Black Americans have financial power and are eager to plan secure financial futures. You have the power to share the products and services to help them achieve their goals.

BY ENGAGING with

�YOUR BUSINESS �

ACCELERATE

new clients

ENGAGING with

ACCELERATE YOUR

BUSINESS BY �

new clients

RESEARCH SHOWS THAT Black Americans

This gives you the opportunity to educate clients and prospects about other ways life insurance can enhance their financial security. For example, in addition to providing a death benefit, some life insurance policies offer the potential to build cash value, which clients can access while still living, to supplement income in retirement, pay for medical expenses, and more.

80

%

of Black Americans plan to pass down some form of wealth to their families.*

have a strong commitment to financial freedom in their later years.*

%

76

say that the primary reason they own life insurance is only for final expenses.*

%

66

Myths vs. Realities�Surrounding Black Wealth

There are many myths surrounding Black Americans’ beliefs about money and their opportunities to build and sustain wealth. When you look beyond the myth and see the reality, then you’re better positioned to have proactive conversations with clients about financial strategies.**

MYTH 3

MYTH 3

MYTH 2

MYTH 2

MYTH 1

MYTH 1

Talk to clients about financial strategies, such as life insurance, that can help protect their families with a death benefit, while also providing ways to build additional income for retirement and pay for long-term health costs.

Black Americans’ economic circumstances are a result of poor financial choices on their part.

A younger generation of Black Americans know that they have agency over their path to wealth. This is your opportunity to offer suitable financial products and services, including life insurance that can help them generate the security and wealth they desire.

Black Americans don’t have sufficient wealth or income to be considered valuable customers.

Building trust is the key to building a strong relationship. �To build that trust, you must show individual clients the products and services you and Prudential can offer that can help them, their families, and their communities become �more financially secure.

Black Americans generally share the same financial lifestyle, values, and behaviors.

Black Americans are not all at the same point in their financial journeys, which is why it’s so important not to presume what products they do or don't need. The LUV+ model is a simple way to start meaningful conversations with clients. It comprises four steps—Listen, Understand, Validate, and Iterate—that help you understand clients’ mindsets, uncover their needs, and start to build trust.

START THE DISCUSSION WITH

THE LUV+ MODEL

ITERATE

ITERATE

VALIDATE

VALIDATE

UNDERSTAND

UNDERSTAND

LISTEN

LISTEN

Listen intently to clients and be sure to grasp their emotional and financial needs. Keep an open mind and put aside any assumptions.

LISTEN

Make sure you truly understand what clients are telling you about their financial situation. Understand their family dynamics and sources of income.

UNDERSTAND

Take in what is said and respond with respect, grace, and humility. Demonstrate that you understand what their challenges and goals are in your own words.

VALIDATE

Come to an understanding of the plan to start the wealth-building journey. Explain that together, you’ll monitor progress toward reaching goals and make changes as needed.

ITERATE

Check out the Tools and Resources section for a variety of materials to help you educate clients about the ways they can achieve their financial goals.

If you have questions about Blueprints to Black Wealth, please contact your Prudential wholesaler.

Questions?

Get started

For Financial Professional Use Only. Not for Use With the Public.

For nearly 50 years, Prudential has been investing in the Black community. Blueprints to Black Wealth continues to build and expand on that commitment.

Be a champion for Black Americans’ financial security.

At Prudential, we are steadfastly committed to meeting the needs of our customers. Blueprints to Black Wealth was built on a deep understanding of the diversity within the Black community and acknowledges the power and readiness of first-generation Black wealth builders.

Committed to the Needs of each and every customer

Reality: �Black Americans have been systematically denied access to information, tools, and opportunities to increase their wealth.

Opportunity:�Talk to clients about financial solutions, such as life insurance, that can help protect their families with a death benefit, while also providing ways to build additional income for retirement and pay for long-term health costs.

Black Americans’ economic circumstances are a result of poor financial choices on their part.

Reality: �Black Americans have the income and desire to build strong financial futures.In fact, employment among Black Americans is currently at a record high and their buying power is expected to rise to $1.8T by 2024. Furthermore, nearly 6 in 10 Black Americans say they are likely to buy life insurance within the next 12 months.*

Opportunity:�A younger generation of Black Americans know that they have agency over their path to wealth. This is your opportunity to offer suitable financial products and services, including life insurance that can help them generate the security and wealth they desire.

Black Americans don’t have sufficient wealth or income to be considered valuable customers.

Come to an understanding of the plan to start the wealth-building journey. Explain that together, you’ll monitor progress toward reaching goals and make changes as needed.

ITERATE

Take in what is said and respond with respect, grace, and humility. Demonstrate that you understand what their challenges and goals are in your own words.

VALIDATE

Make sure you truly understand what clients are telling you about their financial situation. Understand their family dynamics and sources of income.

UNDERSTAND

Listen intently to clients and be sure to grasp their emotional and financial needs. Keep an open mind and put aside any assumptions.

LISTEN

Black Americans are not all on the same point in their financial journies, which is why it’s so important to not presume what products they need. The LUV+ model is a simple way to start meaningful conversations with clients. It’s comprised of four steps — Listen, Understand, Validate, and Iterate — that help you understand clients’ mindsets, uncover their needs, and start to build trust.

THE LUV+ MODEL

START THE DISCUSSION WITH

Disclaimer:

*Source: LIMRA 2023 Barometer Report.

** Source: 3 myths from Seven Elements Research (2022)

© 2023 Prudential Financial, Inc. and its related entities. Prudential, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any clients or prospective clients. The information is not intended as investment advice and is not a recommendation about managing or investing a client’s retirement savings. Clients seeking information regarding their particular investment needs should contact a financial professional.

Life insurance is issued by The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

INVESTMENT AND INSURANCE PRODUCTS ARE:�NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, ANY BANK OR ITS AFFILIATES �• SUBJECT TO INVESTMENT RISKS INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

ISG_DG_ILI439_01�1050873-00004-00

If you have questions about Blueprints to Black Wealth, please contact your Prudential wholesaler.

Questions?

ACCESSIBILITY

Text Alternative

Get started

Check out the Tools and Resources section for a variety of materials to help you educate clients about the ways they can achieve their financial goals.

tend to buy life insurance �just to cover final expenses.*

*Source: LIMRA 2023 Barometer Report.

of Black Americans plan to pass down some form of wealth to their families.*

have a strong commitment to financial freedom in their later years.*

say that the primary reason they own life insurance is only for final expenses.*

There are many myths surrounding Black Americans’ beliefs about money and their opportunities to build and sustain wealth. When you look beyond the myth and see the reality, then you’re better positioned to have proactive conversations with clients about financial strategies.**

Black Americans don’t have sufficient wealth or income to be considered valuable customers.

Black Americans’ economic circumstances are a result of poor financial choices on their part.

Black Americans generally share the same financial lifestyle, values, and behaviors.

Reality: �Black Americans have the income and desire to build strong financial futures. In fact, employment among Black Americans is currently at a record high and their buying power is expected to rise to $1.8T by 2024. Furthermore, nearly 6 in 10 Black Americans say they are likely to buy life insurance within the next 12 months.*

Reality:

Opportunity:

Black Americans have been systematically denied access to information, tools, and opportunities to increase their wealth.

Reality:

Black Americans have the income and desire to build strong financial futures.I n fact, employment among Black Americans is currently at a record high and their buying power is expected to rise to $1.8T by 2024. Furthermore, nearly 6 in 10 Black Americans say they are likely to buy life insurance within the next 12 months.*

Opportunity:

Reality:

Black Americans are not a monolith. They have different lifestyles, financial goals, attitudes towards wealth, etc. �Some may already own financial products or have experience with financial professionals. Others may be starting their financial journey.

