Engaging Women Clients

Women Prospect Profiles

Tools & Resources

Text Alternative

Insights for Growing Your Business with Women.

A guide to helping them achieve financial well-being.

You’re always there for the clients you serve, helping them achieve financial success. And as women make positive financial strides and experience challenges, the time is right for you to grow your business with them.

Now What? Gain the insight you need and help them make more confident financial decisions with the tools in this playbook.

What?

Now

What ?

Gain the insight you need and help them make more confident financial decisions with the tools in this playbook.

Tips for engaging

women clients

Women Prospect Profiles

COMING SOON

Women’s purchasing power is increasing.

47%

$10.9t

of women now have primary or shared responsibility for their families’ financial decisions.*

in assets are controlled by women, and that’s expected to grow to $30 trillion by 2030.**

And they’re looking for financial protection–including life insurance.

96%

67%

of U.S. women own life insurance— compared with 58% of U.S. men.***

of U.S. women say they need insurance or need more insurance.***

*Source: Financial Advisor Magazine, “Women Hold Majority of Personal Wealth, But Still Minorities in Advisory Field,” March 25, 2020).

Hungry for financial info?

Watch this video to learn how women are confidently taking control of their financial situations—and what they are looking for financial professionals to provide.

Please reach out to your Prudential wholesaler for more information or to schedule an appointment.

Engaging Women Clients

Transcript

Who’s

Rock?

COMING SOON

Tools & Resources

Your

Life insurance is issued by Pruco Life Insurance Company (except in NY), and Pruco Life Insurance Company of New Jersey (in NY). All are Prudential Financial companies located in Newark, NJ.

© 2025 Prudential Financial, Inc. and its related entities.

For Financial Professional Use Only. Not For Use With Consumer.

ISG_DG_ILI521_01

1068679-00005-00 Ed. 04/2025

Disclosure:

Accessibility

Who’s Your Rock?

96% of women now have primary or shared responsibility for their families’ financial decisions.

47% of U.S. women own life insurance— compared with 58% of U.S. men.

67% of U.S. women say they need insurance or need more insurance.

***Source: Life Insurance Brief: U.S. Women, LIMRA, 2022. Among women ages 18 – 75.

*Source: Financial Advisor Magazine, “Women Hold Majority of Personal Wealth, But Still Minorities in Advisory Field,” March 25, 2020.

**Life Insurance Brief: U.S. Women. LIMRA, 2022.

You want to better understand women's financial needs.

Transcript

Now What ?

10.9 trillion dollars in assets are controlled by women, and that’s expected to grow to 30 trillion dollars by 2030.**

Discover helpful tips for engaging women clients

Now

You want to better understand women's financial needs.

Back

to top

Discover helpful tips for engaging women

Discover helpful tips for engaging women

Life insurance is issued by Pruco Life Insurance Company (except in NY), and Pruco Life Insurance Company of New Jersey (in NY). All are Prudential Financial companies located in Newark, NJ.

© 2024 Prudential Financial, Inc. and its related entities.

For Financial Professional Use Only. Not For Use With Consumer.

ISG_DG_ILI521_01

1068679-00005-00 Ed. 04/2025

Disclosure:

Accessibility

Text alternative

Home

Tools & Resources

Women Prospect Profiles

Engaging Women Clients

"Growth - financial wellness for all" video.

Who’s your rock

Source: Financial Advisor Magazine, “Women Hold Majority of Personal Wealth, But Still Minorities in Advisory Field,” March 25, 2020.

Life Insurance Brief: U.S. Women. LIMRA, 2022.

Source: Life Insurance Brief: U.S. Women, LIMRA, 2022. Among women ages 18 – 75.

***Source: Life Insurance Brief: U.S. Women, LIMRA, 2022. Among women ages 18 – 75.

Source: Life Insurance Brief: U.S. Women, LIMRA, 2022. Among women ages 18 – 75.

