Increasing Indications of Escalation

Seerist Deep-Dive

SCroll down to explore

7-Day Update:

Last 24 Hours of Conflict

Israel and Iran will continue to sustain their air strike campaigns, with Israel vowing escalated attacks on Iran in retaliation for the hospital strike in Beersheba.

US media outlets reported that US President Donald Trump on 17 June approved plans to attack Iran but has not given the final order to do so.

Airspace closures and disrupted flight routes across the Gulf region will likely persist due to Iran issuing a notice to aviation (NOTAM) over the Persian Gulf and Sea of Oman.

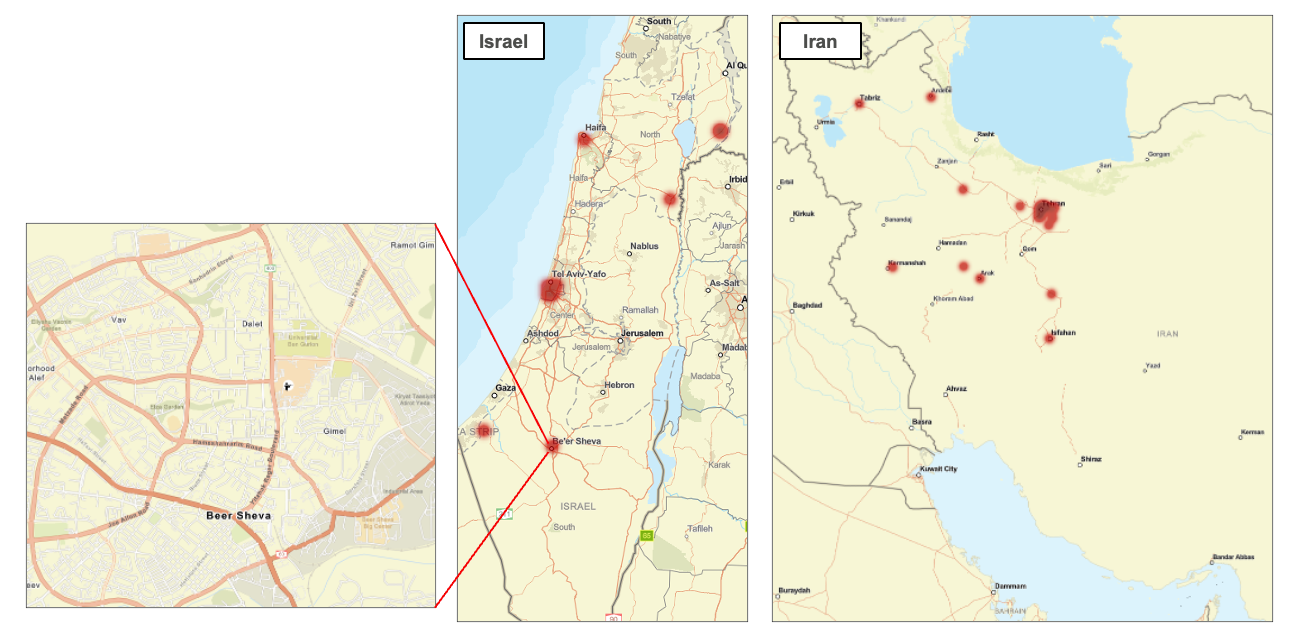

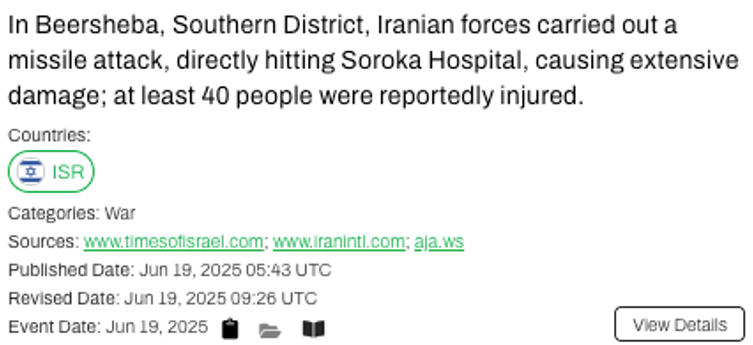

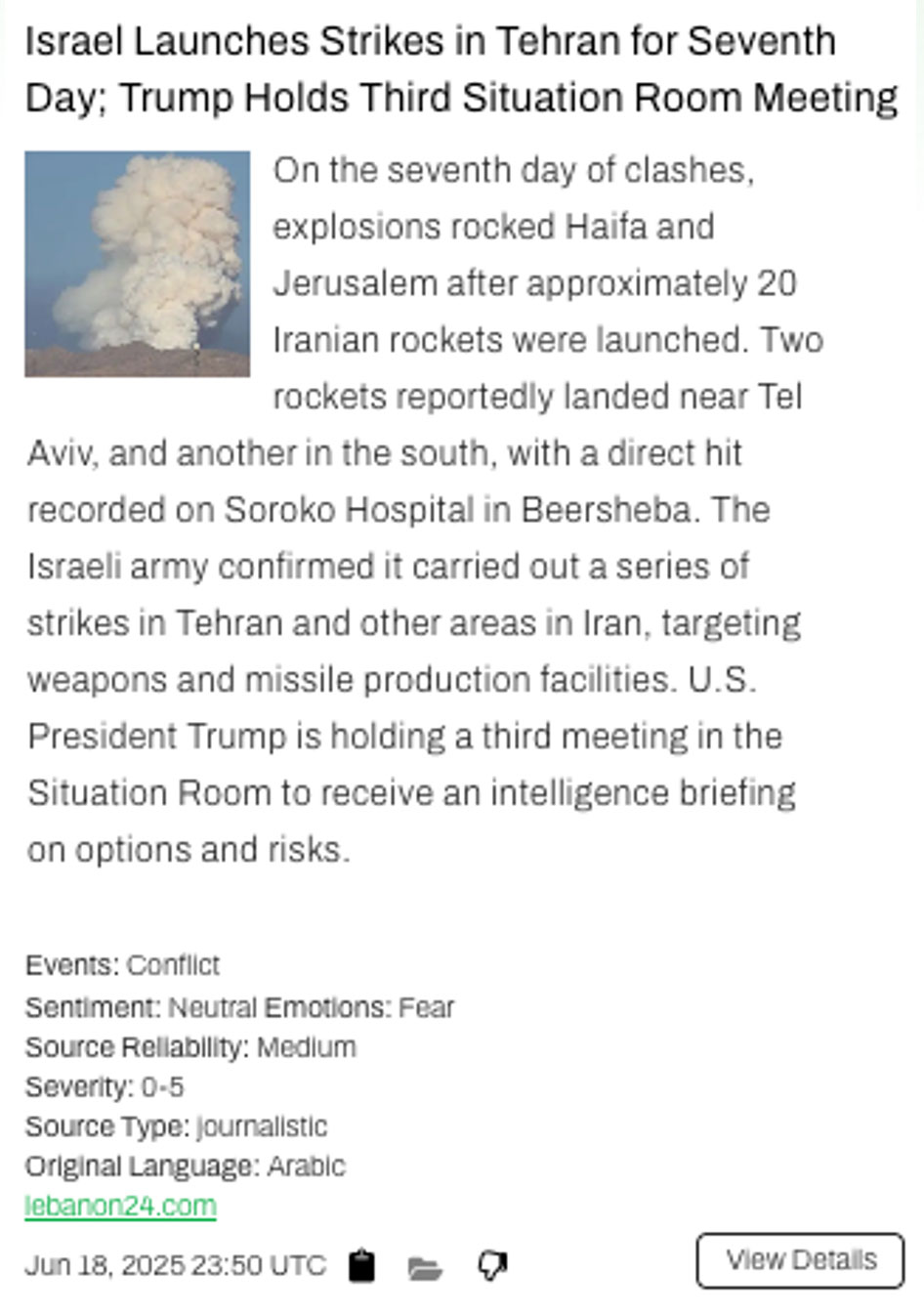

Iran and Israel on 19 June exchanged strikes for a seventh consecutive day, with an Iranian missile hitting the Soroka Medical Centre in Beersheba (Southern district, Israel), causing extensive structural damage. �

The Israel Defence Forces (IDF) claimed on 19 June that it hit the Arak nuclear facility (Markazi province) and a nuclear weapons development site near Natanz (Isfahan province). The IDF claimed that at the Arak facility it specifically targeted “the structure of the reactor’s core seal, which is a key component in plutonium production”. Iranian state TV confirmed that the facility had been attacked.

(Control Risks Analysis)�

IRAN-ISRAEL

Control Risks Analysis

Verified Event

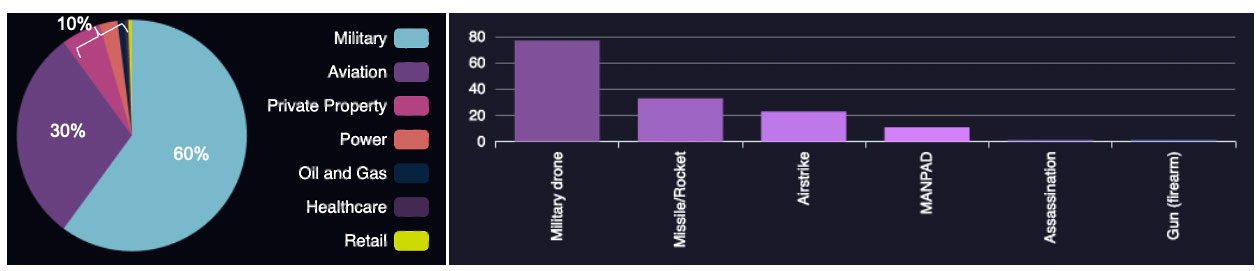

Seerist’s Verified ‘War’ Events indicating Israeli and Iranian reciprocal strikes from the last 24 hours heatmapped to the right�

