SAP Certifications �and Endorsed Apps �for ONESOURCE

The technology industry is moving at lightening speed, but indirect tax teams are often stuck battling outdated systems, complex global regulations, and mounting compliance risks. Did you know that 62% of tech tax teams spend most of their time reacting to issues instead of planning strategically, and under-resourced departments are 72% more likely to be audited?

With digital business models, constant regulatory changes, and a shrinking talent pool, the stakes have never been higher. Discover how leading tech companies are leveraging automation and smarter data integration to turn these challenges into strategic advantages.

scroll to keep learning

By leveraging SAP-certified and Endorsed Apps ONESOURCE solutions, businesses can achieve more accurate and efficient tax processes. These tools help drive digital transformation and address key business challenges. Additional ONESOURCE extensions and APIs are also available for purchase on the SAP® Store.

Explore now

© 2025 Thomson Reuters TR6006938/08-25

Thomson Reuters ONESOURCE stands as a comprehensive tax technology solution that integrates robust tax content with built-in local and regional calculations. This makes it an invaluable asset for organizations managing complex, multi-jurisdictional tax requirements.

Several ONESOURCE solutions have achieved SAP Endorsed Apps status, a prestigious certification that ensures high standards of security and performance. This status is awarded after thorough testing, making these solutions a reliable choice for businesses using SAP systems.

ONESOURCE Tax Provision for SAP S/4HANA Cloud

Budget Constraints

65%

65%

Human Capital Shortages

Features

Benefits

Market-leading, patented �calculation engine

Self-reconciling reports with �an intuitive interface

Enhanced management of tax liability �and planning

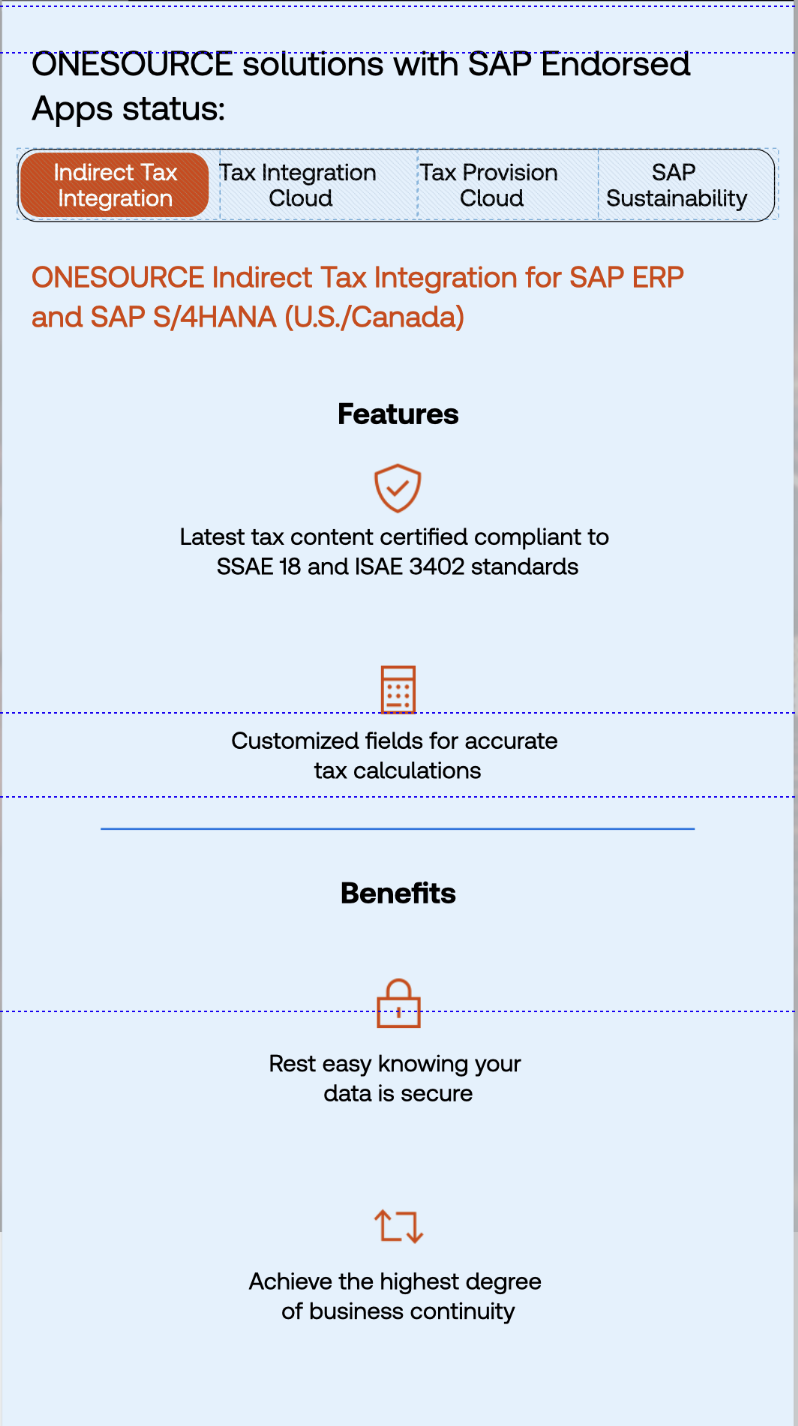

ONESOURCE solutions with SAP Endorsed Apps status:

Automation of �income tax provisioning

Achieve the highest degree �of business continuity

Rest easy knowing your �data is secure

Benefits

Customized fields for accurate �tax calculations

Latest tax content certified compliant to SSAE 18 and ISAE 3402 standards

Features

ONESOURCE Indirect Tax Integration for SAP ERP and SAP S/4HANA (U.S./Canada)

Reduced audit risk

Accurate tax decisions

Benefits

Seamless integration with �SAP S/4HANA Cloud

Standardized reconciliation reporting

Features

ONESOURCE U.S. Tax Integration for SAP S/4HANA Cloud

Decreased likelihood of �supply chain delays

Increased ROI �and visibility

Benefits

Up-to-date global �trade content

Network of duty �suspension programs

Features

ONESOURCE Global Trade Integration for SAP ERP and SAP S/4HANA

65%

Budget Constraints

65%

Human Capital Shortages

Leverage cloud-native and �self-healing technology

Apply correct tax treatments �with ease

Benefits

ISO 9001 and ISO 27001 �certified compliance

Supports global indirect taxes �such as VAT and GST

Features

ONESOURCE Tax Service Integration for SAP S/4HANA

Get unparalleled �flexibility

Stay up to date with �global tax content

Benefits

Scalable tax data on a �secure cloud platform

Trusted tax content

Features

ONESOURCE Indirect Tax Integration for SAP Commerce Cloud

Indirect Tax �Integration

Tax Service �Integration

Global Trade �Integration

ONESOURCE solutions with SAP certifications:

Indirect Tax �Integration Global

Reduced �IT maintenance

Real-time sales and �use tax calculations

Benefits

Next generation �interface

Features

ONESOURCE Indirect Tax Integration for SAP ERP and SAP S/4HANA - Global

End-to-end �solution for indirect tax

Indirect Tax �Integration

Tax Integration�Cloud

Tax Provision�Cloud

SAP Sustainability�Control Tower

Simplified ESG compliance with emerging global regulations

Streamlined last-mile reporting for multinational corporations

Benefits

Compliance support for CSRD, SEC, and ISSB reporting standards

Unified ESG data platform integrating with SAP Sustainability Control Tower

Features

ONESOURCE Statutory Report for Environmental, Social and Governance