For the past 13 years, Sun Life has been at the forefront of analyzing our comprehensive claims data to empower self-funded employers. Our mission: to provide crucial insights into high-cost claims and injectable drug trends, enabling self-funded employers to make informed decisions that benefit both their employees and their bottom line.

Armed with these insights, you'll be better equipped to refine your risk management strategy, optimize your benefit offerings, and stay ahead of industry shifts.

Click on the report to the right to get a full copy.

Keep scrolling for additional research insights and recommendations!

Download the report here

Sun Life report highlights

To learn more, contact your Sun Life Stop-Loss Specialist or reach out here!

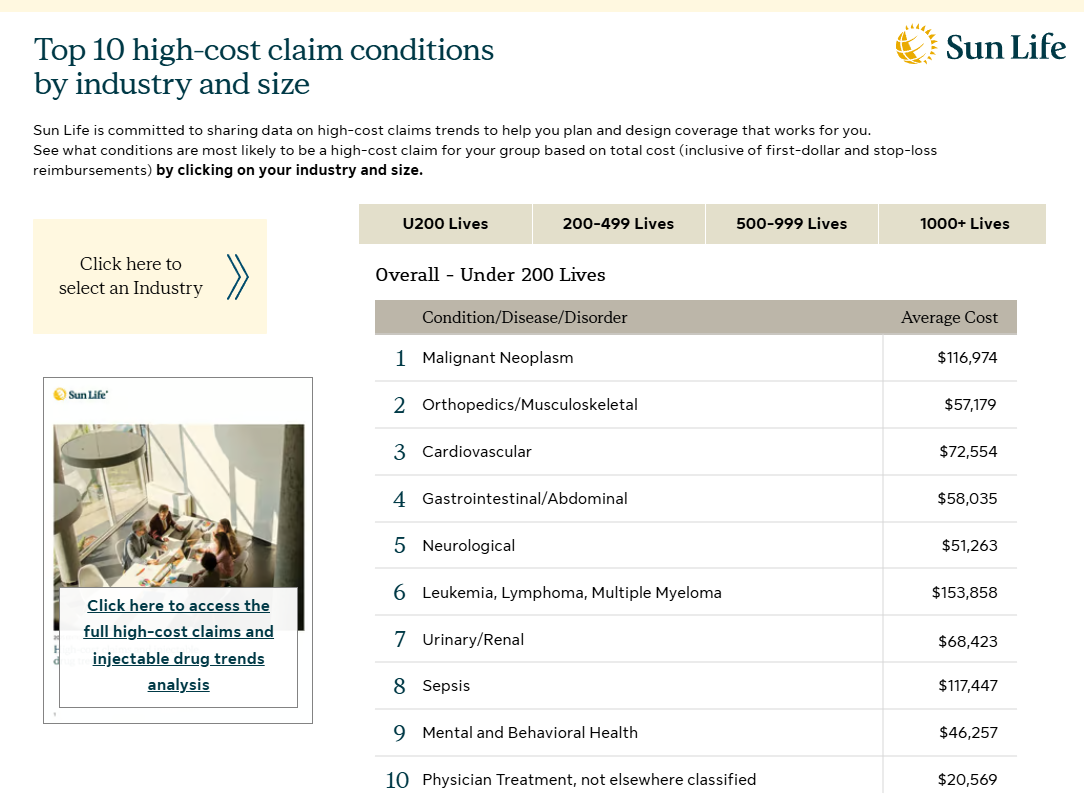

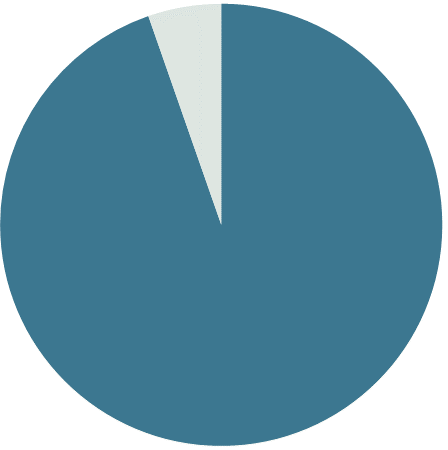

72% of all reimbursed stop-loss claims are from the top 10 conditions.

