Reduce motion

File and manage your short-term disability claim online

This guide will help you understand your short-term disability benefits and the steps to file your claim online.

Get to know short-term disability

Now that you’ve confirmed that you’re in the right place, start your short-term disability claim.

Prefer to speak to someone about your claim?

There are a lot of things to manage when you’re out of work.

User guide support

Mental health resources

NOT11_DG_GI719_01

1081955-00001-00

For residents of all states and jurisdictions except Alabama, Arizona, Arkansas, California, the District of Columbia, Florida, Kentucky, Louisiana, Maine, Maryland, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Puerto Rico, Rhode Island, Utah, Vermont, Virginia, and Washington: WARNING—Any person who knowingly and with intent to injure, defraud, or deceive any insurance company or other person, or knowing that he is facilitating commission of a fraud, submits incomplete, false, fraudulent, deceptive, or misleading facts or information when filing an insurance application or a statement of claim for payment of a loss or benefit commits a fraudulent insurance act, is/may be guilty of a crime, and may be prosecuted and punished under state law. Penalties may include fines, civil damages, and criminal penalties, including confinement in prison. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant or if the applicant conceals, for the purpose of misleading, information concerning any fact material thereto.

ALABAMA RESIDENTS: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison, or any combination thereof.

ARIZONA RESIDENTS: For your protection Arizona law requires the following statement to appear on this form. Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

ARKANSAS, DISTRICT OF COLUMBIA, LOUISIANA and RHODE ISLAND RESIDENTS—Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

CALIFORNIA RESIDENTS: For your protection, California law requires the following to appear on this form. Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

FLORIDA RESIDENTS: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing false, incomplete, or misleading information is guilty of a felony of the third degree.

KENTUCKY RESIDENTS: Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

MAINE and WASHINGTON RESIDENTS: Any person who knowingly provides false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company commits a crime. Penalties include imprisonment, fines, and denial of insurance benefits.

MARYLAND RESIDENTS: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

NEW HAMPSHIRE RESIDENTS: Any person who, with a purpose to injure, defraud, or deceive any insurance company, files a statement of claim containing any false, incomplete, or misleading information is subject to prosecution and punishment for insurance fraud, as provided in RSA 638:20.

NEW JERSEY RESIDENTS: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

NEW MEXICO RESIDENTS: Not for residents of New Mexico.

Not for use in New Mexico.

NEW YORK RESIDENTS: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation. This notice ONLY applies to accident and disability income coverages.

NORTH CAROLINA RESIDENTS: Any person who, with the intent to injure, defraud, or deceive an insurer or insurance claimant, knowing that the statement contains false information concerning a fact or matter material to the claim may be guilty of a class H felony.

PENNSYLVANIA and UTAH RESIDENTS: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any material fact thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

PUERTO RICO RESIDENTS: Any person who knowingly and with the intention of defrauding presents false information in an insurance application, or presents, helps, or causes the presentation of a fraudulent claim for the payment of a loss or any other benefit, or presents more than one claim for the same damage or loss, shall incur a felony and, upon conviction, shall be sanctioned for each violation by a fine of not less than five thousand dollars Reporting an Absence or Disability ($5,000) and not more than ten thousand dollars ($10,000), or a fixed term of imprisonment for three (3) years, or both penalties. Should aggravating circumstances be present, the penalty thus established may be increased to a maximum of five (5) years, if extenuating circumstances are present, it may be reduced to a minimum of two (2) years.

VERMONT RESIDENTS: Any person who knowingly presents a false or fraudulent claim for payment of a loss or knowingly makes a false statement in an application for insurance may be guilty of a criminal offense under state law.

VIRGINIA RESIDENTS: Any person who, with the intent to defraud or knowing that he/she is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement may have violated state law.

This policy provides disability income insurance only. It does NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Department of Financial Services.

IMPORTANT NOTICE—THIS POLICY DOES NOT PROVIDE COVERAGE FOR SICKNESS.

North Carolina Residents: THIS IS NOT A MEDICARE SUPPLEMENT PLAN. If you are eligible for Medicare, review the Guide to Health Insurance for People with Medicare, which is available from the company.

THIS IS AN EXCEPTED BENEFITS POLICY. IT PROVIDES COVERAGE ONLY FOR THE LIMITED BENEFITS OR SERVICES SPECIFIED IN THE POLICY.

Short Term Disability Insurance coverage is issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. Contract Series: 83500.

