The Freight Economist

January 2026

Executive summary

Monthly economic and market update

Class 8 tractor orders

rose 118% in December

as the surge in spot

rates sparked carrier optimism.

U.S. economy

Housing Market

Peak Season Spending

Economic

Outlook

Freight demand

Imports

Manufacturing

Retail Sales

Containerized imports ended 2025 slightly below 2024.

Imports

What does it mean for truck tonnage?

Retail Sales

Key data points and commentary

Trucking

volume

Intermodal

rates

Geographic

trends

Routing guide trends

Routing guide trends

Geographic trends

Trucking volume

Despite the recent tight market, demand indicators have yet to signal a recovery. The Cass Freight Shipments Index saw a month-over-month increase of 2.7% in November, but this was still 7.6% below the level recorded the previous year. Similarly, the American Trucking Associations Truck Tonnage Index posted only a marginal 0.2% increase in November. This followed consecutive declines of 1.9% in October and 0.8% in September. Year-over-year, the index contracted by 0.3%, worsening from the 1.5% decrease seen in October.

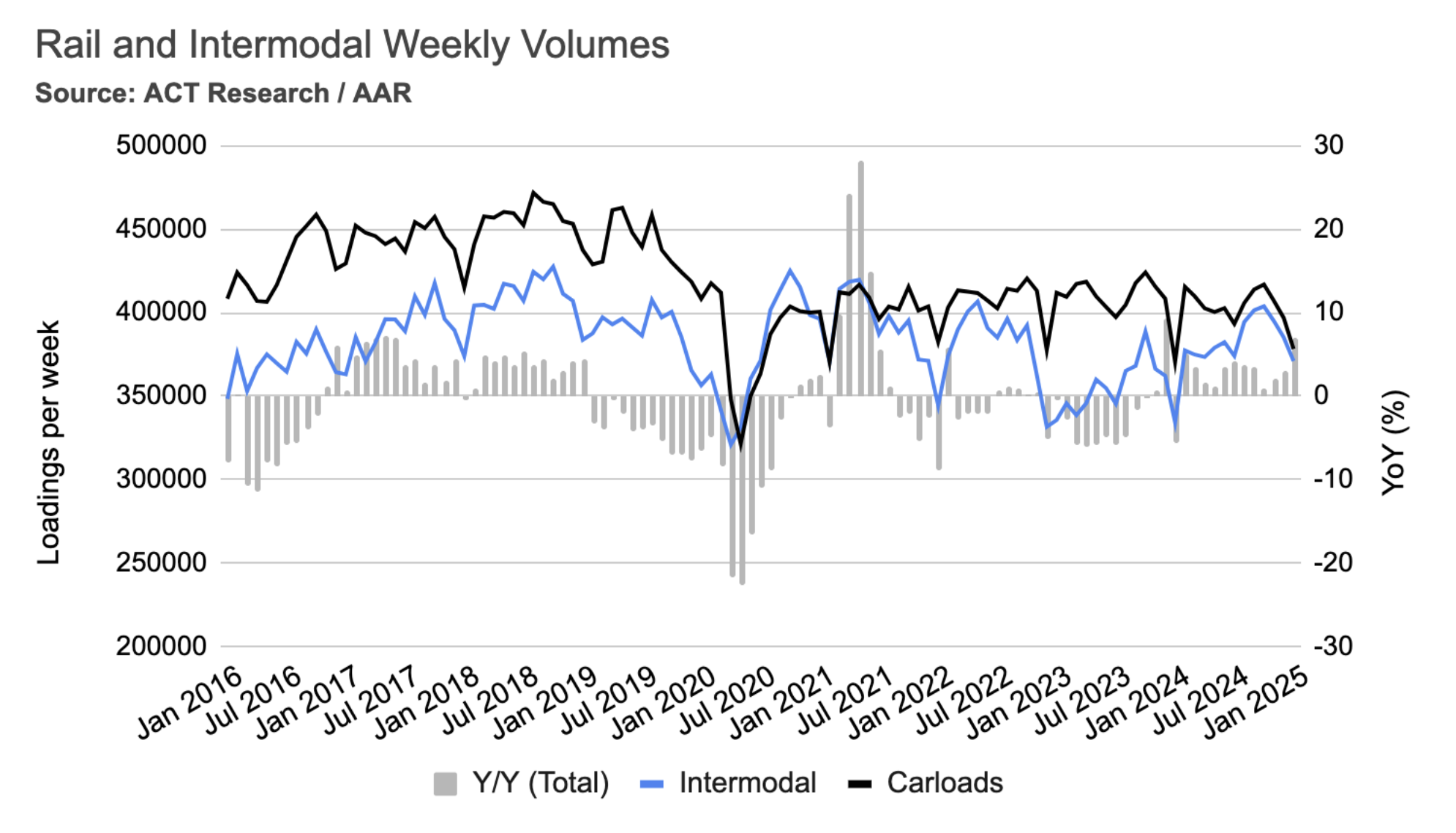

Intermodal rates

In January, average weekly intermodal loads decreased by 3.7%, and weekly carloads dropped by 4.7%. However, compared to the same time last year, intermodal volumes were significantly higher, up 11%, and carloads increased by 2.1%. It's worth noting that this January's declines were less severe than those of the previous year, which saw 7.7% and 9.3% reductions in intermodal and carload loadings, respectively.

Mazen’s work focuses on analyzing the freight transportation landscape, and producing short- and long-term forecasts based on supply and demand dynamics. He is also a research affiliate with the Intelligent Transportation Systems (ITS) Lab at MIT, where he completed his PhD in 2019. His work falls at the intersection of ITS, economic modeling, and analytics.

mdanaf@uberfreight.com

By Mazen Danaf, Senior Economist and Applied Scientist, Uber Freight

Featuring insights and contributions from Uber Freight leadership,

technologists and market specialists.

The tightening market strained route guide performance, according to Uber Freight’s Transportation Management data insights. The average First Tender Acceptance Rate fell from 92% in November to 86% in December. Similarly, route guide compliance decreased during this period, falling from 94% to 90%. This rise in tender rejections led to a substantial financial burden on shippers, with the average cost over the primary carrier rising from 1.7% in November to 5.5% in December.