Tools & Resources

Women Prospect Profiles

Engaging Women Clients

Home

Women Prospect Profiles

There’s not just one type of financial experience for women

We’ve created profiles to capture five key women’s segments. When you’re ready to align these segments with Prudential’s products, visit our product portfolio.

Young Professionals

Mature Women

Affluent Women

Sole Parents

Stay-at-Home Moms

Young Professionals

Average age: 37 years old

Majority married

87% HHI $75k+

65% HH Assets $100k+

Please reach out to your Prudential wholesaler for more information or to schedule an appointment.

Visit Now

The following profiles and data are based on research from the 2022 LIMRA What Women Want in Financial Services study and 2022 Kantar U.S. Monitor.*

•

•

•

•

65%

Risk Tolerance:

65% would take risks to take advantage of rewards.

How do they want to feel?

Confidence to plan:

76%

70%

Want to feel competent

Want to feel successful

23%

Have confidence to plan for their financial future.

What are their financial needs?

Wealth building

Retirement savings

Debt management

Financial emergencies

Protection in case of premature death

Debt management

Protection in case of premature death

Financial emergencies

Wealth building

Retirement savings

Debt management

Protection in case of premature death

Financial emergencies

Wealth building

Retirement savings

59%

Want to save

for retirement

Want to

build wealth

53%

Want to feel prepared for financial emergencies

48%

Want to ensure family is secure in case of death

43%

Want to manage and pay off debt

40%

Have challenges with balancing short-term needs and long-term goals

46%

Are overwhelmed by debt

48%

Are overspending

58%

Are overwhelmed by investing

72%

Needs vs. Goals

Debt

Overspending

Investing

Needs vs. Goals

Debt

Overspending

Investing

Needs vs. Goals

Debt

Overspending

Investing

What are their challenges?

Considerations:

Actions:

They have the longest time horizon for growth potential.

Consider balancing affordability and upside potential with products offering cash value, such as Variable Life.

For more information about our products and riders, key features, and commonly used strategies, visit our product portfolio.

Visit Now

Term Life that can be converted to a permanent life insurance policy later in life.

Actions:

May face unique challenges if they become chronically ill in the future.

Considerations:

Are worried about unexpected expenses

52%

Are overspending

56%

Are overwhelmed by investing

68%

Are living paycheck-to-paycheck

66%

Unexpected expenses

Overspending

Investing

Financial security

Unexpected expenses

Overspending

Investing

Financial security

What are their challenges?

Want to ensure family is secure in case of death

41%

Want to save for retirement

52%

Want to manage and pay down debt

52%

Want to ensure family is secure in case of income loss

54%

Want to feel prepared for financial emergencies

56%

Protection in case of premature death

Retirment

Debt

Protection against income loss

Financial emergencies

Protection in case of premature death

Retirement

Debt

Protection aganist income loss

Financial emergencies

What are their financial needs?

Have confidence to plan for their financial future.

21%

Confidence to plan:

Want to feel empowered

90%

Want to feel safe and protected

91%

How do they want to feel?

63%

Risk Tolerance:

63% would take risks to take advantage of rewards.

Average age: 41 years old

69% HHI $35k – $75k, 31% $75k+

32% HH Assets <$25k+,

43% $25k– $100k,

21% $100k+

About half are single mothers, half are divorced or separated mothers.

•

•

•

•

Sole Parents

May need supplemental income in future as part of overall goals.

Death benefit protection.

Death benefit protection.

May face unique challenges if they become chronically ill in the future.

May need supplemental income in future as part of overall goals.

A cash value life insurance policy such as Indexed Variable Universal Life or Indexed Universal Life.

A budget-friendly alternative, such as Term Life.

A chronic illness rider to help cover unexpected expenses later in life.

•

•

Prudential policies also offer protection and cash value growth potential that can help supplement income later in life.

Actions:

They need protection and the ability to grow assets to enjoy later in life.

Considerations:

Have challenges with balancing short-term needs and long-term goals

47%

Are overspending

48%

Feel overwhelmed by investing

63%

Needs vs. goals

Overspending

Investing

Needs vs. goals

Overspending

Investing

What are their challenges?