© 2024 Prudential Financial, Inc. and its related entities. Prudential, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

DISCLOSURES

Read the MyBenefits Guide

to learn more about the site.

LEARN MORE

You can call us at

You have access to NeuroFlow’s self-service tools and resources, which may help support you during this time.

Reasons to file a claim

could include

Before you start, learn more about short-term disability.

(800)-842-1718

LEARN MORE

• Pregnancy: During pregnancy, childbirth, and recovery you are unable to work and qualify for

benefits under short-term disability. This may include prenatal and post-partum complications.

• Accident/Injuries: An unexpected and unintentional incident resulting in an injury.

• Illness: A disease or sickness affecting the body or mind.

3 For illustrative purposes only. Exclusions may apply so please review your plan document for specific benefits and definitions.

Get to know short-term disability

1 Please check your plan documents for details on your specific benefits and definitions.

Reasons to file a claim could include:

The Prudential Insurance Company of America, Newark, NJ.

ACCESSIBILITY

1 For contractual definitions, please contact your employer or association.

Examples of short-term disability claims may include:

Short-term disability can provide partial income replacement if you are disabled as defined under the terms of the plan.¹ You generally need to be unable to work for a minimum period of time before benefits begin.²

• If you’ll be absent from work due to an injury or illness and are under a physician’s care.

• If you are unable to work due to childbirth or pregnancy complications.

• If you are hospitalized.

Final Step

Step 3

Step 2

Step 1

Final Step

Step 3

Step 2

Step 1

Get paid faster by signing up for Electronic Fund Transfer (EFT) if your plan allows. Payments will go directly into your bank account. Opt into EFT under the Payments section during your claim submission.

Check your status any time

When submitting your claim online, you have the option to receive certain communications from us relating to your benefits electronically via email or text.

To update your communication preferences, login to Mybenefits.com and click "Review/update your profile."

