Theme 1

The global growth outlook has stabilized amid shifting trade dynamics

Theme 2

U.S. tariff threats have receded but will leave a bad taste on growth, labor market, and inflation

Theme 3

The Federal Reserve needs an inflation or labor market nudge to cut rates this year

Key themes

Hover over each tile to read more about this quarter's key themes.

Global economic resilience is emerging despite recent macro, policy, and geopolitical shocks, while investor focus has shifted away from U.S. dominance toward a more balanced global outlook.

Read more about this theme

Recession odds have receded, but tariffs and policy uncertainty may soon manifest in slowing macro data. Yet, household and corporate balance sheets should provide a cushion, limiting layoffs and significant consumer weakness.

The Fed will keep policy rates on hold until late 2025 unless there is a sustained run of soft inflation or labor market prints. On the fiscal front, a gradual improvement in the budget deficit would come at the expense of growth.

Theme 4

U.S. equity markets: positive gains to persist even amidst continued macro and policy volatility

Theme 5

Elevated fixed income yields should continue to attract investors

Theme 6

Diversification has rarely looked so attractive

The U.S. market’s full recovery implies a limited cushion against policy disappointment in the near term. Yet positive, albeit slower, economic growth implies continued earnings growth, with markets likely still trending higher.

Credit spreads have re-tightened back close to historic lows. With the constructive global macro backdrop meaning that fundamentals remain solid, investors can once again consider higher-yielding fixed income solutions.

In an era of active global policymaking and higher for longer rates, diversification - both geographic and across a broader set of assets, will be critical. U.S. exceptionalism hasn’t disappeared; its key structural advantages remain intact. But as other global economies gain momentum, U.S. outperformance is likely to be more muted.

�

A series of global shocks test long-term trends

Key takeaway

The global economy has absorbed the multiple shocks of recent months without suffering long-term damage. Yet, the U.S. exceptionalism narrative has sustained a severe blow.�

The global economy has confronted a series of shocks this year, including trade and geopolitical uncertainty, as well as monetary credibility and fiscal unsustainability. Increasingly, headline fatigue is setting in, enabling a clearer narrative to emerge.

U.S. economic forecasts have been revised sharply lower, but downgrades have plateaued, and importantly, it is expected to avoid recession in 2025. In China, a strong growth performance in the first half of 2025, combined with policy potential, has led forecasts to remain fairly robust. European forecasts have been gradually downgraded, but fiscal action is driving a rise in 2026 growth forecasts.

Shifting global dynamics have prompted investors to question a key long-held assumption: U.S. exceptionalism. This has been reflected in a drop in the U.S. dollar to a three-year low, defying both interest rate differential dynamics and its traditional behavior during times of heightened volatility. Instead, gold has been a key beneficiary of safe haven flows, while Germany's fiscal stimulus and Asia’s tech expertise have also attracted greater investor interest. Looking ahead, robust macro dynamics and improved policy stability may moderate further USD decline as investors assess the relative return prospects of U.S. assets.

Tariffs: A (less) punishing picture for U.S. growth

Key takeaway

The average U.S. tariff rate is likely to settle at around 15-17%, meaningfully higher than at the start of the year, suggesting some potential for economic scarring.

With the Trump administration stepping back from its most punitive tariff announcements, peak trade policy pessimism is firmly in the rear-view mirror, and recession odds have been

significantly reduced.

Yet, despite these corrective turns in tariff policy, there remains potential for economic scarring, as trade barriers will likely remain higher than they were at the start of the year. We expect the average effective U.S. tariff rate to ultimately settle at around 17%, the highest level since the 1930s Smoot-Hawley tariffs and meaningfully higher than 2% at the start of 2025. This should create a lasting drag on GDP worth about 1.7% and a one-time increase in inflation of 1.6%. While not as severe as initially seemed likely, the ensuing negative impact of these tariffs remains a sizable headwind on both U.S. growth in 2025 and 2026.

Importantly, trade policy uncertainty is likely to remain elevated. Legal challenges to the administration’s ability to act unilaterally on tariffs suggest a gradual shift toward sectoral rather than country tariffs should be expected. Meanwhile, the administration will likely use tariffs as a negotiating tool going forward, making tariff noise a more permanent feature of the economic backdrop.

