Consensus Corporate Earnings Outlook

Source: FactSet 12/31/2020. Past performance does not guarantee future results.

An earnings revival will likely be the key driver for equity markets in 2021. Profit growth will likely be very strong this year, driven mainly by improvements in revenue growth and operating leverage (due to cost cutting during the downturn). Any decline in valuation should be measured, orderly and consistent with strong equity returns, given the still supportive backdrop on interest rates and inflation.

CORPORATE EARNINGS REVIVAL IN 2021

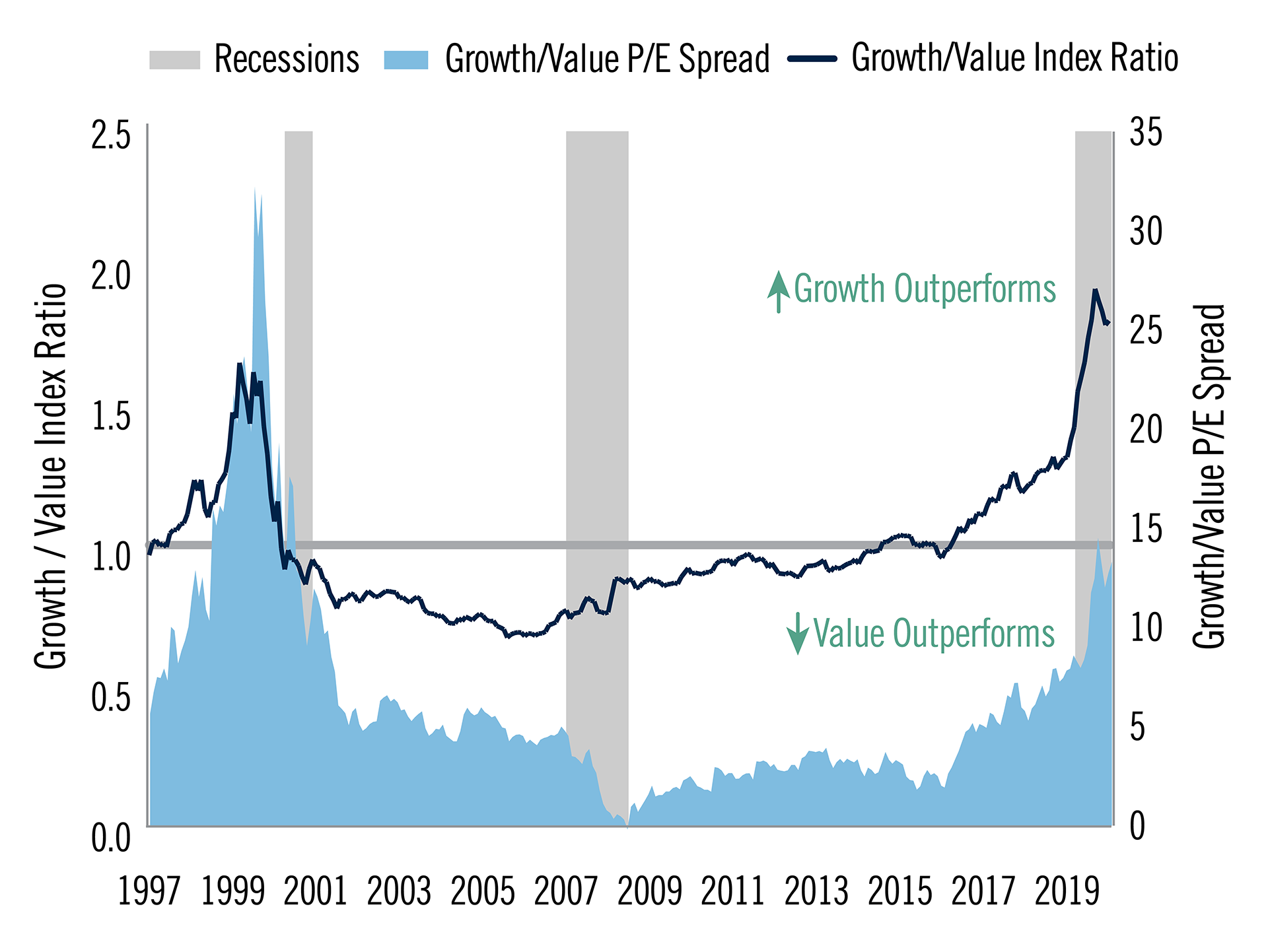

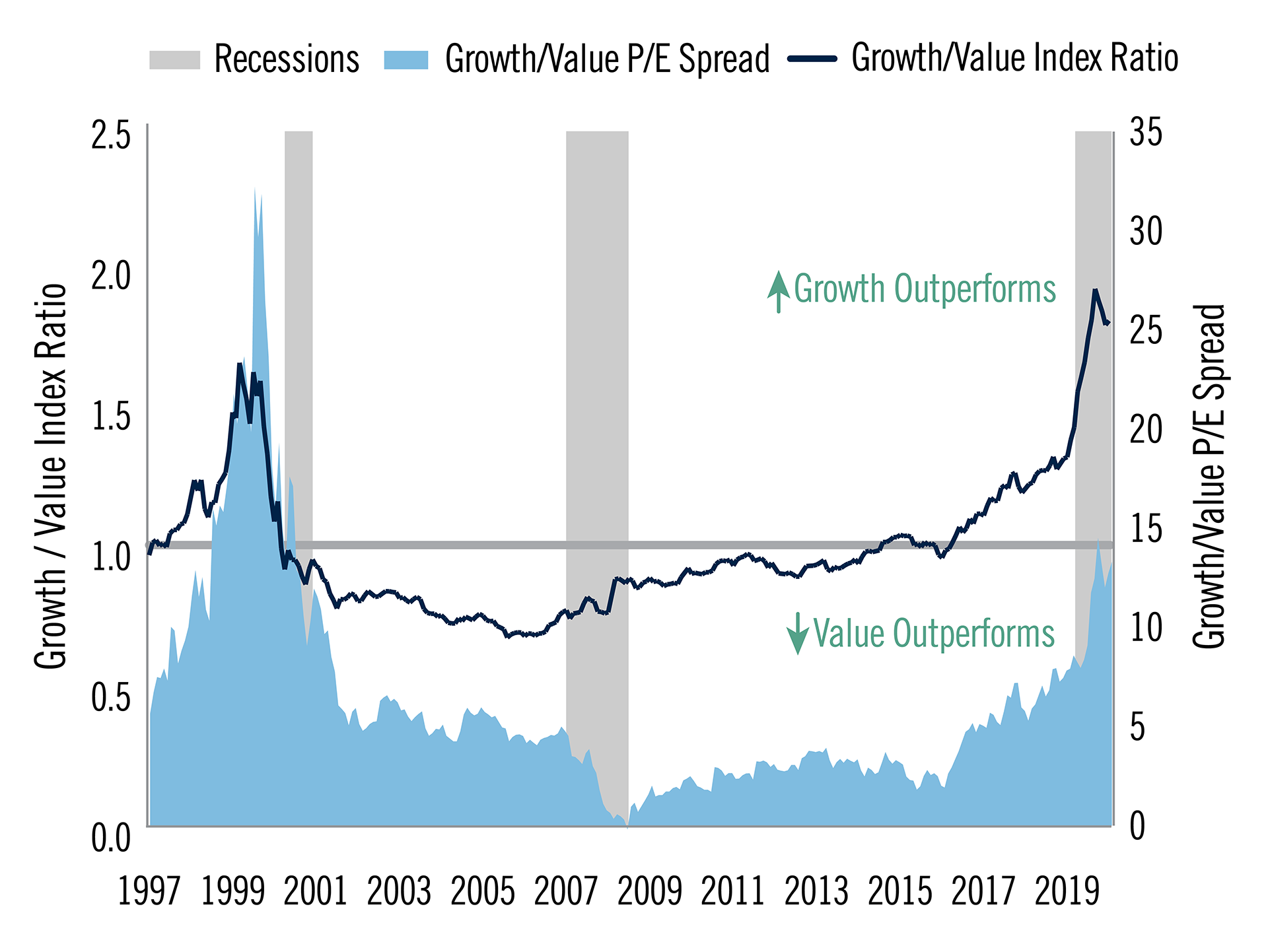

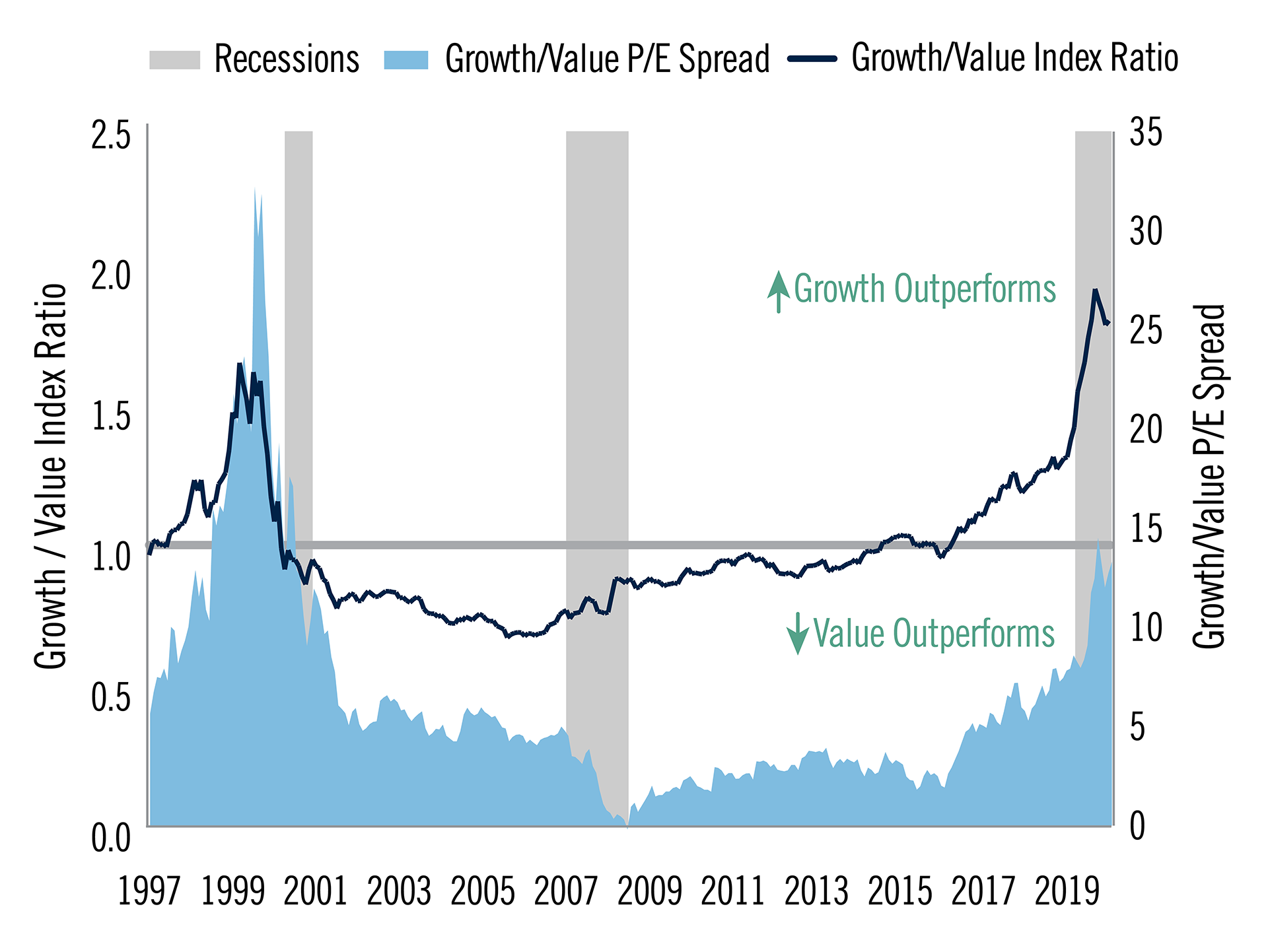

TIME FOR A GREAT ROTATION IN U.S. EQUITIES?

The theme of broader market participation in the context of continued strong equity market performance could presage performance in 2021. This year may not turn out to be a raging value market (though it could be), but the “reopening trade” (dominated by cyclicals and value stocks) should, at a minimum, vie with the “secular growth trade” for leadership. Value stocks have underperformed growth massively in recent years and may be a coiled spring if the 2021 recovery becomes more of a boom.

Source: Bloomberg as of 12/31/2020. Growth = Russell 1000 Growth Index, Value = Russell 1000 Value Index. Past performance does not guarantee future results.

Growth Outperformance and Valuations at Extreme