We communicate with you at your convenience

Current step: step 4

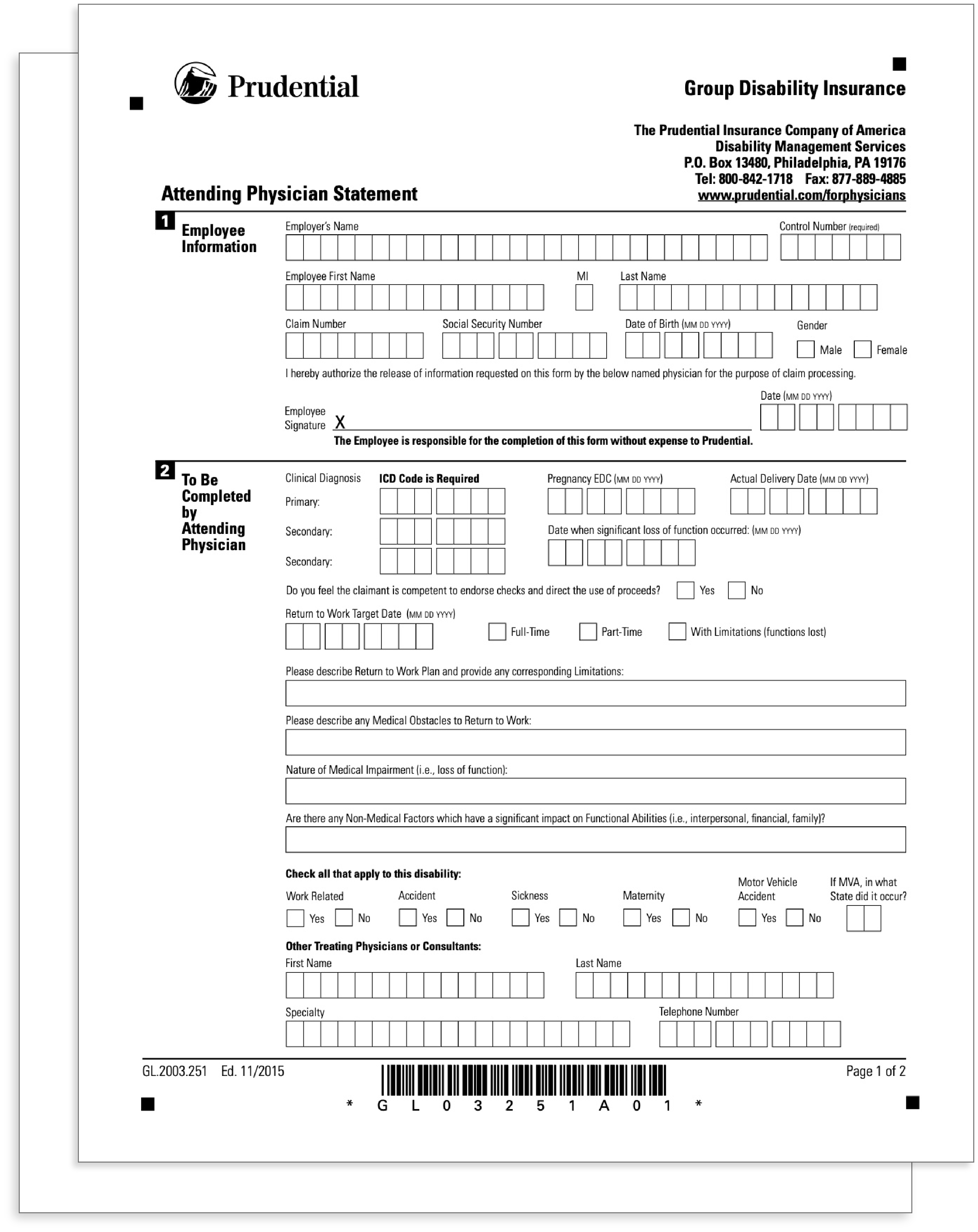

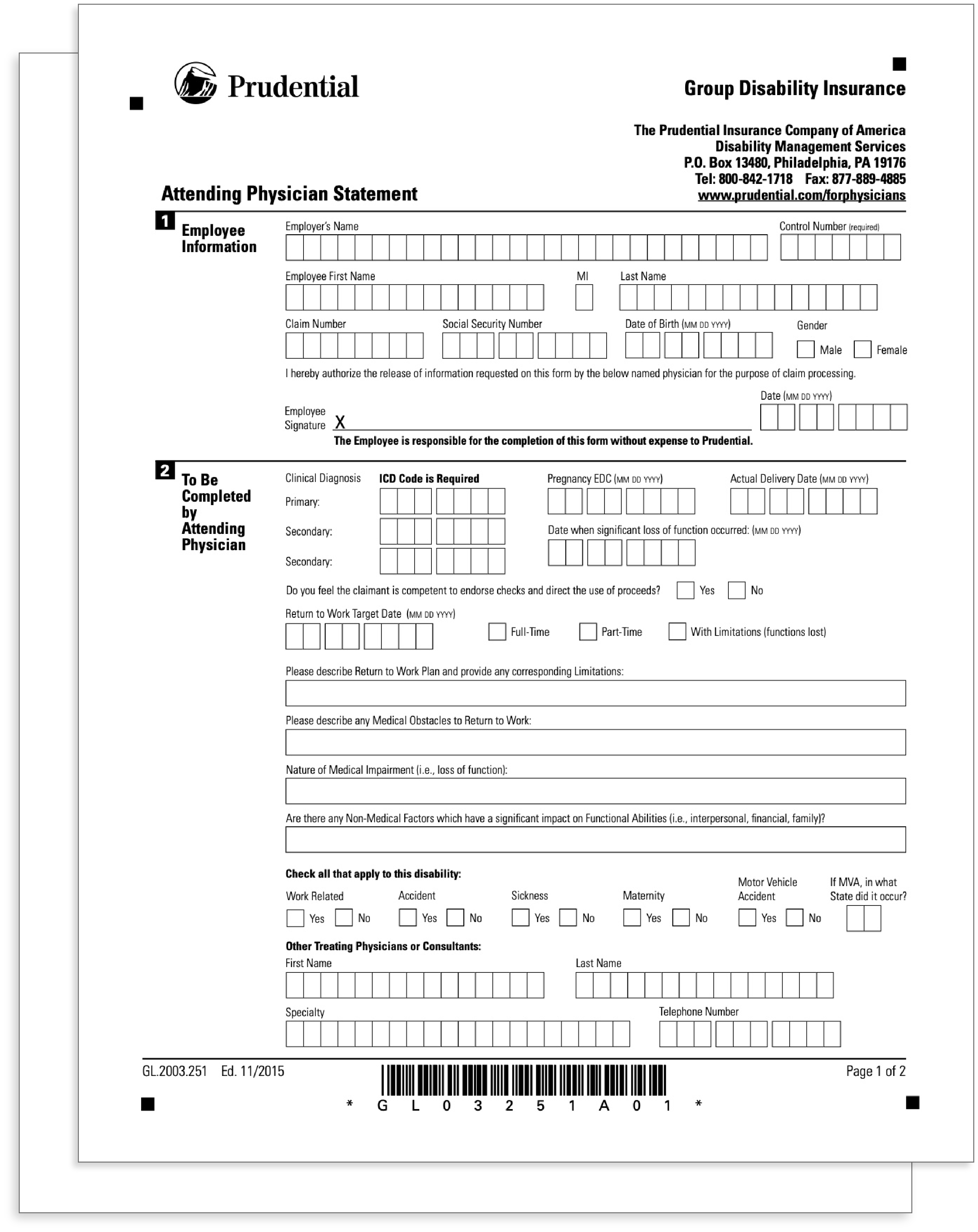

If you provide your doctor’s contact information, Prudential

will reach out to your doctor on your behalf to obtain an

Attending Physician Statement.

To help us process your claim faster, we may ask you to complete and upload forms to your claim in your MyBenefits account.

Gather medical information

Current step: step 3

• Your contact information

• Company Name

• Control Number

• Treating Physician's Name, Phone,

and Fax Number

Information you should have available:

To begin the claims submission process, you will need to provide some basic information. Starting a new claim takes about 15 minutes.

Submit your claim online

Current step: step 2

Sign into Prudential MyBenefits

New to Prudential MyBenefits? It's easy to register for your account here. You can file your claim, check your claim status, update your information, check your payment amounts and the dates payments will be made.

Setting up your account online

Current step: step 1

Click to explore

3

2 Standard contractual language ranges from 7 – 14 days.

Get paid faster by signing up for Electronic Fund Transfer (EFT) if your plan allows. Payments will go directly into your bank account. Opt into EFT under the Payments section during your claim submission.

Check your status any time

Check your claim status any time on MyBenefits. All letters sent to you are also available on MyBenefits.

Most claims will have a decision within 10 business days, but the processing time for your claim may take longer depending on different circumstances.

Check your claim status

Current step: step 5 final step

Step 4

Step 4

1

During intake, you can electronically give permission to have your medical providers release information such as medical records to Prudential. If your doctor will not accept an electronic signature, we may need you to submit the Authorization for Release of Information.

You can easily upload forms and medical documentation to your claim via your online MyBenefits account.

Get paid faster by signing up for Electronic Fund Transfer (EFT) if your plan allows. Payments will go directly into your bank account. Opt into EFT under the Payments section during your claim submission.

Current step: step 2

Step 4

Step 3

Step 2

Step 1

Step 4

Step 3

Step 2

Step 1

