Global markets company with the largest financial derivatives exchange in the world — includes Chicago Mercantile Exchange, Chicago Board of Trade, New York Mercantile Exchange, and The Commodity Exchange

Product suite includes a range of markets, including futures and options on rates, foreign exchange, equities, energy, and metals

They have been able to step in and take advantage of the void left after banks left certain areas of the derivatives market after regulation meant capital requirements became too onerous — many banks are actually now becoming their customers and regulation is generally a positive for CME

Business has been restructured and is now able to have a greater focus on customer demand driving the offering

CME does not take capital risk as they only match buyers and sellers and with most of their revenue growth coming from trading and clearing

Can be counter cyclical as volatility is their friend — higher volatility, outside a 2008 type scenario, typically means more trading

A global bioscience company who are one of the leaders in developing natural solutions for the food, nutritional, pharmaceutical and agriculture industries

The company has a long history of innovation which continues to this day, along with highly scalable production facilities which all provide barriers to entry for competitors wishing to enter the space

Christian Hansen have been working with microbes for over 145 years so have significant expertise in finding new and useful strains and can then produce them at scale to help their customers

With health and wellbeing such a significant focus, some of the work Christian Hansen do attempts to effectively help the food and agriculture industry achieve better crop yields and reduce the need for additives, along with providing probiotic supplements for a healthier digestive system.

Finally, there continues to be a significant but vital focus around the world on food waste — Christian Hansen produces solutions to improve freshness, safety, and the life of food products thereby making strides to support the need to reduce food waste

Largest industrial gases company in world created by the merger of Linde and Praxair in 2018 with around a 30% market share

Diverse global exposure and a very diverse customer base coming from Manufacturing, Chemicals, and Healthcare sectors to name a few

Innovative solutions for their customers that are vital to their operations, such as a C02 based solution for paper mills helps improve pulp washing efficiency, helping increase capacity without shelling out on new equipment, or ultra-high purity oxygen to keep a room ‘clean’ for electronics manufacturing

A resilient business model with either resilient end markets, or large fixed fee components, such as a rental on gas cylinders, which has historically been very resilient due to the low overall cost to the end user, and need to retain the cylinders in order to be able to restart manufacturing quickly

A US software company that creates digital media, design and publication tools for professionals and hobbyists alike

Outside of the pros most will know Adobe for the PDF which has become a mainstay of the digital document world

Adobe’s expansion into areas like digital marketing software, cloud collaboration and document digitisation provide further drivers of growth in the future

Like many software companies, Adobe moved from licensing to subscriptions, which has provided attractive levels of cashflow and line of sight to future revenues

As more publishing and design has moved to digital Adobe has been at the forefront of this transition, providing people with the vital tools required for modern designers and marketeers — in the digital marketing and design world it’s pretty hard to do your job without them these days

A global health care company focused on medical devices, diagnostics, nutrition and generic pharmaceuticals

Medical devices make up the largest portion of sales and is well diversified across a range of conditions, with cardiovascular and diabetes being two particular areas of focus

Abbott’s Freestyle Libre 2 is a wearable device that is designed to monitor blood glucose levels for diabetes patients and remove the need for finger stick testing — the ability to track blood glucose in real time can help patients and their medical professionals better monitor and manage their condition

The company was also heavily involved in COVID-19 testing with their competitively priced and rapid antigen test which produced results in 15 minutes and gave you access to a free app to display your negative test result if asked to do so

Overall global demographics and the increasing need to manage medical conditions for lengthier periods as people live longer leaves Abbott and their innovative product suite well supported in the long-term.

A global auto parts technology company with exposure to the key themes of vehicle electrification and connectivity, increasing infotainment, autonomous driving and active safety technology like sensors and automatic controls

Their products are used in both commercial and consumer vehicles with increasing technology content being a key growth area in the autos space

25 of the world’s largest auto manufacturers are customers, so it matters less to Aptiv which car company wins in the race for electric vehicles, autonomous driving, and other technological advances as they supply many of the key players

Their long-standing presence and key customers in China help to broaden the growth opportunities

Ongoing additional regulations support many key business areas for Aptiv, whether that be around quicker moves to electric vehicles, or the increasing safety standards requiring more safety software and sensors in cars

US based multi-utility company providing energy to predominantly Wisconsin, with some assets in Illinois and Minnesota

The company is consistently considered one of reliable electricity company in the US and a market leader, critical in places where weather can be severe (-20 degrees Celsius is not uncommon)

Favourable regulatory and political regime compared to UK or European equivalents — reduced threat of nationalisation!