Verified Event

EventsAI

US Naval, Air Deployments Indication of US Plans to Strike Iran

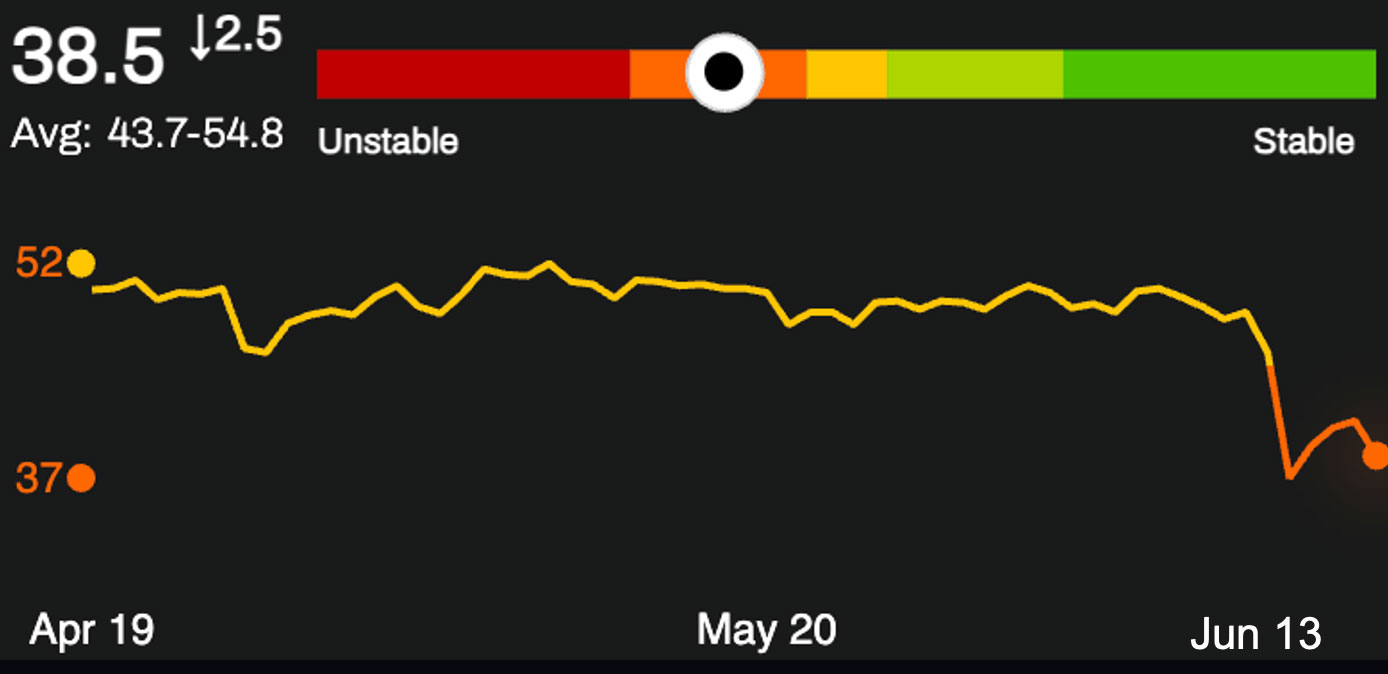

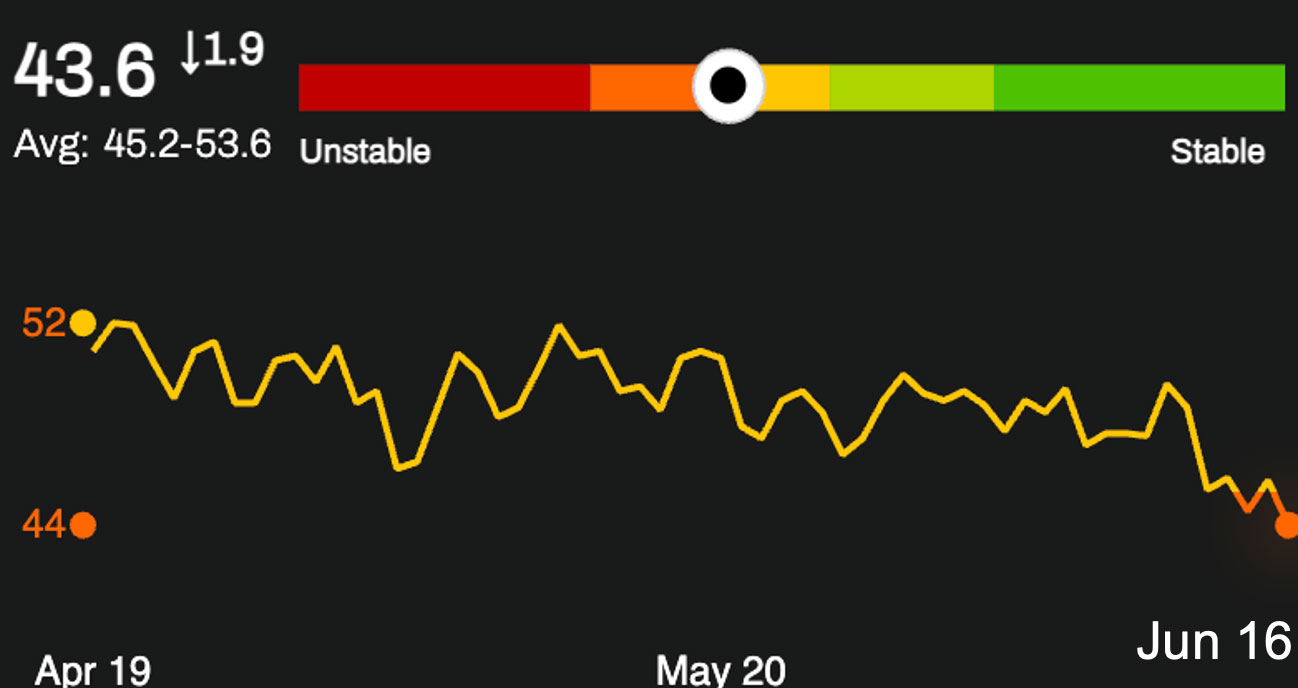

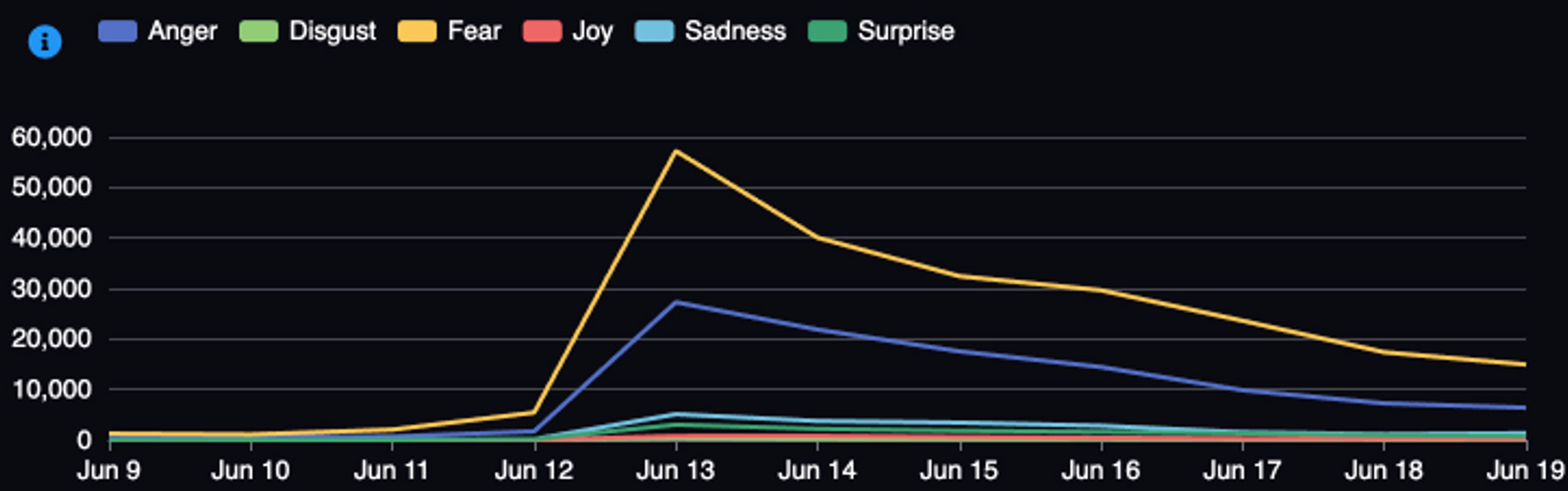

EventsAI sentiment models show consistently above average fear and anger associated with news and social focused on potential US involvement.�

EventsAI 1/3

EventsAI 2/3

Iran on 19 June launched 30 ballistic missiles targeting several sites in Israel. A missile targeting the Soroka Medical Centre, which was evacuated on 18 June, caused extensive damage to the facility. Ballistic missiles also impacted seven other sites in Israel, including sites in Holon and Ramat Gan (Tel Aviv district), and injured at least 240 people. (Control Risks Analysis)�

Three strike groups will now soon be within striking range of Iran, consisting of at least 21 warships plus special forces units, in addition to 50 other US naval vessels in the Gulf region. Meanwhile, multiple US destroyers have been repositioned around the Red Sea and Eastern Mediterranean to bolster Israeli air defences against air attacks by both Iran and Yemen’s Houthi rebel movement.

Alongside air force movements, the extensive asset deployment, including refuelers and B-52 deployments at the Diego Garcia UK-US military base in the Chagos Archipelago, indicates that the US is positioning itself for an air campaign in the coming days.

The size of the naval deployment does not necessarily suggest the US is planning a wide-ranging sustained air campaign. They are likely being positioned to also respond to any potential Iranian attempt to close the Strait of Hormuz, which still remains unlikely. �

CNN on 18 June reported that the USS Gerald R. Ford Carrier Strike Group (CSG) is expected to be deployed to the Eastern Mediterranean area in the coming days. �

Control Risks Analysis

Seerist’s news and social coverage via EventsAI over the last 3 days depicted below. Above, select high reliability news articles from journalistic sources.

EventsAI 3/3

Scenarios for Regional Conflict Evolution

In our most likely scenario, Israel continues operations over the coming days, possibly weeks, prompting retaliatory attacks from Iran. Israel intercepts most Iranian attacks but some material damage does occur, including in urban areas.