The housing market is poised to become a significant catalyst for freight demand in 2026. This is largely due to two recent policy actions. First, President Trump directed the purchase of $200 billion in mortgage-backed securities, which immediately reduced borrowing costs and lowered the 30-year fixed mortgage rate to 6.06%—a level not seen since September 2022. Second, the administration intends to permit home buyers to use funds from their 401(K) accounts for down payments. These measures are expected to generate a wave of home sales, thereby stimulating stagnant freight sectors, such as furniture, appliances, and building materials.

Executive

summary

U.S.

economy

Freight

demand

Freight

supply

Housing Market

Average m/m and y/y van spot rate index by destination regions – August

Source: DAT

December saw broad-based double-digit increases in spot rates across all regions. Consistent with typical seasonal patterns and the impact of adverse weather, Northern regions (Northeast, Midwest, and West) experienced more significant rate hikes than Southern regions (Southeast and Southwest). Looking at year-over-year changes, the Midwest led the increases (+15.4%). In contrast, the West's rates were only up 1% annually, likely due to a strong 2024 (driven by high imports and pre-stocking), followed by a 2025 weakening as import volumes slowed, potentially due to tariffs.

Key data

points

Freight Supply

Carrier Population

Retail sales grew at a healthy rate in November.

Labor Market

Truckload demand slowed in June after a pre-stocking surge.

In August, truckload demand remained largely flat. A slight increase in retail and manufacturing demand was counteracted by a significant drop in imports. Consumer-driven demand rose 3.2% year-over-year, while manufacturing demand decreased by 0.2%. Full visibility into all demand indicators, such as wholesalers' sales and inventories, was not possible due to the government shutdown.

1/2

2/2

Despite ongoing contraction in the manufacturing sector and negative year-over-year import figures due to tariffs, which keep freight demand stagnant, potential inflationary shifts are on the horizon. President Trump’s recent decision to purchase mortgage bonds is expected to reduce mortgage rates in 2026. This action should stimulate the housing market, consequently boosting demand for adjacent, currently stagnant sectors such as appliances, furniture, and building materials.

1/3

While December saw a surge in truckload rates, intermodal rates remained relatively stable. Uber Freight data indicates the intermodal linehaul rate per load increased only slightly by 0.2% in December, keeping it 0.3% below the rate from the previous year. However, a 2.2% drop in the all-in rate per load was driven by falling fuel prices, resulting in a 0.7% year-over-year decline.

Intermodal rates usually lag truckload rates by one to two quarters. Therefore, if the current tightness in the truckload market continues, intermodal rates are expected to rise in 2026, following the recent spike in truckload spot rates.