Download full PDF

Fiscal and monetary policy tread a narrow path

Key takeaway

Rising inflation and low layoffs will keep the Fed on the sidelines until Q4. The positive growth impact from the tax bill will be more than offset by the negative impact from tariffs.

The Federal Reserve is navigating a narrow path. Trade uncertainty is ripe ground for policy missteps, particularly when jobs data remains resilient, inflation is still running above target and likely to see a tariff-induced boost in Q3, and short-term inflation expectations have shifted higher.

The latest Fed dot plot still showed 50bps worth of cuts this year. Yet, with the economy providing little reason for urgent and significant cuts, we continue to expect the Fed to resume rate cuts only in late Q4, followed by a further three cuts next year. A caveat: a more dovish Fed chair could accelerate the easing path—but only if inflation pressures remain contained.

Meanwhile, with increased focus on debt sustainability, fiscal policymakers are equally navigating a difficult path. The net effect of fiscal policy on growth is likely to be contractionary over the next year as the positive impact from the tax bill is more than offset by the combined effect of tariffs—a de facto tax hike—and a decrease in federal grant spending. This should see a gradual improvement in the budget deficit at the expense of growth.

Fiscal policymakers need to tread carefully to avoid triggering a sharp slowdown in growth that inadvertently worsens historically elevated budget deficits.

Download full PDF

U.S. equities: Resilience amid macro shocks

Key takeaway

In the near-term, the diminished cushion of caution implies U.S. markets are vulnerable to disruption. Beyond that, however, earnings growth should ensure positive returns.

U.S. equity markets have fully recovered from earlier losses, with the S&P 500 reaching a new record high in late Q2. While several sectors contributed to the rebound, including financials, industrials, and utilities, technology—particularly the Mag 7—was the primary driver, rebounding sharply from its April 9 trough, as big tech earnings continued to deliver and AI productivity gains come closer into view.

Yet, this broad market recovery contrasts with an economic backdrop of slower growth, elevated inflation, and ongoing policy uncertainty. With the impact of earlier tariff tensions likely to begin manifesting in upcoming data, near-term volatility is expected to persist.

Beyond the short term, however, investors should expect to see continued gains in the S&P 500. Market disruptions from policy uncertainty are typically short-lived if companies continue to deliver on earnings. In turn, earnings generally follow economic growth—even if it is modest.

AI innovation should remain a key driver of performance despite rising global competition, especially from China. While global markets, mainly Europe, have benefited from pro-growth policies, the structural U.S. investment case that has fueled recent outperformance remains compelling.�

Learn more about the factors impacting markets and portfolios in the quarter ahead by downloading the full PDF.

Download full PDF

Download full PDF

Corporate credit: Looking at the income on offer

Key takeaway

Credit remains well positioned to perform strongly for the latter half of the year. Further spread tightening is unlikely, but credit offers investors an important source of income.

Strong corporate fundamentals, along with solid balance sheets and elevated profit margins, are keeping the overall corporate credit environment constructive.

Increased pessimism about the economic backdrop and a rise in trade frictions led to wider credit spreads at the start of Q2, but this was quickly reversed as tariff concerns were swept to the side. While Treasury yields ended the quarter just a few basis points lower, spreads across much of the credit landscape are once again close to historic tights.

Yet, while additional spread compression may be limited, elevated yields mean that investors should remain attracted to the income that credit offers.

Global diversification: The world is not enough

Key takeaway

Diversification—both geographic and across an even broader set of asset classes—will be�critical as global economies gain momentum and in a higher rate environment.

For the past decade, diversification was advised but rarely rewarded. Concentrated exposure to U.S. mega-cap tech delivered far superior returns than a diversified mix across assets, sectors, or regions. This persistent outperformance led to stretched valuations and masked opportunities elsewhere.