Opportunity:

HOME

TOOLKIT

ENGAGEMENT

tend to buy life insurance �just to cover final expenses.*

MYTH 4

MYTH 4

Connecting with the individual client while also recognizing their role in their family and how their actions affect their community helps create a more authentic connection. Creating authentic connections is key to unlocking business conversion.

Opportunity:

While all people have certain basic needs that may be similar, factors such as culture, race, family structures, marriage rates, intergenerational dependencies, and more influence everyone’s financial beliefs, expectations, and decisions.

Reality:

Family structures, needs, and values are basically the same for most people regardless of culture or race.

Family structures, needs, and values are basically the same for most people regardless of culture or race.

MYTH 5

MYTH 5

Position yourself and the brand as an ally, guide, and stabilizing force for clients along their financial journey. Establishing trust and connection to the brand is as important as providing the right products and services.

Opportunity:

For Black Americans, the financial journey is as much emotional as it is functional. Historically, Black Americans have been excluded from accessing financial information and tools, which has left them more vulnerable, unsure, and distrusting with respect to financial understanding and security.

Reality:

Financial needs, values, and behaviors are functional not emotional.

Financial needs, values, and behaviors are functional not emotional.

TOOLS AND RESOURCES

ENGAGEMENT

HOME

Reality: �Black Americans are not a monolith. They have different lifestyles, financial goals, attitudes towards wealth, etc. Some may already own financial products or have experience with financial professionals. Others may be starting their financial journey.

Opportunity:�Building trust is the key to building a strong relationship. To build that trust, you must show individual clients the products and services you and Prudential can offer that can help them, their families, and their communities become more financially secure.

Black Americans generally share the same financial lifestyle, values, and behaviors.

Reality: �Black Americans are not a monolith. They have different lifestyles, financial goals, attitudes towards wealth, etc. Some may already own financial products or have experience with financial professionals. Others may be starting their financial journey.

Opportunity:�Building trust is the key to building a strong relationship. To build that trust, you must show individual clients the products and services you and Prudential can offer that can help them, their families, and their communities become more financially secure.

Black Americans generally share the same financial lifestyle, values, and behaviors.

*Source: LIMRA 2023 Barometer Report.

*Source: LIMRA 2023 Barometer Report.

* Source: LIMRA 2023 Barometer Report.

** Source: 5 myths from Seven Elements Research (2022).

* Source: LIMRA 2023 Barometer Report.

Highlight products and strategies that can accelerate debt reduction and increase cash flow but aren’t complex. Express confidence and optimism without diminishing her challenges. Help her picture a future where financial worries no longer hold her back.

ITERATE

Making your money work for you now can secure the lifestyle you imagine for yourself in the future. Planning and investing with an advisor doesn’t have to be complicated.

”

“

VALIDATE

I can understand your preference for convenience when it comes to money management and investing. I also appreciate your focus on paying down debt to secure economic independence.

”

“

UNDERSTAND

I’m interested in learning more about the lifestyle you want for yourself in the future.

”

“

LISTEN

Click through to see how you can apply the LUV+ Model to this persona.

She is a single female who thinks “it’ll all work out.” She has a moderate risk tolerance and uses few financial products. She �doesn’t think she needs a financial professional because her finances �aren’t that complicated.

Motivator: Caring for self.��Key demographics: Female, millennial, 37 years old, lower income, single, renter.

Opportunities to meet her needs: Encourage her to pay down expensive debt now as a pathway to a more secure future.

Opportunities to connect: Give her a vision of herself in the future, able to do all that she wants.

MS. INDEPENDENCE

MS. INDEPENDENCE

MS. INDEPENDENCE

Highlight how you help her navigate to financial security. Express confidence and optimism without diminishing her challenges. Share products and strategies that can accelerate debt reduction and increase cash flow.

ITERATE

Protecting your money and freeing yourself from debt are top of mind for you. Budgeting and saving can be overwhelming when you don’t know where to begin, but you’re already in a good position as a homeowner.

”

“

VALIDATE

I can see that you are careful with your money and that paying off debt is a priority for you. Many people feel left out of the game when it comes to financial planning.

”

“

UNDERSTAND

Thank you for trusting me. I understand how difficult it is to manage obligations and save for the future at the same time.

”

“

LISTEN

Click through to see how you can apply the LUV+ Model to this persona.

She is a risk-averse woman who’s concerned about protecting the little money she has, while paying off debt. She often feels left out of the larger financial conversations from major institutions.

Motivator: Providing for others.

Key demographics: Female, millennial, 38 years old, lower income, homeowner.

Opportunities to meet her needs: Prioritize paying off debt and creating a budget she can work with.

Opportunities to connect: Discuss tangible ways to start saving now while providing ways she can start a long-term savings plan.

PROTECTOR

PROTECTOR

PROTECTOR

Highlight innovative products and strategies that help create a roadmap to financial security while amassing real wealth that he can pass on. Discuss the role of life insurance in leaving a legacy for loved ones. Share your qualifications and skills as an advisor who can help him reach his goals.

ITERATE

Having a plan that positions you to achieve your goals is important to you and within your reach. A diverse portfolio of assets and investments is an important component of your financial planning. You can support your family today while planning for future needs.

”

“

VALIDATE

I can tell that you are focused on having your money work for you. You have definite financial goals and are on your way to achieving them, but it can feel overwhelming at times.

”

“

UNDERSTAND

Thank you for sharing your thoughts and experiences with me. I’d like to hear more about how you leverage resources to support your lifestyle. Are there family members besides you who are involved in making financial decisions for the family?

”

“

LISTEN

Click through to see how you can apply the LUV+ Model to this persona.

A wealthy, married man with children who feels confident and prepared. He’s willing to take risks to grow wealth. However, his priority is taking care of his children, and he believes in donating to charitable causes.

Motivator: Providing for self and others.

Key demographics: Male, millennial, 43 years old, married, homeowner, high income, entrepreneur.

Opportunities to meet his needs: Show him a pathway to increase �his ability to provide for his family while securing his ability to leave �a legacy.

Opportunities to connect: Give him tools that he can use to show that he has a plan for the family. Make him feel like the hero in the story.

PROUD PROVIDER

PROUD PROVIDER

PROUD PROVIDER

Express confidence and optimism about her reaching her financial goals without diminishing her challenges. Show products and strategies that can accelerate debt reduction and increase cash flow. Share stories of clients like her you’ve helped in the past.

ITERATE

You’ve taken important first steps by owning a home and prioritizing debt reduction. Continuing to budget, save, and pay down debt is important.

”

“

VALIDATE

I can see that you’re careful with spending and that paying down debt is a priority. Many people might feel left out of the game when it comes to financial planning because of debt/income constraints.

”

“

UNDERSTAND

Thank you for trusting me. I understand how difficult it is to save for the future while handling current expenses.

”

“

LISTEN

Click through to see how you can apply the LUV+ Model to this persona.

She’s a highly educated homeowner who is confident in her financial standing and future. She started planning early and sticks to a monthly budget. She already has a portfolio of products and trusts financial advisors. ��Motivator: Caring for self and others.

Key demographics: Female, millennial, 38 years old, married, higher income, college graduate, homeowner.

Opportunities to meet her needs: Compliment and celebrate her progress and financial wins to date. Offer examples of how you can help her wealth grow more quickly than it has.

Opportunities to connect: Give her strategies that she can use to show that she is in control of the future.

SAVVY PROFESSIONAL

SAVVY PROFESSIONAL

SAVVY PROFESSIONAL

Highlight products and services that create a roadmap to financial security and real wealth. Explain how making informed decisions now can secure the future he wants. Discuss the benefits of purchasing life insurance while he’s young and healthy.