2/2

Shipper and carrier insights

Online consumer spending during the holiday season (Nov. 1 to Dec. 31) reached a new high of $257.8 billion according to Adobe Analytics. This represented a 6.8% increase year-over-year (y/y), driven by robust discounts that sustained strong consumer demand. Mobile shopping reached a significant milestone, accounting for 56.4% of all online transactions, up from 54.5% in the previous year (2024). More than half (54%) of the total online spending was concentrated in three key categories: Electronics at $59.8 billion (up 8.2% y/y), Apparel at $49.0 billion (up 7.4% y/y), and Furniture at $31.1 billion (up 6.6% y/y).

Peak Season Spending

The U.S. Federal Reserve anticipates a stabilizing U.S. economy in 2026, projecting GDP growth above 2%. According to projections released on December 10, the Federal Funds rate is expected to see a modest decrease, settling within the 3% to 4% range. The unemployment rate is also forecasted to stabilize between 4% and 5%, though the Fed notes a wide margin of uncertainty around this figure.

Regarding consumer activity, many participants viewed overall consumption spending as solid, but some signs of recent deceleration were noted. A clear divergence in spending patterns was observed: higher-income households continue to exhibit stronger spending growth, while lower-income households have become more price-sensitive.

Economic Outlook 2026

In the long run, tariffs might boost domestic freight by giving local manufacturers an edge. However, the magnitude and sudden implementation of tariffs means we probably won't see benefits for a while, and the immediate damage will be greater.

Unlike Canada and Mexico, the 10% percent tariffs on Chinese products went into effect on February 4, and are likely to stay. Tariffs on China were already anticipated by shippers, some of which pulled imports forward in 2024.