Israel’s operations continue over at least the next few days, more likely the next few weeks. Netanyahu directs a strategic shift in the country’s engagement of Iran, with the primary goal to incapacitate its offensive capabilities and set back its nuclear programme by at least several years. Operations mostly focus on nuclear and military targets, including key individuals, but attacks also occasionally take place against critical economic infrastructure. Israel does not pursue regime destabilisation as a matter of priority, but it does constitute a latent goal.�

While Iran’s medium-range missile stocks have been depleted by operations against Israel in April and October 2024, according to US intelligence estimates the country still had 2,000 ballistic missiles with which it could target Israel at the beginning of the conflict. Iran maintains intense targeting of Israel in response to ongoing targeting by Israel, but the pace of attacks starts tapering off as Israel destroys launchers – the IDF assesses it has destroyed 40% of Iran’s launchers. Israel – with the US and other partners’ help – successfully intercepts most projectiles and sheltering procedures help prevent mass casualty incidents, but occasional hits cause damage.

What to watch:

What to watch:

Our credible alternative scenario builds on our most likely scenario’s development, seeing the US getting involved in the conflict and Iran expanding its targeting pattern to include US bases in the region and shipping in the Strait of Hormuz and adjacent waters.

In our credible alternative scenario, which has gained in probability in recent days, the developments laid out in our most likely scenario take place, but the US becomes involved offensively. This results in Iran expanding its targeting to include US bases in the region. Attacks primarily target US military and diplomatic assets in Iraq, but US military assets in the Gulf Arab states also come under limited and targeted fire. Civilian infrastructure is not targeted but major operational disruptions to flights occur regularly. In parallel, Iranian proxies in Iraq and Yemen step up their engagement, prompting renewed destabilisation in these countries.

�Meanwhile, targeting by the US and Israel expands dramatically over the coming weeks, with clear intent to not only destroy Iran’s nuclear and military capabilities, but also increasingly force Iran into submission by targeting economic assets (including oil and gas) and even political institutions. Under this scenario, Tehran attempts to close the Strait of Hormuz – and, in an even more escalatory version of this scenario, targets oil production facilities in Gulf Arab states – hoping that sky-rocketing oil prices can force the US to back down and rein in Israel.

What to watch:�

�

Rhetoric from Iranian leaders escalates but is mostly directed at Israel.

Repeated Israeli strikes nuclear sites and military sites prove damaging.

Iran leaves the treaty on the non-proliferation of nuclear weapons.��

Iran accelerates efforts to weaponise stockpiles of enriched fissile material.

The US actively supports Israeli air strikes on Iran from Gulf bases.