ITERATE

You want a plan to get ahead. A diverse portfolio of assets, investments, and life insurance can help support the lifestyle you want today while you prepare for the future.

”

“

VALIDATE

I can tell that you’re focused on making your money work for you and that multiple income streams are important to you. You know what you want your financial future to look like, but it sounds like you’re not sure how to get there.

”

“

UNDERSTAND

Thank you for sharing your thoughts and experiences. I’m interested in learning more about how you support your current lifestyle. Do you talk to any family members for advice?

”

“

LISTEN

Click through to see how you can apply the LUV+ Model to this persona.

He is an aspirational “American Dream” millennial. He’s thinking about buying a home and starting a family and is optimistic about the future. He’s in control of his own destiny.

Motivator: Caring for self

Key demographics: Male, 32 years old, high school education, single but marriage-minded, renter.

Opportunities to meet his needs: Focus on innovative strategies that will help him see a vision for his future. Show how diversified assets can help build total wealth.

Opportunities to connect: Help him feel like he is helping to bring others along—his family, friends, community.

STRIVER

STRIVER

STRIVER

Do you know a client or prospect who might be similar to one of these personas? See how you can put the LUV+ model into action with clients and prospects who have different lifestyles and financial goals.

PERSONAS

Highlight products and strategies that can accelerate debt reduction and increase cash flow but aren’t complex. Express confidence and optimism without diminishing her challenges. Help her picture a future where financial worries no longer hold her back.

“Making your money work for you now can secure the lifestyle you imagine for yourself in the future. Planning and investing with an advisor doesn’t have to be complicated.”

“I can understand your preference for convenience when it comes to money management and investing. I also appreciate your focus on paying down debt to secure economic independence.”

“I’m interested in learning more about the lifestyle you want for yourself in the future. ”

LISTEN | UNDERSTAND

VALIDATE | ITERATE

Click through to see how you can apply the LUV+ Model to this persona.

She is a single female who thinks “it’ll all work out.” She has a moderate risk tolerance and uses few financial products. She doesn’t think she needs a financial professional because her finances aren’t that complicated.

Motivator:

Caring for self��Key Demographics:

Female, millennial, 37 years old, lower income, single, renter.

Opportunities to meet her needs:

Encourage her to pay down expensive debt now as a pathway to a more secure future.

Opportunities to connect:

Give her a vision of herself in the future, able to do all that she wants.

MS. INDEPENDENCE

Highlight how you help her navigate to financial security. Express confidence and optimism without diminishing her challenges. Share products and strategies that can accelerate debt reduction and increase cash flow.

“Protecting your money and freeing yourself from debt are top of mind for you. Budgeting and saving can be overwhelming when you don’t know where to begin, but you’re already in a good position as a homeowner.”

“I can see that you are careful with your money and that paying off debt is a priority for you. Many people feel left out of the game when it comes to financial planning.”

“Thank you for trusting me. I understand how difficult it is to manage obligations and save for the future at the same time.”

LISTEN | UNDERSTAND

VALIDATE | ITERATE

Click through to see how you can apply the LUV+ Model to this persona.

She is a risk-averse woman who’s concerned about protecting the little money she has, while paying off debt. She often feels left out of the larger financial conversations from major institutions.

Motivator:

Providing for others.

Key demographics:

Female, millennial, 38 years old, lower income, homeowner.

Opportunities to meet her needs:

Prioritize paying off debt and creating a budget she can work with.

Opportunities to connect:

Discuss tangible ways to start saving now while providing ways she can start a long-term savings plan.

PROTECTOR

Highlight innovative products and solutions that help create a roadmap to financial security while amassing real wealth that he can pass on. Discuss the role of life insurance in leaving a legacy for loved ones. Share your qualifications and skills as an advisor who can help him reach his goals.

“Having a plan that positions you to achieve your goals is important to you and within your reach. A diverse portfolio of assets and investments is an important component of your financial planning. You can support your family today while planning for future needs.”

“I can tell that you are focused on having your money work for you. You have definite financial goals and are on your way to achieving them, but it can feel overwhelming at times.”

“Thank you for sharing your thoughts and experiences with me. I’d like to hear more about how you leverage resources to support your lifestyle. Are there family members besides you who are involved in making financial decisions for the family?”

LISTEN | UNDERSTAND

VALIDATE | ITERATE

Click through to see how you can apply the LUV+ Model to this persona.

A wealthy, married man with children who feels confident and prepared. He’s willing to take risks to grow wealth. However, his priority is taking care of his children, and he believes in donating to charitable causes.

Motivator: Providing for self and others.

Key Demographics: Male, millennial, 43 years old, married, homeowner, high income, entrepreneur.

Opportunities to meet his needs: Show him a pathway to increase his ability to provide for his family while securing his ability to leave �a legacy.

Opportunities to connect: Give him tools that he can use to show that he has a plan for the family. Make him feel like the hero in the story.

PROUD PROVIDER

Express confidence and optimism about her reaching her financial goals without diminishing her challenges. Show products and strategies that can accelerate debt reduction and increase cash flow. Share stories of clients like her you’ve helped in the past.

“You’ve taken important first steps by owning a home and prioritizing debt reduction. Continuing to budget, save, and pay down debt is important.”

“I can see that you’re careful with spending and that paying down debt is a priority. Many people might feel left out of the game when it comes to financial planning because of debt/income constraints.”

“Thank you for trusting me. I understand how difficult it is to save for the future while handling current expenses.”

LISTEN | UNDERSTAND

VALIDATE | ITERATE

Click through to see how you can apply the LUV+ Model to this persona.

She’s a highly educated homeowner who is confident in her financial standing and future. She started planning early and sticks to a monthly budget. She already has a portfolio of products and trusts financial advisors. ��Motivator: Caring for self and others.

Key Demographics: Female, millennial, 38 years old, single, higher income, college graduate, homeowner.

Opportunities to meet her needs: Compliment and celebrate her progress and financial wins to date. Offer examples of how you can help her wealth grow more quickly than it has.

Opportunities to connect: Give her strategies that she can use to show that she is in control of the future.

SAVVY PROFESSIONAL

Highlight products and services that create a roadmap to financial security and real wealth. Explain how making informed decisions now can secure the future he wants. Discuss the benefits of purchasing life insurance while he’s young and healthy.

“You want a plan to get ahead. A diverse portfolio of assets, investments, and life insurance can help support the lifestyle you want today while you prepare for the future.”

“I can tell that you’re focused on making your money work for you and that multiple income streams are important to you. You know what you want your financial future to look like, but it sounds like you’re not sure how to get there.”

“Thank you for sharing your thoughts and experiences. I’m interested in learning more about how you support your current lifestyle. Do you talk to any family members for advice?”

LISTEN | UNDERSTAND

VALIDATE | ITERATE

Click through to see how you can apply the LUV+ Model to this persona.

He is an aspirational “American Dream” millennial. He’s thinking about buying a home and starting a family and is optimistic about the future. He’s in control of his own destiny.

Motivator:

Caring for self

Key demographics:

Male, 32 years old, high school education, single but marriage-minded, renter.

Opportunities to meet his needs:

Focus on innovative solutions that will help him see a vision for his future. Show how diversified assets can help build total wealth.

Opportunities to connect:

Help him feel like he is helping to bring others along—his family, friends, community.

STRIVER

Do you know a client or prospect who might be similar to one of these personas? See how you can put the LUV+ model into action with clients and prospects who have different lifestyles and financial goals.