Get paid faster by signing up for Electronic Fund Transfer (EFT) if your plan allows. Payments will go directly into your bank account. Opt into EFT under the Payments section during your claim submission.

Check your status any time

When submitting your claim online, you can opt into email communications. Email is the fastest way to track your claim.

Check your claim status any time on MyBenefits. All letters sent to you are also available on MyBenefits.

Most claims will have a decision within 10 days, but the processing time for your claim may take longer depending on different circumstances.

We communicate with you at your convenience

Current step: step 4

If you provide your doctor’s contact information, Prudential

will reach out to your doctor on your behalf to obtain an

Attending Physician Statement.

To help us process your claim faster, we may ask you to complete and upload these forms to your claim in your MyBenefits account.

We may need you to submit the Authorization for Release of Information. This form gives your permission to have your medical providers, employer and others release information such as medical records

to Prudential. During the online claims submission process E-signature is an option. You can also print and bring a copy of the authorization form to your provider.

Gather medical information

Current step: step 3

Your claim will begin processing once you confirm your personal information and submit your claim online. Most claims are processed within 10 days. Please note that your claim may take longer to process depending on different circumstances.

• Company or association name

• Control number found in the email your employer or association shared with you,

or select "Register Here" when submitting a claim through MyBenefits and

enter the company or association name

• Date of birth

• Employee ID or Social Security number

• Job title

• Contact information

• Physician information

• Last day worked, first day out and expected return-to-work date

• Reasons for absence

Information you should have available:

You only have to provide some information from this list, and then the process should take about 15 minutes.

Submit your claim online

Current step: step 2

Sign into Prudential MyBenefits

New to Prudential MyBenefits? It's easy to register for your account here. You can file your claim, check your claim status, update your information, check your payment amounts and the dates payments will be made.

Setting up your account online

Current step: step 1

Click to explore