Israeli attacks target top regime figures.���

Control Risks Analysis

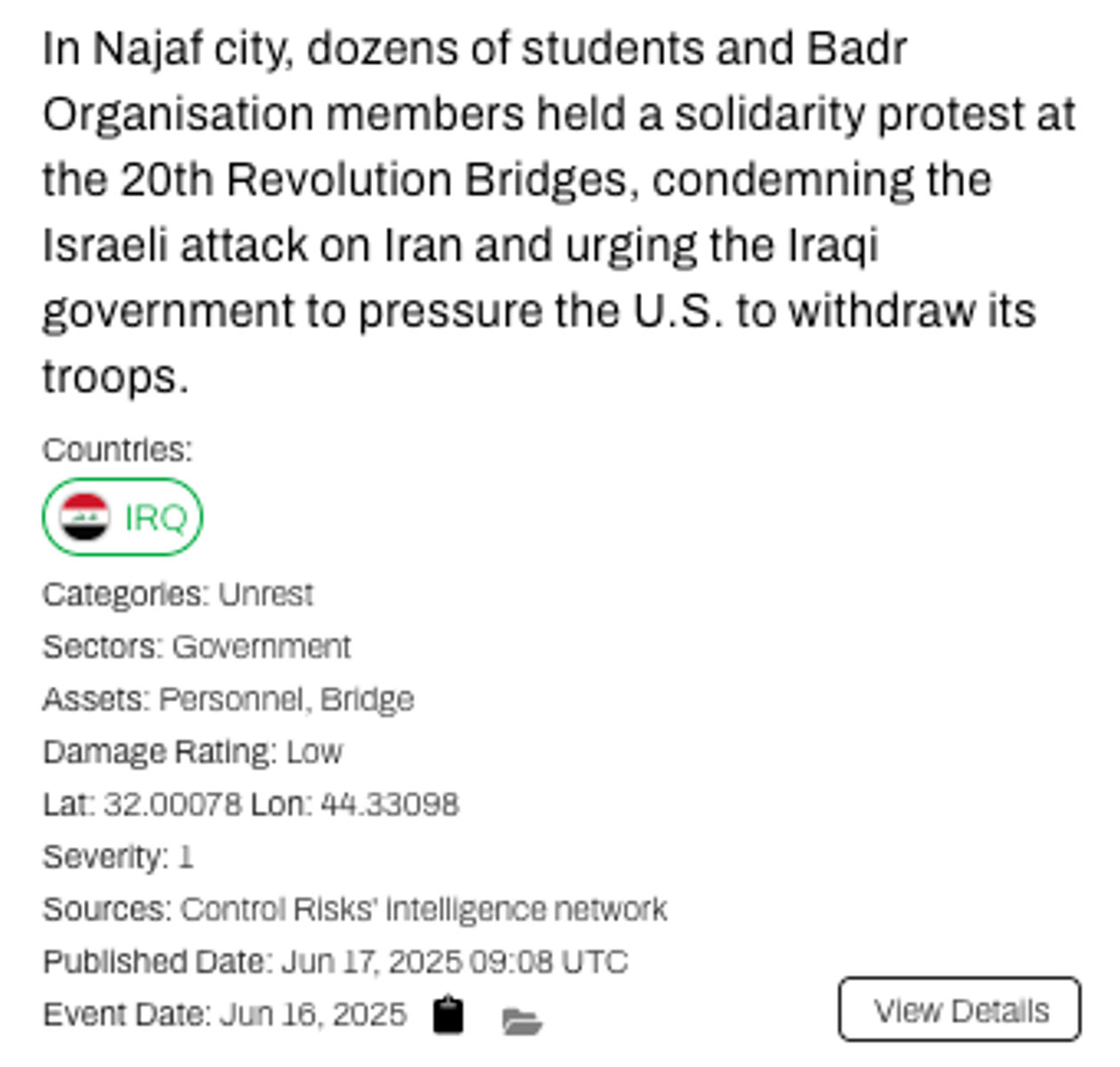

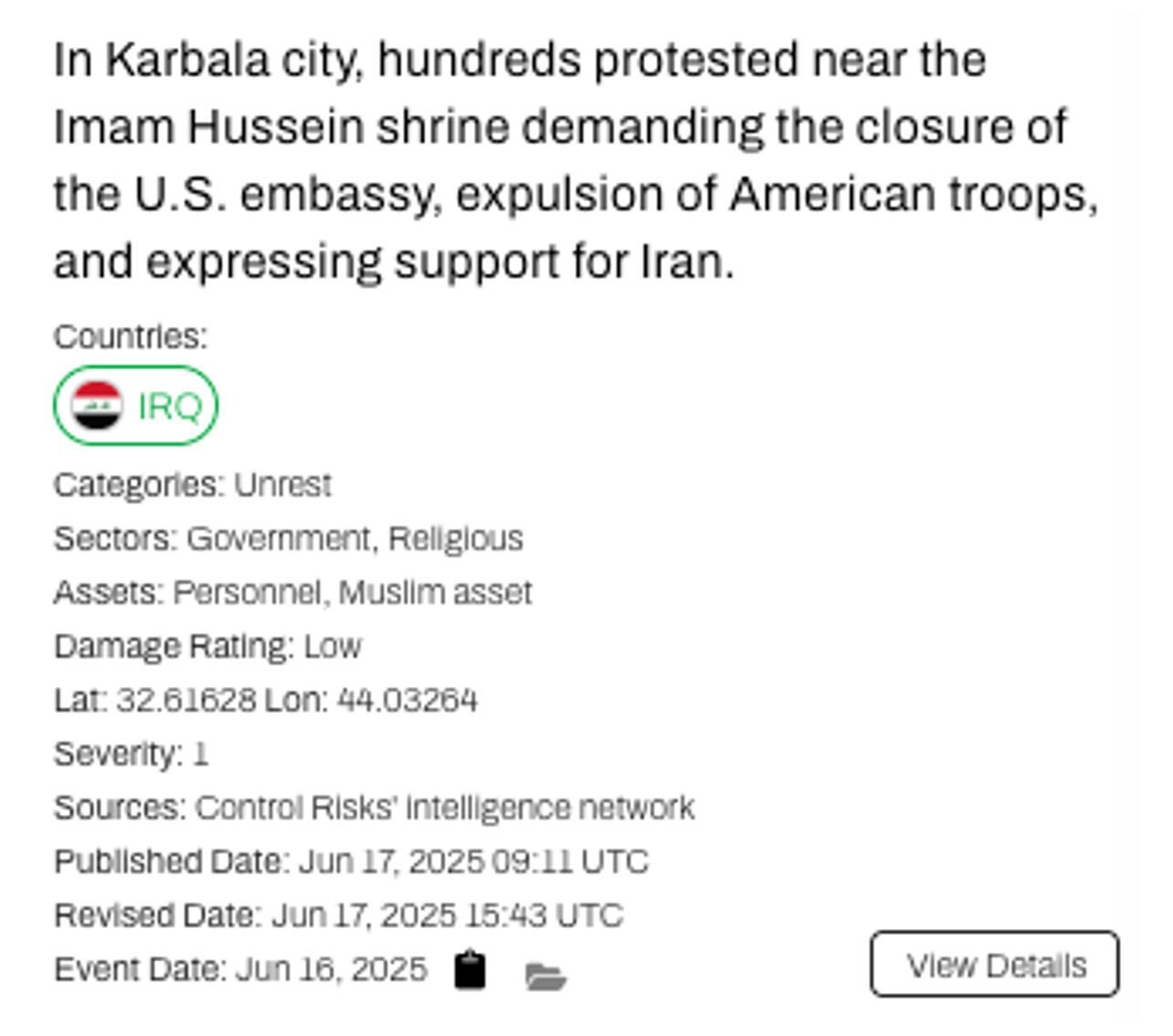

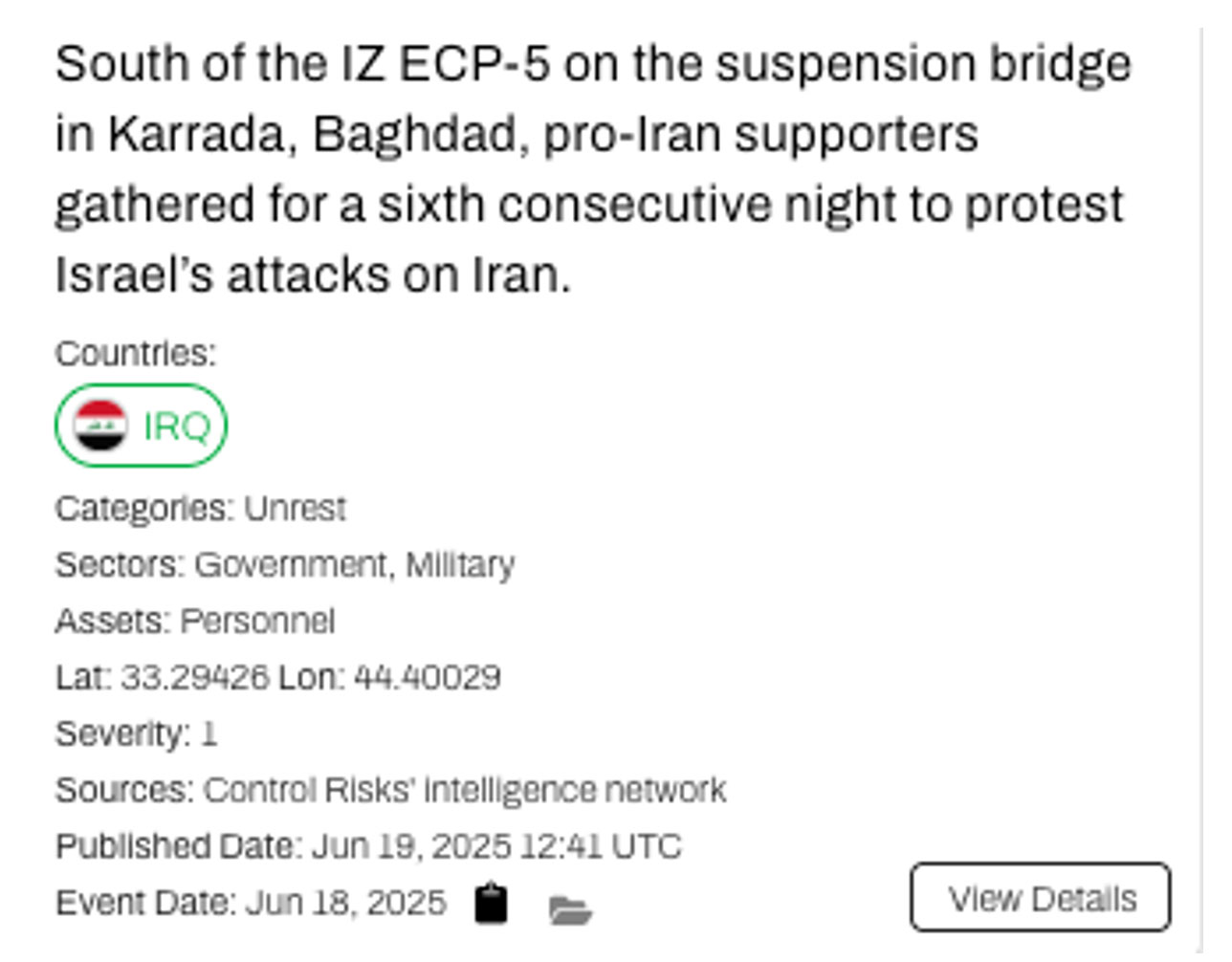

Pro-Iran Demonstrations to Increase as Israel-Iran Conflict Continues

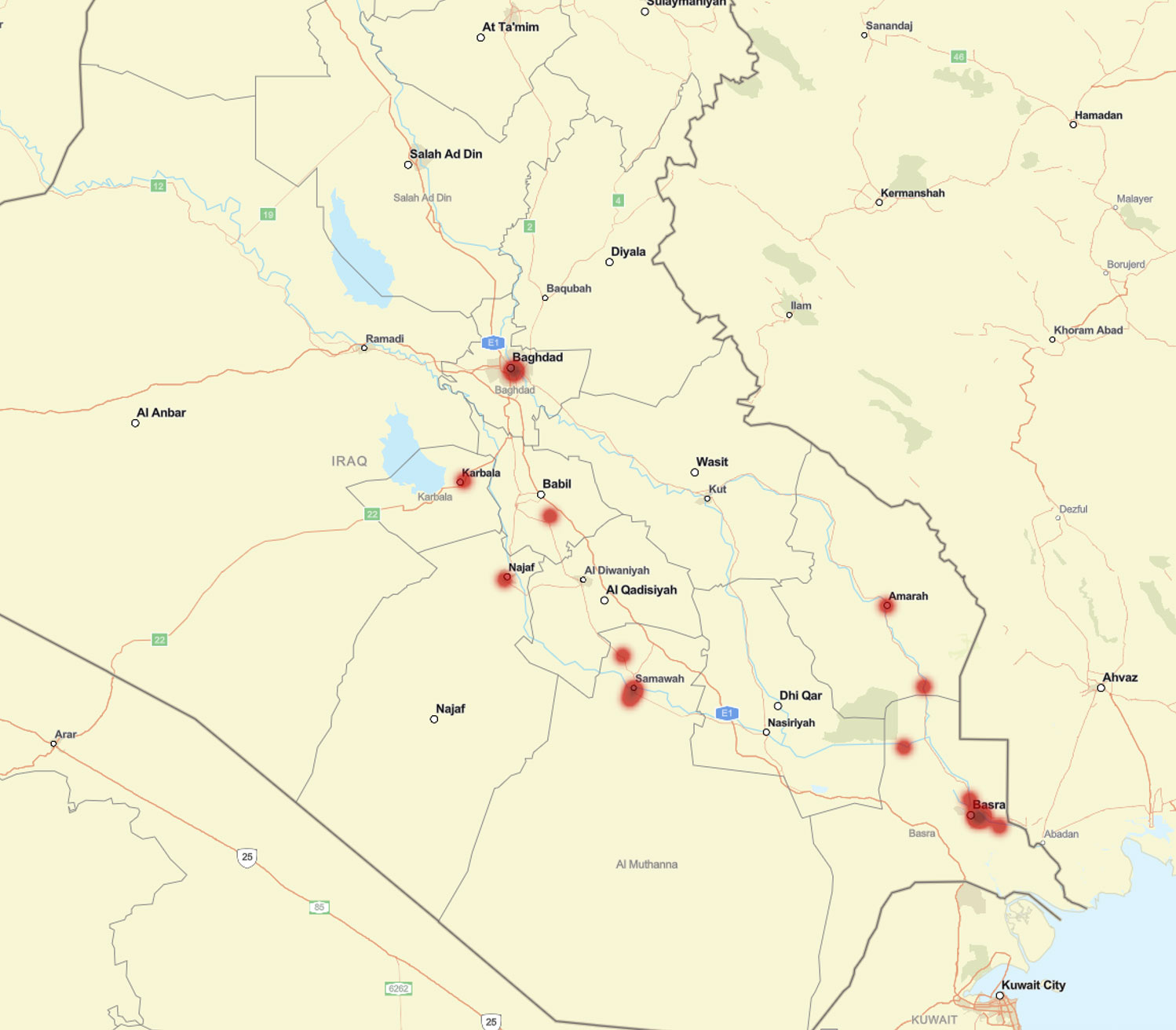

Iran-backed factions on 17 June organised protests in Karbala, Najaf and Baghdad provinces in support of Iran amid Israeli military operations against Tehran.

Further protests are likely to take place across Iraq in the coming days, particularly as the Israel-Iran war deepens and Western governments voice support for Israel.