PERSONAS

© 2025 Prudential Financial, Inc. and its related entities. Prudential, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any clients or prospective clients. The information is not intended as investment advice and is not a recommendation about managing or investing a client’s retirement savings. Clients seeking information regarding their particular investment needs should contact a financial professional.

Life insurance is issued by The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

INVESTMENT AND INSURANCE PRODUCTS ARE:

• NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

• NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, ANY BANK OR ITS AFFILIATES

• SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

ISG_PS_ILI5_01�1050873-00012-00

Disclaimer:

ACCESSIBILITY

Transcript

Explore this page to gain insight into the specific needs of Black Americans and access impactful sales content designed to help you guide them as they build and sustain generational wealth. Also, be sure to watch the short video for more ways Prudential can help you deepen client relationships and grow your book of business.

EMPOWER YOUR PRACTICE WITH HIGH-IMPACT SALES CONTENT

HOME

TOOLKIT

ENGAGEMENT

Text Alternative

Click through the topics below to find tools and resources that can help you drive proactive conversations with clients and prospects. We'll continue to add content to this page, so be sure to check back often.

blueprints to black wealth educational materials

Use these materials to better understand how the Blueprints to Black Wealth strategy can help you grow your business and help Black Americans build generational wealth.

Download

FINANCIAL PROFESSIONAL USE ONLY

Share

View now

Share this microsite with clients so they can access financial tools, resources, and information.

Blueprints to Black Wealth Consumer Microsite

CONSUMER FRIENDLY

Blueprints to Black Wealth Consumer Flyer

CONSUMER FRIENDLY

Blueprints to Black Wealth Consumer Microsite

Blueprints to Black Wealth Consumer Flyer

Blueprints to Black Wealth Consumer Microsite

Blueprints to Black Wealth Consumer Flyer

Blueprints to Black Wealth Consumer Microsite

Blueprints to Black Wealth Talking Points

Blueprints to Black Wealth Talking Points

Blueprints to Black Wealth Talking Points

This flyer provides a timeline of Prudential’s 50-year legacy of promoting financial inclusion.

Prudential’s History �of Inclusion

CONSUMER FRIENDLY

Share

Download

Use this flyer to help introduce the Blueprints to Black Wealth Strategy to clients and prospects.

Empowering Black Americans to Build Generational Wealth

CONSUMER FRIENDLY

Use this invitation to invite prospects and clients to your presentation.

Invitation to Let's Break the Silence: A Guide to Family Money Conversations

CONSUMER FRIENDLY

Share this flyer with clients to help them start conversations about money with their family that can help with building generational wealth

Your Guide to Discussing Finances with Your Family Flyer

CONSUMER FRIENDLY

Prudential's VP of Business Development, Keita Cline, joins the Your Money Your Life podcast to discuss why families need to talk openly about money, and the role of advisors as financial coaches for their clients.

"Your Money, Your Life" Podcast

CONSUMER FRIENDLY

Encourage the clients you work with to start having conversations about money with their families. Breaking the silence around money is the first step in helping Black families create the right money mindset so they can create generational wealth that you can help manage today and when that wealth gets passed on.

Money: From Taboo Topic to Dinner Discussion

Give a presentation to clients with tips on how they can start age-appropriate conversations about money with each member of their family and start building generational wealth.

Let's Break the Silence: A Guide to Family Money Conversations Presentation

CONSUMER FRIENDLY

This worksheet can give clients a quick estimate of their coverage needs.

Life Insurance Quick Estimator

CONSUMER FRIENDLY

Share this brochure with clients to help them understand the value of term and permanent life insurance.

Life Insurance: A Foundation of Protection for Future Generations Brochure

CONSUMER FRIENDLY

Use this script to help start conversations with clients and prospects.

Myths vs. Truths Phone Script

FINANCIAL PROFESSIONAL USE ONLY

Use this e-mail template to invite clients and prospects to a webinar about life insurance.

Producer to Client Invitation

Use this engaging presentation to host a webinar with clients and prospects.

Myths vs. Truths Powerpoint

Share

Download

Send this flyer to clients or use it as a discussion guide during conversations.

Myths vs. Truths Flyer

CONSUMER FRIENDLY

Share

View now

Share this microsite with clients to dispel the four biggest life insurance myths.

Myths vs. Truths Microsite

CONSUMER FRIENDLY

Life insurance myths are widespread, but you can clarify its true value for clients and prospects—helping to protect their loved ones’ futures. Once clients have their policies, you can maintain strong relationships with them through policy reviews.

THE TRUTH ABOUT LIFE INSURANCE

FINANCIAL PROFESSIONAL USE ONLY

FINANCIAL PROFESSIONAL USE ONLY

This guide can help clients gather the information needed for a productive annual review.

Annual Client Review Guide

CONSUMER FRIENDLY

Use this flyer to remind clients when it’s time to schedule an annual policy review.

Life Keeps Moving Flyer

CONSUMER FRIENDLY

Meet with clients at least once a year to ensure their coverage is still meeting their needs. A marriage, a growing family, and a new home are all reasons why clients' life insurance coverage may need an update.

ANNUAL POLICY REVIEWS

FINANCIAL PROFESSIONAL USE ONLY

CONSUMER FRIENDLY

CONSUMER FRIENDLY

Life insurance can help small business owners protect the ones they love and ensure their businesses continue to thrive, even after they’re gone. Use these materials to learn more and share with clients.

LIFE INSURANCE FOR SMALL BUSINESS OWNERS

FINANCIAL PROFESSIONAL USE ONLY

FINANCIAL PROFESSIONAL USE ONLY

CONSUMER FRIENDLY

CONSUMER FRIENDLY

The LIRP strategy uses the potential cash value of life insurance to help clients mitigate retirement risks on a tax-advantaged basis. Use these materials to learn more and share with clients.

Life insurance in retirement planning

FINANCIAL PROFESSIONAL USE ONLY

Ready to spread the word about Blueprints to Black Wealth? Just copy and paste the client-approved content found in the social media toolkit and start sharing today!

SOCIAL MEDIA TOOLKIT

Download

This presentation shows how you can use policy reviews to build your book of business and strengthen client relationships.

Reviewing a Client’s Insurance Plan

Download

Use our Life Policy Review approach to help clients understand the benefits of life insurance and determine what type of coverage will best meet their needs.

Policy Review Quick Guide

Share

Download

Share

Download

Download

CONSUMER FRIENDLY

Share

Download

CONSUMER FRIENDLY

Share

Download

(COMING SOON)

Download

Use this piece to understand the opportunities available to you in the business market.

Protecting the Future of Small Businesses

Download

Use this email to invite small business owners to a life insurance webinar.

Invitation to Financial Strategies for Small Business Owners Presentation

Share

Download

Show clients several insurance strategies to help them protect their business.

Insurance Strategies that Help Drive Your Business's Financial Wellness

Share

Download

Show clients how a buy-sell agreement can help protect their loved ones and their small business.

A Buy-Sell Agreement Solution

Share

Download

Show clients how life insurance can help them protect their business against the loss of key employees.

Key People Help Drive Your Business

Share

Download

Here’s how small business owners in Texas used life insurance to protect their business.

Case Study: Protect Your Small Business

Share

Download

Show clients how life insurance can help them protect their small business.

Financial Strategies for Small Business �Owners Presentation

CONSUMER FRIENDLY

CONSUMER FRIENDLY

CONSUMER FRIENDLY

CONSUMER FRIENDLY

CONSUMER FRIENDLY

CONSUMER FRIENDLY

CONSUMER FRIENDLY

Download

Help Black Americans realize their dreams of a financially secure retirement.

Four Ways to Help Black Americans Prepare for Retirement

Download

Understand the advantages of life insurance and learn strategies to help grow your business.

