By Jon Gorey

noteworthy

In the shadow of global financial behemoths like Fidelity Investments and State Street, two of Boston’s smaller, boutique investment funds are run a bit differently: They’re managed entirely by Suffolk University students.

About a decade ago, Karen Wilcox O’Connor, MBA ’82, donated $100,000 to create the James and Anne Wilcox Student Investment Club and Scholarship Fund. Under the careful stewardship of Sawyer Business School students—who gain invaluable, real-stakes investing experience as they manage the fund as part of their Investment Analysis course—the Wilcox Fund has roughly doubled in size since its 2011 inception, yielding about $7,000 to $9,000 each year for Suffolk University scholarships.

Managing that very real money provides students with a holistic, hands-on education in financial analysis and portfolio administration.

“They do everything,” says Finance Instructor Ric Thomas. “They analyze stocks, they use discounted cash flow analysis, they’ll look at the income statement and balance sheet, and then they’ll make a pitch based on valuation and company outlook. They will use any techniques that a regular investment analyst would use.”

Amy Zeng, dean of the Sawyer Business School, says the Wilcox Fund embodies Suffolk’s commitment to experiential learning. In fact, the program has been such a success that Zeng spearheaded the idea of expanding it with an additional $200,000 fund, now known as the Tremont Fund, modeled after the Wilcox Fund, for members of Suffolk’s Finance and Investing Club to manage.

Return to Table of Contents

Weighing their investment options are (from left) Hannah Solley, Onur Corbaci (holding cellphone), Thomas Sampson, Liam O’Toole, and Erin Nowak. Inset: Finance Instructor Ric Thomas. Photographs by Michael J. Clarke

“The students have done a great job,” says Thomas, the club’s advisor. “The challenge is that you really can’t get into the Investment Analysis class until you’re a junior or senior, because you have to complete a number of prerequisites. Secondly, it’s a very popular class, so there’s usually a waitlist.”

Zeng says the new fund will give more students the chance to learn practical skills in investment and portfolio management, as well as valuable soft skills like how to work effectively as a team, how to think critically, and how to make hard decisions.

Thomas agrees. “It’s easy to sit back and say, ‘Oh, yeah, I would have done that,’” he says. “Well, you’ve got real money on the line now, and that changes your mindset a little bit.”

To that end, Thomas has his spring semester students produce a trading plan with price targets on every stock in their sector portfolio. “I want them to have a contingency trading plan on every single stock, and that’s their final report.”

Thomas and fellow finance instructor Michael Eisenstein provide advice and guidance to the investment club, but try not to overstep.

“Part of our role is to make sure that it’s diversified, that there are risk controls,” Thomas says. “But we really let the students run this.”

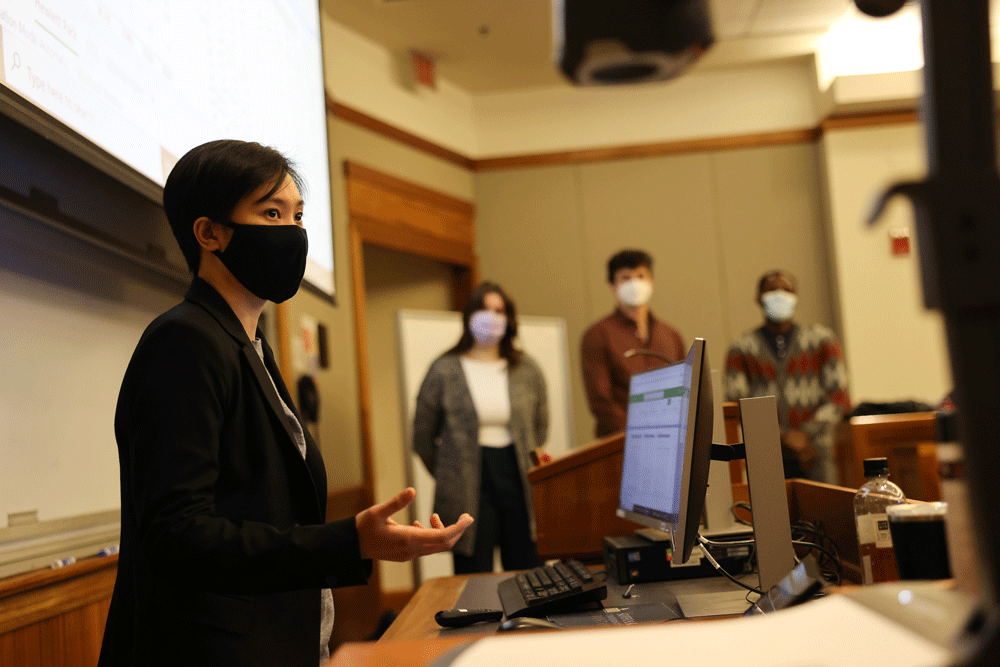

Students in the Sawyer Business School’s Investment Analysis course and its Finance and Investing Club (including MBA grad student Hoa Le, above) manage two separate investment funds, using all the portfolio management techniques a regular investment analyst would.