Peaceful demonstrations will target diplomatic missions and US-linked businesses, especially in the capital Baghdad’s International Zone (IZ), increasing the risk of operational disruption such as road closures.

However, the targeted killing of Iran’s supreme leader or direct US involvement in the conflict would mobilise greater numbers of protesters in Iraq and heighten the risk of demonstrations turning violent.

Control Risks Analysis

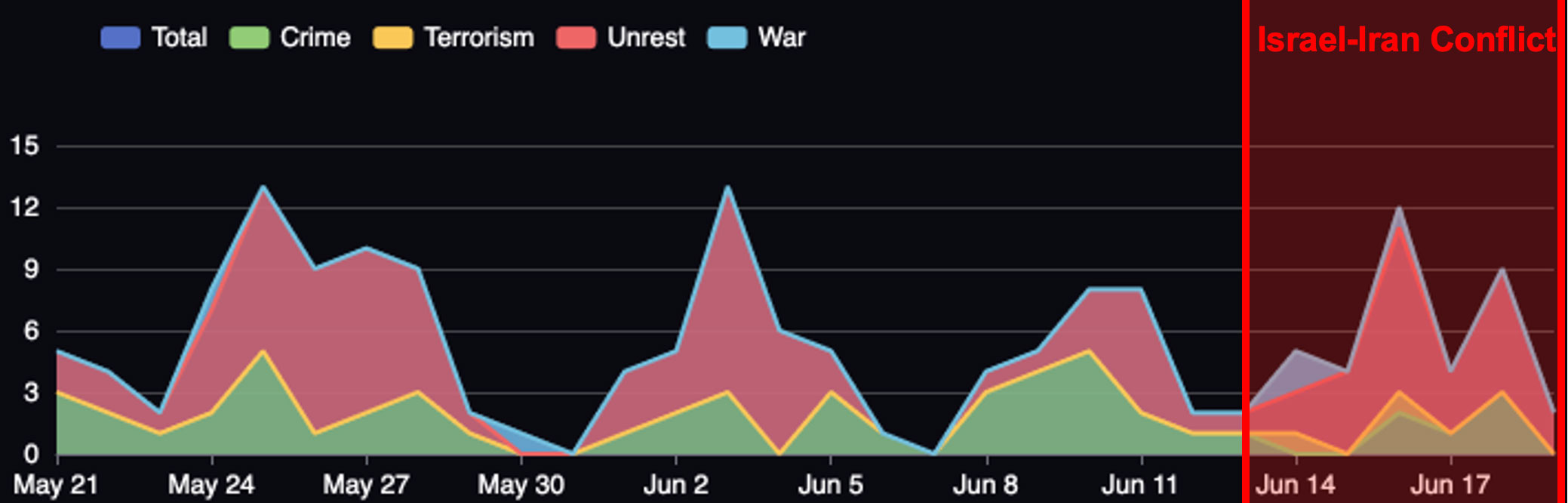

Seerist’s Verified Events in Iraq over the last 30 days, indicating that increases in ‘unrest’, ‘war’ and ‘terrorism’ events since the onset of conflict on Jun 13.�

Other Proxies in Spotlight:

Iran-backed regional actors have largely remained on the sidelines of the conflict. Lebanese Shia movement Hizbullah and Iraq-based militias have issued statements condemning Israel’s strikes on Iran but have not engaged in any cross-border targeting of Israel. Yemen’s Houthi rebel movement on 15 June launched a missile against Israel, but the attack did not constitute a departure from recent weeks’ targeting patterns. Finally, Iran-backed actors in the Palestinian Territories, Lebanon and Syria have seen their capabilities to target Israel extremely degraded in recent years. (Control Risks Analysis)�

Verified ‘Unrest’ Events across Iraq in the last 7 days heatmapped above.