Reimagine the Possibilities Presentation

Download

Look for clients like Kim and David in your book of business who may be ready to discuss retirement planning.

Client Profiler: Retirement Planning

Share

Download

Use this piece to support your conversations with clients about the benefits of cash value life insurance.

Why Consider Cash Value Life Insurance

Share

Download

Share this flyer with clients to help start the retirement planning conversation.

Five Steps to Retirement Readiness

Share

Download

Share this presentation to help clients understand the advantages of life insurance.

Protection for Them. Possibilities for You Presentation

Share

Download

Use this case study to help clients understand what’s in store as they prepare for retirement.

Retirement Case Study

Download

Use this email to invite clients to a life insurance webinar.

Invitation to Protection for Them. �Possibilities for You.

YOUR BLUEPRINTS TOOLKIT

© 2025 Prudential Financial, Inc. and its related entities. Prudential, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any clients or prospective clients. The information is not intended as investment advice and is not a recommendation about managing or investing a client’s retirement savings. Clients seeking information regarding their particular investment needs should contact a financial professional.

Life insurance is issued by The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

INVESTMENT AND INSURANCE PRODUCTS ARE:

• NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

• NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, ANY BANK OR ITS AFFILIATES

• SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

ISG_PS_ILI5_01�1050873-00012-00

Disclaimer:

ACCESSIBILITY

If you have questions about Blueprints to Black Wealth, please contact your Prudential wholesaler.

Questions?

We’ll continue to add more content to this page, so be sure to check back often.

Transcript

Now, you can leverage the principles from the Blueprints to Black Wealth strategy to help clients build and sustain generational wealth. Our insights and high-impact sales content is based on rigorous research, to empower you to deliver effective financial strategies. Watch now to discover more.

Empower Your Practice with Blueprints to Black Wealth

TOOLS AND RESOURCES

ENGAGEMENT

HOME

Share

Disclaimer:

© 2023 Prudential Financial, Inc. and its related entities. Prudential, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any clients or prospective clients. The information is not intended as investment advice and is not a recommendation about managing or investing a client’s retirement savings. Clients seeking information regarding their particular investment needs should contact a financial professional.

Life insurance is issued by The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

INVESTMENT AND INSURANCE PRODUCTS ARE:�NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, ANY BANK OR ITS AFFILIATES �• SUBJECT TO INVESTMENT RISKS INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

ISG_DG_ILI392_01�1050873-00006-00

ACCESSIBILITY

Share

Download

Share

Download

Share

Download

Share

Download

Download

Share

Download

Share

Watch now

Transcript

Transcript

Share

Watch now

See how real families are shaping their financial futures with expert guidance from financial professionals.

Breaking the Silence: Family Conversations About Money

FINANCIAL PROFESSIONAL USE ONLY

Share

Download

Understand the current financial mindsets of Black Americans and how you can empower them to build wealth.

Study: Empowering Black Families

FINANCIAL PROFESSIONAL USE ONLY

Download

Use these banners on your website and email signature line to promote yourself as a Blueprints Certified Advisor.

Blueprints Promotional Banners

FINANCIAL PROFESSIONAL USE ONLY

Share

Download

Share this flyer with clients and prospects to show them how life insurance can be used as part of an overall strategy to help build generational wealth.

5 Ways Life Insurance Can Help You Build Generational Wealth Flyer

CONSUMER FRIENDLY

Share

Watch now

Use this powerful video to inspire clients and prospects to consider the legacy they want to leave to their families.

Building Black Wealth �(video featuring Tré Seals)

CONSUMER FRIENDLY

Help clients understand that life insurance offers more than just a death benefit. Reveal how some policies can build cash value, which can be a crucial part of their overall plan to build generational wealth. Watch clients experience a “lightbulb moment” when they realize they can access this cash for important milestones like a down payment on a home, college tuition, medical expenses, and more.

Life Insurance as part of an overall plan to build generational wealth

Share

Download

Use this presentation to show clients and prospects how life insurance can be used as part of an overall strategy to help build generational wealth.

5 Ways Life Insurance Can Help You Build Generational Wealth Presentation

CONSUMER FRIENDLY

Share

Download

Use this invitation to invite prospects and clients to your presentation.

Invitation to 5 Ways Life Insurance Can Help You Build Generational Wealth Presentation

CONSUMER FRIENDLY

Transcript

If you have questions about Blueprints to Black Wealth, please contact your Prudential wholesaler.

Questions?

We’ll continue to add more content to this page, so be sure to check back often.

Ready to spread the word about Blueprints to Black Wealth? Just copy and paste the client-approved content found in the social media toolkit and start sharing today!

SOCIAL MEDIA TOOLKIT

Reimagine the Possibilities Presentation

Four Ways to Help Black Americans Prepare for Retirement Flyer

Client Profiler: Retirement Planning

Reimagine the Possibilities Presentation

Four Ways to Help Black Americans Prepare for Retirement Flyer

Client Profiler: Retirement Planning

Reimagine the Possibilities Presentation

Four Ways to Help Black Americans Prepare for Retirement Flyer

Client Profiler: Retirement Planning

Download

Understand the advantages of life insurance and learn strategies to help grow your business.

Reimagine the Possibilities Presentation

FINANCIAL PROFESSIONAL USE ONLY

Download

Help Black Americans realize their dreams of a financially secure retirement.

Four Ways to Help Black Americans Prepare for Retirement

FINANCIAL PROFESSIONAL USE ONLY

Download

Look for clients like Kim and David in your book of business who may be ready to discuss retirement planning.

Client Profiler: Retirement Planning

FINANCIAL PROFESSIONAL USE ONLY

FINANCIAL PROFESSIONAL USE ONLY

Retirement Case Study

Why Consider Cash Value Life Insurance Flyer

Invitation to Protection for Them. �Possibilities for You Presentation

Protection for Them. �Possibilities for You Presentation.

Five Steps to Retirement Readiness Flyer

Retirement Case Study

Why Consider Cash Value Life Insurance Flyer

Invitation to Protection for Them. �Possibilities for You Presentation.

Protection for Them. �Possibilities for You Presentation.

Five Steps to Retirement Readiness Flyer

Retirement Case Study

Why Consider Cash Value Life Insurance Flyer

Invitation to Protection for Them. �Possibilities for You Presentation.

Protection for Them. �Possibilities for You Presentation.

Five Steps to Retirement Readiness Flyer

Share

Download

Use this case study to help clients understand what’s in store as they prepare for retirement.

Retirement Case Study

CONSUMER FRIENDLY

Share

Download

Use this piece to support your conversations with clients about the benefits of cash value life insurance.

Why Consider Cash Value Life Insurance

CONSUMER FRIENDLY

Share

Download

Use this email to invite clients to a life insurance webinar.

Invitation to Protection for Them. �Possibilities for You.

CONSUMER FRIENDLY

Share

Download

Share this presentation to help clients understand the advantages of life insurance.

Protection for Them. Possibilities for You Presentation

CONSUMER FRIENDLY

Share

Download

Share this flyer with clients to help start the retirement planning conversation.

Five Steps to Retirement Readiness

CONSUMER FRIENDLY

CONSUMER FRIENDLY

The LIRP strategy uses the potential cash value of life insurance to help clients mitigate retirement risks on a tax-advantaged basis. Use these materials to learn more and share with clients.

Life insurance in retirement planning

Protecting the Future of Small �Businesses Presentation

Protecting the Future of Small �Businesses Presentation

Protecting the Future of Small �Businesses Presentation

Download

Use this piece to understand the opportunities available to you in the business market.

