Double-digit gains in luxury home-buying activity set stage for robust spring housing market

Saskatoon, Montreal and Calgary lead the country with percentage increases over 50%

EXPERT EVALUATION

In some cities where inventory levels are particularly challenging at the lower end, multiple offers have returned with a vengeance. While that isn’t the case at the top end, pent-up demand does exist, and activity is gaining momentum.

Christopher Alexander, President

While figures remain off peak levels reported during Covid, the upswing in luxury sales signals a return to overall health in the country’s major cities. The ripple effect is already underway, with stronger home-buying activity at lower price points pushing sales into the upper end.

2024 Spotlight on Luxury

RE/MAX Canada

Market-by-Market Overview

With the end of quantitative tightening in sight, luxury home-buying activity in most markets across the country are slowly shifting into high gear as buyers reap the benefits of softer housing values.

*Luxury is classified as twice the average residential price.

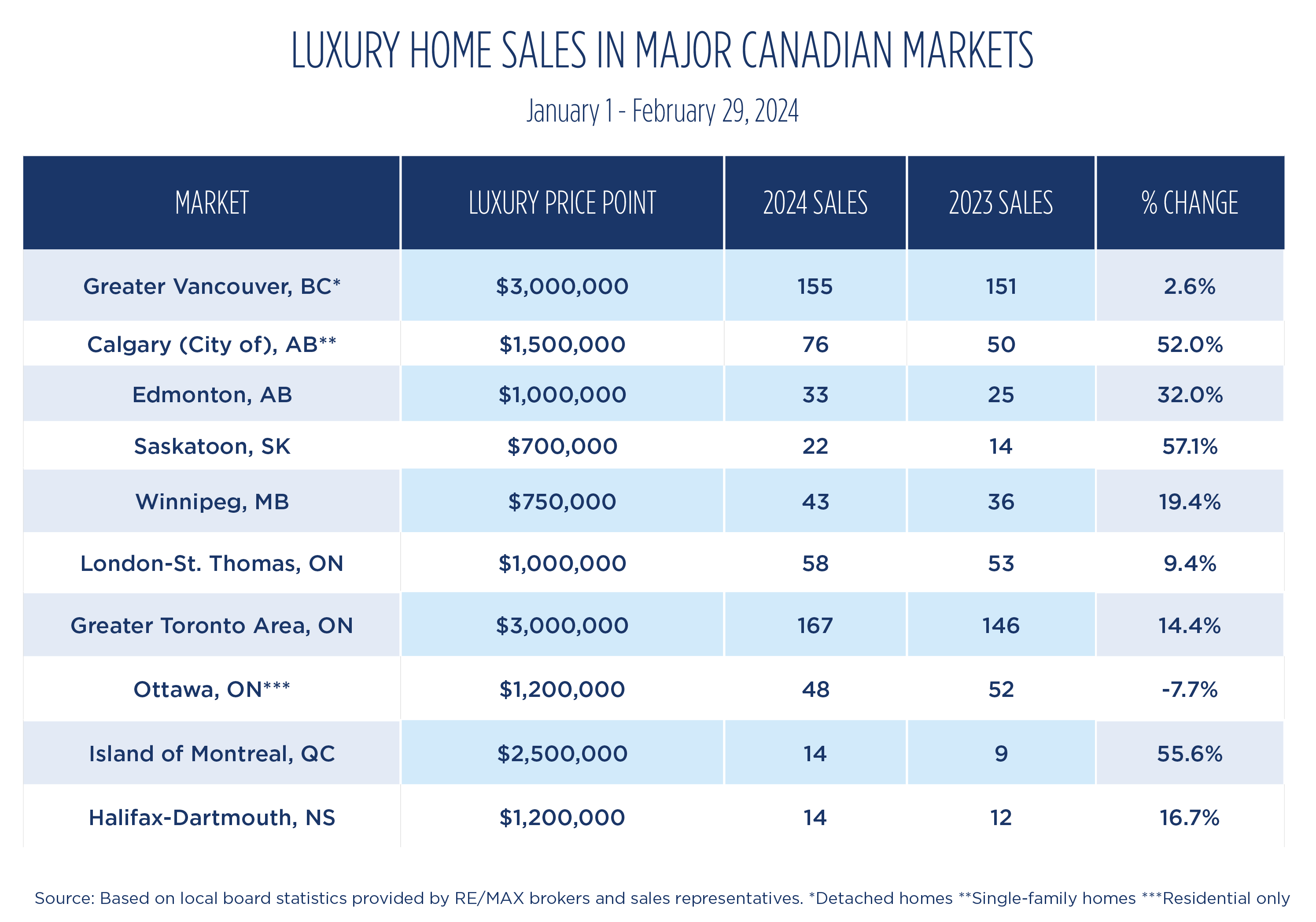

RE/MAX examined luxury home-buying activity in 10 markets across the country in the first two months of the year and found that, despite a disconnect between buyers looking for deals and sellers’ price expectations, almost all regions reported a strong start to the year. Ninety per cent of markets experienced an increase in high-end sales, with more than two-thirds recording double-digit growth. Saskatoon led in terms of percentage increases, with a 57-per-cent uptick in luxury home sales, followed by Montreal at almost 56 per cent and Calgary at 52 per cent. Edmonton posted a 32-per-cent increase in luxury sales year-over-year, while Winnipeg, Halifax, Toronto and London reported increases of 19.4 per cent, 16.7 per cent, 14.4 per cent, and 9.4 per cent respectively. Only Ottawa saw a decline compared to year-ago levels, with sales down nearly eight per cent.