Top high-cost claim conditions

#1 Malignant Neoplasm

#2 Cardiovascular

#3 Orthopedics/Musculoskeletal

#4 Leukemia, Lymphoma, Multiple Myeloma

#5 Newborn/Infant care

#6 Sepsis

#7 Gastrointestinal

#8 Respiratory

#9 Neurological

#10 Congenital Anomaly

This year's highest-cost claim was for a member with a primary diagosis of Newborn/Infant Care at $11.5 million in total cost.

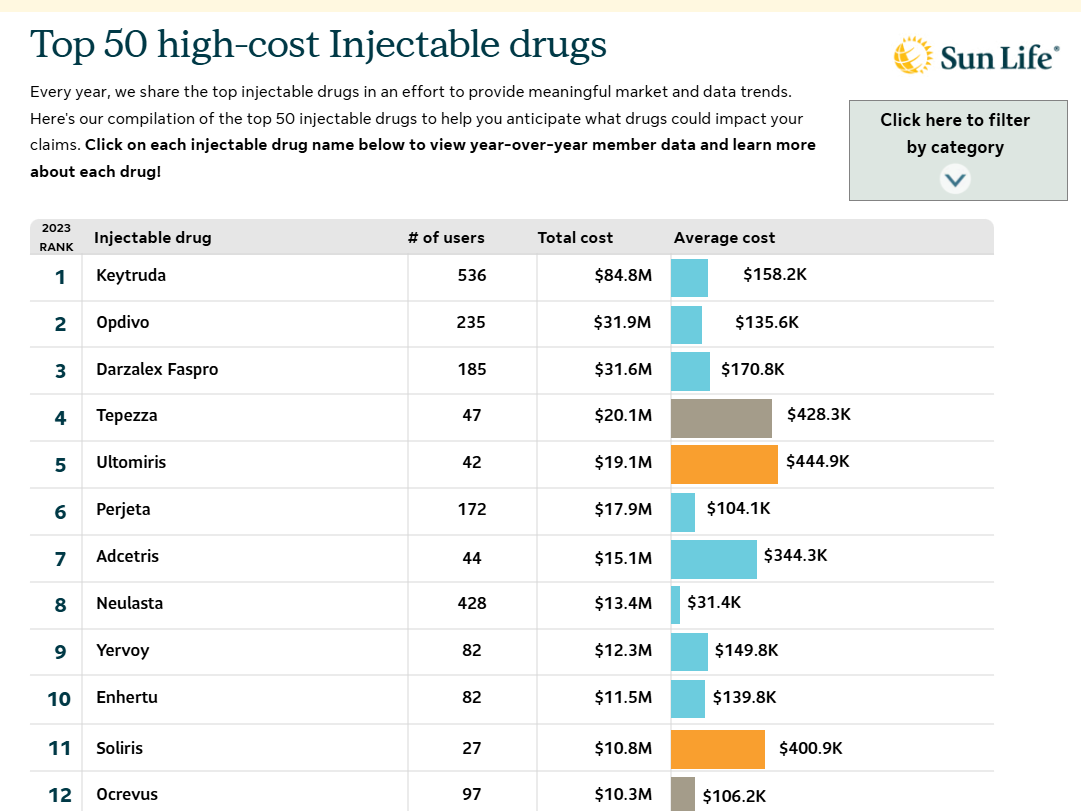

Top injectable drugs

#1 Keytruda

#2 Opdivo

#3 Darzalax Faspro

#4 Tepezza

#5 Ultomiris

#6 Perjeta

#7 Adcetris

#8 Neulasta

#9 Yervoy

#10 Enhertu

Source: average cost, highest cost, and % medical and rx spend from Sun Life book of business data including first-dollar claims and stop-loss reimbursements, 2023.

Top 5 rank from Sun Life book of business data, stop-loss reimbursements from 2020-2023.

Group stop-loss insurance policies are underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) in all states, except New York, under Policy Form Series 07-SL REV 7-12 and 22-SL. In New York, Group stop-loss insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 07-NYSL REV 7-12 and 22-NYSL. Policy offerings may not be available in all states and may vary due to state laws and regulations. Not approved for use in New Mexico.

© 2024 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. The Sun Life name and logo are registered trademarks of Sun Life Assurance Company of Canada. Visit us at www.sunlife.com/us.

SLDX-1573-2-a #1362359261 05/24 (exp. 05/26)

8 of the top 10 injectable drugs are used to treat cancer.

