Ten Global Topics and Trends to Watch in 2026

In this note, our Global Issues team from Control Risks, Seerist's strategic partner, considers the key trends, events and issues likely to shape 2026. Wild cards – unlikely events with a high impact that could catch organisations by surprise – are included to aid scenario planning and response.

Geopolitical volatility in 2026 will likely be viewed by some states as an opportunity to settle scores and gain strategic advantage over rivals, particularly in the context of active border and territorial disputes. Political leaders facing domestic challenges, such as persistent inflation or elevated unemployment, will likely increasingly exploit external threats to rally public support and divert attention from internal challenges.

Hybrid warfare will continue to evolve, with greater sophistication in cyber operations, disinformation campaigns and economic coercion as countries seek to manage escalation risks and avoid direct conflict. However, these tactics will heighten the probability of accidents, miscalculations and misidentification. The result could be short, sharp crises with global ripple effects on trade, energy markets and investor confidence.

Decisive outcomes in Ukraine remain unlikely throughout 2026, as both sides retain the capability and intent to continue fighting without a clear path to victory. Western military and financial support will sustain Ukraine’s defence. Russia will continue to perceive that its strategic advantage remains in prolonging the conflict. A limited ceasefire could emerge, driven by exhaustion or tactical recalibration, yet a comprehensive peace agreement will remain remote given entrenched territorial and political differences.

Spillovers and hybrid warfare across Europe will persist, encompassing state-sponsored sabotage, cyber attacks and disinformation campaigns. Grey-zone tactics are likely to focus on critical infrastructure and strategic sectors such as logistics and defence. A reduction in US involvement in Europe could provide Russia with greater opportunities to mount higher-impact actions, while simultaneously increasing the risk of miscalculation and unintended escalation.

Since the 8 October ceasefire between Israel and Hamas, Yemen-based Houthi militants have paused attacks in the Red Sea, permitting transits by larger vessels along previously targeted routes. Throughout 2026, the durability of the Gaza ceasefire – and Israel’s involvement in related conflicts with Hizbullah and Iran – will impact the Houthis’ position.

Some operators will aim to resume faster Red Sea routes immediately, while others will adjust more slowly due to risk appetite, rates and capacity. A return to the Red Sea will likely see a sharp decrease in freight rates on various routes as shipping will be forced to absorb the costs of vessel over-capacity, with positive impacts for inflation in Europe. Suez transit fees will also buoy Egypt’s finances and political stability. At the same time, ports and associated businesses along the Cape route will see a corresponding drop in revenue.

AI competition in 2026 is likely to harden into a winner-takes-most race for leverage over compute capacity, market share and technical standards. Governments will control the flows of technology and data to support domestic champions, but regulations will struggle to keep pace with the speed of innovation. The more probable path is renewed escalation, fragmenting supply chains and regulatory regimes and raising compliance burdens for global firms.

Major nuclear powers – China, the US and Russia – are expected to accelerate modernisation of strategic nuclear forces in 2026, incorporating hypersonic delivery systems, autonomous capabilities and space-based assets. Non-nuclear states are increasingly questioning the reliability of nuclear umbrellas, prompting serious debate over independent deterrent options, particularly in European countries, South Korea and Japan. With the US-Russia New START treaty expiring in early 2026, mounting concerns about nuclear proliferation and conflict risks could galvanise a new round of arms control negotiations among the US, Russia and China.

Concurrently, increased investment will flow into civil nuclear power as countries seek reliable, diverse energy sources to support economic growth, climate adaptation and digitalisation. Geopolitical relationships will shape access to technology and fissile material, with increased competition for uranium reserves worldwide.

Personalised political violence is likely to increase in 2026, driven by individual grievances, online conspiracy theories and mixed ideologies, including emerging nihilistic extremism. Although attacks will remain relatively rare, the absence of formal group affiliations makes detection and prevention significantly harder for law enforcement and intelligence services.

The threat of an attack is most prevalent in North America, Europe and Australia, but the likelihood of attacks in other regions is increasing, especially in Southeast Asia and Latin America. Radicalisation is increasingly fuelled by generational, economic and identity-based frustrations in regions facing inequality and political instability. Lone actors radicalised online could target public figures, critical national infrastructure or symbolic sites, amplifying political polarisation.