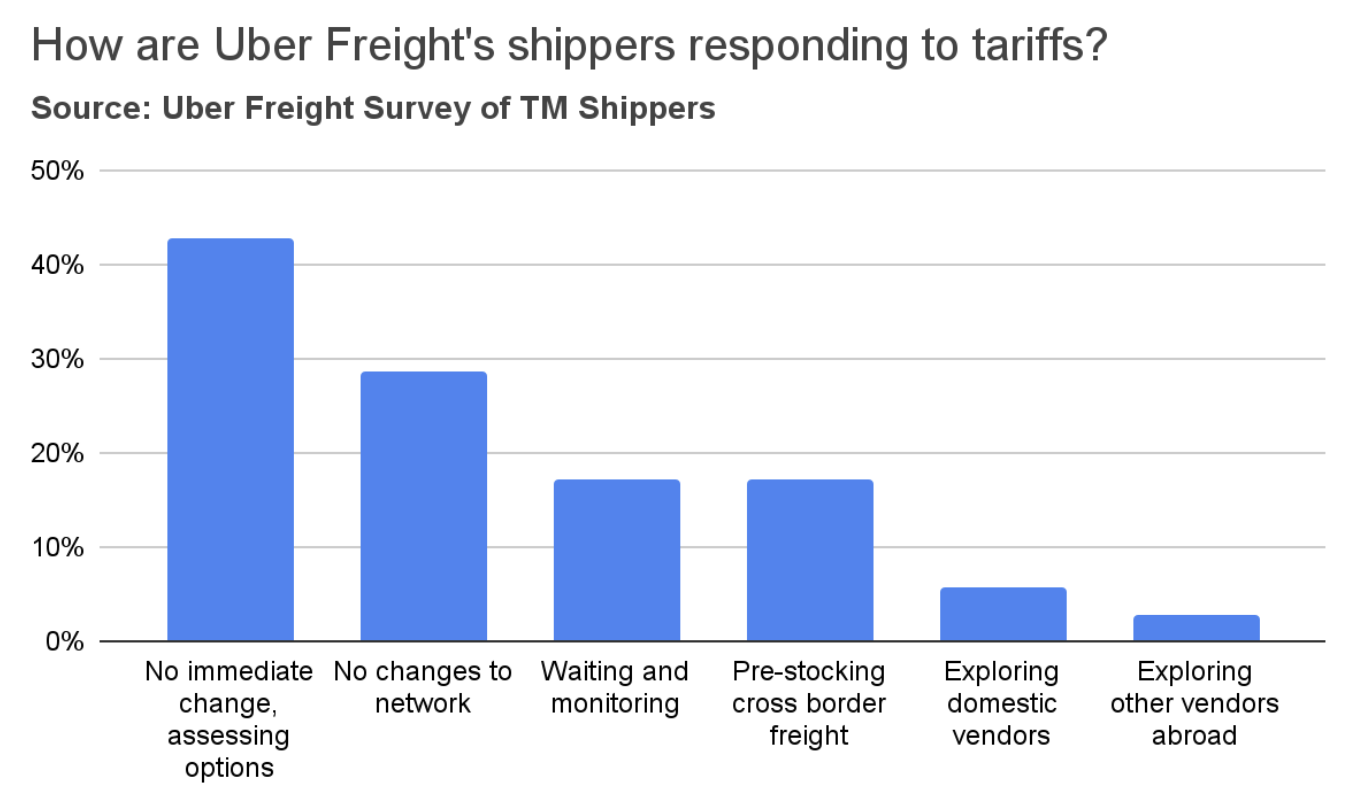

A survey of Uber Freight shippers found that the majority do not foresee immediate changes to their networks. However, a significant minority (42%) are actively assessing various options. Some shippers reported that they anticipate absorbing cost increases and subsequently passing those increases on to their customers. Seventeen percent of shippers indicated they are pre-stocking cross-border inventories. In contrast, very few are exploring domestic alternatives or alternative vendors in countries not impacted by tariffs. Some expressed concerns that it will take several months to adapt their networks.

Labor Market

The U.S. manufacturing sector contracted in every month of 2025, with the exception of January and February.

Manufacturing

The ISM report also highlighted widespread concerns among manufacturers about declining demand and order levels. Respondents across various sectors expressed pessimism about the near-term outlook.

Manufacturing

2/2

Freight supply

Spot and

contract rates

Trucking Employment

Tractor orders

A surge in tractor orders signals returning carrier optimism.

Tractor orders

Spot and contract rates rose across all trucking modes in December.

Spot and contract rates

Market conditions

Market

conditions

While rates are now declining in line with expected seasonal patterns, they remain considerably higher than they were a year ago. We forecast this downward seasonal trend to continue in the near term, though rates are likely to stay elevated on a year-over-year basis. The velocity of this decline will be a critical indicator of the underlying market strength: a slow decrease, after seasonal adjustment, would still signal continued market tightening.

3/3

Long-distance truckload employment decreased further in November.

Trucking Employment

Retail Inventories

Retail inventories are currently slightly leaner compared to last year. This is because consumer spending remained robust in 2025, leading to sales growth that generally outpaced inventory stocking.

Retail sales increased by 3.1% between October 2024 and October 2025, with the growth concentrated in motor vehicles and parts, clothing, and food and beverage stores. This positive trend was offset by a slowdown in furniture and appliance sales, and a decline in year-over-year sales for building materials and garden supplies, both attributed to the ongoing housing recession.

Growth in retail inventories slowed significantly, rising only 1.0% year-over-year. Inventories decreased in clothing, general merchandise stores, and motor vehicles and parts, but increased in food and beverages stores, furniture and appliances, and building materials and garden supplies.

Click to jump to section

On the supply side, the significant capacity correction observed since 2023—a trend unmatched since the Great Financial Crisis—is now manifesting as tighter capacity, particularly during seasonal demand peaks. This was clearly seen in December, where market conditions were much tighter than typical for peak season, resulting in a 14.5% month-over-month surge in dry van spot rates to their highest point since July 2022.

2/3

Online spending grew at a healthy rate in the 2025 peak season.

Industrial production of machinery, primary metals, and fabricated metals has remained relatively flat or slightly declined over the past year. A recovery in these sectors seems unlikely in the near future, as orders and shipments of core capital goods—a key indicator of manufacturing activity—have also stagnated.

Orders for core capital goods, which are nondefense capital goods excluding aircraft, are considered an early indicator of manufacturing activity. Weak orders and shipments in this sector suggest that a broader economic recovery may be delayed.

Despite ongoing contraction in the manufacturing sector and negative year-over-year import figures due to tariffs, which keep freight demand stagnant, potential inflationary shifts are on the horizon. President Trump’s recent decision to purchase mortgage bonds is expected to reduce mortgage rates in 2026. This action should stimulate the housing market, consequently boosting demand for adjacent, currently stagnant sectors such as appliances, furniture, and building materials.

1/3

Industrial equipment and supplies

Automotive

Auto manufacturing has been one of the bright spots in the economy over the past year, driven by pent-up demand and a shortage of vehicles at dealerships. While production rose to meet demand, the market is starting to show signs of saturation, with inventories gradually normalizing and potential glut looming on the wholesale side.