Want to ensure family is secure in case of death

48%

Want to feel prepared for financial emergencies

44%

Want to pay

for college

42%

Need help managing investments

59%

Want to save for retirement

62%

Protection in case of premature death

Financial emergencies

College Tuition

Investments

Retirement

Protection in case of premature death

Financial emergencies

College tuition

Investments

Retirement

What are their financial needs?

Have confidence to plan for their financial future

30%

Confidence to plan:

Want to feel successful

70%

Want to feel connected, relationships

82%

How do they want to feel?

60%

60% would take risks to take advantage of rewards.

Risk Tolerance:

Average Age: 42 years old

100% HHI $150k+

78% HH Assets $100k+

Majority married, with children

•

•

•

•

Affluent Women

Want feel excited, engaged

71%

Consider a Variable Universal Life policy designed for accumulation.

A Survivorship policy, which may offer a cost savings vs. two individual policies.

A chronic illness rider to help with any expenses associated with chronic or terminal illness.

A chronic illness rider to help prepare for the potential impact of unexpected chronic illness.

Protection-focused products that have no market risk or provide downside protection like Universal Life or Indexed Universal Life.

Actions:

Some may not need a death benefit when their spouse passes but may seek coverage for wealth transfer to the next generation.

It’s also important for them to plan for the potential impacts of chronic illness.

Protection and saving for retirement are important to them.

Some may not need a death benefit when their spouse passes but may seek coverage for wealth transfer to the next generation.

It’s also important for them to plan for the potential impacts of chronic illness.

Protection and saving for retirement are important to them.

Considerations:

Have challenges with balancing short-term needs and long-term goals

41%

Are worried about unexpected expenses

44%

Are overwhelmed by investing

53%

Have risk aversion, not willing to take some risk for higher returns, and 40% not investing.

63%

Needs vs. goals

Unexpected expenses

Investing

Risk aversion

Needs vs. goals

Unexpected expenses

Investing

Risk aversion

What are their challenges?

Want to ensure family is secure in case of death

46%

Want to feel prepared for financial emergencies

47%

Don’t want to outlast savings

46%

Want to save for retirement

54%

Are worried about covering the cost of health care

55%

Financial security

Financial emergencies

Savings

Retirement

Health Care

Financial security

Financial emergencies

Savings

Retirement

Health Care

What are their financial needs?

59%

59% would take risks to take advantage of rewards.

Risk Tolerance:

Average age: 60 years old

59% HHI $75k+

56% HH Assets $100k+

Majority married with children

•

•

•

•

Mature Women

Have confidence to plan for their financial future

20%

Confidence to plan:

Want to feel free and autonomous

77%

Want to feel self-reliant and financially independent

81%

Want to feel safe and protected

82%

How do they want to feel?

•

•

Options that offer living benefits and market downside protection.

A cash value life insurance policy can help solve for both needs.

A cash value life insurance policy can help solve for both needs.

Actions:

93% want to feel safe and protected.

Many households have higher incomes and a need to protect and grow money for retirement.

Their average age (38) gives them time to accumulate assets.

93% want to feel safe and protected.

Many households have higher incomes and a need to protect and grow money for retirement.

Their average age (38) gives them time to accumulate assets.

Considerations:

Have challenges with balancing short-term needs and long-term goals

53%

Are worried about unexpected expenses

56%

Are overspending

61%

Are overwhelmed by investing

67%

Needs vs. goals

Unexpected expenses

Overspending

Investing

Needs vs. goals

Unexpected expenses

Overspending

Investing

What are their challenges?

Want to manage and pay down debt

47%

Want to save for retirement

53%

Want to ensure family is secure in case of income loss

53%

Want to ensure family is secure in case of death

56%

Want to feel prepared for financial emergencies

61%

Debt

Retirement

Protection against income loss

Protection in case of premature death

Financial emergencies

Debt

Retirement

Protection against income loss

Protection in case of premature death

Financial emergencies

What are their financial needs?