Protecting the Future of Small Businesses

FINANCIAL PROFESSIONAL USE ONLY

FINANCIAL PROFESSIONAL USE ONLY

Insurance Strategies that Help Drive Your Business’s Financial Wellness Brochure

A Buy-Sell Agreement Solution Brochure

Key People Help Drive Your Business Brochure

Invitation to Financial Strategies for Small Business Owners Presentation

Financial Strategies for Small Business �Owners Presentation

Case Study: Protect Your Small Business

Insurance Strategies that Help Drive Your Business’s Financial Wellness Brochure

A Buy-Sell Agreement Solution Brochure

Key People Help Drive Your Business Brochure

Invitation to Financial Strategies for Small Business Owners Presentation

Financial Strategies for Small Business �Owners Presentation

Case Study: Protect Your Small Business

Insurance Strategies that Help Drive Your Business’s Financial Wellness Brochure

A Buy-Sell Agreement Solution Brochure

Key People Help Drive Your Business Brochure

Invitation to Financial Strategies for Small Business Owners Presentation

Financial Strategies for Small Business �Owners Presentation

Case Study: Protect Your Small Business

Share

Download

Show clients several insurance strategies to help them protect their business.

Insurance Strategies that Help Drive Your Business's Financial Wellness

CONSUMER FRIENDLY

Share

Download

Show clients how a buy-sell agreement can help protect their loved ones and their small business.

A Buy-Sell Agreement Solution

CONSUMER FRIENDLY

Share

Download

Show clients how life insurance can help them protect their business against the loss of key employees.

Key People Help Drive Your Business

CONSUMER FRIENDLY

Share

Download

Use this email to invite small business owners to a life insurance webinar.

Invitation to Financial Strategies for Small Business Owners Presentation

CONSUMER FRIENDLY

Share

Download

Show clients how life insurance can help them protect their small business.

Financial Strategies for Small Business �Owners Presentation

CONSUMER FRIENDLY

Share

Download

Here’s how small business owners in Texas used life insurance to protect their business.

Case Study: Protect Your Small Business

CONSUMER FRIENDLY

CONSUMER FRIENDLY

Life insurance can help small business owners protect the ones they love and ensure their businesses continue to thrive, even after they’re gone. Use these materials to learn more and share with clients.

LIFE INSURANCE FOR SMALL BUSINESS OWNERS

Reviewing a Client's Insurance Plan Presentation

Policy Review Quick Guide

Reviewing a Client's Insurance Plan Presentation

Policy Review Quick Guide

Reviewing a Client's Insurance Plan Presentation

Policy Review Quick Guide

Download

This presentation shows how you can use policy reviews to build your book of business and strengthen client relationships.

Reviewing a Client’s Insurance Plan

FINANCIAL PROFESSIONAL USE ONLY

Download

Use our Life Policy Review approach to help clients understand the benefits of life insurance and determine what type of coverage will best meet their needs.

Policy Review Quick Guide

FINANCIAL PROFESSIONAL USE ONLY

FINANCIAL PROFESSIONAL USE ONLY

Annual client review guide

Life keeps moving flyer

Annual client review guide

Life keeps moving flyer

Annual client review guide

Life keeps moving flyer

Share

Download

This guide can help clients gather the information needed for a productive annual review.

Annual Client Review Guide

CONSUMER FRIENDLY

Share

Download

Use this flyer to remind clients when it’s time to schedule an annual policy review.

Life Keeps Moving Flyer

CONSUMER FRIENDLY

CONSUMER FRIENDLY

Meet with clients at least once a year to ensure their coverage is still meeting their needs. A marriage, a growing family, and a new home are all reasons why clients' life insurance coverage may need an update.

ANNUAL POLICY REVIEWS

Myths vs. Truths Phone Script

Myths vs. Truths Phone Script

Myths vs. Truths Phone Script

Download

Use this script to help start conversations with clients and prospects.

Myths vs. Truths Phone Script

FINANCIAL PROFESSIONAL USE ONLY

FINANCIAL PROFESSIONAL USE ONLY

Myths vs. Truths Flyer

Invitation to Myths vs. Truths Presentation

Myths vs. Truths Presentation

Myths vs. Truths Microsite

Myths vs. Truths Flyer

Invitation to Myths vs. Truths Presentation

Myths vs. Truths Presentation

Myths vs. Truths Microsite

Myths vs. Truths Flyer

Invitation to Myths vs. Truths Presentation

Myths vs. Truths Presentation

Myths vs. Truths Microsite

Share

Download

Send this flyer to clients or use it as a discussion guide during conversations.

Myths vs. Truths Flyer

CONSUMER FRIENDLY

Share

Download

(COMING SOON)

Use this email template to invite clients and prospects to a webinar about life insurance.

Producer to Client Invitation

CONSUMER FRIENDLY

Share

Download

Use this engaging presentation to host a webinar with clients and prospects.

Myths vs. Truths Powerpoint

CONSUMER FRIENDLY

Share

View now

Share this microsite with clients to dispel the four biggest life insurance myths.

Myths vs. Truths Microsite

CONSUMER FRIENDLY

CONSUMER FRIENDLY

Life insurance myths are widespread, but you can clarify its true value for clients and prospects—helping to protect their loved ones’ futures. Once clients have their policies, you can maintain strong relationships with them through policy reviews.

THE TRUTH ABOUT LIFE INSURANCE

Breaking the Silence: Family Conversations

About Money

Study: Empowering Black Families

Breaking the Silence: Family Conversations

About Money

Study: Empowering Black Families

Breaking the Silence: Family Conversations

About Money

Study: Empowering Black Families

Share

Watch now

See how real families are shaping their financial futures with expert guidance from financial professionals.

Breaking the Silence: Family Conversations About Money

FINANCIAL PROFESSIONAL USE ONLY

Share

Download

Understand the current financial mindsets of Black Americans and how you can empower them to build wealth.

Study: Empowering Black Families

FINANCIAL PROFESSIONAL USE ONLY

FINANCIAL PROFESSIONAL USE ONLY

Life Insurance: A Foundation of Protection for Future Generations Brochure

Life Insurance Quick Estimator

Your Guide to Discussing Finances with Your Family Flyer

Invitation to Let's Break the Silence: A Guide to Family Money Conversations Presentation

Let's Break the Silence: A Guide to Family Money Conversations Presentation

"Your Money, Your Life" Podcast

Life Insurance: A Foundation of Protection for Future Generations Brochure

Life Insurance Quick Estimator

Your Guide to Discussing Finances with Your Family Flyer

Invitation to Let's Break the Silence: A Guide to Family Money Conversations Presentation

Let's Break the Silence: A Guide to Family Money Conversations Presentation �

"Your Money, Your Life" Podcast

Life Insurance: A Foundation of Protection for Future Generations Brochure

Life Insurance Quick Estimator

Your Guide to Discussing Finances with Your Family Flyer

Invitation to Let's Break the Silence: A Guide to Family Money Conversations Presentation

Let's Break the Silence: A Guide to Family Money Conversations Presentation

"Your Money, Your Life" Podcast

Share

Download

Share this brochure with clients to help them understand the value of term and permanent life insurance.

Life Insurance: A Foundation of Protection for Future Generations Brochure

CONSUMER FRIENDLY

Share

Download

This worksheet can give clients a quick estimate of their coverage needs.

Life Insurance Quick Estimator

CONSUMER FRIENDLY

Share

Download

Share this flyer with clients to help them start conversations about money with their family that can help with building generational wealth

Your Guide to Discussing Finances with Your Family Flyer

CONSUMER FRIENDLY

Share

Download

Use this invitation to invite prospects and clients to your presentation.

Invitation to Let's Break the Silence: A Guide to Family Money Conversations

CONSUMER FRIENDLY

Share

Download

Give a presentation to clients with tips on how they can start age-appropriate conversations about money with each member of their family and start building generational wealth.