They are well diversified by energy source between coal, natural gas and carbon free, with plans to further reduce coal as they replace the older less efficient coal plants

The company is able to generate the inflation-proofed revenue expansion expected of a utility, but it also benefits from local economic growth too, potentially giving it a growth booster

Ecolab is a US company specialising in water, hygiene and infection prevention solutions to help make the world cleaner, safer and healthier

Ecolab’s strategy is focused across the four areas of water, food, health and climate all of which are supported by long-term macroeconomic and consumer trends, with the health segment particularly catalysed by the COVID-19 pandemic

They have a wide portfolio of innovative products serving a huge variety of industries including water treatment for industrials and cleaning and sanitising products for healthcare and pharmaceuticals

By providing a high-quality service, scientific expertise and data-driven insights they have created a huge competitive advantage leading to strong pricing power and recurring revenues from loyal customers

Through their products and services Ecolab help to save trillions of gallons of water annually and they have launched 2030 Sustainability Impact Goals to further accelerate their action

A highly innovative global biotech company that focuses on cures for diseases using living systems and organisms rather than plants and chemicals

Key focuses on oncology (cancer), haematology (blood), cardiovascular, inflammation issues, bone health, neuroscience, and kidney care

Their three main franchises are in the areas of arthritis, anaemia, and reducing risk of infection during treatments like chemotherapy

Amgen has a number of new drugs in development that have the potential to be blockbusters, along with other drugs that are currently a small part of markets like cholesterol reduction and that could have a strong future

They are pioneering new delivery systems to reduce the number of injections for treatments, which cuts time and cost

The company is well aligned with the increasing need for medical treatment as the global population ages

US bank that defines itself primarily as a wealth management firm, but also offers personal banking, business banking, and trust services

Growth has been fuelled by a very strong brand and unrivalled client service — they have been able to achieve market leading customer service scores consistently, and a large percentage of their new business comes from existing customers making recommendations to friends, colleagues, and family — they are seen as a premium service, so less price orientated

They are very targeted on lending with a focus high quality — they offer lending products such as jumbo mortgages, which tend to have lower loan to value, and consumer loans to those with liquidity and strong cashflows, for example loans to professionals looking to buy into their firms as a partner

Their Relationship Managers take ownership of the loans they originated with compensation supporting high quality lending by including clawbacks to punish bad lending — very low non-performing loan book relative to other bank peers

Targeted branch network with over 70 branches focused on seven bi-coastal hubs — they also have the only bank branch of Facebook’s campus and Twitter’s building

Loans, credit cards and payment services business (owns Diners Club International) — one of the largest credit card companies in the US and aims to be the top card in their customer’s wallet

Typical customer has a good credit score, above average income, and is a property owner — they actively target high quality customers rather than sub-prime

Customer service is a key focus for the business — mostly online with highly rated apps, people answering phones rather than machines, innovative, and a well-recognised brand

Average customer has been with them for around 12 years — service focus helps foster loyalty

Focuses on customer experience, innovation, and employee satisfaction has led to numerous awards and leaves the business well positioned to continue to benefit from the strength of the US consumer.

Ulta has both a cosmetics and beauty offering so provide a one-stop shop of sorts

Number one speciality store in the US with offerings for both mass market and prestige — they are the only national player in the US to have both

Continually bringing new products, brands and partnerships into the business such as Honest Company, Body Shop, and Skyn IcelandIncreasing store footprint across the US, including a tie up with large US retail chain Target, along with ecommerce side of the business growing swiftly

Majority of purchases made via successful loyalty programme, which provides exceptionally valuable information to the brands on customer behaviour

The beauty and skincare industry is historically more resilient through the economic cycle, with Ulta also playing into the key millennial demographic via innovation.