Have confidence to plan for their financial future

16%

Confidence to plan:

Want to feel connected, relationships

78%

Want to have fun and enjoyment

81%

Want to feel safe and protected

93%

How do they want to feel?

54%

54% would take risks to take advantage of rewards.

Risk Tolerance:

Average age: 38 years old

53% HHI $35k – $ 75k, 47% $75k+

33% HH Assets <$25k+, 33% $25k – $100k, 27% $100k+

Married or partnered with children

•

•

•

•

Stay-at-Home Moms

Want to feel sense of independence

72%

Those with a temporary need or who are more budget conscious.

Those with a temporary need or who are more budget conscious.

Term Life for its affordable death benefit protection.

All profiles are based on a research conducted in 2022 by Kantar U.S. Monitor and a commercial research study conducted by LIMRA in August 2022, focusing on the topic of “What Women Want in Financial Services."

The study provides an understanding of how life stage and circumstances impact women's financial goals, capacity, and behaviors critical to serving them well. There is some overlap between segments in life stage and socio-economic groups of women defined by combinations of age, income, job status, and family circumstance.

*

To build on your knowledge of different women’s segments, here are quick tips for productive conversations about financial planning and life insurance.

Five tips for discussing financial planning with women.

Provide immediate emotional benefits. Help them see how life insurance can help them feel more confident about the future and achieve their emotional aspirations.

Be empathetic. Listen more; talk less.

Teach in a way that simplifies and demystifies without being condescending.

Give them control. Women want choices and decision-making opportunities.

Make the experience as simple and convenient as possible—but customize to each client’s needs, like providing digital/mobile options if that’s their preference.

5.

1.

2.

3.

4.

Link its benefits to the specific financial needs above.

3.

Explain how it can help them:

2.

Explain its foundational role in short- and long-term financial planning.

1.

Three tips for discussing life insurance with women.

Frame it as part of a plan to help them feel more in control of and confident in their financial future.

•

Acknowledge the life insurance they currently have and explain why more coverage may be a good idea

•

Feel more in control of their finances, including spending and debt

Feel more prepared for financial emergencies

Save for retirement and invest to build wealth, while also protecting loved ones

•

•

•

Women’s ages, incomes, home lives, personal responsibilities, levels of financial education, and exposure to financial knowledge all affect what they need and how you can help as a financial professional.

Tools & Resources

Tools & Resources

Life insurance is issued by Pruco Life Insurance Company (except in NY), and Pruco Life Insurance Company of New Jersey (in NY). All are Prudential Financial companies located in Newark, NJ.

© 2025 Prudential Financial, Inc. and its related entities.

For Financial Professional Use Only. Not For Use With Consumer.

ISG_DG_ILI521_01

1068679-00005-00 Ed. 04/2025

Disclosure:

Accessibility

Next segment

Previous

Next segment

Previous

Next segment

Previous

Next segment

Previous

Back

to top

Young Professionals

Visit Now

For more information about our products and riders, key features, and commonly used strategies, visit our product portfolio.

• A cash value life insurance policy such as Indexed Variable Universal Life or Indexed Universal Life.

• A budget-friendly alternative, such as Term Life.

Actions:

May need supplemental income in future as part of overall goals.

Considerations:

Are worried about unexpected expenses

52%

Are overspending

56%

Are overwhelmed

by investing

68%

Are living paycheck-to-paycheck

66%

What are their challenges?

Want to ensure family is secure in case of death

41%

Want to save for retirement

52%

Want to manage and pay down debt

52%

Want to ensure family is secure in case of income loss

54%

Want to feel prepared for financial emergencies

56%

What are their financial needs?

Have confidence to plan for their financial future.

21%

Confidence to plan:

Want to feel empowered

90%

Want to feel safe and protected

91%

How do they want feel:

63%

Risk Tolerance:

63% would take risks to take advantage of rewards.

Average age: 41 years old

69% HHI $35k – $75k, 31% $75k+

32% HH Assets <$25k+, 43% $25k -$100k, 21% $100k+

About half are single mothers, half are divorced or separated mothers.