Click green circles for Verified Event.�

Verified Event

Verified Event

Verified Event

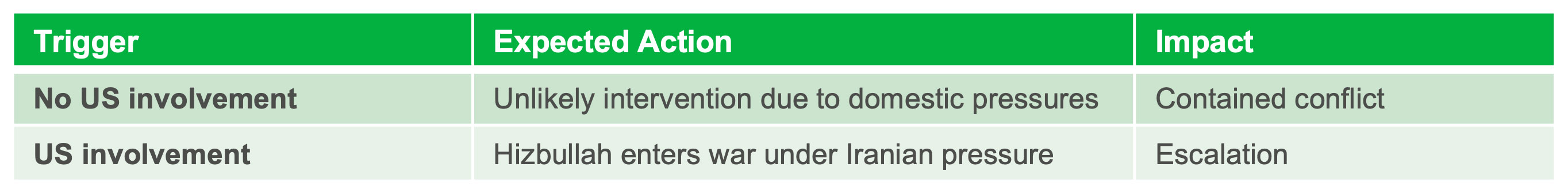

Hizbullah Response Scenarios

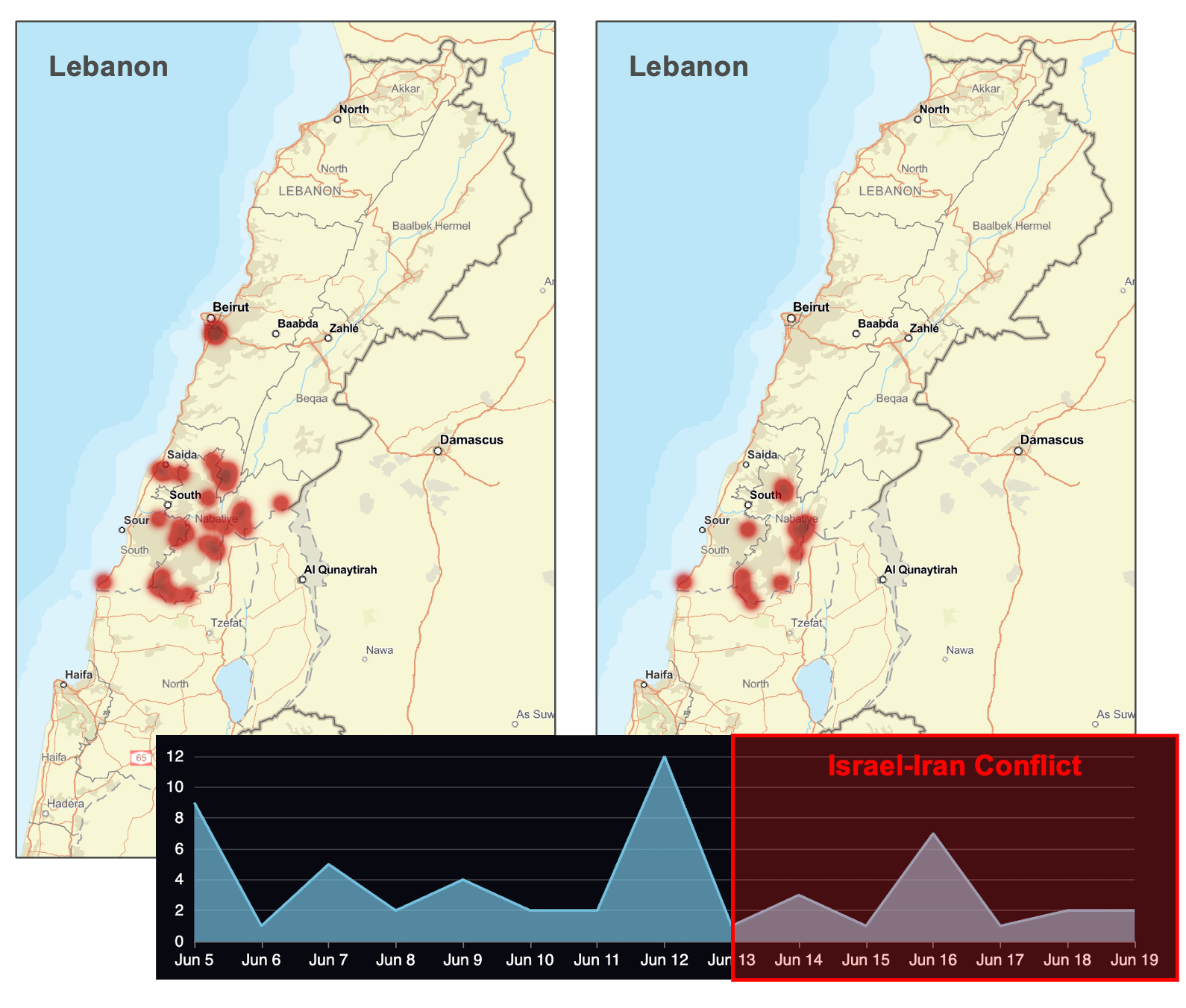

Since the beginning of the Iran-Israel war on 13 June, the Iran-backed Lebanese Shia movement Hizbullah has refrained from intervening in support of Tehran. �

Iranian Proxy Involvement

Hizbullah is unlikely to intervene in the conflict between Iran and Israel: its military capabilities remain limited, while growing domestic pressure continues to deter it.

In an alternative credible scenario, Hizbullah could intervene in the conflict under pressure from Iran, particularly if the US becomes involved.

This would likely trigger a full-scale resumption of hostilities between Israel and Hizbullah, with the Israel Defence Forces (IDF) intensifying its bombardment of Hizbullah-dominated areas, while the Shia militant group exhausts its remaining arsenal.

Control Risks Analysis

The number of Verified ’War’ Events reported in Lebanon dropped by 54.1% since the Israel-Iran conflict began on 13 June, indicating there has been no escalation of hostilities between Israel and Lebanon thus far. �

37 Verified ’War’ Events (5-12 Jun)

17 Verified ’War’ Events (13-19 Jun)�

Potential involvement�Hizbullah is unlikely to get involved in the Iran-Israel conflict in the coming days. The Shia group has seen its military capability severely diminished since October 2023. Hizbullah is also facing increasing pressure from the Lebanese government and the domestic population urging it to refrain from involving Lebanon in regional conflicts. Following a cabinet meeting on 16 June, Information Minister Paul Morcos said that both President Joseph Aoun and Prime Minister Nawaf Salam had affirmed that Lebanon should remain uninvolved in any war.