Rathbone Multi-Asset Portfolios - stock spotlights

Any views and opinions are those of the investment manager, and coverage of any assets held must be taken in context of the constitution of the fund and is in no way an investment recommendation.

Total Return

Defensive Growth

Strategic Growth

Strategic Income

Dynamic Growth

Enhanced Growth

High Risk

Low Risk

Medium Risk

Fund factsheet

Monthly investment commentary

Full portfolio holdings

Quarterly investment commentary

Key investor information document

Fund performance

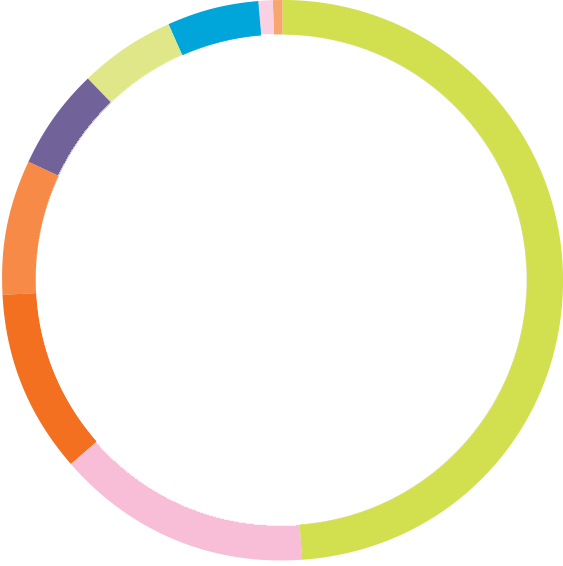

Equities 32.5%

Conventional government bonds

21.27%

Corporate bonds

19.5%

Index-linked bonds

6.03%

Commodities

8.73%

Cash and cash equivalents

3.06%

Alternative investment strategies

8.6%

Private equity

0.31%

Find out more

To find out more about this particular asset contact the team today.

Click an asset class for more information

(Range 10% - 50% of fund)

Liquidity

33%

(Range 20% - 60% of fund)

Equity-type risk

41.65%

(Range 0% - 50% of fund)

Diversifiers

25.35%

380m

Fund size (£)

Bank of England base rate +2%

Return

One third equity risk

Risk

10 June 2009

Fund inception date

Fund ratings

Inc: B86SVM2

Acc: B8JBXD3

Inc: GB00B86SVM24

Acc: GB00B8JBXD38

Sedol

ISIN

0.59

0.59

0.07

0.07

0.66

0.66

Total MifID II charges^

Transaction costs

OCF

MiFID II charges (%)

Income

Accumulation

Key documents/performance

Asset breakdown

LED allocation

Fund facts

Rathbone Total Return

As at 30 June 2022

Fund factsheet

Monthly investment commentary

Full portfolio holdings

Quarterly investment commentary

Key investor information document

Fund performance

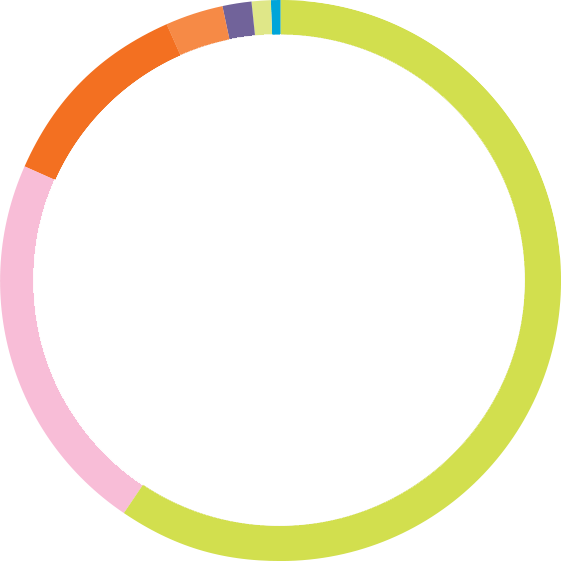

Equities 47.34%

Conventional government bonds

15.26%

Corporate bonds

12.07%

Index-linked bonds

5.83%

Commodities

6.01%

Cash and cash equivalents

4.05%

Alternative investment strategies

8.23%

Private equity

0.29%

Emerging market debt 0.92%

Find out more

To find out more about this particular asset contact the team today.

