

Our Company

Our History

Our Commitment

Our Proven Success

Our Team

Prager and Fenton has provided expert accounting and advisory services for over a century, focusing on the entertainment and music industry, professional practice firms, real estate groups, and private wealth individuals.

Prager Metis CPAs, was formed in January 2013 by the combination of Prager and Fenton LLP and Metis Group LLC.

Our History

Our Company

Our History

Our Commitment

Our Proven Success

Our Team

Prager Metis is a top international advisory and accounting firm with over 100 partners and principals, more than 600 team members, and twenty-six offices worldwide. As one of the fastest-growing firms offering a full range of accounting, audit, tax, consulting, and international services, Prager Metis helps make Your World. Worth More.

Our Company

Our Company

Our History

Our Commitment

Our Proven Success

Our Team

At Prager Metis, we are intimately familiar with the multifaceted challenges and potential risks that Latin American businesses face when expanding their operations to the United States. Our dedicated Latin Americian Team comprises seasoned professionals who possess profound knowledge of U.S. regulations, customs, and business practices.

We are deeply committed to our clients' success, going above and beyond to deliver exceptional results. Our dedicated team works tirelessly to understand your unique needs and provide innovative solutions that exceed expectations.

Our Commitment

Our Company

Our History

Our Commitment

Our Proven Success

Our Team

Back to top

GET IN TOUCH WITH OUR TEAM OF EXPERTs

EMAIL US | REQUEST FOR PROPOSAL

NEVER MISS AN UPDATE

Stay up-to-date with the latest news and industry updates

sign up now

VIEW MORE

Request for proposal

Our LATAM Team provides tailored financial solutions for luxury retail, including inventory valuation, multi-channel sales reporting, and tax optimization. We ensure compliance with Italian luxury goods regulations while maximizing profitability.

Click on the industry to learn more

Our LATAM Team will help investors and developers navigate complex property laws, facilitate transactions, and provide market insights for those entering or expanding into the Latin American property market.

Our specialized LATAM team facilitates market entry, localization, and compliance for software companies and hardware manufacturers expanding into the Latin American market.

Our LATAM Team has a wide range of expertise with regulations, cross-border operations, customs processes, and documentation for logistics companies operating in or with Latin America.

Our specialized LATAM Team has expert knowledge of streamlining financial operations for hospitality businesses, ensuring compliance with local regulations, and optimizing tax strategies for hotels and restaurants.

REAL ESTATE

TECHNOLOGY

LOGISTICS

HOSPITALITY

prager metis and guerrero santana

Beyond Borders: U.S.-Mexico Business and Tax Considerations Case Studies

LEARN MORE

WEBINAR

Partner-in-Charge International Tax

Mr. Ruiz has over twenty years of experience specifically in international tax niche with a specialization in tax advisory, tax planning, structuring and compliance.

Ulises Ruiz, JD, LLM

PRACTICE LEADER

CONTACT

prager metis and guerrero santana

Beyond Borders: Decoding the Investment Landscape in the US and Mexico

LEARN MORE

WEBINAR

prager metis and guerrero santana

Beyond Borders: Decoding the Investment Landscape in the US and Mexico

LEARN MORE

WEBINAR

Here are some commonly asked questions to help you plan better and make the most of our international tax resources. These FAQs address key inquiries about our offerings, helping you navigate our suite of tools and information more effectively.

FREQUENTLY ASKED QUESTIONS

Can you assist with financial reporting and accounting for our international operations?

Yes, our Audit & Accounting team is well-versed in international financial reporting standards, including IFRS and US GAAP. We provide audit, review, and compilation services, as well as accounting advisory and system implementation support, to ensure accurate and transparent financial reporting for your global operations.

How can I ensure tax compliance for my U.S. subsidiary?

How do you approach international estate planning and wealth management?

Can you assist with financial reporting and accounting for our international operations?

How can I ensure tax compliance for my U.S. subsidiary?