�It is therefore not in Hizbullah’s interest to shift its focus to the regional conflict while it continues to deal with the fallout of military and economic setbacks from its 2024 conflict with Israel. According to public media reporting, Hizbullah between October 2023 and November 2024 suffered over 10,000 casualties with more than 4,000 of its members killed, including senior commanders. �

Credible alternative scenario�In a credible alternative scenario where there is US involvement in the conflict in support of Israel, Hizbullah joins the conflict in support of Iran following extensive pressure from Tehran. Hizbullah would likely use its remaining weapons stockpiles, particularly its publicly reported longer-range ballistic missiles, the SCUD B/C/D, which have a range of 300-500km, to increase collateral damage on Israel. Subsequently, this will trigger the full resumption of hostilities between Israel and Hizbullah. The IDF will intensify its bombardment of Hizbullah-controlled areas, including the southern suburbs of Beirut (also known as Dahiyeh), southern Lebanon and areas in Baalbek-Hermel. By utilising the last weapons of its stockpile, Hizbullah will expose the location of its weapons facilities allowing Israel to strike them, which will further weaken the militant group. (Control Risks Analysis)�

Assessed Hizbullah Response Scenario Matrix �

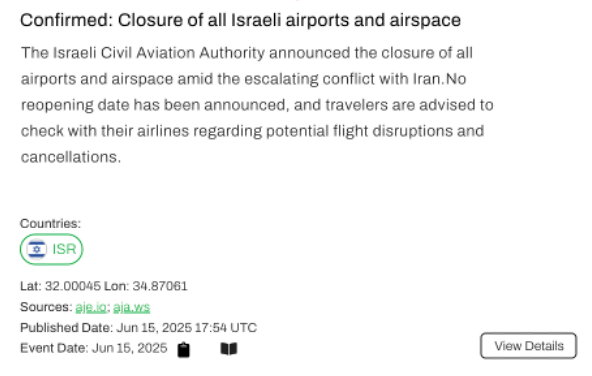

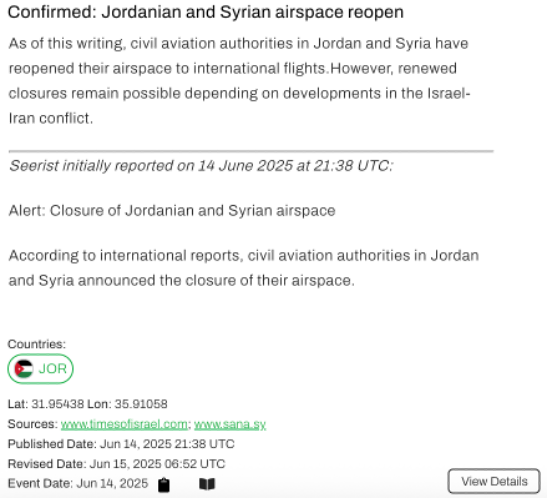

Regional Airspace Disruption Amid Escalating Iran-Israel Conflict

Iran on 18 June issued a Notice to Airmen (NOTAM) for commercial aircraft over the Middle East Gulf and the Gulf of Oman.�

The NOTAM’s wording that the “area of conflict may be extended” is not an Iranian threat to extend hostilities to civil aviation.

Instead, the warning indicates that Tehran believes US military action against Iran is imminent, that such action would result in degraded airspace security off its coast, and that Iran seeks to avoid the accidental targeting of civil airlines.

Any US offensive against Iran would result in missile attacks by each side and the activation of respective air defence systems – both of which pose a threat to aircraft.

Airspace closures and disrupted flight routes across the Gulf region will likely persist due to Iran issuing a notice to aviation (NOTAM) over the Persian Gulf and Sea of Oman.

Control Risks Analysis #1, Control Risks Analysis #2

Warning, not a threat�NOTAM A1933/25 is valid until 28 June. The notice said that the “area of conflict may be extended” to the Middle East Gulf and the Gulf of Oman. The NOTAM has been taken by some analysts as a threat to airlines. However, we assess it is rather a strong indicator that Iran perceives US military action to be imminent.

US action would result in missile attacks by both sides and the activation of air defence batteries, all of which pose a threat to commercial airlines that can mistakenly be identified as incoming hostile weaponry. Civil airlines have been accidentally targeted at times of regional tensions – including historically by the US and Iran. The issuance of the NOTAM signals that Iran seeks to avoid such a scenario. (Control Risks Analysis)�

Airspace disruption �Iran issued NOTAM A1933/25 on 18 June, warning of conflict zone expansion over the Persian Gulf and Sea of Oman, within the Tehran FIR (Flight Information Region). Valid until 28 June, the advisory signals Tehran’s intent to increase its threat posture and deter further Israeli or US air operations in the region. Although it is likely not to represent a direct threat to civilian flights, the move reflects Iran’s heightened caution, and it is likely aimed at preventing a repeat of past accidental strikes on commercial aircraft.

�Airlines will continue to divert flights through Saudi air corridors to avoid higher risk areas such as Jordan and closed airspace over Iraq. Some European and North American airlines have paused their routes to some Gulf locations to manage potential operational risks should regional airspace become further compromised. (Control Risks Analysis)�

Breaking Event�

Breaking Event�

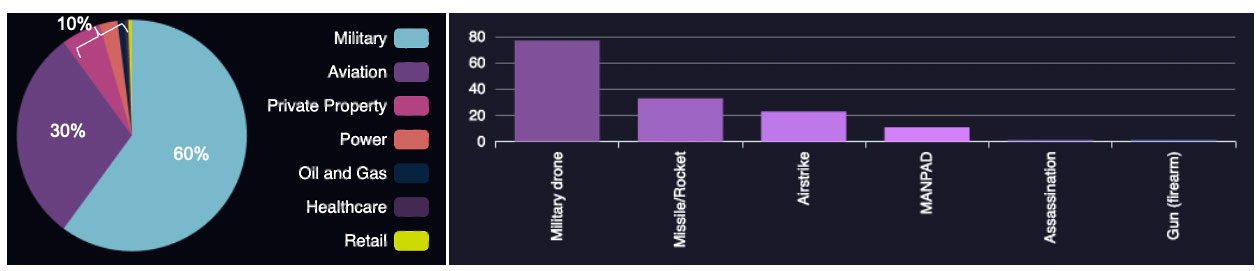

War VEs by ‘Sector’ Impacted�

War VEs by ‘Attack Type’

Explore Now

Learn more about delivering the trustworthy insights you need, right when you need them.

Discover Seerist Today

The foresight to get ahead of what may come.

The insights with the most impact.

Accelerate speed to decision.

Discover the Seerist Solution.

Learn more about delivering the trustworthy insights you need, right when you need them.

Explore Now