Lower overall values, strong equity gains and downward trending interest rates are supporting demand for luxury product including freehold and condominium properties in markets across the country. While a disconnect is somewhat hampering activity in larger markets, with sellers holding out for Covid-era values and buyers seeking bargains, those serious about making moves are finding common ground. An ample supply of product exists in most markets, although some neighbourhoods are experiencing exceptionally low inventory levels at sought-after price points. An influx of fresh, new properties in the spring will renew buyer interest and activity, but chronic supply issues will likely persist at the entry level to luxury.

“Equity continues to play a significant role in the marketplace, driving demand at the top end of the market,” explains Alexander. “Although overall gains have been elusive in recent years, a good percentage of buyers who purchased in 2018 and 2019 are well positioned to make their next moves. For example, in the Greater Toronto market, buyers who purchased homes at an average price in 2018 saw equity rise by almost 43 per cent by the end of 2023 ($787,842/$1,126,591). These buyers are coming to the table with a larger downstroke and reduced risk from a lending perspective.”

Vancouver, BC

Although softer housing values and greater selection have bolstered sales of detached homes over $3 million in the luxury segment of the Metro Vancouver market in the first two months of the year, strata condominium sales have taken the lead in terms of percentage increases, with sales volumes up 68 per cent year-over-year.

READ MORE

READ MORE

READ MORE

READ MORE

READ MORE

READ MORE

READ MORE

READ MORE

READ MORE

Shifts in the Luxury Housing Market

Luxury home-buying activity is also undergoing change as a younger demographic moves into the upper end of the market. Demand is strongest for newer, well-appointed homes in traditional hot pockets. Turnkey properties are most coveted, although there are some buyers that are willing to renovate. The desire for more space and less congestion is once again an emerging trend, as acreage properties boasting large homes in suburban-rural or rural areas experience an upswing in popularity in London, Ottawa, Edmonton and Saskatoon. Building activity is also making a comeback, with new construction and infill on the rise in half of all markets examined.

Some luxury buyers looking to expand their purchasing power are moving over into markets such as London (drawing buyers from the Greater Toronto Area), Halifax, Calgary, Edmonton and Saskatoon (drawing buyers from Ontario and British Columbia). However, activity among foreign buyers has fallen dramatically since the introduction of the Foreign Buyer Ban by the Federal Government in January 2023, which it extended through to early 2027. The impact has been palpable in the uber-luxe segment of major markets, such as Metro Vancouver and Toronto, as well as the condominium market in the City of Montreal.

“While the idea of a Foreign Buyer Ban sounds good in principle, it makes less sense in practice. The ban was originally intended to make a greater number of properties available to Canadians and reduce upward pressure on housing values. The Bank of Canada’s 10 rate hikes were all that was needed to achieve that objective, all the while supply remains at historical lows.”

Condominiums have been a popular option this year, despite single-detached homes comprising the lion’s share of luxury sales. Condo activity was strongest in Metro Vancouver, where sales climbed close to 70 per cent in the first two months of the year (27 versus 16). Solid condominium activity at the high-end price points was also reported in London, fuelled by empty nesters and retirees, and in Ottawa and Montreal. Halifax, which has limited condo product in the top end, has already recorded four sales to date. Some baby boomers in Saskatoon are also opting to downsize from larger homes in high demand areas to newer luxury condominiums in the core.

“Buyer enthusiasm is evident as the spring market ramps up,” says Alexander. “Yet, despite the uptick, we’re still seeing some factors constraining sales at luxury price points. Most significant is the tax implications at the uber-luxe levels, which have been weighing down the segment, particularly in the Greater Toronto Area.”

On the sale of a $4 million home in Vancouver, for example, buyers will pay $90,000 in land transfer taxes. On the sale of a property of similar value in the City of Toronto, land transfer taxes will set buyers back close to $183,000. While sale under $7.5 million remain surprisingly resilient, only one sale has occurred over that threshold (and it was not located in the City of Toronto). The adjustment to higher taxation levels has been slow, but it is being offset somewhat by pent-up demand, with some deciding they can only hold off for so long. Others, meanwhile, are reluctant to list their properties, impacting supply, or are choosing to renovate rather than take a substantial tax hit.