•

•

•

•

A chronic illness rider to help cover unexpected expenses later in life.

Actions:

May face unique challenges if they become chronically ill in the future.

Considerations:

Term Life that can be converted to a permanent life insurance policy later in life.

Actions:

Death benefit protection.

Considerations:

Visit Now

For more information about our products and riders, key features, and commonly used strategies, visit our product portfolio.

Prudential policies also offer protection and cash value growth potential that can help supplement income later in life.

Actions:

They need protection and the ability to grow assets to enjoy later in life.

Considerations:

Have challenges with balancing short-term needs and long-term goals

47%

Are overspending

48%

Feel overwhelmed by investing

63%

What are their challenges?

Want to ensure family is secure in case of death

48%

Want to feel prepared for financial emergencies

44%

Want to pay

for college

42%

Need help managing investments

59%

Want to save for retirement

62%

What are their financial needs?

Have confidence to plan for their financial future.

30%

Confidence to plan:

Want to feel excited, engaged

71%

Want to feel connected, relationships

82%

How do they want feel:

60%

Risk Tolerance:

60% would take risks to take advantage of rewards.

Average Age: 42 years old

100% HHI $150k+

78% HH Assets $100k+

Majority married, with children

•

•

•

•

Want to feel successful

70%

Consider a Variable Universal Life policy designed for accumulation.

Visit Now

For more information about our products and riders, key features, and commonly used strategies, visit our product portfolio.

Are overwhelmed by investing

53%

Have risk aversion, not willing to take some risk for higher returns, and 40% are not investing

63%

What are their challenges?

Want to ensure family is secure in case of death

46%

Want to feel prepared for financial emergencies

47%

Don’t want to outlast savings

46%

Want to save

for retirement

54%

Are worried about covering the cost of health care

55%

What are their financial needs?

Want to feel free and autonomous

77%

Want to feel self-reliant and financially independent

81%

Want to feel safe and protected

82%

How do they want feel:

Have confidence to plan for their financial future.

20%

Confidence to plan:

59%

Risk Tolerance:

59% would take risks to take advantage of rewards.

Average age: 60 years old

59% HHI $75k+

56% HH Assets $100k+

Majority married with children

•

•

•

•

Have challenges with balancing short-term needs and long-term goals

41%

Are worried about unexpected expenses

44%

• A Survivorship policy, which may offer a cost savings vs. two individual policies.

• A chronic illness rider to help with any expenses associated with chronic or terminal illness.

Actions:

Some may not need a death benefit when their spouse passes but may seek coverage for wealth transfer to the next generation.

Considerations:

A chronic illness rider to help prepare for the potential impact of unexpected chronic illness.

Actions:

It’s also important for them to plan for the potential impacts of chronic illness.

Considerations:

Protection-focused products that have no market risk or provide downside protection like Universal Life or Indexed Universal Life.

Actions:

Protection and saving for retirement are important to them.

Considerations:

Visit Now

For more information about our products and riders, key features, and commonly used strategies, visit our product portfolio.

Term Life for its affordable death benefit protection.

Actions:

Those with a temporary need or who are more budget conscious.

Considerations:

A cash value life insurance policy can help solve for both needs.

Actions:

Many households have higher incomes and a need to protect and grow money for retirement.

Considerations:

A cash value life insurance policy can help solve for both needs.

Actions:

Their average age (38) gives them time to accumulate assets

Considerations:

Are overwhelmed by investing

67%

Are overspending

61%

Are worried about unexpected expenses

56%

Have challenges with balancing short-term needs and long-term goals

53%

What are their challenges?

Want to manage and pay down debt

47%

Want to ensure family is secure in case of income loss

53%

Want to save for retirement

53%

Want to feel prepared for financial emergencies

61%

Want to ensure family is secure in case of death

56%

What are their financial needs?

Want to feel connected, relationships

78%

Want to have fun and enjoyment

81%

Want to feel safe and protected

93%

How do they want feel:

Have confidence to plan for their financial future.

