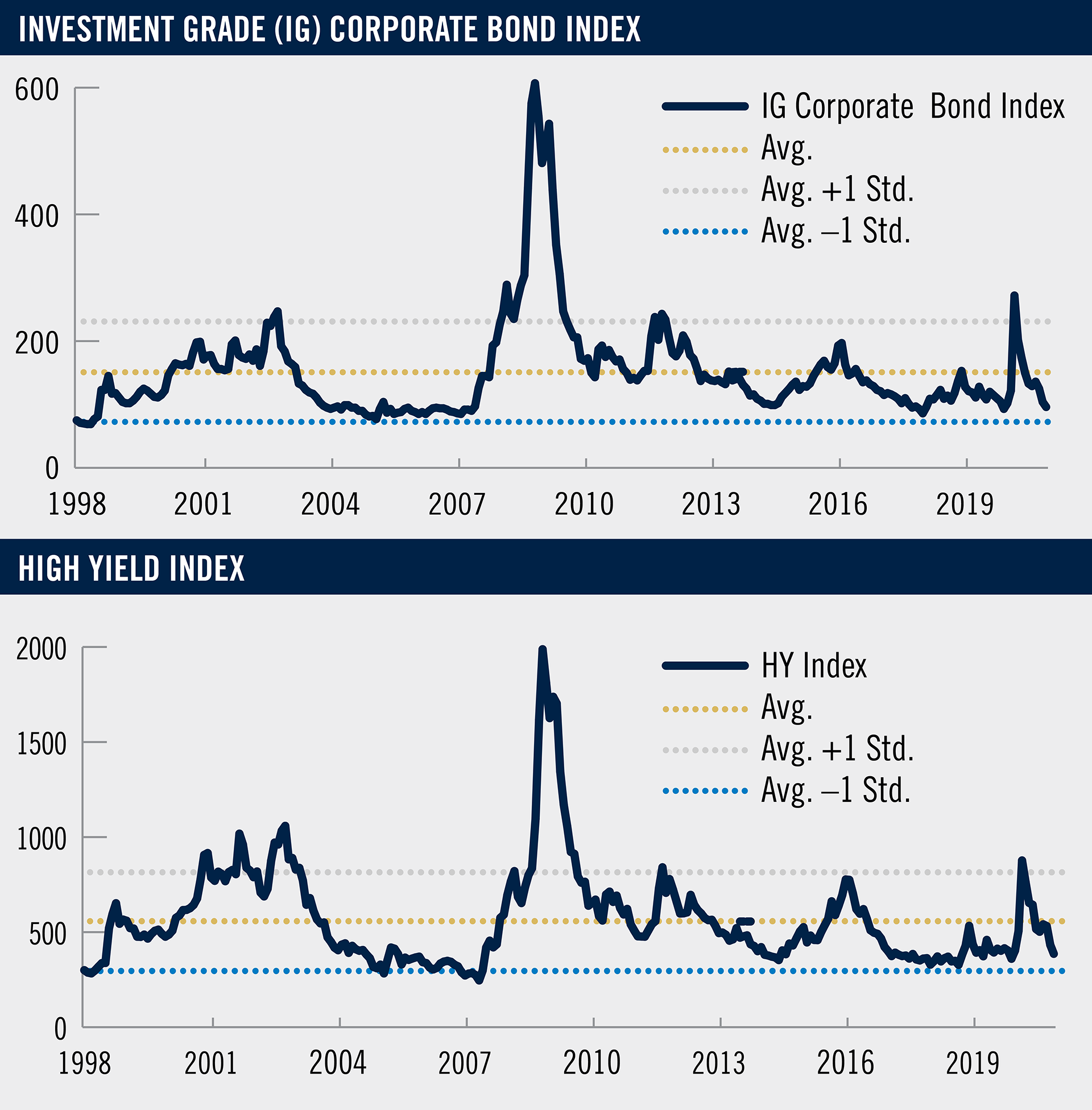

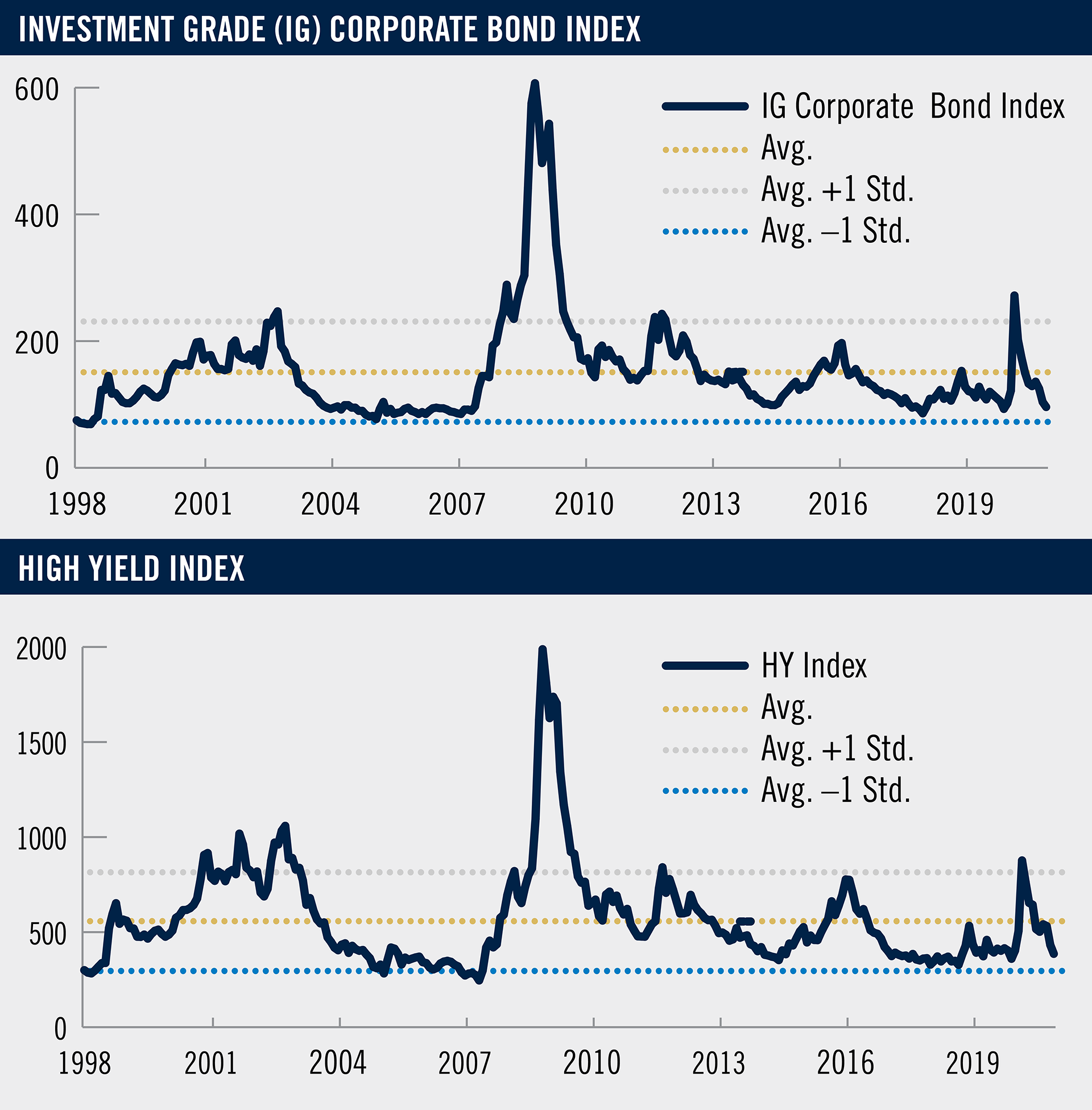

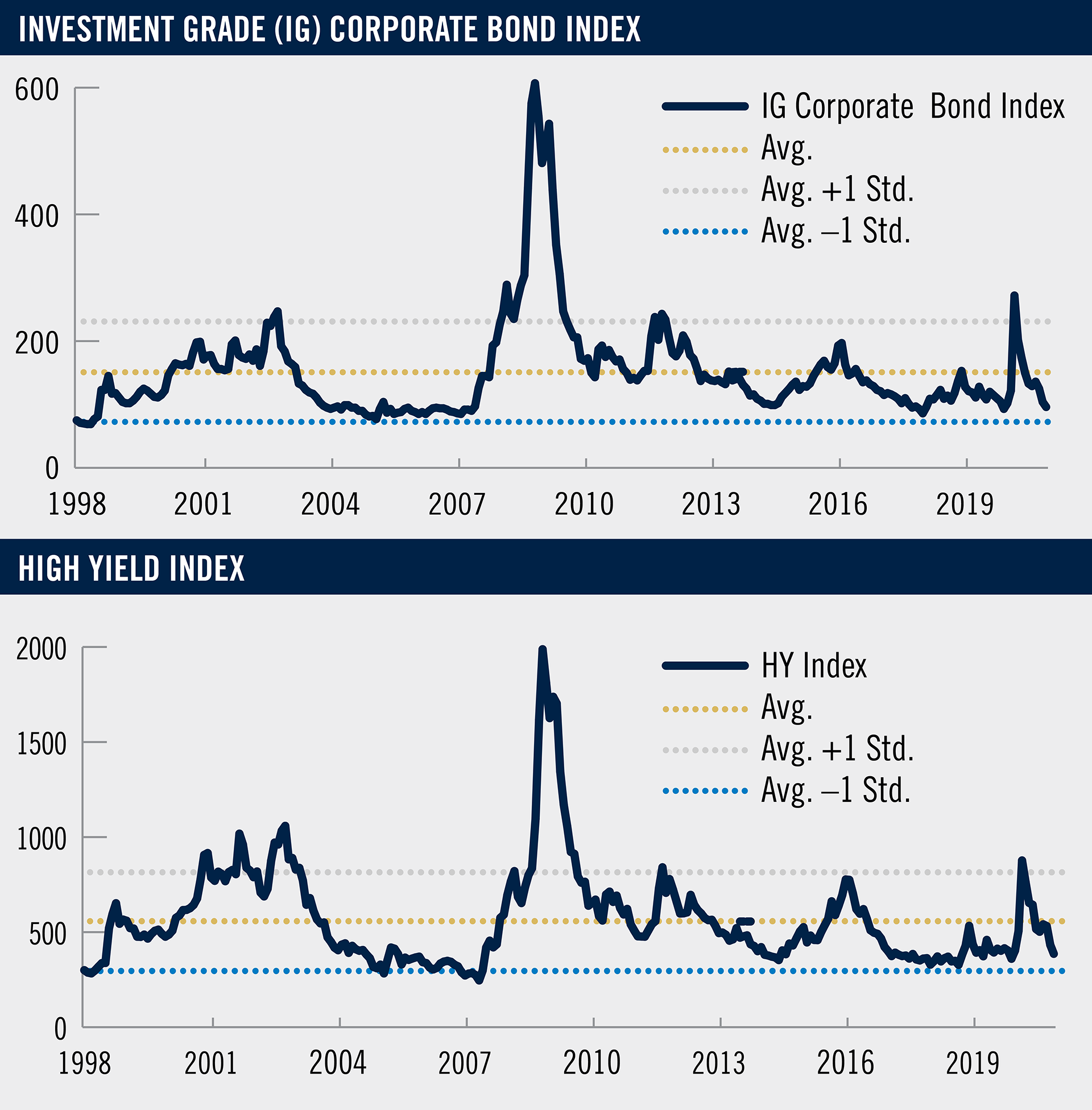

A Nice Recovery in Credit Markets

Source: Bloomberg as of 12/31/2020. IG Corporate: Bloomberg Barclays U.S. Corporate IG Bond Index. High Yield: Bloomberg Barclays U.S. High Yield Corporate Index

While spreads have recovered from their recent wide levels, they still offer long-term value. The first leg of the credit spread rally in 2020 featured assets that were directly targeted by various support programs, namely high-quality assets. For example, AAA-rated securitized products and high-quality, shorter-duration investment-grade corporate bonds rallied strongly and largely recovered. However, the second leg of the spread recovery still has room to play out in some portions of the market. Investment grade (IG) corporate and high yield (HY) bond spreads are expected to compress further, potentially testing all-time tights. Drivers include expectations for lower default rates after vaccinations and high Treasury supply, forcing rates to remain low.

ATTRACTIVE VALUATIONS