Key Insights

Over the 2019-2022 benefit years, 87% of employers were likely to experience a stop-loss claim in any given year.

COVID has fallen to #29 on our list in 2023, compared to #11 in the single year for 2022.

The primary driver of cost for 50% of members with a the $3M+ claim was congenital anomalies.

The top 10 injectable drugs all had over $10M in total spend. Keytruda at #1 had $69.7M in spend.

Over 50% (11 injectable drugs) of the top 20 are used to treat cancer.

2025 Sun Life Stop-Loss high-cost claims and injectable drug trends analysis

Click here to learn more about the top 50 injectable drugs.

Click to view the top 10 high-cost conditions by industry & size.

Click to view the top 5 high-cost conditions by deductible.

Recommendations to improve population health and manage high-cost claims

Orthopedics/ Musculoskeletal reached #3 spot for the first time.

By providing solutions that focus on preventative measures, early intervention, and support for both common and complex health conditions, employers can more effectively manage population health risks and improve employee well-being while better managing high-cost claims.

Supporting population health

Supporting more complicated conditions

• Focus on preventative resources and early intervention solutions before care needs become more severe.

• Offer resources that help employees make timely, informed decisions about their health like second opinion services and care navigation.

• Prioritize keeping employees productively working and supporting successful return to work after illness or injury.

Implement solutions that can make a measurable difference for more severe conditions that are likely to impact your book of business.

– High-cost drugs

– Gene therapy

– Cardiovascular disease

– Chronic kidney disease

– Cancer

Sun Life stop-loss clients have access to many health solutions for their employees that target many of these strategies. Click here to learn more!

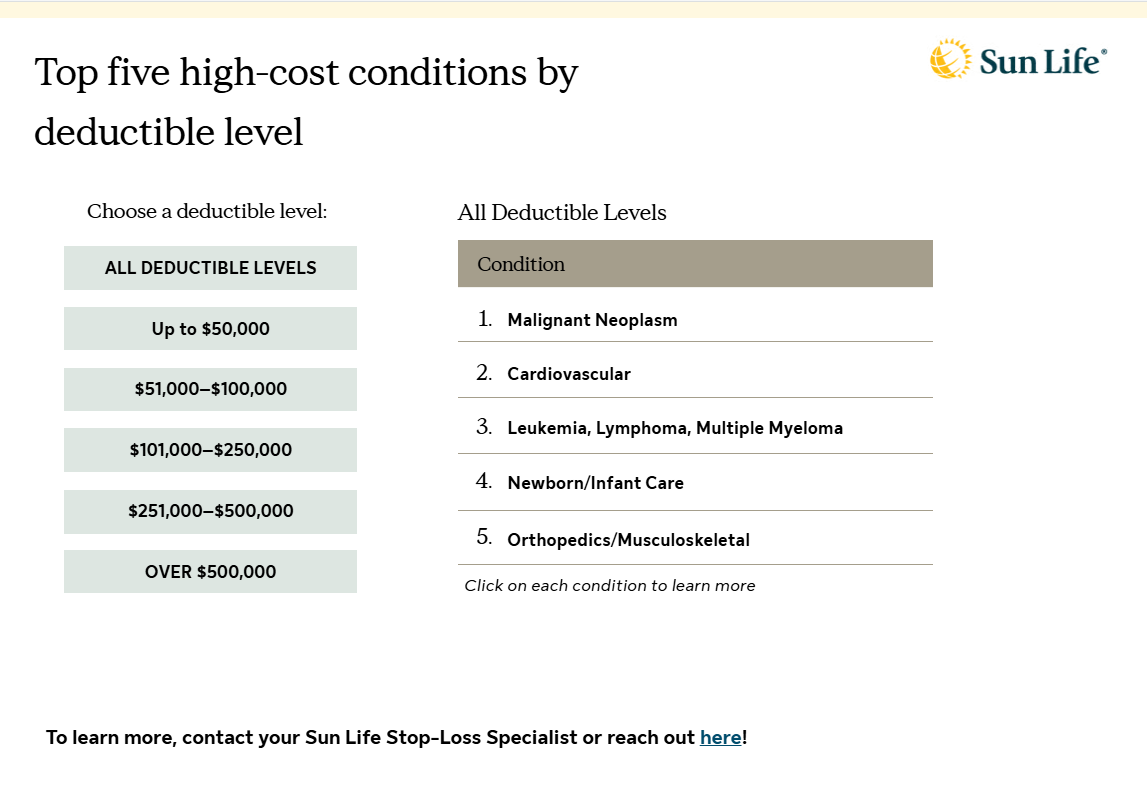

Top five high-cost conditions by deductible level

All Deductible Levels

Up to $50,000

$51,000–$100,000

$101,000–$250,000

$251,000–$500,000

OVER $500,000

Choose a deductible level:

Click on each condition to learn more

Condition

1.