Click an asset class for more information

(Range 5% - 45% of fund)

Liquidity

25.02%

(Range 30% - 70% of fund)

Equity-type risk

55.01%

(Range 0% - 45% of fund)

Diversifiers

19.97%

260m

Fund size (£)

Inflation +2% (UK CPI)

Return

One half equity risk

Risk

19 June 2020

Fund inception date

Fund ratings

Inc: BKKK7X1

Acc: BKKK7Y2

Inc: GB00BKKK7X16

Acc: GB00BKKK7Y23

Sedol

ISIN

0.62

0.62

0.07

0.07

0.69

0.69

Total MifID II charges^

Transaction costs

OCF

MiFID II charges (%)

Income

Accumulative

Key documents/performance

Asset breakdown

LED allocation

Fund facts

Rathbone Defensive Growth

As at 30 June 2022

Fund factsheet

Monthly investment commentary

Full portfolio holdings

Quarterly investment commentary

Key investor information document

Fund performance

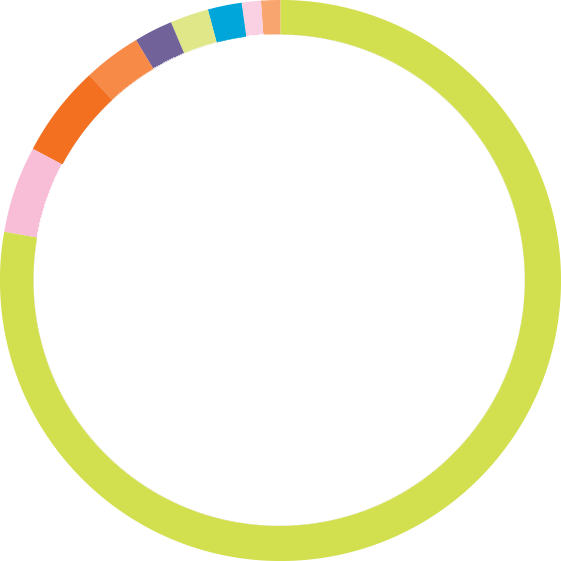

Equities 65.61%

Conventional government bonds 11.47%

Alternative investment strategies 6.75%

Index-linked bonds 2.63%

Commodities 4.49%

Cash and cash equivalents 3.93%

Corporate bonds

3.80%

Private equity

0.34%

Emerging market debt 0.98%

Find out more

To find out more about this particular asset contact the team today.

Click an asset class for more information

(Range 5% - 40% of fund)

Liquidity

15.6%

(Range 40% - 80% of fund)

Equity-type risk

68.81%

(Range 0% - 40% of fund)

Diversifiers

15.59%

1,601m

Fund size (£)

Inflation +3% (UK CPI)

Return

Two thirds equity risk

Risk

10 June 2009

Fund inception date

Fund ratings

Inc: B86NX65

Acc: B86QF24

Inc: GB00B86NX655

Acc: GB00B86QF242

Sedol

ISIN

0.62

0.62

0.11

0.11

0.73

0.73

Total MifID II charges^

Transaction costs

OCF

MiFID II charges (%)

Income

Accumulative

Key documents/performance

Asset breakdown

LED allocation

Fund facts

Rathbone Strategic Growth

As at 30 June 2022

Fund factsheet

Monthly investment commentary

Full portfolio holdings

Quarterly investment commentary

Key investor information document

Fund performance

Equities 52.38%

Corporate bonds 25.02%

Conventional Government Bonds 12.49%

Emerging market debt 2.74%

Alternative investment strategies

1.61%

Private equity

0.81%

Cash and cash equivalents 4.95%

Find out more

To find out more about this particular asset contact the team today.