Paper and plastics

Paper and plastics are highly used in the packaging industry, which has been affected by the recent slowdown in food spending after the economy re-opened. In addition, the demand for paper products was already on a downward trajectory due to factors such as digitalization, adoption of alternatives (plastics), and growth of e-commerce. The pandemic further accelerated this decline. Moreover, a surge in downstream inventories led to a slowdown in manufacturers’ demand.

Nondurable consumer goods

Demand for food consumed at home fell from its pandemic highs as the economy re-opened, normalizing back to its pre-pandemic levels. Demand for other consumer goods (such as apparel) continues to be pressured by external competition, slowing consumer demand, and high downstream inventories.

Durable consumer goods

Durable consumer goods such as appliances, furniture, and wood products are affected by the ongoing housing recession. New home sales remain below the 2019 levels, and about 30% below the pandemic peak. Similarly, housing starts are at their lowest level since the beginning of the housing recession, 32% below the 2022 peak.

Stability and Slight Rate Decrease Expected

The U.S. labor market cools—except in logistics, where the heat could be turning up.

Labor Market

Class 8 tractor orders

rose 118% in December as the surge in spot rates sparked carrier

optimism.

Overall, inventory growth lagged behind sales growth. The inventories-to-sales ratio fell from 1.32 in October 2024 to 1.29 in October 2025. Specifically, the ratios for clothing, general merchandise, and motor vehicles and parts were lower year-over-year. However, the ratios were slightly higher for food and beverage stores and furniture, and notably higher for building materials and garden supplies.

Inventories are generally leaner compared to previous years, except in the furniture, appliances, building materials, and garden supplies sectors. Nonetheless, a projected decrease in mortgage rates (following President Trump’s decision to buy mortgage bonds) could stimulate the housing market, potentially leading to an increase in sales relative to inventories for these specific sectors.

Shipper and carrier insights

Where do inventories stand at the beginning of 2026?

Retail Inventories

Retail inventories are currently slightly leaner compared to last year. This is because consumer spending remained robust in 2025, leading to sales growth that generally outpaced inventory stocking.

Retail sales increased by 3.1% between October 2024 and October 2025, with the growth concentrated in motor vehicles and parts, clothing, and food and beverage stores. This positive trend was offset by a slowdown in furniture and appliance sales, and a decline in year-over-year sales for building materials and garden supplies, both attributed to the ongoing housing recession.

Growth in retail inventories slowed significantly, rising only 1.0% year-over-year. Inventories decreased in clothing, general merchandise stores, and motor vehicles and parts, but increased in food and beverages stores, furniture and appliances, and building materials and garden supplies.

Overall, inventory growth lagged behind sales growth. The inventories-to-sales ratio fell from 1.32 in October 2024 to 1.29 in October 2025. Specifically, the ratios for clothing, general merchandise, and motor vehicles and parts were lower year-over-year. However, the ratios were slightly higher for food and beverage stores and furniture, and notably higher for building materials and garden supplies.

Inventories are generally leaner compared to previous years, except in the furniture, appliances, building materials, and garden supplies sectors. Nonetheless, a projected decrease in mortgage rates (following President Trump’s decision to buy mortgage bonds) could stimulate the housing market, potentially leading to an increase in sales relative to inventories for these specific sectors.

Wholesale Inventories

Last year, real wholesale inventories remained mostly unchanged, while sales exhibited positive momentum. This sales increase, however, was mainly driven by two sectors that do not generate significant freight volumes: electronics and pharmaceuticals.

Overall, the combination of higher sales and flat inventories resulted in a notable drop in the inventories-to-sales ratio, falling from 1.34 in September 2024 to 1.29 in September 2025. At 1.29, the ratio is considerably lower than the cycle peak of around 1.40 seen in 2023, signaling that inventory levels are significantly leaner compared to the past two years.

Stability and Slight Rate Decrease Expected

The Job Openings and Labor Turnover Survey (JOLTS) survey indicates that both job openings and hiring remain near their cycle lows. In a year-over-year comparison, November saw an 11% decline in job openings and a 3.6% drop in hires. Month-over-month, job openings fell 4.1%, and hires dropped 4.7% in November.