Maintaining tax compliance requires understanding federal, state, and local tax regulations, filing appropriate tax returns, and adhering to reporting requirements. Our team can guide you through the process, handle tax filings, and represent you before tax authorities if needed.

How do you approach international estate planning and wealth management?

Can you assist with financial reporting and accounting for our international operations?

How can I ensure tax compliance for my U.S. subsidiary?

How do you approach international estate planning and wealth management?

Our Estates & Trusts specialists take a holistic approach to international estate planning and wealth management. We work closely with our clients to understand their unique circumstances and objectives and develop tailored strategies that address multi-jurisdictional tax considerations, asset protection, and succession planning.

Back to top

GET IN TOUCH WITH OUR TEAM OF EXPERTs

EMAIL US | REQUEST FOR PROPOSAL

London office

New York office

info@pragermetis.com

+1 212-643-0099

14 Penn Plaza, Suite 1800, New York, NY 10122

New York office

ukenquiries@pragermetis.com

+44 (0)20 7632 1400

5A Bear Lane, Southwark, London, SE1 0UH

London office

PRAGER METIS

OFFICE LOCATIONS

offices

NEVER MISS AN UPDATE

Stay up-to-date with the latest news and industry updates

sign up now

Andrea Fantozzi

Navigating the Inflation Reduction Act: Unlocking Opportunities

LEARN MORE

GGI ARTICLE

To support your international tax planning and compliance needs, we provide access to a comprehensive suite of valuable resources.

Our extensive library includes whitepapers and articles on international tax topics, ensuring you stay informed about the latest developments and trends.

Additionally, we offer tax calendars and deadlines, keeping you ahead of critical filing dates and obligations.

INSIGHTS AND NEWS

VIEW MORE

learn more

Security standard that validates our Information Security Management System while protecting sensitive company and customer data.

ISO 27001

learn more

The leading global alliance of independent professional services firms addressing their clients' local and cross-border needs.

GGI Global

Prager Metis stays ahead of the curve by being a valuable member of organizations that bolster our reputation, network, and reach.

Our active involvement in professional associations and industry groups allows us to collaborate with peers, share best practices, and contribute to the advancement of the accounting and tax profession.

ASSOCIATIONS AND CERTIFICATIONS

Partner-in-Charge Italian Services

He has gained more than 20 years of financial and tax experience by providing accounting, audit, due diligence, and financial advisory to national and international medium-sized firms in several industries.

Andrea Fantozzi, CPA, CGMA

PRACTICE LEADER

CONTACT

REAL ESTATE

TECHNOLOGY

LOGISTICS

HOSPITALITY

REAL ESTATE

TECHNOLOGY

LOGISTICS

HOSPITALITY

At Prager Metis, we have professionals with deep expertise in various industries. Our Italian Team understands the unique challenges, regulations, and dynamics of your specific sector, whether manufacturing, technology, retail, or others. We provide tailored solutions catered to your organization's distinctive needs.

With our industry-focused approach and comprehensive services, we help you navigate the complexities of your business environment and achieve your strategic goals.

INDUSTRY FOCUS

Our Italian Team at Prager Metis has wide-ranging expertise in inbound and outbound regulations concerning both the Italian and U.S. tax systems. We routinely leverage our vast knowledge to overcome cultural barriers between Italy and the United States, ensuring a seamless transition for your business operations.

Our deep understanding of the nuances and intricacies that exist within these two distinct regulatory frameworks allows us to provide comprehensive solutions tailored to your specific needs.

Areas of Expertise

OUR SERVICES

CLIENT ACCOUNTING SERVICES

FINANCIAL STATEMENTS

AUDIT AND REVIEW

ADVISORY

DUE DILIGENCE

TAX PLANNING

Request for proposal

At Prager Metis, we are intimately familiar with the multifaceted challenges and potential risks that Italian businesses face when expanding their operations to the United States.

Our dedicated Italian Team comprises seasoned professionals who possess profound knowledge of U.S. regulations, customs, and business practices.

Offices Globally

600

Partners and Principals

100+

Team Members

26

Quick Facts

View in Italian