But that dynamic began to shift in early 2025. A surprise rebound in Chinese tech, Europe’s turn toward expansionary fiscal policy, and growing concerns about the U.S. outlook triggered a rotation toward global markets. A weakening dollar only reinforced the case for international exposure. Looking ahead, diversification, both geographic and across assets, will be critical. U.S. exceptionalism hasn’t disappeared; its structural advantages in innovation, scale, and productivity remain intact. But as other global economies gain momentum, U.S. outperformance is likely to be more muted.

In addition, the traditional 60/40 portfolio, while effective in recent years, faces headwinds in a higher-for-longer rate environment. Real returns may be lower, and volatility higher. That strengthens the case for even broader asset class diversification, including alternatives and private markets. Active management will be key to managing risk, enhancing returns and identifying opportunities as this cycle unfolds.

�

�

global market perspectives

For Public Distribution in the United States. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Shaken, but not stirred

4Q 2024

Download full PDF

Watch webcast

Meet the team

View next theme

View next theme

View last theme

View next theme

View last theme

Click through arrows below to learn more about our key themes.

As global growth has weakened, policymakers have started to respond. The U.S. Federal Reserve is committed to avoiding recession, while China’s recent policy measures also raise the odds of a global soft landing.

Read more about this theme

01

02

Theme 2

The U.S. economy: Slowdown does not imply recession

Labor market cooling has triggered recession concerns, but the continued strength of consumer and corporate balance sheets implies that job layoffs, and therefore recession, can be avoided. A moderation to trend growth is likely.

03

Theme 3

Central banks are determined to secure soft landings

The Fed is set to lower rates towards 3% and may frontload rate cuts if there are further signs of labor market weakness. The Fed’s commitment to a soft landing will be mirrored by other central banks keen to avoid overly strong currencies.

View next theme

View last theme

View next theme

View last theme

View last theme

Hear why Seema Shah, Chief Global Strategist, believes that despite global economic and geopolitical risks, coordinated central bank easing offers a prime risk-on investing opportunity.

3Q 2025

Global market perspectives

Seema Shah

Chief Global Strategist

Principal Global Insights Team

Brian Skocypec, CIMA

Director, Global Insights & Content Strategy

Benjamin Brandsgard

Insights Strategist

3Q 2025

Synchronized easing cycles to limit dollar downside

Key takeaway

As global central banks confront slowing growth and strengthening currencies, they will likely accelerate their pace of easing to match the Fed’s.

A synchronized global monetary easing cycle is underway. Such concerted efforts raise the odds of a global soft landing.

The initial stages of the ECB easing cycle were less intense than the Fed's, cutting rates at every other meeting. With the Euro area economic backdrop so stagnant and euro strength further challenging the struggling manufacturing sector, the ECB is unlikely to maintain its gradual pace. It will likely shift to back-to-back rate cuts during 4Q 2024, falling in line with the Fed's policy path. For the Bank of England, currency pressures and fiscal tightening will likely contribute to an acceleration of its rate-cutting pace in 2025.

With the People's Bank of China firmly in easing mode, the Bank of Japan remains the only outlier of the major central banks. Yet, the vicious unwind of the yen carry trade during early August as the BoJ announced a sharper-than-expected tightening of monetary policy has likely served as a warning signal. Going forward, the BoJ will likely adopt a gradual and cautious approach to hiking, limiting yen appreciation. With most central banks likely to match the Fed's pace of easing in 2025 and the BoJ tightening at a modest pace, the scope for further dollar weakness is limited.

U.S. equity: Dependent on Fed soft landing success

Key takeaway

Fed success in piloting a soft landing should drive further positive gains in earnings and, therefore, U.S. equities.

Strong policy easing moves have helped U.S. markets recover and even hit new highs after having been whipsawed in early August when concerns about the U.S. economy spiked. History suggests that the Fed’s success in piloting a soft versus hard landing will play a key role in dictating the forward path for U.S. equities. For example, in 1985 and 1995, rate cuts supported strong equity gains as recessions were avoided, while in 2001 and 2007, even aggressive easing could not prevent steep market declines amid economic downturns. Today, the absence of glaring household or corporate balance sheet vulnerabilities means Fed rate cuts should be enough to prevent recession, supporting a positive backdrop for corporate earnings and, therefore, equities.

