Artificial Intelligence (AI) is no longer just a buzzword—it’s becoming a trusted companion in the world of banking and personal finance.

According to TD Bank’s inaugural 2025 AI Insights Report, the majority of Americans are ready to embrace AI to help manage their money in some capacity. In fact, 61% of millennial respondents already use AI tools to handle financial tasks, from budgeting to credit monitoring.

While trust in AI remains a work in progress, half of those surveyed say they believe AI can provide reliable and competent information—equal to their level of trust in news organizations and double the trust placed in social media influencers. Still, tried and true institutions like banks (83%) ranked among the highest in trust for bringing customers accurate information.

“We are seeing increased optimism and curiosity around AI to help make smarter, more informed decisions, with more than half of Americans believing that AI can offer financial advice that is tailored to their situation,” said Ted Paris, Executive Vice President and Head of Analytics, Intelligence & AI at TD Bank. “For financial institutions, this signals a call to action to build understanding, increase awareness and demonstrate how AI can enhance everyday financial decisions. Trust is what matters most.”

The study, which surveyed 2,500 �adults across the country, found:

89

%

of respondents feel comfortable adopting new technologies in their daily lives.

68

%

are at least somewhat familiar with AI and its applications.

AI’s role in financial planning

The research suggests that while Americans remain cautious about turning over major financial decisions to AI, they are already on board with more uses of the technology, especially financial protection:

70%

are comfortable with �AI being used for �fraud detection

64%

trust it for credit �score calculations

For everyday money management, consumers are leaning into AI's strengths:

60%

are comfortable using AI for budgeting

59%

support automated �savings features

Jo Jagadish, Head of Digital Banking & U.S. Contact Centers at TD Bank, is a strong believer in the role of AI to support not only the customer, but also the colleague.

"Consumer behavior is changing rapidly," Jo said. "Customers are embracing AI to make their lives easier, and it’s happening at an unprecedented pace. Our job now is to ensure that the same technology that supports our customers is also available to our Contact Center teams so they can better serve our customers’ evolving needs.”

Contact Center agents will have access to AI to find answers faster and reduce call times, Jo said.

"For us, it’s about investing in our people so they’re empowered to create more meaningful, impactful experiences for our customers—and this is just the beginning," she added.

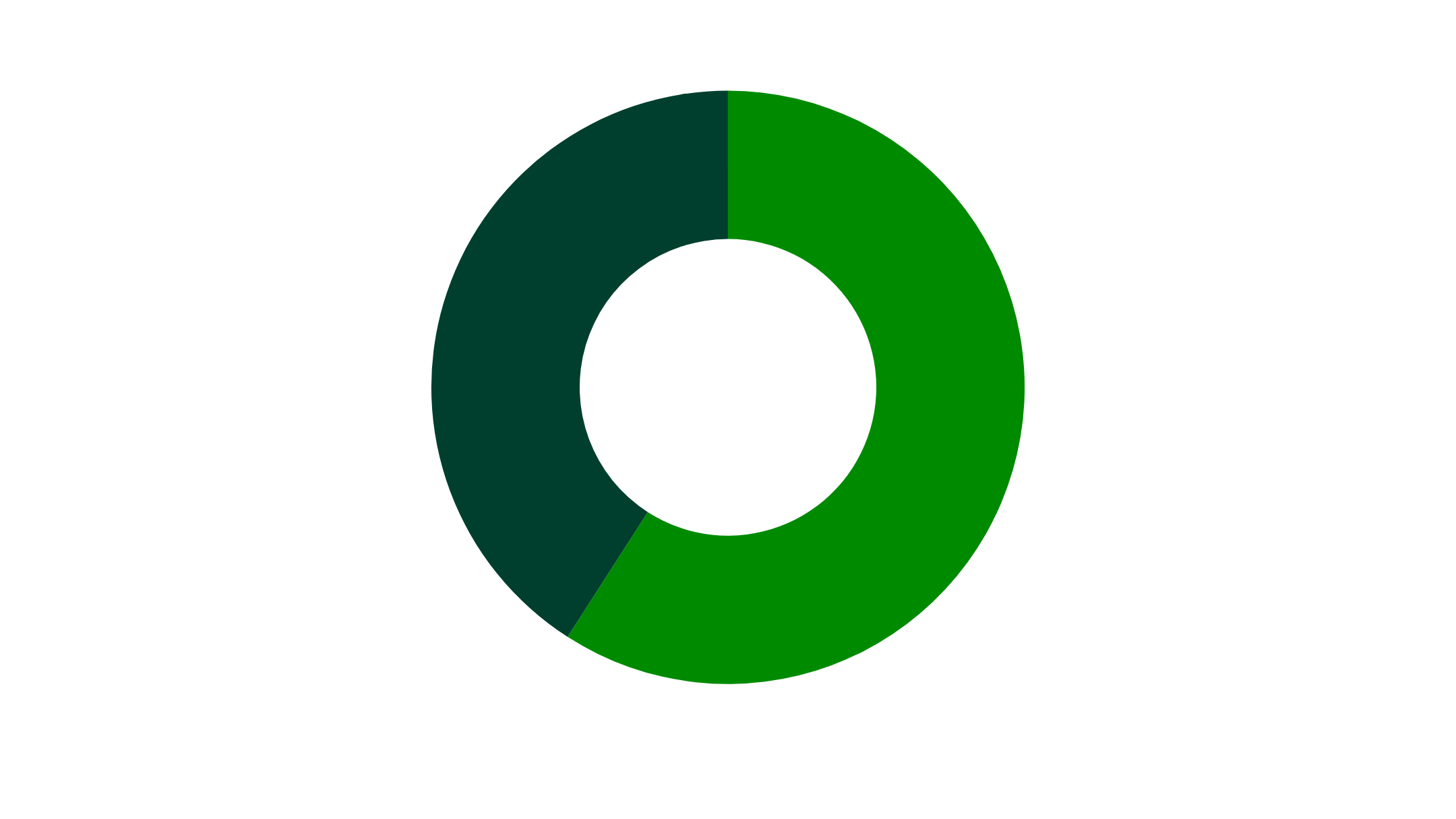

48%

44%

are open to using AI for retirement planning

are open to using AI for investing

Trust in AI starts to waver with �more complex financial tasks:

Interestingly, 48% of respondents said AI would help them avoid potentially awkward conversations with bank representatives—underscoring a desire for self-service and the opportunity for AI to fulfill that need.

“Furthermore, a significant majority (65%) believe that AI has the potential to expand access to financial tools for individuals who currently lack them. We view AI as a powerful enabler — capable of increasing access to financial services, particularly for underserved and underrepresented communities,” added Ted.

Navigating challenges and building a transparent future

These concerns point to a pressing need for banks and tech developers to build systems that are not only effective, but blend the old models with the new, including human connection for trust.

Still, 22% of Americans say they don’t see any benefits to AI in financial services, and 50% worry AI will not give them financial advice that is fair and unbiased — indicating there’s still a significant trust gap to close. According to Ted, this is where the human touch still plays a critical role.

“When it comes to financial access and decision-making, AI is a catalyst for information and solutions,” Ted said. “The proliferation of AI in banking is recognized for its potential to deliver improved financial tools. At the end of the day, finance remains personal and there remains a greater need for banks to build trust and effectively communicate AI's benefits.”

65%

56%

49%

While enthusiasm is on the rise, �consumers are also clear about their concerns:

data privacy �and security

reduced human interaction

lack of transparency in AI decision-making