Target Q1 2025 Results

Despite softer-than-expected sales and profit pressures in Q1, we saw momentum in key areas and made progress in further enhancing the shopping experience.

-3.8%

Comparable�Sales

-5.7%

Stores

Comparable�Sales

+4.7%

Digital

Comparable

Sales

$2.27

GAAP EPS

*Adjusted EPS is a non-GAAP financial measure most directly comparable to GAAP EPS. Adjusted EPS is reconciled to GAAP EPS in our Q1 2025 earnings release posted on our investor relations website.

Statements in this document about our future financial and operational performance, and our strategy for growth are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Please see our Q1 earnings release and our SEC filings for risks and uncertainties that could cause Target’s results to differ materially from what was expected as of the date of this document, May 21, 2025.

$1.30

Adjusted EPS*

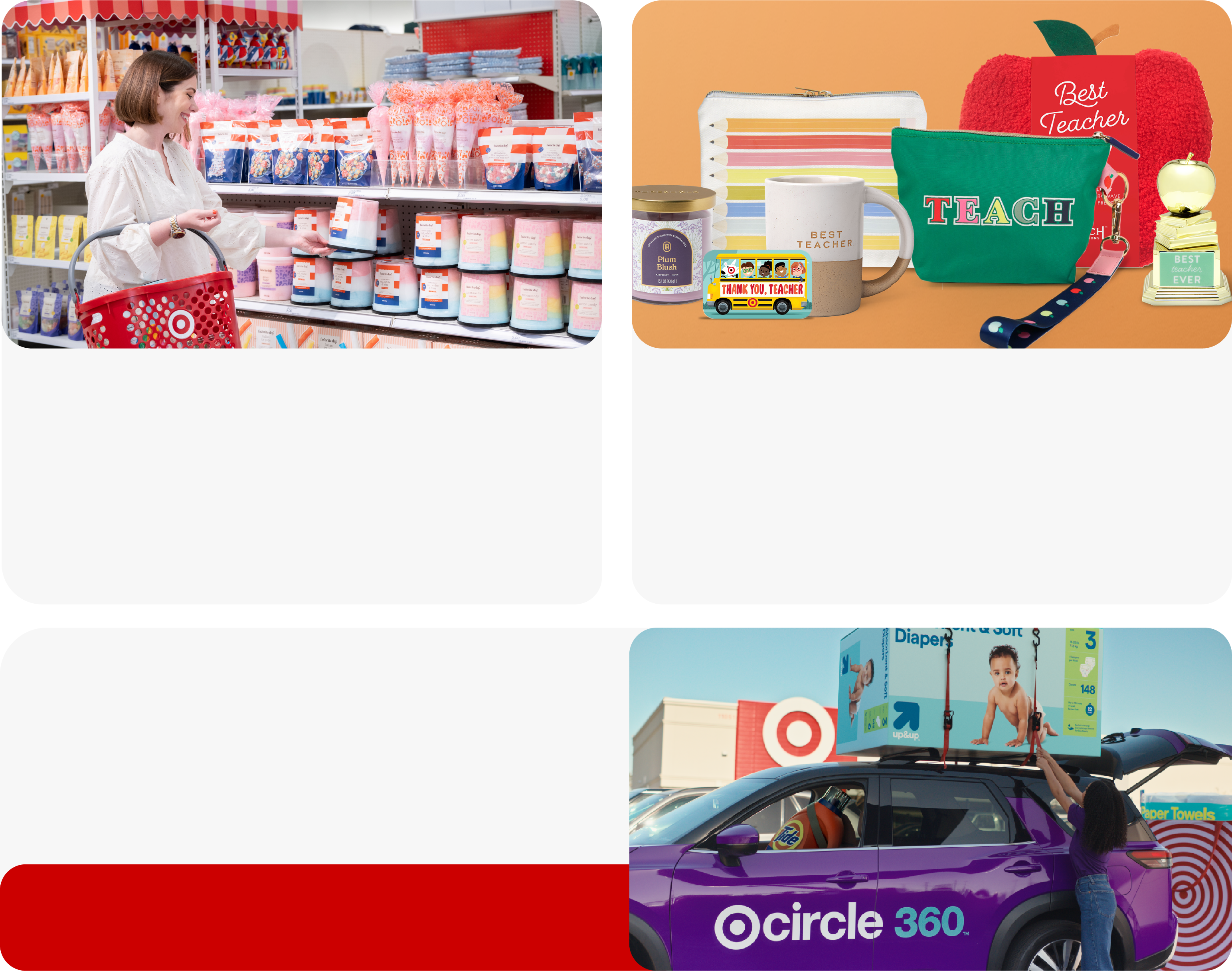

Guests also responded to newness, value and seasonal assortments throughout the quarter.

We’ll offer even more newness and value in Q2 as we aim to improve traffic and business trends.

In Q1, our team navigated a challenging environment that impacted performance, �and we remained focused on delivering what we know resonates with consumers: �an outstanding assortment, experience and value.

was driven by 5% growth in same-day services. Same-day delivery powered by Target Circle 360 increased 36%. Drive Up also grew and now accounts for nearly half of our total digital sales.

Continued strength in digital

We opened 3 new stores and started many more remodel projects across the chain to bring the best of Target closer to more consumers.

Investments in our stores

Our retail ad business Roundel and third-party digital marketplace Target Plus each saw double-digit net sales growth in Q1.

Growth in Roundel and Target Plus

We saw strong surges in traffic and sales around Valentine’s Day and Easter.

A destination for seasonal moments

Our kate spade new york x Target collaboration was our strongest limited-time partnership in the last decade.

Our exclusive Parachute for Target premium bedding and bath collection made a strong debut.

Our new Disney and Marvel collections by Pillowfort were popular with guests.

Our assortment of toys and sporting goods under $20 delivered outstanding value.

Our first Good & Gather Collab with Chef Ann Kim encouraged discovery in food and beverage.

New owned brand Good Little Garden offered fresh florals and plants at exceptional value.

with 10,000 new products starting at $1, �a “Hello Summer” sale, weekly Target �Circle deals and new in-store events.

Gearing up for summer

now extended to 100+ retailers through our newly announced Target Circle 360 benefit.

No price markups on same-day delivery

It’s one of many ways we’re differentiating our loyalty program to drive preference for our brand.

We’re focused on maintaining the health of our core business as we navigate the balance of 2025 and accelerating our strategy to drive long-term, profitable growth.

Target’s strategy, scale and long-term perspective enable us to stay resilient in difficult times and keep investing in the future. We are not satisfied with recent performance, and we’re focused on accelerating our strategy to drive long-term profitable growth and deliver the assortment, experience and value consumers expect from Target.

— Brian Cornell, chair and CEO

We’ve established a multi-year Enterprise Acceleration Office led by Chief Operating Officer Michael Fiddelke to drive even greater speed and agility across the company by improving how functions work together to advance key priorities, clearing the way for our team to accelerate our performance and growth.

Delivering faster progress

with exceptional value across our assortment, digital wish lists, easy-to-shop on-trend items to personalize college dorm rooms and more.

Easy back-to-school and college shopping