Although positive returns may be constrained by a more subdued performance from Magnificent Seven technology stocks, the broadening risk appetite and earnings growth across a variety of other companies, sectors, and cap sizes are meaningfully less stretched and provide reassurance about the diversity and resilience of the U.S. markets.

View last theme

View last theme

Realization of a soft landing could provide a lift to yields

Key takeaway

While history suggests Fed cuts should push yields lower, the improvement in economic outlook suggests some mild upward drift in long-end yields, resulting in a steeper yield curve.

The third quarter of 2024 saw an acceleration in expectations of global central bank policy easing amid growth concerns. As a result, sovereign yields declined through the quarter, with 10-year U.S. Treasury yields ending around 60bps lower than where they began.

With the Fed’s cutting cycle finally underway, history suggests there may be some additional downward pressure on U.S. Treasury yields. Yet, with significant Fed easing already priced into forward rates, the front end of the yield curve may already be close to its floor. A steepening of the yield curve is likely as the long-end should drift modestly higher as preemptive Fed easing engineers a soft landing. U.S. election-related volatility, plus market focus on fiscal sustainability as 2025 tax cut extension negotiations come into view, also likely limits the downside for bond yields.

Overall, fixed income has continued to deliver positive performance in 2024, as macro conditions remain largely solid. The total yield generated from fixed income today remains attractive relative to history, and credit continues to offer additional carry to U.S. Treasurys.

Cash is not optimal in a rate cutting environment

Key takeaway

Rate cuts are reducing the attractiveness of cash. With global stimulus lifting prospects for risk assets across the globe, investors should be optimizing this constructive environment.

With the Fed’s monetary easing cycle now underway and rate cuts potentially front-loaded, the attractiveness of cash has declined. Some $6.4 trillion is currently sitting in money market funds, potentially representing an important tailwind for risk assets.

Putting a number on the potential flow into risk assets is difficult. In recent years, some of the increases in money market funds have simply been a conversion of demand deposits such as checking accounts and savings, which investors will likely maintain in liquid, safe assets. Yet, with risk assets facing a fairly positive outlook, there will inevitably be some flows into equities and credit.

Equities not only offer exposure to important secular themes, such as artificial intelligence and technology, but in a rate-cutting, soft landing environment, there is strong potential for positive returns. Similarly, high yield credits should also benefit from a rotation out of MMFs as investors look to higher yielding assets. In addition, core fixed income can offer important income stability and a hedge against downside economic risk. The final quarter of 2024 will likely be beset by U.S. election volatility. Investors will need to keep cool heads, focus on the fundamentals, and resist the temptation to revert to cash.

Read more about this theme

Read more about this theme

View last theme

View last theme

04

Theme 4

Equity markets confront valuation challenges, but Fed cuts should support continued gains.

Historically, a Fed cutting cycle without recession has resulted in a strong equity market performance. While stretched valuations suggest gains may be more limited this time, a broadening of gains beyond just tech presents opportunities.

05

Theme 5

Fixed income typically shines in a late cycle slowdown.

Fixed income spreads are tight, but elevated yields continue to draw investor interest. Fed cuts, combined with strong growth, should reduce default risk, extending the credit cycle.

06

Theme 6

With potential gains across asset classes, staying in cash is the leading risk.

With the Fed’s rate cutting cycle now underway, the attractiveness of cash is rapidly diminishing. With stimulus lifting prospects for risk assets globally, investors should be optimizing this constructive environment.�

Download Full PDF

Meet the Team

Download Full PDF

Watch Webcast

Meet the Team

Coming Soon

Read more about this theme

Read more about this theme

Read more about this theme

Seema's Key Takeaways

Seema's Key Takeaways, 1Q 2025

Hear why Seema Shah, Chief Global Strategist, believes a shift toward easier financial conditions positions investors for potential outperformance during the remainder of 2024.