However, the logistics sector showed a distinct pattern. While job openings in Transportation, Warehousing, and Utilities initially surged by almost 30% in October before receding in November, the long-term trend remains positive. Openings in this sector were 6% higher year-over-year, suggesting returning optimism among carriers and logistics providers about a market recovery after three years of shedding excess capacity.

This sustained downturn is reflected in the Institute for Supply Management Purchasing Managers Index (ISM PMI), which decreased to 47.9. A reading below the 50.0 mark signals an ongoing contraction. Key leading indicators, specifically New Orders and Backlogs, showed further weakness. Additionally, the Employment Index remained well under 50, indicating that the manufacturing workforce has been shrinking for 11 straight months. Amidst the settling of tariff uncertainties, the Prices Index stabilized near 58.5, suggesting a moderation in the price inflation of raw materials and commodities.

Retail sales saw a healthy 0.6% increase in November, resulting in a robust 3.3% rise year-over-year. This growth was broad-based, with particular strength in motor vehicles and parts (+1.0%) and building materials and garden supplies (+1.3%), categories that had lagged over the previous 12 months.

Year-over-year, the 3.3% growth was driven by several sectors: nonstore retailers (e-commerce) jumped 7.2%, clothing grew 7.5%, health and personal care products increased by 6.7%, and food and beverage stores were up 2.9%.

However, while the nominal retail sales growth exceeded 3% last year, the actual volume of goods sold (real growth) was likely lower. This disparity suggests that price inflation, potentially due to tariffs, accounted for some of the increase. With the latest Consumer Price Index (CPI) showing a 1.6% year-over-year rise in commodities inflation, the real growth in retail sales is estimated to be less than 2%.

Retail sales grew at a healthy rate in November.

U.S. container import data for December 2025 shows a total volume of 2.23 million TEUs, according to Descartes. This figure represents a 2% increase from November 2025, but a 5.9% decline compared to December 2024. Despite a significant pre-stocking surge that boosted imports earlier in 2025, the total import volumes for the year finished 0.4% lower than 2024's total. Specifically, containerized imports from China in December 2025 totaled 705,789 TEUs, a 1.0% drop month-over-month and a substantial 21.8% year-over-year decrease. Furthermore, imports from China are now 31% below their peak volume reached in July 2024.

For-hire trucking employment remained stable both month-over-month and year-over-year in December. However, employment in the long-distance truckload sector, which is a better indicator of rate changes, saw a 0.2% drop in November and was down 1.2% year-over-year. We anticipate that actual employment levels are significantly lower than these figures. The upcoming annual calibration by the BLS (expected in February), utilizing the Quarterly Census of Employment and Wages (QCEW) data, is expected to confirm a substantial decrease in employment.

Class 8 tractor orders surged in December, reaching the highest level since October 2022. This dramatic increase—118% from November and 16% y/y—was fueled by an optimistic outlook following a jump in spot rates, which encouraged carriers to expand their fleets. Notably, this surge reversed a trend seen throughout 2025, where orders had consistently been running below 2022-2024 levels.

The spot market experienced a significant surge in December, with rate increases reminiscent of the tight market conditions during the pandemic era. Dry Van spot rates led the increase, jumping 14.5% month-over-month (m/m) and 9.8% year-over-year (y/y). This marks the first time such a substantial y/y increase has been observed since the start of the freight recession, significantly surpassing the previous highest y/y gain of 5%. Reefer rates saw similar strength, rising 10.2% m/m and 9.7% y/y. Flatbed rates unexpectedly defied typical seasonal weakness, climbing 5.1% m/m and 6.2% y/y.

While seasonal factors contributed to the strength, the December dry van spot rate increase was notably above the typical seasonality (usually 4% to 5% up from November) and exceeded the increase seen the year before (approximately 5% up from November 2024). The tightening trend continued into the first week of January, which was stronger than the comparable week in both 2025 and 2024, despite the fact that 2024 and 2025 experienced more severe nationwide weather conditions during that period.

It’s important to note that in 2021, pandemic-related lockdowns led consumers to spend most of their stimulus money on goods, as services spending was suppressed. Future stimulus impact could differ significantly, as services now account for a larger share of overall consumer spending.

Finally, it is estimated that the current accumulated tariff revenues, approximately $120 billion to date, are insufficient to meet the $300 billion required to issue a $2,000 dividend to 150 million individuals. Consequently, the distribution of these tariff dividends, if it happens at all, is likely to be delayed until the first or second quarter of 2026 at least.

Tariff Dividends

2/2

Despite rising inflation, the labor market continued to show signs of softening.