16%

Confidence to plan:

54%

Risk Tolerance:

54% would take risks to take advantage of rewards.

Average age: 38 years old

53% HHI $35k - $75k, 47% $75k+

33% HH Assets <$25k+, 33% $25k -$100k, 27% $100k+

Married or partnered with children

•

•

•

•

Want to feel sense of independence

72%

Options that offer living benefits and market downside protection.

Actions:

93% want to feel safe and protected.

Considerations:

Sole Parent

Affluent Women

Mature Women

Stay-at-Home Moms

Life insurance is issued by Pruco Life Insurance Company (except in NY), and Pruco Life Insurance Company of New Jersey (in NY). All are Prudential Financial companies located in Newark, NJ.

© 2024 Prudential Financial, Inc. and its related entities.

For Financial Professional Use Only. Not For Use With Consumer.

ISG_DG_ILI521_01

1068679-00005-00 Ed. 04/2025

Disclosure:

Accessibility

Text alternative

Home

Tools & Resources

Women Prospect Profiles

Engaging Women Clients

1

2

3

4

5

5

4

3

2

1

5

4

3

2

1

5

4

3

2

1

5

4

3

2

1

5

4

3

2

1

23% have confidence to plan for their financial future.

Risk Tolerance:

21% Have confidence to plan for their financial future.

Actions: Term Life that can be converted to a permanent life insurance policy later in life.

Actions: A cash value life insurance policy such as Indexed Variable Universal Life or Indexed Universal Life.

A budget-friendly alternative, such as Term Life.

Actions: A chronic illness rider to help cover unexpected expenses later in life.

30% Have confidence to plan for their financial future

20% Have confidence to plan for their financial future

16% Have confidence to plan for their financial future

Back

to top

Have challenges with balancing short-term needs and long-term goals

Have challenges with balancing short-term needs and long-term goals

Are worried about covering the cost of health care

Have risk aversion, not willing to take some risk for higher returns, and 40% not investing.

Have challenges with balancing short-term needs and long-term goals

Want to feel prepared for financial emergencies

Want to ensure family is secure in case of death

Want to ensure family is secure in case of income loss

Have challenges with balancing short-term needs and long-term goals

Actions: Protection-focused products that have no market risk or provide downside protection like Universal Life or Indexed Universal Life.

Actions: A chronic illness rider to help prepare for the potential impact of unexpected chronic illness.

Actions: A Survivorship policy, which may offer a cost savings vs. two individual policies.

A chronic illness rider to help with any expenses associated with chronic or terminal illness.

Actions: A cash value life insurance policy can help solve for both needs.

Actions: A cash value life insurance policy can help solve for both needs.

Actions: Options that offer living benefits and market downside protection.

Actions: Term Life for its affordable death benefit protection.

The following profiles and data are based on research from 2022 LIMRA What Women Want in Financial Services study and 2022 Kantar U.S. Monitor.*

The following profiles and data are based on research from 2022 LIMRA What Women Want in Financial Services study and 2022 Kantar U.S. Monitor.

Visit Now

For more information about our products and riders, key features, and commonly used strategies, visit our product portfolio.

Visit Now

For more information about our products and riders, key features, and commonly used strategies, visit our product portfolio.

Visit Now

For more information about our products and riders, key features, and commonly used strategies, visit our product portfolio.

Visit Now

For more information about our products and riders, key features, and commonly used strategies, visit our product portfolio.

Variable Life.

A cash value life insurance policy such as Indexed Variable Universal Life or Indexed Universal Life.

A budget-friendly alternative, such as Term Life.

Variable Life.

• A cash value life insurance policy such as Indexed Variable Universal Life or Indexed Universal Life.

• A budget-friendly alternative, such as Term Life.

Term Life that can be converted to a permanent life insurance policy later in life.

•

•

Variable Universal Life

Universal Life

Indexed Universal Life.

Term Life

Tools &

Resources

Tools & Resources

Women Prospect Profiles

Engaging Women Clients

Home

Prudential can be the rock that you

rely on to reach the women’s market.