Let's Break the Silence: A Guide to Family Money Conversations Presentation

CONSUMER FRIENDLY

Share

Watch now

Prudential's VP of Business Development, Keita Cline, joins the Your Money Your Life podcast to discuss why families need to talk openly about money, and the role of advisors as financial coaches for their clients.

"Your Money, Your Life" Podcast

CONSUMER FRIENDLY

CONSUMER FRIENDLY

Encourage the clients you work with to start having conversations about money with their families. Breaking the silence around money is the first step in helping Black families create the right money mindset so they can create generational wealth that you can help manage today and when that wealth gets passed on.

Money: From Taboo Topic to Dinner Discussion

Transcript

Transcript

Blueprints Promotional Banners

Blueprints Promotional Banners

Blueprints Promotional Banners

Download

Use these banners on your website and email signature line to promote yourself as a Blueprints Certified Advisor.

Blueprints Promotional Banners

FINANCIAL PROFESSIONAL USE ONLY

FINANCIAL PROFESSIONAL USE ONLY

Invitation to 5 Ways Life Insurance Can Help You Build Generational Wealth Presentation

5 Ways Life Insurance Can Help You Build Generational Wealth Presentation

5 Ways Life Insurance Can Help You Build Generational Wealth Flyer

Building Black Wealth (video featuring Tré Seals)

Invitation to 5 Ways Life Insurance Can Help You Build Generational Wealth Presentation

5 Ways Life Insurance Can Help You Build Generational Wealth Presentation

5 Ways Life Insurance Can Help You Build Generational Wealth Flyer

Building Black Wealth (video featuring Tré Seals)

Invitation to 5 Ways Life Insurance Can Help You Build Generational Wealth Presentation

5 Ways Life Insurance Can Help You Build Generational Wealth Presentation

5 Ways Life Insurance Can Help You Build Generational Wealth Flyer

Building Black Wealth (video featuring Tré Seals)

Share

Download

Use this invitation to invite prospects and clients to your presentation.

Invitation to 5 Ways Life Insurance Can Help You Build Generational Wealth Presentation

CONSUMER FRIENDLY

Share

Download

Use this presentation to show clients and prospects how life insurance can be used as part of an overall strategy to help build generational wealth.

5 Ways Life Insurance Can Help You Build Generational Wealth Presentation

CONSUMER FRIENDLY

Share

Download

Share this flyer with clients and prospects to show them how life insurance can be used as part of an overall strategy to help build generational wealth.

5 Ways Life Insurance Can Help You Build Generational Wealth Flyer

CONSUMER FRIENDLY

Share

Watch now

Use this powerful video to inspire clients and prospects to consider the legacy they want to leave to their families.

Building Black Wealth �(video featuring Tré Seals)

CONSUMER FRIENDLY

CONSUMER FRIENDLY

Help clients understand that life insurance offers more than just a death benefit. Reveal how some policies can build cash value, which can be a crucial part of their overall plan to build generational wealth. Watch clients experience a “lightbulb moment” when they realize they can access this cash for important milestones like a down payment on a home, college tuition, medical expenses, and more.

Life Insurance as part of an overall plan to build generational wealth

Transcript

Advanced Planning Legacy Presentation

Advanced Planning Legacy Presentation

Advanced Planning Legacy Presentation

Download

Use the tips and strategies in this presentation to talk to clients about legacy planning.

Advanced Planning Legacy Presentation

FINANCIAL PROFESSIONAL USE ONLY

FINANCIAL PROFESSIONAL USE ONLY

How You Can Start Building Your Legacy, �Today Flyer

Invitation to Start Planning Your Legacy, �Today Presentation

Start Planning Your Legacy, Today Presentation

How You Can Start Building Your Legacy, �Today Flyer

Invitation to Start Planning Your Legacy, �Today Presentation

Start Planning Your Legacy, Today Presentation

How You Can Start Building Your Legacy, �Today Flyer

Invitation to Start Planning Your Legacy, �Today Presentation

Start Planning Your Legacy, Today Presentation

Share

Download

Use this flyer to help clients understand what should be considered when planning a legacy.

How You Can Start Building Your Legacy, �Today Flyer

CONSUMER FRIENDLY

Share

Download

Use this to invite clients and prospects �to your presentation.

Invitation to Start Planning Your Legacy, �Today Presentation

CONSUMER FRIENDLY

Share

Download

Use this presentation to show clients and prospects why it’s important to be intentional about planning their legacy.

Start Planning Your Legacy Today Presentation

CONSUMER FRIENDLY

CONSUMER FRIENDLY

Whether clients have existing wealth or are first-generation wealth builders, they’ll want to ensure that wealth is passed safely to future generations. As their trusted advisor, you can start meaningful conversations with clients and help them create a multi-generational legacy that reflects their values.

Guiding Legacy Conversations with Black Americans

Download

Dispel the myth that you have to be wealthy to create a legacy.

A client’s legacy

CONSUMER FRIENDLY

Download

Quick points about Blueprints to Black Wealth and how the program can help you grow your business.

Blueprints to Black Wealth �Talking Points

FINANCIAL PROFESSIONAL USE ONLY

GUIDING LEGACY CONVERSATIONS

GUIDING LEGACY CONVERSATIONS

GUIDING LEGACY CONVERSATIONS

Family money discussions

Family money discussions

Family money discussions

Building GENERATIONAL WEALTH

building GENERATIONAL WeALTH

Building GENERATIONAL WEALTH

truths about life insurance

truths about life insurance

truths about life insurance

retirement planning

retirement planning

retirement planning

small business owners

small business owners

small business owners

annual policy reviews

annual policy reviews

annual policy reviews

Download

Encourage clients to explore life insurance options that can help ensure their legacies stand the test of time.

Celebrate and strengthen your financial foundation

CONSUMER FRIENDLY

Download

Share this candid short video so clients can meet Dr. Soaries, founder of the free Financial Freedom Movement®.

Meet Dr. Soaries

CONSUMER FRIENDLY

Download

Add your headshot and proudly identify yourself as Blueprints to Black Wealth Certified Financial Professional.

Blueprints to Black Wealth �Certified Advisor

CONSUMER FRIENDLY

Estate Planning

Estate planning

Estate Planning

Download

Help clients create a financial blueprint that helps them reach their goals.

Free to enjoy your wealth and leave a legacy (animated and static)

CONSUMER FRIENDLY

Download

Life insurance can help empower clients’ legacies for generations to come.

Build a legacy that lasts lifetimes

CONSUMER FRIENDLY

Download

Prudential has the tools and resources to help clients build their financial blueprint.

Make wealth building run in your family (animated and static)

CONSUMER FRIENDLY

Download

Break the myth that life insurance is too expensive. Help clients understand that life insurance can be affordable.

More affordable than you think

CONSUMER FRIENDLY

Download

Share this short clip to show clients how renowned typeface designer, Tré Seals is taking steps to preserve his family’s legacy.

Meet Tré Seals

CONSUMER FRIENDLY

Download

No matter what stage of life clients are in, you can help them protect their life's work.

Start where you are, protect what you’ve built

CONSUMER FRIENDLY

Download

Life insurance from Prudential can help clients protect their dreams—and their family’s future.

Protecting your dreams through all of life’s seasons

CONSUMER FRIENDLY

Download

Break the myth that life insurance is too expensive. Help clients understand that life insurance can be affordable.

Protect priceless moments without breaking the bank

CONSUMER FRIENDLY

Download

Understand the current financial mindsets of Black Americans and how you can help empower them to build wealth.