Click an asset class for more information

(Range 5% - 40% of fund)

Liquidity

26.42%

(Range 40% - 80% of fund)

Equity-type risk

69.94%

(Range 0% - 40% of fund)

Diversifiers

3.64%

95m

Fund size (£)

Inflation +3% (UK CPI) Minimum target yield of 3%

Return

Two thirds equity risk

Risk

01 October 2015

Fund inception date

Fund ratings

Inc: BY9BSL8

Acc: BY9BT48

Inc: GB00BY9BSL83

Acc: GB00BY9BT482

Sedol

ISIN

0.74

0.74

0.08

0.08

0.82

0.82

Total MifID II charges^

Transaction costs

OCF

MiFID II charges (%)

Income

Accumulative

Key documents/performance

Asset breakdown

LED allocation

Fund facts

Rathbone Strategic Income

As at 30 June 2022

Fund factsheet

Monthly investment commentary

Full portfolio holdings

Quarterly investment commentary

Key investor information document

Fund performance

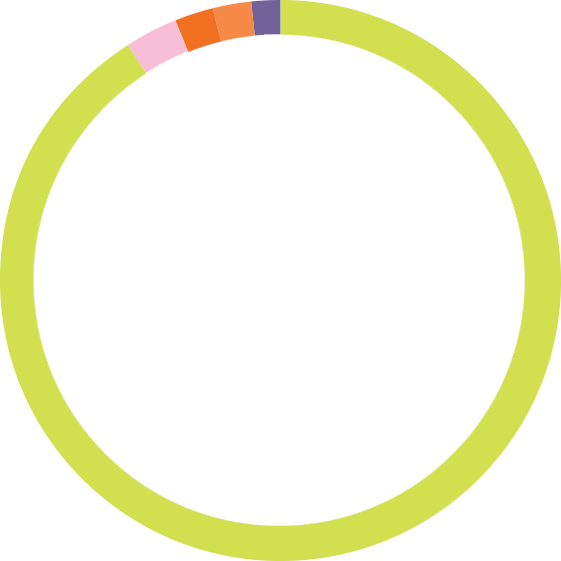

Equities 77.56%

Cash and cash equivalents 2.06%

Alternative investment strategies 6.16%

Corporate bonds 6.18%

Commodities 2.66%

Emerging market debt 1.51%

Index linked bonds

1.25%

Private equity

0.68%

Click an asset class for more information

Conventional government bonds 1.94%

Find out more

To find out more about this particular asset contact the team today.

(Range 0% - 30% of fund)

Liquidity

5.25%

(Range 50% - 90% of fund)

Equity-type risk

83.78%

(Range 0% - 30% of fund)

Diversifiers

10.97%

132m

Fund size (£)

Inflation +4% (UK CPI)

Return

Five sixths equity risk

Risk

19 June 2020

Fund inception date

Fund ratings

Inc: BKKK6W3

Acc: BKKK6X4

Inc: GB00BKKK6W34

Acc: GB00BKKK6X41

Sedol

ISIN

0.67

0.67

0.05

0.05

0.72

0.72

Total MifID II charges^

Transaction costs

OCF

MiFID II charges (%)

Income

Accumulative

Key documents/performance

Asset breakdown

LED allocation

Fund facts

Rathbone Dynamic Growth

As at 30 June 2022

Fund factsheet

Monthly investment commentary

Full portfolio holdings

Quarterly investment commentary

Key investor information document

Fund performance

Equities 90.76%

Cash and cash equivalents

2.98%

Commodities

1.36%

Private equity

1.3%

Alternative Investment strategies 2.21%

Find out more

To find out more about this particular asset contact the team today.

Click an asset class for more information

(Range 0%‑20% of fund)

Liquidity

2.98%

(Range 70%‑100% of fund)

Equity-type risk

93.45%

(Range 0%‑20% of fund)

Diversifiers

3.57%

258m

Fund size (£)

Inflation +5% (UK CPI)

Return

Equal to equity risk

Risk

01 August 2011

Fund inception date

Fund ratings

Acc: B7ZPKY2

Acc: GB00B7ZPKY25

Sedol

ISIN

0.65

0.12

0.77

Total MifID II charges^

Transaction costs

OCF

MiFID II charges (%)

Income

Accumulative

Key documents/performance

Asset breakdown

LED allocation

Fund facts

Rathbone Enhanced Growth

As at 30 June 2022

Rathbone Multi-Asset Portfolios — the funds