There will likely be more severe climate disasters in 2026 in more regions that exceed expectations and tolerances. These events will cause significant physical damage, disrupt operations and supply chains, and strain food and energy systems. Extreme temperatures will challenge power grids and agricultural productivity while flooding and wildfires will damage infrastructure and housing. Prolonged drought in some countries and regions will threaten food and water security, driving internal (rural to urban) and external migration.

Policy shifts on tariffs, immigration and technology are creating uncertainty and volatility for business, undermining business confidence and constraining investment. The IMF and World Bank project modest global growth (3.1%) in 2026, a slight slowdown from 2025.

An even sharper slowdown is possible in the US, with negative knock-on effects for close trade partners such as Mexico, Canada and China. Weak commodity prices, meanwhile, will strain government budgets in commodity exporting countries in Latin America, Africa and the Middle East.

Elections across the Americas region may result in significant shifts in political orientation and governing. Rising right-wing sentiment in Latin America will increase the likelihood of a pivot to conservative candidates in major elections, including Colombia and Peru. Conversely, Brazil’s President Lula da Silva currently enjoys a lead in the polls against far-right rivals of the general elections on 4 October, though he will face challenges from dissatisfaction with high living costs. Towards the end of 2026, opposition Democrats in the US will seek to capitalise on economic concerns to win partial control of Congress and more effectively check the Trump administration.