2.

3.

4.

5.

ALL DEDUCtiBLE LEVELS

Malignant Neoplasm

Orthopedics/Musculoskeletal

Cardiovascular

Leukemia, Lymphoma, Multiple Myeloma

Newborn/Infant Care

Up to $50K

Malignant Neoplasm

Cardiovascular

Orthopedics/Musculoskeletal

Gastrointestinal/Abdominal

Leukemia, Lymphoma, Multiple Myeloma

$51K–100K

Malignant Neoplasm

Cardiovascular

Orthopedics/Musculoskeletal

Gastrointestinal

Leukemia, Lymphoma, Multiple Myeloma

$101K–250K

Malignant Neoplasm

Cardiovascular

Orthopedics/Musculoskeletal

Leukemia, Lymphoma, Multiple Myeloma

Gastrointestinal

$251K–500K

Malignant Neoplasm

Cardiovascular

Leukemia, Lymphoma, Multiple Myeloma

Newborn/Infant Care

Orthopedics/Musculoskeletal

Over $500K

Malignant Neoplasm

Newborn/Infant Care

Cardiovascular

Leukemia, Lymphoma, Multiple Myeloma

Congenital Anomaly

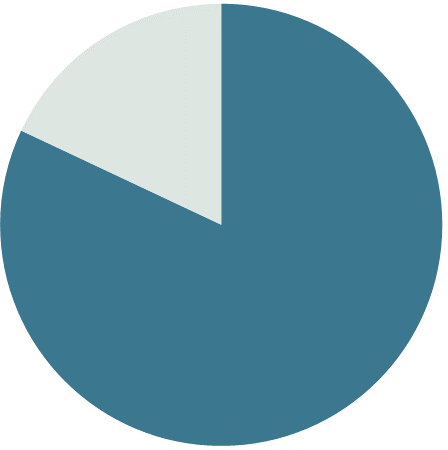

Malignant neoplasm

This category contains diagnoses of what are commonly thought of as solid tumors, including treatment for the tumor, secondary conditions directly related to the tumor, and/or its treatment. Malignant neoplasm claims are over double the spend of the second most expensive condition: Leukemia, lymphoma, and/or multiple myeloma (blood cancers)

Average cost: $213.3K

Highest cost: $2.7M

Medical

61%

Rx

39%

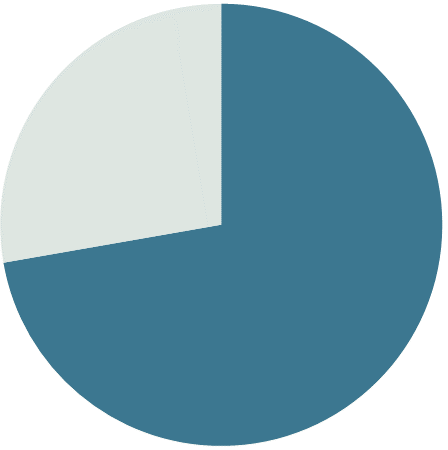

Leukemia, lymphoma and/or multiple myeloma

This category contains acute and chronic diagnoses of what are commonly thought of as cancers of the blood, secondary conditions directly related to leukemia, and/or its treatment.

Average cost: $222.2K

Highest cost: $2.1M

Medical

66%

Rx

34%

Neurological

This category contains acute and chronic disease and injury related to the neurological system, including traumatic injury, primary and acquired disease, infectious disease, secondary conditions directly related to neurological compromise, and complications of treatment. This category combines what was previously five separate categories.

Average cost: $97.5K

Highest cost: $2.86M

Medical

73%

Rx

27%

Gastrointestinal/Abdominal

This category contains disease and injury related to the gastrointestinal system (mouth to anus), including traumatic injury, infectious disease, thoracic organ disease, dental conditions covered under medical plan, oral and pharyngeal-esophageal disease, secondary conditions directly related to GI system compromise, and complications of treatment.

