When you invest what you earn, you should never settle for good enough. Countless mutual funds and ETFs tout tax efficiency, but they are unable to provide a truly active approach that systematically targets tax drag and strategically maximizes after-tax wealth.

Russell Investments’ tax-managed solutions overcome the inefficiencies of these surface-level products by offering an array of custom-built and vigilantly-monitored strategies that attack tax burden at its core, while also taking a total-portfolio approach to active wealth and tax management. We call this the active advantage.

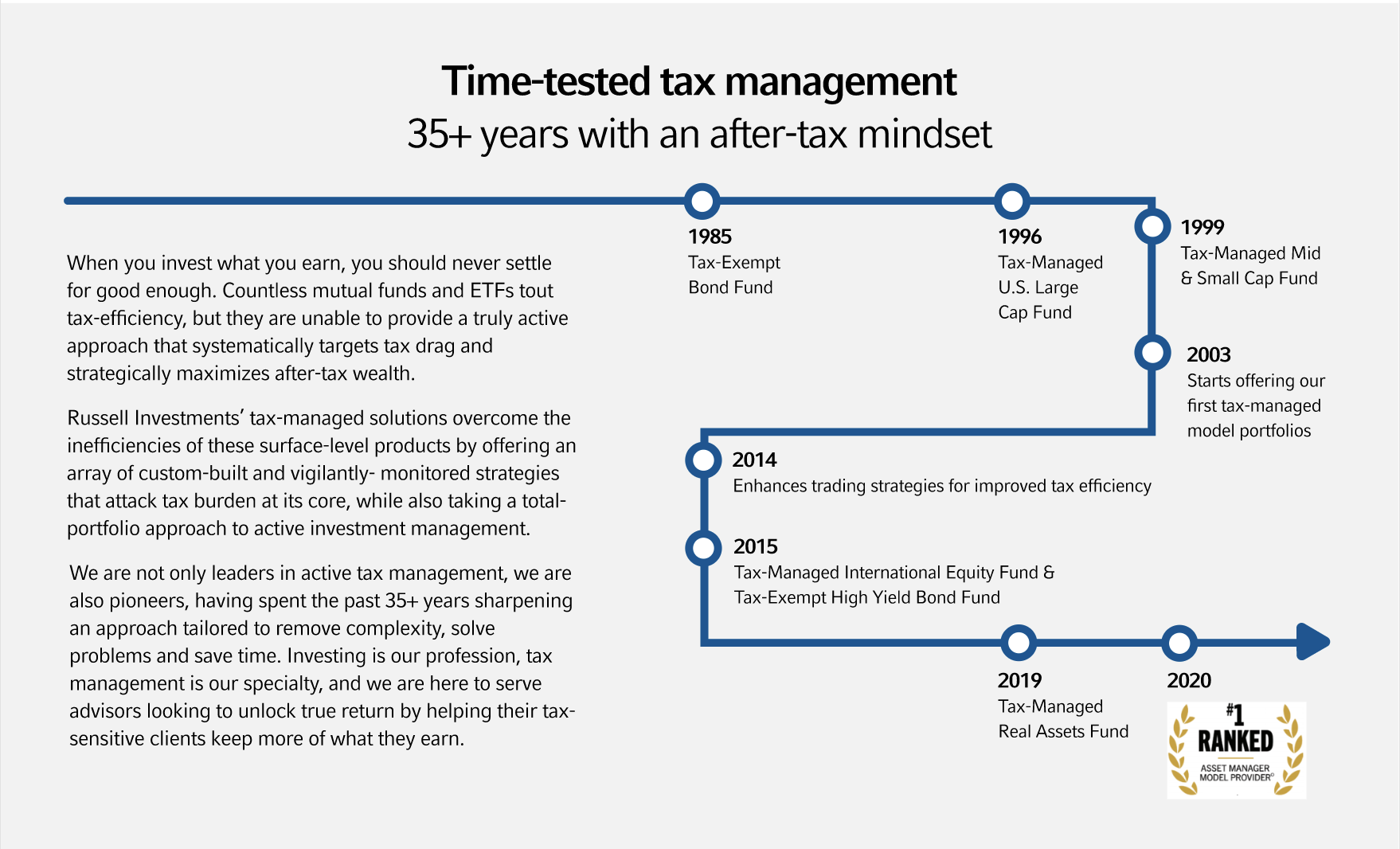

We're not only leaders in active tax management, we are also pioneers, having spent the past 35 years sharpening an approach tailored to remove complexity, solve problems and save time. Investing is our profession, tax management is our specialty and we are here to serve advisors looking to unlock true return by helping their tax-sensitive clients keep more of what they earn.

1985

1996

1999

2003

Tax-Managed Mid & Small Cap Fund

Starts offering our first tax-managed model portfolios

Tax-Managed U.S. Large Cap Fund

Tax-Exempt Bond Fund

2014

Enhances trading strategies for improved tax efficiency

2015

Tax-Managed International Equity Fund & Tax-Exempt High Yield Bond Fund

2019

Tax-Managed Real Assets Fund