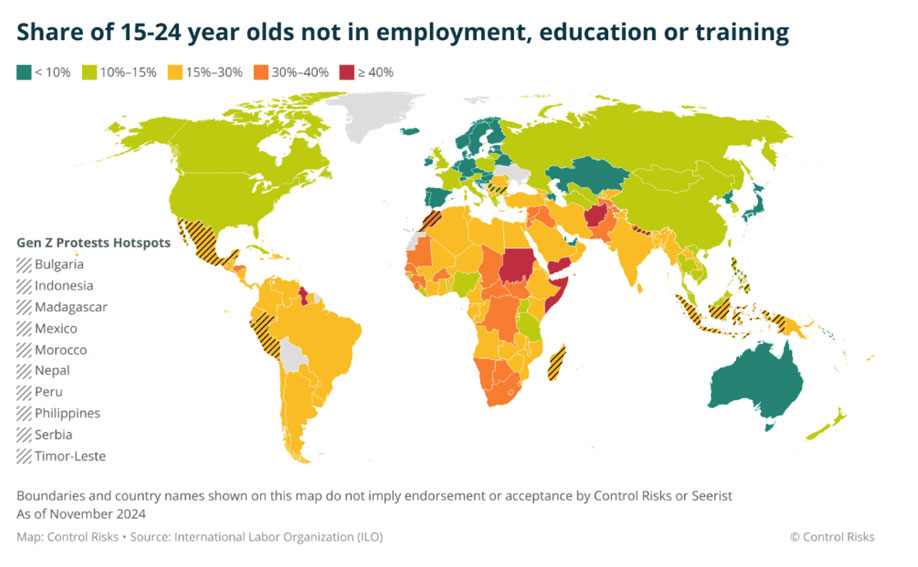

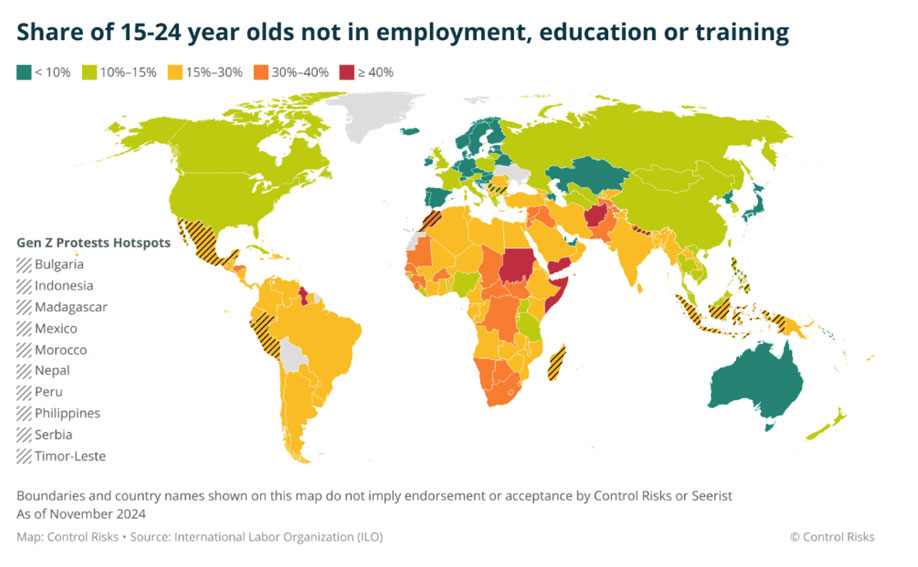

Social tensions, economic instability and declining trust in institutions will drive social unrest worldwide. Young people will lead protest movements, citing broad discontent with cost-of-living pressures, declining public services and narrowing employment opportunities.

Broad-based protest movements will pose elevated threats of political instability, mainly in fragile states facing significant economic challenges. Notably, latent political instability and civil unrest risks will persist in countries where there has been a government turnover. This is due to heightened expectations for robust system change and limited patience with those in power.

Sources:�“Non-proliferation, SIPRI’s warning: ‘The world heading for nuclear rearmament’”, eunews

“Ukraine and U.S. divided over territory after intense negotiations”, Axios

“Fifth La Niña in Six Years to Disrupt Crops and Supply Chains”, Bloomberg

“Energy demand from AI”, IEA

“The Suez Canal Reopening Is a 2026 Gift for Commodities”, Bloomberg

Control Risks

1

Border wars

Wild card

Fatal clashes between Philippines fishermen and Chinese coast guard forces in the South China Sea.

2

Ukraine war

3

Red Sea shipping

Wild card

Russia achieves a major breakthrough in eastern Ukraine, posing a renewed threat to Kyiv.

Wild card

Israel, encouraged by US support, forcefully annexes the West Bank (Palestinian Territories). Consequently, Houthi attacks restart and escalate rapidly, again disrupting Red Sea supply chains.

4

AI competition

Wild card

Financial pressures or a collapse in investor confidence causes the AI bubble to burst, prompting a severe downturn in the global stock markets.

5

Nuclear renaissance

Wild card

Iran enriches the uranium that was not damaged during US strikes and conducts a nuclear weapons test without notice.

6

Individual terrorism

Wild card

Nihilistic extremists mount a co-ordinated chemical, biological, radiological and nuclear (CBRN) attack in a major urban area in North America.

7

Climate hazards

Wild card

A severe heatwave in Europe triggers a major regional power grid failure, which causes prolonged residential and industrial power outages.

8

Economic slowdown

Wild card

A financial crisis or stock market collapse in the US triggers a global financial crisis.

9

Americas elections

Wild card

A “blue wave” gives Democrats control of the US Congress, leading to increased confrontation with the Trump administration.

10

Activated societies

Wild card

The proliferation of data centres drives left-wing militants and environmental activists to mount an international sabotage campaign against AI infrastructure.

Explore the Seerist Solution.

See how Seerist combines AI and human verified analysis to proactively monitor these key issues in 2026.

Request a demo

Major geopolitical flashpoints, including the Ukraine war, hybrid war campaigns and border conflicts, will continue to pose potential operational and security risks for businesses in the coming year.

Social tensions and online radicalisation fuelling discontent and even unpredictable violence will increase civil unrest and terrorism risks in 2026.

Climate volatility will remain a systemic risk multiplier, driving operational and financial risks for businesses, especially those in the infrastructure, insurance and logistics sectors.

Businesses must monitor and prepare for high-impact, low-likelihood events, as wild cards could trigger severe market and operational shocks.

Analysis Details

Explore Now

Learn more about delivering the trustworthy insights you need, right when you need them.

Discover Seerist Today

The foresight to get ahead of what may come.

The insights with the most impact.

Accelerate speed to decision.