Study: Building Generational Wealth with Life Insurance

FINANCIAL PROFESSIONAL USE ONLY

Study: Building Generational Wealth with Life Insurance

Study: Building Generational Wealth with Life Insurance

Study: Building Generational Wealth with Life Insurance

Download

Understand the current financial mindsets of Black Americans and how you can empower them to build wealth.

Study: Guiding Legacy Conversations

FINANCIAL PROFESSIONAL USE ONLY

Study: Guiding Legacy Conversations

Study: Guiding Legacy Conversations

Study: Guiding Legacy Conversations

(COMING SOON)

(COMING SOON)

(COMING SOON)

(COMING SOON)

Share

Download

This flyer provides a timeline of Prudential’s 50-year legacy of promoting financial inclusion.

Prudential’s History �of Inclusion

CONSUMER FRIENDLY

Transcript

Study: Guiding Legacy Conversations

Starting the Estate Planning Conversation with Black Americans

Study: Guiding Legacy Conversations

Starting the Estate Planning Conversation with Black Americans

Study: Guiding Legacy Conversations

Starting the Estate Planning Conversation with Black Americans

Download

Understand the current financial mindsets of Black Americans and how you can empower them to build wealth.

Study: Guiding Legacy Conversations

FINANCIAL PROFESSIONAL USE ONLY

Download

Use the tips and strategies in this presentation to talk to clients about estate planning.

Starting the Estate Planning Conversation with Black Americans

FINANCIAL PROFESSIONAL USE ONLY

FINANCIAL PROFESSIONAL USE ONLY

The Estate Planning Checklist Flyer

Invitation to It's Your Estate: Are You in Control? Presentation

It's Your Estate: Are You in Control? Presentation

The Estate Planning Checklist Flyer

Invitation to It's Your Estate: Are You in Control? Presentation

It's Your Estate: Are You in Control? Presentation

The Estate Planning Checklist Flyer

Invitation to It's Your Estate: Are You in Control? Presentation

It's Your Estate: Are You in Control? Presentation

Share

Download

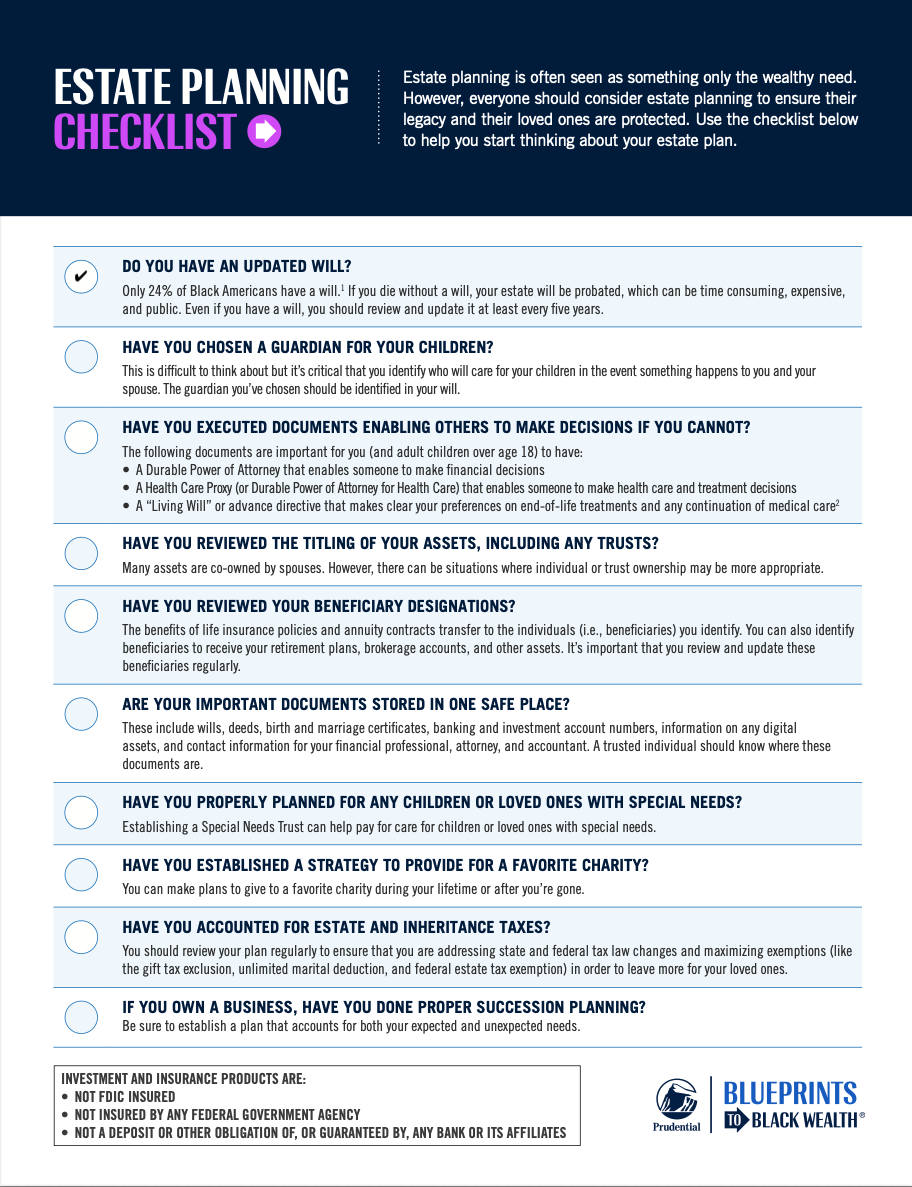

Use this checklist to guide your conversations with clients as they create their estate plans.

The Estate Planning Checklist Flyer

CONSUMER FRIENDLY

Share

Download

Use this to invite clients and prospects �to your presentation.

Invitation to It's Your Estate: �Are You in Control? Presentation

CONSUMER FRIENDLY

Share

Download

Use this presentation to show clients and prospects why it’s important to be intentional about estate planning.

It’s Your Estate: Are You in Control? Presentation

CONSUMER FRIENDLY

CONSUMER FRIENDLY

Estate planning is a valuable step for every client, regardless of the size of their wealth. As their advisor, you can help Black American families recognize that any amount of cash, possessions, or assets forms their estate—and that intentional planning ensures those resources can help support loved ones and build a lasting legacy for generations to come.

Starting the Estate Planning Conversation with Black Americans

Share

Download

Help clients save on taxes and create a lasting legacy to leave to loved ones.

Estate Planning Today and Tomorrow Flyer

CONSUMER FRIENDLY

Estate Planning Today and Tomorrow Flyer

Estate Planning Today and Tomorrow Flyer

Estate Planning Today and Tomorrow Flyer

Share

Download

Help clients save on taxes and create a lasting legacy to leave to loved ones.

Estate Planning Infographic

CONSUMER FRIENDLY

Estate Planning Infographic

Estate Planning Infographic

Estate Planning Infographic (Coming Soon)

COMING SOON

Download

Break the myth that life insurance is too expensive. Help clients understand that life insurance can be affordable.

More affordable than you think

CONSUMER FRIENDLY

Download

Dispel the myth that you have to be wealthy to create an estate plan. Encourage clients to start thinking about their estates and take action.

Estate planning is for everyone

CONSUMER FRIENDLY

Download

Share this short clip to show clients how renowned typeface designer, Tré Seals is taking steps to preserve his family’s legacy.

Meet Tré Seals

Transcript

CONSUMER FRIENDLY

Whether clients have existing wealth or are first-generation wealth builders, they’ll want to ensure that wealth is passed safely to future generations. As their trusted advisor, you can start meaningful conversations with clients and help them create a multi-generational legacy that reflects their values.

Guiding Legacy Conversations with �Black Americans