The government shutdown has created a data blackout, delaying official economic reports vital for our analysis and forecasting. In the absence of federal data, the ADP National Employment Report stood out, showing that private sector employment fell by 32,000 in September, signaling continued weakness in the U.S. labor market. Adding to the concerns about labor market softness, in August, Job Hires fell 2.2% m/m and were down 2.0% y/y, to their second lowest level since April 2020.

The U.S. housing market saw volatility amidst shifting mortgage rates.

The U.S. housing market continues to contract, with new permits decreasing 2.3% month-over-month in August and 9.9% year-over-year. Despite this, August saw a positive shift: a slight dip in mortgage rates led to a 20.5% month-over-month surge in new home sales, reaching their highest level since January 2022. This suggests a significant pool of potential homebuyers awaiting lower mortgage rates, indicating a substantial amount of dormant freight demand that could be unleashed next year if rates fall.

This sustained downturn is reflected in the Institute for Supply Management Purchasing Managers Index (ISM PMI), which decreased to 47.9. A reading below the 50.0 mark signals an ongoing contraction. Key leading indicators, specifically New Orders and Backlogs, showed further weakness. Additionally, the Employment Index remained well under 50, indicating that the manufacturing workforce has been shrinking for 11 straight months. Amidst the settling of tariff uncertainties, the Prices Index stabilized near 58.5, suggesting a moderation in the price inflation of raw materials and commodities.

Retail sales saw a healthy 0.6% increase in November, resulting in a robust 3.3% rise year-over-year. This growth was broad-based, with particular strength in motor vehicles and parts (+1.0%) and building materials and garden supplies (+1.3%), categories that had lagged over the previous 12 months.

Year-over-year, the 3.3% growth was driven by several sectors: nonstore retailers (e-commerce) jumped 7.2%, clothing grew 7.5%, health and personal care products increased by 6.7%, and food and beverage stores were up 2.9%.

However, while the nominal retail sales growth exceeded 3% last year, the actual volume of goods sold (real growth) was likely lower. This disparity suggests that price inflation, potentially due to tariffs, accounted for some of the increase. With the latest Consumer Price Index (CPI) showing a 1.6% year-over-year rise in commodities inflation, the real growth in retail sales is estimated to be less than 2%.

U.S. container import data for December 2025 shows a total volume of 2.23 million TEUs, according to Descartes. This figure represents a 2% increase from November 2025, but a 5.9% decline compared to December 2024. Despite a significant pre-stocking surge that boosted imports earlier in 2025, the total import volumes for the year finished 0.4% lower than 2024's total. Specifically, containerized imports from China in December 2025 totaled 705,789 TEUs, a 1.0% drop month-over-month and a substantial 21.8% year-over-year decrease. Furthermore, imports from China are now 31% below their peak volume reached in July 2024.

An emergency order targeting non-domiciled CDLs could drive a capacity crunch in 2026.

U.S. Transportation Secretary Sean P. Duffy issued an emergency order immediately halting states from issuing or renewing non-domiciled Commercial Driver’s Licenses (CDLs). This rule closes loopholes created by states that had been granting CDLs to foreign nationals who lacked required employment-based visas or whose licenses were improperly extended long past the expiration of their lawful presence. The Federal Motor Carrier Safety Administration (FMCSA) estimates that its interim final rule on non-domiciled CDLs will remove 194,000 drivers from the market over the next two years.

Additionally, the carrier population continues to shrink due to ongoing capacity reduction. FMCSA data indicates a net decrease of 385 carriers in Q3, following a modest increase of only 671 in Q2.

A 25% tariff on new tractors could also contribute to the potential capacity tightening next year.

President Donald Trump announced plans to impose a 25% tariff on medium- and heavy-duty trucks starting next month. This action directly targets Mexico, which is a major manufacturing hub under the USMCA trade agreement. Mexico exported 159,466 heavy-duty trucks in 2024, with 95.5% going to the U.S. These trucks are currently permitted to cross the border tariff-free under the USMCA, provided they meet strict rules of origin requiring 64% of their value to originate regionally (a threshold set to increase to 70%). This announcement comes at a time when tractor orders are near their lowest levels in 5 years. Preliminary Class 8 orders totaled 20,800 units in September, down 44% y/y.