Only Prudential has a nearly 150-year history of helping families, individuals, and institutions to achieve financial well-being.

Rock?

Your

Who’s

The information in this playbook can help you play a key role in Prudential’s mission of making lives better by helping to solve the financial challenges of our changing world, and in particular, of women in the United States.

Helpful links and resources:

Post-Sale

Point of Sale

Pre-Sale

Conversation Starters

Educational

Materials to help you learn more about women’s life insurance needs.

How to Create Financially Fearless Women

A presentation that provides insights to help FPs understand how to address the women’s market.

Download Now

Life Insurance Needs in the Women’s Market

A conversation starter flyer for FPs when having discussions with women about the importance of life insurance.

Download Now

Download Now

Help with how to truly connect with the women’s market.

Expand your Client Reach

Download Now

This flyer provides information to help FPs educate women about the importance of financial wellness.

Help Women Understand the Benefits of Life Insurance

Watch Now

A video of Prudential women clients sharing honest reflections on financial decisions and why women are vital to the future of life insurance.

Unlocking Growth: Women’s Insights in Life Insurance

Download Now

A presentation that provides insights into how women perceive the financial industry, their marketing and engagement preferences, and the significance of advisor gender.

The Crucial Role of the Women’s Market in the

Life Insurance Industry

Download Now

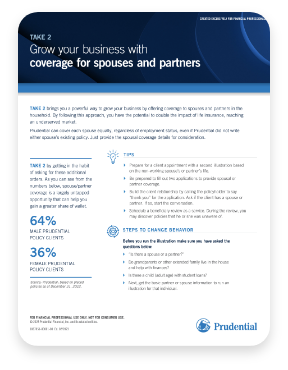

A flyer with tips on asking about coverage for a non-working spouse or partner.

Pru Take 2 flyer

Pru Take 2 flyer

The Crucial Role of the Women's Market

Women's Insights in Life Insurance

Help Women Understand the Benefits…

Expand your Client Reach

Life Insurance Needs in the Women's Market

How to Create Financially Fearless Women

Download Now

A guide for FPs to have conversations with women about the importance of financial preparation.

Cocktails and Conversation Discussion Guide

Download Now

An email FPs can use to reach out to women business owners

Small Business Prospecting Email

Cocktails and Conversation Invitation

Your Guide to the Ultimate Post Event Strategy

Cocktails and Conversations Discussion…

Small Business Prospecting Email

Everything you need to start the life insurance conversation with women.

Download Now

A flyer that provides follow-up strategies and best practices after hosting an event with prospects and clients.

It’s Just the Beginning – Your Guide to the Ultimate Post-Event Strategy

Download Now

An invitation template that invites women to cocktails and conversation about planning for their legacy.

Cocktails and Conversation Invitation

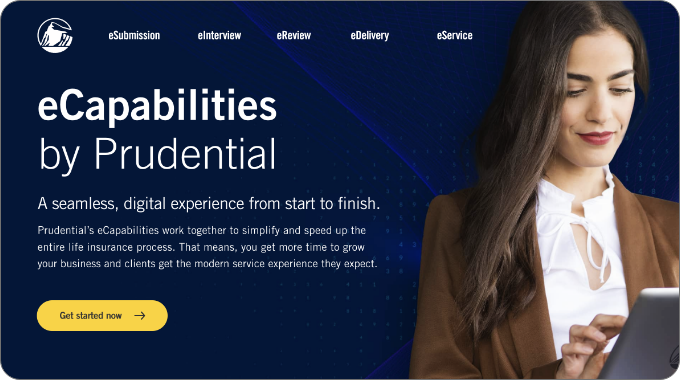

A pre-sale digital experience that explains how eCapabilities can expedite and simplify the entire life insurance process.

Visit Now

Learn how you can get more time to grow your business and provide clients with the modern service experience they expect with Prudential’s eCapabilities.

eCapabilities Digital Experience

Download Now

A flyer FPs can share with consumers to help them understand why coverage is important for a non-working spouse or partner.