4Q 2024

Global market perspectives

Seema's

Takeaways

Christian Floro, CFA, CMT

Market Strategist

Jordan Rosner

Sr. Insights Strategist

Christian Floro, CFA, CMT

Market Strategist

Jordan Rosner

Sr. Insights Strategist

Watch Webcast

Read more about this theme

Read more about this theme

Read more about this theme

Read more about this theme

Read more about this theme

Download full PDF

Download full PDF

Download full PDF

Download full PDF

Coming soon

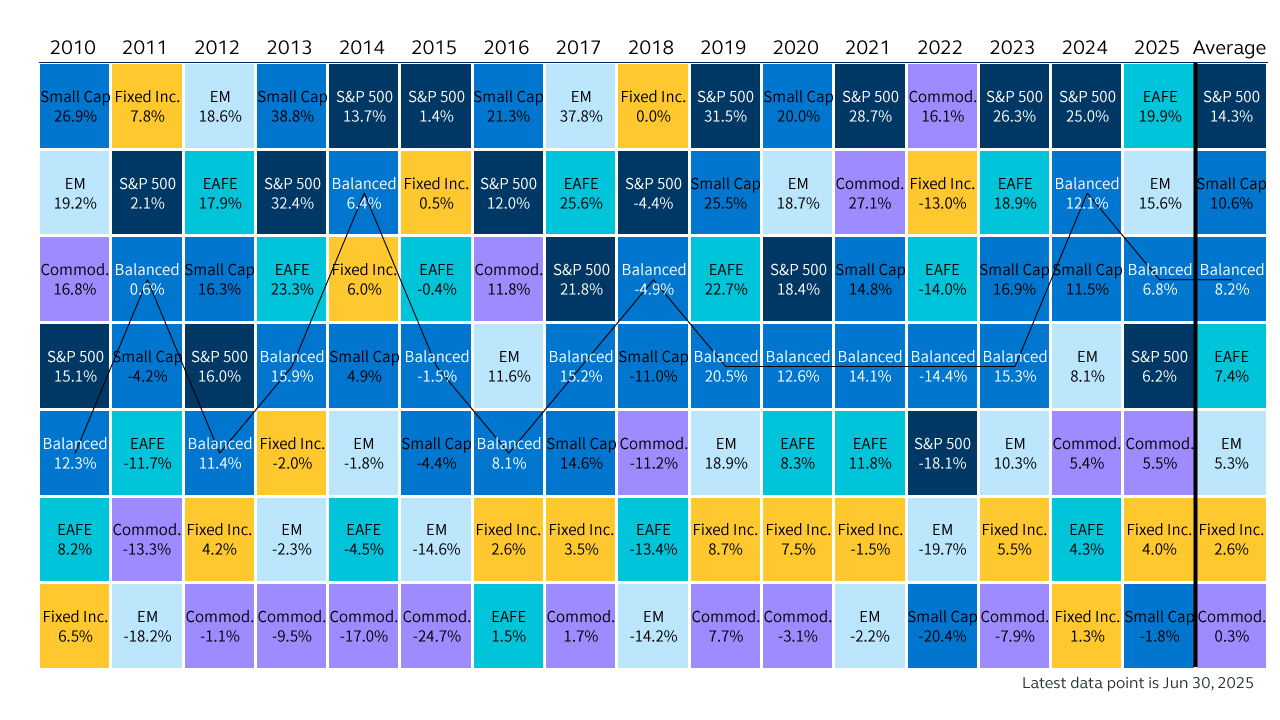

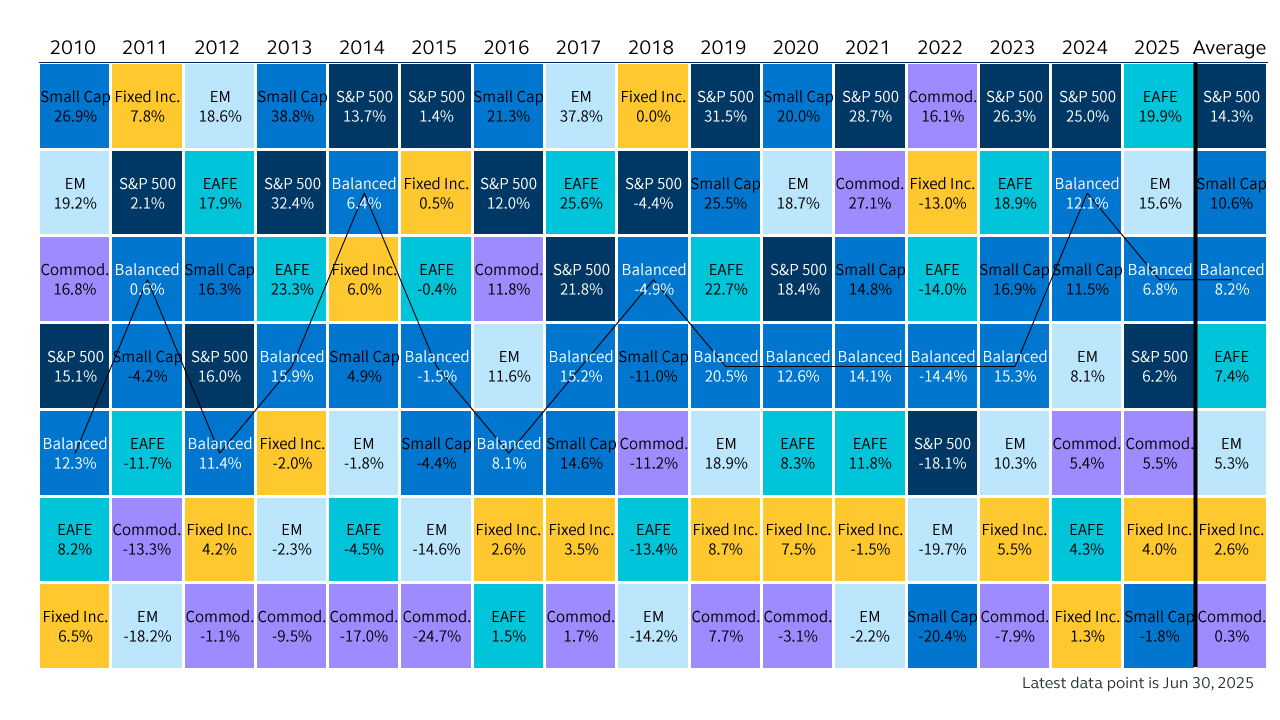

Asset class performance

�

Total return, annual averages over period shown, 2010-2025 YTD�

Source: Clearnomics, LSEG, Bloomberg. Asset classes are represented by the S&P 500, MSCI EM, MSCI EAFE, Russell 2000, iShares Core U.S. Bond Aggregate and Bloomberg Commodity Index. The Balanced Portfolio is a hypothetical 60/40 portfolio consisting of 40% U.S. Large Cap, 5% Small Cap, 10% International Developed Equities, 5% Emerging Market Equities, 35% U.S. Bonds, and 5% Commodities. Data as of June 30, 2025.

Diversification—both geographic and across an even broader set of asset classes—will be critical as global economies gain momentum and in a higher rate environment.

Asset class performance

Total return, annual averages over period shown, 2010-2025 YTD

Christian Floro, CFA, CMT

Market Strategist

Magdalena Ocampo

Market Strategist

Solid high-grade corporate balance sheets, strong fundamentals, and attractive yields create a favorable outlook for investment grade.

As defaults are unlikely to meaningfully increase if earnings hold up, high yield offers compelling value - although credit selection will be crucial.

Local currency EM debt should benefit from a weaker dollar, lower energy prices, and rate cuts.

Strong corporate fundamentals, along with solid balance sheets and elevated profit margins, are keeping the overall corporate credit environment constructive.

Increased pessimism about the economic backdrop and a rise in trade frictions led to wider credit spreads at the start of Q2, but this was quickly reversed as tariff concerns were swept to the side. While Treasury yields ended the quarter just a few basis points lower, spreads across much of the credit landscape are once again close to historic tights.

Strong corporate fundamentals, along with solid balance sheets and elevated profit margins, are keeping the overall corporate credit environment constructive.

Increased pessimism about the economic backdrop and a rise in trade frictions led to wider credit spreads at the start of Q2, but this was quickly reversed as tariff concerns were swept to the side. While Treasury yields ended the quarter just a few basis points lower, spreads across much of the credit landscape are once again close to historic tights.

Yet, while additional spread compression may be limited, elevated yields mean that investors should remain attracted to the income that credit offers.