The spot market experienced a significant surge in December, with rate increases reminiscent of the tight market conditions during the pandemic era. Dry Van spot rates led the increase, jumping 14.5% month-over-month (m/m) and 9.8% year-over-year (y/y). This marks the first time such a substantial y/y increase has been observed since the start of the freight recession, significantly surpassing the previous highest y/y gain of 5%. Reefer rates saw similar strength, rising 10.2% m/m and 9.7% y/y. Flatbed rates unexpectedly defied typical seasonal weakness, climbing 5.1% m/m and 6.2% y/y.

While seasonal factors contributed to the strength, the December dry van spot rate increase was notably above the typical seasonality (usually 4% to 5% up from November) and exceeded the increase seen the year before (approximately 5% up from November 2024). The tightening trend continued into the first week of January, which was stronger than the comparable week in both 2025 and 2024, despite the fact that 2024 and 2025 experienced more severe nationwide weather conditions during that period.

It’s important to note that in 2021, pandemic-related lockdowns led consumers to spend most of their stimulus money on goods, as services spending was suppressed. Future stimulus impact could differ significantly, as services now account for a larger share of overall consumer spending.

Finally, it is estimated that the current accumulated tariff revenues, approximately $120 billion to date, are insufficient to meet the $300 billion required to issue a $2,000 dividend to 150 million individuals. Consequently, the distribution of these tariff dividends, if it happens at all, is likely to be delayed until the first or second quarter of 2026 at least.

Tariff Dividends

In 2025, wholesale activity increased across most sectors, with machinery and paper products being among the few exceptions. While most sectors saw a decline in their inventories-to-sales (I/S) ratios, three sectors experienced an increase: alcoholic beverages, groceries, and paper products.

For paper products, the higher I/S ratio resulted from both declining sales and increasing inventories. Alcoholic beverages and groceries, despite seeing sales growth in 2025, had a greater increase in inventories, leading to a higher I/S ratio for both. Notably, machinery inventories decreased at a faster rate than the decline in sales, unlike paper products.

The spot market typically cools sharply in late January and February before stabilizing in March. Specifically, Western markets in California and the Pacific Northwest experience a significant softening, while other regions remain largely neutral relative to annual averages.

Wholesale Inventories

Last year, real wholesale inventories remained mostly unchanged, while sales exhibited positive momentum. This sales increase, however, was mainly driven by two sectors that do not generate significant freight volumes: electronics and pharmaceuticals.

Overall, the combination of higher sales and flat inventories resulted in a notable drop in the inventories-to-sales ratio, falling from 1.34 in September 2024 to 1.29 in September 2025. At 1.29, the ratio is considerably lower than the cycle peak of around 1.40 seen in 2023, signaling that inventory levels are significantly leaner compared to the past two years.

In 2025, wholesale activity increased across most sectors, with machinery and paper products being among the few exceptions. While most sectors saw a decline in their inventories-to-sales (I/S) ratios, three sectors experienced an increase: alcoholic beverages, groceries, and paper products.

For paper products, the higher I/S ratio resulted from both declining sales and increasing inventories. Alcoholic beverages and groceries, despite seeing sales growth in 2025, had a greater increase in inventories, leading to a higher I/S ratio for both. Notably, machinery inventories decreased at a faster rate than the decline in sales, unlike paper products.

What does it mean for the freight market?

The spot market typically cools sharply in late January and February before stabilizing in March. Specifically, Western markets in California and the Pacific Northwest experience a significant softening, while other regions remain largely neutral relative to annual averages.

What does it mean for the freight market?

As we start 2026, inventory levels are generally leaner than in previous years. Although these levels are not sufficiently high to negatively impact freight demand, as was the case over the last three years, they are also not low enough to trigger a substantial increase in demand, absent any unexpected demand shocks.

As we start 2026, inventory levels are generally leaner than in previous years. Although these levels are not sufficiently high to negatively impact freight demand, as was the case over the last three years, they are also not low enough to trigger a substantial increase in demand, absent any unexpected demand shocks.

Source: U.S. Federal Reserve.

January typically experiences lingering tightness following the peak season. While Southern markets like California and Florida begin to cool, Northern regions often remain constrained by weather disruptions. Notably, these disruptions in 2024 and 2025 pushed spot rates significantly above December levels.

Short-term Rate Outlook

January typically experiences lingering tightness following the peak season. While Southern markets like California and Florida begin to cool, Northern regions often remain constrained by weather disruptions. Notably, these disruptions in 2024 and 2025 pushed spot rates significantly above December levels.

Short-term Rate Outlook