Pru Take 2 Flyer - Consumer

Download Now

A flyer that tells the story of Jennie, who explains how cash from her husband’s life insurance policy helped her after his death.

Case Study - How Life Insurance Helped Me Get On With Living

Download Now

This checklist helps women start the retirement conversation with their financial professional.

Women & Retirement Infographic and Checklist

Download Now

A consumer presentation that helps FPs educate women on how to be fearless when it comes to making financial decisions for themselves and their family.

Becoming Financially Fearless Women

Case Study-How life Insurance Helped…

Women and Retirement Infographic

Becoming Financially Fearless Women

Prudential Survivorship Suite of Products

Pru Take 2 flyer

Insurance Strategies for Your Business

Download Now

A flyer that describes the advantages of survivorship life insurance and showcases

why Prudential is committed to this market.

Prudential Survivorship Suite of Products

Download Now

A brochure FPs can share with consumers that provides general information on insurance strategies for their businesses. (Can be used in all states but not Puerto Rico.)

Insurance Strategies for Your Business

LifeInsight is an interactive policy management tool that simplifies monitoring policy goals, assumptions, and performance.

A post-sale digital experience that helps you support your policy management needs.

For more information about our products and riders, key features, and commonly used strategies, visit our product portfolio.

Visit Now

Life insurance is issued by Pruco Life Insurance Company (except in NY), and Pruco Life Insurance Company of New Jersey (in NY). All are Prudential Financial companies located in Newark, NJ.

© 2025 Prudential Financial, Inc. and its related entities.

For Financial Professional Use Only. Not For Use With Consumer.

ISG_DG_ILI521_01

1068679-00005-00 Ed. 04/2025

Disclosure:

Accessibility

Back

to top

Text alternative

Home

Tools & Resources

Women Prospect Profiles

Engaging Women Clients

Life insurance is issued by Pruco Life Insurance Company (except in NY), and Pruco Life Insurance Company of New Jersey (in NY). All are Prudential Financial companies located in Newark, NJ.

© 2024 Prudential Financial, Inc. and its related entities.

For Financial Professional Use Only. Not For Use With Consumer.

ISG_DG_ILI521_01

1068679-00005-00 Ed. 04/2025

Disclosure:

Accessibility

Only Prudential has a nearly 150-year history of helping families, individuals, and institutions to achieve financial well-being.

The information in this playbook can help you play a key role in Prudential’s mission of making lives better by helping to solve the financial challenges of our changing world, and in particular, of women in the United States.

Prudential can be the rock that you

rely on to reach the women’s market.

Tools & Resources

Educational

Everything you need to start the life insurance conversation with women.

Conversation Starters

A pre-sale digital experience that explains how eCapabilities can expedite and simplify the entire life insurance process.

Pre-Sale

Product-specific materials to share with clients for individual financial needs.

Point of Sale

A post-sale digital experience that helps you support your policy management needs.

Post-Sale

Visit Now

For more information about our products and riders, key features, and commonly used strategies, visit our product portfolio.

Who's Your Rock?

Pru Take 2 flyer

The Crucial Role of the Women's Market

Women's Insights in Life Insurance

Help Women Understand the Benefits…

Expand your Client Reach

Life Insurance Needs in the Women's Market

How to Create Financially Fearless Women

Cocktails and Conversation Invitation

Your Guide to the Ultimate Post Event Strategy

Cocktails and Conversations Discussion…

Small Business Prospecting Email

Insurance Strategies for Your Business

Prudential Survivorship Suite of Products

Pru Take 2 flyer

Case Study-How life Insurance Helped…

Women and Retirement Infographic

Becoming Financially Fearless Women

Product-specific materials to share with clients for individual financial needs.

Back

to top

You can use LifeInsight to:

• Simplify the policy review process so you can

cut down on administrative time

• Focus on clients’ goals and easily identify

changes in performance

• Provide clients with industry-leading

reporting so they can make informed decisions

• Build confidence with customers by

proactively staying aware of actionable items

•

•

•

•

Contact your local Sales Representative for more information.

Transcript