“Assuming a continuation of current economic fundamentals, momentum is set to climb at luxury price points from coast to coast,” says Alexander. “With recent inflation numbers coming in lower than expectations at 2.8 per cent, the possibility of further improvement in interest rates only strengthens growing optimism. Yet, there is an air of caution as the challenges of recent years remain fresh in the minds of buyers and sellers. Confidence is building, with the light at the end of the tunnel clearly visible. Demand is coming from a mix of high-income professionals/executives, retirees, empty-nesters, Gen X and millennials, newly landed immigrants, as well as large and multigenerational families – a good sign, as the diversity of buyers at the top end of the market today bodes well for its overall health in the future.”

Condominium sales are up almost 70% in Greater Vancouver.

Condo Sales

27 strata condo sales averaging $4 million were recorded between January 1 and February 29 of this year. In contrast, there were 16 sales during the same period in 2023, with an average price of $4.5 million.

Multiple Offers

Multiple offers occurring in Calgary; some homes selling sight unseen.

Some multiple offers are occurring in Saskatoon, although at the lower price points. This may filter upward in coming months.

Calgary and Edmonton have been bolstered by affordability, providing buyers with more bang for the buck.

Alberta markets remain strong.

Affordable Luxury

These include Saskatoon (57%), Montreal (+55.6%), Calgary (+52%), Edmonton (+32%), Winnipeg (+19.4%), Halifax (+16.7%) and Toronto (+14.4%).

Double-digit sales growth was seen in 7/10 markets.

Sales Growth

The Greater Toronto Area experienced a 77% jump in sales over $5 million, split fairly evenly between the 416 and 905 regions. On the west coast, demand for uber-luxe properties has fallen year-over-year, largely attributed to the Foreign Buyer Ban.

The uber-luxe market heats up in Toronto, cools in Vancouver.

Uber Luxury

However, values are being held in check for the most part, for now.

Inventory in Toronto is tight in many hot-pocket areas.

Inventory

View & Download This Data Table

Find an Agent

–Christopher Alexander, President of RE/MAX Canada

Calgary’s juggernaut real estate market continues to advance, with home-buying activity at the top end of the market climbing 52 per cent in the first two months of 2024. Seventy-six single family homes changed hands over $1.5 million between January 1 and February 29, up from 50 properties during the same period in 2023. Nearly 60 per cent of sales took place in February.

Calgary, AB

Edmonton’s luxury market continues to fire on all cylinders as both local buyers and those migrating from Ontario and British Columbia spark home-buying activity over the $1 million price point. Sales of high-end homes are up 32 per cent year over year, with 33 single-family and condominium properties sold between January and February of 2024, up from 25 sales during the same period one year earlier.

Edmonton, AB

Saskatoon’s luxury market is off to a strong start heading into the traditionally busy spring market. Sales of high-end homes over $700,000 are up 57 per cent in the first two months of the year, with 22 homes changing hands between January 1 to February 29, up from 14 during the same period in 2023. A healthy economy and an influx of new Canadians and out-of-province buyers have buoyed home-buying activity in Saskatoon.

Saskatoon, SK

READ MORE

Affluent purchasers were strong out of the gate in Winnipeg’s luxury housing market, with sales up 19 per cent in the first two months of the year. Forty-three homes sold for over $750,000 between January and February of 2024, the most expensive of which topped

$4 million, up from 36 sales during the same period last year.

Winnipeg, MB

London’s housing market is off to a strong start overall with sales up almost 30 per cent in the first two months of the year. Multiple offers are occurring unabated between $400,000-$700,000, yet softer demand exists for luxury properties in the city. Fifty-eight properties have sold to date over $999,999, up 9.4 per cent from year-ago levels for the same period.

London, ON

The Greater Toronto Area’s (GTA) luxury market has sprung back to life in the first two months of the year, with home sales over the $5 million price point leading the way. Thirty-two freehold and condominium properties changed hands between January 1 and February 29, up 77 per cent from the 18 sales reported during the same period in 2023. Of the 32 properties sold over $5 million to date, 17 sales occurred in the 416, while 15 were in the 905.

Greater Toronto Area, ON

While luxury home-buying activity in Ottawa was strong out of the gate, sales softened somewhat in February with affordability taking a backseat to inventory. Just 48 freehold properties priced over $1.2 million changed hands in the first two months of 2024, down over seven per cent when compared to the 52 sales that took place between January and February of 2023.

Ottawa, ON

Strong activity early in the year has set the stage for a robust spring housing market in the City of Montreal’s luxury sector. Year-to-date (January 1 – February 29) sales priced over $2.5 million have increased 55 per cent, with 14 freehold and condominium properties changing hands so far this year, compared to nine during the same period in 2023.

Montreal, QC

Despite an overall flattening in residential real estate activity at luxury price points, sales of properties priced over $1.2 million in Halifax reported a 16-per-cent increase in the first two months of the year. Fourteen sales occurred between January 1 and February 29, with 10 single-family homes and four condominium-townhomes changing hands, compared to 12 sales during the same period in 2023.

Halifax, NS

Browse Luxury Listings

Sign Up for the Newsletter

Follow us:

Vancouver

Calgary

Edmonton

Saskatoon

Winnipeg

London

Toronto

Ottawa

Montreal

Halifax