Average cost: $96.5K

Highest cost: $2.4M

Medical

65%

Rx

35%

Respiratory

This category contains acute and chronic disease and injury related to the respiratory system, including primary and acquired disease, infectious disease, pulmonary heart disease, secondary conditions directly related to respiratory dysfunction, and complications of treatment. This category includes five conditions from our prior claims mapping.

Average cost: $99.5K

Highest cost: $5.5M

Medical

82%

Rx

18%

Orthopedics/ Musculoskeletal

This category contains acute and chronic disease and injury of bone and soft tissue, including traumatic injury, primary and acquired disease and deformity, secondary conditions directly related to orthopedic dysfunction, and complications of

treatment.

Average cost: $102.5K

Highest cost: $3.3M

Medical

71%

Rx

29%

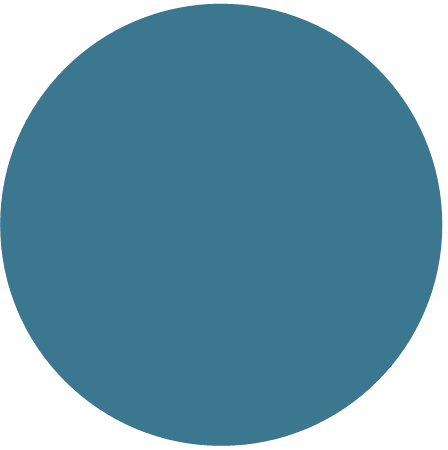

Newborn

This category contains disease

and injury related to newborn infants, including disease and complications of prematurity and/or low birthweight, complications related to maternal conditions, complications and birth trauma related to labor/delivery, dysfunction related to immaturity of body systems, and complications of treatment. Four categories from our prior grouping system are now included in this condition.

Average cost: $470.8K

Highest cost: $11.5M

Medical

100%

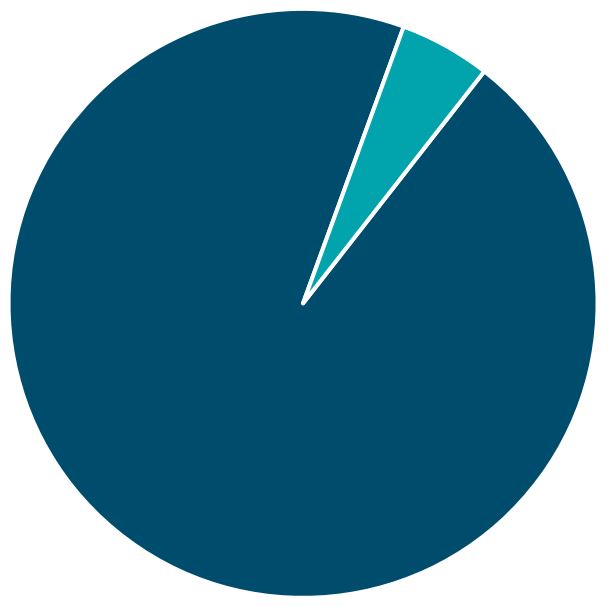

Cardiovascular

This category contains acute and chronic disease and injury related to the heart and blood vessels, including primary and acquired disease, traumatic injury, secondary conditions directly related to cardiovascular dysfunction, and complications of treatment.

Average cost: $144.2K

Highest cost: $5.3M

Medical

94%

Rx

6%

To learn more, contact your Sun Life Stop-Loss Specialist or reach out here!

Source: average cost, highest cost, and % medical and rx spend from Sun Life book of business data including first-dollar claims and stop-loss reimbursements, 2023.

Top 5 rank from Sun Life book of business data, stop-loss reimbursements from 2021-2024.

Group stop-loss insurance policies are underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) in all states, except New York, under Policy Form Series 07-SL REV 7-12 and 22-SL. In New York, Group stop-loss insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 07-NYSL REV 7-12 and 22-NYSL. Policy offerings may not be available in all states and may vary due to state laws and regulations. Not approved for use in New Mexico.

© 2025 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. The Sun Life name and logo are registered trademarks of Sun Life Assurance Company of Canada. Visit us at www.sunlife.com/us.

SLDX-1573-2-a #1362359261 05/24 (exp. 05/26)