Donald Trump will be inaugurated for a second term as US president on 20 January. The confirmation of cabinet nominees and the emergence of detail on policy over the quarter will provide some clarity around the implications of the Trump presidency for businesses globally, at least in the near term. Some of the policies will be significantly different to those pursued by President Joe Biden.�

Trump’s inauguration comes at a time of significant political instability in Germany and France, which will also have knock-on impacts on European policymaking.�

Terrorism threat levels will be elevated toward the end of Q1 and start of Q2 when several religious holidays will be observed: Ramadan, Passover (Pesach) and Easter.

Key Geopolitical Trends to Monitor in Q1 2025

Trump 2.0

EXECUTIVE SUMMARY

Political (in)stability in Europe

Middle East conflicts

Elevated terrorism threat

Rise in antisemitism

Companies should prepare for significant changes to US domestic and foreign policies when Trump is inaugurated as US president on 20 January. In his first 100 days in office, Trump is likely to focus on key domestic policy areas that he highlighted during his campaign: immigration, tax cuts and deregulation. Tariffs and trade restrictions are likely to be key foreign policy tools of the administration, and the US will use these tools in negotiations over a variety of issues (e.g. trade deficits) with rivals and allies alike.

�Companies globally are most likely to be impacted by the new US trade policy approach. Trump on 25 November stated that he would impose tariffs on Mexico, Canada (both 25%) and China (additional 10%). During his presidential campaign Trump floated a 10% to 20% universal baseline tariff on all imports and 60% on those from China. However, the tariffs are unlikely to be imposed at the level or speed threatened by Trump, given the economic impact and legal constraints.

�

TRUMP 2.0

Europe will face significant political issues in Q1, not least as the Trump presidency will prove difficult for many European countries to manoeuvre. We continue to assess that a fundamental breakdown in relations between Europe and the US – while credible – is unlikely. Trump’s hawkish position on NATO (he has warned the US would not be committed to NATO unless European allies “pay their bills”), the Ukraine war and trade relations will present plenty of friction points in the transatlantic relationship in the coming months. Such friction points will also impact Europe’s political landscape, particularly if significant US policy shifts impact long-term budget planning.

Political (in)stability in Europe

Overlapping and unresolved conflicts in the Middle East are evolving but will continue to drive geopolitical divisions, global supply chain disruption and terrorism threats. Israeli attacks targeting Iran’s nuclear programme and regional energy infrastructure would be likely to draw the US more directly into a conflict. Supporting Israel will be a key foreign policy objective of the Trump 2.0 administration, which will also aim to expand and more aggressively enforce sanctions against Iran.

�

Middle East conflicts

The conflicts in the Middle East will continue to increase the intent of Islamist extremist groups in the Middle East and their affiliates and sympathisers worldwide to carry out attacks targeting Israeli, US and other Western assets and interests. Furthermore, terrorism threat levels will be elevated globally towards the end of Q1 and into the start of Q2, when several religious festivals coincide. Terrorism threats will be elevated during the Muslim holy month of Ramadan (likely to take place between 28 February and 20 March), the Jewish Passover (Pesach) holiday (12-20 April) and Easter Sunday (20 April). Anti-Jewish and anti-Muslim hate crimes are more likely to take place during religious holidays that also often function as rallying points for protest movements. The Christian Easter religious holiday is not generally associated with elevated violent extremist threats, though attacks have targeted religious services in some countries in the past (Sri Lanka in 2019).

Elevated Terrorism threat

Trump 2.0

Political (in)stability in Europe

Middle East conflicts

Elevated terrorism threat

Rise in antisemitism

Back to Executive Summary

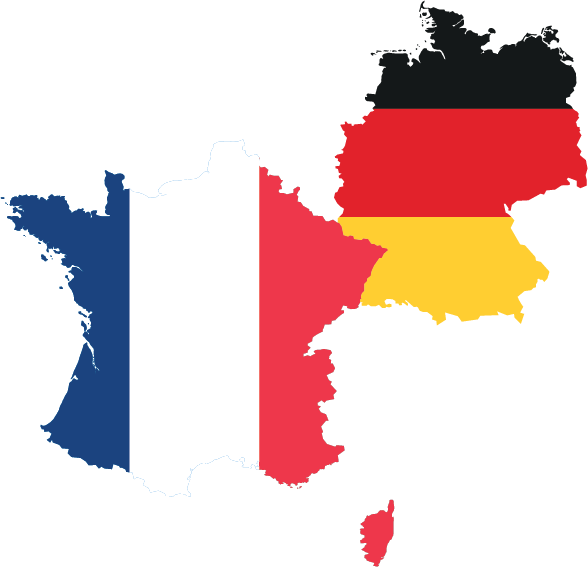

OSCE hate crime tracking show significant rise in antisemitic hate crimes

Incidents = violent attacks against people and properties as well as threats. Reported incidents took place in a variety of countries, mostly in Europe and Central Asia. Most recent data ends at 2023.

4,000

3,000

2,000

1,000

595

997

768

840

570

511

333

287

337

247

2,021

2,322

2,529

3,557

4,490

Anti-Christian hate crime

Anti-Muslim hate crime

Antisemitic hate crime

Chart: Control Risks • Source OSCE

© Control Risks

2019

2020

2021

2022

2023

Trump coming into office will boost expectations for negotiations to end the war in Ukraine. He repeatedly pledged to negotiate a quick end to the war but provided no details. Companies should review existing Ukraine war scenarios and closely monitor for indications of an emerging Ukraine policy.

Trump’s inauguration comes at a time of significant political instability in Europe’s two largest economies. With Germany facing an election on 23 February and France’s government at a critical juncture, each of these countries will be focusing on domestic political issues. The leadership vacuum in Germany and French political turbulence will likely hinder EU policymaking in Q1 as new EU regulations need the clearance of all EU governments. While Berlin will be hesitant to agree on any significant new EU policy without an elected government, Paris will struggle to get parliamentary support for new EU policies. This dynamic will also negatively impact the EU’s ability to react in union to US policy in the first months of 2025.

Conflict escalation could result in further disruptions to regional air traffic and increased threats to Gulf shipping. Meanwhile, despite US and Israeli attacks, Yemen-based Houthi militants retain the capability and intent to target shipping in the Red Sea.

�Following the downfall of Syrian President Bashar al-Assad, the political transition in Syria will drive geopolitical competition in the region in Q1. The US, Israel, Russia, Turkiye, Iran and Gulf countries all have vested interests in Syria that are likely to prolong the country’s fragmentation. While adding fuel to existing geopolitical tensions in the region, events in Syria are unlikely to pose direct risks to global energy or financial markets.

Donald Trump will be inaugurated for a second term as US president on 20 January. The confirmation of cabinet nominees and the emergence of detail on policy over the quarter will provide some clarity around the implications of the Trump presidency for businesses globally, at least in the near term. Some of the policies will be significantly different to those pursued by President Joe Biden.

Trump’s inauguration comes at a time of significant political instability in Germany and France, which will also have knock-on impacts on European policymaking.

Terrorism threat levels will be elevated toward the end of Q1 and start of Q2 when several religious holidays will be observed: Ramadan, Passover (Pesach) and Easter.

EXECUTIVE SUMMARY

Sources:

“Trump details sweeping changes he’ll carry out on day one and beyond in an exclusive interview”, NBC News

Control Risks

Trump’s inauguration comes at a time of significant political instability in Europe’s two largest economies. With Germany facing an election on 23 February and France’s government at a critical juncture, each of these

Explore the Seerist Solution.

See how Seerist combines AI and human verified analysis to proactively monitor these key issues in 2025.

Request a demo

Request a demo